I’ll be back tomorrow

Monday, Jun 1, 2020 - Posted by Rich Miller

* My plan last week was to post Monday and then take the rest of the week off. I didn’t anticipate all heck breaking loose. There’s just no way I’ll be able to stay away from my computer now. So, you’re stuck with me for a bit longer. Let’s hope things settle down a little. Peace.

16 Comments

|

* ISP Director Brendan Kelly spoke to reporters today…

Let me first just touch on really why we are here. Our fellow citizens our fellow human beings, wish to be heard. They wish to be heard so that action can come from being heard. And it is difficult to be able to hear them in a peaceful and productive way if that message and those voices are overwhelmed and drowned out by crime and by being hurt by violence, and by destructive activity and petty crime.

Director Kelly went on to talk a bit about what the ISP had done in Chicago and in Aurora.

Please pardon all transcription errors.

* More…

We’ve had requests for assistance from every part of the state. Obviously there was some activity in Springfield in Champaign, Aurora Rockford, other communities throughout the state that have called upon for the ISP to provide the systems, but also something called ILEAS. Not many members of the public may be aware of something called the Illinois Law Enforcement Alarm System, essentially that is a mutual aid system that has been in place for some years for departments to provide assistance to other departments that may be overwhelmed by particular events, catastrophe, mass casualty type of situation or other events, which may require additional law enforcement manpower beyond what that particular community has. So, as these events unfolded over the weekend as a peaceful protest shifted to unfortunately some criminal conduct as we’ve been saying, there have been requests to the Illinois State Police request to ILEAS, and to some extent those resources and the manpower that’s been available has been reaching the point where additional resources have been needed. We’ve seen looting, we’ve seen thefts went to criminal damage and we’ve seen some Parsons throughout the state. And again, there’s not one particular location or one particular community in which this is entirely focused on it sometimes. We are very quick to say there’s a hotspot here or a hotspot there.

But frankly, the information that we’ve been receiving and how this process has evolved over the past 24 hours 48 hours 72 hours, has been that we have seen a number of individuals who are between the ages of 17 to 25, young people, communicating with one another on social media, targeting a particular business, particular retail, saying let’s meet at this location at this time. And once they reach a critical mass of people they find a way to break the windows, either using rocks or a hammer or picking up trash can or more location with a bicycle breaking those windows going into the business then taking as much property as they can in some cases, there’s some indication that maybe attempted to set fires in some locations, but as a process which has been repeated as the governor said today we are in close communication with our federal partners at all times.

The information we have consistently received from them and they’ll be approved and providing to them, is it does not appear to be yet, any indication of an organized structured group that is driving a critical mass of these incidents.

In large part these are, as described at that particular age group of people seeing a pattern and practice that they’re modeling after what they’ve seen on social media. There are people who are traveling around different communities they’re maybe not from that community, they come from different parts of the state. They are driving in their vehicles sometimes hanging outside their vehicles, waving signs, making gestures. We’ve seen people with bats and other types of items that are potential weapons, driving around and voicing their opinion with regards to law enforcement. But then some of those individuals committing the type of acts that we’ve been that we’re describing here that have resulted in looting have resulted in criminal damage to property theft. And the type of activity we’ve seen play out and Champaign, Aurora and other locations.

We’ve seen many ramp closures, more closures of ramps on interstates in this state than anybody can remember. We don’t have a record going back all the way to when interstates were open but it appears of the records that are available, including the collective memory of the men and women of the Illinois state police that this is the first time we’ve seen a point in our history where this many ramps to the interstates have been closed at the same time.

* More from Director Kelly…

We’re seeing activity today, but it is so far of a different tone and tenor than the activity that we saw over the weekend and we hope it stays that way. But in order to make sure it stays that way, there are steps that the governor has directed us to do. He’s very concerned that making sure that these peaceful protests are protected and that human life is protected, infrastructure is protected, that the livelihoods of so many people who are just struggling to get their lives back together now. After the first phase of the pandemic that that activity is protected, while people are practicing peaceful protest during the weekend.

* Types of policing…

While we have been responding to incidents, the division of patrol, crowd control group, SWAT, as well as the state bioterrorism Intelligence Center which is a component of the Illinois State Police that works with our homeland security advisor.

* Limitations of ILEAS…

But the way it works, essentially, is if your neighbor’s house is on fire, we all go to help our neighbor, put out that fire. The problem with the limitations of that model is if everybody’s house is a little bit on fire, how are we all supposed to respond to the one critical thing? So when we see these various brush fires, these small incidents being repeated in any number of communities around the state, all at the same time, it makes it very difficult for that process to work.

So, to respond to the governor’s concern that he has for protecting the people at the state and protecting property and human life and the right to be able to peacefully protest. I shifted some resources that we have within the ISP to be able to devote more human resources to the role of patrol.

He then went into some detail about what resources had been shifted.

* Unprecedented?…

What’s interesting to hear from the men and women who have been doing this for many years, people that are in all walks of law enforcement, is that this cycle of activity is is not like the usual cycle of crime. This is different than other protests. This is different than other types of flare ups that we’ve seen or other types of confrontations that have occurred in response to a particular event.

And what we’re seeing here is some factors that we don’t have any way to measure or anything to compare to. This is the first time, where we’ve seen a huge surge in the number of people that are temporarily unemployed. With the economy we’re hoping we hope that goes down but we’re at a point where that is a factor and we don’t know how that is impacting public safety. We’re at a point where people are coming out of the various phases in the first round of the pandemic. People that have pent up energy, they have concerns about their health, they have concerns about their economic future that have been impacted by measures that have been needed to protect public health. We’re not sure how that how that’s gonna play out yet in terms of public safety.

We don’t have good criminology and sociology numbers to compare rates of crime and the time those crimes that occur. The days those crimes occur what type of crimes would occur to compare to from the 1918 pandemic criminology sociology of prediction of criminal activity and being able to respond to that was not developed the way it is now, with last time we had a pandemic so that is a factor that is impacting the way people are behaving.

And again, we’re not quite sure how that looks. How some of the protests and the level of aggression, the level of violence that has mutated from peaceful protests, peaceful protest majority of peaceful protests to some things that really are distinct and apart from the peaceful protests. That’s not something that has played out in a way that it does. There are some consistencies with previous protests and previous response to these type of events, but they’re in terms of what time of night in terms of where and when it has been different in some ways, so because of that we have to take additional measures, we have to be different.

* Three regions…

The state police with ILEAS and with the support of the National Guard will be coordinated through three regions. During the pandemic, we have set up three law enforcement support centers, the Illinois state police have and coordinated with with guard resources as necessary and with at least some local departments, we are going to continue that model of having regional law enforcement support centers in the northern part of the state, the central part of the state and the southern part of the state. We’ll divide the state into three areas to be able to provide support and maximizing the additional resources that the Illinois State Police are bringing to bear and maximizing the manpower, from the Illinois National Guard, that will help us free up a local law enforcement in the state police to be able to focus on the needs as they arise.

