* From the speaker’s office…

Rich – Statement from Speaker Madigan:

“I understand that the last couple of weeks have been difficult for our caucus and party, and I have had many candid conversations with members of the Democratic caucus on this matter. The feedback is positive and demonstrates continued support for me and my leadership roles. I have no plans to resign. I have never made a legislative decision with improper motives and any claim otherwise is unfounded. I will continue to lead the effort to defeat Donald Trump, expand the Illinois congressional delegation and the majorities in the Illinois House and Senate.”

Thanks.

Eileen

Perhaps the most unsurprising MJM statement ever.

38 Comments

|

* Center Square…

State Sen. Andy Manar, D-Bunker Hill, told WMAY he would like to see a special session of the legislature to deal with ethics reforms.

“The time has come to do them,” Manar said. “These [various ethics reforms proposals] have been around for a very, very long time and I think most of them would receive broad bipartisan support from both sides of the aisle.”

But Manar said Madigan should only step down if he’s indicted, something he said: “could be coming at any time.”

Pritzker Thursday said the Speaker needs to speak up.

“I think the Speaker has an enormous amount to answer for,” Pritzker said. “There are questions that the public needs to hear the answer to. I do too. So that’s what I would start with here, questions, about, you know, what happened here?”

14 Comments

|

* Press release…

The following is a statement from State Rep. Kelly Cassidy, in response to recent news about Illinois Democratic House Speaker Michael J. Madigan and the federal investigation into ComEd:

“I have long been an outspoken critic of Speaker Madigan, but I have always stopped short of calling for his resignation, deferring to many of my colleagues’ concerns about due process. In fact, many have cited the so-called ‘Arroyo rule,’ referring to the Speaker’s own declaration that a colleague who was under indictment should resign or be removed. As a leader on criminal justice reform, I feel strongly about the principles of innocent until proven guilty and the right to due process. I also believe leadership must be held to a higher standard, and it is clear that the constant drip of corruption stories will interfere with our ability to advance a progressive agenda. Whether these investigations ultimately implicate him or continue to pick away at his inner circle, the damage is done.”

“We are heading into the most consequential election of my lifetime. Democrats are in serious races up and down the ballot. And thanks in large part to the bold, progressive leadership of Gov. Pritzker, we finally have a Fair Tax Amendment on the ballot–something I have worked toward for most of my adult life. I cannot pretend that we have another minute to wait and see, or look the other way and hope for the best. The stakes are too high. Speaker Madigan must step down from his leadership roles, both in the House and in our party.”

“Finally, I must note that I am following the lead of several of my colleagues–particularly first term women–who spoke up, despite the risk of political repercussions. In a truly democratic body, everyone should feel safe taking a principled stand without fear of retaliation. I plan to do everything in my power to make sure anyone who shares our values of equity and fairness is not left in the cold because they decided it was time for new leadership.”

55 Comments

|

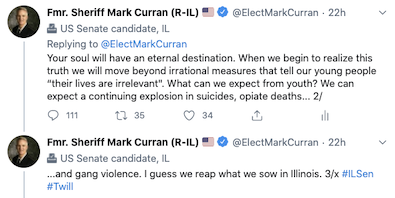

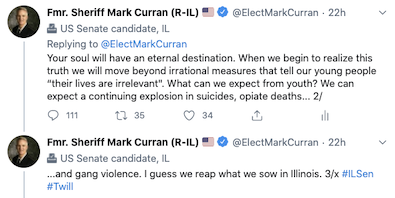

* I just can’t even…

…Adding… I’m not sure what this proves, but OK…

Hi Rich,

My name’s Jim Minardi and I am the Communications Director for the Curran campaign.

I am responding to the post you did today on your website of a tweet THREAD the campaign put out in response to the change in IHSA sports schedules. Why did you leave out the rest of the thread? There were two other tweets in the reaction Mark wrote. Please correct immediately and provide your readers the full context of Mark’s thought, tweets 1-3. The other tweets were written by staff as the account is primarily staff managed which is clearly stated in the bio.

Screen shot of tweet two and three (the remaining context of Mark’s thoughts) are attached. Please update your post accordingly. And clarify with your readers.

Thank you.

