Question of the day

Thursday, Jan 18, 2024 - Posted by Rich Miller

* Background is here if you need it. Tribune…

Will the South Siders be playing baseball in the South Loop?

According to the Chicago Sun-Times, “serious” negotiations have taken place between the Chicago White Sox and developer Related Midwest in regard to possibly building a baseball-only stadium at Roosevelt Road and Clark Street — an area known as “the 78.”

Related Midwest owns the site. The Illinois Sports Facilities Authority — which owns Guaranteed Rate Field — has not been involved in the talks, the organization’s CEO, Frank Bilecki, told the Tribune.

“I’m not part of the discussion, at least as of yet,” Bilecki said. “I truly know nothing. I’m a landlord and they’re a tenant, and they’re looking at options as tenants do everywhere.”

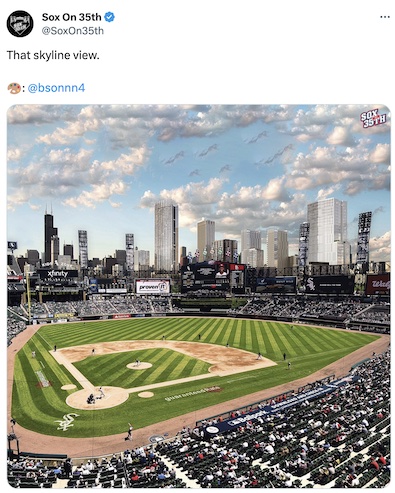

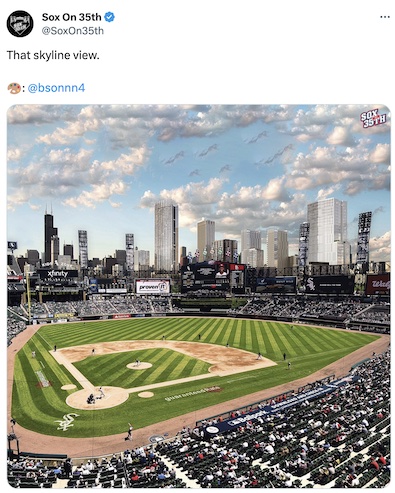

* A park that close to downtown would be a great after-work draw. A cool stadium would also bring in tourists. And the view could be just tremendous…

Ownership being what it is means I ain’t holding my breath on any of it.

* Gov. Pritzker has opposed public funding for a new suburban Bears stadium, but the White Sox play in a park owned by a state agency, so he was asked today whether he would support state funding for this…

Nobody’s made the ask yet. So having said that, I think you know my views about privately owned teams and whether the public should be paying for private facilities that will be used by private businesses. Having said that, I mean, there are things that government does to support business all across the state, investing in infrastructure, making sure that we’re supporting the success of business in Illinois. So, as with all of the other, whether it’s sports teams, or other private businesses, we’ll be looking at whatever they may be suggesting or asking for.

* The Question: Your own thoughts on this topic?

…Adding… In response to some comments, here’s NBC 5…

State taxpayers still owe roughly $50 million on bonds used to construct the stadium. The White Sox lease expires after the conclusion of the 2028 season.