Adam Toledo react

Thursday, Apr 15, 2021 - Posted by Rich Miller

* Posted in the order they were received. Illinois Latino Agenda…

On March 29, 2021, 13-year-old Adam Toledo was shot and killed by a Chicago police officer. Since the shooting, there have been different narratives formed of who Adam Toledo was. Various media have made allegations saying he was a gang member, had a negligent mother, and possessed a gun.

The Illinois Latino Agenda urges all journalists to maintain a critical lens when publishing such claims. We exist in a world where a young white man like Kyle Rittenhouse can walk around with an AR-15 assault rifle, shoot and kill two people, and still be taken into custody peacefully by police officers. Some media outlets published articles about Rittenhouse that highlighted how he was a cadet who shadowed police officers. They reported that he was protecting the people he idolized, and that cops were his heroes.

Adam Toledo, a boy from Little Village, is not offered that same grace – Brown and Black boys never are. We must grapple with the reality that much of the media upholds white supremacy, and it is evident in the narratives written about youth of color in comparison to their white counterparts.

Many in the media and public at large will begin the blame game: “It was the 21-year-old’s fault.” That young man will have to face his day in court. “It was the white police officer.” He too will have to face critics and the law. But this is the common, lazy narrative espoused by our more cynical media outlets and the politicians who pander to them. Here’s the reality: This was the fault of a system built to vilify young men of color and to arm and militarize police departments, putting these two actors on a collision course, creating tragedy after tragedy.

Here is the story that should run about Adam Toledo: A 13-year-old boy was shot by police in Little Village, a working-class neighborhood on Chicago’s Near West Side. Adam Toledo was a victim of the inability of Chicago and of our county to offer young Brown and Black boys hope and opportunity. He was the victim of a police system in need of major reform. But we have the chance to be the collective heroes in this story. We the People can change the system and deliver justice to all.

Let’s not be lazy. Let’s shun the blame game. If we do not, it will only lead to adding more police, everyone buying firearms, and young Brown and Black men being further vilified and marginalized. Instead, let’s work on the real issues.

We need systematic reform of police departments across the country, starting here in Chicago. We also must commit to substantive, sustained investments in Brown and Black communities. Let’s put a laser focus on creating real futures for young Brown and Black boys.

While we proactively work to eradicate racist policing, we as a society need to apply the same force to expanding opportunities for young men of color to excel in school, the professional world, and life. By focusing on economic empowerment and police reform in communities like the one where Adam Toledo lived, we create a foundation for success that promotes life and stymies senseless murders that kill youth and devastate our communities.

Let’s commit to these changes in Adam Toledo’s memory. Let’s do it for this 13-year-old boy, and for every other child of this city. We grieve for him.

* Joint Statement from Mayor Lori E. Lightfoot, Corporation Counsel Celia Meza, and Toledo Family Counsel, Adeena Weiss Ortiz and Joel Hirschhorn…

Yesterday, the City of Chicago’s Corporation Counsel, Celia Meza, met with Adeena Weiss Ortiz and Joel Hirschhorn, legal representatives for the Toledo family. Based on the Civilian Office of Police Accountability’s announcement that it will be releasing the videos, both parties agree that all material should be released, including a slowed-down compilation of the events of March 29 that resulted in the tragic death of 13-year-old Adam Toledo.

We acknowledge that the release of this video is the first step in the process toward the healing of the family, the community and our city. We understand that the release of this video will be incredibly painful and elicit an emotional response to all who view it, and we ask that people express themselves peacefully.

COPA’s investigation is ongoing as we seek to determine the full facts in this case. To that end, we call for full cooperation with COPA. We remain committed to working together toward reform. We ask that you continue to respect the Toledo family’s privacy during this incredibly painful and difficult time.

* SEIU Local 1 President Tom Balanoff…

“Our region has been rocked by two police killings in a matter of weeks: First, of 13 year-old Chicagoan Adam Toledo and second of Daunte Wright just outside Minneapolis, miles from where officer Derek Chauvin is on trial for the murder of George Floyd. These killings are not unfortunate accidents - they are systemic violence against Black and brown communities.

“2020 saw a nationwide uprising against the brutality inflicted by police on communities of color across the United States. Police will continue to brutalize with impunity until elected leaders heed the calls of their constituents and hold these departments accountable.

“Local 1 members throughout the Midwest - across racial lines and different backgrounds - condemn the killings of Daunte Wright and Adam Toledo by police. The fundamental truth remains that both should be alive today, with a full life ahead and surrounded by loving family.”

* Colleen Connell, Executive Director, ACLU of Illinois…

“The release of the body camera footage and other materials by Chicago police today cannot obscure one, central fact: a 13-year-old boy was shot and killed by those sworn to protect and serve our community. The video released today shows that police shot Adam Toledo even though his hands were raised in the air. The pain of seeing this footage only adds to the pain and grief experienced by the Toledo family and the community. We join all those mourning this loss of life.

The investigation of this death must be complete and transparent. The people of Chicago deserve answers about the events surrounding this tragic interaction, These answers must come through complete disclosure and public reporting, and not through careful assertions crafted by police and prosecutors. Given the long, sad history of the CPD, public accountability must be the guide post for this moment.

The anger and frustration expressed by many in viewing the video is understandable and cannot be ignored. Now is a moment to truly embrace impacted communities in a critical discussion about needed changes to policing – including the adoption of a long-overdue foot chase policy that emerges from true, face-to-face community dialogue and real change.”

* Speaker Chris Welch…

“What happened to Adam Toledo is a tragedy that should never have happened. While I appreciate the release of this video, I can’t imagine what it’s like for Adam’s parents to have to relive their loss. Given that, I hope we can all learn from this heartbreaking event. Adam was a kid who deserved a full, happy life, but the system failed him. That’s what I intend to focus on—not just as a legislator, but as a father. As we work through this tragedy, I plead with everyone to please keep the peace. We all have the right to protest peacefully, but please keep our streets safe so we can focus on fixing the broken system that led to this in the first place.”

* Sen. Dick Durbin…

“In the midst of the trial of Derek Chauvin and the fatal shooting of 20-year-old Daunte Wright, Chicago has come to face the shocking fatal shooting of 13-year-old Adam Toledo. He was a seventh grader at Gary Elementary School in Little Village with his whole life ahead of him. My heart breaks for his family and friends, who are grieving the loss of his young life.