Here it is…

100 Comments

|

MJM calling around to his members

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Subscribers know more…

…Adding… NBC 5…

Four Democratic Illinois lawmakers told NBC 5 Thursday that House Speaker Michael Madigan contacted them individually to ask if he should step down, as calls for him to resign continue to grow after he was implicated in a federal court filing alleging a bribery scheme with ComEd that lasted nearly a decade.

One of the legislators said Madigan called at around 9 a.m. Thursday. Another lawmaker who Madigan consulted said they told him he should not resign - saying that Democrats needed to focus on defeating President Donald Trump in November, and that a vacancy in party leadership less than 100 days before the election would harm that effort.

NBC 5 is not identifying the lawmakers, who requested anonymity to openly discuss the ongoing developments. A spokesman for Madigan did not immediately respond to request for comment.

…Adding… I told subscribers about this earlier…

The sources, two members of Madigan’s 73-member House majority, said the 78-year-old speaker was asking members of his caucus if they agreed with two Democrats, state Reps. Terra Costa Howard of Glen Ellyn and Stephanie Kifowit of Oswego, who have asked Madigan to step down from his governmental post. Howard also said Madigan should resign as state Democratic chair.

64 Comments

|

COVID-19 roundup

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Reuters…

One person in the United States died about every minute from COVID-19 on Wednesday as the national death toll surpassed 150,000, the highest in the world

The United States recorded 1,461 new deaths on Wednesday, the highest one-day increase since 1,484 on May 27, according to a Reuters tally.

U.S. coronavirus deaths are rising at their fastest rate in two months and have increased by 10,000 in the past 11 days.

* This is a sound idea…

Dr. Anthony Fauci suggested Wednesday that Americans should consider wearing goggles or a face shield in order to prevent spreading or catching COVID-19.

“If you have goggles or an eye shield, you should use it,” the nation’s top infectious disease expert told ABC News Chief Medical Correspondent Dr. Jennifer Ashton during an Instagram Live conversation on ABC News.

When asked if we’re going to get to a point where eye protection is recommended, the director of the National Institute of Allergy and Infectious Diseases responded, “It might, if you really want perfect protection of the mucosal surfaces.”

“You have mucosa in the nose, mucosa in the mouth, but you also have mucosa in the eye,” he continued. “Theoretically, you should protect all the mucosal surfaces. So if you have goggles or an eye shield you should use it.”

* Good to see the governor out and about…

Illinois Governor J.B. Pritzker visited the Peoria County Health Department Thursday to address concerns regarding COVID-19. The county is among four that state health officials last week said had reached a “warning level” for their coronavirus metrics, with two or more COVID-19 risk indicators.

Pritzker said things are “moving backwards” and there needs to be “real change” in Peoria County. If the region has four more days of people getting sicker and more needing hospital admissions, bars will be ordered to close again and that there would be more restrictions on restaurant services, the Governor said.

* Civic Federation…

At all times, it is important that the Illinois General Assembly be able to conduct its legislative duties safely, effectively and in open view of the public. This remains true during emergencies such as the ongoing COVID-19 pandemic. To ensure a fully functioning legislature now and in the future, the Civic Federation urges the General Assembly to authorize virtual legislative sessions and committee meetings during the rare occasions when face-to-face gatherings are too dangerous. All remote sessions and meetings should be accessible to the public through widely available technology.

* Bernie…

Sangamon County Wednesday reported its highest daily total of new COVID-19 cases – 49 – part of a trend of rising numbers the director of the county’s health department called alarming.

“People are not listening or taking advantage of the guidance to wear masks and socially distance,” said Gail O’Neill, the department director. “That appears to be the problem, especially in so many young people.”

Bars, restaurants and families were key to the spread of the infection, O’Neill said.

Of the 49 newly identified infected people, 31 were younger than 40. The new cases include a 5-month-old, a 6-year-old, five female and one male teens, eight women and eight men in their 20s, seven women in their 30s, two women and two men in their 40s, two women and three men in their 50s, three women and two men in their 60s, a woman and man in their 70s and a woman and man in their 80s.

* The Southern…

Egyptian Health Department is sounding the alarm about an increase in COVID-19 cases and hospitalizations in southeastern Illinois.

