Isabel’s afternoon roundup

Monday, Jan 29, 2024 - Posted by Isabel Miller

* Congressman Mike Bost wins FOP endorsement…

U.S. Representative Mike Bost (IL-12) today announced that his 2024 re-election campaign has been endorsed by the Illinois Fraternal Order of Police State Lodge.

“The men and women of law enforcement have always known they can count on Mike Bost for his unwavering support. Mike has always had our backs, even when many other elected officials abandoned us,” said Chris Southwood, Illinois FOP State Lodge President. “He has supported bills to give law enforcement officers better pay and benefits in our dangerous but vital profession. The Illinois FOP State Lodge gives Mike Bost our sincere and hearty endorsement.”

“I have never wavered in my support for our law enforcement officers, especially now when woke liberals in Illinois and Washington, D.C. continue to demonize them with an anti-police agenda,” said Bost. “I would like to thank the Illinois Fraternal Order of Police State Lodge for putting their confidence in my re-election. I’ll always Back the Blue in Congress and will never stop defending the brave men and women who protect and serve our communities.”

* Press release…

Governor JB Pritzker joined the Illinois Department of Human Services (DHS) and Google Public Sector on Monday to announce the creation of BEACON (Behavioral Health Care and Ongoing Navigation): A Service Access Portal for Illinois Youth. Powered by Google Cloud’s secure, scalable, and advanced artificial intelligence (AI) and cloud computing technology, the new state-of-the-art online portal will provide a user-friendly experience for Illinois families to access behavioral and mental health resources for children. The Division of Mental Health (DMH) at DHS is collaborating with Google Public Sector to deliver this ongoing statewide transformation.

“We are doing away with decentralized, difficult-to-navigate behavioral health resources scattered across different agencies, providers, and websites,” said Governor JB Pritzker. “Instead, families will have a modern, easy to use online system to guide them through the behavioral health universe. This is another example of Illinois is leading the way — to mobilize public-private partnerships and couple ingenuity with empathy.” […]

On February 15, 2023, the Pritzker Administration published this groundbreaking transformation plan, entitled “Blueprint for Transformation: A Vision for Improved Behavioral Healthcare for Illinois Children.” A team of experts, led by Dr. Dana Weiner, Director of the Children’s Behavioral Health Transformation Initiative, will work closely with various Illinois agencies to create a comprehensive approach to expanding resource availability. […]

The centralized point of access will improve the experience of families engaged with the Department of Human Services (DHS), the Department of Healthcare and Family Services (HFS), the Department of Children and Family Services (DCFS), the Department of Juvenile Justice (DJJ), the Department of Public Health (DPH), and the Illinois State Board of Education (ISBE). This distinct support service will eliminate any further frustration for parents and caretakers who are already challenged by their child’s distress.

The development of the BEACON portal moves the State closer to accomplishing the five goals recommended by the Children’s Behavioral Health Transformation Initiative:

- Streamlining processes to make it easier for youth and families to access services,

- Adjusting capacity to ensure the right resources are available to youth in need,

Intervening earlier to prevent crises from developing,

- Increasing accountability to ensure the State has a transparent system, and

- Developing agility so that the system can adjust to meet the evolving needs of youth.

* Here’s the rest…

* South Side Weekly | CPD Reported Hundreds of Missed Shootings to ShotSpotter Last Year: “I got my head handed to me yesterday by Dan Casey,” wrote Gary Bunyard, ShotSpotter’s vice president of public safety solutions, in an email to other senior employees. “This incident involved a high-profile shooting with ‘55’ rounds. And, we missed it! …I am a big boy—I can deal with Dan. However, I owe Dan some explanation! Obviously, I cannot tell him that we have a bunch of down sensors in that area and insufficient resources to service our largest customer.”

* IPM | Champaign hired Police Chief Timothy Tyler despite disciplinary past and allegations of misconduct: After receiving information and questions about Tyler’s background and disciplinary history from Invisible Institute and IPM Newsroom, City Council member Davion Williams forwarded the email to City Manager Dorothy Ann David and asked, “Were we aware of these incidents as a city?” Several of the investigations into Tyler’s misconduct led to settlements and disciplinary action. Among those: an off-duty domestic incident with an ex-girlfriend, an improper vehicle pursuit that ended in a crash outside of Chicago Police headquarters, and missing currency from a narcotics bust. In addition, federal civil rights lawsuits accused him of false arrest and conspiring with city officials to illegally shut down a nightclub in his previous position in Markham.

* Herald-News | What’s happening in Joliet mass shooting investigation: A spokesperson for Will County State’s Attorney James Glasgow said his office will not be able to provide a response on Friday to questions regarding the $100,000 bond in Nance’s 2023 case, the SAFE-T Act and the statement from the Illinois Network for Pretrial Justice.

