* Gov. Pritzker praised the leaders of governments in Chicago, Springfield, Sangamon County, Champaign-Urbana and Carbondale today for taking action against COVID-19. He talked about another increase in testing capabilities. And then he unleashed…

Those who have stood up at press conferences to question the data and fuel conspiracy theories. Those who have taken their absurd crusade to the courts and lost nearly every single time. Those who have flat-out told the businesses in their communities to ignore what their local and state public health departments and experts, some of the best in the nation, are telling them what is it going to take to get you to be a part of the solution.

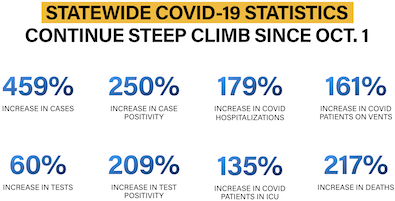

Doctor Ezike and I have stood up here every day, telling you the facts. We’ve had dozens of the nation’s leading experts, present, and give you the info or giving you the information there epidemiological information they’re modeling information. They’ve stood here with us to show you how bad things can get. We’ve given you the data here in Illinois and the best studies from across the nation and the globe. We’ve shown you what this looked like in the spring, and how this wave is already worse than that in many regions of the state.

What will it take to make this real for you?

Do we have to reach a positivity rate of 50% like we’re seeing in Iowa today? 50%. Are you waiting for health care workers to get sick to a point where you don’t have enough staff in the local hospital to cover the next shift? What about if the hospitals become so overrun that you’re sick and you’re dying have nowhere left to turn?

Because I promise you, if you fail to take responsibility in your city and your county, that day is coming closer. And it will be on you.

Meanwhile, the rest of us will still do our jobs. The state will do all that it can to help hospitals surge their capacity and find additional staff. Health care workers will take up their posts on the front lines as they have every single day since this began, but more people will get sick, more people will struggle to breathe and more people will die because you’ve failed to do your job.

While good people do the right thing by wearing masks to keep each other safe, elected leaders in some communities have allowed others to infect their constituents because they’re afraid of the few loud anti-maskers or because the elected leaders themselves are anti-maskers.

In too many of these communities, responsible business owners have followed public health guidelines, only to see competitors flout the rules and prolong the mitigations for everyone else.

There may be a vaccine on the way in just a few months, but a lot of lives can be saved before that happens. And when this is over there will be an accounting by your constituents of who worked to keep the public safe, and who just ignored the science. This is the moment to step up and get it right.

Winter is coming, folks.

I pledged to be honest with you throughout this COVID crisis, and that won’t ever change. We’re running out of time. And we’re running out of options. Our growth in new cases is now exponential. We are seeing current numbers and future projections worse than what we saw in the spring. We’re more practiced at responding to this virus now. So we have significant stockpiles of PPE, we have overflow capacity that’s already planned by our hospitals, and we have much more testing available. That won’t slow the spread of the virus.

Since the stay at home order ended in May, we’ve allowed local governments to make decisions about whether they needed tougher mitigations and enforcement. And we’ve only imposed certain select mitigations at the state level on a regional basis. Those tools worked where people acted responsibly in local communities. But with many community leaders choosing not to listen to the doctors, we are left with not many tools left in our toolbox to fight this. The numbers don’t lie.

If things don’t take a turn in the coming days, we will quickly reach the point when some form of a mandatory stay at home order is all that we’ll be left with every fiber of my being. I do not want us to get there. But right now, that seems like where we are heading.

Please pardon all transcription errors.

67 Comments

|

* The counting trend was moving away from Sen. Oberweis for days, so this is unsurprising…

*** UPDATE 1 *** US Rep. Underwood…

“I am honored to be reelected to represent Illinois’ beautiful 14th District in Congress. This was a tough race under some very difficult circumstances, and I want to say thank you to my supporters, the voters, and our elections officials for their diligent work.”

“We face urgent challenges as a community and a country. I remain focused on getting results: protecting our families, ensuring a robust economic recovery, and lowering the cost of health care. Whether you voted for me or not, I pledge to represent every member of this community. That’s my responsibility, and I take it seriously. It’s a privilege to bring northern Illinois voices and values to Washington and I can’t wait to build upon all that we’ve accomplished, together.”

*** UPDATE 2 *** Travis Akin, Jim Oberweis Campaign Spokesman…

“The Associated Press calling the race in the 14th Congressional District for Lauren Underwood does not change anything in this race from a legal standpoint. Illinois election law has provisions to allow parties in a closely contested race to seek a recount to ensure that all legal votes are counted and to ensure that the final outcome is the right outcome. There are still votes that have yet to be counted. The totals at this point are unofficial totals as the race has yet to be certified. We are committed to exploring all of the legal options at our disposal and will pursue these options that are afforded our campaign under law.”

…Adding… Here’s a quickie roundup of the recount statutes…

Candidate-Initiated Options :

Close vote margin required

Candidate determines how many/which precincts to recount

Contested election

Candidates “nominated, elected, or declared eligible for a runoff election” for any office may petition for a recount. However, a close vote margin is required: candidates must have received “at least 95% of the number of votes cast for any successful candidate for the same office” to be eligible for a recount. 10 ICSL 5/22‑9.1. These recounts are considered “discovery recounts,” and the results are explicitly not binding on the outcome of the election. The statutes require that the results of the examination and count shall not be certified, used to amend or change the abstracts of the votes previously completed, used to deny the successful candidate for the same office his certificate of nomination or election, nor used to change the previously declared result of the vote on a question of public policy.

Neither candidates nor voters may petition to recount precincts “exceeding 25% of the total number of precincts within the jurisdiction of the election authority.” 10 ILCS 5/22-9.1.

As noted above in “Court-Ordered Recounts,” candidates may also initiate a recount through the election contest process, in which the judge overseeing the contest may hold a hearing to determine if a recount is warranted.

For election contests, any candidate on the ballot and any write-in candidate in any election may contest the election. Candidates may also specifically request an “examination of records and equipment” as part of the contest. Unlike “discovery recounts,” the ruling resulting from an election contest is binding upon the election results. 10 ILCS 5/23 1.6a, 5/23 1.2a, 5/23-1.10a, 5/23-26 and 5/23-28.

…Adding… Chairman Madigan…

“We have won a hard-fought victory in the 14th Congressional District, and I extend my congratulations to Congresswoman Underwood. For the last week, Democratic Party of Illinois attorneys and poll watchers have worked side-by-side with State Central Committee members, including Lake County Chair Lauren Beth Gash and McHenry County Chair Kristina Zahorik, and Democratic volunteers to ensure that every vote was counted until this critical victory was final.”

…Adding… I’m told there are no court-ordered recounts for congressional races…

No Illinois court recount. Goes to the Floor of the House.

C. Congressional Office

The Federal Contested Election Act, Pub.L. No. 91-138, 83 Stat. 284 (1969), controls contests for election to federal office. See also the election contest rules for the house involved. Strict pleading requirements apply. H.R.Rep. No. 759, 94th Cong., 1st Sess. (1975); Young v. Mikva, 66 Ill.2d 579, 363 N.E.2d 851, 6 Ill.Dec. 904 (1977).

