An apparent success story at Cook County Jail

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* The jail was at one point among the largest outbreaks in the country…

Through the use of “aggressive intervention strategies” and widespread testing, the Cook County Sheriff’s Office was able to successfully mitigate the spread of COVID-19 inside the Cook County Jail, according to a new study from the Centers for Disease Control and Prevention.

Penned by members of the CDC as well as medical officials from Cook County Health, the Chicago Department of Public Health and the Sheriff’s Office itself, the report found that jail staff were able to limit the spread of the coronavirus through physical distancing, limiting movement and expanded testing.

“Early in the outbreak, increases in cases among staff and detained persons paralleled that in Chicago, Illinois,” the report states. “After implementation of interventions, cases declined in detained persons and staff, even as cases increased dramatically in Chicago.”

Within two months of the first confirmed COVID-19 case at the jail in March, nearly 1,000 detainees and jail staffers had been infected with the disease, and seven detainees, three correctional officers and one court deputy died after testing positive.

The study is here.

* Tribune…

The paper has not yet undergone peer review, and its authors include medical experts from the jail’s health center and the sheriff’s office, along with the CDC and the University of Illinois at Chicago.

Even to an outsider’s eye, however, the drop in COVID-19 cases at the jail is significant. In March and April, the jail counted more than 900 cases among detainees and staffers. Seven detainees died at local hospitals after testing positive.

But as of Tuesday, only 11 detainees out of about 4,800 are positive, Dart said, and eight of them entered the jail with the virus.

“We’re testing at the door now,” he said. “You could literally say being in the jail is one of the safest places to be right now.”

* WGN TV…

Nonviolent offenders were released from the jail early on in the outbreak to reduce its population, with some put on electronic monitoring. Governor JB Pritzker also signed an executive order to stop new inmates from being admitted to state prisons during the pandemic, with only a few exceptions.

Officials also implemented measures including moving inmates to single-person cells, and halting visitation and programming.

“Inmates are tested in intake while in separate housing and not allowed into the general population until a second test,” said Connie Minella, Chair of Correctional Health. “This has proven to be an important part of our containment; no other jail is doing this type of testing.”

The CDC says this plan should serve as a model to jails, prison, nursing homes and other congregate settings. Cook County Jail officials say they can’t let their guard down yet.

* Patch…

And Dart criticized the county’s court system, which has left some pretrial detainees jailed for up to 11 years as they await a trial date.

“You cannot have these cases lingering for a decade waiting for trial,” he said. “We can’t have that happening.”

6 Comments

|

Question of the day

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* If you could ask Gov. Pritzker one question, what would it be? Serious question, serious answers only. Thanks.

41 Comments

|

Travel advisory

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* July 1, 2020…

The first day of July continued Indiana’s statewide trend of lower numbers, as the state added 358 cases total and eight deaths.

Indiana’s 7-day positivity rate was 4.9 percent at the time.

* Also on July 1…

Governor Holcomb gave a briefing Wednesday afternoon. He announced that instead of moving forward to stage 5, the state will move to stage 4.5 from July 4-17.

Through at least July 17, the following restrictions will continue:

• Social gatherings following the CDC’s social distancing guidelines will be limited to up to 250 people. This limit applies to wedding receptions, parties, and other events where people are in close physical contact for extended periods of time, particularly indoors.

• Dining room food service may continue operations at up to 75 percent capacity as long as social distancing is observed. Bar seating in restaurants may continue operations at 50 percent capacity. Bars and nightclubs may continue operations open at 50 percent capacity as long as they adhere to social distancing guidelines.

• Cultural, entertainment and tourism sites may continue operations open at 50 percent capacity.

• Movie theaters, bowling alleys and similar facilities may continue operations open at 50 percent capacity.

• Amusement parks, water parks and similar facilities may continue operations open at 50 percent capacity. Reservations are encouraged to limit the number of customers at any one time.

• Raceways may continue operations open at 50 percent grandstand capacity.

Beginning July 4, fairs, festivals and other similar outdoor events may open. Pari-mutuel horse racing and county and state fair racing may begin with 50 percent spectator capacity. Youth overnight camps may open.

On July 4th, when the new phase was entered, Indiana’s case numbers had shot up 61 percent, to 576, and its 7-day positivity rate had risen to 6 percent.

* Today, Indiana reported 700 new cases. Its latest reported average positivity rate was 8.4 percent.

So, even though Indiana’s daily case numbers have risen 21.5 percent in 11 days and its average positivity rate has jumped by 40 percent, the governor next door decided today to just continue with stage 4.5…

Gov. Eric Holcomb is keeping the reopening of Indiana’s economy on pause for at least two more weeks due to the growing number of COVID-19 infections in the Hoosier State.

The Republican chief executive said Wednesday he soon will sign an executive order keeping the state at stage 4.5 of his five-stage Back on Track reopening plan through the end of July.

* One of Illinois’ new triggers for regional mitigation is “three consecutive days averaging ≥ 8% positivity rate.” Not including today (numbers haven’t been posted yet that I can find), Indiana’s last three days averaged 7.9 percent, which is right at what would be the edge here.

There’s also a real problem with testing there…

Dr. Kristina Box, the commissioner of the Indiana Department of Health, said one issue is a lack of supplies. The state had partnered with Indianapolis-based pharmaceutical maker Eli Lilly & Co. and the Indiana Hospital Association to make a $66 million order for reagents to perform testing at Indiana labs. The state still awaits that order to be filled, and the federal government has reduced the amount of supplies it’s providing.

She noted wait times for coronavirus test results have grown longer, and should be no more than three to five days. The current average is up to seven days for Optum sites. She says Indiana is trying to keep the lab work for the testing in the state to assure quicker results. She says the lack of supplies is due to “external factors beyond our control.”

* And here’s their plan for the future…

[State Health Commissioner Dr. Kristina Box] said if Indiana climbs to a 10-15% positivity rate and stays there consistently, the state will re-evaluate what might need to be done and make strong recommendations.