* Daily-Journal | Kankakee Auditor’s job function comes under scrutiny at finance committee: During County Treasurer Nick Africano’s report, he shared with the committee the results of a Freedom of Information Act, or FOIA, request for how many times Lee logged into the county’s bank accounts online to view the inflows and outflows of money since Jan. 1, 2021. Africano said more than $200 million flows through the county’s bank accounts annually. […] The report showed that there were 9,372 total logins to see the county’s bank accounts in the approximate three-year time span. All the logins were people from the treasurer’s office and no logins by Lee.

* Bond Buyer | Muni advisor to Harvey, Illinois library district charged $86,000 by SEC: Brandon Comer and his firm Comer Capital Group, the Mississippi-based municipal advisor to the library district of the City of Harvey, Illinois, have been fined a total of $86,000 in a final judgment reached in the Northern District of Illinois after years of litigation.

* NPR | Cook County kicked off a wave of local governments erasing billions in medical debt: New York City pledged last week to pay down $2 billion worth of residents’ medical debt. In doing so, it has come around to an innovation, started in the Midwest, that’s ridding millions of Americans of health care debt. The idea of local government erasing debt emerged a couple of years ago in Cook County, Illinois, home to Chicago. Toni Preckwinkle, president of the county board of commissioners, says two staffers came to her with a bold proposal: The county could spend a portion of its federal pandemic rescue funds to ease a serious burden on its residents.

* Crain’s | Ascension nurses threaten another strike at Joliet hospital: The union said a third strike is being called in response to leadership implementing an offer rejected by the union in December. INA said its members voted against the offer for several reasons, including management’s “insistence on certain nonmonetary terms and conditions of employment which would pose serious health and safety risks to both nurses and patients.”

* NBC Chicago | When will new I-PASS stickers replace Illinois Tollway transponders? What to know: Officials say the stickers will be available at oases, participating Jewel-Osco stores and the Tollway’s headquarters at the end of January. They will be available for online ordering by February.

* Press Release | SIU researchers work to place Southern Illinois Black heritage sites on National Register: Work by Southern Illinois University Carbondale researchers in recognizing significant Black heritage properties in the region could also reveal more information about a Union Army military camp that hosted up to 5,000 freed Blacks in Cairo at one point during the Civil War. The work is part of a project led by Mark Wagner, a professor in SIU’s Center for Archaeological Investigations and anthropology department. Wagner and his team of graduate students will produce National Register of Historic Places (NRHP) nominations for several locations in Southern Illinois associated with Black history and amend existing National Register nominations for three other sites in the region. The Illinois Department of Natural Resources (IDNR) announced the $75,000 grant in late November. Wagner hopes all of the applications can be completed by the end of the semester in May.

* Press Release | UChicago engineer driving key role in Great Lakes water transformation: For Junhong Chen, Crown Family Professor at the Pritzker School of Molecular Engineering at the University of Chicago and Lead Water Strategist at Argonne National Laboratory, the announcement is the culmination of years of effort – and the promise of years more important work ahead on a critical task. Chen is the co-Principal Investigator and Use-Inspired R&D Lead for Great Lakes ReNEW.

* Block Club | The CTA Will Let You Charter Your Own Train — For $3,000: The agency books “a few” private train parties a year, usually for birthdays and nonprofit fundraisers, and once a wedding reception, the spokesperson said. The chartered trains are mostly used for movie productions and commercial shoots, the spokesperson said.

* Crain’s | THC-infused wing sauce for the Super Bowl? It’s a sign Illinois’ cannabis industry is maturing: Green Thumb Industries’ edible brand Incredibles launched chocolate bars with New York’s Magnolia Bakery just before the holidays last year. And Okay Cannabis, a newer dispensary chain, sells infused brownie and cake mixes using West Town Bakery’s recipes. The collaborations are one more step in the industry’s long-running effort to build identifiable consumer brands. Such products also rope in new customers. A fan of Magnolia Bakery might come into the dispensary to try a Swirled Famous Banana Pudding Bar and pick up a few other items.

* WCIA | Daylight saving time: How long until the clocks change, and could it be the last time?: More than two dozen states at least considered withdrawing from the biannual clock change. Unfortunately, they’re largely hoping for permanent daylight saving time, not permanent standard time. For a state to observe daylight saving time all year, Congress ultimately needs to take action. There have been multiple bills introduced to make that change.

* The Guardian | ‘Chaos campaign’: how an Armenian enclave became the center of an anti-LGBTQ+ battle: On a gray afternoon last June, the school board in Glendale, California, was preparing to make what was once a routine vote to honor June as LGBTQ+ pride month. School board meetings used to be pretty placid affairs. This year, however, cops in riot gear surrounded the building and helicopters hovered overhead. As Erik Adamian, an alum of the school district, waited in line to get inside the meeting, he heard demonstrators shout: “You are all a bunch of pedophiles!” “Stop grooming our kids!”

* AP | Prisoners in the US are part of a hidden workforce linked to hundreds of popular food brands: Unmarked trucks packed with prison-raised cattle roll out of the Louisiana State Penitentiary, where men are sentenced to hard labor and forced to work, for pennies an hour or sometimes nothing at all. After rumbling down a country road to an auction house, the cows are bought by a local rancher and then followed by The Associated Press another 600 miles to a Texas slaughterhouse that feeds into the supply chains of giants like McDonald’s, Walmart and Cargill.