“The Civilian Office of Police Accountability has committed to completing a full, thorough, and objective investigation of the entire incident. That process should move forward in a fair and expeditious manner.

“From Laquan McDonald to Breonna Taylor, George Floyd, Sandra Bland, and tragically many other Black and Brown men and women whose names we do not know, their lives have been lost to brutal acts of racial injustice. The evidence shows that we are dealing with a system of justice that isn’t being applied equally—and we need to change that.

“As Chair of the Senate Judiciary Committee, I’m committed to meeting this historic moment with real change.

“I am grateful that protests so far have remained peaceful and urge all Chicagoans to continue to face this tragedy with peaceful resolve in order to honor Adam’s memory and work constructively to bring the change we need.”

* Senate President Don Harmon…

“Everything about Adam’s death is horrifying. As a parent, I can’t imagine having to watch a video like this. This has to stop.”

* llinois Federation of Teachers President Dan Montgomery…

“The members of the Illinois Federation of Teachers join all those who are grieving the loss of another child of color at the hands of police. Our hearts are with the Toledo family during these difficult times. Their grief is unimaginable.

“As a society, we must acknowledge that our current system of law enforcement must be transformed. Quick reforms and larger budgets won’t eradicate systemic racism.

“Now more than ever, we have an opportunity to bring positive change to our communities by investing in education, trauma-informed practices, youth programs, and wraparound services instead of perpetuating a system that disproportionately penalizes, incarcerates, and kills Black and Brown people, especially youth.

“As educators, we condemn violence and pledge to continue to work to dismantle racism to achieve a truly just society for our students and communities. The IFT and our members are committed to that work.”

* Voices for Illinois Children Executive Director Tasha Green Cruzat…

The loss of any child is tragic and painful. As noted by Chicago Mayor Lori Lightfoot, viewing the body camera footage of 13-year-old Adam Toledo’s death will be difficult to watch. Our thoughts and prayers are with the Toledo Family.

In 2019, there were 148 recorded child and teen homicides by firearms in Illinois. Any death is unacceptable. Whether it is poverty, the state’s criminal justice system, or investments in our communities, we have let down our children. We can do better. Voices for Illinois Children remains committed to ensuring that all of our children are safe and have the resources they need to lead productive and healthy lives.”

* Governor JB Pritzker…

The loss of any child is tragic and painful. As noted by Chicago Mayor Lori Lightfoot, viewing the body camera footage of 13-year-old Adam Toledo’s death will be difficult to watch. Our thoughts and prayers are with the Toledo Family.

In 2019, there were 148 recorded child and teen homicides by firearms in Illinois. Any death is unacceptable. Whether it is poverty, the state’s criminal justice system, or investments in our communities, we have let down our children. We can do better. Voices for Illinois Children remains committed to ensuring that all of our children are safe and have the resources they need to lead productive and healthy lives.”

“As a father, I know to my core that Adam Toledo’s family is living a parent’s worst nightmare. My heart goes out to all who love him,” said Governor JB Pritzker. “Parents deserve neighborhoods that will nurture their kids. Children deserve to be safe. Communities deserve to live with hope for the future. Adam Toledo, a 13-year-old child, was shot to death. This is a moment that calls for justice for our children and accountability in all our public institutions. The State of Illinois is committed to this work, whether it is transforming our justice system or investing in communities to create durable and long-term progress.”

* LG Stratton…

* 22nd Ward Alderman Michael D. Rodriguez…

In the early morning hours of March 29th, a tragedy occurred in our community. A 13-year-old child, Adam Toledo, was shot in the chest and killed by a Chicago police officer. I offer my deepest condolences to the Toledo family. This is a time for us to wrap our arms around the Toledo family as they suffer the most tragic of circumstances.

While we embrace the Toledo family, we must remind ourselves, that this incident, this horrific tragedy is a result of continued failed policies and our inability to provide community-based oversight of the police or implement reforms mandated by the federal consent decree.

We have failed to address these issues. We have failed to pass legislation that would strengthen police oversight, and other measures to implement best practices in policing, and because of this, we have failed Adam.

And we will continue to fail our children, our young black and brown kids, if we do not act. Now is the time to call for civilian oversight of the police.

Chicago should and can lead in the civilian oversight of police. I am committed to supporting the groundbreaking compromise ordinance that grassroots organizations have come together to craft that will lead to increased accountability, better policing, and safer communities.

This is also a time to call for peace and unity in our community. Our community mourns the loss of Adam Toledo. Death and destruction are too commonplace in our community and we cannot afford more of this from anyone in our community. As Elizabeth Toledo, Adam’s mother, stated: “No one has anything to gain by inciting violence,” “Adam was a sweet and loving boy. He would not want anyone else to be injured or die in his name.”

However, being peaceful does not mean to stifle your anger or to lessen our demand for justice. We have to be vocal. We have to be vocal in our demand for justice and our demand for action. I reaffirm my commitment to this as alderman of the 22nd Ward. It is time for the Chicago City Council to take action.

* Cook County Board President Toni Preckwinkle…

My thoughts right now are on a 13-year-old child who should still be with us.

Adam Toledo.

I grieve with his family and loved ones who mourn the unimaginable. My heart breaks as I think of my own children, grandchildren, and former students.

Let us pray for peace, which, I must admit, even I cannot find in this moment and every single time a person of color is killed by an officer.

There are far too many of these times now.

Adam Toledo was just a child and should still be alive.

We must demand justice and accountability for this tragedy and address the law enforcement system that have allowed this to happen time and time again.

* Moms Demand Action…

The Illinois chapter of Moms Demand Action and Students Demand Action, both part of Everytown for Gun Safety’s grassroots networks, released the following statement responding to the video and subsequent reports of the fatal police shooting of 13-year-old Adam Toledo in Little Village, Illinois on March 29. Police had claimed that there was an “armed confrontation” and prosecutors said the boy was holding a gun when the officer shot him. Video released by the city today shows Toledo had his hands up when he was shot and shows no indication that Toledo was holding a gun when he was shot. According to the Chicago Tribune, Toledo is the youngest person to be fatally shot by the Chicago police in years.

“We’re heartbroken,” said Valerie Burgest, Senior Survivor Fellow with the Everytown Survivor Network and Illinois Moms Demand Action chapter lead whose son, Craig Williams, was shot and killed in 2013. “Adam Toledo will never have the chance to grow up, a chance cut short by someone supposed to protect and serve. We refuse to accept police violence as normal, and we join Adam’s family and the community in demanding a full investigation.”

