* Filed by the state with the Illinois Supreme Court today. The opening and closing paragraphs…

On July 2, 2020, the Circuit Court of Clay County entered an unenforceable and nonappealable partial summary judgment order against Defendant-Petitioner J.B. Pritzker in his official capacity as Governor of the State of Illinois. On August 7, 2020, that court ordered the Governor to appear in the Clay County Courthouse on Friday, August 14 and show cause why he should not be held in indirect civil contempt for his purported disregard of the July 2 order. The Governor requests that this Court exercise its supervisory authority under Illinois Supreme Court Rule 383 on an emergency basis to immediately stay the contempt hearing set for August 14, 2020, pending the resolution of this motion. Additionally, the Governor asks this Court to exercise its supervisory authority to answer the underlying legal question raised by this case, which is whether the Governor acted within the scope of his authority under the Illinois Emergency Management Agency Act (“Act” or “IEMAA”), 20 ILCS 3305/1 et seq., and Illinois Constitution in issuing disaster proclamations and executive orders in response to the Covid-19 pandemic. […]

Defendant-Petitioner J.B. Pritzker, in his official capacity as Governor of the State of Illinois, requests that under Illinois Supreme Court Rule 383, this court immediately stay the contempt hearing scheduled for August 14, 2020, in this case pending the resolution of this motion. Additionally, the Governor requests that this Court answer the underlying legal question raised by this case, which is whether the Governor has acted within the scope of his authority under the Act and Illinois Constitution in issuing disaster proclamations and executive orders in response to the Covid-19 pandemic. In the course of definitively answering that important question, this Court should stay the proceedings below, expedite the response to this motion, and ultimately reverse the circuit court’s July 2, 2020 order.

18 Comments

|

Question of the day

Monday, Aug 10, 2020 - Posted by Rich Miller

* This Tribune editorial omits some important historical context to make its point. Lee Daniels’ Republicans had the map for ten years, but Daniels only controlled the chamber for two, which eventually caused his top contributors to soften their support. His longtime political patron was Gov. George Ryan, who, along with the Medical Society, saved him from a coup attempt after the 1990 electoral debacle. Ryan who was on his way out in 2002 and appeared headed for his own legal troubles. Attorney General Jim Ryan was the new party standard-bearer and he was running for governor on an ethics reform platform. And the then-Speaker of the US House, Dennis Hastert, wanted his own guy in as the state’s House Republican Leader…

In June 2002, then-Illinois Republican Party Chairman Lee Daniels abruptly announced his resignation from that party post as pressure mounted, including from the GOP state attorney general, to remove unwanted “distractions” in an election year. Daniels and his chief of staff had fallen under the radar of federal prosecutors who were investigating whether GOP staff members did campaign work on state time. […]

Not long after, the House Republican caucus voted 33-18 to install a new House leader, Rep. Tom Cross, after Daniels lost support among his colleagues in that role too. Daniels had not been charged and was only peripherally linked to a time sheet scandal, but the whiff of a federal corruption probe pushed his members to force him out of leadership. […]

Shortly after [Daniels’ former chief of staff Michael Tristano’s] indictment in 2005, Daniels announced he would retire from his remaining position as a state representative. Daniels was not implicated in Tristano’s indictment, and he was never charged with wrongdoing. But he left anyway. A top GOP party and policy leader in the state who once held three positions of power was gone, pushed out by his own members and a nudge from the previous GOP attorney general, Jim Ryan, who had forwarded corruption allegations to federal investigators.

Under the lens of compare and contrast, then and now, one takeaway is this state’s breathtaking tolerance for corruption. It has settled into the system of governance and politics as its own permanent institution. Corruption is an expected byproduct of serving in public office, like wind makes waves.

Now it’s happening again with Madigan. He’s at the heart of a wide-ranging bribery probe involving utility giant ComEd. He has been served with subpoenas. At least three of his top aides’ and allies’ homes have been raided, along with other confidants targeted in inquires involving red-light camera bribes, sexual harassment payoffs, property tax clout and nepotism.

* The Question: Your thoughts on what Madigan should do now?

34 Comments

|

|

Comments Off

|

* Cook County Republican Party v. JB Pritzker et al, filed today in federal court in Chicago…

1. Voting is a fundamental, constitutional right that is central to our American democracy.

2. Governor J.B. Pritzker violated this right by signing into law a partisan voting scheme that is designed to harvest Democratic ballots, dilute Republican ballots, and, if the election still doesn’t turn out the way he wants it, to generate enough Democratic ballots after election day to sway the result. See Public Act 101-0642 a/k/a SB 1863, 101st General Assembly (“SB 1863”). The remaining Defendants are charged with carrying out this partisan scheme.

3. This civil action for declaratory and injunctive relief is filed to stop SB 1863 from going into effect. The claims arise under the First and 14th Amendments of the U.S. Constitution; 42 U.S.C. Section 1983; 28 U.S.C. § 2201(a); and Article III, Section 4 of the Illinois Constitution.

* There are a ton of political claims made in the “Factual allegations” section…

The Democrats in the Illinois General Assembly snuck through SB 1863 in five days, from May 18-22, 2020, by hijacking a bill about the Freedom of Information Act, amending it to advance their partisan election agenda, and rushing it to passage before the people of Illinois could weigh in with their opposition.