33 Comments

|

Chicago mayor issues “Stay-at-Home Advisory”

Thursday, Nov 12, 2020 - Posted by Rich Miller

* The advisory is similar to what the governor has already issued. The regulations appear to anticipate the state’s Tier 2 mitigations…

Mayor Lori E. Lightfoot, the Chicago Department of Public Health (CDPH), and the Department of Business Affairs and Consumer Protection (BACP) today launched a new citywide strategy - “Protect Chicago” - an effort to help Chicago bend the COVID-19 curve for the second time. This strategy calls on all Chicagoans to change their behavior through targeted regulations, strong messaging, and a community-based outreach strategy. If changes are not made by Chicago residents, businesses, and visitors to mitigate the spread of COVID-19, the city is on track to lose 1,000 more Chicagoans by the end of the year or even more.

“Chicago has reached a critical point in the second surge of COVID-19, demanding that we undertake this multi-faceted and comprehensive effort to stop the virus in its tracks,” said Mayor Lightfoot. “The gains we have made this past year have been the result of our willingness to work together. Even in this difficult moment, we will continue to unite as we always have for our city in order to halt the rise we’re seeing, shake out of the fatigue we’ve been experiencing, and make the crucial difference in what our future is going to look like.”

A key pillar of the “Protect Chicago” strategy will be the implementation of several regulatory measures aimed at combating the alarming rise in COVID-19 cases and hospitalizations. Chief among these new efforts is a Stay-at-Home Advisory, which calls on all Chicagoans to follow clear measures to protect their community and help us flatten the curve. Residents are strongly advised to adhere to the Advisory by following these guidelines, which will go into effect on Monday, November 16, 2020, at 6:00 a.m.:

• Only leave home to go to work or school, or for essential needs such as seeking medical care, going to the grocery store or pharmacy, picking up take-out food, or receiving deliveries. If you do leave home, practice social distancing by staying 6 feet away from others and wearing a face covering at all times.

• Do not have gatherings in your home with anybody outside of your household (except for essential staff such as home health care workers or educators), even with trusted family or friends.

• Avoid all non-essential, out-of-state travel; if travel is essential, quarantining or testing negative prior to travel is required, depending on which state a traveler is originating from.

• Comply with City and State Orders, including wearing face coverings, limiting gatherings, and mandating early closure of non-essential businesses at 11 p.m.

• Practice social distancing and avoid touching surfaces frequently touched by others if you go outside to get fresh air.

• Use remote modes of communication like phone or video chat instead of visiting friends or family, especially on holidays such as Thanksgiving.

In addition to the Stay-at-Home Advisory, the City is imposing new restrictions to limit meetings and social events to 10 individuals (both indoors and outdoors), which will also go into effect on Monday, November 16, 2020, at 6:00 a.m. This capacity limit applies to events such as weddings, birthday parties, business dinners/social events, and funerals, and is applicable to any venue where a meeting or social event is taking place, including meeting rooms. However, the capacity limit does not supersede industries that have specific capacity guidelines in place, which include fitness clubs, retail stores, personal services and movie theaters (generally, 40% or 50 individuals max., whichever is fewer). More information on the new restrictions can be found at chicago.gov/reopening.

“We are at a critical point in our ongoing fight against the COVID-19 pandemic,” said BACP Commissioner Rosa Escareno. “Everybody needs to step up right now to flatten the curve, save lives and help our businesses reopen safely.”

These new regulations and the Stay-at-Home Advisory will be paired with the activation of a community-based outreach strategy that aims to reach all Chicagoans, especially those who live and work in COVID-19 hotspots, which are currently on Chicago’s Northwest and Southwest Sides. The “Protect Chicago” strategy will be pushed out citywide on digital assets and through collateral materials, all zeroing in on the guidance that will keep Chicagoans safe and healthy. The City plans to leverage more than 1,000 City workers, up to 550 contact tracers, and a network of hundreds of community-based organizations to reach Chicagoans who have been adversely impacted by COVID-19. The outreach team will be conducting data-based, geo-targeting efforts to focus on the highest-incidence zip codes, neighborhoods and census tracts to provide resources, information and support to individuals and families who have been hardest hit by the pandemic. Chicago has seen spread in every zip code, age group, and race and ethnicity, and the City has partnered with minority-owned communications firms – Flowers Communications Group and Imagen Marketing Consultants – to ensure the strategy is targeted to COVID-19 hotspots and resonates with the communities most severely impacted by the virus.

“Protect Chicago” builds upon already-existing regulations and guidelines designed to manage the second wave of COVID-19. The City continues to recommend that Chicagoans avoid all gatherings in private residences, with an exception for essential staff such as home healthcare workers or educators. Furthermore, CDPH Health Orders require that indoor gatherings within private residences be limited to six non-household members. The City has the authority to fine individuals for breaking this requirement and hosting large social gatherings in their private residences. Lastly, earlier this week, CDPH updated the City’s emergency travel order, however, the recommendation remains for residents to avoid all non-essential, out-of-state travel.

“Protect Chicago” has been developed in coordination with CDPH to respond to evolving public health data and trends that show Chicago deep into a second surge of COVID-19. Chicago, the region, and the nation as a whole have experienced several weeks of steeply rising new daily cases, and the test positivity rate has also been increasing and is now above 14% in the city. Chicago is seeing more than 1,900 new daily cases based on a 7-day rolling average, which is a higher rate than at any time during the pandemic. While Black and Latinx residents continue to be disproportionately impacted by the pandemic, these increases are being seen across age, race and ethnicity.

“The data are troubling, and I’m very concerned we could be looking at tens of thousands of more cases, which would overwhelm the healthcare system and lead to hundreds more deaths,” said CDPH Commissioner Allison Arwady, M.D. “But we know what works and what we need to do to bend the curve. We did it once and I know we can do it again.”

…Adding… Michael Jacobson, president and CEO, Illinois Hotel & Lodging Association…

It’s very disappointing to hear Mayor Lightfoot spread a falsehood that Chicago hotels are actively marketing and hosting parties or other events that violate current Covid-19 protocols or existing fire code capacity limits. That theory simply is not true. Like every sector of businesses, hotels have unfortunately been victims of a citywide uptick in crime in and around our properties throughout the Central Business District. While there are occasional instances where guests violate the hotel’s policy on the amount of people allowed in each room, those rare cases are dealt with by hotel staff immediately and the guests are evicted. Hotels have far exceeded the guidelines that the City of Chicago set in place to control Covid-19 and are dedicated to protecting our employees and guests. We welcome the opportunity to hear from City of Chicago officials of any reports to the contrary so that they can be resolved immediately.

2 Comments

|

* AP…

The number of people seeking U.S. unemployment benefits fell last week to 709,000, a still-high level but the lowest figure since March and a sign that the job market might be slowly healing.

The figures coincide with a sharp resurgence in confirmed viral infections to an all-time high above 120,000 a day. Cases are rising in 49 states, and deaths are increasing in 39. The nation has now recorded 240,000 virus-related deaths and 10.3 million confirmed infections.

As colder weather sets in and fear of the virus escalates, consumers may turn more cautious about traveling, shopping, dining out and visiting gyms, barber shops and retailers. Companies in many sectors could cut jobs or workers’ hours. In recent days, the virus’ resurgence has triggered tighter restrictions on businesses, mostly restaurants and bars, in a range of states, including Texas, New York, Maryland, and Oregon.

Last week’s new applications for unemployment benefits was down from 757,000 the previous week, the Labor Department said Thursday. The still-elevated figure shows that eight months after the pandemic flattened the economy, many employers are still slashing jobs.

* CBS 2…

The Illinois Department of Employment Security reported 67,158 new unemployment claims were filed across the state last week, the week of Nov. 1.

Illinois’ estimated claims were among 709,000 total filed across the country last week.