Latinx people are twice as likely to be killed in a gun homicide as white people and are also more likely to be fatally shot by police. Black people in the United States are nearly three times more likely to be shot and killed by law enforcement than their white counterparts, and data from Mapping Police Violence shows that most people killed by police are killed with guns and that 99% of killings by the police from 2013-2019 did not result in officers being charged with a crime.

* AG Raoul…

Attorney General Kwame Raoul today issued the following statement in response to the release of the video footage of the shooting of 13-year-old Adam Toledo by a Chicago police officer.

“No parent should have to endure the unimaginable grief of losing a child, and my thoughts are with Adam Toledo’s family and the community as they attempt to heal from this tragedy.

“The video of Adam’s death is shocking and extremely difficult to watch. As we all come face to face with this tragedy, I am particularly mindful of the trauma Adam’s loved ones and members of the community must be experiencing.

“I understand the shock and horror that many feel after viewing the video, and I share it. It is understandable that people in Illinois and across the nation want to gather to express their grief and discontent, and to call for change. They have a constitutional right to do so, but it should be done peacefully.”

* SEIU Local 73…

“SEIU Local 73 is deeply troubled by the shooting of Adam Toledo,” said Dian Palmer, President of SEIU Local 73. “The video clearly shows that Adam Toledo did not have a gun in his hand when he was shot while raising his hands to comply with the police officer.”

“We are praying for justice for Adam and his family. But we know thoughts and prayers are not enough to solve the ongoing systemic racism facing Black and Brown communities. Adam Toledo should be alive today. And we will continue to work to prevent senseless tragedies like this in the future.””

“The use of excessive force by police officers against people of color is a problem we must address together. It’s long past time we create a police accountability system which will ensure public safety.”

“What’s more we need to tackle the issues of poverty and access to quality healthcare including mental healthcare, in our communities.”

* Ald. Byron Sigcho-Lopez…

“A police officer shot and killed a 13-year-old boy who stopped and put his hands up when the officer told him to. A boy whose body was fully open and vulnerable to a police officer’s weapon. What we see is exactly what happens when police are taught that their lives matter more than anyone else’s.

“Our system protects that broken notion that people — Black and Brown children — are disposable.

“Now is the time to tear down that racist, violent system and fix our city. The Mayor doesn’t have any more chances and our city can’t spare to lose another life. We have to pass police accountability, establish civilian oversight, and truly reimagine what public safety looks like for the communities most exploited for decades by institutionalized injustice and white supremacy.

“My heart is with Adam Toledo’s mom and all mothers who are doing everything they can to raise their kids in a city that protects police impunity before our beautiful children.”

* Chicago City Council Latino Caucus…

The Civilian Office of Police Accountability (COPA) has released the police body camera footage of the tragic shooting death of Adam Toledo. There is no question of what transpired now: a scared thirteen year old child stopped when he was directed to by police, he raised his hands as directed, and he complied. That did not prevent him from being killed by police.

The body camera footage shows that Adam Toledo was an unarmed child with his hands up when he was shot by a Chicago police officer.

The shooting death of Adam Toledo is a tragedy by all measures. Our deepest condolences and love go out to Adam’s mother and the Toledo family as they mourn the death of their son, a 7th grader at Gary Elementary School, a member of our community — who shared the same struggles, aspirations, and tribulations that our immigrant families often face. Our hearts are with the Toledo family and all the mothers who are doing everything they can to raise their kids in a city that has prioritized police more than our children.

This horrible incident exposes an issue that we all know too well. Policing is broken. It’s been broken for a very long time. As we grieve and mourn another life lost to police violence we want to stress the need to pass the Empowering Communities for Public Safety (ECPS), a unity ordinance born out of the years long efforts from the Grassroots Alliance for Police Accountability (GAPA) and the coalition for a Civilian Police Accountability Council (CPAC).

ECPS will put the power in the hands of the people to set police policies and hold police accountable. ECPS will be a major step towards fixing our broken policing system. The time to pass ECPS is now.

Beyond enacting community control of the police, we must move away from broken policing and move towards proven public safety strategies. Study after study shows that investing in education, jobs, housing, and health services are far more successful at increasing public safety than police or prisons. The time to divest from broken policing and reinvest in proven public safety measures is now.

Our hearts to the Toledo family, the Little Village community and our city. Adam was our child.

* Rep. Aarón Ortiz…

I would like to extend my most sincere condolences to the Toledo family and peers that knew Adam including his classmates at Gary Elementary. Like many of you, I watched the video in absolute horror. The youth in our neighborhoods undergo constant trauma and after cataclysmic incidents like this we should all be demanding investments into programs to rehabilitate our kids; this is not and should never be accepted as a normal part of life. Our kids should not have to carry the burden of this trauma for the rest of their lives.

Prior to becoming a legislator I was an educator at Back of the Yards College Prep High School. Our school worked with youth, like Adam Toledo on a daily basis to support them and their families through unimaginable circumstances. While hundreds of my students were able to graduate high school and attend college, many were not bestowed with those opportunities because of circumstances out of their control.

The shooting of Adam shook our community, and the aftermath is angering. It took two days for authorities to notify the Toledo family of his death despite the fact that there was an outstanding missing persons report. Nothing less than a thorough investigation should be demanded into the shooting and the promotion of unfactual statements by the Chicago Police Department and the Office of the Cook County State’s Attorney which pushed a now-debunked “official” narrative for two weeks. Had the video not been released it could have remained as such. Events such as the killing of Adam shed light on the need for stronger police oversight and accountability in a broken system.

Adam Toledo was a 13-year old child, he raised his hand and was unarmed before being shot and killed by a member of the Chicago Police Department. The now-retracted “official” accounts following his death lied and only served to further assassinate the character of this child and cast doubt into his “right” to live. Everyone deserves the right to life. Adam Toledo deserved the right to live.

16 Comments

|

* From Senate Majority Leader Kim Lightford’s amendment, backed by Mayor Lightfoot, to elect a small portion of the Chicago school board…

After the 2026 election, the Chicago Board of Education shall be comprised initially of a 7-member board, of which 5 members shall be appointed and 2 members shall be elected pursuant to subsection (b-10).