* On to questions for the director. Asked about bricks thrown off an I-55 overpass…

I can’t talk about particular locations where bricks have been thrown. I can tell you that there have been examples of not just bricks but batteries, you know, rocks, things that are made of cement, you name it any number of objects that have been thrown at law enforcement vehicles, and I’m not aware of any civilian vehicles yet. It would surprise me if that’s happened in the midst of some of these riots, but we know that that’s a pattern of conduct that we’ve seen from some people that are taking again, a moment that should be about righteous justice and turning that into something that’s violent and just purely destructive so we the only state police have only had two vehicle, which have been damaged that were damaged by bricks, so far. I know that other departments have had vehicle set on fire. I’ve had vehicles taken damaged objects thrown at them, destroyed so that is a that is a phenomena that we’re aware, but that’s that’s specific case that’s not something I can comment on here.

He was also asked a question about Mayor Lightfoot’s criticism of CPD’s efforts over a week ago and declined.

* No more questions, so he concluded with this…

It is the duty of this department and this agency, as it is for all men and women who serve in this capacity, to be ready for anything. And we are going to be ready for anything and we are ready for anything.

I’ve asked for a list of communities that the ISP has deployed to and will update if I get one.

-30-

7 Comments

|

* Gov. Pritzker at his briefing today…

Yesterday into today, 375 members of the Illinois National Guard joined local law enforcement in Chicago to assist with street closures. We implemented stringent parameters on their mission and use of force, including no interference with peaceful protesters expressing their first amendment rights. Since that deployment we have received additional reports of escalating situations and requests for assistance from communities around the state. We have now called up an additional 250 members of the Illinois National Guard, to be ready to assist other cities across the state that have faced a surge of destructive action, notably looting over the last 24 hours.

Again, our role is to support the response led by local law enforcement and municipalities, we are working with local leaders and law enforcement to meet their requests for assistance to the greatest extent possible. An additional 300 Illinois State Police troopers are also coming online today into tonight to help keep our communities outside, Chicago safe, with a focus on preventative measures and supporting local law enforcement, where departments are running thin.

* More from the governor…

The State Emergency Operations Center in Springfield is monitoring requests from local governments around the state. Individuals from Illinois Emergency Management Agency, and various mutual aid networks are on standby to assist. Illinois State Police director Brendan Kelly will provide a live update from the Blue Room at the Capitol in Springfield at 5:30pm today, with more details on our statewide response

I guess I’ll be covering that, too. Please remember to pardon all transcription errors.

* More news from the governor…

To bolster this response and give us greater flexibility, I have today issued a disaster proclamation for Cook, Champaign, DuPage, Kane, Kendall, Madison, Macon, Sangamon and Will counties to coordinate state agencies and resources as we work to assist local governments with their disaster response and recovery operations.

…Adding… The proclamation is here.

* Back to Pritzker…

In time property can be rebuilt. But the pain will fall disproportionately on the backs of our small business owners, our working families and our communities of color. And it has to stop. We have to take care of our people. And for that reason we will continue to flexibly deploy Illinois State Police and the National Guard strategically as we work with the dual purpose of protecting Illinoisans, as well as the first amendment rights of peaceful protesters.

I know there are people in this country, including some elected officials, who will point to the looting we’ve seen in Chicago and across Illinois and use it to dismiss the pain and anguish and sorrow of the moment.

Let me be clear. We cannot allow those who have taken advantage of this moment to loot and smash to also steal the voices of those expressing a need for real meaningful change. That will not be our story here in Illinois. Because this anger doesn’t come out of nowhere, it’s born of decades and centuries of systemic racism and injustice. The White House might fan the flames, but the fear that of what happened to George Floyd could happen to you or to your son or daughter is woven deeply into the fabric of what it means to be black in America. And that’s what all of us have to recognize. That’s where our work begins.

* On to questions for the governor. This morning, President Trump got on a conference call with governors, he had choice words. Calling governors weak, said that they need to be much tougher, that states are being overridden, and you’re making yourself look like fools. Much has been made this morning that he said to Governors that you have to dominate. First of all, what was your takeaway from that conversation. And what was your interpretation of when the President said you have to dominate?…

Well you heard my reaction. The truth is that the President has fanned the flames instead of bringing peace and calm. It is usually the job of the president to stand up in these circumstances, and try to bring down the temperature, that’s not what this president does. And so I felt, you know, after many minutes on that call I mean I think we were on that call for 40 minutes hearing him express what I found to be inflammatory rhetoric. And then I heard other governors get on and not call it out. And so I spoke out, and felt that was my obligation. I wish that the President would hold his words, I wish he would, if he can’t say something that is going to help us across the nation to bring the temperature down then he shouldn’t say anything at all.

* Yesterday you approved the National Guard in Chicago in a limited role as you have discussed. What is it going to take, you know you’ve seen the images of looting, not only in the city but in neighborhoods around Chicago. What is it going to take for the National Guard’s role to be enhanced?…

Well, as you see, we are enhancing it, we respond though to local law enforcement to local municipalities, we were asked to play a limited role yesterday. I did so at the request of the city of Chicago. I think it’s an appropriate request by the way I think the city of Chicago has a significant police force, and much of it was out last night doing their job. Even though I know that there was a lot of looting.

The fact is that the National Guard doesn’t have the job and doesn’t regularly train to be a frontline police officer doing law enforcement in municipalities. We have military police that are trained to be military police, some of them are police officers in their home counties or home cities across Illinois, but many of them are not. And so I think they were providing a support function, they’ll continue to do that more. As you heard me talk about today we’ll have more of them out all across wherever the municipalities have requested and where we can. But the important thing to know is that between the state police, which are going to have 200 plus troopers out there, almost 300, add that on top of the 375 that we already had up from the National Guard plus 250 more than been called up. It’s a pretty significant force.

* If you had any hope President Trump would take your advice, what’s the suggest you do to address the unrest and violence across the country?…

Well I think he should speak to the pain that’s being experienced by people all over the country. African Americans people of color who have been subject to situations like we’ve seen you know the unfortunately the George Floyd situation was not a unique one. And so I’d like to hear the president stand up and talk to that situation and also bring clergy together ask clergy to step up, I would do that. I am doing that. I really think it is time to call for calm around, not just the city of Chicago, the entire state of Illinois and entire country. That is, in part, the job of a president, this one hasn’t done it.

* Will the National Guard’s work change so they’re not just managing the perimeter in downtown?…

Well it’s their job to support local law enforcement so we’ll continue to do that and do it wherever they are asked to do it. And again, we have resources that we’re bringing to bear you’ve heard when you add up everything that we’re bringing forward it’s approaching 1000 personnel from state police and from National Guard and we’ll do what’s necessary here to help. First of all, to allow the peaceful protesters to do the kind of protest that’s appropriate. And then to catch the bad guys.

