Question of the day

Thursday, May 13, 2021 - Posted by Rich Miller

* Press release…

In a report released today, the Civic Federation offered its general support for Governor JB Pritzker’s proposed FY2022 budget. The reasonable one-year proposal holds most areas of agency spending flat at a time of uncertain revenues, makes the full statutorily required pension payment and appropriately shifts some capital funds to the operating budget for one year. The Federation’s full analysis is available at civicfed.org/FY22ILRecommendedBudget

Governor Pritzker unveiled his spending plan earlier this year, before billions of dollars in funding were made available to the State of Illinois and local governments as part of the federal American Rescue Plan Act (ARPA). To balance the budget at that time, the Governor urged the General Assembly to implement $932 million in corporate tax treatment changes.

“Fortunately for the State of Illinois, more than eight billion dollars in federal funding will soon be deposited in its coffers, which will give officials a little breathing room as budget negotiations continue in the coming weeks,” said Civic Federation President Laurence Msall. “Given the increased flexibility, the proposed business tax changes should be excluded from the enacted budget. Increasing taxes during a recession can easily exacerbate the negative impacts of the recession and hamper the economic recovery.”

Because Illinois has a long, bipartisan fiscal tradition of proposing gimmicky budgets during economically difficult times, the Federation was pleased that Governor Pritzker’s initial proposal largely broke with that tradition to hold most agency spending flat and not rely on dubious revenues. The federal stimulus should therefore be used responsibly rather than reversing the Administration’s efforts to balance the budget.

“Not to spoil the potential eight-billion-dollar spending party before it gets started, but these funds absolutely should not be used to create new multiyear programs or new areas of ongoing spending obligations,” said Msall.

Little information about how the bulk of Illinois’ ARPA funding would be spent has yet been made public. Governor Pritzker, Illinois Senate President Don Harmon and Illinois House Speaker Chris Welch previously expressed plans to prioritize paying off $2.0 billion borrowed from the Federal Reserve under the provisions of an earlier stimulus package. Following guidance issued this week by the U.S. Department of Treasury, it is now unclear if the State can pay any debt service with the proceeds. The Office of Illinois Comptroller Susana Mendoza has asked the Treasury for additional direction.

“The Civic Federation eagerly awaits additional detail on how the federal ARPA funds can and will be used by the State,” said Msall. “No matter the permitted uses, the State must seize this opportunity to work on its long-term plan so that it will not enter future economic crises in the worst shape of any state in the nation.”

In order to achieve fiscal stability, a comprehensive, long-term plan would aim to ensure annual budgets are balanced, eliminate the bill backlog, assist struggling local governments, set aside adequate reserves and address long-term, structural challenges such as unfunded pension liabilities and infrastructure needs.

The full report is here.

* Meanwhile…

A compromise could be on the way to reduce the fee on small trailers many Illinoisans have decided not to comply with over the past year.

The fee for small trailers in 2018 was $18. That increased to $118 as part of the governor’s capital construction bill enacted in 2019.

State Rep. Katie Stuart, D-Edwardsville, said her House Bill 36 is an effort to drop it back to $18. She said there was obvious sticker shock last year.

“According to the Secretary of State we had 150,000 fewer trailer license applicants last year compared to the previous year and I worry that we’re going to see that number continue to decrease as people don’t register their trailers,” Stuart said.

* The Question: What’s your outlook for the new state budget?

18 Comments

|

* HB4080, sponsored today by Rep. Adam Niemerg (R-Dieterich)…

Amends the General Assembly Operations Act. Provides that the wearing of masks shall not be required for any member of the House of Representatives, or the staff thereof, while present on the floor of the House of Representatives. Provides that any such rule or provision of law mandating the wearing of masks on the floor of the House of Representatives is void. Effective immediately.

* HB4081, sponsored today by GOP Reps. Andrew S. Chesney, Joe Sosnowski, Blaine Wilhour, Adam Niemerg, Brad Halbrook, Chris Miller and Tony McCombie…

Creates the Vaccine Credential Act. Provides that a unit of local government or the State may not require a person to have a vaccine credential or show a vaccine credential before the person enters a public event or public venue. Limits home rule powers. Defines “vaccine credential” as any written or electronic record evidencing that a person has received a vaccine. Effective immediately.

* HB4083, sponsored today by Rep. Niemerg…

Amends the School Code. Prohibits the State Board of Education, school districts, and elementary and secondary schools from requiring the teachers, other staff, or students of a school to wear a face mask due to the COVID-19 public health emergency disaster declared by the Governor pursuant to the Illinois Emergency Management Agency Act. Effective immediately.

Not that these bills would’ve gone anywhere anyway, but the Third Reading passage deadline for House bills was weeks ago. These are purely for right-wing social media pops, and maybe a big story on Center Square.

[Headline explained here.]

…Adding… Oops. Forgot this one sponsored today by Rep. David Friess…

Amends the Interscholastic Athletic Organization Act. Provides that any athletic team or sport that is under the jurisdiction of an association or entity that provides for interscholastic athletics or athletic competition among schools and student must be expressly designated as (i) a male athletic team or sport, (ii) a female athletic team or sport, or (iii) a coeducational athletic team or sport. Provides that an athletic team or sport designated as being female is available only to participants who are female, based on their biological sex. Requires a school district or nonpublic school to obtain a written statement signed by a student’s parent or guardian or the student verifying the student’s age, biological sex, and that the student has not taken performance enhancing drugs; provides for a penalty for false or misleading statements. Prohibits a governmental entity or an association or entity that provides for interscholastic athletics or athletic competition among schools and students from entertaining a complaint, opening an investigation, or taking any other adverse action against a school district or nonpublic school for maintaining athletic teams or sports in accordance with these provisions.

*** UPDATE *** Center Square…

State Rep. Adam Niemerg said Wednesday he plans to introduce a bill that would do away with face masks in the Illinois House and in schools, which drew immediate criticism from some lawmakers even though it has yet to be assigned a bill number.

Hilarious.