The most recent claims represent a nearly 9% decrease from the prior week when 73,515 unemployment claims were filed in Illinois, but a 510% increase over the 11,015 claims filed during the same week of 2019.

*** UPDATE *** I asked the governor about this today…

Well I think I mentioned the other day that we had a huge spike in this PUA unemployment. And a lot of that is fraud-related we believe, based on the analytics. And so we’re trying to address that.

Look, unemployment is never good no matter what that is, it’s not good. We very much want to continue growing our economy. I have believed from day one that the way you do that is tackle the virus, and make sure that you’re doing everything you can. While you’re tackling the virus to keep people safe in the economy that is up and running. And to some degree is continuing to grow from a low that had hit last spring.

21 Comments

|

Get with the program, central Illinois

Thursday, Nov 12, 2020 - Posted by Rich Miller

* IDPH Region 3, which runs from Sangamon County west to the Mississippi River, now has a seven-day rolling positivity rate of 16.4 percent. Sangamon County’s rate is 16.2 percent, but its most recent one-day rate is 21.2 percent.

* Fortunately, some attitudes are starting to change in the county…

Just days into their two-week plan to allow bars and restaurants to continue indoor service despite Gov. JB Pritzker’s order to curb COVID-19’s rapid resurgence in the region, Sangamon County and Springfield officials are reversing course.

Beginning Friday, area bars and restaurants must stop serving indoors, or risk their liquor or food license if they stay open. That’s according to new executive orders signed Tuesday by Sangamon County Board Chair Andy Van Meter and Department of Public Health Director Gail O’Neill.

Springfield Mayor Jim Langfelder said at a city council meeting he plans to sign a similar order on Thursday.

Region 3 – which includes Springfield and west-central Illinois – triggered the mitigations late last month after the region saw a COVID-19 positivity rate greater than 8% for three straight days. The rules, which include shuttering indoor dining and bar service, were set to take effect Nov. 1.

When local officials announced the plan to defy the governor’s orders last week, they also said if numbers were bad enough, they’d reconsider and implement all regulations aimed at slowing the spread of COVID-19.

In consultation with medical advisors, they set the threshold at an average positivity rate above 12% for the county for three straight days, which would trigger closure of indoor service. The rolling average reached 14.4% Saturday for the county, according to the most recent data available from the Illinois Department of Public Health. It was 13.4% Friday, and 12.5% the day before that. The average rates lag three days behind.

Unfortunately, every day they delayed meant that getting those numbers down to a reasonable level became that much more difficult.

* The SJ-R is getting a little salty…

“We are getting very, very dangerously close to overwhelming our healthcare system, which was the point of all this to begin with — don’t overwhelm the healthcare system,” said Ward 6 Ald. Kristin DiCenso. “With flu season coming, we are about to be in very, very bad shape.”

With news of the county’s plans to enter full mitigations breaking just before the meeting started, several aldermen had not been briefed on the subject.

Langfelder, who was on a call with county officials where the mitigations were discussed earlier that afternoon, also appeared unfamiliar with the contents of the new restrictions.

He repeatedly told council members that all bar service would cease under the new order before being corrected and told that outdoor service could continue. During the meeting, he asked a reporter with The State Journal-Register to confirm when the mitigations would actually go into effect.

The answer is 12:01 a.m. Friday.

* The governor responded to the course change on Facebook yesterday…

I’m pleased to see local governments are starting to take action to stop the spread. I urge all local government leaders to put the health and safety of your community above all else.

* WICS…

The coronavirus pandemic and the upcoming winter months are taking a toll on the tourism industry in Illinois.

Add to it the veto session at the Capitol being canceled, which usually brings in money to the capital city.

Springfield Convention and Visitors Bureau Director Scott Dahl said now, they are looking ahead.

“Literally thousands of people come in town for session. It is a large impact to the city,” Dahl said. “We are hoping for an early spring session and an extended session, as well, to make up for the spring and fall session loss in 2020.”

A long session will not happen if Springfield and the county don’t prove they’re taking this seriously. The capital city should be setting an example for the rest of the state. Until this week, it had been setting precisely the wrong example.

* Meanwhile in Chicago…

13 Comments

|

* Another hospitalization record. Press release…

The Illinois Department of Public Health (IDPH) today reported 12,702 new confirmed and probable cases of coronavirus disease (COVID-19) in Illinois, including 43 additional deaths.

- Adams County: 1 male 80s

- Brown County: 1 male 90s

- Bureau County: 1 male 90s

- Clinton County: 1 male 50s, 3 females 80s, 1 male 80s, 1 male 90s

- Cook County: 1 female 50s, 2 males 50s, 1 female 70s, 2 males 70s, 1 female 80s, 1 male 80s

- DeKalb County: 1 male 50s

- DuPage County: 1 male 70s, 2 males 80s

- Edwards County: 1 male 70s

- Fulton County: 1 male 70s

- Knox County: 1 male 80s

- Lake County: 1 male 70s, 2 females 80s

- LaSalle County: 1 male 80s

- Macon County: 1 male 80s

- Montgomery County: 1 male 60s, 1 female 80s

- Morgan County: 1 male 50s

- Peoria County: 1 female 70s, 1 female 90s

- St. Clair County: 1 male 80s

- Tazewell County: 1 male 80s

- Vermilion County: 1 female 90s

- Wayne County: 1 male 80s

- Whiteside County: 1 male 40s, 1 female 70s, 1 female 80s

- Will County: 1 female 70s, 1 male 80s

Currently, IDPH is reporting a total of 536,542 cases, including 10,477 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 100,617 specimens for a total 8,765,100. As of last night, 5,258 people in Illinois were reported to be in the hospital with COVID-19. Of those, 956 patients were in the ICU and 438 patients with COVID-19 were on ventilators.

The preliminary seven-day statewide positivity for cases as a percent of total test from November 5– November 11 is 12.6%. The preliminary seven-day statewide test positivity from November 5, 2020 – November 11, 2020 is 13.9%.

To help decrease the positivity rate, IDPH recommends the following.

Yesterday, IDPH released additional recommendations for how best for Illinoisans to keep themselves and their families safe as cases continue to rise in the state. For the next three weeks, IDPH is asking people to stay home as much as possible, leaving only for necessary and essential activities, such as work if working from home is not an option, buying groceries, and visiting the pharmacy. CDC and IDPH recommend limiting travel no matter the distance. In our current situation, with a rising prevalence of the virus, attending even small gatherings that mix households, or traveling to areas that are experiencing high rates of positivity, is not advised.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. For health questions about COVID-19, call the hotline at 1-800-889-3931 or email dph.sick@illinois.gov.

* Wednesday…

The Illinois Department of Public Health (IDPH) today reported 12,657 new confirmed and probable cases of coronavirus disease (COVID-19) in Illinois, including 145 additional deaths.