* And has the state closed down any of its COVID-19 testing facilities in response to protests and separate looting and having to call the National Guard to focus their attention on the issues at hand?…

Yes, it’s one of the unfortunate consequences of what’s happened is we can’t have guardsmen out there unprotected providing the testing well you know we can’t have police out there protecting the guardsman. We’re out there trying to protect the public and we just it’s impossible at the moment. So temporarily, the guard which has done an unbelievably great job. Let me just be clear, we would not have the kind of testing numbers that you have across the state if the guard wasn’t manning these posts, but unfortunately this situation has forced us to shut down some of those temporarily.

[The governor did not have the numbers of shuttered facilities.]

…Adding… Press release: “On Sunday, IEMA Director Alicia Tate-Nadeau ordered the closure of all Community Based COVID-19 Testing Sites in Illinois in order to protect staff and those utilizing these services. A reopen date will be announced as soon as determined.”

* What advice would you have for small business owners who are seeing images of looting and rioting, how can you assure them that the state is doing everything that it can to protect private property?…

We’ll do everything that we can to protect private property, that’s, you see here, some of the bravest individuals representing the bravest individuals in the state and they are out there protecting private property public property and lives. So we’ll continue to deploy as needed. These things have popped up overnight unexpectedly in some other areas outside of the city of Chicago and then outside of even the center of the city of Chicago. And so we’re being responsive as municipalities have asked us to step in. But it’s not our job to go in and take over for law, local law enforcement. Our job is to go help them deliver their mission locally.

* Some have question though, you know after seeing images yesterday on the south on the west side that were at times there were stretches where there was no presence of local law enforcement to enter calling into question, you know, is all is everything being done possible?…

Well, again, local law enforcement have strategies, the city of Chicago and the Chicago Police Department as you know managed the NATO protests and other protests, historically has the capability to manage this. They’re the ones who set the mission here. But I must say that our Illinois State Police which really was responding on an emergency basis to situations around the state, brought down the temperature in places. They managed to dispel people disperse the people who are in Aurora that were surrounding a police department in in Aurora Police Headquarters and we’re doing as we are asked by local law enforcement and the Chicago PD has this capability.

* Not counting the Bulls championship, the Illinois National Guard hasn’t been utilized for civil unrest within the United States since the Kent State shooting and the protests of the Vietnam War. Given the gravity of that time, what does the significance of this moment mean to you as you prepare to deploy the guard under these current circumstances?…

Well we live in some extraordinary and difficult moments. Now, during my lifetime I have not seen this, I was very young in 1968. What I can say is that this has something to do about leadership in the nation. When you don’t have national leaders who are bringing down the temperature in situations like this, it tends to fan the flames. Please look at the words that the President has put out on Twitter, look at the words that he says, he talks about total domination.

I don’t want to dominate peaceful protesters who have legitimate grievances. I do want us to put down the situations of people destroying property or violent behavior. And so I just, to me this is an extraordinarily unusual [time]. Having said that, we will meet the challenge, and we have the capability, need to challenge the people of Illinois have the capability. And again, I would ask for people to step up and call for calm and peace in our streets. It is time really for people all across our state and particularly for our faith leaders to step up and remind us who we are. I am doing it every day but I think it’s very important coming from the various faiths that represent faiths that are represented across the state.

* Several Chicago aldermen are calling for 3000 members of the National Guard to be deployed to the south and west sides of Chicago because of all of the looting in those areas. They’ve been critical that the Guard has been used to help secure downtown but not the city’s neighborhoods. What is your reaction to the widespread looting on the south and west sides and this request for additional members of the guard to specifically target those, the looting on the south and west sides and really all over the city?…

What I would say is that it’s the mission that gets set by local law enforcement that is being followed. We’re providing support services which is the appropriate thing to do, and State Police have been stepping up on the front lines because they have the kind of training that’s necessary to be right there on the front lines, making arrests for example. And so you’ve seen we’re deploying state police, significant numbers of state police and deploying significant numbers of guardsmen and women.

* How does it help Illinois for you call out the president as you did today?…

I think there are two things. One is I think we have to express our values. What I said is an expression of the values of the people of the state of Illinois. That inflaming the kind of violence and looting by simply calling for utter dominance of everybody including the peaceful demonstrators is, that’s just one example. You saw when the looting starts the shooting starts you saw that the President said that, and repeated something that comes from a racist past in the United States. So I think it’s an important thing to call out the values of the people of Illinois at an appropriate moment. And, it helps the state of Illinois because I think people should know what we stand for. I mean we are, we’re great people the state of Illinois, as you know, has produced some amazing presidents of the United States because of the values that we all share. And so I’m just reminding everybody that that that’s who we are.

* Can you expand on what the 300 state police troopers will do in pursuing preventative measures and assisting local law enforcement what types of preventative measures?…

ISP Colonel: We have several missions that we have identified that we’re going to use those additional personnel for. So, of course we already have our crowd control aspect, and we’ve been using that for the last three days and they have been doing an amazing job. We have a need from local law enforcement local municipalities for assistance with traffic control. They are requesting us for those type of details. We also are going to be using our officers to do just some of the calls for service that we have right now within the city. We have been inundated with calls of service so those extra personnel will help us they’re there. They’re there investigative components that we’re going to be using our additional officers for as well. So, there are several different missions that we do have identified in place, and we will be using those additional officers for all of those.

Gov. Pritzker: Something important if I may, just there is an enormous amount of coordination that is going on between law enforcement at the federal, state and local level and I’m really proud of that fact. I was on a call earlier today with federal officials, with our state officials, with our National Guard. We are getting briefings from the city of Chicago, and briefing them on our capabilities and what we can do to be helpful. So I just wanted to point out that the state police, which has the ability to rapidly to respond where there’s a need, the coordination that’s going on between all of these levels of government and in particular law enforcement is really spectacular.

* What do you plan to do with your disaster orders for these counties, what executive orders will you issue. Will you release funds via EO to help build rebuild businesses. What else can you do to provide security through an EO? How long will the disaster orders last, should a large relief package be considered legislatively?…

That’s an awful lot to read leading down a road that we haven’t yet gone down. I think what we’re trying to do is to operate flexibly and that’s what a disaster proclamation allows us to do in these circumstances. But it is limited right now to simply law enforcement and being responsive to the needs of those counties without having to deal with a lot of red tape when you need to move quickly within minutes or hours to help local law enforcement.

Again, the proclamation is here.

-30-

21 Comments

|

Rep. Maurice West has an 8-point plan

Monday, Jun 1, 2020 - Posted by Rich Miller

* In continuance of our new series, here is Rep. Maurice West (D-Rockford)…

The black community is gasping for air.