SB 1863 was introduced in the Senate on February 15, 2019, as an amendment to the Freedom of Information Act, passed the Senate on April 4, 2019, underwent First Reading in the House on April 9, 2019, underwent Second Reading in the House on May 22, 2019, and languished for a year.

SB 1863 was suddenly rewritten in 2020 by House Floor Amendment 5, which was filed on May 19, 2020, and House Floor Amendment 6, which was filed on May 21, 2020. The bill passed the House later the same day, with only one Republican voting in favor. The Senate passed it the next day, with no Republicans voting in favor. […]

SB 1863 creates a partisan voting scheme that is designed to directly disenfranchise voters disfavored by Pritzker, to dilute the votes of those disfavored by Pritzker, and to violate the secrecy of voting in Illinois.

Many aspects of SB 1863 work together to create the scheme by which Pritzker plans to disenfranchise the Republican Party

The scheme begins by putting as many ballots into play for the election as possible by mailing an application for a mail-in ballot to every voter who voted in the 2018 general election, the 2019 consolidated election, or the 2020 general primary election. 10 ILCS 5/2B-15(b). That amounts to roughly 5 million mail-in ballot applications, which were supposed to have been sent by August 1.

A high likelihood exists that applications were sent to people who may no longer be eligible to vote in Illinois. For example, the Wall Street Journal discovered that at least one former voter in Washington state recently received his ballot in the mail at his new address in Texas.

The states that use mail-in voting took years to perfect their process as they enlarged eligibility gradually before launching statewide. Implementing vote- by-mail is a learning process. State officials must identify qualified vendors for printing ballots, develop tracking systems so voters can be assured their ballots will arrive on time, and develop methods of reviewing signatures that reduce the number of rejected ballots. Doing so takes “decades, not months.”

Attempting to implement a process overnight in a state as large as Illinois will inevitably lead to thousands of lost and delayed ballot applications and ballots. A recent election in another large state that rushed into voting by mail shows the perils that lie ahead for Illinois. Over 80,000 New York City Democratic presidential primary ballots were not counted in the June 23 election because they arrived late, lacked a postmark, failed to include a signature, or contained other defects. This number meant that a staggering 21% of the votes cast were not counted.

The hurried nature of implementation is not the only hurdle Illinois faces. Illinois state government is one of the most inept in the Union, and the public has no reason to expect a vote-by-mail system to work any more smoothly than a variety of projects Illinois has stumbled through in recent years.

For example, Illinois has suffered more than 120,000 cases of unemployment fraud during the ongoing COVID-19 pandemic.

And it goes on and on like that for a while.

* To the meat of it…

Among many of the practical deficiencies of the Illinois vote-by-mail scheme is that it does not comport with recommendations issued by the United States Postal Service.

According to the USPS Inspector General, “ballots requested less than seven days before an election are at a high risk of not being delivered, completed by voters, and returned to the election offices in time.”

But Illinois allows voters to request an absentee ballot as late as October 29, 2020 – three business days before the election.

Indeed, the Inspector General’s report indicates that the Illinois deadline “put[s] ballots at high risk of not being delivered to voters before an election.”

Also, the Inspector General’s report states that “election offices should be educated on the benefits [that Intelligent Mail Barcodes] provide.” Id. at 7. Intelligent Mail Barcodes (IMbs) allow mailers and the Postal Service to track each ballot and would enable the Postal Service and election authorities to track ballots and identify delays.

SB 1863 makes no provision that mail ballots be tracked with IMbs or any other tracking device; therefore, thousands of voters will be disenfranchised when their ballots are lost in the mail.

For the ballots that are received by election authorities, the system for counting so many mail-in ballots will be overtaxed, leading to lax procedures for ensuring the secrecy of the ballot.

In addition to incompetence, SB 1863 will breed corruption. While other states may use mail-in voting, implementing a system overnight “in a state as notorious for election fraud as Illinois is” will open the door to criminal activity. Nader v. Keith, 385 F.3d 729, 733 (7th Cir. 2004). As the Seventh Circuit Court of Appeals already recognized, “Oregon, for example, has switched to a system of all- mail voting. O.R.S. § 254.465. But what works in the state of Oregon doesn’t necessarily work in Illinois, especially in light of the colorful history of vote fraud we’ve seen.”

The provision of the voting scheme that is most important to committing voter fraud is ballot harvesting. SB 1863 allows for ballot harvesting, in which a paid, partisan operative may collect Democratic mail-in ballot applications and ballots to ensure that they are turned in and counted and may collect Republican mail-in ballot applications and ballots to ensure that they are not turned in and counted.

And, again, it goes on like that for a while.

* To the postal service aspect, here’s Bernie…

As he was planning last month for the rollout of the state’s new rules concerning mail-in ballots for the Nov. 3 election, Sangamon County Clerk Don Gray said he wouldn’t be using the option of having drop-boxes.

Gray, whose office oversees elections in the county, had said that he had “concerns about the chain of custody of ballots” if they weren’t mailed or brought to his office in person during business hours.