Adams County: 1 female 70s, 1 male 70s, 1 male 80s

Boone County: 1 male 50s, 1 male 60s, 1 female 70s

Carroll County: 2 males 80s, 1 female 90s

Clinton County: 1 male 70s, 1 female 80s

Coles County: 1 male 70s, 1 female 90s

Cook County: 1 male 20s, 1 male 30s, 2 males 40s, 3 females 50s, 5 males 50s, 6 males 60s, 8 females 70s, 6 males 70s, 4 females 80s, 7 males 80s, 5 females 90s, 2 males 90s

Crawford County: 1 male 70s, 1 male 80s

DuPage County: 1 female 70s, 1 female 80s, 3 males 80s

Edwards County: 1 female 90s

Ford County: 1 female 70s, 1 male 90s

Franklin County: 1 male 80s

Grundy County: 1 male 70s

Hamilton County: 1 female 60s

Henry County: 1 male 40s, 1 male 80s

Jefferson County: 1 male 90s

Kane County: 1 female 50s, 2 males 60s, 1 male 70s, 1 female 80s, 1 female 90s

Kankakee County: 1 male 80s,

Knox County: 1 male 60s, 2 females 90s

Lake County: 1 female 70s, 1 male 70s, 1 male 90s, 1 female 90s

Lee County: 1 male 80s

Livingston County: 1 male 70s, 1 male 80s

Macon County: 1 female 60s, 1 female 70s, 1 male 70s, 1 female 80s, 1 male 80s, 1 female 90s

Macoupin County: 1 female 70s

Madison County: 1 female 70s, 1 male 70s

Marion County: 1 female 40s, 1 male 70s, 1 female 80s

Mason County: 1 female 60s

McHenry County: 1 female 70s, 1 male 70s, 1 female 80s

McLean County: 1 male 70s, 1 female 80s

Morgan County: 1 female 80s

Peoria County: 1 female 60s, 1 male 80s, 1 female 90s

Pike County: 1 female 70s

Rock Island County: 1 female 70s, 1 male 90s

Saline County: 1 male 80s

St. Clair County: 1 male 80s

Tazewell County: 1 male 70s, 1 female 80s

Vermilion County: 1 female 90s

Warren County: 1 male 70s

Wayne County: 1 male 90s

White County: 2 males 80s

Whiteside County: 1 male 40s, 1 male 70s

Will County: 1 female 50s, 1 female 60s, 2 males 60s, 2 females 80s, 2 males 80s, 1 female 90s

Williamson County: 1 male 80s

Winnebago County: 2 males 60s, 1 male 70s

Currently, IDPH is reporting a total of 523,840 cases, including 10,434 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 93,464 specimens for a total 8,664,483. As of last night, 5,042 people in Illinois were reported to be in the hospital with COVID-19. Of those, 951 patients were in the ICU and 404 patients with COVID-19 were on ventilators.

The preliminary seven-day statewide positivity for cases as a percent of total test from November 34– November 10 is 12.4%. The preliminary seven-day statewide test positivity from November 4, 2020 – November 10, 2020 is 13.6%.

Sadly, another resident at the Illinois Veterans’ Home LaSalle (IVHL) has passed away. This is the seventh resident death at the home. Currently, there are 72 residents with COVID-19 and 72 employees.

The Illinois Department of Veterans’ Affairs (IDVA) is in regular consultation with IDPH and the Federal Department of Veterans’ Affairs and is following all public health guidance. After the first positive tests at the facility on November 1, 2020, visitation was halted on November 2, 2020 and new admissions postponed. All positive residents are isolating in a separate wing of the facility. Over the summer, IDVA constructed 25 negative pressure rooms with capacity for 44 residents, which is now in use in this wing. IDVA is also ramping up the use of antigen testing in the facility in order to more rapidly test residents and staff.

To help decrease the positivity rate, IDPH recommends the following.

Work from Home if Possible

For the next three weeks, work with your employer to plan to work from home unless it is necessary for you to be in the workplace. We ask employers to make accommodation for this. Our goal is to reduce transmission as we head into the holidays so businesses and schools can remain open.

Participate in Essential Activities Only

For the next three weeks, stay home as much as possible, leaving only for necessary and essential activities, such as work that must be performed outside the home, COVID-19 testing, visiting the pharmacy, and buying groceries.

Limit Travel and Gatherings

The Centers for Disease Control and Prevention (CDC) and other health experts tell us that gatherings and travel in and out of communities present a high risk of spreading the infection. In our current situation, with a rising prevalence of the virus, attending even small gatherings that mix households, or traveling to areas that are experiencing high rates of positivity, is not advised and is potentially dangerous. Please, travel only if necessary.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. For health questions about COVID-19, call the hotline at 1-800-889-3931 or email dph.sick@illinois.gov.

12 Comments

|

600+ Days Later, It’s Time For Clean Jobs

Thursday, Nov 12, 2020 - Posted by Advertising Department

[The following is a paid advertisement.]

It’s been more than 600 days since the Clean Energy Jobs Act (CEJA) was first introduced, but communities across the state that developed this bill are still waiting for their lawmakers to take action.

Since its introduction in February of 2019, support for CEJA has continued to grow. 82% of Illinois voters support the bill, and 74% of voters say that legislators must pass it this year, not delay it until 2021.

CEJA was recently updated to include stronger utility reforms, end automatic rate hikes and double down on our commitment to equity for Black and Brown communities through meaningful wealth-building opportunities. CEJA isn’t just a set of ideas, it’s a fully drafted bill. You can read about it at ilcleanjobs.org.

As the COVID-19 pandemic continues to ravage our state’s economy, we need solutions that will create thousands of new jobs by unlocking millions of dollars in private investment, without raising taxes or hiking rates. CEJA can’t wait.

Comments Off

|

Maybe the answers are right in front of you?

Thursday, Nov 12, 2020 - Posted by Rich Miller

* Yesterday evening…

Reasonable request.

* 90 minutes later…

Sen. Rezin lives in Morris, which is in Grundy County, which has a seven-day average positivity rate of 20.7 percent. It’s most recent daily rate was 30.3 percent.

The veterans’ home is in a county with a seven-day average positivity rate of 19.9 percent. That virus had to get into the home somehow. Think it might’ve come from the community, whose leaders are resisting mitigations?

Just a thought.

Also, this isn’t a statewide closure of indoor dining. It was done on a regional basis and every region is now in dire straits.

* Meanwhile…

State Senator Sue Rezin (R-Morris) and State Representative La Shawn Ford (D-Chicago) joined together to call on Senate President Don Harmon and House Speaker Michael Madigan to call a joint hearing of the General Assembly to discuss the state’s response to the COVID-19 pandemic.

“We are now eight months into this pandemic. It is well past time for the General Assembly who is a coequal branch to take a more active role in the management of this pandemic,” said Sen. Rezin. “Legislative hearings will allow the public to hear directly from the Governor’s Office, state and local public health officials, small businesses, and other impacted stakeholders about what exactly goes into the decision-making process for our state’s response. In addition to providing the public with much needed transparency, these hearings will finally give legislators the opportunity to directly ask the Administration about the data and assumptions they choose to use. For too long, we have been left in the dark with more questions than answers. This has been particularly true when it comes to the Administration’s mitigation rules.”

Enhanced mitigation has been imposed across the state that disproportionately impacts the hospitality industry despite contradictory claims from local health departments about their role in spreading the virus.

“The surge in positive COVID-19 cases in Illinois forced the cancellation of the Fall Veto Session,” said Rep. Ford. “The General Assembly can’t leave the weight of this virus on the back of the executive branch. In order to protect the well-being of Illinoisans, we need a bipartisan and bicameral plan working with the executive branch.”

Additionally, the two legislators are encouraging Governor Pritzker to join with the General Assembly as an equal partner by supporting public legislative hearings and agreeing to make state officials and consultants available.

The letter is here.

24 Comments

|

Please do better, or I’m gonna lose my mind

Thursday, Nov 12, 2020 - Posted by Rich Miller

* April 23, 2020…

Illinois residents will soon be required to cover their faces when in public spaces like grocery stores, Gov. J.B. Pritzker announced Thursday.