That’s taking an awfully big chance. Texas’ governor said last month that a 10 percent positivity rate was a “warning flag.” You’ve seen what has happened since then. Its positivity rate is now above 17 percent and the state reported more than 10,000 new cases yesterday.

You might wanna steer clear of Indiana for a while.

15 Comments

|

* Not surprising…

* Before he talked about Duckworth, Durbin talked about his own campaign…

I have an unusual challenge this time that I’ve never faced, and it’s one that we all need to take seriously, I take it seriously as I take every election seriously. But there is a Republican nominee, that you probably heard of the former Sheriff of Lake County. And now it appears, if he files the appropriate petitions, there will be a third party challenger, to me, an independent candidate, his name is pretty well known, Willie Wilson.

Mr Wilson has an incredible life story emerging from virtual slavery to the point where he became a successful business executive, a franchisee from McDonald’s, and then started his own business making personal protective equipment in China or Mongolia, I’m not sure where, but he has made a lot of money. He’s a multi millionaire. And he gives some of that money around, thank you for doing it in so many instances, it’s a real act of magnanimity on his part to help other people.

However, when it comes to the world of politics, it’s hard for me to follow what I just said, with his politics of today. He admits that he voted for President Donald Trump. He supported Governor Bruce Rauner. In this election cycle he has donated over $30,000 to Republican candidates for the Illinois House and the Illinois Senate is an active participant in the Illinois Republican Party, and yet he styles himself as an independent.

Well, I’ve got some issues I can raise with him if he’s going to be a Trump independent or whatever that means, obviously in the course of this election campaign.

But there’s a party issue here which I want you to think about for a second. Mr Wilson is not just running, Dr. Wilson is not just running to be the United States Senator. He wants to create another political party in Illinois, such as the Libertarian and Green Parties which we already have our state. And he has filed his petitions in a way that he would be creating the new Willie Wilson Party. And you think to yourself well what are the chances that that’ll happen.

Roughly 15% of the vote in November is likely to be African-Americans. If Mr Wilson can bring in 5% of the electorate, one third of the African American voters and others, then he will have established that third party. If he does that on a statewide basis, he’ll be able to field statewide candidates in the Willie Wilson Party in the next election cycle. He could do it as well if he has 5% in a legislative district or a congressional district.

So what’s at stake here is not just his candidacy for the Senate, but the establishment of a new political party and a new political dynamic in the state. I’m appealing to you and appealing to everyone in the state to join me and making certain that he doesn’t get 5% of the vote before it’s all said and done. I’m going to work hard to make sure that that doesn’t happen. I hope you’ll join me in that effort I need your help.

*** UPDATE *** Wilson just dropped $29,411.20 on a cable buy. Mostly in Chicago, but he’s spending about $4K in Peoria-Bloomington and Rockford.

29 Comments

|

Casten has large cash advantage over Ives

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* Press release…

Today, Sean Casten announced that his campaign raised over $748,000 in the second quarter of 2020. The campaign’s impressive fundraising haul brings the total raised this cycle to more than $4 million, with over $3 million cash on hand.

“There is incredible enthusiasm from voters in the 6th District for reelecting Sean Casten to Congress,” said Casten for Congress Campaign Manager Chloe Hunt. “Our strong fundraising numbers are a reflection of a widespread outpouring of support for Rep. Casten and his work in the House. Rep. Casten won his seat because he pledged to be responsive to voters’ needs and lead on the issues that matter to them, and he’s lived up to that promise by holding more than 30 town halls and leading on legislation to strengthen the Affordable Care Act and combat climate change. That’s why he was elected in 2018, and that’s how he intends to win re-election in 2020. ”

* Press release…

Illinois 6th District Congressional candidate Jeanne Ives announced a strong Second Quarter fundraising haul of $531,039.03, with $483,239.03 raised for Jeanne for Congress, and an additional $47,800 in funds raised for Jeanne Victory.

The report indicates that Ives’ ability to raise the funds necessary to compete with her opponent continues to exceed the expectations of the chattering class.

Sean Casten, the incumbent Congressman in IL-06, only raised $748k in the second quarter. Ives fundraising has consistently been on pace with her opponent’s - despite the fact that he enjoys the power of the incumbency, and the franking privileges and publicity that come with it.

“A year ago, I launched this campaign from my kitchen table. Since then, we have built an army of hundreds of dedicated volunteers, interns and donors who are tired of Sean Casten’s unfair self-serving agenda of special deals and higher taxes. We’re proud that an overwhelming amount of support came from individual contributors, people mostly inside the state of Illinois. In contrast Congressman Casten relies on corporate PACs and special interest groups for funding. While my donors both large and small are making real sacrifices to reach voters, Sean Casten voted for HR1 which would force taxpayers to fund campaigns - he must have forgotten we have $26 trillion in debt. That’s the difference between us: He’s working to line his pockets. I am running to protect your pocketbook.

“This race was never going to be easy, but if we raise enough money to connect with enough people — we win. I am incredibly grateful for the support and generosity so many have shown. Now we just have to buckle down and take it over the finish line.”

Ives had $366K in the bank at the end of the first quarter.

* Ives fundraising email today…

Dear Friend,

Past behavior is the best predictor of future behavior.

So I can’t say that I’m surprised about Sean Casten’s latest actions to enrich himself.

Sean just re-introduced green energy subsidies and tax deals from 10 years ago that were included in the 2009 Stimulus Package - the same subsidies and tax deals that he and his company benefited from.

He doesn’t care that these subsidies will make energy more expensive for you. He isn’t bothered that while many families continue to struggle to make ends meet, he is using his position to cut taxes for his friends and raise taxes on everyone else.

Chip in today to help us stop Sean from putting his interests ahead of our hardworking families and small businesses.

Sean lobbied Congress in 2008 for these kinds of tax credits, and his company received over $8 million in corporate welfare.

And now as a member of Congress, he should have been lobbying for the 6th District’s fair share of relief aid.

But Sean was too busy trying to get a second helping of these tax breaks that made him a wealthy man back in 2009.