* The Philadelphia Inquirer | Self-checkout can be convenient, but human cashiers may inspire more customer loyalty, study finds: Businesses including Costco, Kmart, and Jewel-Osco have removed self-checkout in many stores, the study cites. Others are still betting on the machines. [Yanliu Huang, associate professor of marketing at the Drexel University’s LeBow College of Business] says more research is needed to understand if this study’s findings are also applicable in other retail environments, if the kinds of products being purchased influences the outcome, or if the use of other shopping technologies such as smart carts or scan-and-go apps affect customers’ loyalty.

* WBEZ | An end of an era for Pitchfork: What’s next for music journalism?: Reset’s Sasha-Ann Simons spoke with Pitchfork founder Ryan Schreiber, former Pitchfork president Chris Kaskie and former executive editor Amy Phillips. Journalists Britt Julious, a music critic for the Chicago Tribune, and Alejandro Hernandez, a freelance music writer in Chicago, later joined Simons to discuss Pitchfork’s influence and what the changes mean for the future of music journalism.

* SJ-R | Springfield’s Super Bowl connection: Brendan Daly headed again to the NFL’s big game: Daly, 48, played for Ken Leonard, the winningest high school football coach in Illinois history, at Sacred Heart-Griffin High School. He has remained friends with Leonard, who retired from coaching after the 2022 season, through the years. […] Before reaching the National Football League, Daly had a nomadic coaching career, starting off at a high school in New Port Richey, Florida. His father, Mike, a former aide to U.S. Sen. Dick Durbin of Illinois, recalled in a 2021 interview with The State Journal-Register that the team didn’t win a game that season.

11 Comments

|

Question of the day

Monday, Jan 29, 2024 - Posted by Rich Miller

* Danville Commercial-News…

Illinois State Police Troop 7 Commander, Acting Captain Brian Dickmann, has announced the results of Occupant Restraint Enforcement Patrols (OREP) held in Macon and Vermilion counties during January.

These OREPs provided extra patrol coverage for the ISP so officers could focus on saving lives by making sure all vehicle occupants were buckled up.

Among violations reported were 25 safety belt citations; 1 child restraint citations; 34 total citations; and 11 total written warnings.

* The Question: How often do you wear your seat belt? Explain.

47 Comments

|

Asylum-seekers coverage roundup

Monday, Jan 29, 2024 - Posted by Rich Miller

* Reporter for Austin TV station KXAN…

* People helping people, part one…

Chicago rapper and activist Vic Mensa was among Showtime’s “The Chi” cast members who helped feed asylum seekers waiting for shelter.

Mensa hosted two events Friday, including one across the street from a temporary migrant shelter in Wicker Park.

* Part two…

A south suburban community is trying to help asylum seekers who are now living in Chicago.

Three weeks ago, the discussions at a Markham City Council meeting focused on migrants and what people in this community could do to help them. […]

They came up with a plan to hold a community dinner, with all the proceeds donated to Chicago to help with the migrant crisis. […]

Officials said hundreds of $15 spaghetti dinners were sold before the event, with volunteers from the VFW cooking and plating the meals.

* Part three…

Large cardboard boxes full of coats, hats and gloves are tidily arranged along one wall. Volunteers are working there daily, accepting donations of socks, puffy North Face jackets, snow pants and bars of soap. When busloads of migrants are dropped off in Wilmette — where their chaperones help them catch trains to downtown Chicago to be transferred to a shelter — they are first met by volunteers at the Wilmette station and given a few essentials.

* Part four…

Among the many legal clinics that have popped up across Chicago to help newly arrived migrants, one that took place on Saturday offered a face-to-face with local labor representatives.

The legal clinic — held at the UNITE HERE Local 1 Headquarters on South Wabash Avenue in the Loop — did more than simply introduce dozens of migrants to Chicago Federation of Labor (CFL) partners. The volunteers, which included attorneys and translators, helped individuals fill out the piles of legal paperwork necessary to gain Temporary Protected Status and work authorization.

* The limits of processing paperwork…

The City of Chicago began a partnership on Nov. 9 with the federal government, state government, and The Resurrection Project, a nonprofit organization, to help migrants apply for work permits so they can legally get a job. […]

That’s the good news, according to Rendón, who explained the lengthy application migrants have to fill out to be able to legally work in the U.S. First, they have to be eligible. Out of the 14,200 who are in the city’s shelters, only 3,600 qualify, according to The Resurrection Project. […]

Of the 2,722 migrants who submitted applications through the [city/state/federal] partnership, about 1,800 have been approved, and 1,011 have their documents in hand, per data from the nonprofit. That represents a significant increase from Dec. 28, when CBS 2 reported that only 279 received social security cards and 284 received work permits.

Still, only about 13% of migrants in the city’s shelters are eligible and have been approved.