The Mayor shall appoint 3 more members to the Chicago Board of Education to hold office and serve terms of 4 years, from terms commencing on July 1, 2026, to serve along with the appointed members whose terms run through June 30, 2028 and the members elected in 2026.

Beginning with the 2028 election, the Chicago Board of Education shall transition to an 11-member board, of which 8 members shall be appointed and 3 members shall be elected pursuant to subsection (b-10).

The Mayor shall appoint 5 more members to the Chicago Board of Education to hold office and serve terms of 4 years, from terms commencing on July 1, 2028, to serve along with the members appointed in 2026 and the elected members.

Mayor Lightfoot campaigned in favor of a fully elected school board.

30 Comments

|

* Press release…

The Illinois Department of Public Health (IDPH) today reported 3,581 new confirmed and probable cases of coronavirus disease (COVID-19) in Illinois, including 40 additional deaths.

Adams County: 1 female 80s

Bureau County: 1 female 70s

Champaign County: 1 male 80s

Christian County: 1 male 80s

Clay County: 1 male 90s

Cook County: 1 male 50s, 2 females 60s, 1 male 60s, 2 males 70s, 1 female 80s, 1 male 80s, 2 females 90s, 1 male 90s

DuPage County: 1 male 70s, 1 female 80s

Jersey County: 1 female 80s

Knox County: 1 female 80s

Lake County: 1 female 90s

LaSalle County: 2 females 80s

Lee County: 1 female 80s

Macon County: 1 male 70s

McHenry County: 1 female 80s

Menard County: 1 male 90s

Montgomery County: 1 female 80s

Moultrie County: 1 male 70s

St. Clair County: 1 female 40s, 1 male 60s

Stephenson County: 1 female 60s

Tazewell County: 1 female 90s

Whiteside County: 1 male 50s

Will County: 1 female 60s, 1 male 60s, 1 male 70s, 1 male 90s

Williamson County: 1 female 80s

Winnebago County; 1 female 90s

Currently, IDPH is reporting a total of 1,292,515 cases, including 21,609 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 105,661 specimens for a total of 21,477,421. As of last night, 2,043 individuals in Illinois were reported to be in the hospital with COVID-19. Of those, 468 patients were in the ICU and 190 patients with COVID-19 were on ventilators.

The preliminary seven-day statewide positivity for cases as a percent of total test from April 8-14, 2021 is 4.2%. The preliminary seven-day statewide test positivity from April 8-14, 2021 is 4.9%.

The total number of COVID-19 vaccine doses for Illinois is 9,636,355. A total of 7,612,405 vaccines have been administered in Illinois as of last midnight. The seven-day rolling average of vaccines administered daily is 129,317 doses. Yesterday, 129,755 doses were reported administered in Illinois.

*All data are provisional and will change. In order to rapidly report COVID-19 information to the public, data are being reported in real-time. Information is constantly being entered into an electronic system and the number of cases and deaths can change as additional information is gathered. Information for a death previously reported has changed, therefore, today’s numbers have been adjusted. For health questions about COVID-19, call the hotline at 1-800-889-3931 or email dph.sick@illinois.gov.

4 Comments

|

Adam Toledo videos released

Thursday, Apr 15, 2021 - Posted by Rich Miller

* WGN…

A key detail raised in court about the fatal police shooting of 13-year-old Adam Toledo may have been wrong.

During a bond hearing for 21-year-old Ruben Roman, who was with Adam the night of the shooting, Cook County Assistant State’s Attorney James Murphy described the altercation in a proffer: “The officer tells [Toledo] to drop it as [Toledo] turns towards the officer. [Toledo] has a gun in his right hand.”

But now, in response to a WGN Investigates inquiry, the state’s attorney’s office says the detail about Adam having a gun in his hand the moment he was shot was inaccurate.

“An attorney who works in this office failed to fully inform himself before speaking in court,” Sarah Sinovic, a spokesperson for Cook County State’s Attorney Kim Foxx, told WGN Investigates Thursday. It comes just before the Civilian Office of Police Accountability releases several videos of the incident.

* This is really hard to watch…

* Related…

* Chicago Mayor Lori Lightfoot says video of Adam Toledo’s fatal shooting by police ‘incredibly difficult to watch,’ calls for peace as city braces for its release

* Lightfoot says Chicago ‘failed’ Adam Toledo, vows to do more to save teens like him

…Adding… In case you do not want to watch the videos, here’s a description from Block Club Chicago…

Video released Thursday shows a Chicago police officer fatally shooting 13-year-old Adam Toledo as he raised his hands in a Little Village alley on March 29. […]

Video taken from the front door of a Little Village church shows Toledo and 21-year-old Ruben Roman walking down the street before stopping at the corner of 24th Street and Sawyer Avenue, where it appears Roman fired shots at a target that is out of view. Toledo and Roman leave, video footage shows.

Body-camera footage shows an officer chasing Toledo through an alley, with the officer yelling at Toledo to stop. The officer catches up to Toledo, who appears to have stopped running near a gap in a fence between the alley and a church parking lot.

The officer flashes a strobe flashlight at Toledo and says, “Hands! Show me your f***ing hands!” The body-camera footage appears to show Toledo standing near the fence with a gun in his hand, holding it behind his back.

Immediately after commanding Toledo to show his hands, the officer shot the boy at close distance. Toledo’s hands were raised when he was shot, the footage shows. […]

Footage released by police does not show Toledo point or raise a gun at the officer at the conclusion of the chase. Toledo does not appear to be holding the gun as an officer shot him, though video does not clearly show him dropping the gun.

80 Comments

|

* Bloomberg…

A new kind of power plant that doesn’t add greenhouse gases to the atmosphere is being built in the U.S., potentially providing a way for utilities to keep burning natural gas without contributing to global warming.

Net Power intends to build two natural-gas power plants in the U.S. that will have all its emissions captured and buried deep underground. The startup licensed its technology to developer 8 Rivers Capital LLC, which will work with agriculture giant Archer-Daniels-Midlands Co. to replace some emissions from a coal power plant in Illinois. […]

Net Power’s technology uses a new kind of turbine to burn natural gas in oxygen, rather than the air. As a result, the plant only produces carbon dioxide and water as a byproduct. The water can be frozen out of the mixture and the pure stream of CO₂ can be buried in depleted oil and gas wells or similar geological structures.