We need leaders who we can trust to look out for us.

I have always stood up against those who would use their government position for personal gain. I voted against crony special tax credits in Springfield and I will do the same in Congress.

This is not complicated, you can elect someone who stands with you or someone who stands with special interests.

Join our team today and together we will defeat the self-serving grifter Sean Casten and start looking out for our neighbors again.

All In For Ives

* Greg Hinz…

Democrat Rep. Lauren Underwood of Naperville pulled in $1.2 million and has $3 million in the bank, Politico reports. Compare that to $250,000 in income for GOP challenger Jim Oberweis, who has $373,000 in cash on hand.

However, signs are that national GOP groups believe the 14th is more winnable than the 6th, so they may open their wallets later. Even more on point, dairy-owner and investment mogul Oberweis lent himself $1 million for the March primary and most definitely can do so again in the fall.

Yep.

6 Comments

|

* The governor was asked today what would happen if a region is put into mitigation…

There’s a menu of things that I talked about, some of them in my remarks, for example, and I mentioned yesterday bars as an example of something that would certainly be, you know, two thing we look at ,we’ve seen studies of the spread transmission that can take place. If bars are overcrowded, and often even though there’s been a capacity limit of 25%, put on bars, they are not following the rules in many cases and there’s transmission. That’s one example. Another example is youth sports . We’ve seen this summer, just some examples I talked about.

And so those are among the menu of items you’ve heard me talk about. But let’s not focus on the 8% failsafe number. This could happen much before that. In other words, the menu of items that are mitigations beat are about the numbers moving the wrong direction in a sustained period of time that doesn’t mean it got all the way to 8%. It could be that a region is moving very quickly upward, but doesn’t reach 8 percent but over a sustained period of seven days of 10, the seven day average positivity is moving up. That is a trigger along with the availability of hospital beds or the increase in hospitalizations, so those are I mean I know it’s complex but we wanted to lay out for you and be very transparent about what the triggers are what we’re looking at. You know I’ve said to you all every day I wake up and look at these numbers on a daily basis. I look at the rolling averages of these numbers, and so does Dr. Ezike and we’re constantly evaluating and making decisions about what is it that we may need to do, but long before we ever get to those points. As you heard, I call local officials or Dr. Ezike speaks to the local health department to say, there is a problem in your county, what are we doing, how can we be of help to you? What are you doing about it?

Local governments have the ability, more immediately to do things than state government does, and so we encourage that. But where state government needs to step in, we do and we will.

Please pardon all transcription errors.

* A question about the impact of other states on Illinois…

It’s an excellent question you’re right on. We asked that question of ourselves too because when you look at areas like St Clair County and Madison County right across the river from St. Louis, Missouri has a, I forget the exact number for Missouri, but I think it’s around a 7% positivity rate. Ours is three.

So, if you live in that area and you’re traveling across the bridge to Missouri, you’re essentially doubling the possibility that you could contract this or at least the number of people tthat you’re end up in front of. It’s very important for people who live in those areas to be aware of following mitigations that we’ve suggested in Illinois.

* Infection rates among young people…

Dr. Ezike: I will say that we’ve made tremendous, tremendous progress with our long term care residents which are obviously a much older population. So that used to be a very significant driver, but in the recent weeks we have seen that the 20 to 29 and again we have so much data when you break it out, it might be the case for, I think, non Hispanic whites 20 to 29. That’s the largest group. Then you also had that in blacks 20 to 29 but then you just you’ve never seen this high rate for the 10 to 19, that is new in terms of the numbers climbing over time they’re now at the highest rate that they’ve ever had from the beginning of this pandemic.

* Kids 10-19 can’t be in bars, so where are they getting it?…

Dr. Ezike: I have teenagers, right, they’ve been on lockdown but they are complaining that their friends are out and about and so kids are congregating, yeah social action social gatherings, home get togethers, trips that are not in schools that are not involving, you know, masking and distancing. … We know that if schools are to happen there has to be masking and distancing, but to get there we have to not have widespread community transmission at rates that are not sustainable to even safely do school. So that’s why our actions today, right now, will determine what school even looks like. And so we need to get the gains that we have achieved. We can’t rest on them, but we need to aggressively and fiercely protected and that will involve universal masking and distancing.

* New IDES phone system. Call-backs aren’t happening in a week or ten days…

This is an enormous challenge. IDES as you know was overwhelmed, there’s just no doubt about it. And I’ve talked about some of the reasons for that. But that’s less important than, you know, how can we overcome the challenges? We have more than 500 additional people answering phones. That’s in addition to the people who are already working at IDES that were in charge of answering phones to begin with. And we’ve moved people from back of the house to sort of front of the house to answer phones phones are absolutely in this ridiculously enormous wave of filings. And don’t forget people have to refile every week you have to recheck in every week.

And to the extent that people are using the phone to do that, or to, you know, in any way to avoid being online I would say, if you can go online if you can work online to get your filing to re-verify, for example, or just to file originally, that is absolutely the best way to do it. Not 100% of people are successful at doing that, but quite a lot because we see the numbers and literally hundreds of thousands of people, much easier for them to have done that online. As to the calls and again this is where there’s no doubt about this is where the big challenge has been. I want to solve this as much as anybody.

The challenge has been even with additional people answering phones that in order for them to deal with your specific case, they have to meet a federal requirement that is about 10 months of training. We haven’t even been in this pandemic for no more than five months. And having said that, we’ve tried to take any goal that doesn’t require that federal level of expertise and move that into a different category and try to get people there.

You’re asking about callback systems, it’s a new callback system. When you’re talking about maybe eight days instead of a few minutes, remember that at the very beginning here, you know, it’s very difficult to get, you know, a call in.

We’re, there’s no doubt, we have a lot of progress that needs to be made. It’s one of the reasons why we reached out and got somebody who’s been working at Employment Security for a lot of her career to come in and be the director of IDES. She’s already providing great ideas for us.