But after receiving a copy of an ominous letter from the general counsel of the United States Postal Service, Gray is rethinking his position.

″… (U)nder our reading of Illinois’ election laws, certain deadlines for requesting and casting mail-in ballots are incongruous with the Postal Service’s delivery standards,” said the July 30 letter from Thomas Marshall. “This mismatch creates a risk that ballots requested near the deadline under state law will not be returned by mail in time to be counted under your laws as we understand them.”

That USPS letter is here.

*** UPDATE *** Jordan Abudayyeh in the governor’s office…

This lawsuit is a desperate political attempt to suppress the vote.

24 Comments

|

* You gotta figure this money will go fast. Like lightning fast…

Illinois residents struggling to pay their rent because of a lost a job or reduced income due to COVID-19 can now apply for state assistance through the Emergency Rental Assistance program.

“For too many people weathering this crisis begins with keeping a roof over their family’s heads,” Gov. J.B. Pritzker said Monday. “Even before this pandemic, over 70% of low-income families dedicated more than half (of their) income to rent, and now nearly 1 in 3 renters are worried about (their) ability to pay August rent.”

The Illinois Housing Development Authority has set aside $150 million in federal funds to help approximately 30,000 residents pay their rent due to a pandemic-related loss of income. To be eligible for the grant, renters must have fallen behind on rent on or after March 1 and have a household income at or below 80% of the area median income. Interested renters can also check their eligibility online.

The one-time $5,000 grants will be paid directly to a renter’s landlord to pay back missed rent and cover rent payments through December.

I mean, before this crisis began, 450,590 Illinois households were classified as “extremely low income,” which is 27 percent of the approximately 1.8 million renting households in this state.

I don’t know how many times I have to say this, but the federal government really needs to get its act together.

9 Comments

|

* Press release…

The Illinois Department of Public Health (IDPH) today announced 1,319 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 1 additional confirmed death.

- Cumberland County: 1 female 90s

Currently, IDPH is reporting a total of 195,399 cases, including 7,637 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 32,353 specimens for a total of 3,106,341. The preliminary seven-day statewide positivity for cases as a percent of total test from August 3 – August 9 is 4.1%. As of last night, 1,481 people in Illinois were reported to be in the hospital with COVID-19. Of those, 352 patients were in the ICU and 138 patients with COVID-19 were on ventilators.

Following guidance from the Centers for Disease Control and Prevention, IDPH is now reporting both confirmed and probable cases and deaths on its website. Reporting probable cases will help show the potential burden of COVID-19 illness and efficacy of population-based non-pharmaceutical interventions. IDPH will update these data once a week.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. For health questions about COVID-19, call the hotline at 1-800-889-3931 or email dph.sick@illinois.gov.

* Sunday…

The Illinois Department of Public Health (IDPH) today announced 1,382 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 8 additional confirmed deaths.

Cook County: 1 female 20s, 1 female 40s, 1 male 40s, 1 male 50s, 1 female 60s, 2 males 60s

Pulaski County: 1 male 60s

Currently, IDPH is reporting a total of 194,080 cases, including 7,636 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 41,354 specimens for a total of 3,073,988. The preliminary seven-day statewide positivity for cases as a percent of total test from August 2 – August 8 is 4.1%. As of last night, 1,488 people in Illinois were reported to be in the hospital with COVID-19. Of those, 322 patients were in the ICU and 114 patients with COVID-19 were on ventilators.

* Saturday…

The Illinois Department of Public Health (IDPH) today announced 2,190 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 18 additional confirmed deaths.

Bureau County: 1 female 80s

Cook County: 1 male 40s, 2 males 70s, 1 male 80s

DuPage County: 1 female 80s

Kane County: 1 male 80s, 1 female 90s

Lake County: 1 male 60s

Madison County: 1 female 70s, 1 male 80s

Mercer County: 1 female 80s

Rock Island County: 1 male 70s, 1 male 80s

St. Clair County: 1 male 60s

Whiteside County: 1 male 80s

Winnebago County: 1 female 60s, 1 male 70s

Currently, IDPH is reporting a total of 192,698 cases, including 7,631 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 48,016 specimens for a total of 3,032,634. The preliminary seven-day statewide positivity for cases as a percent of total test from August 1 – August 7 is 4.2%. As of last night, 1,538 people in Illinois were reported to be in the hospital with COVID-19. Of those, 338 patients were in the ICU and 125 patients with COVID-19 were on ventilators.

6 Comments

|

Lather, rinse, repeat

Monday, Aug 10, 2020 - Posted by Rich Miller

* July 2008…

With gun violence at a crisis, Gov. Rod Blagojevich on Wednesday said he is in talks with Illinois State Police and the Illinois National Guard to see if more police officers can be deployed to the streets of Chicago.

* April 2010…

Two lawmakers who believe violence has become so rampant in Chicago that the Illinois National Guard must be called in to help made a public plea to Gov. Pat Quinn on Sunday to deploy troops.

A recent surge in violent crime, including a night last week that saw seven people killed and 18 wounded — mostly by gunfire — prompted the request from Chicago Democratic Reps. John Fritchey and LaShawn Ford. They were joined by Willie Williams, whose son was shot and killed in 2006.