We experience microaggressions on a daily basis. But in this current moment we have lists of names that bring us to tears, vandalism that deters the message of our voices, and a virus that is no longer breaking news but is yet breaking up black families. The black community is gasping for air.

George Floyd. Saying his name reminds me of names that cried aloud in the Rockford community: Mark Barmore, Logan Bell, Kerry Blake. Names of black men who died at the hands, or the knee, of a police officer. Sadly, I find myself hesitant to start listing names in fear of missing a name – that’s how long the list is of black men and women killed by the police in the past 10 years, often captured on video.

It’s counterproductive to vandalize and terrorize a community that we live in. However, we must acknowledge the reasons behind the rage and violence as well as commend the peaceful protests that rose up for the sake of seeking justice, seeking equality. We must not mistake protesters for looters or vandals. There was a DISTINCT difference this past weekend in Rockford and I commend the organizers of the protest.

I encourage the Rockford community to understand the weight of current events that makes it hard for black people to breathe. On top of police violence and the fear many of us feel in living our daily routines, COVID-19 is roaming freely throughout the world and is killing black people in disproportionate numbers. There’s economic hardship in the Black community that makes it hard for us to live before and especially during this pandemic. To make matters worse –healthcare inequalities add to this strain as the ONLY west side hospital in the Rockford community has decided to dump their primarily black Medicaid patients.

The black community everywhere is gasping for air.

In Rockford and in Illinois we have political leaders who truly love the people they represent more than the job itself. Let us work together to address the underlying issues: police reform, economic redevelopment, healthcare, and education.

1. Not all police are bad. However, we need a statewide system where police officers can be held accountable to answer circumstance around deaths of unarmed black people.

2. The funds that are going into Rebuild Illinois and other capital improvements must include African Americans in these well-paying infrastructure projects.

3. Healthcare equity on both the west and east side of the Rock River must be a priority.

4. Illinois has some of the best higher education institutions in the country – however, the black representation is weak. We need a pipeline to advance black students at community colleges, state colleges, and private universities.

5. There are hundreds of millions of dollars going into hiring contact tracers for COVID-19. 80% of that money should go to black nonprofits not universities. This is the moment to strengthen the infrastructure of our black communities to stop black deaths, contain the spread of the virus, and create jobs. I want to thank Dr. Sandra Martell, the Director of the Winnebago County Health Department, for committing to working with me on that.

6. Looters have destroyed small businesses – businesses that were already suffering due to the pandemic. We need business relief and equity for these businesses by releasing the nearly $400M small business grants and technical assistance funds to save these businesses and especially black businesses.

7. Provide real and immediate economic relief to people who are unemployed and can’t get through the flooded IDES system. Our community needs immediate federal stimulus checks so that people can feed and clothe their families.

8. Provide mortgage and rental assistance immediately to stop foreclosures and evictions in our communities.

While we work on that, we also need the people protesting in this country to utilize their voice and go to mycensus2020.gov and complete the form. Your vote and your voice is necessary – you are the boss of EVERY ELECTED OFFICIAL. If they are not hearing you, then it’s time for them to go. Get involved in the political process. If I could do it, I know you can too!

There are so many names that we must never forget – and my heart aches for the loss of their lives and for their families. It’s time for a strategy – it’s time for a response. Now is that time.

Maurice West

State Representative, 67th District

11 Comments

|

A quick programming note

Monday, Jun 1, 2020 - Posted by Rich Miller

* From the governor’s office…

Updated: Daily Public Schedule: Monday, June 1, 2020

What: Gov. Pritzker to hold a media availability.

Where: James R. Thompson Center, 15th Floor, Blue Room, Chicago

When: 4:30 p.m.

Watch live: https://www.Illinois.gov/LiveVideo

Note: One broadcast and one print reporter will be allowed in the room. Pool information to follow.

We’ll have live coverage and then that’ll be it for the week, I think.

Comments Off

|

974 new cases, 23 additional deaths

Monday, Jun 1, 2020 - Posted by Rich Miller

* Press release…

The Illinois Department of Public Health (IDPH) today announced 974 new cases of coronavirus disease (COVID-19) in Illinois, including 23 additional deaths.

- Cook County: 1 male 40s, 1 female 50s, 1 female 60s, 4 males 60s, 1 female 70s, 2 males 70s, 3 females 80s, 2 males 80s, 2 females 90s

- DuPage County: 1 male 80s, 1 female 100+

- Kankakee County: 3 males 80s

- Lake County: 1 male 70s

Currently, IDPH is reporting a total of 121,234 cases, including 5,412 deaths, in 101 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 20,014 specimens for a total of 918,273. The preliminary seven-day statewide positivity for cases as a percent of total test from May 25–May 31 is 6%.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. Information for a death previously reported has changed, therefore, today’s numbers have been adjusted.

* Sunday…

The Illinois Department of Public Health (IDPH) today announced 1,343 new cases of coronavirus disease (COVID-19) in Illinois, including 60 additional deaths.

Cook County: 3 females 30s, 1 male 40s, 2 females 50s, 2 male 50s, 2 females 60s, 3 males 60s, 1 unknown 60s, 6 females 70s, 4 males 70s, 8 females 80s, 2 males 80s, 4 females 90s, 1 female 100+

DuPage County – 1 female 60s, 1 female 70s, 2 females 90s, 1 male 90s

Kane County – 1 male 50s, 1 female 90s

Lake County – 1 female 80s, 1 male 80s, 1 female 90s

Madison County – 1 female 60s

Monroe County – 1 female 60s

Peoria County – 1 male 80s

St. Clair County – 1 male 70s, 1 male 80s

Union County – 1 male 90s

Whiteside County – 1 male 90s

Will County – 1 male 50s, 1 male 60s, 1 female 80s

Williamson County – 1 male 50s

Currently, IDPH is reporting a total of 120,260 cases, including 5,390 deaths, in 101 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 21,154 specimens for a total of 898,259. The preliminary seven-day statewide positivity for cases as a percent of total test from May 24–May 30 is 7%.

* Saturday…

The Illinois Department of Public Health (IDPH) today announced 1,462 new cases of coronavirus disease (COVID-19) in Illinois, including 61 additional deaths.

Coles County: 1 male 80s

Cook County: 4 males 40s, 1 female 50s, 3 males 50s, 1 unknown 50s, 1 female 60s, 4 males 60s, 1 female 70s, 6 males 70s, 5 females 80s, 2 males 80s, 5 females 90s, 1 male 90s

DuPage County: 1 female 60s, 2 males 70s, 1 male 80s, 1 female 90s

Kane County: 2 males 60s, 1 female 70s, 2 males 70s, 1 female 80s

Kankakee County: 1 female 60s

Lake County: 1 male 90s

Madison County: 1 female 90s

McDonough County: 1 female 50s, 1 male 70s, 1 female 80s

McHenry County: 1 male 80s

St. Clair County: 1 female 90s

Tazewell County: 1 male 70s

Union County: 1 female 90s

Will County: 1 female 80s, 2 males 80s, 1 male 90s

Winnebago County: 1 female 90s

Currently, IDPH is reporting a total of 118,917 cases, including 5,330 deaths, in 101 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 25,343 specimens for a total of 877,105. The preliminary seven-day statewide positivity for cases as a percent of total test from May 23–May 29 is 7%.