The required oxygen is secured by separating it from the air, which needs energy. But Net Power says its turbine is more efficient so that, on balance, the overall efficiency of the system matches that of an advanced natural-gas power plant that pumps its emissions into the atmosphere. Another upside of using oxygen is that Net Power plants do not produce any nitrogen emissions, which would cause local air pollution.

* Press release…

One of the world’s first zero emissions Allam-Fetvedt cycle power plants, the Broadwing Clean Energy Complex, is poised to be built in Illinois, generating 280 MW of clean power to help decarbonize the industrial, transport, and electricity sectors. 8 Rivers Capital, LLC (8 Rivers) and ADM (NYSE:ADM) announced today that they have agreed in principle to locate the Broadwing facility adjacent to ADM’s processing complex in Decatur, storing captured carbon safely a mile and a half underground via ADM’s proven carbon capture and storage system. […]

8 Rivers, through its Zero Degrees development business, aims to reach a final investment decision in 2022 and begin operations by 2025. Warwick Capital Partners LLP (Warwick) will serve as a development financing partner through its targeted investment vehicle Warwick Carbon Solutions. NET Power continues to lead the commercialization of the Allam-Fetvedt power cycle technology that was invented by 8 Rivers and will be deployed at Broadwing.

I checked and they’re not asking for anything special out of the omnibus energy bill, but the project is in an enterprise zone, so they are watching the legislation to make sure it has no impact.

27 Comments

|

It’s Time To Finally Hold Utilities Accountable

Thursday, Apr 15, 2021 - Posted by Advertising Department

[The following is a paid advertisement.]

Bribery, corruption, and formula rates have decimated public trust in utility regulation.

Instead of passing another rate hike, let’s pass a comprehensive clean energy bill.

Illinois’ legislature has an opportunity to finally hold utilities accountable, while addressing the climate crisis, creating thousands of equitable clean energy jobs, and lowering electric bills all at the same time.

The Clean Energy Jobs Act (CEJA) is the only energy bill that installs an independent monitor in the headquarters of ComEd and Ameren. CEJA also refunds customers for ComEd’s violations and creates a new Accountability Division at the Illinois Commerce Commission to protect residents against future offenses. You can read the full list of CEJA’s accountability measures here.

As we get closer to May 31st, profit-hungry utilities are getting more aggressive. Missouri-based Ameren spent more than $35,000 on Facebook ads alone in just the last few weeks as they try to pass a bill that would drastically increase electric formula rates and expand them to gas customers.

We have just six weeks left to pass the Clean Energy Jobs Act. Let’s get it done.

Comments Off

|

* SJ-R…

A Springfield man who is alleged to have stormed the floor of the U.S. Senate during the Jan. 6 attack on the U.S. Capitol that interrupted the Electoral College vote faces federal charges.

Thomas B. Adams Jr., 39, of the 2800 block of Ridge Avenue, was in court at the Paul Findley Federal Building & U.S. Courthouse in Springfield Tuesday, charged with entering a restricted building, violent entry and disorderly conduct on Capitol grounds and obstructing an official proceeding, according to records filed in federal court.

Adams was released on his own recognizance.

* Sun-Times…

He is at least the sixth person from Illinois to face federal charges in connection with the riot. The charges against him were filed April 2 in federal court in Washington, D.C., records show.

An FBI special agent explained in a court affidavit that authorities first noticed Adams because of an interview he gave to the publication Insider following the riot. The article said Adams trampled over police barricades, made his way into the Capitol, and eventually reached the Senate chamber after lawmakers had been evacuated, according to the affidavit.

The article also quoted Adams as saying, “It was a really fun time,” and it said he described the scene as “hilarious.”

But only one day after the riot — on Jan. 7 — the FBI was already driving by Adams’ home in Springfield as part of its investigation, records show. An agent then interviewed Adams on Feb. 4, according to the affidavit.

* WICS…

Adams told authorities that, once inside the building, he thought to himself, “What are they going to do if a half a million people are here and standing inside of a building and want to be heard?”

He noted seeing people running into the building and grabbing things to take.

The suspect also recorded videos of himself and his friend inside the Capitol. […]

The Statement of Facts says that Adams confirmed that he was the person seen in this photo holding a Trump flag on the U.S. Senate floor.

The full criminal complaint is here.

27 Comments

|

* CBS 2…

The U.S. Department of Labor estimates 16,944 new unemployment claims were filed during the week of April 5 in Illinois, according to the DOL’s weekly claims report released Thursday. […]

There were 16,182 new unemployment claims were filed during the week of March 29 in Illinois.

There were 14,189 new unemployment claims were filed during the week of March 22 in Illinois.

There were 15,595 new unemployment claims were filed in Illinois during the week of March 15.

There were 71,175 new unemployment claims filed in Illinois during the week of March 8.

* One year ago…

Illinois Department of Employment Security (IDES) reported 141,160 new unemployment claims were filed during the week of April 6 in Illinois.

And that was down 60,000 from the previous week.

* The rest of the country is starting to catch up…

The number of Americans filing first-time jobless claims last week fell to the lowest level since the onset of the COVID-19 pandemic, according to the Labor Department.

Data released Thursday showed 576,000 Americans filed for first-time unemployment benefits in the week ended April 10, down from an upwardly revised 769,000 the week prior. Analysts surveyed by Refinitiv were expecting 700,000 filings.

6 Comments

|

Show Your Work

Thursday, Apr 15, 2021 - Posted by Advertising Department

[The following is a paid advertisement.]

If lawmakers’ goal is to create a map that ensures representation for communities of color and driven by community input, then why not show the work?

Lawmakers should showcase their redistricting work so all Illinoisans, especially people of color, can see whether the maps are in their best interest.

Let’s start with more notice for public hearings, transparency for map proposals, prioritizing the Federal Voting Rights Act and Illinois Voting Rights Act, and ensuring the public can weigh in and hear back from lawmakers about the final maps before votes are cast.

A compliance report is necessary to show how map-makers used public input and met voting rights acts requirements.

These changes can ensure that constituents in communities across Illinois understand the process.

Learn more at changeil.org.

Comments Off

|

It’s just a bill

Thursday, Apr 15, 2021 - Posted by Rich Miller

* Sun-Times…

House members voted in favor of legislation that would amend the state’s insurance code to provide coverage for the “diagnosis and treatment of infertility … without discrimination on the basis of age, ancestry, color, disability, domestic partner status, gender, gender expression, gender identity,” according to the language of the bill.