…Adding… And now the ILGOP spox wants to get into the act…

People who choose to wear a mask outside are hurting nobody, unlike those who refuse to wear masks indoors. So, maybe mind your own business and let them be, bub.

38 Comments

|

Dick Kay

Thursday, May 13, 2021 - Posted by Rich Miller

* Maureen O’Donnell at the Sun-Times…

Dick Kay, a no-nonsense, incisive inquisitor who had one of the longest political reporting careers in Chicago, died early Thursday at 84, according to his son Steven Snodgrass.

Mr. Kay had a stentorian voice that sliced through the noise at crime scenes and news conferences like a bass baritone in an opera. It seemed to command answers from politicians and public relations people who might have preferred to slink away from a mic.

Mr. Kay, who lived in St. Charles and had taken ill earlier this week, worked 38 years for WMAQ-Channel 5, covering countless political conventions, indictments, court trials, aldermen, mayors, governors, senators and presidents. He was hired there as a writer in 1968. Within months, he was covering one of the most tumultuous political stories of the century.

“They sent me out on the street, a green kid. The Democratic Convention, in the middle of it! I was stunned,” he once said in an interview with the Chicago Sun-Times.

He began appearing on air two years later, rising to the post of political editor. He also hosted the show “City Desk” and wrote commentaries for the station. […]

He grew up in New Dellrose, Tennessee, a self-described “country boy” who was born in a log cabin. He was just 3 when his sharecropper-father died. His mother worked as a seamstress or cook all her life, he said in the Sun-Times interview. At 14, he dropped out of school so he could make money digging ditches, picking cotton and washing dishes.

Dick Kay was a giant of Chicago TV news back in the days when all the city’s stations strove for excellence.

He was a gruff, hard-hitting and unsparing reporter and won a coveted Peabody Award in 1984…

With extraordinary zeal and completeness, WMAQ-TV reporter Dick Kay and his associates set out to investigate reports of financial waste and corruption in the Illinois State Legislature. The result was Political Parasites, a series of reports on “dead-wood” committees and meaningless commissions that were costing the taxpayers of Illinois millions of dollars. Through effective interviews backed by documented evidence, WMAQ-TV was able to provide extensive proof of duplication, waste, and nepotism in these committees. The result was the swift passage of legislation eliminating the Political Parasites, along with substantial savings of public funds. For an exceptionally well-done investigative report, a Peabody Award to WMAQ-TV for Political Parasites.

* He could also be a sweet and kind man. I introduced myself to him many years ago by telling him I’d been watching his work since I was a little kid. That was the beginning of a friendship that lasted years. It was one of the highlights of my life knowing that he respected my work. He even commented on the blog.

I disagreed with his post-retirement decision to work temporarily for the Blagojevich administration, but he was excited to promote the governor’s health care proposals. And he really let his freak flag fly on his WCPT show.

But, as a reporter and an inquisitor, I’d be hard-pressed to name anybody better than Dick.

* Related…

* ‘That ain’t bad for a country boy from the wrong log cabin’ – Remembering Dick Kay

* Longtime Chicago political reporter Dick Kay dies at 84

16 Comments

|

* New CDC guidance for those who are fully vaccinated…

• You can resume activities that you did prior to the pandemic.

• You can resume activities without wearing a mask or staying 6 feet apart, except where required by federal, state, local, tribal, or territorial laws, rules, and regulations, including local business and workplace guidance.

• If you travel in the United States, you do not need to get tested before or after travel or self-quarantine after travel.

• You need to pay close attention to the situation at your international destination before traveling outside the United States.

o You do NOT need to get tested before leaving the United States unless your destination requires it.

o You still need to show a negative test result or documentation of recovery from COVID-19 before boarding an international flight to the United States.

o You should still get tested 3-5 days after international travel.

o You do NOT need to self-quarantine after arriving in the United States.

• If you’ve been around someone who has COVID-19, you do not need to stay away from others or get tested unless you have symptoms.

o However, if you live or work in a correctional or detention facility or a homeless shelter and are around someone who has COVID-19, you should still get tested, even if you don’t have symptoms.

[…] • You will still need to follow guidance at your workplace and local businesses.

• If you travel, you should still take steps to protect yourself and others. You will still be required to wear a mask on planes, buses, trains, and other forms of public transportation traveling into, within, or out of the United States, and in U.S. transportation hubs such as airports and stations. Fully vaccinated international travelers arriving in the United States are still required to get tested within 3 days of their flight (or show documentation of recovery from COVID-19 in the past 3 months) and should still get tested 3-5 days after their trip.

• You should still watch out for symptoms of COVID-19, especially if you’ve been around someone who is sick. If you have symptoms of COVID-19, you should get tested and stay home and away from others.

• People who have a condition or are taking medications that weaken the immune system, should talk to their healthcare provider to discuss their activities. They may need to keep taking all precautions to prevent COVID-19.

“Fully vaccinated” is defined as two weeks after the second dose in a 2-dose series, such as the Pfizer or Moderna vaccines, or two weeks after a single-dose vaccine, such as Johnson & Johnson’s Janssen vaccine.

* From the governor’s office…

The Governor believes firmly in following the science and intends to revise his executive orders in line with the upcoming CDC guidelines lifting additional mitigations for vaccinated people. The scientists’ message is clear: if you are vaccinated, you can safely do much more.

* Meanwhile, from NBC 5…

The Cubs and White Sox will both increase capacity limits at Wrigley and Guaranteed Rate fields to 60% later this month as Chicago continues to further lift COVID restrictions, the teams announced Thursday. […]

The White Sox will designate Sections 108-109 as vaccinated-only without physical distancing for four games this weekend, starting with Game 1 of the doubleheader against Kansas City on May 14. Fans who purchase these tickets must show proof of vaccination and a photo ID upon entering the ballpark, the team said.

The Sox also announced that beginning May 24, the team will offer two vaccination sites for fans at Guaranteed Rate Field, offering those who get vaccinated before the game a $25 gift card for use inside the ballpark.