“We have had quite the spike in cases in our local communities that we serve,” said Angie Hampton, CEO of the health department that covers Saline, Gallatin and White counties. “The numbers are real,” she added, “and they are concerning to us.”

On July 1, Saline County had reported a total of nine cases since the start of the pandemic. By Wednesday, it had reported 87 cases.

During that same time period, Gallatin County has seen its total case count rise from 2 to 42; and White County’s cases have increased from 5 to 54.

* Meanwhile…

* Tribune live blog headlines…

Coronavirus relief package talks at a standstill as $600 per-week jobless aid lapses, GDP drops

Will Chicago teachers strike —again — if CPS schools reopen this fall? Union officials remain mum so far.

What’s different at Halas Hall this year? Bears Infection Control Officer Andre Tucker details the changes made because of COVID-19.

Uptick in COVID-19 cases makes it difficult to bring back jobs. ‘Some people may be put out of the job market for a long time.’

A dozen students at Bradley University test positive for COVID-19, including some at orientation, after social gathering

Park District workers call for more communication and safety protocols when parks are closed because of COVID-19

* Sun-Times live blog…

Herman Cain dies after weeks-long battle with COVID-19

Will mask mandates be the end of lipstick?

Private jet usage soaring for Chicago charter companies amid pandemic

Pritzker warns public, pols on COVID-19 precautions: ‘If things don’t change, a reversal is where we’re headed’

Fallout from Trump canceling Jacksonville convention events: GOP mega-donor perks vanish

19 Comments

|

* Yikes…

The Illinois Department of Public Health (IDPH) today announced 1,772 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 18 additional confirmed deaths.

- Champaign County: 1 female 90s

- Cook County: 1 male 50s, 1 male 60s, 1 female 70s, 2 males 70s, 1 female 80s, 2 males 80s

- DeKalb County: 1 female 80s, 1 female 90s

- DuPage County: 1 male 80s

- Kane County: 1 female 70s

- Kankakee County: 1 male 60s

- Lake County:1 male 80s

- Macon County: 1 male 50s

- Madison County: 1 male 60s

- Winnebago County: 1 male 80s

Currently, IDPH is reporting a total of 176,896 cases, including 7,478 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 41,134 specimens for a total of 2,649,786. The preliminary seven-day statewide positivity for cases as a percent of total test from July 23 –July 29 is 3.8%. As of last night, 1,452 people in Illinois were reported to be in the hospital with COVID-19. Of those, 353 patients were in the ICU and 149 patients with COVID-19 were on ventilators.

Following guidance from the Centers for Disease Control and Prevention, IDPH is now reporting both confirmed and probable cases and deaths on its website. Reporting probable cases will help show the potential burden of COVID-19 illness and efficacy of population-based non-pharmaceutical interventions. IDPH will update these data once a week.

14 Comments

|

DeVore demands legislature reconvene

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Rebecca Anzel at Capitol News Illinois…

The attorney challenging aspects of Illinois Gov. JB Pritzker’s COVID-19 response said Wednesday he would halt the progress of his “dozen or so” lawsuits if legislators return to Springfield.

At the heart of Thomas DeVore’s many cases in several Illinois counties is the question of whether an Illinois governor is constitutionally and legally authorized to exercise unilateral control over the management of a disaster, such as the public health emergency posed by the novel coronavirus. […]

In an open letter DeVore sent to the General Assembly’s four legislative leaders Wednesday afternoon, the attorney wrote he is “imploring” lawmakers to determine rules for schools and businesses so both can safely resume operations without harming public health. […]

Spokespeople for three of the leaders — House Speaker Michael Madigan (D-Chicago), House Minority Leader Jim Durkin (R-Western Springs) and Senate Minority Leader Bill Brady (R-Bloomington) — did not return requests for comment at the time of publication.

A spokesperson for Senate President Don Harmon (D-Oak Park) wrote in an email that “the Senate has no plans at this time to reconvene before the scheduled veto session in November.”

I dunno. Maybe win a court case outside of Clay County first? Or at least allow something to be appealed?

Sheesh.

24 Comments

|

* Sen. Iris Martinez (D-Chicago)…

“I applaud the women who are calling for new leadership for the Democratic Party of Illinois. I agree with the powerful statements issued by State Senators Heather Steans and Melinda Bush. The time for change is now,” says Martinez.