State Rep. Margaret Croke, D-Chicago, the lead sponsor of the bill, said it’s “about equal access to coverage and will make Illinois insurance far more inclusive. […]

But state Rep. Mark Batinick, R-Plainfield, urged his colleagues to vote no on the bill, saying he thinks it covers “situations that I wouldn’t consider a medical condition. […]

The House also passed a bill Wednesday that would require Illinois schools to teach students about Asian American history following a spike in violence against Asian Americans and the killing of six Asian American women in Atlanta.

State Rep. Jennifer Gong-Gershowitz said she introduced the bill because Asian Americans “are part of the American fabric, but we are often invisible.”

* Capitol News Illinois…

The Illinois House Judiciary Criminal Committee advanced two bills Tuesday with unanimous support, one to decriminalize transmission of HIV and another to expand protections for survivors of sexual assault.

An amendment to House Bill 1063, introduced by Democratic state Rep. Carol Ammons, of Urbana, changes several Illinois statutes related to persons living with HIV/AIDS and its transmission. On Wednesday, the House approved the bill 90-9, sending it to the Senate for consideration.

Under current Illinois law, a person who transmits HIV to another person can be charged with “criminal transmission of HIV.”

The AIDS Confidentiality Act, meant to protect Illinoisans from having an HIV-positive status disclosed or used against them, contains exceptions allowing law enforcement officials to subpoena or petition for the HIV status of criminal defendants in order to determine whether they should be charged for potential criminal transmission.

* Capitol News Illinois…

A bill which would implement term limits on leadership roles in the Illinois General Assembly advanced out of committee Wednesday.

House Bill 642, introduced by Rep. Anthony DeLuca, D-Chicago Heights, would bar any individual from serving more than 10 consecutive years in a leadership position in the General Assembly, including speaker of the House, president of the Senate and minority leader positions in each chamber.

The bill, if signed into law, would take effect for all legislators taking office on or after the second Wednesday in January 2023.

While the Illinois House and Senate both passed term limits on party leadership in their respective chamber rules in January, DeLuca said his bill would be important to enforce the new rules via state law.

* Center Square…

The Illinois Legislative Inspector General asked lawmakers Tuesday for more independence to investigate claims of wrongdoing by legislators.

Legislative Inspector General Carol Pope told a committee Tuesday her office is supposed to be an independent body. But, she said she has to get permission from the Legislative Ethics Commission to investigate and even issue subpoenas. In one instance, she acknowledged former state Sen. Terry Link was on the commission while he was under investigation and even later charged with tax fraud. Pope didn’t mention Link by name.

“The problem is that person was getting all of my information and I try to be as vague as I can but they are entitled under the way that this commission operates now to know what the allegations are that I am investigating,” Pope said.

* No relation…

The bill in question is explained here.

* WTAX…

How much is that doggie in the window? It better be from a shelter or similar place, if a bill which has passed the Illinois House becomes law.

State Rep. Andrew Chesney (R-Freeport) says the “puppy mills,” of which there are perhaps 19 he’s targeting, are inhumane to animals and shady to customers, and he says he speaks from experience, as his wife purchased a “mall dog” some years ago, a dog which is now in terrible shape.

While the bill had a hefty margin to get out of the House, some opponents said the bill is anti-business. Others noted Chesney’s voting record on Legislative Black Caucus matters, with one – State Rep. Curtis Tarver II (D-Chicago) – going so far as to say, “This is proof that, in God’s white America, dogs matter more than people.”

* Other stuff…

* Bill would tie state spending to household income growth

* House eyes ending qualified immunity for ‘bad apples’ in law enforcement

8 Comments

|

* Lovely…

Many of you may have already read about the Brood X cicadas that are set to emerge from their underground habitat starting around mid-May 2021 or once temperatures below ground reach 64°F. Once these critters come marching out of the ground, a host of other critters will descend upon them. Cicadas make a tasty meal for many other creatures including birds, amphibians, fish, some mammals, and reptiles including copperheads. Watch out this spring and summer! There may be more copperheads than normal slithering about as they hunt for some crunchy cicada snacks.

These cicadas are special and were last seen in 2004. This year, millions of them will march out from the ground across 15 states, including Illinois, and will first search for higher ground.

The nymphs will shed their external skeleton and will be able to fly - that is, if they survive potential predators and make it to this stage. They then mate, lay eggs, and die several days later. The next Brood X crew won’t emerge for another 17 years.

These insects are incredibly noisy but harmless. But what isn’t harmless is at least one predator - the eastern copperhead.

Yes, eastern copperheads do exist in Illinois. They are found mainly in the southern third part of the state in forests, river bluffs, and rocky outcroppings.

Depending on where you live in the Prairie State, you may not have to worry about these venomous snakes. But if you do live close to where they do and in an area that will also experience a Brood X cicada infestation, let this serve as a warning to watch out!

It’s too early in the day to post the pics, so click here to see them yourselves.

More info here and here.

13 Comments

|

* SJ-R…

After firearms owners identification card and concealed carry license applications backed up over the last year, lawmakers are trying to address the delay and make the renewal process more efficient with support from Illinois State Police Director Brendan Kelly.

“The ISP is requesting legislation to consolidate the FOID and CCL card into a single card,” Kelly said at a Wednesday press conference.

If passed, House Bill 745 and Senate Bill 1165 would allow FOID and concealed carry cards to be renewed at the same time to make the process faster and easier for the state police. It would also provide a way for the card to be automatically renewed.

State Sen. Dave Koehler, D-Peoria, said this would “modernize the FOID card.” It would also allow for the card to be digital.

The bill would also allow gun owners to voluntarily submit their fingerprints to expedite renewal. Normally, this idea draws sharp criticism from Republicans. However, state Rep. Dan Caulkins, R-Decatur, said the voluntary nature of this bill can help the ISP deal with the backlog without forcing people to submit fingerprints for state record.

Other Republicans also voiced support for the ISP bill.

* However, G-PAC hates the legislation…

Today Gun Violence Prevention PAC (G-PAC) Illinois released the following statement in anticipation of Senator David Koehler’s press conference on SB 2889, a gun-lobby backed bill that guts critical background check provisions included in real gun safety legislation:

“Senator Koehler’s gun lobby-backed bill guts real universal background checks in exchange for nothing,” said Kathleen Sances, President of Gun Violence Prevention PAC Illinois. “24 Democrats in the Senate are cosponsoring our bill because of their commitment to a safer Illinois, unlike the NRA and ISRA who continue to push desperate legislation like this bill that does nothing to actually close dangerous loopholes in our gun laws.”