The mandate is part of an amended statewide stay-at-home order, which begins May 1 and continues through the end of the month.

That widely covered order was, of course, extended with the next EO, and then the next, etc.

* August 7, 2020…

Gov. JB Pritzker has created new enforcement rules for mask wearing.

Pritzker said the statewide emergency order allows warnings and then fines of up to $2,500 against businesses and other organizations that do not ensure that people wear masks on the premises.

That much-noted rule was approved by JCAR, so it’s still on the books today.

* From yesterday’s news media Q&A with the governor…

Q: Are you considering a statewide mask mandate?… Is that a consideration?

*facepalm* *heavysigh* *screamatmycomputer*

For months as I’ve watched these media briefings I’ve been quietly repeating to myself a lesson I was taught growing up: “There’s no such thing as a stupid question.” But I think I’ve finally reached my limit on that.

Combine this with the ridiculously out of control COVID-19 problem in the town where I live, and I feel like I need to take some time off over Thanksgiving and socially distance on some beach somewhere before I wind up at the happy home with trees and flowers and chirping birds and basket weavers who sit and smile and twiddle their thumbs and toes…

Whew. OK. I think I’m better now. Sorry you had to witness this. And I really do like that reporter. He usually does good work and probably just had an off day. We all make mistakes. And Springfield’s mayor does seem to finally be getting the message. We’ll see.

I’m still gonna do the socially distant beach-bum thing, though. And I have just the spot.

50 Comments

|

|

Comments Off

|

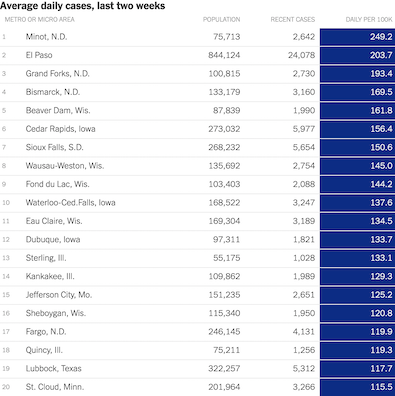

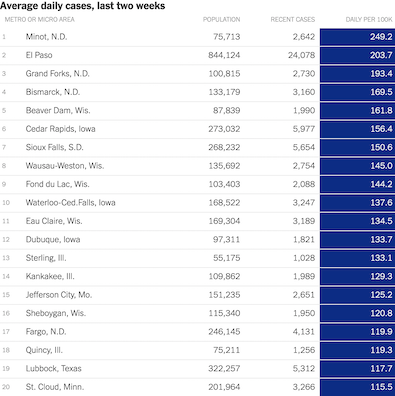

* These first two are from the New York Times. Here are the national metro areas with the greatest number of new cases, relative to their population, in the last two weeks…

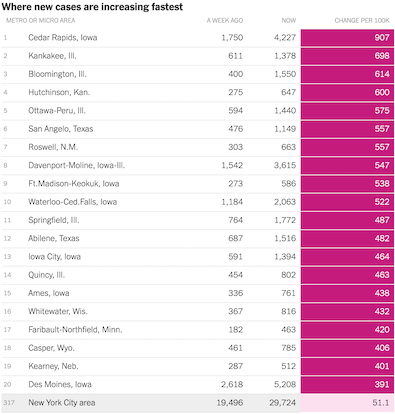

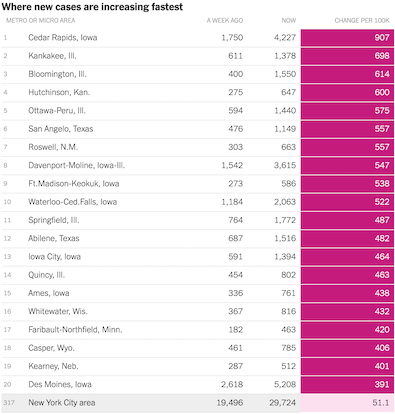

* The national metro areas where new cases are rising the fastest, on a population-adjusted basis…

Man. Kankakee is a freaking mess. And with Ottawa’s ranking, we can clearly see why there are problems at the LaSalle Veterans’ Home. Also, Bloomington? Do better, please.

* And this is from the Covid Act Now website. Illinois counties sorted by test positivity rate. The Eastern Bloc’s territory dominates..

17 Comments

|

Because… Madigan!

Thursday, Nov 12, 2020 - Posted by Rich Miller

* Rep. Steve Reick…

On Tuesday, Speaker of the House Mike Madigan’s Chief of Staff announced that the fall veto session has been canceled due to concerns over COVID-19 and proximity to the upcoming holidays. In response to the announcement, State Representative Steve Reick (R-Woodstock) issued the following statement:

“No one is discounting the severity of COVID-19, especially now that we are in the midst of a second wave. However, we were able to meet safely in May and, with proper precautions, we can meet safely now. We have a top-notch Springfield staff that pulled together a safe environment in May that included testing, mask mandates, an abundance of hand sanitizer, and more than enough room to practice social distancing. Not one legislator contracted COVID-19 during our session in May, so we know full well the staff is capable of pulling this off.

“I can’t help but wonder if the cancelation has more to do with political unrest within the House Democratic caucus than it has to do with health and safety. I certainly hope that’s not the case, because it would be a great injustice if Speaker Madigan has placed his political problems ahead of our ability to do the people’s work during a scheduled veto session. We have a multi-billion dollar budget hole to fill and we need to be in session in order to have a voice in crafting a solution. In addition, I mentioned in a recent letter to the Governor that we need to return to Springfield so we can hit the reset button on our COVID-19 response and work together on a better plan.”

* Rep. Grant did more than just wonder…

On Tuesday, Speaker of the House Mike Madigan’s Chief of Staff announced that the fall veto session is canceled due to concerns over COVID-19 and proximity to the upcoming holidays. In response to the announcement, State Representative Amy Grant (R-Wheaton) issued the following statement:

“I question the motivation behind this cancelation. We were able to meet safely in May in an environment that included testing, mask mandates, regular use of hand sanitizer, and more than ample room to practice social distancing. No one from the House, Senate or staff contracted COVID-19 during our session in May, so we know staff is capable of putting adequate safety precautions in place. Congress is meeting and there’s no reason why we shouldn’t be.

“The people of Illinois are counting on us to do our jobs, and since we know we can safely meet, I must wonder if the cancelation is more about Madigan’s growing unpopularity within his caucus and the Governor’s disinterest in engaging with the legislature than it is about our health. We have to get back to Springfield and legislators must be allowed to have a voice in future COVID-19 decisions. This cancelation sends a bad message to Illinoisans who want their voices heard through their elected representative to the House.”

* And the Tribune editorial board just came right out and said it…

Rather than bring lawmakers back to the capital where face-to-face interactions could intensify conversations to oust him; rather than deal with a major budget shortfall, a pension crisis or a timely Legislative Black Caucus agenda that includes criminal justice reform; rather than pass overdue ethics legislation that would put the ComEd investigation in the spotlight; Madigan canceled veto session altogether. Let Gov. J.B. Pritzker, who recently joined others in calling for Madigan’s ouster as state party chair, struggle with the budget and pension headaches himself. Make him wear the jacket. This is about that too.

…Adding… Rep. Halpin is the second House Democrat to disclose a COVID-19 diagnosis this week. Subscribers know that Rep. Deb Conroy also contracted the virus…

State Rep. Mike Halpin, D-Rock Island, is recovering from COVID-19 after five days of enduring chills and fever.