Last year, I called on Madigan to resign after WBEZ reported that Mike McClain, who is directly tied to Madigan, sent an email in 2012 urging the administration of then-governor Quinn to be lenient in a disciplinary case against a state worker who kept quiet about “the rape in Champaign.”

Before that shocking email became public, I called on Madigan to explain himself or resign as chairman of the DPI following revelations about a culture of sexual harassment within DPI and Madigan’s political office. At the time, Madigan claimed he knew nothing about the claims of a female employee who said she’d been sexually harassed by a manager who worked directly for Madigan. He also claimed he knew nothing about payments his cronies made to the accused harasser.

Ten days ago, ComEd admitted in federal court filings to engaging in a decade-long scheme to bribe Madigan. The company agreed to pay a $200 million fine for its wrongdoing. Though Madigan again claims he did nothing wrong, his many controversies are too distracting for him to remain in leadership.

Defeating Donald Trump is a priority matter for all Democrats. Every day that Madigan remains chairman of DPI is another day we are focused on Madigan’s controversies instead of our critical electoral contests.

I am asking my fellow DPI members to come together, call for Madigan’s resignation, and hold a special meeting to elect a new leader. Our party and our state deserve better.

16 Comments

|

Question of the day

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Bruce Rushton…

A definitive answer [about the Lincoln stovepipe hat controversy] might be within reach, but shortly after museum trustees and members of the museum’s foundation, which owns the hat, decided to consult with clothing experts, the museum fired the man who came up with a plan to resolve the controversy.

Via email, ALPLM spokesman Chris Wills says that former state historian Sam Wheeler was terminated “for performance.” In a December report, Wheeler had been critical of higher-ups at the institution and in the governor’s office for demanding that he publish findings before his hat research was complete. In his report, Wheeler wrote that he hadn’t been able to confirm the hat’s authenticity and recommended that it be examined by clothing and textile experts.

Wheeler first proposed experts in the spring of 2019, but that didn’t happen. Asked then to allow an examination of the hat, the foundation said it wanted to collaborate on the research project, according to Wheeler’s report, and the matter went no further. Finally, during a July 7 meeting that included museum trustees and members of the nonprofit board, an agreement was reached: Wheeler would find experts to come to Springfield and examine the hat. The Smithsonian was mentioned.

“It’s putting a smile on my face,” Wheeler declared during the meeting when members of the foundation and museum boards approved his plan. “I love to see this level of collaboration, and it is a story I will tell often.”

Eight days later, Wheeler was fired. His dismissal wasn’t discussed at a July 15 trustee meeting that adjourned shortly before Wheeler was reportedly escorted from the building.

* The Question: Should the state try to turn over administration of the ALPLM to the National Archives and Records Administration, which administers other presidential libraries? Take the poll and then explain your answer in comments, please…

panel management

39 Comments

|

* Leader Durkin had previously issued one of those “if true” statements about Speaker Madigan. Gov. Pritzker mentioned Durkin’s comments yesterday to defend his own “if true” demand. Welp…

Illinois House Republican Leader Jim Durkin released the following statement regarding the call for Speaker Madigan’s immediate resignation and will be filing a House resolution to call for another vote on Speaker for the Illinois House of Representatives:

“The federal charges outlined in the ComEd prosecution highlight a scheme solely for the benefit of Speaker Madigan. These facts are a disgrace of the highest level to the citizens of Illinois and to the institution of which we serve, the Illinois House of Representatives.

The House Rules for the 101st General Assembly provide great responsibilities and duties of the Speaker of the House. After reviewing the facts contained in the ComEd deferred prosecution agreement, it is abundantly clear that Michael J. Madigan is unable to execute his responsibilities as Speaker of the Illinois House of Representatives and as state representative for the 22nd House District.

I call for the immediate resignation of Speaker Madigan from the Illinois House of Representatives, and will be filing a resolution to have the House Chamber vote on a new Speaker immediately.”