…Adding… Hospitalization numbers…

As of 5/31 (11:57pm)

Total COVID patients in ICU: 902

Total COVID patients on ventilators: 547

Total COVID patients in hospital (non-ICU): 2313

Total COVID patience in hospital: 3215

16 Comments

|

* From the Illinois State Police…

As of 1:28 p.m., the following additional closures are in place until further notice:

I-94 N/B and S/B ramps to Sibley E/B

I-80 E/B and W/B at Torrence

* From earlier today…

-EXIT RAMP CLOSURES - June 1, 2020 -

As of 12:15 p.m., the following Interstate exit ramp closures are effective until further notice:

I-94 N/B and S/B to Lake Street

I-94 N/B and S/B ramps to Old Orchard Road

I-290 E/B to Congress

I-94 N/B ramp to Congress

I-90 N/B ramp to Ohio

I-90 S/B to Ohio

ALL exit ramps on I-90/94 from 18th Street to Division Street are closed until further notice.

The exit ramps are listed below:

18th Street

Roosevelt Road

Taylor Street

Polk Street

Van Buren Street

Jackson Boulevard

Adams Street

Monroe Street

Madison Street

Washington Boulevard

Randolph Street

Lake Street

Ohio Street

Ogden Street

Milwaukee Street

Augusta Boulevard

Division Street

*** UPDATE *** From the ISP…

*This closure is NO LONGER in effect: I-94 E/B ramp to IL-21*

________________________________________________________________________

As of 4:40 p.m., the following additional closures are in effect until further notice:

I-88 E/B and W/B ramps to IL-31

I-88 E/B and W/B ramps to Farnsworth Avenue

I-88 E/B and W/B ramps to IL-59

I-94 W/B ramp to IL-132

_______________________________________________________________

20 Comments

|

* This phony post was plastered all over Facebook and Twitter yesterday…

Yeah. JB and MK hanging out with Jack Franks in Wisconsin on Saturday. Right. Toooooooootally believable.

The Franks bit should be your first clue. The man has been banned from the Statehouse. Pritzker is a super-cautious dude. Do you really think he’d go openly partying in Cheeseland with that guy? If you do, you really need to check yourself.

Also, notice that they were standing in front of Gordy’s. Here’s another photo from the same day last year supplied by the governor’s office…

27 Comments

|

A quick look around

Monday, Jun 1, 2020 - Posted by Rich Miller

* While we can always hope, nothing good is coming from any of this right now. A man is dead for no good reason. Again. Our nation is in turmoil, much of it understandably so. And now we have all this collateral damage and genuine fear of another coronavirus spike at absolutely the worst possible moment…

This was supposed to be the week Chicago took its biggest step back to normal.

Now it’s not even clear how to step back into the Loop.

Though the mayor’s office said Sunday that people with legitimate reason to enter the Loop would be free to go about their business, several restrictions on public transportation and expressway ramps seemed to limit access points.

Meanwhile, Chicago Mayor Lori Lightfoot acknowledged she is concerned about what the protests, and the riots that followed, will mean for Chicago’s reopening following the coronavirus pandemic.

“I’m worried,” Lightfoot said Sunday. “I’m absolutely worried about a potential outbreak as a result of what we saw yesterday. Thousands of people, in cheek to jowl, in small spaces is exactly the opposite of what we have been preaching now for 10 weeks’ time.”

* And it’s not just Chicago…

More…

The protest started off peaceful at the Aurora Police Department, but turned violent in the downtown area with many businesses and buildings damaged.

In at least two separate instances, instigators set fire to buildings in the downtown area, Aurora Police Department spokesperson Paris Lewbel said. […]

In at least two instances, shots were fired at the officers working to contain the crowds, Lewbel said. Three squad cars were also set on fire and completely destroyed.

In multiple other instances, bricks, glass and rocks were also thrown at the officers. One Aurora Police officer suffered injuries as a result of items being thrown, Lewbel said.

The Aurora Police Department requested mutual aid assistance through the Illinois Law Enforcement Alarm System, with officers from all over the state coming in to assist with the response.

* Waukegan…

Approximately two dozen businesses were broken into and looted, and somewhere around a dozen of people were arrested by police, Lake County Sheriff Spokesman Sgt. Christopher Covelli said.

* Champaign…

Between early Sunday evening and Monday morning, 27 people were arrested and booked in the Champaign County Jail.

The charges the arrestees face range from burglary and criminal trespass to mob action to possession of stolen property.

The breakdown of those arrested is split between 10 women and 17 men, whose ages range from 19 to 36-years-old.

* His Facebook profile indicates that he’s actually supportive of the protests, so I have no idea what happened here…

A Bloomington man has been arrested on multiple traffic charges in relation to a crash that involved protesters in downtown Bloomington Sunday night. Two people were injured.

McLean County jail documents indicate Marshall R. Blanchard, 21, was booked into the McLean County jail at 10:30 p.m. Sunday on a charge of reckless conduct, failure to obey a police office and being involved in an accident that causes injury.

* Rumors were everywhere. Kankakee County Sheriff Department…

“While we are aware of multiple reports of rumors, particularly on social media, we currently have no reports of any lootings or shootings in Kankakee County and all large-group gatherings appear to have remained peaceful at this time.”

Nothing happened other than peaceful protests.

* A Southwest Side lawmaker told me last night that he and others spent much of yesterday dealing with “an unbelievable amount of half truths and outright lies on social media.” More from his texts…

A Walmart got hit near 83rd and the Ryan by a roving band of looters who jumped in their cars and headed west. Walmart alerted the Evergreen Park store that they might be coming their way and the police converged on the Evergreen Park store, but nothing happened. That sparked a round of panic closings all over the area.

“I hate Facebook and Twitter,” the legislator said.

* More on the rumors and online threats…

Businesses across the suburbs, including at least four shopping malls, closed abruptly Sunday amid threats of looting and vandalism, authorities said. […]

Oakbrook Center in Oak Brook closed as numerous reports surfaced online about looting at the mall and nearby businesses. Police confirmed the closure on Facebook, but in a follow-up post stated there were no looters and the mall is secure.

Lombard officials in a tweet said Yorktown Center and several surrounding stores also closed early Sunday because of looting fears. […]

Police in Schaumburg confirmed that Woodfield Mall closed early Sunday as a result of social media threats, but said no looting or property damage was reported.