* Supposedly random neighborhood resident quoted in the news media, part one (January 2023)…

Kerwin Spratt, who has lived in Woodlawn more than 20 years, said he would like the city to show the South Side residents the same respect officials are showing asylum seekers. He noted that the city’s presentation mentioned providing mental health services for asylum seekers and pointed out that the city had shuttered mental health centers across Chicago.

“You threw this upon us with no regard to us at all,” Spratt said.

* Part two (February 2023)…

Kerwin Spratt, a longtime resident who was driving by the school, said he didn’t agree with the city’s decision because of “unfair allocation of resources.”

“They’re going to provide three meals a day and a computer lab. Many schools out here don’t have that,” Spratt said. “The senior home — nobody’s giving them three meals a day.”

Just happened to be driving by.

* Part three (today)…

Kerwin Spratt has lived in Woodlawn 22 years. Wadsworth Elementary is right outside his back door. Spratt told the Crusader he’s grown weary of the migrant situation in his neighborhood.

“One night a lady resident came home and found a car parked in her spot. She asked a migrant to move their car and they busted out her windows and came into her house,” Spratt said.

“The city is pouring out resources towards non-citizens. But many of us can’t even pay our property taxes.”

* This could be interesting…

* From Isabel…

* WBBM | Chicago unions step up to help migrants obtain work permits, avoid exploitation: The legal clinic — held at the UNITE HERE Local 1 Headquarters on South Wabash Avenue in the Loop — did more than simply introduce dozens of migrants to Chicago Federation of Labor (CFL) partners. The volunteers, which included attorneys and translators, helped individuals fill out the piles of legal paperwork necessary to gain Temporary Protected Status and work authorization.

* WBEZ | Tips for Chicago migrants applying for a work permit: There are two ways in which many migrants from Venezuela and a few other countries qualify for a work permit — through TPS, a program that protects people from deportation while allowing them to legally work in the U.S. Some migrants can also apply for work permits through humanitarian parole.

* Block Club | How Many People Experience Homelessness In Chicago? Annual Count Aims To Boost Services: City staffers and volunteers connected with hundreds of unhoused Chicagoans during the annual point-in-time count Thursday night. Meanwhile, thousands of migrants face homelessness as the city’s shelter stay limit approaches.

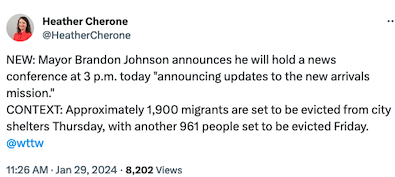

* WTTW | Pritzker and Johnson Trade Blame Over Migrant Shelter Shortfalls; Haley Sharpens Attacks on Trump: Gov. J.B. Pritzker says he’s “deeply concerned” with Chicago’s handling of the migrant crisis. The governor and Mayor Brandon Johnson publicly trade blame over the handling of housing new migrant arrivals. Meanwhile, more than a dozen Chicago City Council members call on the mayor to halt the 60-day migrant shelter eviction policy.

* WGN | Chicago native Vic Mensa, cast of ‘The Chi’ helps feed unhoused asylum seekers: Mensa hosted two events Friday, including one across the street from a temporary migrant shelter in Wicker Park. The efforts were part of the “Feed the Block, Warm the Block” initiative, which distributes meals and clothing to those in need.

* WLSAM | Alderman Bill Conway Addresses Migrant Crisis and Federal Relief Fund Spending on Steve Cochran Show: 34th Ward Alderman Bill Conway appeared on the Steve Cochran Show to talk about his proposal, which suggests that any expenditure of federal relief funds exceeding $1 million should need approval from the City Council. They also delve into whether city politics are getting in the way of solving the migrant crisis, and the advantages of offering work visas to migrants seeking employment opportunities.

5 Comments

|

|

Comments Off

|

Today’s quotable

Monday, Jan 29, 2024 - Posted by Rich Miller

* Maia McDonald in the Chicago Reader…

In Illinois, the latest legal decision to impact reproductive health care involves so-called crisis pregnancy centers (CPCs), organizations (typically affiliated with national religious groups opposed to contraception) that pose as medical clinics to dissuade pregnant people from considering abortion and other pro-choice options, often through deceptive means.

In a shocking about-face, Illinois attorney general Kwame Raoul’s office announced an agreement last month with anti-abortion advocates that the state will not enforce legislation that would have cracked down on deceptive practices by these fake abortion clinics. It was a surprising move for the attorney general, who’d helped introduce such legislation himself earlier in 2023. As a result, many Illinois abortion rights advocates say they’ll need to work even harder to protect residents seeking reproductive health care. […]

State representative Terra Costa Howard, who carried the bill in the house, says she and other sponsors were initially confident in its chances (similar laws in Colorado and Connecticut had been successful) and are disappointed in its outcome. Costa Howard, who says she has a CPC in her district, also doesn’t believe the First Amendment should shield groups that jeopardize the health of Illinois residents from being held accountable for dishonesty and misinformation.