* August 2016…

As Chicago capped off its deadliest month in almost 20 years, Gov. Bruce Rauner on Wednesday ruled out the idea of deploying the National Guard to help combat street violence in the city, saying that to do so would be an “emotional” reaction that “wouldn’t make sense.”

* Today…

Illinois House Republican Leader Jim Durkin (R-Western Springs) released the following statement on the looting, rioting and violence that has occurred in the city of Chicago:

“Once again, Illinois government has failed to protect its residents and businesses. It is time to bring in the National Guard and accept any and all federal assistance to stop the chaos that is destroying our state. No more excuses. No more failures.”

Also today…

Yes, the Guard was called out in the wake of the George Floyd protests, but they were kept on the perimeter.

32 Comments

|

Report: Big Ten cancels football season

Monday, Aug 10, 2020 - Posted by Rich Miller

* Detroit Free Press…

The Big Ten has voted to cancel the 2020 college football season in a historic move that stems from concerns related to the ongoing coronavirus pandemic, multiple people with knowledge of the decision confirmed to the Free Press.

The sources requested anonymity because they were not authorized to speak publicly on the decision. A formal announcement is expected to Tuesday, the sources said.

The presidents voted, 12-2, Sunday to end the fall sports in the conference. Michigan and Michigan State — which both has physicians as presidents — voted to end the season, sources said. Only Nebraska and Iowa voted to play, Dan Patrick said on his radio show Monday.

The move comes two days after the Mid-American Conference became the first in the FBS to cancel ts season, and sources told the Free Press the Big Ten is trying to coordinate its announcement with other Power Five conferences.

35 Comments

|

|

Comments Off

|

* Just remember that anyone can sue anyone for just about anything, but this may leave a mark…

Earlier today, a putative class of Commonwealth Edison customers filed a civil racketeering lawsuit against Illinois Speaker of the House Michael Madigan, Commonwealth Edison Company (“ComEd”), ComEd’s parent Exelon Corporation, and several other defendants.

Stuart Chanen and Ariel Olstein of Chanen & Olstein; Patrick Giordano of Giordano & Associates, Ltd.; and Paul G. Neilan of The Law Offices of Paul G. Neilan, P.C., all Chicago-area lawyers, filed a two-count class action Complaint in federal court under the Racketeer Influenced and Corrupt Organizations Act (“RICO”), Potter et al. v. Madigan et al., 20 cv 4675, Dkt. 1 (N.D. Ill. Aug. 10, 2020).

The lawsuit, a copy of which is attached, alleges one count of racketeering under RICO’s civil provisions and one count of RICO conspiracy. The lawsuit asks for the following relief for ComEd’s consumers:

1. Payment by Defendants of at least $450 million in damages to ComEd consumers, including the $150 million in ill-gotten gains ComEd has admitted to and an additional $300 million under the RICO Act’s treble damages provision.

2. Immediate injunctive relief preventing Michael Madigan from participating in legislative activities involving electricity matters affecting Commonwealth Edison and Exelon.

3. Immediate injunctive relief preventing Michael Madigan from continuing to Chair the Democratic Party of Illinois and running it as a corrupt organization.

4. Additional injunctive relief enjoining ComEd from continuing to charge consumers for subsidies of Exelon-owned nuclear power plants.

Attorney Stuart Chanen, a former Assistant U.S. Attorney who in private practice has won major civil rights cases on behalf of wrongfully convicted individuals, said: “We filed our civil RICO case now to protect Illinois ratepayers from further damage by Michael Madigan – in both his capacity as Speaker and as Chair of the Democratic Party of Illinois – and also to get our clients back the damages they have suffered from ComEd’s and Madigan’s bribery scheme.”

Mr. Chanen pointed out that neither the U.S.’s July 17 federal criminal case against ComEd, nor the fact that Madigan has not yet been included in that case, prohibit ComEd customers from obtaining injunctive relief against Madigan or from pursuing damages against ComEd in a civil RICO action.

In addition to Michael Madigan, among the prominent figures named as Defendants, are: former ComEd CEO Anne Pramaggiore; former ComEd EVP John Hooker; former ComEd SVP Fidel Marquez; Jay Doherty, the longtime President of the City Club of Chicago; and former City of Chicago Alderman Michael R. Zalewski.

In crafting the Complaint, Plaintiffs’ lawyers rely heavily on the admissions ComEd had already made in its Deferred Prosecution Agreement with U.S. Attorney John Lausch. ComEd’s admissions strongly implicated all of the Defendants. The Complaint puts particular emphasis on ComEd’s admission that it profited from the bribery scheme in excess of $150 million.

Because ComEd admitted the over $150 million bonanza and because the RICO statute specifically includes a treble damages award to punish racketeers, Attorney Patrick Giordano said that ComEd should carefully consider this choice: “Pay back the $150 million to ratepayers now or pay a joint and several $450 million judgment down the road.”