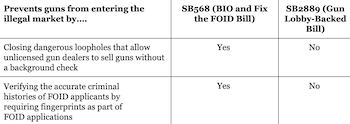

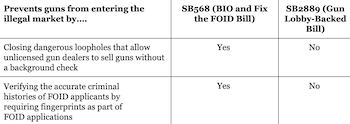

COMPARISON: SB568/HB3245 (The Block Illegal Ownership and Fix the FOID Bill) and SB2889/HB745 (The Gun Lobby-Backed Bill)

How do these two differences change the ability of these bills to block Illegal guns from entering the criminal market?

Without background checks on all gun sales and fingerprints to verify the criminal histories of FOID applicants, illegal guns can be sold to prohibited people when:

• A gun is sold by an unlicensed dealer without a background check

• A gun is sold to a prohibited person who has obtained a FOID card with an incomplete criminal history.

Why is Universal Background Checks for All Gun Sales in Illinois Important?

• Current law requires that unlicensed gun dealers see a valid FOID card, but does require them to run the background check to verify a potential gun buyer’s mental health and criminal history.

• Requiring a background check for every gun sale is the foundation of a strong and effective gun violence prevention policy and a valuable tool to help reduce illegal firearm trafficking. For example, a 2009 study found intrastate gun trafficking was 48% lower in cities in states that regulated unlicensed handgun sales.

• Polling shows that 81% of Illinois support expanding background checks to all gun sales.

Why are Fingerprints as Part of FOID Application Important?

• Fingerprinting is the only form of background check search that verifies the identity and criminal history of FOID card applicants. This would better protect the public through rapid completion of background checks and efficient processing of FOID applications. The live scan fingerprint vendor fee is capped at $30 in HB3245/SB568.

• Fingerprints as part of FOID applications would have prevented the Aurora, IL shooting because the shooter’s criminal history was not accurately verified when he applied for and received his FOID card. He was then able to buy and keep illegal guns.

• Polling shows that 88% of Illinoisans support requiring fingerprints to acquire a firearm.

SB2889 is now SB1165.

* Director Kelly was asked yesterday for the ISP’s position on universal background checks at the above-mentioned press conference…

So, after Aurora, the position of the administration has been clear and it continues to be clear and consistent that we support universal background checks. We absolutely do that. That is the position of the administration that we support universal background checks. I think the governor has been very clear that that is the policy of this administration to support legislation that has universal background checks.

But by eliminating and reducing waste in a government system, the background check process, is not one which is mutually exclusive from improving the requirements of the background check.

* Asked about negotiations on the bill, Kelly said…

We will provide information and give feedback and provide specific statistical analysis of the statute as they are based on how they are operating within the Illinois State Police and we provide that to legislators all the time. … We don’t do negotiate. That’s what these these folks do. And I’ll leave it in their capable hands. We will talk to anybody on any issue, whatever the perspective is, as it relates to information from the police, they can make informed decisions about about whatever legislation they’re discussing.

* The ISP later emphasized in a statement that it also supports the G-PAC bill…

The lessons of the Henry Pratt shooting clearly exposed gaps in the state and federal background check system. The FOID processing system and statutes desperately need amending and we support those legislative efforts, while the administration continues to advocate and strongly support stricter, universal background check legislation contained in the BIO bill.

* Sun-Times…

The Illinois State Rifle Association denied backing Koehler’s bill, saying that they were “neutral.”

But Pearson’s group is firing blanks, said a spokesperson for the gun control PAC.

“The gun lobby speaks pretty loudly on just about every piece of gun legislation under the sun, so their silence or claims of neutrality on this bill is deafening,” the spokesperson said.

*** UPDATE *** G-PAC…

“We appreciate the Illinois State Police clarifying yesterday that this administration supports universal background checks and the BIO Bill.”

28 Comments

|

[The following is a paid advertisement.]

Employers in Illinois provide prescription drug coverage for nearly 6.7 million Illinoisans. In order to help keep care more affordable, employers work with pharmacy benefit managers (PBMs), who deploy a variety of tools to reduce prescription drug costs and help improve health outcomes. In addition to helping employers, PBMs also work with the Illinois Medicaid program in the same way to help control costs. Over the last five years, PBMs have saved the state and taxpayers nearly $340 million.

Today, Illinois faces a multibillion budget shortfall as more Illinoisans are relying on Medicaid to help meet their health care coverage needs. As legislators work to address these challenges, one way to help ensure continued cost savings is by strengthening the PBM tools that the State and employers use, which are poised to save employers, consumers and the State $39 billion over the next 10 years. These are meaningful savings that will help continue to contain costs, ensure consumer access to medicines and drive savings in public health programs.

Amid a pandemic and economic challenges, now is the time to strengthen, not limit, the tools that employers, consumers and the State rely on to manage costs and ensure consumers can access the medicines they need.

Learn more

Comments Off

|

* Sen. Rob Martwick’s bill to create an elected Chicago school board passed the Senate Executive Committee yesterday, but its fate is still uncertain in the face of a completing plan (not yet introduced) from Mayor Lori Lightfoot that will be sponsored by Majority Leader Kim Lightford. Sun-Times…

Majority Leader Kimberly Lightford voted for the bill, but said it was important to continue negotiations to “come up with the absolute best process and the best model that we can” for students and families.

“There’s so much that goes into this huge change that we will be making, for the better is my hope, but we can’t do it because we’re siding with this group versus that group,” the Maywood Democrat said.

State Sen. Rob Martwick, sponsor of the bill, said he was open to amending it, but the Northwest Side Democrat said concerns mentioned Wednesday were already considered.

“Whether it does it adequately or not, I guess we can debate about that,” he said. “I am always open to hearing how we can improve it.”

* ChalkBeat…

Sybil Madison, Chicago’s deputy mayor for education and human services, testified against the elected school board bill, citing progress that public schools have made since 1995, when the state gave the mayor control over the board.

“In 2020, CPS had a record-high graduation rate at 83%. The University of Chicago research shows that CPS’ English language learners have equivalent gains and achievement from K through eighth grade as their peers who never classified as English language learners,” Madison said.