At Wrigley, the vaccinated section will be the upper section of the center field Budweiser Bleachers, sold at full capacity and not physically distanced, only available for the Cubs’ four-game series against the Washington Nationals from May 17 to May 20. Tickets will be $20 plus taxes and fees, and all who purchase tickets must show proof of vaccination and a photo ID, the team said.

28 Comments

|

It’s just a bill

Thursday, May 13, 2021 - Posted by Rich Miller

* Capitol News Illinois…

As Illinois lawmakers continue to push for the passage of an energy overhaul this spring, the Illinois House Energy and Environment Committee discussed the latest proposal to enter the discussion – Gov. JB Pritzker’s Consumers and Climate First Act.

House Bill 4074, sponsored by Rep. Kam Buckner, D-Chicago, was brought before committee for discussion only. Pritzker’s 900-page proposal was released at the end of April with the goal of transitioning Illinois to 100 percent carbon-free energy – including nuclear power – by 2050. […]

Deputy Gov. Christian Mitchell, who also presented the bill in committee, said many of the ideas in Pritzker’s proposal align with the goals of other energy bills, especially the Clean Energy Jobs Act. Sponsored by Rep. Ann Williams, D-Chicago, CEJA was initially introduced to the General Assembly in spring 2019 and has been one of the most publicized bills amid ongoing energy negotiations. […]

No action has been taken on Pritzker’s proposal yet, but as the General Assembly reaches their final stretch of session, negotiations on a compromise measure continue. Mitchell said Pritzker’s administration is willing to continue to work on a final product.

Lots more in that story, so click here if this topic is of interest.

* Looks like the governor could be put on the spot…

Senate Bill 1965 lead by Rep. La Shawn Ford, D-Chicago, and Sen. Kimberly Lightford, D-Maywood, would make June 19 an annual state holiday to commemorate the end of slavery in the United States after Abraham Lincoln signed the Emancipation Proclamation in 1863. The holiday is celebrated on June 19 as the day when slaves in Texas found out they were free in 1865, over two years since they had legally been granted freedom.

This version of the bill would take effect immediately upon the governor’s signature. If passed by the House and signed by Gov. JB Pritzker by June 19, this year’s Juneteenth would be an official state holiday. Because the holiday falls on a Saturday this year, Monday would be the day off for state workers. The bill already passed unanimously in the Senate.

Ford and Lightford are leading another version of the bill that is currently in the Senate. House Bill 3922 already passed the House unanimously. However, if this version was sent to the governor, Juneteenth would not be a state holiday until 2022. It also would not give state workers the following Monday off should the holiday fall on a weekend, which makes it less costly than the Senate bill.

* NPR Illinois interview with Comptroller Mendoza…

NPR Illinois: Your office has one initiative, House Bill 571, which would call for municipalities…to report more details about tax increment financing districts. Could you just first tell me a little bit about what that bill would accomplish? And also because such a big portion of education dollars are wrapped up in property taxes, do you believe that school districts should have a say on whether a TIF is created in their district or whether or not their dollars should be allocated to go towards a TIF, especially since not all TIFs, you know, lead to a return on investment?

Mendoza: Well, look, I feel that transparency has been the hallmark of my administration, and I think that it’s also the road to restoring trust in government. When people believe that all of the decisions related to their school district or in any environment, right, are done behind closed doors without input by the people that are actually toiling away at this endeavor, it creates distrust and animosity towards the process…What happens is that all of these dollars are being generated and districts are missing out on money because it’s going to investments on potential job creation or economic development. But we’ve also seen that a lot of, they’re supposed to be going to blighted areas, and a lot of these TIF dollars are not in what we would consider by any stretch of the imagination blighted areas.

The other issue with the TIFs is that, interestingly enough, the developers are the ones who choose the consultants who determine whether or not this TIF is meeting its expected goals or deliverables in a return on investment for those tax dollars. Which is an inherent conflict of interest…So, we decided to at the very least, as part of our big reform here, is that the city would be responsible for choosing their consultant because they want somebody who will advocate for the city’s position here, not the developer’s position in this deal. Of course, the consultant’s always going to say, “This is going to pay off great in 10 years,” and it usually never does, right? So moving forward, these TIFs will have a lot more transparency and they’re going to have to report to my office whether or not they’ve met their deliverables and what their expectations are for meeting them, their timeline, and most importantly the city will now have a vested interest in choosing a consultant that will make sure that these deliverables are legitimate. And then that gives the constituency a much greater voice.

* Press release…

House Bill 12 passed out of committee and is now poised for passage in the Senate. The legislation was drafted by the Illinois Education Association (IEA) and would expand coverage of the Family and Medical Leave Act to thousands of education support professionals across the state.

“This bill would help those who need it the most. HB12 will lift up our education support staff, knowing they have access FMLA without the risk of losing their job and health insurance,” IEA President Kathi Griffin said. “Supporting working families is important. FMLA is not just for pregnant mothers. It can also be used if an employee needs time to recuperate from a serious health condition, care for a family member with a serious health condition or care for a family member who has sustained injuries while on active service duty for the military.”

Currently, to be eligible for FMLA an employee must have worked 1,250 hours during the previous year. Unfortunately, this disqualifies many of our educational support staff from meeting the requirements of FMLA due to the limited number of days they are able to work during a school year. HB 12 reduces the minimum threshold to 1,000 hours, so that more education support professionals would qualify for FMLA. Education support professionals are support staff in schools like secretaries, teachers’ aides, paraeducators, maintenance workers, school bus drivers and cafeteria workers.

“We currently have a shortage of education support professionals in our schools. COVID helped to exacerbate the problem. These support staff are so important to our children’s education. They support our students every day, some working with our most vulnerable students,” Griffin said. “We should be doing everything in our power to attract new hires to the profession and to keep the talented professionals we already have on staff.”

HB12 now moves to the Senate.

5 Comments

|

* Press release…

The Illinois Department of Public Health (IDPH) today reported 1,918 new confirmed and probable cases of coronavirus disease (COVID-19) in Illinois, including 35 additional deaths.