Halpin said his test result came back positive on Monday, but he believes he contracted coronavirus from a family friend on Oct. 31.

“I’m feeling better now, but I had woken up on Election Day in the middle of the night with fever and chills,” Halpin said. “At that point, I made the decision to contact the doctor. For about five days or so, I was in a lot of pain with a headache and fever. I never had any trouble breathing, but it was definitely a miserable five days. After that, I started feeling better with less fatigue.”

But, yeah, it’s all Madigan.

* Meanwhile…

Chicago Unions’ Statement on Partnering with Speaker Madigan to Strengthen Worker Power in Illinois

The unions of Chicago’s labor movement, including the Chicago Federation of Labor, released the following statement supporting Speaker Madigan and partnering with him to strengthen worker power in Illinois:

“As the electoral dust settles and we look toward the next legislative session, the Chicago labor movement is excited and energized to bolster worker power and protections through state legislation. Our best chance to do so is in partnership with House Speaker Michael J. Madigan, a staunch defender of working people. Speaker Madigan has steadfastly advanced workers’ rights, resulting in some of the strongest prevailing wage, collective bargaining, gender pay equity, minimum wage, and worker safety laws in the country. He also spent four years valiantly defending the rights of union members from former Gov. Bruce Rauner’s reckless ideological attacks. Given the choice, Speaker Madigan held the line for working people and we thank him.

“There was a time, not that long ago, when Illinois was heading down the same political path as our Great Lakes neighbors— Indiana, Michigan, Wisconsin and Ohio — where Democrats and labor were shut out of power, and right-to-work-for-less became the law. If it were not for Speaker Madigan, working people would have been marginalized and their voices silenced like those in neighboring states.

“Instead of political in-fighting, we encourage everyone to focus their energy on finding ways to support the workers who are sacrificing so much right now, especially Illinois’ public employees who have risked their own health and safety to keep Illinois running during this pandemic.”

Bob Reiter, Chicago Federation of Labor

Don Villar, Chicago Federation of Labor

Rosetta Daylie, CBTU

James Connolly, Chicago Laborers’ District Council

Jesse M. Rios, AFGE

Sam Cicinelli, Automobile Mechanics’ Local 701

James F. Coyne, Plumbers Local 130

Donald Finn, International Brotherhood of Electrical Workers Local 134

James M. Gardiner, Iron Workers District Council of Chicago & Vicinity

Terrence J. Hancock, Teamsters Local 731 and Teamsters Joint Council 25

Brian Hickey, IUOE Local 399

Mack I. Julion, National Association of Letter Carriers - Branch #11 Chicago

Thomas Balanoff, SEIU Illinois State Council

Gregory Kelley, SEIU Healthcare

Karen Kent, UNITE HERE Local 1

Ronald D. McInroy, UAW Region 4

William W. Niesman, IBEW Local 9

Robert O’Toole, UFCW Local 1546

Gary Perinar, Chicago Regional Council of Carpenters

Jesse Sharkey, Chicago Teachers Union

John Spiros, Jr., International Union of Painters and Allied Trades District Council #14

Raymond Suggs, Sheet Metal Workers’ Local 73

James M. Sweeney, IUOE Local 150

James T. Tracy, Chicago Fire Fighters Local 2

The Illinois AFL-CIO issued a similar statement on Tuesday.

* Hannah Meisel…

Republicans opened the door to voting for a Democrat for House Speaker in January if it meant ousting Madigan — instead of casting their usual ceremonial votes for the House Minority Leader.

State Rep. Mark Batinick (R-Plainfield) last week survived a well-funded Democratic challenger in a race targeted by Madigan’s political organization.

“I’m willing to do whatever it takes to turn the state around,” Batinick said. “For me, the one “no: vote is the vote for Speaker Madigan. Beyond that, I would be willing to engage in conversations and negotiations.”

State Rep. Mike Marron (R-Fithian) said he wouldn’t even mind ending up with a speaker politically to the left of Madigan.

“I’d be happy to take the risk of a more progressive member getting in charge just to have a fair fight in the arena of ideas,” Marron said.

Rather than seeking GOP support for a candidate against Madigan (which could easily turn off a whole lot of Democrats), the easier way to do this is to simply deprive the House Speaker of 60 votes. The House rules require “the affirmative vote of a majority of those elected.” If enough Democrats vote “Present,” then he can’t get to 60. They can then try to coalesce around someone else later.

22 Comments

|

* Remember, hospitalization is a lagging indicator. The exploding number of positive cases you see today will eventually translate into increased numbers of people in the hospital…

Illinois COVID-19 hospitalizations have increased 76 percent in the past two weeks. The state also has the fewest number of available hospital beds since the pandemic began.

* Tribune…

Faced with a record number of COVID-19 patients, some Illinois hospitals are returning to strategies similar to those they adopted in the early days of the health crisis, including limiting elective surgeries and adding more beds.

One health care provider, NorthShore University HealthSystem, has converted its Glenbrook Hospital in Glenview back into a COVID-19 hospital, meaning it is no longer taking patients in need of overnight care if they don’t have COVID-19. Non-COVID-19 patients who need to be hospitalized are being sent to other facilities in the system.

The five-hospital system also has started evaluating elective surgeries on a case-by-case basis, delaying some depending on their urgency, said Dr. Lakshmi Halasyamani, chief medical officer. […]

Concerns also are growing about staffing levels. Though hospitals can add beds, they can only add as many beds as they have the ability to staff. Amid this second COVID-19 surge, hospitals are seeing their medical workers catch COVID-19, outside the hospital, preventing them from working. Nurses are in high demand nationwide, unlike in the spring when some areas had many COVID-19 cases and others did not.

Hospital leaders are pleading with community members to wear masks and social distance.

The staffing issue is not discussed nearly enough. You can have plenty of beds, but if you have a staff shortage due to illness or whatever, you can’t fill your hospital.

* And it’s becoming a real problem in southern Illinois…

Yesterday, there were 50 hospitalized patients at SIH, a record high since the pandemic began. Staff at SIH is prepared to care for patients, but the extra steps involving PPE make caring for them more intensive.

“It’s not really a bed issue right now, we have the beds. It’s more the staffing demand to care for a patient with COVID-19 is much more substantial than taking care of a medical patient that’s in the hospital or a critical care patient that’s in the hospital. It’s, logistically, it’s just much more difficult” said Chief Nursing Officer Jennifer Harre. […]

Right now, with more than 100 healthcare workers out sick or in quarantine, they stress the need all of us to do our part to stop the spread of the virus.

* Champaign…

Like many other healthcare facilities, Carle Foundation Hospital is seeing an increase in staff members with COVID-19. In a statement they said in part…

“We continue to offer leading safeguards in our workplace to protect our staff and patients. While we’re continuing to monitor the situation closely and working through numerous solutions we know we are at a critical juncture in our community.”

* The Quincy area is at a critical stage…

The Adams County COVID-19 Medical Capacity dashboard shows hospital bed availability at one percent. […]

[Dr. Mary Frances Barthel with Blessing Health System] said what she’s seeing in the hospital reflects how the community is acting. She says it’s time to stop gathering in large groups, or things are going to get real bad.

“At some point, it will just overrun the system,” Barthel said.

When we said available beds, these aren’t just for COVID-19 patients, they’re for everyone.

So if you get in a car accident, or have another medical emergency, the low capacity of beds could impact you even if you don’t have the virus.

Barthel said the need for staff is more important now than ever, especially if they add beds.

She said like community members, many staff members are out with COVID or possible exposure.

