Isabel’s afternoon roundup

Tuesday, Jan 23, 2024 - Posted by Isabel Miller

* Governor Pritzker spoke at the ribbon cutting ceremony for the new Unlimited Potential DCFS Women’s Transitional House in Blue Island this morning. No reporters showed up to ask questions. Press release…

Governor JB Pritzker joined Unlimited Potential House (“UP House”) and the Illinois Department of Children and Family Services (DCFS) today to announce the grand opening of UP House’s new campus and its transitional living facility, “Logan’s Place,” that offers housing, education, and support services for young women in the care of DCFS as they begin their journey toward independent living.

“This is exactly the kind of facility — and organization — that young women in DCFS care deserve as they embark on a new chapter of their lives,” said Governor JB Pritzker. “The funding the state is providing to UP House builds on DCFS’ critical work to add capacity throughout the system, work we will continue to prioritize, so every Illinois youth gets the support they need and deserve.”

The new campus, located on the grounds of the former Mother of Sorrows Convent in Blue Island, will provide a safe, enriching, and supportive environment fostering personal growth and well-being for up to 50 young women aged 17½ to 21. Staff will offer mentorship and individualized attention. Once all 21 currently available beds at the facility are occupied, DCFS will invest $3M/year to pay for the costs of room and board and program fees. This funding from DCFS is an appropriation for external organizations that aid in the transition of DCFS youth from foster care to transitional living to provide support and prevent homelessness among those who age out.

Logan’s Place is a residential facility equipped with a rec room, theater, art room and resident lounge, and serves as the entry-level program for all young women served by UP House. Each young woman will be paired with a mentor who will provide guidance and life skills support. Residents will also have access to educational resources through partnerships with Moraine Valley and South Suburban College; and participate in job readiness training and vocational programs to explore various career paths.

After developing skills at Logan’s Place, the residential program participants will have the opportunity to continue their development at UP House by transitioning to Kumari’s Place. With a residential capacity of 21 young women, Kumari’s place represents the pinnacle of UP House’s transitional living program. This fully outfitted building combines the independence of collegiate dormitory-style living with access to support resources. Residents at Kumari’s Place have access to communal and educational spaces, as well as thoughtfully curated living quarters.

* Sen. Linda Holmes…

State Senator Linda Holmes sponsors legislation on a variety of topics each year, and it isn’t unusual for her animal welfare bills to gain media attention. That has risen to a new level this month as her “bear selfie” law has been featured in National Geographic.

“Throughout my career in the Illinois Senate, I have championed laws that address how wild and domestic animals are confined and used for profit, often in dangerous and unhealthy conditions,” said Holmes (D-Aurora). “The Wild Animal Public Safety Act addresses concerns with roadside zoos and traveling exhibitions by prohibiting close public contact with all primates and bears.”

The new law took effect Jan. 1, 2024, making it a Class B misdemeanor for any person to allow any member of the public, except for certain exempted people, to encounter a bear or primate. The National Geographic story added that Holmes’ 2017 law made Illinois the first state to prohibit using captive elephants in traveling circuses.

* WBEZ…

Ford Heights hasn’t had a real, standalone library in about 30 years. Public records show the south suburb has collected more than $100,000 in taxpayer money over the past decade, although it’s a mystery as to where the money is going and why volunteers instead created a makeshift library the size of a dining room.

Records requested by WBEZ show the Ford Heights Public Library District has requested $842,724 in levies from its residents between 2011 and 2021. And over that time, the Cook County Treasurer has distributed more than $121,522 to the Ford Heights Public Library District.

[Ladell Jones, president of the Ford Heights volunteer library board] was listed in documents from the Cook County Clerk’s Office as the public library president for the first time in 2017, and intermittently held that title throughout the subsequent years. He was most recently the president in 2022. WBEZ reached out to Ford Heights officials to get an explanation about where the money is going, but they did not return phone calls.