…Adding… HRO…

State Representative candidates Amy Elik, Lisa Ciampoli, and David Friess released the following statements regarding the ongoing corruption scandal surrounding House Speaker Michael Madigan and State Representatives Monica Bristow (IL-111), Katie Stuart (IL-112), Nathan Reitz’s (IL-116), continued silence on the matter as their Democratic legislative colleagues call for Madigan’s resignation.

“It’s impossible to reform Illinois as long as Speaker Madigan remains in power,” said Amy Elik, state representative candidate for the 111th district. “Speaker Madigan continues to block any chance of ethics reform, property tax reform, and term limits, and Monica Bristow is a willing conspirator by remaining silent.”

“The people are demanding change to how Springfield operates,” said Lisa Ciampoli, state representative candidate for the 112th district. “Speaker Madigan has a clear conflict of interest to continue serving as speaker. It’s time for him to step down, and for Katie Stuart to stop playing follow the leader by remaining silent on the matter.”

“Speaker Madigan cannot lead the House of Representatives, and must resign,” said David Friess, state representative candidate for the 116th district. “It’s time for Nathan Reitz to end his silence and let his constituents know if he’s with them or Speaker Madigan.”

This incident is not the first-time area state representatives failed to speak out. When WBEZ covered the story alleging a “powerful former Springfield lobbyist and close friend of House Speaker Madigan” covered up a rape in Champaign and ghost payrolling of government workers, State Representatives Bristow, Stuart, and Reitz failed to hold Madigan accountable.

Alaina Hampton, the individual who sued and settled with Madigan’s operation for sexual harassment, noted in a July 26, 2019 tweet to the Democratic Women’s Caucus, saying:

“I’ve now been waiting a year & a half for you to support me publicly, or even address me by name in a statement. Where are you? What is your stance? We all want to know.”

Why are Representatives Bristow, Reitz, and Stuart among the few House Democrats yet to speak out on Speaker Madigan?

23 Comments

|

*** UPDATED x1 *** ComEd on the hot seat

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Dan Mihalopoulos at WBEZ…

In his first public comments since Commonwealth Edison admitted a Springfield bribery scheme, CEO Joe Dominguez said Wednesday he was sorry for the power company’s conduct – but quickly added that he did not think the public suffered as a result of the scandal.

“I wanted to apologize on behalf of the entire company,” Dominguez told officials at a meeting of the Illinois Commerce Commission, which regulates ComEd and other public utilities in the state.

Dominguez quickly pivoted from that mea culpa to show the limits of his contrition. He focused largely on defending the company’s overall performance as excellent – and protecting the legislative gains ComEd achieved during the eight-year-long bribery scheme. […]

In an effort to add what he said was “context” for his company’s state regulators, Dominguez told the ICC that the “deferred prosecution agreement,” or DPA, with the U.S. attorney’s office in Chicago “is not a criminal conviction of ComEd” and that “a few orchestrated the improper conduct” but most employees do a superb job.

Dominguez also said the state laws mentioned in the deal with federal law enforcement authorities actually had benefited the people of Illinois, even though lawmakers locked in electricity delivery rate hikes.

* ComEd is borrowing from its parent…

ComEd doesn’t have $200 million in cash flow to pay the fine, Dominguez told commissioners, so it would borrow the money from its parent company, Exelon. […]

“In order to pay the government, Exelon, like other large holding companies, has a cash balance, is able to use some of that cash. It goes down to ComEd so that it meets its obligation under the [deferred prosecution agreement] to make that payment. In the future, when we otherwise would have provided our profits to the shareholder, our profits are actually going to repay that $200 million. At the end of the day, the capital structure remains the same and shareholders, not customers, will pay all of the fine.”

* Iulia Gheorghiu at Utility Dive…

The utility is strengthening its compliance practices outside of the federal investigation, Gomez told Illinois regulators. Cost changes and percentages that will fall on ratepayers for the compliance function are not available, she added.

ICC commissioners insisted that ComEd’s ratepayers should not fund any changes the utility makes in reaction to the deferred prosecution agreement.

* The person leading that particular charge was the embattled ICC Chair…

Commission Chair Carrie Zalewski told Dominguez and Glockner that she wasn’t comfortable “with one penny” of ratepayer money going to an improved compliance system made necessary by actions over nearly a decade at ComEd that resulted in a criminal charge of bribery.

“I find it very hard to believe Exelon was going to enhance their policies regardless,” she said.