One last thing, and you may have seen this in a Washington Post article just a couple of days ago. Many many states are plagued with challenges in their Employment Security Department and unemployment claims. I just heard from a Senator about a meeting that the Secretary of Labor had at the very beginning, letting everybody know that most state systems are not capable of handling what’s probably coming.

And so this challenge has been, you know, vexing. That’s the best I can say about it. And so we’ve thrown everything that we can think up to throw it out, we’ve gone to outside providers we’ve hired more people we’ve moved people from the back of the house to the front of the house. It’s not that we do it, that we take the applications over the phone less efficiently. There’s only one way to do those. It’s just that the numbers that come in every day and every week, I mean, we’re talking about hundreds of thousands of calls and it’s just, if you think about the amount of time it takes to take an application, or even to just answer a series of questions, and how many you could do in a single day. If you were working at IDESs it would be impossible to have enough people to be able to to answer every call as it comes in.

* Social equity applicants for cannabis…

No new licenses are given until these social equity licenses are given. So, you know, we want to make sure that we’re getting accomplished as fast as possible. The, you know, people of color, having the opportunity to enter this industry to own and to work in this industry. We believe that over the next six weeks that those licenses. I might I might say, by the way, that if I’m wrong I’m off by a week here or there. But that we believe that that there will be movement on this over the net over those weeks. But it’s a absolute goal of ours we see the opportunity this industry. Remember there’s an opportunity for 500 licenses in total, based on the legislation. About 55 of them were granted, or you know before. And now, there’ll be 75 that will be granted to retailers and then the numbers of people who will be transporters and grow cultivators and craft growers and so on. So I’m very, I’m looking forward to finally getting past that milestone.

* Confident he can do this new plan considering the case in Clay County?…

Multiple, multiple courts have issued rulings. This applies to one person, this ruling that has taken place by the way it hasn’t even been entered as a final order. Because the judge held on one of the three items he needed to rule on and then went on vacation. So I know that there may be a ruling in the next few days but suffice to say that even with the final ruling, it only applies to the one plaintiff, that was represented there.

…Adding… I asked the governor’s office about why the governor said the ruling only applied to Rep. Darren Bailey…

It’s not a class action suit, he didn’t ask for it to be and it wasn’t treated as such so in our legal view it only applies to the person who files it. And he did not get an injunction and it’s not a final order.

* President Trump said today he will announce unspecified federal action next week to quell violence in cities, including Chicago. He compared the cities to a war zone…

Well, it’s a sign of desperation by the president to try to improve his own standing somehow by making these declarations. Look, if he really wants to help, we have violence prevention programs that need funding. We have programs that are intended to provide mental health, that are intended to help kids get jobs during the summer, that are funded by federal dollars. We would love to get that kind of help. I fear that the President is really thinking about other things and not thinking about what really would help. In Washington DC he brought out the National Guard when there was a peaceful protest. That seems you know like irrational to me, and you know he’s acted irrationally all along. So that’s, I can’t imagine, frankly on a day to day basis it seemed, everything seems irrational.

* The White House has ordered hospitals to report data directly to it rather than the CDC…

Pritzker: The President has tried to politicize every aspect of this pandemic. This should not be political This is about saving lives. CDC is something that public health departments all across the nation rely upon. They’ve been a trusted source of information, advice, help, and to go politicize it by by interrupting the flow of data. I don’t know what is the purpose of interrupting the flow of the data to CDC, where the data really belongs and where the experts really are. It can only be political. And that really concerns me greatly. Because I’m focused on the health and safety of our people in Illinois, I want to get the best advice that we can get. I reach out to epidemiologists, we have some of the best in the world in Illinois thank goodness, but I also talked about, you know, to get to get the right kind of advice to keep people healthy and safe. But CDC is one of those places that you want to rely upon. And then when you see a president politicizing interrupting data intervening, it gives one pause.

Dr. Ezike: CDC is our foundational public health entity, not just in this country but serves as a leader throughout the world. I’m on the call with representatives from the CDC on a regular basis. Dr. Redfield has reached out to me, has taken my calls consistently, we’ve had dozens of people come from the CDC to help us right here in Illinois, to support us with this effort. We send our hospital admissions data directly to through syndromic surveillance directly to the CDC. And just last week I had a call with people who are looking at that data and telling us things other ways that we can look at the data so that we can make sure we have additional clues to identify outbreaks or anything that may escape detection. I would be very concerned and fearful to move into a new situation where the CDC does not have that ability to intervene and support the states, as it has been. We also want to make sure that we have data that we can trust and that we can use to make sound decisions going forward and there’s never been a question of that when we share all that information with our public health foundational champion, which is the CDC. Ao we will continue at the state level, and all of our state departments will continue to work so closely with CDC, and we are hoping that we will come to a point where we’re all working together for the same goal of trying to achieve the health and safety of the people of this country.

-30-

17 Comments

|

* Press release…

The Illinois Department of Public Health (IDPH) today announced 1,187 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 8 additional confirmed deaths.

- Cook County – 1 male 40s, 1 male 60s, 1 male 70s, 1 female 90s

- DuPage County – 1 male 80s

- Kane County – 1 female 80s

- Will County – 1 male 50s, 1 female 70s

Currently, IDPH is reporting a total of 156,693 cases, including 7,226 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 38,161 specimens for a total of 2,079,601. The preliminary seven-day statewide positivity for cases as a percent of total test from July 8–July 14 is 3.1%. As of last night, 1,454 people in Illinois were reported to be in the hospital with COVID-19. Of those, 324 patients were in the ICU and 130 patients with COVID-19 were on ventilators.

…Adding… Press release…

A diverse coalition of business groups renewed calls for Illinoisans to wear face masks when in public to save lives and protect the state’s economy.

Recent data from the Illinois Department of Public Health show that the number of Illinoisans infected with COVID-19 and hospitalization rates have increased since Illinois moved to Phase 4 just over two weeks ago. The Centers for Disease Control and Prevention and numerous public health studies have demonstrated that masks are effective in slowing the spread of the virus by as much as 85 percent.