This case is not these lawyers’ first battle with ComEd. Attorney Patrick Giordano has 40 years of experience in litigation against ComEd and has won over $3 billion in refunds and rate reductions for consumers. Paul Neilan has twenty years of experience litigating against ComEd, including a 2013 lawsuit in Cook County challenging one of the very statutes, the Energy Infrastructure Modernization Act (“EIMA”), which we now know was procured through a bribery scheme. Mr. Chanen was co-counsel with Mr. Neilan in that case, Hawkins v. Commonwealth Edison Company, 2015 IL App (1st) 133678.

Mr. Neilan summed up matters this way: “Back then, our clients were the lone wolves crying foul. We knew that EIMA was bad for the ratepayers and obliterated any true regulation of ComEd as a utility. We also knew that Speaker Madigan had crammed the legislation through the General Assembly – we just didn’t know then that he did so as payback for numerous bribes ComEd had paid to his associates. But we know it now.”

No hearing date has been set in this case.

Some bold claims there.

The complaint is here.

*** UPDATE *** ComEd responded to Center Square…

“We apologize for the past conduct that did not live up to our values and have made significant improvements to our compliance practices to ensure that nothing like it ever happens again,” said ComEd Vice President of Communications Paul Elsberg. “The improper conduct described in the deferred prosecution agreement, however, does not mean that consumers were harmed by the legislation that was passed in Illinois.”

“The DPA makes no such allegations, and in fact the bipartisan legislation resulted in substantial benefits for ComEd’s customers, including 70 percent improved reliability since 2012 and billions of dollars in savings for customers, while residential customers’ bills are lower than they were nearly a decade ago and ComEd recently requested a third delivery rate decrease in a row, its fifth in 10 years,” Elsberg said. “ComEd has made some of the largest improvements in service at the best value of any utility serving a U.S. major metro area. This in no way excuses the conduct described in the DPA, but that is a distinct issue from the effect of the legislation for ComEd’s customers.”

“We filed our civil RICO case now to protect Illinois ratepayers from further damage by Michael Madigan – in both his capacity as Speaker and as Chair of the Democratic Party of Illinois – and also to get our clients back the damages they have suffered from ComEd’s and Madigan’s bribery scheme,” said attorney Stuart Chanen.

37 Comments

|

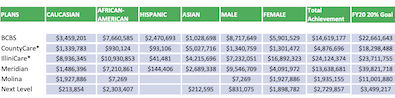

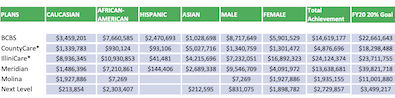

* After weeks of prodding, HFS finally released the racial data for Medicaid managed care providers. And the results are not pretty. Press release…

State Rep. Emanuel “Chris” Welch, D-Hillside, is calling on Illinois Medicaid providers to face consequences for failing to meet fair contracting goals for businesses owned by racial and ethnic minorities and women.

“As the largest health insurance program in Illinois, Medicaid offers the ability for the state and its health care partners to demonstrate a commitment to equity and inclusion in contracting for services,” Welch said. “Unfortunately, most providers in the Illinois Medicaid program have failed to meet fair contracting goals. This failure is a disservice to the patients served by Medicaid, the health care professionals that serve those patients, and all the people of Illinois.”

The Illinois Department of Healthcare and Family Services (HFS) recently released fair contracting data for Illinois Medicaid providers after a request by Welch. The six Medicaid providers for the state, Blue Cross and Blue Shield, CountyCare, IlliniCare, Meridian, Molina, and Next Level, met just 52% of their combined fair contracting goal. Only one of the six providers, IlliniCare, met or exceeded fair contracting goals. Without the inclusion of IlliniCare, the other five providers met less than 40% of their combined fair contracting goals.

Welch is demanding that HFS explore penalties against Medicaid providers for failing to meet fair contracting goals. Penalties could include clawing back money paid to the providers, fining the providers, or banning them from doing business with the state.

“Economic justice is a critical aspect of racial justice and the goal of fair contracting standards is to advance economic justice. Unfortunately, most health care providers in Medicaid are failing to meet fair contracting goals and failing to meet the urgent need for economic and racial justice,” Welch said. “The health care providers that have failed to meet contracting goals for Medicaid need to face consequences for their lack of commitment to economic justice and fair contracting.”

* Click the pic for a larger view, but take a look at these numbers…

CountyCare is run by Cook County. I cannot imagine how President Preckwinkle justifies those numbers. An $18.8 million goal and Black-owned businesses make up less than a million bucks?

And does it look to you like Molina is even trying?

This is not some new program that was foisted on companies a few months ago. HFS needs to crack down hard on managed care groups that don’t or won’t live up to statutory expectations. And the maximum allowable $100,000 fines will be just a drop in the bucket. I mean, that’s equivalent to the cost of maybe one employee.

Our politicians like to talk a lot about our state’s diversity, yet the state can’t even meet smallish goals on huge multi-billion-dollar programs. It’s just downright shameful.

20 Comments

|

* Tribune…

Gov. J.B. Pritzker was joined by several medical experts Sunday afternoon to urge Illinoisans to mask up and help stop the spread of the coronavirus.