- Coles County: 1 male 60s

- Cook County: 1 male 20s, 1 female 60s, 2 males 60s, 2 females 70s, 4 males 70s, 2 females 80s

- DuPage County: 1 female 60s, 1 male 90s

- Henry County: 1 female 80s

- Kane County: 1 female 70s

- Knox County: 2 females 80s, 1 female 90s

- Lake County: 1 male 70s

- Macon County: 1 male 40s

- McLean County: 1 male 90s

- Peoria County: 1 female 60s, 1 male 60s, 1 female 70s, 1 male 70s

- Rock Island County: 1 male 80s

- Tazewell County: 1 male 50s, 1 male 70s, 1 female 80s, 1 male 80s

- Wayne County: 1 male 60s

- Will County: 1 female 70s

- Winnebago County: 1 male 70s

Currently, IDPH is reporting a total of 1,361,666 cases, including 22,320 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 88,682 specimens for a total of 23,594,096. As of last night, 1,765 individuals in Illinois were reported to be in the hospital with COVID-19. Of those, 465 patients were in the ICU and 236 patients with COVID-19 were on ventilators.

The preliminary seven-day statewide positivity for cases as a percent of total test from May 6-12, 2021 is 2.7%. The preliminary seven-day statewide test positivity from May 6-12, 2021 is 3.2%.

A total of 10,179,004 vaccines have been administered in Illinois as of last midnight. According to Centers for Disease Control and Prevention data tracking, 62% of adults in Illinois have received at least one dose of COVID-19 vaccine. The seven-day rolling average of vaccines administered daily is 76,082 doses. Yesterday, 68,035 doses were reported administered in Illinois. Due to a reporting issue, doses from CVS are not included in today’s count, but will be reflected in the numbers in the next couple days.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. For health questions about COVID-19, call the hotline at 1-800-889-3931 or email dph.sick@illinois.gov.

5 Comments

|

* CBS 2…

The U.S. Department of Labor estimates 17,931 new unemployment claims were filed during the week of May 3 in Illinois, according to the DOL’s weekly claims report released Thursday. […]

There were 15,134 new unemployment claims were filed during the week of April 26 in Illinois.

There were 17,141 new unemployment claims filed during the week of April 19 in Illinois.

There were 15,248 new unemployment claims were filed during the week of April 12 in Illinois.

There were 18,986 new unemployment claims were filed during the week of April 5 in Illinois.

The four-week moving average is down 82 percent from a year ago.

* Bloomberg…

Applications for U.S. state unemployment insurance fell to a fresh pandemic low last week as business confidence strengthens and employers seek to fill more positions left open by restrictions.

Initial claims in regular state programs declined by 34,000 to 473,000 in the week ended May 8, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for 490,000 claims. The prior week’s figure was revised up to 507,000.

That’s still “More than twice a typical non-recession week.”

* Related…

* Illinois taxpayers who received unemployment benefits and filed before March 15 could be eligible for refund

Comments Off

|

Time Is Running Out To Hold Utilities Accountable

Thursday, May 13, 2021 - Posted by Advertising Department

[The following is a paid advertisement.]

With just weeks remaining in the legislative session, time is running out to pass a comprehensive clean energy bill like the Clean Energy Jobs Act (CEJA) that will hold utilities accountable.

Despite federal prosecutors fining ComEd a record $200 million in a bribery scandal, ComEd continues to profit off their wrongdoing and avoid refunding customers for their corruption.

Meanwhile, Ameren didn’t even show up to an April 27th House Energy and Environment Committee hearing on utility accountability. Instead, they’ve spent more than $80,000 in the last two months on misleading digital ads - outspending every other political advertiser in the state.

In the midst of all of this, both ComEd and Ameren are requesting millions in rate hikes from the state, hurting working families who pay more for their insider deals.

Legislation like CEJA will hold these utility companies accountable, placing an independent monitor in the headquarters of ComEd and Ameren and providing restitution for ComEd customers.

Illinois lawmakers must pass a comprehensive energy bill that will address the climate crisis, create equitable jobs, and advance the strongest utility ethics measures in state history. But we have less than 20 days left to get it done. CEJA can’t wait.

Learn more at ilcleanjobs.org.

Comments Off

|

Bridge Phase will begin tomorrow as scheduled

Thursday, May 13, 2021 - Posted by Rich Miller

* Press release…

Governor Pritzker and the Illinois Department of Public Health (IDPH) confirmed today the entire state will move into the Bridge Phase of the Restore Illinois reopening plan tomorrow, Friday, May 14th. The Bridge Phase is the final step before the full reopening of Phase 5.

Under Bridge Phase, there are expanded capacity limits for businesses, dining, offices, events, conferences and gatherings. Barring any significant reversals in key COVID-19 statewide indicators, including increasing hospitalizations, Illinois could enter Phase 5 as soon as Friday, June 11th.

The state will continue to follow Centers for Disease Control and Prevention guidance on mask-wearing in Phase 5.

“Illinoisans have worked so hard over the past year and a half to keep their families and neighbors safe, and reaching Bridge Phase means that we’re closer than ever to a return to normalcy,” said Governor JB Pritzker. “To keep up this progress, I urge every eligible Illinoisan – now including 12 to 15-year-olds – to get vaccinated as soon as possible.”

More than 10.3 million vaccine doses have been administered to Illinoisans at mass vaccination sites, local health departments, pharmacies, federally qualified health centers, mobile clinics, and other locations across the state. Doctors’ offices are starting to administer vaccine to their patients. Beginning today, the Pfizer-BioNTech vaccine is available to youth ages 12 through 17 years after the Centers for Disease Control and Prevention on Wednesday accepted the recommendation from the Advisory Committee on Immunization Practices to expand the use of the vaccine. The Moderna and Johnson & Johnson vaccines are authorized for those 18 years of age and older.

“The more people who are vaccinated, now including our youth as young as 12-years-old, the quicker we can end this pandemic,” said IDPH Director Dr. Ngozi Ezike. “While more than 62% of adults in Illinois have received at least one dose of the vaccine, we still need more people to get vaccinated. Please talk with your doctor or health care provider if you have questions about the vaccine and know the facts so that you can make the most informed decision.”