* Picking up the pieces…

Hundreds of volunteers, many armed with brooms and other cleaning supplies, were working to make repairs in downtown Aurora Monday morning following an evening of violence and looting.

There were so many volunteers, in fact, that some said they couldn’t find anything to actually clean.

* And this story caused some sort of liquid substance to run out of my eyeballs…

Driving home from his overnight shift at the Perry County Counseling Center Saturday morning, Nicholas Tate felt called to join the movement across the country calling for an end to violence against black people by police officers.

He didn’t have time to plan a larger gathering, so decided he would do his own one-man protest.

“I just wanted to spark a movement for people to stand up for love,” he said.

On the way home, he picked up materials to make a sign. At Dollar Tree, he ran into a friend, Tenielle Worthington, and told her about his plans. She offered to join him, doubling the expected attendance count from one to two. They met up at 2 p.m. on a visible corner of Du Quoin, between the RollnUp Smoke Shop & Liquor and Taco Bell.

Tate carried a sign that said, “One Honk to Acknowledge Black Lives Matter.”

They set a simple goal: 100 honks.

“Within 30 minutes, we got that done,” said Tate, a 28-year-old African American resident of Du Quoin. The small town of about 5,700 is about 7% black.

But what happened Saturday afternoon surpassed Tate’s expectations.

“Some people drove by, they started honking, and before you know it, people that were honking were pulling over in the parking lot of the grocery store and they were coming and joining us,” he said. “We had probably 20 people out there with signs and stuff helping with the protest.”

11 Comments

|

* Sigh…

*** UPDATE *** Transcript from the governor’s office…

GOV: Mr. President, can you hear me? This is Governor Pritzker.

POTUS: I can hear you.

GOV: Thank you, you know, I wanted to say Mr. President…

POTUS: Are you on your cell phone? JB, are you on your cell phone?

GOV: Can you hear me ok? Sorry, can you hear me ok, Mr. President. Thank you.

GOV: I wanted to take this moment - and I can’t let it pass - to speak up and say that I’ve been extraordinarily concerned about the rhetoric that’s been used by you. It’s been inflammatory, and it’s not okay for that officer to choke George Floyd to death. But we have to call for calm. We have to have police reform called for. We’ve called out our national guard and our state police, but the rhetoric that’s coming out of the White House is making it worse. And I need to say that people are feeling real pain out there and we’ve got to have national leadership in calling for calm and making sure that we’re addressing the concerns of the legitimate peaceful protestors. That will help us to bring order.

POTUS: Okay well thank you very much JB. I don’t like your rhetoric much either because I watched it with respect to the coronavirus, and I don’t like your rhetoric much either. I think you could’ve done a much better job, frankly. But that’s okay. And you know, we don’t agree with each other.

GOV: Mr. President, we’re the second

POTUS: I saw it, what happened, it was a disgrace. But I spoke about it probably as long as I did about Barack and himself, and those police officers, what they did, including the three of them, that stood there and watched, and they didn’t even participate in it. The whole world was disgraced by it — that’s just our country — and the whole world was watching. So I - someone can tell me I haven’t spoken about, I’ve spoken about it at great length, at great length, and I will continue to speak about it. But I also have to speak about law and order. We need law and order in our country. And if we don’t have law and order, we don’t have a country. So we need law and order. Okay, who’s next?

91 Comments

|

Rep. Chris Welch outlines a way forward

Monday, Jun 1, 2020 - Posted by Rich Miller

* From this morning’s subscriber edition…

So, I will make this offer: I will reserve as many blog posts as necessary for any and all Illinois Legislative Black Caucus members who have a plan. The posts will be unfiltered and unedited. They’re all yours, and you’ll have my audience’s full attention. The idea will be to construct a dialogue about how this state moves forward.

Illinois has a real opportunity to be the first state to step up to solve this seemingly intractable problem.

I want to help make this happen and I am all ears.

I am still planning to shut down the blog the rest of this week. But I will post these proposals as soon as I can get to them.

* From Rep. Chris Welch…

Dear Rich,

First I would like to thank you for your thoughtful column today. You asked for policy recommendations from the Illinois Legislative Black Caucus to meet this moment of pain and heartbreak. I don’t purport to speak for the caucus. I speak as a black legislator who led on equity measures like representation of black people on corporate boards and payment for black student athletes in the NCAA. I speak as a black father who had difficult conversations with my young son and daughter on what is happening.

But since you kindly committed to print words from black caucus members, here are my thoughts:

George Floyd was murdered by policemen in broad daylight as onlookers pleaded for humanity. Only one of the four policemen involved has been charged. And now our country is in flames and our City of Chicago is in flames. Of course I don’t think it’s right to burn cop cars, bust out windows, break into stores, hurt innocent police officers and reporters who are just doing their jobs. Some of the violence and destruction is coming from provocateurs and opportunists, and some of it is a violent expression of rage and hurt at the lack of justice and equality in our Country. Have you read the names of all of the black men and women killed by the police in the past 10 years, often on film? Did you watch the videos of the shooting of Laquan MacDonald and the killing of George Floyd? How would anyone expect a black person to feel about that?

The police violence, the disproportionate numbers of African Americans dying of the COVID 19, and the economic devastation in Black communities during this economic crisis are a poisonous stew. Can we finally address some of the underlying issues? Is this the moment?

In Illinois we have good, decent political leaders who deeply want to address underlying issues. Let us begin with police reform, economic redevelopment, healthcare, and education.

1. Statewide system where bad police officers can be held accountable for the deaths of unarmed black men and women.

2. Create a pipeline to advance black students at community colleges, State colleges and private Universities. We have some of the nation’s top institutions of higher education but the representation of black students is pathetic.

3. Rebuilding Illinois and Capital funds must include African Americans in these well paying infrastructure projects.

4. Healthcare equity so hospitals like Westlake serving poor black people are not first on the chopping block.

5. Release 80% of the hundreds of millions of contact tracing dollars to black nonprofits not universities. Take this moment to strengthen the infrastructure of our black communities to stop black deaths, contain the spread of the virus and create jobs.

6. Business relief and equity for black businesses by releasing the nearly 400M small business grants and technical assistance funds to save black businesses. Absent immediate and targeted intervention, what happened this weekend will be a final nail in their coffin,

7. Provide real and immediate economic relief to people who are unemployed and can’t get through the flooded IDES system. Our community needs immediate stimulus checks so that people can feed and clothe their families; and

8. Provide mortgage and rental assistance immediately to stop foreclosures and evictions in our communities.

We also need the people protesting in this country to go to mycensus2020.gov and fill out the census. Finally, people protesting need to vote in the upcoming Presidential Election, vote in the upcoming local elections for Mayors who appoint police boards and police chiefs, and run for office yourselves.