Since Ford Heights technically has a library district, its residents cannot get full-access cards at other libraries. The majority-Black suburb has 1,800 residents, and 39% of them earn less than $25,000 a year. According to the Cook County Treasurer, Ford Heights has the lowest property tax collection rate in the county – 29.3% vs. the countywide rate of 96%.

* Block Club…

There is a “total loss of privacy, especially for ground floor tenants,” one Roscoe Village resident posted on Reddit in a public plea for the end to rat hole madness. […]

“This past weekend was absolute hell for me and my neighbors,” they wrote. “We have always liked the rat (or squirrel) — it was a cute, quirky little thing in our neighborhood. People would smile and laugh as they walked by, and that was it. It’s been there at least 20 years.

“But now the internet has learned about it, and taken things waaaaay too far. What was once a fun little quirk has become a trashy, cheap marketing ploy.” […]

“Let me reiterate that we don’t want to fill in or otherwise destroy the rat hole. I’m glad that it has brought people joy,” rat-hole-neighbor wrote. “But we need you all to chill out. Please.”

* Here’s the rest…

* Center Square | Nonprofit lauds impact of Illinois’ Predatory Loan Prevention Act: Woodstock Institute is highlighting the positive impact of Illinois’ Predatory Loan Prevention Act (PLPA) which capped interest rates at 36%. Illinois passed the PLPA in January 2021 and Gov. J.B. Pritzker signed it into law later that year. The report found that most lenders stopped making predatory loans, saving consumers more than $600 million in interest and fees.

* CNI | State Police report fewer deaths on Illinois highways in 2023: Illinois State Police report the declines came at the same time troopers were beefing up their enforcement on the state’s transportation arteries. Arrests were up 3 percent, gun recoveries up 12 percent, and vehicle recoveries were up 7 percent.

* The Bond Buyer | Moody’s revises Chicago’s rating outlook to positive: Moody’s Investors Service revised Chicago’s outlook up to positive Friday and affirmed the city’s bond ratings. The rating agency cited stronger pension contribution practices and upward movement in the city’s financial position. It also said it expects the city’s reserves will stay stable to growing going forward.

* WGEM | New Illinois law expands tenants rights if radon found in home: State lawmakers also recently took action. A new law, which took effect Jan. 1, requires landlords tell prospective tenants whether radon is present and let them know their rights. Tenants have 90 days to test for radon. If it comes back positive, the landlord must cover at least half the mitigation costs. The tenant can also end the lease if radon levels exceed IEMA’s safety standard. Tenants can test after 90 days but the law would not automatically allow them to void their lease if the test comes back positive.

* Crain’s | Natural gas ban on new construction and renovations heads to City Council: The proposal would limit the use of carbon-emitting gas in both new buildings and on any additions that increase the square footage of an existing building by more than 10,000 square feet or by 25% of the existing floorspace. The ordinance would take effect one year after passage and would apply to those buildings, with the exception of some including hospitals, crematoriums and some commercial kitchens.

* Crain’s | Here’s who will pay how much if the transfer tax proposal passes: This house on West 63rd Place in Clearing sold in December for $310,000, the median price of homes sold that month in the city. Included in the revised structure Johnson endorsed in August was something that hadn’t been in previous plans to boost the transfer tax: a cut for anyone paying less than $1 million for a property. If the referendum passes, the transfer tax on those sales will drop from 0.0075% to 0.0060%. In December, the buyers of this house paid $2,325 in transfer taxes, or $463 more than they would pay in the new structure.

* WTTW | Effort to Crack Down on New Dollar Stores in Chicago Advances: At one point, 47 alderpeople signed on as a co-sponsor of the measure, introduced back in October. But several of those City Council members said they would vote against it — and O’Shea blamed an intense lobbying effort by Dollar Tree for swaying his colleagues.