She mentioned that any version of the board should include parents’ voices because they have often felt left out of board decisions.

After public testimony during the committee hearing, Lightford said that while she supported the idea of an elected school board, the Senate proposal for 21 members would be hard to implement. She raised concerns about the number of members, the cost of the board, finances for each race, and how to draw voting districts to ensure that all sides of the city are represented. […]

Lightford has been instrumental in passing ambitious legislation. During the lame-duck session in fall, she pushed through a bill that created new graduation requirements for all Illinois students and more access to advanced courses.

* WTTW…

Adrian Segura, Chicago Public Schools’ deputy chief of family and community engagement, also testified, and cautioned that an elected board doesn’t necessarily come with guarantees.

“L.A. has the largest elected school board in the country and currently there are no parents on their board. An election does not guarantee equity among representation, as was seen in the elections in California. They cost millions of dollars, which for most of our parents – at least mine, I know – they don’t have, which brings up the question of special interests and who is funding school board elections and for what reason,” Segura said.

Many parents and community members testified in favor of the bill, saying it would give parents and community members a long-overdue seat at the table when deciding how students in Chicago should be educated. And while many parents want to see elected representatives on the school board, there are a variety of views as to how it should be structured.

* Politico…

Nonprofit leaders have written a letter to legislators asking that they make sure Chicago’s school board represents parents, especially from Chicago’s “disadvantaged and disenfranchised” communities.

*** UPDATE *** Meant to add this earlier…

* Related…

* School board politics, revisited - There are billions of reasons that have nothing to do with education to keep the schools under mayoral control.

* Why can’t my daughter return to high school? Three words: Chicago Teachers Union

38 Comments

|

* From this past January…

The Pritzker administration has hired an outside firm to scrutinize Exelon’s claims that some of its Illinois nuclear plants are losing money.

The Illinois Environmental Protection Agency early this month finalized a $215,000 emergency contract with Cambridge, Mass.-based Synapse Energy Economics. The firm, which has done work in the past for consumer advocates like the Illinois attorney general’s office and the Citizens Utility Board, will report back on the financial condition of the nukes by April 1.

It’s tasked with auditing the company’s plants, assessing costs and revenues given now and projecting over the next five years, according to the emergency purchase statement. Among the qualifications the Pritzker administration specified for the role was that the firm chosen could not have done work for Exelon in the past. That disqualified a fair number of bidders.

The move comes as Exelon for the second time in four years has said it would shutter nukes in Illinois unless they’re subsidized by the state. In August, the company announced it would close the Dresden and Byron reactors this coming fall without government action.

* Click here for the completed audit. And here’s today’s Tribune story…

Synapse Energy Economics concluded that keeping Byron and Dresden open would cost dramatically less than the $235 million-a-year bailout negotiated in 2016 by former Republican Gov. Bruce Rauner — a deal that prompted Exelon to back down from its plans to close two other nuclear plants outside the Quad Cities and downstate Clinton. […]

Unlike the Rauner bailout, which guaranteed Exelon subsidies for a decade, Synapse said the Pritzker administration could limit special payments for Bryon and Dresden to five years and provide them during each of those years only if the company opens its books and proves the power plants need the money. The program would cost $150 million a year at most, according to a redacted copy of the audit shared Wednesday with the Chicago Tribune.

It remains unclear if the findings will provide enough political cover to muscle another subsidy package through the Democratic-controlled General Assembly, which is still roiling from a multiyear bribery scheme involving jobs, contracts and payments from ComEd to allies of former House Speaker Michael Madigan.

But there are significant climate and labor ramifications if Byron and Dresden close.

* WBEZ…

The Pritzker administration’s study, released Thursday, found the plants “do face real risk of becoming uneconomic in the near term.

“This has implications for Illinois’ policy goals because the plants generate carbon-free electricity that is currently undervalued or even ignored within current wholesale electricity markets,” the report by Cambridge, Mass.-based Synapse Energy Economics concluded.

“In addition, the plants employ hundreds of workers directly and contribute to the economies of numerous Illinois communities,” the report continued. “Illinois could reasonably determine that it is in the public interest for the plants to remain in operation, warranting public support.” […]

But whether the company believes roughly a $70 million increase in annual ratepayer subsidies is enough, as Synapse recommends, is another question. Legislation pushed by labor unions aligned with Exelon recommends subsidy levels roughly quadruple what Synapse proposes for the two plants, administration sources said.

“To anyone who’s making a proposal on this that says these numbers are too low, we’re going to want to see their math,” said Deputy Gov. Christian Mitchell, the governor’s point person on utility legislation.

* Crain’s…

Pritzker is likely to advocate for setting Illinois’ first-ever price on carbon, which would be paid by generators whose plants emit the heat-trapping gas. A modest price, similar to what Northeastern states have imposed for years, would reduce the need for direct subsidies to Exelon. In that case, only Dresden would need support to remain open, the report said. […]

Synapse’s methodology for assessing the plants’ financial health differs from Exelon’s. The auditor questioned the large amount the Chicago-based company labels a “cost” when it in fact is a cushion for scenarios in which the plants don’t operate. […]

Asked whether the governor’s support for another bailout is, in effect, rewarding past bad behavior by the company, [Deputy Gov. Christian Mitchell] said there are clear differences this time compared with four years ago, when the company demanded that policymakers take its word that plants were losing money. “There was a reason Gov. Pritzker called for an audit,” Mitchell said.

The state has more information than it’s ever had on plant financials. And the governor will support only the minimum amount needed by the plants to remain in the black, as well as annual audits. If the plants don’t need as much money in a given year, the subsidies should decline, Mitchell said.

The question will be if organized labor, which is supporting a much larger bailout, can agree.

* Related…

* Chicago biz figures exit ComEd board while CEO is paid like 2020 was a good year

…Adding… Illinois Clean Jobs Coalition…

“We applaud Governor Pritzker for requiring this independent audit, and putting consumers and the goal of 100% clean energy ahead of utility profits. The Synapse study proves there are many different ways Illinois can keep producing carbon-free electricity from nuclear plants, without the giant subsidy Exelon and their allies are demanding. Putting Illinois on a path to a carbon-free power sector by 2030 by passing compressive energy policy as proposed in the Clean Energy Jobs Act (CEJA) is critical to combating climate change, creating equitable jobs, and ending excessive subsidies to fossil fuels.”

5 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|