Adams County’s 7-day average positivity rate is 16 percent.

* A different sort of shortage is hitting the Rockford area, which is in a region that appears to be completely ignoring state mitigations…

Additional hospital bed sets have been requested by Winnebago County agencies due to the recent surge in COVID-19 patients in Region 1 hospitals.

Winnebago County Emergency Management, city of Rockford Emergency Management, and the Winnebago County Health Department requested the bed sets from the Illinois Emergency Management Agency through the Regional Hospital Coordinating Center

A bed set includes a bed, headboard with suction and oxygen, HEPA filter, lamp, trunk, tent and chair. The bed set does not include additional medical personnel.

“The increasing rate of COVID-19 infection has stressed the healthcare systems in the region and highlights the consequences of unchecked transmission in the community,” officials said in a news release. “All entities should be adhering to the Tier 2 mitigations outlined in Executive Order #2020-62 to protect the community.

Winnebago County’s average positivity rate is 18.4 percent.

* We talked about this earlier in the week, but here’s the Washington Post…

A group of Illinois health-care workers wrote an open letter to Gov. J.B. Pritzker (D) and Chicago Mayor Lori Lightfoot (D) on Monday predicting that “Illinois will surpass its ICU bed capacity by Thanksgiving.”

Two leaders of the group, the Illinois Medical Professionals Action Collaborative Team (IMPACT), said Illinois is “on a bad trajectory.”

“Cases have been rising really sharply, especially in Illinois, where for the past four days we had more than 10,000 cases, which was the highest number of cases that a state had experienced,” said Vineet Arora, chief executive of the team.

Arora, who is also a hospitalist at the University of Chicago, is afraid the rate of infection will reach a point similar to New York at the height of its spring surge, “where physicians were having to decide, does this patient have a higher chance of surviving, or this patient?”

Maybe the Tribune will now revisit its irresponsible May 6 editorial that essentially said Pritzker should declare victory and ease up. This is what happens when you ease up too much.

* Which brings us to the evolving mayor of Springfield…

At the end of October, right before the record-breaking case numbers and positivity rates, Springfield Mayor Jim Langfelder was already worried about hospitals in Springfield.

“Are they bringing people in from outside that region?” Langfelder said in an Oct. 29 interview. “If so, that should stop immediately. We should take care of the ones within their service area. If it’s beyond that, we need to make a determination how to approach that.”

On Wednesday, Nov. 11, Langfelder eased his stance.

“When you’re in healthcare, you’re there to serve the public, so they’re not going to restrict healthcare,” Langfelder said.

HSHS St. John’s Hospital in Springfield confirmed this, saying they don’t plan on turning people away.

26 Comments

|

* Sun-Times…

The Illinois High School Association announced Wednesday that it has formally invited representatives from Governor J.B. Pritzker’s office and the Illinois Department of Public Health to its board meeting on Nov. 19.

“The board hopes to create a dialogue and build a more collaborative relationship with all the entities involved with developing sports policy in our state as everyone tries to navigate the myriad issues caused by the pandemic,” IHSA Executive Director Craig Anderson said. “The board’s decision to move forward with the IHSA basketball season was not meant to be adversarial. It was rooted in a desire to receive more direct communication and data from our state partners. They hope all the groups will see the mutual benefit of increased discourse and be represented at the meeting on November 19.”

The invite comes after only eight of the IHSA’s [813] member schools announced they would participate in the IHSA’s basketball season.

The board’s decision wasn’t meant to be adversarial? Right. They stood by silently while their supporters were picketing outside the homes of administration officials and told the Illinois Department of Public Health to shove their public health rules where the sun doesn’t shine and went full speed ahead for “the kids,” and, of course, their sweet income stream, some of it due to state law.

But this was completely predictable…

Without adhering to the COVID-19 guidelines set forth by the governor and the IDPH, insurance companies would not cover the liability costs for schools.

The IHSA administers a state-mandated liability insurance program for catastrophic injuries, so it should’ve known its plan was doomed. The IHSA is accustomed to getting its way, so perhaps the people who run the group thought they could bully the state into changing course.

Nope.

*** UPDATE *** WSIL TV…

The Southern Illinois University men’s basketball program has paused team activities due to positive COVID-19 test results, head coach Bryan Mullins announced on Thursday.

SIU will not participate in the Wade Houston Tipoff Classic in Louisville, Ky., from November 25-29, as previously scheduled.

“We have diligently followed the safety protocols established by our administration and local health officials, but as we’ve seen throughout the country, Covid cases can and will arise,” Mullins said. “We will resume preparation for the season as soon as our medical professionals deem it is safe to do.”

73 Comments

|

* November 9…

Dear President Harmon, Speaker Madigan, Leader Brady, and Leader Durkin,

As you are well aware, our state faces an immediate and significant set of financial challenges – revenue loss due to the continued economic impact of COVID-19, uncertainty regarding additional federal aid for state and local governments, need for maintaining vital state services that taxpayers expect, and significant revenue from the fair tax constitutional amendment now taken off the table. The situation calls for us as elected leaders to come together and develop a set of solutions with the goal of bringing our budget into balance.

To this end, my administration is continuing to take pro-active steps in an ongoing effort to responsibly manage our way through this current crisis, including undertaking cost reductions and efficiencies within executive branch operations. In addition, I’ve engaged in regular discussion with Congressional leaders and members about the need for support for replacement of COVID-related revenue losses by local and state governments.

While I have responsibility for making difficult yet necessary internal budget management decisions, this alone cannot solve the current challenge. As you are aware, statutory and court ordered limitations provide varying degrees of legal protections for a large portion of this year’s budget approved by the General Assembly. My predecessor and his administration made the decision to plunge the state into a fiscal disaster for two years in part by utilizing executive powers he did not legally possess. I refuse to follow that same path. With the current pandemic causing health, education and financial turmoil for working families, our state must address our budget challenges without delay.

Given the defeat of the fair tax and given the pandemic’s deepening effect on our fiscal situation as it wears on longer than expected, the time is now for us to act. Therefore, as an important first step, I will be convening a meeting with the two Democratic and two Republican legislative leaders. Our immediate focus should be on reconciling our FY21 budget and bringing it into balance this fiscal year. As you know, without federal coronavirus relief for the state (and local governments), budget stresses remain even in the current year. In short, your ideas, your input, and your feedback are critical at this moment. Ultimately and as always, the legislature will need to approve the efforts to balance our expenditures and revenues.