At a news conference at Northwestern’s Prentice Hospital, Pritzker called mask requirements and physical distancing during a pandemic “common sense,” noting the majority of Americans support a mask mandate, and that health professionals with whom he has spoken all count masking and distancing among the most effective ways to slow the virus’s spread.

“In the last few months, research has evolved from the early days of the coronavirus, when it was shown that wearing masks protected others you’re with,” Pritzker said. “Now, study after study after study has shown us that if you wear a mask, it protects you too.”

* Sun-Times…

Pritzker said having rules requiring masks and proper social distancing makes “common sense.” But his new rule changes were met with some opposition.

The Illinois Retail Association on Friday issued a statement, saying Pritzker should focus on the customers who refuse to wear a mask rather than “demonize innocent businesses.” In the political realm, Illinois House Republican leader Jim Durkin on Friday called on Pritzker to “abandon his mask rule” and work with legislature on the issue.

On Sunday, Pritzker said a public health crisis shouldn’t be politicized.

“The worst possible outcome for public health right now is to turn this into political football,” he said. “There’s an unfortunate tendency in our politics these days to dig in your heels in a debate — but our actions in a public health crisis should be inspired not by elected officials, but by the scientists and doctors and researchers who know this stuff firsthand.”

* NBC 5…

Pritzker’s comments come as the state continues to face an increase in coronavirus cases, with nearly 1,400 more cases reported Sunday alone. The state’s 7-day rolling positivity rate currently sits at 4.1%, which is significantly lower than it was at the peak of the pandemic, but is much higher than it was at the metric’s low-point in June.

The governor says that the new rules on enforcement actions are designed not to punish violators, but to encourage them to adhere to rules that many businesses and individuals are following across the state.

“We’re doing this for the businesses that are following the rules while their competitors flout them,” he said. “We’re doing this for the people who have to work in the stores where their bosses won’t enforce public health rules, thereby putting their lives and health at risk.”

* Some press releases issued yesterday. From Illinois State Medical Society President Robert W. Panton…

I was proud to stand with Governor Pritzker today to demonstrate the Illinois State Medical Society’s support for widespread public mask use. It is incredibly important that Illinoisans take mask use seriously. Our state can’t bring any semblance of normal back if our COVID-19 infection rates continue to increase. Illinois is in real danger of a major setback and the likely reintroduction of more restrictions. Businesses will suffer because the economy will continue to struggle if the pandemic is not contained. Not to mention the unnecessary suffering and deaths that this virus brings with it.

The simple action of mask use will make a huge difference. To those of you wearing masks and social distancing. Good job! To those of you choosing not to wear a face covering, listen to your doctor. Wear a mask.

* A.J. Wilhelmi, President & CEO of the Illinois Health and Hospital Association…

The Illinois Health and Hospital Association (IHA) and the hospital community strongly support the Governor and IDPH in taking this decisive action – based on public health and science – to protect Illinoisans against a rapidly spreading, deadly pandemic. Numerous studies demonstrate that face coverings are highly effective in slowing the spread of the coronavirus, which is critically important now as communities across the state are seeing troubling increases in new COVID-19 cases. We respectfully urge the Joint Committee on Administrative Rules to allow the emergency rules on face coverings to move forward to help ensure the health and safety of students and teachers, employees and customers, healthcare professionals who are on the frontlines providing lifesaving care, and our loved ones and neighbors.

* George N. Miller, board member of the Illinois Association of Safety Net Community Hospitals (ASNCH) and President and CEO of The Loretto Hospital…

As safety-net hospitals, we have seen firsthand the devastating effects that the COVID-19 pandemic has taken on some of the vulnerable communities in our state, disproportionately affecting low-income and minority populations. The toll this pandemic has taken on safety net healthcare providers has never been more evident, exhausting what limited resources and scarce reserves they have to help provide care and services to an overwhelming number of patients. The time has come and passed for there to be policies put in place to help protect people from further exposure and provide consequences for those who knowingly disregard them, putting everyone around them at risk.

We stand in support of the governor’s proposed rules requiring face coverings for businesses, schools, and childcare providers. It is up to our elected leaders to make the decisions needed to help stop the spread of COVID-19, and while they are never easy, they are now more than necessary. Black and brown communities have unfairly suffered the brunt of this pandemic since the beginning, with a loss of life and economic activity that will take years to recover from. These proposed rules are a more than reasonable step to help lower the transmission of this virus and ultimately help halt the pandemic that has devastated the communities we serve.

* Illinois Public Health Association…

On behalf of the 88 certified local health departments our association represents, we stand in support of these emergency rules proposed by the governor to help stop the spread of COVID-19 and protect the health of the public. The last few days have shown an alarming increase of COVID-19 cases, and it’s clear that in order to protect the safety and wellness of our communities, something must be done to enforce the needed precautions to help save lives. Leadership in these uncertain times requires tough decisions that are rooted in fact and science to help slow the spread of this pandemic, and those who knowingly put others at risk of exposure must be held accountable.

These proposed rules allow for multiple opportunities and flexibility to help businesses and others come into compliance. As frontline defenders of the public’s health, we have a responsibility to support initiatives that are proven to help prevent the spread of this virus, and we believe these proposed rules are a measured and necessary step to reduce future transmission of coronavirus and ultimately save many lives across our state. It is incumbent on all of us to do our part to keep Illinois citizens safe. We implore the public to voluntarily comply with these emergency rules in order to combat the spread of COVID-19.