“Wearing masks is not a Republican issue or Democrat issue – it’s a public health issue and a jobs issue. We must unite for the sake of our families, businesses, and our communities,” said Mark Denzler, president & CEO of the Illinois Manufacturers’ Association. “We are facing the worst economic and health crisis in generations and every Illinoisan can wear a mask to help slow the spread of the pandemic. If we do not act strongly and quickly, we’ll see manufacturing facilities close and supply chain reductions that will impact consumers across the globe.”

While Governor JB Pritzker issued an order on May 1 directing Illinoisans to wear face coverings when outside the home and unable to socially distance from other individuals, compliance has been uneven. Both the Governor and Chicago Mayor Lori Lightfoot have stated they would consider reverting to previous stages if the metrics increase, including the potential closure of businesses that only recently reopened.

“Retailers must interact with customers every single day and wearing a mask protects both the workers and customers,” said Rob Karr, president & CEO of the Illinois Retail Merchants Association. “Wearing a mask is a small act that will literally save lives and help protect one of the state’s largest economic engines. One case of COVID-19 can shut down a restaurant, movie theatre, or grocery store for weeks, threatening lives and livelihoods.”

“It’s very possible we could lose the progress Illinois has made against COVID-19 if people aren’t wearing masks in public,” said Robert W. Panton, MD, President of the Illinois State Medical Society. “Not only is wearing a mask a best public health practice in the fight against this virus, doing so can heal Illinois’ economic condition by slowing the spread.”

“We are now seeing a dramatic and troubling surge in COVID-19 cases in many states, including some of our neighboring states, as well as an uptick in Illinois, threatening to erase the hard-won gains we have made in battling the pandemic,” said Illinois Health and Hospital Association President & CEO A. J. Wilhelmi. “That’s why hospitals that are on the frontlines providing life-saving care and supporting the reopening of our economy urge everyone to take a simple and proven step to help stop the spread of the virus – wear a face mask. Together, by protecting ourselves, our loved ones, and our neighbors, we will get through this.”

Other business organizations calling on Illinoisans to wear masks to protect Illinois’ economic health and public safety include:

Associated Beer Distributors of Illinois

Chemical Industry Council of Illinois

Chicagoland Chamber of Commerce

Chicagoland Food & Beverage Network

Illinois Association of Aggregate Producers

Illinois Chamber of Commerce

Illinois Credit Union League

Illinois Fertilizer & Chemical Association

Illinois Hotel & Lodging Association

Illinois Petroleum Marketers Association

Illinois Trucking Association

Illinois Movers’ and Warehouseman’s Association

Mid-West Truckers Association

NFIB Illinois

The Greater Springfield Chamber of Commerce

Valley Industrial Association

8 Comments

|

* Gov. JB Pritzker held a press conference in Chicago today, saying he wanted to talk about how to “preserve the progress” that this state has made on COVID-19. Make sure to pardon all transcription errors…

The people of Illinois have once again proven themselves to be the most resilient dedicated and compassionate people in the United States to put some perspective on this, Illinois now has the lowest infection rates among all of our neighboring states, between one half and one third of their positivity rates. Indeed we have one of the lowest positivity rates in the country. And it’s because of the individual actions of millions of residents. […]

Ours was the first state in the nation to be able to test for COVID-19. Now Illinois is hitting a record weekly average of more than 33,000 tests per day, crossing the 2 million test threshold earlier this week. […]

And we have tripled the number of contact tracers that we had just six weeks ago.

In the first two months, our seven-day rolling average positivity reached over 23% at its peak. Today we’re averaging 3%. […]

That said, many people want to know if we’re out of the woods, and they’re wondering what’s next. So I’m here today to outline the path ahead and make sure that we all know what will cause us to impose further mitigations.

* OK, here we go…

The epidemiologists and professionals at IDPH have determined that we need to take action in a region if we see a sustained rise in the positivity rate, along with either a sustained increase in COVID-19 hospital admissions, or a reduction in hospital surge capacities.

A sustained rise in the positivity rate is defined as an increase in the seven-day rolling average for seven days out of a 10 day period. In addition, if any region hits three consecutive days of an 8% average positivity rate that will require action period. […]

We’re also today changing the boundaries and the number of health regions in Illinois. Unlike when we first introduced the restoring Illinois plan at the beginning of May, our growth in testing and tracing has given us a much more surgical ability to manage outbreaks and address problems locally. […]

For example, the city of Chicago will be in a region of its own. As will suburban Cook County. As for the collar counties, we’ve shifted regions based on geographic contiguity. For example, Kendall and Grundy counties will now be in a region that is not part of the collar counties. […]

This plan lays out an array of mitigation strategies that can be applied if a region breaches the Resurgence metrics. These mitigations cover categories like bars and restaurants, meetings, social events, religious gatherings and organized group recreational activities like adult and youth sports.

I’ll get you those maps as soon as I receive them. Updates in a moment.

* Youth sports…

I’m also deeply troubled by outbreaks that we’re seeing all around the state tied to activities like youth sports, like in Lake Zurich where dozens of students and parents have tested positive in a related outbreak. And in Knox County, where a teen softball league is also experiencing an outbreak. Remember, the degree to which we can reduce risk and restore aspects of our daily lives is still unfolding. We’re continually evaluating what works and what doesn’t work. And we’re taking a good hard look at how youth sports fits into that conversation.

* Regarding the ISBE guidelines for reopening schools…

To be very clear here, any district that intends to disregard this guidance is gambling with the lives of our children, teachers, and families. Districts that don’t live up to public health guidelines and standards and don’t make a genuine attempt to protect their communities from this virus could be held liable in the courts by community members who are ill-affected.

I’m a father. I understand that parents are worried sick about having to choose between seeing their kids miss even more in-person schooling at critical ages and the very real threat of this virus. Good people with good intentions can disagree on how and when kids should go back to school. But let me be clear, I wouldn’t let my own children return to a school where masks are not mandatory and serious effort hasn’t been made to keep students distanced during the day. This should not be controversial.