I am heartbroken by black bodies piling up and black businesses burning. But the question for all of us is this finally the time to address underlying causes?

Chris Welch

State Representative, 7th District

33 Comments

|

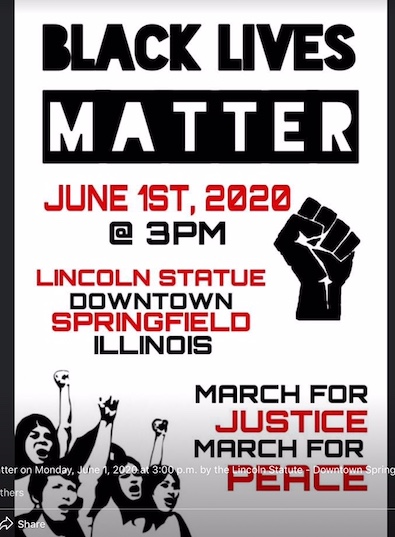

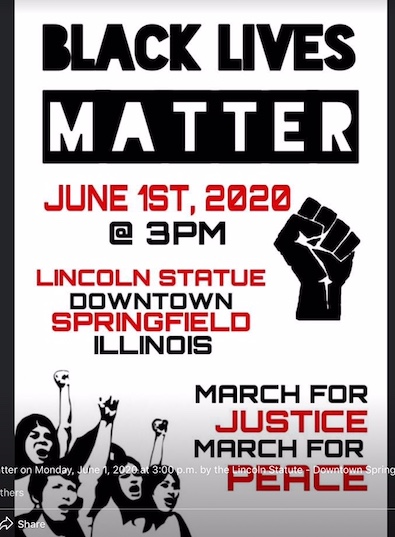

* The Illinois Statehouse is also being closed at 2 o’clock, I’m told…

Secretary of State office buildings in Springfield are closing today at 2 p.m.

The Springfield buildings impacted include, but are not limited to, the following: The Howlett Building, the Illinois State Library, the Herndon Building and the Driver Services facility located at 2701 S. Dirksen Parkway. All of the buildings will reopen tomorrow, June 2.

Out of an abundance of caution and after conferring with law enforcement, these buildings are being closed at 2 p.m. today to protect the public and employees.

* The SoS confirmed to me that this rally prompted the closure decision…

…Adding… Illinois Legislative Correspondents Association…

Spokesman Henry Haupt says media are not required to vacate the [Statehouse] pressroom, but the office is advising it out of “an abundance of caution.”

* Last night…

* Yesterday…

* ‘My silence won’t allow it’: Vehicle procession organized by Black Lives Matter Springfield remembers George Floyd, others

…Adding… From the scene…

10 Comments

|

Jacobson sues

Monday, Jun 1, 2020 - Posted by Rich Miller

* Center Square…

A Chicago-area broadcaster and the company she works for have filed a lawsuit against Gov. J.B. Pritzker in federal court over her exclusion from news briefings after the reporter spoke at a protest in Chicago in May.

Salem Media and AM 560 broadcaster Amy Jacobson filed a lawsuit against the governor in federal court on Monday.

“Attorneys also are asking the court to take immediate action to allow Jacobson back into the press briefings,” said Liberty Justice Center, the nonprofit organization that is representing Salem Media in the lawsuit.

Last month, attorneys representing Salem and Jacobson said Jacobson “broke the story that Pritzker’s family had traveled to their equestrian estate in Wisconsin amid Illinois’ stay-at-home order – weeks after it was reported that his family was at another estate in Florida.”

“The news raised questions about why the stay-at-home order did not apply to the governor’s family,” the statement said.

Last month the governor defended the decision to bar Jacobson from news briefings after she attended and spoke at a rally in Chicago focused on reopening Illinois.

“Look, when you’re standing up at a rally, where people are taking a political position, holding up Nazi swastikas, holding up pictures of Hitler and taking an extreme position as she did, it strikes me that that’s not objective in any way,” Pritzker said. “It’s not the way you act it’s not the way that your colleagues in the media act, who are reporters.

“That is not a reporter,” the governor said. “She represents a talk show that has a particular point of view, we allowed her to ask questions because once upon a time she was a reporter, but she proved that she is no longer a reporter.”

I don’t think the governor himself handled this very well and I said so at the time. To this day, Jacobson has access to the governor through the pool reporters, like I do, like we all do. Pritzker should’ve made that clear in public. Now her attorneys are trying to cast her as some sort of martyr.

I’ve been to press conferences where I couldn’t get my questions answered. I may have already told you this story, but Gov. Blagojevich tried that with me once, so I walked around the room and whispered questions to every Chicago TV reporter there. He had no choice but to answer questions from them.

* Robert Feder…

“The reason we sent Amy to these press briefings is because she is a dogged reporter with a reputation for holding public officials accountable,” said Jeff Reisman, regional vice president and general manager of AM 560 The Answer. “Over the last two months Amy has done her job well, asking the tough questions that are on the minds of so many of our listeners.

“We’re disappointed that the governor would retaliate against her and take the unprecedented step of blocking her from his press briefings. We had hoped litigation would not be necessary, but it’s imperative for Amy to get back into the room and keep doing her job.” […]

Jacobson and Salem are being represented by Liberty Justice Center, a Chicago-based non-profit conservative public-interest litigation center with ties to the Illinois Policy Institute.

Patrick Hughes, president and co-founder of the Liberty Justice Center, said: “It’s not up to Governor Pritzker to pick and choose which reporters can cover him based on how much he agrees with their coverage or their points of view. And keeping reporters out of the room because he disagrees with their line of questioning or point of view is a gross violation of the First Amendment.”

Um, she can’t get “back into the room” because access is being limited for everyone right now due to COVID-19.

And while Pritzker most certainly disagrees with her points of view, she did speak at a rally in opposition to his stay at home order. That goes well beyond attendance.

On the one hand, she’s a show-boating hyper-partisan. On the other, I’ve always been opposed to the government deciding who is and who is not a reporter, although it is indisputable that legislative leaders can limit access to their press boxes based on broad criteria (like working for a lobbying group). On the third hand, if reporters were really upset about this, they would’ve stood up for Jacobson and her access would’ve been restored by now.

Your thoughts?

27 Comments

|

Looking for something to do?

Monday, Jun 1, 2020 - Posted by Rich Miller

* Last night…

If you can’t physically make it to the neighborhood today, you can help South Shore businesses with the financial costs of cleaning up and repairing some of the physical damage by clicking here. More on ABJ Center is here.

If you know of other constructive ways to help, let us know in comments. Thanks.

4 Comments

|

We need a national system

Monday, Jun 1, 2020 - Posted by Rich Miller

* My Crain’s Chicago Business column…

“It was designed with all these different things, basically to fail, I think,” Florida Gov. Ron DeSantis said in late April about his state’s unemployment insurance application system.