* Some legislators and other elected officials may be alarmed about this…

As part of the deal to defer prosecution of bribery charges against the company, ComEd and its parent company Exelon agreed to pay the fine, to cooperate with a continuing federal investigation, to adopt internal policies and controls regarding their dealings with public officials to prevent similar crimes from occurring again and to file reports with the U.S. Attorney’s office at least once every 12 months detailing how it is complying with the terms of the agreement.

“They create, among other things, a detailed tracking system to capture information about our interactions with public officials,” said David Glocker, Exelon’s executive vice president for compliance and audit. “Going forward, beginning when these policies went into effect on July 6, any request, recommendation or referral from a public official has to be reported, has to be tracked, and it can only be acted on with the concurrence of a series of people within the organization, including, importantly, the compliance function.”

Legislators and other electeds routinely forward constituent complaints to utility companies.

*** UPDATE *** From ComEd…

All requests, referrals and recommendations from public officials for things of value for themselves or others will be reported and tracked. The only exceptions are routine requests for constituent assistance or information.

[ *** End Of Update *** ]

* And, of course…

Here’s an opening sentence one might only get to write in an Illinois newspaper:

Nearly two weeks after admitting to a bombshell bribery charge, ComEd executives outlined their ethics reform plan to a panel of state regulators led by the relative of an alleged player in the criminal plot.

Illinois Commerce Commission Chairwoman Carrie Zalewski, whose agency oversees utility rates and safety practices, opened Wednesday’s meeting with demands for “transparency” and “accountability” in light of federal court records that allege ComEd engaged in a “yearslong bribery scheme” involving jobs, contracts and payments to allies of House Speaker Michael Madigan.

One of the Madigan associates that prosecutors say got such a job? Carrie Zalewski’s father-in-law, former 23rd Ward Ald. Michael Zalewski.

That connection was largely ignored during the hearing, however, even as Zalewski herself called the payments “unethical.”

* Steve Daniels…

“I have not done anything wrong,” Carrie Zalewski shot back, and added, “I take umbrage at the assumption.”

Oliva is a Republican appointee of former Gov. Bruce Rauner. Rauner’s ICC chairman, Brien Sheahan, was quickly replaced with Zalewski after Gov. J.B. Pritzker took office. Zalewski since has reversed some of Sheahan’s policies and priorities.

17 Comments

|

* So, in a political environment like this…

President Donald Trump is for the first time floating a “delay” to the Nov. 3 presidential election, as he makes unsubstantiated allegations that increased mail-in voting will result in fraud.

Whew.

* Knowing all this, some local Republicans just made things worse…

Rock Island County Clerk Karen Kinney is asking voters to disregard absentee ballot request forms arriving with a return address of Peoria, saying she has received hundreds of calls to her office from concerned voters. […]

“While this is technically legal, these outside groups do not meet the high standards of protecting the process that I do,” Kinney said. […]

Rock Island County Republican Party Chairman Drue Mielke said Wednesday his office participated in sending out the ballot request applications from Peoria and that voters can trust the process. […]

Mielke said the Rock Island County Republican Party partnered with the Whiteside and Peoria County Republican parties to send ballot applications to all registered voters in the three counties as a way to pool resources and increase voter participation. He said once the applications are filled out and returned to Peoria, all Rock Island County applications will be forwarded to Kinney’s office.

So… they send ballot applications to voters in Rock Island and Whiteside counties with a Peoria return address and they think this is OK in this environment?

If I was a tinfoil hatter, I’d think they were deliberately trying to bolster the president’s arguments. But I’m guessing they’re not that bright.

35 Comments

|

Sheriffs complain about new EO

Thursday, Jul 30, 2020 - Posted by Rich Miller

* Jerry Nowicki at Capitol News Illinois…

While Gov. JB Pritzker issued a new executive order this week allowing for transfers into state prisons at the discretion of the Illinois Department of Corrections director, an association representing the state’s sheriffs contends that the move was more show than substance.

Jim Kaitschuk, executive director of the Illinois Sheriffs’ Association, said Wednesday that the new order’s stipulation that transfers are allowed “within the sole discretion of the Director of IDOC” effectively renders the latest executive order inconsequential.