“I don’t believe that the First Amendment protects lies, and that’s what’s occurring. If these fake clinics were giving accurate information—that’s one thing,” Costa Howard says. “There is nothing in the bill that required the fake clinics to provide information about abortion. There’s nothing in the bill that requires them to give that information. You can’t lie about health care.” […]

Costa Howard says she and other members of the Illinois General Assembly who’d previously supported Senate Bill 1909 are working to find ways to address the negative impacts of CPCs, though they’ll also “have to make sure that we have somebody who’s in place who’s actually going to enforce the laws that we pass.”

Ouch.

14 Comments

|

* My weekly syndicated newspaper column…

Chicago Mayor Brandon Johnson’s budget that he passed last November deliberately underfunded programs for asylum-seekers. The meager appropriation could be exhausted by April, but nobody knows yet what the city plans to do when it reaches that point.

Also last November, Gov. J.B. Pritzker made it clear to reporters “the state doesn’t run shelters” and said he was waiting for the city to recommend shelter sites. “The state doesn’t control property in the city of Chicago that could provide a location. The city really has to do that.”

Pritzker also criticized the city for not asking the General Assembly for additional money and noted, “We have spent much more money to support the system of asylum-seekers arriving here than the city has.”

In December, the state declined to fund a huge, 2,000-bed tent shelter in the city’s Brighton Park neighborhood after an evaluation of a city contractor’s report by the Illinois Environmental Protection Agency found the remediation completed by the city “did not meet IEPA standards to receive [a formal letter stating no more mediation was needed] and was therefore not approved,” an IEPA spokesperson reiterated last week.

The city was furious at the denial, and Johnson complained to reporters again last week that the state still has not fulfilled its promise to open those 2,000 new beds. The state claimed then and has ever since then that, despite repeated requests, the city has not yet offered up any more sites. Johnson told reporters this was not true. I’m still checking on this.

Also in December, Johnson announced a program to ticket and even impound buses carrying migrants to the city from Texas unless drivers followed rules for when and where their passengers could be dropped off.

That quickly had the effect of forcing the bus companies to dump people in the suburbs and exurbs, where they are then directed to public transportation to Chicago. During the week ending Jan. 19, not a single bus from Texas arrived directly in Chicago, according to a document released to city officials.

Mayor’s no longer very welcoming

The city has opened no new migrant shelters since November, although Chicago officials made it appear as if they were still working on plans to do so in December, specifically a shelter on the city’s Northwest Side at a site owned by the Catholic Archdiocese. Will Chicago still open and operate that shelter? No. But the city has been hoping the state and/or the Archdiocese could open it, and now I’m hearing the shelter might possibly go forward.

On Jan. 12, city officials went even further and told state legislators the city had “begun planning for rightsizing” its shelter system. That’s corporate-speak for “downsizing,” although a city official now says they probably shouldn’t have used that word.

And then last week, Johnson told reporters the state government “can build a shelter anywhere in the state of Illinois,” adding the state “does not have to build a shelter in Chicago.”

This, of course, ignores the fact the migrants’ stated preference is a Chicago destination. More importantly, it’s also the politically targeted destination set by the Texas governor. In other words, the mayor can say what he wants, but they’re coming regardless.

His comment also ignores the fact the state has spent hundreds of millions of dollars on infrastructure and caring for asylum-seekers in Chicago. Expanding that out would be prohibitively expensive and disperse scarce human resources.

There are only so many people who are willing to do the work and qualified to do it. Dispersing those workers throughout a large geographic area would make their task a lot tougher. It may be unfair to the city, but that’s where the infrastructure is.

Not to mention that suburban mayors aren’t exactly falling all over themselves to take any of these folks in. When a reporter asked Cook County Board President Toni Preckwinkle last week if any suburban mayors had taken up her offer to open shelters, Preckwinkle said, “Those conversations didn’t result in offers of assistance.”

It’s becoming more clear almost every day that, despite his initial promises to welcome the new arrivals with open arms and share with them the city’s “abundance,” Johnson’s aim for weeks if not months has been to pull back from the task of accepting and caring for the continuing influx of asylum-seekers and return to his progressive agenda, like banning natural gas connections in most new construction.

Meanwhile, April gets closer every day.

* A few hours after I wrote that column, this story was published by Nadig Newspapers…

Plans are moving forward for a migrant shelter at the former Saint Bartholomew school and convent in Portage Park, while another former parochial school in the 30th Ward would be converted into 24 apartments, said Alderwoman Ruth Cruz. […]

Officials have said that 300 to 350 people would be housed on the site.

It’s unclear from the story what entity will actually be responsible for opening and operating the shelter, but I was told by a top city official late last week that it wouldn’t likely be them.

*** UPDATE *** Gov. Pritzker was asked today to respond to Mayor Johnson’s statement that the state doesn’t have to build more shelters in Chicago…

Well, it’s unfortunate that the governor of Texas is sending thousands of migrants to the city of Chicago. That is where they think they’re going, that is where they expect to be arriving. Not in Elmhurst, not in other suburbs, but in the city of Chicago.