IDPH will continue to monitor the number of ICU hospital beds that are available, the number of patients who are hospitalized with COVID-19, and the number of people being newly admitted to the hospital because of COVID-19-like-illness. Should the state see a significant increase in deaths, hospitalizations, and the number of people being admitted to the hospital because of COVID-19, the state will remain in the Bridge Phase instead of moving to Phase 5.

Details of the phase are here.

6 Comments

|

* Tribune editorial…

A bill moving through the Illinois House and Senate in Springfield has private schools worried. It establishes state-mandated “metrics” that schools must meet before they can offer in-person learning. The concern: The legislation could make it harder for schools to reopen this fall.

Um, no.

The mandated “metrics” were in the introduced version…

In-person instruction at schools. The Department shall establish metrics for school districts and public institutions of higher education to use during the public health emergency in determining if the district or institution may safely conduct in-person instruction or if the district or institution must implement remote learning or blended remote learning to keep students and staff safe. .

That language caused an uproar last month.

* So the original bill was amended to delete the offending “metrics” language and to change the bill’s focus…

The Department shall establish requirements by rule for providing in-person instruction at nonpublic schools and public schools that include, but are not limited to, personal protective equipment, cleaning and hygiene, social distancing, occupancy limits, symptom screening, and on-site isolation protocols and shall disseminate information about those requirements to nonpublic schools and public schools with the assistance of the Illinois State Board of Education. The authority to enforce the rules adopted pursuant to this Section lies with the Department and local departments of public health. Upon receipt of a complaint that a school cannot or is not complying with the Department’s rules under this Section, the Department or local public health department shall investigate the complaint within 45 days after receiving the complaint. If upon investigation, a school is found to be in violation of the rules adopted under this Section, the Department has the authority to take the appropriate action necessary to promote the health or protect the safety of students, staff, and the public, including, but not limited to, closure of a classroom, gym, library, lunch room, or any other school space until such time that the Department determines that the violation or violations have been remedied. Nothing in this Section limits the authority or requirements of the Department or local public health departments. All complaints and related documents shall be maintained and are subject to applicable disclosure requirements under the Freedom of Information Act. […]

In order to provide in-person instruction, nonpublic schools and public schools must follow the requirements adopted by rule by the Department of Public Health under Section 2310-705 of the Department of Public Health Powers and Duties Law of the Civil Administrative Code.

In other words, the proposal went from proactive to reactive and basically just codifies what has been happening in Illinois for close to a year. Also, notice that, despite the editorial, local public health departments are involved.

* Back to the editorial…

Many private schools, including most in the Archdiocese of Chicago and other faith-based schools across the state, worked with local health officials last summer and fall to figure out how to safely offer in-person learning when many public school buildings remained closed due to COVID-19. […]

But it also removes local control from all school districts which have shown, particularly during the pandemic, that a one-size-fits-all approach would be the wrong one. Each district, each community, had the ability to shape how and when their students returned to school. This would change that.

While each district and private school has been allowed to set their own specific rules, they all had to follow basic guidelines set forth by the state. There was even a lawsuit over this…

Illinois Gov. JB Pritzker and the Illinois Department of Public Health have won an injunction against three school districts who said they did not need to mandate face masks for in-person learning this year.

The Archdiocese of Chicago’s rules were primarily based on state rules with additional guidance from the city’s public health department.

The editorial board needs to get off Facebook.

*** UPDATE *** The governor was asked about the bill today and he said work is still being done on the legislation. Again, you’d think the largest newspaper in the state would pick up a phone before getting so far over its skis on something like this.

15 Comments

|

Rodney Davis claims he missed the Cheney vote

Thursday, May 13, 2021 - Posted by Rich Miller

* Politico…

The voice vote to bump Rep. LIz Cheney from leadership happened moments after Republicans said “amen” in a morning prayer. The action was so quick that numerous members, including Illinois Republican Reps. Rodney Davis and Darin LaHood missed the vote.

“I actually wasn’t there,” Davis told POLITICO’s Congress reporter Olivia Beavers. “I had a meeting that went long.” Davis remembered the last time Cheney ran for the leadership spot. “I whipped for her,” he said, recalling that the discussion went on for “four hours.”

Pressed on how he would have voted this time, Davis said, “I am a big supporter of Liz. I am a big fan. … there was no vote but I would’ve been there as a supporter of Liz.”

LaHood, who was seen arriving late to the vote, wouldn’t answer how he would have voted. He issued a statement saying, “I am grateful for Congresswoman Cheney’s leadership as Conference chair.”

* CNN…

The vote to oust Rep. Liz Cheney from her leadership position took only 16 minutes.

Before the House Republican Conference met Wednesday morning to oust the Wyoming congresswoman from her position as the third-ranking Republican member in Congress, sources told CNN they expected it to be quick.

But it happened so quickly that some members arrived just in time for the vote.

46 Comments

|

[The following is a paid advertisement.]

Employers in Illinois provide prescription drug coverage for nearly 6.7 million Illinoisans. In order to help keep care more affordable, employers work with pharmacy benefit managers (PBMs), who deploy a variety of tools to reduce prescription drug costs and help improve health outcomes. In addition to helping employers, PBMs also work with the Illinois Medicaid program in the same way to help control costs. Over the last five years, PBMs have saved the state and taxpayers nearly $340 million.

Today, Illinois faces a multibillion budget shortfall as more Illinoisans are relying on Medicaid to help meet their health care coverage needs. As legislators work to address these challenges, one way to help ensure continued cost savings is by strengthening the PBM tools that the State and employers use, which are poised to save employers, consumers and the State $39 billion over the next 10 years. These are meaningful savings that will help continue to contain costs, ensure consumer access to medicines and drive savings in public health programs.

Amid a pandemic and economic challenges, now is the time to strengthen, not limit, the tools that employers, consumers and the State rely on to manage costs and ensure consumers can access the medicines they need.