“I think the perception was from the EO that he issued on Monday was that the prisons were open,” Kaitschuk said. “Well, that’s not factually accurate. It’s kind of like having a sign on your door for a business saying it’s open, but the door’s locked.” […]

The requirements are difficult for county jails to meet, Kaitschuk argued, because COVID-19 test results must have been received within three days before the transfer, and tests results often take longer than that. If an inmate has to leave a facility for a test, that restarts the requirement of 14 days of quarantine as well.

18 Comments

|

* I appreciate the effort, but, um…

The Democratic Party of Illinois (DPI) today unveiled an updated website and branding as a part of a larger effort to make the state Democratic party more accessible to voters on digital platforms – a key step in getting out the vote during the most consequential election in a lifetime and in a heavily virtual world due to the COVID-19 public health crisis.

“As a part of our work to make Illinois Democrats more accessible to voters, we’ve updated our website to help Illinois residents better understand our issue platforms, get to know our elected officials and candidates, and easily get involved in our efforts to elect Democrats up and down the ballot,” Michael J. Madigan, Chairman of the Democratic Party of Illinois, said.

DPI’s versatile website will be updated regularly to provide voters information on safely and easily voting by mail and about critical Democratic initiatives and ballot measures, including the Fair Tax amendment that will level the playing field for middle- and low-income taxpayers across the state. The new website provides voters with updates on the 2020 election and ways to get involved virtually, as well as allowing voters to quickly contact their local county Democratic party, as well as 2020 candidates running in their area.

“Our updated website is just one step in a larger effort to better connect with candidates, volunteers, and voters in every corner of Illinois,” Madigan added. “The Democratic Party of Illinois believes the strength of the party lies in its diversity, and is expanding the ways we reach voters of all backgrounds.”

OK.

The new site is here.

16 Comments

|

* Oy…

Gross domestic product from April to June plunged 32.9% on an annualized basis, according to the Commerce Department’s first reading on the data released Thursday. Economists surveyed by Dow Jones had been looking for a drop of 34.7%.

Still, it was the worst drop ever, with the closest previously coming in mid-1921.

* And…

In yet another sign that the economic recovery is teetering in a resurgence of coronavirus cases, the number of Americans filing first-time unemployment claims rose for the second week in a row.

Some 1.4 million people filed for initial jobless claims last week, up 12,000 from the prior week’s revised level, which was the first increase in 16 weeks.

On an unadjusted basis, 1.2 million people filed first-time claims, down 171,000 from the week before. The seasonal adjustments are traditionally used to smooth out the data, but that has tended to have the opposite effect during the pandemic.

Continued claims, which count workers who have filed for at least two weeks in a row, stood at 17 million for the week ending July 18, up 867,000 from the prior week’s revised level. These seasonally adjusted claims peaked in May at nearly 25 million.

*** UPDATE 1 *** One Illinois…

The news was far better in Illinois, where new claims dropped 4,000 to 32,000 last week from 36,000 the week before. Claims for expanded federal benefits for independent contractors, freelancers, and so-called gig workers not eligible for conventional unemployment dropped precipitously, from a record 74,000 the week before to just 6,000 last week.

That PUA spike last week was really odd.

*** UPDATE 2 *** Press release…

“Today’s announcement of a 32.9 percent drop in U.S. GDP, the largest on record, reiterates what the Chamber has been saying all along - that the government must address both the economic and public health crises simultaneously,” said Illinois Chamber President and CEO Todd Maisch.

“These dual crises necessitate that the administration weigh the priorities of job creators on equal footing with the dictates of scientists. While Illinois is releasing daily public health metrics, we cannot have state government considering economic metrics as an inconvenient afterthought. COVID-19 has created both crises, but we have to recognize that government decisions have contributed to the implosion of our economy.

That is why the Chamber is reiterating our call for four actions:

· Suspension of the minimum wage increase, that makes it even harder for small businesses to reopen;

· Immediate suspension of support for the progressive income tax amendment, that will put another burden on job creators forcing them across state lines;

· A complete repudiation of CEJA, a piece of legislation that threatens all Illinoisans with increased energy costs; and

· A rapid review of regulations to reduce red tape and administrative costs on employers.”

21 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|