He’s right. The system was specifically designed by DeSantis’ predecessor to make it more difficult to obtain unemployment benefits, according to an early April article in Politico.

The director of Michigan’s Unemployment Insurance Agency told the New York Times his state’s system is stacked against applicants. It was, he said, “built to assume that you’re guilty and make you prove that you’re innocent.”

Elsewhere, including in Illinois, years of neglect and disinvestment produced rickety, aging systems that were and are still nowhere near capable of handling 41 million unemployment benefit applications filed in the nation over just 2½ months.

For many, if not most of those Americans, this is the first time they’ve ever had to file for unemployment benefits. I did so once, back in the 1980s. It was a simple process. But the nation was in an economic expansion when I suddenly found myself out of a job. I don’t think I even had to wait in line at the local office.

That’s not the case now. The pandemic has closed pretty much all unemployment insurance office doors to the public. Police have been called to some offices.

Phone lines have been jammed as untold thousands of desperate human beings try as one to access the benefits that they paid into from their own paychecks. We’ve all read about or even experienced firsthand the hours-long waits to talk to a “real” person.

Ohio’s unemployment agency had just 40 people working the phones when the economy crashed, according to the Cincinnati Enquirer. The state has averaged 350,000 calls per day, a Cincinnati TV station reported. It’s like a mouse trying to drink from Niagara Falls.

The Illinois Department of Employment Security was a tiny bit better off. It had 173 employees answering and processing calls at the beginning of the economic crash, according to a report by CBS2 Chicago. IDES has since added 41 employees to take calls and contracted with Deloitte to run a call center with 242 people.

Click here to read the rest before commenting, please. Thanks.

11 Comments

|

With mandates off, pray for common sense

Monday, Jun 1, 2020 - Posted by Rich Miller

* My weekly syndicated column was submitted to newspapers on Friday afternoon, which now seems like almost an eternity ago…

In the period just before and after Gov. J.B. Pritzker issued his first stay-at-home order in March, houses of worship in Illinois reportedly experienced 13 COVID-19 outbreaks, resulting in 88 cases.

Since then, according to the Illinois Department of Public Health, Illinois has seen no such outbreaks — until one was revealed last week. IDPH told me of a very recent church-related outbreak of 39 cases, including the pastor.

That outbreak was acknowledged last Wednesday by the administrator of the Jackson County Health Department. The administrator told WSIU Radio that the unnamed Southern Illinois church had been holding services in defiance of the governor’s stay-at-home order.

And now, you gotta figure more church-related outbreaks could happen if people aren’t careful.

Pritzker told reporters last week that his administration will be posting “guidance, not mandatory restrictions, for all faith leaders to use in their efforts to ensure the health and safety of their congregants.” He said the guidance would be “suggestions” on capacity limits, indoor gatherings of 10 persons or less, etc.

“Governor Pritzker has capitulated, and the Thomas More Society is claiming victory in a trio of church lawsuits charging Illinois’ governor with religious discrimination,” a spokesperson for the organization said.

And then Illinois Attorney General Kwame Raoul filed his office’s response, mandated by U.S. Supreme Court Justice Brett Kavanaugh, to an emergency request by two Illinois churches that wanted the governor’s restrictions lifted. In that response, Raoul claimed the two churches’ filing was basically moot because the governor’s executive order would expires the next day.

“The governor, Raoul wrote, “has announced that after that date religious gatherings will no longer be subject to mandatory restrictions.”

The governor’s subsequent order specifically says it “does not limit the free exercise of religion.”

Pritzker has always predicted ultimate victory in every case filed against his stay-at-home order, and his office pushed back against suggestions that he has capitulated to churches. But the demand from Kavanaugh, a Trump nominee, may have spooked him.

Either way, nobody wants to make arrests or create a martyr, particularly a religious martyr. And most religious denominations will be complying with the new guidance. As for those who won’t listen, there’s not much anyone can do outside of law enforcement, and local sheriffs would likely resist orders to put preachers in jail.

Best to just declare victory and move on. If there are more outbreaks like those before the stay-at-home order was issued, perhaps church leaders and their congregations will eventually learn from it.

Meanwhile, the governor appears to be pushing ahead into the even less restrictive Phase 4 of his “Restore Illinois” plan next month without first setting up a robust contact tracing program.

For weeks and weeks, Pritzker’s “Three T’s” have been: Testing, Tracing and Treatment. The state, he has said, can’t do much about developing a treatment for COVID-19, but he has pledged to ramp up the state’s testing and contact tracing program.

Pritzker has done well with testing, but he didn’t hire anyone to set up a contact tracing program until early May, and he appeared in East St. Louis near the end of May to showcase the start of a local pilot project.

The governor’s Restore Illinois plan explicitly states that one condition for the state’s four IDPH regions moving into Phase 4 by the end of June is: “Begin contact tracing and monitoring within 24 hours of diagnosis for more than 90% of cases in region.”

On Wednesday, the governor said, “We’re at about 30 percent of the contact tracing that we need today.” The governor’s office claims they’re actually above that right now, but Pritzker repeated that figure on Friday.

And then Pritzker said, “we’re going to get to hopefully about 60-plus percent, it’s going to take us weeks and weeks, I can’t tell you how long, I mean some people think it will take through August to do it.”

One issue, the governor said, is that contact tracing cannot be mandated. A quick foray into social media will show you how insane the ever-growing conspiracy theories have become on this particular topic.

Anyway, my colleague Hannah Meisel asked Pritzker yesterday whatever happened to that 90 percent target. “Those are, I guess, internal goals,” the governor replied.

I was told by the governor’s office that Pritzker wants to focus on readily quantifiable, health-related goals. Contact tracing is apparently no longer essential.

Not to mention that Chicago isn’t scheduled to have its contact tracing fully operational until sometime in September. The city won’t want to be left behind.

* Since then…

The Supreme Court on Friday turned away a request from a church in California to block enforcement of state restrictions on attendance at religious services.

The vote was 5 to 4, with Chief Justice John G. Roberts Jr. joining the court’s four-member liberal wing to form a majority.

“Although California’s guidelines place restrictions on places of worship, those restrictions appear consistent with the free exercise clause of the First Amendment,” Chief Justice Roberts wrote in an opinion concurring in the unsigned ruling.

“Similar or more severe restrictions apply to comparable secular gatherings, including lectures, concerts, movie showings, spectator sports and theatrical performances, where large groups of people gather in close proximity for extended periods of time,” the chief justice wrote. “And the order exempts or treats more leniently only dissimilar activities, such as operating grocery stores, banks and laundromats, in which people neither congregate in large groups nor remain in close proximity for extended periods.”

19 Comments

|

Open thread

Monday, Jun 1, 2020 - Posted by Rich Miller

* Please keep it Illinois-centric and be nice to each other. Thanks.

21 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|