Learn more

Comments Off

|

* SJ-R…

The state of Illinois will open up vaccinations to 12-15 year olds Thursday, following approval from the Centers for Disease Control and Prevention to distribute the Pfizer vaccine to that age group.

Vaccination sites across Illinois can begin providing the vaccine to the adolescents with sign up commencing Wednesday afternoon. Memorial Health System and CVS also announced Wednesday that they would begin distribution at their sites Thursday, with appointments and walk-ins accepted.

* New York Times…

According to a new U.S. census estimate, some 30 million American adults who are open to getting a coronavirus vaccine have not managed to actually do so. Their ranks are larger than the hesitant — more than the 28 million who said they would probably or definitely not get vaccinated, and than the 16 million who said they were unsure. And this month, as the Biden administration set a goal of 70 percent of adults getting at least one dose by July 4, they became an official new focus of the nation’s mass vaccination campaign.

In addition to “the doubters,” President Biden said at a news briefing last week, the mission is to get the vaccine to those who are “just not sure how to get to where they want to go.”

If the attention has centered on the vaccine hesitant, these are the vaccine amenable. In interviews, their stated reasons for not getting vaccines are disparate, complex and sometimes shifting.

They are, for the most part, America’s working class, contending with jobs and family obligations that make for scarce discretionary time. About half of them live in households with incomes of less than $50,000 a year; another 30 percent have annual household incomes between $50,000 and $100,000, according to an analysis of the census data by Justin Feldman, a social epidemiologist at Harvard. Eighty-one percent do not have a college degree. Some have health issues or disabilities or face language barriers that can make getting inoculated against Covid-19 seem daunting. Others do not have a regular doctor, and some are socially isolated.

Technically, they have access to the vaccine. Practically, it is not that simple.

* Crain’s…

Northwestern University is another local college to require students to be vaccinated before returning to campus this fall.

“As confidence increases in the effectiveness and safety of the vaccine and the supply has met the demand in Illinois, Northwestern will require students to be vaccinated against COVID-19 for the 2021-22 academic year,” the school said. “COVID-19 vaccines are the most important tool to help end the pandemic, and requiring students to be vaccinated will best support the health of our community and position us for in-person classroom and co-curricular activities for the fall term.” […]

NU is not currently requiring vaccination for faculty and staff. “We have not yet made a decision on whether to require faculty and staff to be vaccinated. We are continuing to evaluate the situation,” a spokesman said in an email.

* ABC 7…

An I-Team analysis of IDPH data since vaccine demand peaked statewide in mid- April reveals in the southern region of Illinois, the seven-day average of vaccines administered is down 60%. For the Northwest regions, demand has dipped 54%. In the suburban regions, including Cook County, there’s a decrease of 46%. Chicago has seen a 48% drop over the same period.

* I received a lot of texts about this yesterday…

Officials across the United States are looking for unique solutions to overcome coronavirus vaccine hesitancy, and Ohio Gov. Mike DeWine upped the ante in a big way.

In a series of social media posts Wednesday, DeWine announced that the state of Ohio will randomly select five residents who have received at least one dose of the coronavirus vaccine, and those residents will receive a prize of $1 million.

The drawings will begin on May 26, and will occur on each successive Wednesday for five consecutive weeks, DeWine says:

*** UPDATE *** Press release…

Following yesterday’s expansion of vaccine eligibility to 12- to 15-year-olds, Governor JB Pritzker announced that Six Flags Great America – the Thrill Capital of the Midwest – will offer 50,000 free tickets to their parks in Gurnee and Rockford to newly vaccinated Illinois residents.

The value of the donated tickets is $4 million.

“Throughout the pandemic, Six Flags has been All In for Illinois, putting the health of workers and visitors first,” said Governor JB Pritzker. “I know it’s been a difficult year – but that just makes it all the more exciting to be back at the park. Thanks to the life-saving power of vaccinations, it feels once again like summer’s in the air.”

“Six Flags Great America is proud to support the state of Illinois vaccination efforts, especially in underrepresented communities,” said Six Flags Great America Park President Hank Salemi. “We’re getting back to the thrills and want to do our part to encourage residents to get vaccinated.”

Health experts agree that getting vaccinated is how we’ll all get back to the things we’ve missed during the pandemic, including thrilling rollercoasters, waterparks and live entertainment.

To make sure the tickets have broad reach, the state is sending Illinois National Guard mobile vaccination teams to their Gurnee location starting the first weekend in June: Saturday the 5th and Sunday the 6th. If turnout is high, vaccination teams will return to continue offering this lifesaving protection to residents. Six Flags Great America will announce additional details in the coming weeks.

In addition, a significant portion of the tickets will be distributed through local health departments to use in the way that will best work in their community. Specific initiatives will be rolled out by the departments of public health in the city of Chicago, Cook County and the Collar Counties — including equity mobile missions in neighborhoods with lower vaccination rates, school-based clinics, full-family vaccination initiatives and mass vaccination clinics. More information will become available on a county-by-county basis.

Finally, to focus on underserved youth and their families, the Vaccine Corps Partnership incubated at Michael Reese Health Trust will deploy the tickets as a part of their hyper-local vaccine education campaign. The organization works with community-led organizations to build trust in the vaccine, primarily in the city of Chicago and Cook County. Learn more about the partnership on their website.

The latest vaccine incentive announcement comes on the heels of the federal authorization of the Pfizer vaccine for 12- to 15-year-olds, which young people can get on its own or along with other routine vaccinations. Residents are encouraged to use the CDC’s vaccine finder tool at www.vaccines.gov to see which locations have vaccine available and to filter by manufacturer.

24 Comments

|

Mendoza argues for state credit upgrade

Thursday, May 13, 2021 - Posted by Rich Miller

* Peter Hancock at Capitol News Illinois…

Illinois Comptroller Susana Mendoza is asking the nation’s three major credit rating agencies to reconsider the state’s credit rating with an eye toward a possible upgrade.