* Here are the new regions…

NORTH: Boone, Carroll, DeKalb, Jo Daviess, Lee, Ogle, Stephenson, Whiteside, Winnebago

NORTH-CENTRAL: Bureau, Fulton, Grundy, Henderson, Henry, Kendall, Knox, La Salle, Livingston, Marshall, McDonough, McLean, Mercer, Peoria, Putnam, Rock Island, Stark, Tazewell, Warren, Woodford

WEST-CENTRAL: Adams, Brown, Calhoun, Cass, Christian, Greene, Hancock, Jersey, Logan, Macoupin, Mason, Mason, Menard, Montgomery, Morgan, Pike, Sangamon, Schuyler, Scott

METRO EAST: Bond, Clinton, Madison, Monroe, Randolph, St. Clair, Washington

SOUTHERN: Alexander, Edwards, Franklin, Gallatin, Hamilton, Hardin, Jackson, Jefferson, Johnson, Marion, Massac, Perry, Pope, Pulaski, Saline, Union, Wabash, Wayne, White, Williamson

EAST-CENTRAL: Champaign, Clark, Clay, Coles, Crawford, Cumberland, De Witt, Douglas, Edgar, Effingham, Fayette, Ford, Iroquois, Jasper, Lawrence, Macon, Moultrie, Piatt, Richland, Shelby, Vermillion

SOUTH SUBURBAN: Kankakee, Will

WEST SUBURBAN: DuPage, Kane

NORTH SUBURBAN: Lake, McHenry

SUBURBAN COOK: Suburban Cook

CHICAGO: City of Chicago

* Metrics that will trigger mitigation…

• Sustained increase in 7-day rolling average (7 out of 10 days) in the positivity rate and one of the following severity indicators:

o Sustained 7-day increase in hospital admissions for a COVID-19 like illness

o Reduction in hospital capacity threatening surge capabilities (ICU capacity or medical/surgical beds < 20%)

• OR three consecutive days averaging ≥ 8% positivity rate

* Mitigation…

Some mitigation strategies in higher risk settings, like indoor bars and restaurants, will be automatically applied in a region that meets resurgence criteria to prevent rapid spread of COVID-19. A larger list of mitigation strategies relating to settings like retail, fitness, and salons and personal care will be available if testing and contact tracing data at the local level indicate those mitigations to be prudent.

* Contact tracing…

The state has also worked to expand its contact tracing operation, with approximately 1,450 contact tracers now working across Illinois. Over the next week, 26 local health departments will receive additional funding from the state, representing over $127 million of available grant funds for contact tracing. With these funds, local health departments will hire approximately 1,330 contact tracers over the next few months and significantly expand their contact tracing efforts.

The state currently has about a third of the tracers it needs.

* Back to the governor…

When you go out without a mask, or host secret parties, stuff your bar or restaurant to capacity despite the warnings, ignore common sense in your worship practices, it’s not a political statement. You’re hurting your neighbor who is desperate to keep their business open, or your friend who has an immunocompromised child who has been inside for months, or your parents who don’t have the same defenses against this virus that you may.

I’ll have questions on another post.

21 Comments

|

* From Speaker Madigan’s chief of staff Jessica Basham to all House members…

The purpose of this memorandum is to communicate protocols for the conduct of committee hearings for the foreseeable future. Protocols will be subject to ongoing changes, based on public health and safety guidelines, experience and member feedback. As usual, committee chairs interested in scheduling a subject matter hearing should contact me or committee staff.

COMMITTEE GUIDELINES

Going forward, committees conducted will adhere to the following guidelines. These guidelines were developed in consultation with the Department of Public Health and comply with the recent changes made to the House Rules (HR 846).

1. Attendance at committee hearings, including members, staff, and members of the public, will be kept to the lesser of 50 people or 50% of the committee room capacity. This will limit our largest hearing rooms, 114 Capitol and C-600 Bilandic to not more than 50 attendees. Public participation may be further limited to protect the health and safety of actual or potential participants for the duration of the COVID-19 disaster proclamation.

2. Social distancing practices must be maintained at all times. Seating will be arranged to accommodate 6 feet of distancing.

3. Face coverings that cover the mouth and nose must be worn by all participants at all times (1), even while speaking to a legislative issue.

4. All participants must submit to and pass a temperature check of 100.4F degrees or lower prior to entrance into the committee room (unless such check was required for admittance to the building). Those with elevated temperatures will not be permitted to enter.

5. Witnesses who want to testify are encouraged to provide written testimony in advance, rather than appear in person. Those who wish to provide in-person, oral testimony must wear a face covering at all times; witness table settings will be sanitized after every witness.

6. Members of the public who seek to engage with the democratic process are encouraged to do so by live streaming or engaging with their legislator by means of communication that include emails, telephone, or by filing an electronic witness slip.

7. Committee hearings will be streamed on ilga.gov. Additionally, one or more remote viewing areas will be available for additional access to live streaming for members of the public. Such areas will be limited to the lesser of 50 people or 50% of the area capacity.

In addition to these guidelines, additional safeguards may be in place relative to the buildings in which hearings are conducted. The Secretary of State (“SOS”) and Central Management Services (“CMS”) may screen all those entering the State Capitol Complex, the Michael A. Bilandic Building or any other building intended for conducting state business for an elevated temperature and/or other COVID-19 related symptoms. SOS, CMS, or other staff will have a robust sanitizing practice for the Capitol Complex, Bilandic Building, or other building intended for conducting state business, with special attention paid to door handles, elevator buttons, and other frequently touched surfaces.

Participants should also follow general guidelines for reducing the spread of COVID-19:

1. Public transportation and ridesharing should be used only when no other means of transportation are possible. If possible, participants should drive themselves.

2. Anyone feeling ill or known to have been in recent close contact with a person who has tested positive for COVID-19 should NOT travel to or participate in person at the committee hearing. They should call their doctor, a nurse hotline, any telehealth hotline set up specifically for COVID-19, or an urgent care center. If they are experiencing symptoms, they should return home and follow the guidelines provided by their physician.