* Daily-Herald | Most suburban residents are worried about climate change, but we’re still not talking about it, study says: While some trends are rising, other questions of interest such as whether people “discuss global warming at least occasionally” are stagnant. “People are still not talking about it. It’s only 36% (nationwide) who say they talk about this issue, at least occasionally. And people are still not hearing about it in the media – that’s only 32%,” senior research scientist Jennifer Marlon said. “We’re not talking about it more, and if anything, we’re talking about it a little bit less in some states, which to me was really shocking.”

* SJ-R | Criticism and ovation surround Terrence Shannon in return to Illinois basketball team: Steve Greenberg of the Chicago Sun-Times wrote about Shannon’s return. “Some were outraged by his presence. … Many others — Illini fans, naturally — have piled in to defend Shannon’s due process,” he wrote. “Some of these folks even are going so far as to proclaim Shannon’s innocence, despite the tiny fact they have utterly no idea what’s true or isn’t.”.

* Sun-Times | City announces 50 finalists for snowplow naming contest, including ‘Chance the Scraper’ and ‘Casimir Plowaski’: The six names with the most votes will be featured on a snowplow in each of the city’s six snow districts, joining the named snowplows announced last year. Those who submitted winning names will get the chance to take a photo with the plow they named.

* LexisNexis | Gender-Affirming Care Continues to Occupy—and Divide—State Lawmakers: In the past few years the legislative trend associated with gender-affirming care that has drawn the most media attention is the passage, mostly in Republican-governed states, of laws banning such care for minors. The bans typically cover the prescription of puberty blockers and hormones, as well as the performance of gender transition surgeries, on minors up to the age of 18. As of September 2023, 22 states had enacted such bans. A handful of those laws make the provision of such care a felony.

8 Comments

|

* Among all the talk about apparent mass non-compliance with the assault weapons owner registry, the points made by GPAC CEO Kathleen Sances have been pretty much lost in the coverage…

One year ago, the Protect Illinois Communities Act effectively and immediately stopped the sale of assault weapons in the state.

There was no sunset, no grace period. Just an immediate halt to the manufacturing and sale of assault weapons that have increased the number of mass shootings across the country; high-capacity magazines that fire multiple rounds in quick succession without taking the time to reload; and, switches that convert legal handguns into military-style assault weapons.

And here’s how you measure the success of that law on the heels of its one-year anniversary: Our analysis of data from the Gun Violence Archive shows 10% fewer mass shootings in Illinois between 2022 and 2023; gun dealers haven’t sold assault weapons in Illinois in the past 12 months and there isn’t any evidence of violations by dealers.

Gun dealers are complying with the ban, and that’s evidenced by their complaints about the loss of sales, collectively costing dealers millions of dollars, and saving an untold number of lives. In fact, when assault weapons or high-capacity magazines are used in shootings, 155% more people are shot and 47% more people are killed.

* And about that gun registry…

In their response to a Fifth Amendment challenge to the state’s gun ban and registry in the Southern District of Illinois federal court, attorneys for the state say the right against self-incrimination isn’t violated by the registry.

The state’s lawyers argue the registration is a “voluntary benefit that exempts owners of certain” firearms from “otherwise applicable criminal penalties.” They also argue the “government has no authority to impose” penalties on those that don’t register and the idea someone would be prosecuted for what they file is “not real.”

“[T]he fanciful chain of events they have dreamed up has no serious chance of coming to fruition,” the filing said.

Discuss.

13 Comments

|

|

Comments Off

|

* Yesterday, the FAA told airlines to check panels on yet another Boeing plane. New York Times…

The Federal Aviation Administration recommended late Sunday night that airlines begin visual inspections of door plugs installed on Boeing 737-900ER planes, the second Boeing model to come under scrutiny this month.

The F.A.A. said the plane had the same door plug design as the company’s newer 737 Max 9. The agency grounded about 170 Max 9 jets after a door panel blew off one of the planes shortly after an Alaska Airlines flight left Portland, Ore., on Jan. 5, forcing an emergency landing.