In an April 28 letter to executives at Moody’s Investors Service, S&P Global Ratings and Fitch Ratings, Mendoza argued that Illinois has virtually eliminated its backlog of past-due bills while keeping current on its bond payments and pension obligations, all in the midst of a global pandemic. […]

Both Mendoza and Gov. JB Pritzker had said in earlier interviews that they wanted to use a portion of the roughly $8 billion in federal relief funds that Illinois expects to receive through the recently-passed American Rescue Plan to pay off the Federal Reserve loans. But new guidelines from the U.S. Treasury Department that were released on Tuesday specifically prohibit using those funds for “payment of interest or principal on outstanding debt instruments, including, for example, short-term revenue or tax anticipation notes, or other debt service costs.”

State Rep. Michael Zalewski, D-Riverside, who chairs the House Revenue Committee, said in an interview Wednesday that he does not believe the relief funds can be used to repay the Federal Reserve and that any repayment plan will have to be “part of a broader budget conversation.”

But Mendoza said in a statement Wednesday that she believes there may be room to negotiate with Treasury on the use of those funds.

34 Comments

|

Today’s must-read

Thursday, May 13, 2021 - Posted by Rich Miller

* Hannah Meisel at NPR Illinois…

Unemployed Illinoisans will keep receiving an extra $300 in pandemic-enhanced weekly benefits, Gov. JB Pritzker said Wednesday, even as Republican-led states around the nation move to end those benefits early, claiming they’re disincentivizing working-age people from getting jobs.

“Our job here is to make sure we’re creating jobs and helping people to rebuild the lives they had before the pandemic, and so we’re not going to pull the rug out from under people,” Pritzker told reporters at an unrelated event Wednesday.

The governor’s comments came a few hours before one of the state’s leading business groups representing employers sent Pritzker a letter asking for an early end to the boosted unemployment benefits, which are set to expire Sept. 6.

In his letter, Illinois Manufacturers’ Association President and CEO Mark Denzler cited data from the state’s Department of Employment Security showing approximately 358,800 fewer Illinoisans in the state’s workforce in March versus March 2020, when the pandemic began. Denzler attributes this labor shortage to the extra $300 in weekly COVID unemployment benefits, which means an individual with no dependents in Illinois can receive the equivalent of more than $19 an hour.

Hannah obviously put a lot of work into this piece, so go take a look at the whole thing.

59 Comments

|

* Not unexpected, of course…

* Underwood press release…

Today the U.S. House of Representatives voted to officially dismiss Jim Oberweis’ 2020 election contest, filed in early January after Congresswoman Lauren Underwood was sworn into the 117th Congress. Underwood campaign spokesperson, Jordan Troy, issued the following statement in response:

“Earlier this afternoon, the House of Representatives voted to dismiss Jim Oberweis’ official election contest against Congresswoman Lauren Underwood. For the past six months, he has taken the attention away from the issues affecting our communities by wasting taxpayer resources with his political theater. And while this chapter may finally be over, many members of the Republican Party still continue to question the merits of our democratic process by undermining our free and fair elections.

“With this election contest behind us, Lauren will continue to prioritize the residents of IL-14 by bringing home the resources our hardworking families and businesses need to fully recover from the COVID-19 pandemic.”

*** UPDATE *** Rick Pearson…

The committee’s Republican minority issued its own recommendation to dismiss Oberweis’ challenge, saying he failed to serve “proper and timely” notice of the challenge to Underwood, calling it “a fatal procedural error.”

The GOP recommendation was issued by the committee’s top minority member, Rep. Rodney Davis, a Republican from downstate Taylorville.

15 Comments

|

* COGFA…

(R)eceipts for both March and April have been booked, and despite final payment deadlines for personal income tax being slightly delayed, revenues have been interpreted to continue to significantly outpace expectations. As a result, as discussed in the following revenue update, the Commission is making a revision for FY 2021, as revenues are expected to total $45.616 billion, or $2.025 billion above the March projection.

It is important to note that the majority of those upward revisions will be contained within the FY 2021 estimate and should not be assumed to repeat or be considered “baseable” for FY 2022 due to timing and historical receipt pattern disruptions brought about by the pandemic’s impact. That said, there is a measure of base growth that can be expected to be carried forward from the FY 2021 adjustment, particularly as it relates to continuation of underlying improvement of economic conditions as we distance ourselves from the worst of the pandemics impact. Therefore, the Commission’s revised revenue forecast for FY 2022 improves to $41.188 billion. The updated outlook reflects $792 million in total upward adjustments.

* Center Square has the biz react…

Some, like the Illinois Manufacturers Association, say that means the governor should drop his push to close or limit tax incentive programs to the tune of nearly $1 billion.

“In light of record revenue growth and billions of dollars in federal stimulus, there is no need to raise taxes on Illinois job creators that will only serve to constrain job growth and limit economic investment in the state,” said IMA’s Mark Denzler. “As we emerge from the pandemic, the Governor should be looking at ways to help the business community rather than harm them.”

Jack Lavin, with the Chicagoland Chamber of Commerce, is advocating the extension of the film tax credit that Pritzker is also advocating for. But, Lavin said if the governor cuts or limits other tax incentive programs on the chopping block, that will hurt the economy, especially during a pandemic.

“There’s only so much money that’s gonna come out of Washington D.C. to help us, what happens when that dries up?” Lavin told WMAY. “We have to have these kinds of tax credits that are helping invest in jobs, create jobs, jobs you can raise a family on.”

Josh Sharp, with the Illinois Fuel and Retail Association, said with the better-than-expected revenues reported, Pritzker should find revenue elsewhere.

Except that FY22 projected revenue increase does not appear to be enough to close the projected state deficit. Also, because of these rosier forecasts, Gov. Pritzker last week called for spending $350 million more on K-12 education.

*** UPDATE *** Slightly different, but still upward projections from GOMB…

The Governor’s Office of Management and Budget revised upward its General Funds revenue estimates by $1.469 billion for fiscal year 2021 and by $842 million for fiscal year 2022, compared to the estimates published with the Governor’s introduced budget in February 2021.

Strong year-to-date receipts in the state’s main revenue sources (individual and corporate income tax and sales tax) have led GOMB to revise its estimates. Through April, fiscal year 2021 General Funds revenues were outperforming revenue estimates from the February estimates by about 5 percent.