It is also where all the services are that they need when they arrive. It is also where the major landing zone that we’ve paid for, to make sure that we’re welcoming them as appropriate to the city. And frankly, the city has a shelter system like none other.

So all I would say is that we certainly have encouraged other jurisdictions to step forward. We’ve created grant programs. Some of them have taken us up, Oak Park, for example. And we’re providing resources for other jurisdictions. So that is happening, there is shelter and services.

But the major and majority part of what’s necessary needs to be in the city of Chicago. And we have been supporting the city of Chicago with literally tens of millions of dollars directly as well as hundreds of millions of dollars indirectly.

19 Comments

|

It’s just a bill

Monday, Jan 29, 2024 - Posted by Isabel Miller

* HB4589 from Rep. Jay Hoffman…

Amends the Illinois Vehicle Hijacking and Motor Vehicle Theft Prevention and Insurance Verification Act. Eliminates the provision that provided for the repeal of the Act on January 1, 2025. Amends the Illinois Vehicle Code. Includes “catalytic converter” in the definition of “essential parts”. Amends the Recyclable Metal Purchase Registration Law. Excludes catalytic converter from the definition of “recyclable metals”. Requires transactions involving a catalytic converter to include the identification number of the vehicle from which the catalytic converter was removed and the part number or other identifying number of the catalytic converter that was removed. Provides that, in a transaction involving a catalytic converter, the recyclable metal dealer must also require a copy of the certificate of title or registration showing the seller’s ownership in the vehicle. Makes it unlawful for any person to purchase or otherwise acquire a used, detached catalytic converter or any nonferrous part thereof unless specified conditions are met. Provides that a used, detached catalytic converter does not include a catalytic converter that has been tested, certified, and labeled for reuse in accordance with the United States Environmental Protection Agency Clean Air Act. Defines terms. Makes technical changes.

* Center Square…

Illinois farmers and landowners are concerned that Illinois law makes it too easy for developers to use eminent domain to seize land for carbon dioxide pipeline projects.

Bill Bodine, the Illinois Farm Bureau’s director of business and regulatory affairs, said preventing the use of eminent domain for CO2 pipeline rights of way and storage areas is a top priority for IFB members in the current state legislative session. […]

In 2011, the legislature passed the Carbon Dioxide Sequestration Act. It grants CO2 pipeline developers eminent domain authority. Illinois Farm Bureau members want to see that power taken away from developers. […]

Illinois landowners want regulators to require proof of progress being made on willing agreements between landowners and developers before a pipeline project can be approved, Bodine said.

* Rep. Joyce Mason filed HB4596…

Amends the Paid Leave for All Workers Act. Removes a provision that the Act shall not apply to any employee who is covered by a bona fide collective bargaining agreement with an employer that provides services nationally and internationally of delivery, pickup, and transportation of parcels, documents, and freight. Provides that the definition of “employee” does not include an employee as defined in the Federal Employers’ Liability Act.

* SB2897 from Sen. Tom Bennett…

Creates the Campus Free Speech Act. Requires the governing board of each public university and community college to develop and adopt a policy on free expression; sets forth what the policy must contain. Requires the Board of Higher Education to create a Committee on Free Expression to issue an annual report. Requires public institutions of higher education to include in their freshman orientation programs a section describing to all students the policies and rules regarding free expression that are consistent with the Act. Contains provisions concerning rules, construction of the Act, and enforcement.

* Rep. Edgar Gonzalez filed HB4595 Friday…

Amends the General Not For Profit Corporation Act of 1986. Provides that the Secretary of State shall include data fields on its annual report form that allows a corporation to report, at its discretion, the aggregated demographic information of its directors and officers, including race, ethnicity, gender, disability status, veteran status, sexual orientation, and gender identity. Provides that, within 30 days after filing its annual AG990-IL Charitable Organization Annual Report, a corporation that reports grants of $1,000,000 or more to other charitable organizations shall post on its publicly available website, if one exists, the aggregated demographic information of the corporation’s directors and officers, including race, ethnicity, gender, disability status, veteran status, sexual orientation, and gender identity. Provides that the aggregated demographic information shall be accessible on the corporation’s publicly available website for at least 5 years after it is posted. Provides that the Department of Human Rights shall work with community partners to prepare and publish a standardized list of demographic classifications to be used by the Secretary of State and corporations for the reporting of the aggregated demographic information. Provides that, in collecting the aggregated demographic information, a corporation shall allow for an individual to decline to disclose any or all personal demographic information to the corporation. Effective January 1, 2025.

* Sen. Sue Rezin filed SB2908…

Specifies that the amendatory Act may be referred to as Sami’s Law. Amends the Equitable Restrooms Act. Provides that the owner or operator of each public building and State-owned building shall install and maintain in that building at least one adult changing station that is publicly accessible if the building is constructed 2 or more years after the effective date of the amendatory Act or if certain alterations or additions are made to the building 4 or more years after the effective date of the amendatory Act. Requires the owner or operator of a public building and the owner or operator of a State-owned building to ensure that certain information about the location of adult changing stations in the buildings is provided. Defines terms.