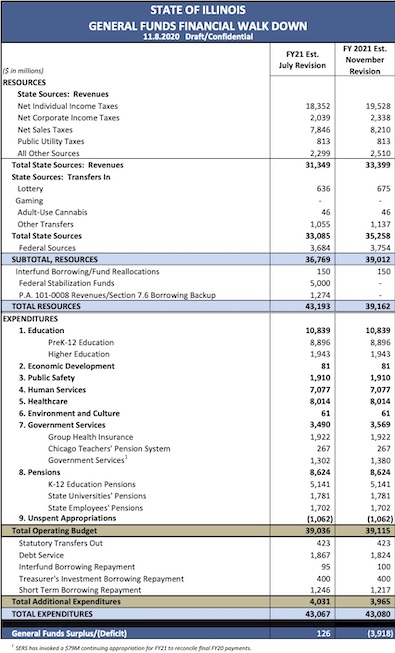

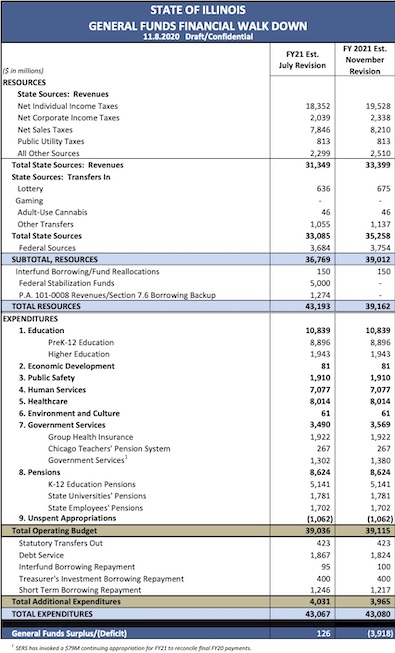

My Chief of Staff Anne Caprara will be reaching out to your respective offices to identify an agreeable date and time next week to convene this meeting which I hope could take place as soon as possible. While all of us have been asked about both potential cuts and revenue options in the wake of the defeat of the fair tax amendment and the impact the pandemic has had on our state’s revenues, I would suggest that the agenda for our first meeting focus on coming to an agreement on the size and scope of the deficit we face in the current fiscal year. For your review, I have enclosed a copy of the FY21 budget summary reflecting GOMB’s accounting and estimate of revenues and expenditures associated with the General Funds as of the date of this communication.

Thank you for your service to the State of Illinois. I look forward to our discussions ahead.

Sincerely,

Governor JB Pritzker

* Attachment…

We’re actually doing well with state revenues and state spending hasn’t exploded out of control. The problem is that the state relied on $5 billion from the federal government which hasn’t come through (and may not, considering the US Senate situation) and the failure of the graduated income tax. Because of that, the budget is $3.9 billion in the red.

* House Republican Leader Jim Durkin warned this could happen and he was not pleased with the governor’s letter…

“The House Republican Caucus saw this coming back in the early days of the pandemic, but instead of heeding any warning, the majority Democratic Party decided to go it alone and depend on higher taxes and more reckless spending,” Durkin wrote in a letter to Pritzker on Tuesday.

“Passing a budget based on hypothetical revenue and false promises from a now-failed tax increase was unconstitutional and totally disingenuous to the citizens of our state who depend on government services,” Durkin said.

Durkin urged Pritzker to use his authority to make unilateral cuts to bring the budget into balance. “I suggest you begin with the 6.5% cuts your office directed agencies to identify in 2019,” Durkin wrote.

Pritzker has said cuts alone will not be enough to address the state’s long-term structural deficits.

Also, keep in mind that cuts made half-way through a fiscal year have twice the impact that they do at the beginning of a fiscal year. A $3.9 billion cut in January, for instance, is equal to a $7.8 billion cut made during the previous July.

* Senate President Don Harmon was asked about this hole back in May…

Q: Was it responsible to put together a budget with so much borrowing? The Rauner administration, for example, had a $4 billion hole for the grand bargain.

A: There is so much we don’t know today that we hope to know in a few months. We don’t know the depths of the economic hit we’ve taken from this virus. We don’t know how much more we’re going to have to spend in order to respond to it. We don’t know whether the voters are going to approve a constitutional amendment in November. We don’t know how the federal government is going to respond, although I believe that they will. And we don’t know who is going to be in charge in Washington for the next four years. In the next several months, we’re going to know all of that, and that will give us much better information about how to put together a durable state budget.

And, as we all know by now, things didn’t quite go as they hoped. And now here we are.

I figure the state will borrow $5 billion from the Federal Reserve if the US Senate doesn’t come through and try to work things out over time.

What a mess.

* I’ll end this post with a quote from Professor John Jackson of the Paul Simon Public Policy Institute at SIU…

According to Jackson, in prevailing political theory, “the American people, and certainly I think the people of Illinois, are what are called symbolic conservatives and operational liberals. That is, they want low taxes. They don’t want any new taxes or new revenue increases whatsoever, and yet they also don’t want any cuts.”

Several years ago, the Senate Republicans proposed a “menu” of possible cuts that they said legislators could pick and choose from to balance the budget. The menu was their argument against a possible income tax hike. The Senate Democrats beat up the Republicans constantly for those “draconian” cuts and the SGOP messaging against tax increases was overwhelmed.

51 Comments

|

The news media is missing a great story

Thursday, Nov 12, 2020 - Posted by Rich Miller

* Finke…

“It’s not Madigan’s fault that they lost the two seats in southern Illinois because just what’s been happening. There’s no Democratic Party down there anymore,” Redfield said. “What the Democrats have been successfully doing is trading suburban seats for downstate seats.”

The problem for Madigan, Redfield said, is that the Democrats were expected to do a lot better in the suburbs than they did.

“It’s the expectations game and the money game,” Redfield said. “They spent an ungodly amount of money to not win seats.”

It looks like the House Democrats are going to come out of the suburbs with a wash. The HDems appear to have lost two seats. With some counting to go, Rep. Mary Edly-Allen of Libertyville is trailing by almost 1,600 votes (down from more than 4,000) and Rep. Diane Pappas of Itasca is losing badly. But they’re also picking up two seats. GOP Reps. Grant Wehrli and Allen Skillicorn both lost.

And, of course, the HDems lost two southern Illinois seats when Reps. Monica Bristow and Nathan Reitz both were defeated by Republicans. Reitz was expected. Bristow was given a shot at winning.

* The Downstate race that isn’t getting much, if any media attention is in the Rockford area, where Rep. John Cabello (R-Machesney Park) is currently ahead of Democrat Dave Vella by just 315 votes with a lot of votes yet to count (including “disinformation” about the tallying).

Rep. Cabello was the first Illinois elected official to endorse Donald Trump for president in the 2016 campaign and now it’s possible that he may not be reelected even though Trump was on the ballot.

Unions were once a Cabello ally, but they went all-out to defeat him in 2018 and again this year because he flipped on organized labor over an important prevailing wage bill. Their candidate this year is the grandson of the father of Rockford Democratic politics, the late Rep. Zeke Giorgi, a mentor to embattled House Speaker Michael Madigan. The state even has a Rockford building named after Zeke. And Madigan was a huge issue in the campaign.

At one point, a video of Cabello went semi-viral. The video showed him saying to Vella during a televised debate: “I call bullsh*t. I cannot believe that you sit here and tell the people of the 68th District that you will not vote for Mike Madigan.” The video (click here to watch it) then played a clip of a Snoop Dogg song as “Thug Life” flashed on the screen and a white ballcap bearing that phrase was superimposed on Cabello’s head along with sunglasses on his face and a gold chain around his neck.

How are y’all missing this?

Cabello was also an early and outspoken opponent of the Democratic governor’s stay at home order, even filing his own lawsuit (which he eventually withdrew). He has been the most vocal critic of the governor’s decision to release inmates early to avoid prison virus outbreaks. Heck, he even held an in-person campaign event right before election day. As mentioned elsewhere on the blog today, Winnebago County’s 7-day average positivity rate is 18.4 percent and its overwhelmed local public health department has requested hospital bed sets from the state.

And to wrap it all up in a nice bow, Rockford has been the scene of several Black Lives Matter protests and Cabello is a city cop who lives in a blue-collar suburb that is less than three percent Black.

It really could be a great news story, perhaps even nationally, but it’s mostly being ignored. Ballot counting will end next Tuesday, so maybe they’ll pay attention then.

* In the meantime, check out what one of Cabello’s supporters made…

I rest my case.

13 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|