“While the increase in revenues is good news, and a sign our economy is coming out of the pandemic, much of these funds are one-time in nature and should not be expected to recur in FY2022,” said Deputy Governor Dan Hynes. “The administration was pleased to propose last week that we increase the state’s education budget for the coming year, using these funds and our proposal to end $1 billion in corporate welfare. However, the pandemic is still with us, and we have a lot of work ahead of us to ensure the state remains on sound fiscal footing, including repaying the federal government for loans used to cover current coronavirus expenses.”

Total General Funds state revenues for fiscal year 2021 are now estimated at $36.703 billion, compared to $35.311 billion in February, with total revenues, including federal sources, estimated at $44.949 billion. Total General Funds state revenues for fiscal year 2022 are now estimated at $35.283 billion, compared to $34.589 billion in February, with total revenues, including federal sources and the governor’s proposed closure of corporate tax loopholes, estimated at $42.552 billion.

The one-time sources of revenue include the double final income tax payments receipted in fiscal year 2021, and the tax receipt benefits from economic activity following individual stimulus payments and a full year of enhanced unemployment benefits throughout fiscal year 2021. Expanded unemployment benefits are currently only extended through September 2021, early in fiscal year 2022.

The resilience of the state’s economy and the continued impacts to the state from stimulus payments to taxpayers by the federal government and extended enhanced unemployment benefits led to the changed forecasts.

The revisions were published in GOMB’s April 2021 Report to the Legislative Budget Oversight Commission (LBOC) issued today. The full report is available here.

17 Comments

|

Another day, another lawsuit

Thursday, May 13, 2021 - Posted by Rich Miller

* Center Square…

A Sangamon County judge has taken arguments under advisement in a legal challenge over Gov. J.B. Pritzker’s COVID-19 orders impacting high school sports.

Attorney Laura Grochocki represents the mother of Trevor Till, an 18-year-old who committed suicide in October, among other clients. She filed a lawsuit against the governor over his COVID-19 prohibitions that kept competition for certain high school sports from happening for most of last year.

The case is an equal rights challenge claiming the governor overstepped his authority when he blocked high school sports while allowing college and professional sports to continue. […]

Arguing for summary judgement, Grochocki told the court Wednesday afternoon during a Zoom conference call that the governor is violating equal protection laws by imposing state regulations on high school sports while not leveling any on college or professional sports.

“The issue is the discrimination of different classes of athletes based on age and the wealth of the organization that is sponsoring them. Wealthy athletes, powerful college and pro sports leagues that are worth a lot of money and probably have a lot of political clout, were given the opportunity to determine for themselves what was safe and what was not,” Grochocki said. “This is a fundamental violation of equal protection that is unreasonable, irrational, arbitrary and imposed without a legitimate state interest.” […]

While the initial lawsuit was filed in December when high school sports like football and basketball were not allowed to compete per the governor’s orders, those sports have resumed, but Grochocki said the student athletes still have to wear masks while college and professional teams don’t. […]

The governor’s attorney said college and pro sports have the resources to compete safely and Grochoski hasn’t proven the equal protection violation.

“It is not an equal protection violation if the government adopts a reasonable regulation that applies to some people within a category, but not all people within a category,” said attorney Darren Kinkead, who was representing Pritzker in the virtual courtroom. “It’s not an equal protection violation if the government chooses to address some of the problem, but not all of the problem.”

9 Comments

|

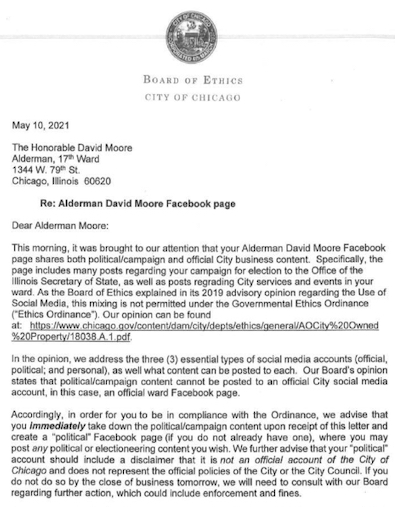

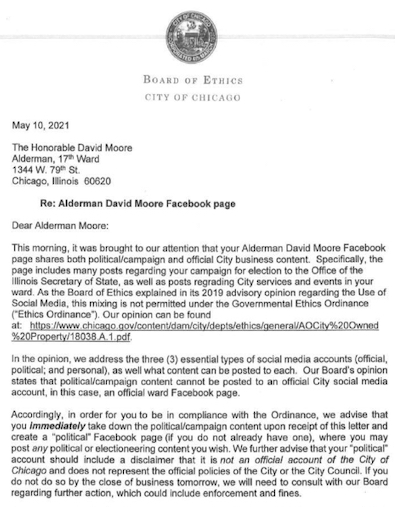

* Capitol Fax readers voted 86 percent to 14 percent that Ald. Moore’s campaign kickoff idea to put ads on license plates was a no-go. And now, this…

Just days after announcing his candidacy for the Democratic nomination for secretary of state, South Side Ald. David Moore was admonished by the city Board of Ethics for using the official government 17th Ward Facebook account to campaign for the statewide office.

In a letter written Monday, two days after his formal campaign announcement, the ethics board warned Moore he faced potential fines for mixing posts about his secretary of state candidacy with posts regarding city services and events in his ward. […]

Moore, in a statement, said he makes it a point to “abide by the rules” and had taken corrective action. But he also indicated he felt singled out by a policy others on the council ignore.

“We were even told in those (ethics) sessions that we couldn’t use our official title. Over the last year, I saw this being ignored many times,” he said.

* From the letter…

9 Comments

|

Open thread

Thursday, May 13, 2021 - Posted by Rich Miller

* Some morning Zen…

Got anything to say?

15 Comments

|

* That Stand for Children Illinois TV ad is here. And ignore the politics in the tweet if you want, but here’s that new mailer…

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|