* SB2926 from Sen. Natalie Toro…

Amends the Illinois State Police Act and the Illinois Police Training Act. Provides that a person may not be selected or appointed as a State Police officer or certified as a law enforcement officer unless the person has performed satisfactorily on the Minnesota Multiphasic Personality Inventory 2 (MMPI-2) or another preemployment personality test prescribed and administered by the Illinois State Police or the Illinois Law Enforcement Training Standards Board. The test shall be taken by all applicants in the final selection process for a State Police officer or law enforcement position. Includes provisions relating to interpretation and evaluation of the preemployment personality test and testing dates. Provides that the Illinois State Police or law enforcement agency shall screen all officers at least once annually to evaluate the overall mental health of the officer, including whether the officer has negative impact of lateral trauma, signs of depression or post-traumatic stress disorder, or other negative outcomes related to the officer’s career.

* Lake County News-Sun…

After a wildcat being kept as a pet got loose in a Vernon Hills neighborhood, a state representative introduced legislation proposing a ban on the possession of the African feline, called a serval, in Illinois.

Rep. Daniel Didech, D-Buffalo Grove, proposed the legislation during the first week of the 2024 General Assembly session. Vernon Hills is part of Didech’s district. […]

Because servals are not included in the state’s dangerous animal statute, Didech said it limited Vernon Hills’ ability to respond to the November incident.

Deputy Police Chief Shannon Holubetz said the village was not able to cite the serval owners because the animal was not regulated under any local, county or state statutes.

* Sen. Tom Bennett filed SB2905…

Amends the Legislative Commission Reorganization Act of 1984. Provides for the acquisition and placement of statues depicting: (1) President Ronald W. Reagan; and (2) President Barack H. Obama. Provides that the Architect of the Capitol may provide for the design and fabrication of the statues, or may otherwise acquire, using funds collected for such purpose or through donation, a suitable statue for placement on the grounds of the State Capitol. Requires the Architect of the Capitol to take actions necessary to provide for the placement and unveiling of the statues within specified periods of time. Requires the Architect of the Capitol to issue a report to the Governor and General Assembly detailing actions taken to acquire and place the statues. Provides that the Capitol Restoration Trust Fund shall contain separate accounts for the deposit of funds donated for the payment of expenses associated with the placement of the statues. Provides that the separate accounts may accept deposits from any source, whether private or public, and may be appropriated only for use by the Architect of the Capitol for expenses associated with the acquisition, placement, and maintenance of the statues.

10 Comments

|

Isabel’s morning briefing

Monday, Jan 29, 2024 - Posted by Isabel Miller

* ICYMI:Illinois election officials to consider removing Trump from March primary ballot. WBEZ…

- The Illinois State Board of Elections is expected to consider the recommendation Tuesday.

- The effort in Illinois to keep Trump off the March ballot is similar to those filed in several other states.

- The objection to Trump’s candidacy was brought by five Illinois voters, a national voting-rights organization involved in trying to keep Trump off the ballot and two Chicago law firms.

* Related stories…

* Isabel’s top picks…

* Tribune | Despite state law to address controversy, Wheeling Township blocks taxes for new mental health program approved in referendum: “It’s just frustrating,” mental health advocate Lorri Grainawi said. “The effect is that people with mental health issues, developmental disabilities, and substance abuse are not getting the funding they need.” To honor the will of the voters, she said, the township should proceed with the new tax, or use money from its reserves to fund increased mental health services until the issue is resolved.

* NYT | As Buses of Migrants Arrive in Chicago Suburbs, Residents Debate the Role of Their Towns: In Wilmette, a town of 27,000 people where the median household income is about $183,000, dozens of residents have mobilized to help the migrants with clothing and other needs before they board trains for the so-called landing zone in downtown Chicago, where they are then routed to shelters around the city. Jessica Leving Siegel, a nonprofit marketing consultant, lugged trash bags around the Metra station one evening last week and directed fellow volunteers. Ms. Leving Siegel, who wore a messy bun and a maroon T-shirt printed with the words “We are all refugees,” has organized clothing drives and helped migrants make money by shoveling snowy sidewalks in Wilmette.

* Tribune | No help: The federal immigration deal won’t fix the migrant crisis in Chicago — and it’s unlikely to pass Congress anyway: While details of the bipartisan bill have not been made public, proposals from Republican senators center around raising the bar for migrants to claim asylum and curbing the president’s ability to grant parole — or permission to enter the United States on a temporary basis while asylum claims are reviewed by the courts. These efforts may deter the flow of migrants across borders, but there are larger factors that could keep driving immigrants to Chicago.

At 10 am Governor Pritzker will be at Google’s Chicago offices to announce next steps for Children’s Behavioral Health Transformation Initiative. Click here to watch.