3. Members of a vulnerable population should consider not traveling to or participating in person at the committee hearing.

AUDIO/VISUAL SYSTEM UPGRADES

The Office has recently contracted with a vendor for the purchase and installation of new audio/visual (A/V) equipment. Not only will this initiative upgrade old equipment in need of replacement, but it will also allow for remote participation. For now, this new system will be upgraded in 114 Capitol and C-600 Bilandic. Depending on the level of success of this initiative, it may be expanded to other committee rooms in the future.

These upgrades will take place around late September/early October, with 114 Capitol upgraded first and C-600 Bilandic upgraded second. Each room will be unavailable for up to 2 weeks while the installation is in progress.

Given the concerns about remote participation by members expressed during the May session held at the BoS Center, it is not currently contemplated that members would be able to formally participate remotely (i.e., be added to the roll or take votes). Instead, this will facilitate remote participation by witnesses and members in an unofficial capacity. Should the House alter its position on members’ remote participation, this system will be in place to facilitate that.

(1) To the extent medically able and except as reasonably necessary for eating and drinking.

2 Comments

|

Three legislators want Douglas statue removed

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* Neal Earley at the Sun-Times…

The “Little Giant” has towered over the Bronzeville neighborhood for well over a century — and three Chicago Democrats say that’s far too long.

State Representatives Kam Buckner, Curtis J. Tarver II and Lamont J. Robinson Jr. wrote a letter to Gov. J.B. Pritzker on Tuesday calling for the governor to remove a nine-foot-tall bronze statue of Stephen Douglas from atop his tomb on Chicago’s South Side.

“There is an edifice dedicated to allowing a bigot even in his grave to look down upon the Black community,” the three South Side lawmakers wrote. “This is indefensible.”

The three members of the Illinois Legislative Black Caucus made it clear they are not calling for Douglas’ body to be exhumed from the tomb, just removal of the statue, dubbing it “a tribute to a widely known racist and sexist who even staked his presidential platform on the subjugation of any non-white male in America.”

* The full letter…

* Sun-Times…

Getting the Douglas monuments out of the Illinois Capitol and its grounds — and cutting his legacy down to size in Bronzeville — is a good start toward making amends.

But let’s not forget about the bigger picture: A more economically fair Illinois and nation will go a much longer way toward ending racism.

That’s part of the solution.

24 Comments

|

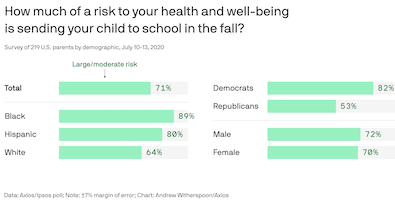

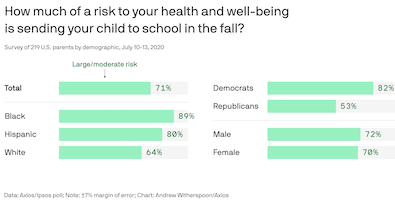

* New polling…

A majority of voters oppose the Trump administration’s demand that K-12 schools and day care centers be fully opened for in-person instruction during the coming academic year, according to a POLITICO/Morning Consult poll.

In addition, a decisive 65 percent of voters rejected President Donald Trump’s threat to cut federal funding for schools that don’t reopen, agreeing instead that schools need resources for continued virtual learning or other types of instruction. Only 22 percent said schools should have their federal money reduced if they don’t fully reopen. […]

Fifty-three percent of voters say they are somewhat or strongly opposed to fully reopening day cares or K-12 schools, while a slightly smaller 50 percent say they are opposed to fully reopening colleges and universities. […]

Women were slightly more opposed (53 percent) than men (47 percent) to colleges and universities fully reopening, as well, while 53 percent of suburbanites opposed the idea, somewhat or strongly.

The poll surveyed 1,992 registered voters between July 10 and 12 and has a margin of error of plus or minus 2 percentage points.

Toplines are here.

* I told you about this poll yesterday…

* Meanwhile, here’s a press release…

The Illinois High School Association (IHSA) announced on July 14, 2020 that it will defer to the Illinois Department of Public Health (IDPH), Illinois State Board of Education (ISBE), and the Governor’s Office on all of its Return To Play Guidelines moving forward.

“There is an unprecedented level of planning for this school year due to COVID-19, and we have come to understand that there needs to be a greater consistency between the guidelines for returning to learn and returning to interscholastic athletics,” said IHSA Executive Director Craig Anderson. “Some of the recommendations by the IHSA Sports Medicine Advisory Committee (SMAC) and directives from IDPH have come into direct conflict with each other, especially as it relates to the use of masks by student-athletes. As a result, we feel it is important to let IDPH and ISBE provide a consistent direction for our membership moving forward. We will wait on direction from these organizations for further guidance on Return to Play plans for the 2020-21 school year.”

* Press release…

The Lake County Health Department continues to work closely with Lake Zurich School District 95 in response to multiple cases of Coronavirus Disease (COVID-19) identified last week among participants of high school athletic camps and recent social gatherings. In the past week, 36 Lake Zurich High School students have tested positive for COVID-19, and all participants of Lake Zurich High School athletic camps are being instructed to self-quarantine for 14 days from their last possible exposure. […]

On Sunday, July 12, the Illinois Department of Public Health (IDPH) contracted with a private company to run a mobile testing site at Lake Zurich High School. Despite high demand for testing which resulted in long wait times, 355 individuals were tested throughout the day.

* And then there’s this problem…

A dramatic slowdown in testing turnaround times is undermining the U.S. response to the coronavirus, rendering tools like contact tracing almost useless in some instances.

Quest Diagnostics, one of the main companies doing coronavirus testing, said Monday that “soaring demand” due to the surge in cases across the South and Southwest had pushed back their average turnaround time for getting results of a coronavirus test to at least seven days for all but the highest priority patients.