* Chicago is not a member of the state public health association, but the city’s public health commissioner, Dr. Allison Arwady, released this statement yesterday…

Wearing masks and practicing proper social distancing are absolutely vital to containing the spread of this virus. We have seen a recent uptick in cases so need everyone to continue to follow this and other health guidance as the response to COVID-19 continues.

29 Comments

|

* Background is here if you need it. Press release…

On p. 22 of its new Credit Outlook released today (attached), Moody’s notes last week an appellate court for the State of Illinois (rated Baa3/negative outlook) reversed a lower court’s dismissal of a case challenging approximately $14 billion in outstanding general obligation (GO) debt for non-capital needs. The ruling is credit negative for the state because it prolongs a legal challenge that, while unlikely to prevail, carries severe risk and limits the state’s financial options at a time when the coronavirus pandemic is weighing on revenue. A court-ordered debt service disruption would harm bondholders and other parties, as well as the state’s capital market access.

Nothing in the appellate court opinion signals support for the plaintiff’s stated goal of forcing the state to stop paying debt service on bonds still outstanding from a $10 billion pension issue in 2003 and a $6 billion payment backlog financing issue in 2017. The state’s debt also includes $13 billion of GO bonds for capital projects and another $1.2 billion of one-year GO notes issued under state law allowing borrowing for unexpected deficits. We still view an ultimate ruling in favor of the plaintiff as highly unlikely, in view of the state’s constitutional power to borrow for statutorily defined needs.

An appellate court ruling at this stage supporting the lower court (and dismissing the case) could have settled questions on the state’s ability to use statutorily authorized debt for pension or bill-payment purposes and potentially alleviated some of the investor concern that has driven up Illinois’ borrowing costs compared with other issuers. The state’s fiscal year 2021 (ending June 30, 2021) general fund budget includes the potential issuance of about $1.3 billion in additional backlog bonds, which could provide a cushion if budget pressures intensify in the fiscal year’s second half. The existence of litigation against the backlog bonds would likely keep the state from using this option even if voters in November defeat a proposal to allow the state to raise revenue by imposing a progressive income tax.

Moody’s declaration of “credit positive” or “credit negative” does not connote a rating or outlook change. It is indicative of the impact of a distinct event or development as one of many credit factors affecting the issuer.

5 Comments

|

* AP…

Trump announced an executive order Saturday that extends additional unemployment payments of up to $400 a week to help cushion the economic fallout of the pandemic. Congress had approved payments of $600 a week at the outset of the coronavirus outbreak, but those benefits expired Aug. 1 and Congress has been unable to agree on an extension. Many Republicans have expressed concern that a $600 weekly benefit, on top of existing state benefits, gives people an incentive to stay unemployed.

But under Trump’s plan, the $400 a week requires a state to commit to providing $100.

Many states are already facing budget crunches caused by the pandemic. Asked at a news conference how many governors had signed on to participate, Trump answered: “If they don’t, they don’t. That’s up to them.”

Trump expressed a different view on Sunday night, following a day of state officials questioning how they could afford even $100 per person in additional weekly payments. He told reporters as he returned to Washington that states could make application to have the federal government provide all or part of the $400 payments. Decisions would be made state by state, he said.

* CNN…

Because Congress has not authorized an extension of extra federal unemployment assistance, the state will have to set up an entirely new system to deliver the additional aid.

“The state has to enter an agreement saying not only can they pay the benefit, but that they have some ability to administer the benefit,” said Michelle Evermore, an unemployment expert at the National Employment Law Project.

Building a brand new program could take states months to accomplish, Evermore said. She added Trump needed to do it this way because “in order for states to administer a benefit it has to be authorized by Congress, so they can’t use their administrative systems to pay a benefit that hasn’t been authorized by Congress.”

Few will be helped. Evermore, one of the nation’s leading experts on unemployment, told CNN she considered the chances of this effort helping many of the newly unemployed due to Covid-19 “low.”

Lastly, according to the memorandum, an individual can only receive the $300 federal benefit if he or she first qualifies for $100 in aid from their state. Evermore said this will cut out a large group of people. “There are so many problems with people getting a benefit under this,” she said.

* Statement from Gov. JB Pritzker…

Serious problems require serious leadership, which is why it’s a shame Donald Trump is in the White House. The President needs to do what’s right and work with Congress to pass a comprehensive aid package that supports working families instead of legally questionable theatrics.

19 Comments

|

* My weekly syndicated newspaper column…

“I need to be able to look myself in the mirror every day,” was how Rep. Terra Costa Howard (D-Glen Ellyn) explained to me recently why she decided to call for House Speaker Michael Madigan’s resignation.

“More importantly,” the freshman suburban Democrat said, “I had to look at my daughters and remind them what it means to do what’s right.”

Costa Howard said she didn’t take a poll before making her decision. “My data collection is what I hear when I talk to people, the emails I receive, the comments that are on my Facebook pages. That speaks volumes,” she said. “I live in a community where I am out publicly all the time, so I talk to people all the time.” And they have all been giving her an earful about Madigan.