* Here’s the rest of your morning roundup…

* WBEZ | The DNC is launching a neighborhood ambassadors program to recruit volunteers: The main responsibility of an ambassador will be to help recruit some of the roughly 12,000 volunteers needed for the convention. Ambassadors are expected to recruit at least 50 volunteers from their respective neighborhoods. Volunteers will be responsible for everything from assisting with media or security logistics, to meeting people at O’Hare and Midway airports to help direct them to the city.

* SJ-R | Flood stages on Sangamon River subside; rise on Illinois River still expected: “There may still be some ice on the Sangamon,” [NWS meteorologist Nicole Albano] added, “so we do need to stay vigilant for maybe some ice jam or ice activity, but with temperatures continuing to stay mild and even increasing this week, we should start to see a decrease in ice activity, at least along the Sangamon.”

* Sun-Times | Illinois home-based child care providers often make minimum wage — or less: Represented by SEIU Healthcare Illinois, the providers are currently in contract negotiations with the state over retirement benefits, training and, most importantly, pay — in the form of the state’s rates per child, which range from around $22 to $48 a day per child, depending on license status, geographic location and the child’s age.

* Chicago Reader | (Don’t) be deceived: In a shocking about-face, Illinois attorney general Kwame Raoul’s office announced an agreement last month with anti-abortion advocates that the state will not enforce legislation that would have cracked down on deceptive practices by these fake abortion clinics. It was a surprising move for the attorney general, who’d helped introduce such legislation himself earlier in 2023. As a result, many Illinois abortion rights advocates say they’ll need to work even harder to protect residents seeking reproductive health care.

* Shaw Local | Election 2024: Meet the 5 who want Lance Yednock’s seat in Illinois House: At a candidates forum Wednesday at Illinois Valley Community College, some expressed divergent views on how to alleviate the tax burden on Illinois residents. Crystal Loughran and Liz Bishop are vying for the Republican nomination, and both are political newcomers who trumpet their allegiances to constituents rather than special interests.

* Daily Herald | How much property taxes per person does it cost to run your town?: Property taxes used to fund daily operations of suburban municipalities have climbed an average of $44 per resident from 10 years ago. In at least nine suburbs, the amount of property taxes charged per resident has climbed more than $100 from a decade ago.

* Tribune | Illinois appeals courts see ‘dramatic increase’ in cases following elimination of cash bail: From Sept. 18, when the law took effect, through the end of the year, more than 1,300 pretrial appeals of detention decisions were filed in the state’s five appellate districts, an increase that comes on top of the normal caseload. In all of 2022, there were 1,981 criminal appeals filed across all five districts, according to data from the court.

* Intelligencer | ‘Enough is enough’: Feds argue against further delays in former senator McCann’s trial: McCann, a one-time gubernatorial candidate, is accused of using some of about $5 million in campaign money he oversaw for personal purchases and concealing it from donors, the state and law enforcement authorities. He originally was scheduled for trial in April 2021, two months after being indicted by a federal grand jury. Since then, scheduled trial dates have come and gone after changes in defense attorneys or because of the contention that volumes of documents and files — nearly 70,000 pages — prosecutors compiled in the case required more time to review.

* Tribune | Illinois farmers struggle to balance livelihoods with reducing agricultural runoff, a major contributor to Gulf dead zone: Nitrogen and phosphorus are flowing from the Mississippi River Basin into the Gulf of Mexico, creating an oxygen-void area along southern Louisiana and eastern Texas over 18 times larger than Chicago. Fish, shrimp and other commercial species swim farther from the coast to escape, and those that can’t move fast enough die. Fishermen must follow, spending more time and money to sail away from this “dead zone” with dicier odds of a good catch.

* Sun-Times | Chicago restaurants struggled with labor shortages last year. Relief is coming slowly: A new report says city eateries had trouble finding workers last summer, with 82% of them short at least one kitchen staffer. Local owners say things have started to improve, but food and labor costs are still a concern.

* Tribune | Man who conspired with sister in infamous 1993 ‘black widow’ murder case released from prison: Suh had been serving an 80-year sentence for the Sept. 25, 1993, murder of his sister’s boyfriend, Robert O’Dubaine, in Chicago’s Bucktown neighborhood. Suh has long admitted he pulled the trigger in the premeditated, ambush-style killing. But, in repeated clemency requests, he argued his remorse and efforts to better himself have earned him a measure of mercy.

* Pantagraph | One year in, Budzinski remains ‘optimist’ while touting wins for 13th District: The freshman lawmaker introduced 15 bills and co-sponsored nearly 300 more during her first year. She touts the closing of more than 700 constituent cases, which often include helping people navigate federal agencies and resolve issues with benefits like Social Security, among other tasks. She has also been bringing home the bacon, claiming more than $320 million in federal dollars for projects in the district. An analysis from Roll Call last year found Budzinski to be the top Democrat in securing earmarks, which are funds directed by members of Congress towards specific projects.

10 Comments

|

|

Comments Off

|

|

Comments Off

|

Live coverage

Monday, Jan 29, 2024 - Posted by Rich Miller

* You can click here or here to follow breaking news because, as I initially suspected, that widget we were using didn’t last long.

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|