LabCorp, another major testing company, said last week that its turnaround times were only slightly better, at four to six days, because of “significant increases in testing demand and constraints in the availability of supplies and equipment.”

The longer delays from previous waits of around two days as recently as late June in getting test results make it much harder to slow the spread of the virus. The fundamental strategy to help contain the virus is to test people quickly so that those who test positive can isolate. Contact tracers can then reach out to people who have been in contact with those infected to avoid spreading the virus on to others.

In Dallas, Texas, there’s a wait of up to 8-10 days for some facilities.

* Related…

* Trump Administration Strips C.D.C. of Control of Coronavirus Data - Hospitals have been ordered to bypass the Centers for Disease Control and Prevention and send all patient information to a central database in Washington, raising questions about transparency.

12 Comments

|

* Cook County Record…

Illinois landlords who have been barred for months under an order from Gov. JB Pritzker from evicting tenants who either can’t or won’t pay rent will only suffer temporary harm, and shouldn’t be allowed to sue the governor for allegedly illegally taking their property, attorneys for Pritzker have argued in a new court filing.

Pritzker asserted he has the authority under the state’s so-called “police power” to take steps to prevent public health from suffering “devastation,” should landlords begin evicting tenants too soon.

“A resurgence of the deadly virus could undo the State’s hard-won progress and waste the tremendous sacrifices all residents and business have made since March to fight the pandemic,” lawyers from the Illinois Attorney General’s office wrote. […]

“The Governor’s orders merely put a temporary hold on one means to enforce Plaintiffs’ contracts,” Pritzker’s lawyers argued. “Plaintiffs are still entitled to pursue delinquent tenants based on the breach of payment terms and may initiate eviction proceedings as soon as the suspension of evictions ends…”

The state’s brief asserts the governor intends to lift the evictions ban on Aug. 1, as the state expects to then have in place a new rental assistance program, which they said would send assistance payments directly to landlords on behalf of tenants.

“… Any harm Plaintiffs might suffer because they are unable to evict their tenants for a few more weeks is relatively slight compared to the devastation that could result if the Governor’s order were enjoined,” Pritzker’s lawyers wrote.

* The full quote…

Further, the Governor has announced he intends to suspend residential evictions for just a few more weeks until an emergency rental assistance program begins providing help to affected tenants (and their landlords) in August. An injunction would provide minimal benefit to Plaintiffs while threatening to reverse much of the progress Illinois has made in its fight against COVID-19. The law does not require this tragic result.

* So, I asked the governor’s office if it was true that the eviction order will be lifted in August…

The administration is currently assessing what assistance granted through executive order needs to be extended as we continue fighting this pandemic. The state has invested $150 million in rental assistance that Illinoisans will be able to apply for in a few weeks.

* Some background…

• The Illinois Housing Development Authority (IHDA) is launching a $150 million program with grants up to $5,000 to provide emergency rental assistance to Illinois tenants who are unable to pay their rent.

• Eligible tenants must already carry an unpaid rent balance from March through present day and certify that the reason they were unable to pay rent was due to a COVID-19 related loss of income on or after March 1, 2020.

• The assistance will be paid directly to a property owner or landlord on behalf of the tenant and as a condition of accepting the assistance, landlords must agree not to evict the tenant for the duration of the ERA.

* The governor is addressing reporters today at noon, so we’ll likely learn more…

What: Gov. Pritzker to give a COVID-19 update.

Where: James R. Thompson Center, 15th Floor, Blue Room, Chicago

When: 12:00 p.m.

Watch live: https://www.Illinois.gov/LiveVideo

Subscribers got a bit of a preview on Tuesday.

11 Comments

|

Today’s quotable

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* WCIA…

Restaurants and bars have been reopened for indoor seating for a little over two weeks since Illinois moved into Phase 4 of Governor Pritzker’s reopening plan. Some areas are seeing increases in cases of COVID-19 connected to those openings. It is a trend that’s been happening nationally with states like California already making moves to shut down indoor dining. Leaders around the Capital City are looking into ways to stop that from happening here.

Public health leaders are asking people in Springfield to stay vigilant as they go out to eat.

“It really seems to be people’s behaviors that are putting them at risk,” said Sangamon County Department of Public Health Director Gail O’Neill.

Ya think?

42 Comments

|

* Rebecca Anzel at Capitol News Illinois…

With fewer than four months remaining until the general election, House Republicans said Tuesday they want to remind Illinoisans of Democratic lawmakers’ “failure” to address corruption in the General Assembly.

It has been 260 days since former Chicago Democratic Rep. Louis Arroyo was charged by federal officials with bribery, House Minority Leader Jim Durkin said during a virtual news conference. Arroyo’s case remains pending.

Durkin, of Western Springs, also mentioned the case of former Sen. Martin Sandoval, a Chicago Democrat who pleaded guilty in January to federal charges of bribery and tax fraud.

Democratic representatives “appeared sickened and dismayed” by those ethics violations before the novel coronavirus pandemic hit, Durkin said, but “cannot be found nor heard from today.”

* Mike Miletich…

“The only way to stop the cycle of corruption from continuing is for the taxpayers of our state to show up at the voting booths in November, and earlier these days, and vote them out of office. All of them,” exclaimed Rep. Mark Batinick (R-Plainfield). […]

The Republicans also emphasized their disappointment with the Joint Commission on Ethics and Lobbying. The group spent months listening to testimony about changes needed in Springfield, but missed the deadline for a final report to lawmakers.

“This is not a priority for the leadership of the Democratic party. They do not believe ethics reform is a priority,” said Rep. Patrick Windhorst (R-Metropolis). “The things that are a priority for them they move, and they move quickly. Things that are not a priority take forever.”

Windhorst wants the Commission to finish their report so the General Assembly can begin passing reforms. House Minority Leader Jim Durkin (R-Western Springs) says rank and file members never challenge their leaders due to “the culture of corruption.”

37 Comments

|

Open thread

Wednesday, Jul 15, 2020 - Posted by Rich Miller

* Talk amongst yourselves. Just please keep it local and polite.

24 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|