“There are people who are unhappy that I stepped out on this,” she said when pressed. And some of those folks run labor unions. “We have labor unions who are upset. They’re disappointed that I would say anything.”

But she quickly pointed to her own pro-labor voting record, saying, “I’m not really sure how much more I can say about where I stand about unions. It’s incredible to me that anybody would question those values.”

She did, however, vote against the minimum wage hike, which was a major union priority last year — although Madigan himself has blocked or watered down several such pay increase proposals in the past.

Costa Howard also talked about a confrontation at a recent weekend event with a “buddy” who is also a “high-ranking labor person.”

“It got really ugly,” she said. “And the beauty of it was everybody around me went after him about it.”

“What I found to be so ironic was him having this whole conversation about power and, you know, keeping the working person” in power. “And I looked at him and I’m like, the only reason anybody has power is if somebody gave it to them. When you take that away, who are they? The emperor has no clothes in that situation, and people need to wake up and see that.”

That’s what I’ve been telling the “mushrooms” for years: You’re the ones who have all the power. Without you, Madigan has no majority. And no majority means no power. The entire caucus has revolved for decades around getting Madigan’s most vulnerable members re-elected, whether they agreed with those decisions or not. Vote your conscience and then make him go out and re-elect you, not the other way around.

They never listened.

While Costa Howard was quick to say she didn’t want to “make it sound like it’s all organized labor,” she did claim that she knows colleagues who “received calls from ‘certain groups’ to say, ‘Stand down, don’t expect us to financially support you if you [call on Madigan to resign].’ And I find that really troubling.”

And what about her colleagues? “Do I have colleagues who are upset because they may feel I put them on a hot seat? Well, I can’t control other peoples’ districts, I can only control myself and what’s best for me and my district and what the people of the state of Illinois are looking for with leaders.”

Costa Howard said she will not vote for Madigan if he runs again for House Speaker. But she said she won’t reject any money spent on her behalf by the state party he controls.

“I am the Democratic candidate for the 48th District. So, saying I’m not supposed to be supported by the Democratic Party is not fair. It’s my party, I represent the party and when individuals make contributions to the Democratic Party they expect it to be used on Democratic candidates, which I am one of.”

She did say, though, that she would refuse direct cash contributions from Speaker Madigan’s personal campaign committee.

And what about objections made by some of her colleagues that she and others have no plan for what happens after Madigan steps down? What should happen?

“Exactly what happened in the Senate,” when Senate President John Cullerton abruptly retired last year, she said. “There is a caucus, a conversation about who should step up to be speaker. They were able to do it in the Senate.”

Terra Costa Howard is genuinely liked by many of her colleagues and she hasn’t been a showboat who instinctively sought refuge with the knee-jerk anti-Madigan’s of the world. It’s going to be fascinating to see what happens to her in the coming weeks and months.

Subscribers have more details, but the Democratic Party of Illinois has continued spending on Costa Howard’s race.

10 Comments

|

A night of looting in Chicago

Monday, Aug 10, 2020 - Posted by Rich Miller

* Sun-Times

Two people were shot, more than 100 people were arrested and 13 police officers were injured as crowds broke windows and looted stores along Michigan Avenue and on the Near North Side overnight and into Monday morning. […]

[Supt. David Brown] said “the seeds for the shameful destruction we saw last night” started with a police-involved shooting in Englewood Sunday afternoon. About 2:30 p.m., officers responded to a report of a man with a gun. He fled as they arrived, Brown said, and fired at officers. They returned fire, striking the man, who was taken to the University of Chicago Hospital and is expected to survive. The 20-year-old man had previously faced charges of domestic battery, reckless conduct and child endangerment, Brown said.

After the shooting, a crowd gathered in the area. “Tempers flared, fueled by misinformation,” Brown said. Shortly after that, police became aware of “several social media posts” about looting planned downtown. He said the department reacted by deploying 400 officers to the downtown area. […]

The first looting incident, Brown said, was at 87th Street and the Dan Ryan Expressway, but “soon, car caravans were headed into the Loop” to begin looting.

* This sounds a lot like what happened the last time…

Witnesses said the looting appeared to be a coordinated effort with multiple cars dropping off groups of people, who then smash-and-grab merchandise in the store, and take off running in opposite directions before police can respond to each incident.

They organize large groups on social media and then try to overwhelm any police response with their numbers…

The looting began shortly after midnight as people darted through broken store windows and doors along Michigan Avenue carrying shopping bags full of merchandise. Cars dropped off more people as the crowd grew. At least one U-Haul van was seen pulling up. […]

The looting seemed to be centered in Streeterville and North Michigan Avenue, but some looting was reported on State Street in the Loop and on the Near North Side. By 4 a.m. police appeared to be getting things under control.

But some vandalism continued into the daylight hours, and the CTA suspended train and bus service into downtown during the morning rush, while the Illinois state police blocked off ramps from expressways. Bridges across the Chicago River were raised, except for the one on LaSalle Street for emergency vehicles.

* This is from around 12:30 this morning…

119 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|