The door plugs are placed as a panel where an emergency door would otherwise be if a plane was configured with more seats. […]

Alaska Airlines and United Airlines, which both use the 737-900ER, said in statements that they had already started inspecting their planes of that model. Delta Air Lines, which also flies the aircraft, said it had “elected to take proactive measures to inspect our 737-900ER fleet.” None of the airlines expected any disruptions to their operations.

* Today from the NYT…

What Boeing has missed, as it tried to dump costs and speed production, was the chance to ensure that safety was a cultural core and a competitive advantage. Corporations can choose to push back against the Wall Street-driven notion that safety equals cost, and thus lower profits. In the late 1980s and ’90s, the aluminum giant Alcoa, under its chief executive Paul O’Neill, made safety the top priority demonstrating that a culture built around safety can actually be efficient, because accidents and defects decrease when employees know the company cares about their well-being. While assembling an airframe isn’t as dangerous as working with molten metal, when employees know they’ll be supported in building the safest possible aircraft as opposed to the cheapest, the end product will benefit — and buyers will have more confidence.

Choices made by Boeing’s leaders also had consequences. In 2011, the chief executive at the time, W. James McNerney Jr., made what became a fateful decision by greenlighting the 737 Max, rather than investing billions in developing a new short-haul aircraft. His decision wasn’t necessarily a bad one — there was looming competition from the Airbus A320neo — but it committed Boeing to a flight path the company proved unable to navigate.

Mr. McNerney’s decision meant rushing development of the 737 Max while at the same time managing the Federal Aviation Administration so that the certification of redesigned jet — whose engines had been physically moved forward — would not require retraining of pilots, thus saving customers time and money. Being good at managing the agency charged with ensuring your product’s safety can put the whole process at cross purposes. That combined with the decline in the company’s other competencies contributed to the two fatal crashes in 2018 and 2019 that prompted the 737 Max’s grounding for nearly two years. And even before the Alaska Airlines 737 Max 9 incident, Boeing had been having significant problems assembling its 787 Dreamliner on its South Carolina production line.

And just when Boeing needed experienced employees the most, it suffered a brain drain. In late 2022, many Boeing engineers started heading for the door to lock in pension payouts (which could be hurt by rising interest rates) they had accumulated. When full airframe production returned after the pandemic, a lot of the talent didn’t.

* AP…

United Airlines CEO Scott Kirby says he is “disappointed” in ongoing manufacturing problems at Boeing that have led to the grounding of dozens of United jetliners, and the airline will consider alternatives to buying a future, larger version of the Boeing 737 Max.

Kirby said Tuesday that Boeing needs “real action” to restore its previous reputation for quality.

His comments came one day after United disclosed that it expects to lose money in the first three months of this year because of the grounding of its Boeing 737 Max 9 jets.

United has 79 of those planes, which federal regulators grounded more than two weeks ago after a panel blew out of an Alaska Airlines Max 9 in midflight, leaving a gaping hole in the plane. Investigators are probing whether bolts that help hold the panel in place were missing or broke off.

Kirby said on CNBC that he believes that the Max 9s could be cleared to fly again soon, “but I’m disappointed that the manufacturing challenges do keep happening at Boeing.”

* Business Insider…

“The Max 9 grounding is probably the straw that broke the camel’s back for us,” Scott Kirby said. “We’re gonna build an alternative plan that just doesn’t have the Max 10 in it.” [..]

Kirby told CNBC he believes the best case for 737 Max 10 deliveries is still five years behind schedule.

* The Hill…

Scott Kirby said Boeing needs “real action” to restore its reputation and that he has spoken with Dave Calhoun, Boeing’s CEO, to express his frustration.

“Well, look, you know, we’re Boeing’s biggest customer in the world. They’re our biggest partner in the world,” Kirby said in an interview with CBNC. “We need Boeing to succeed … but they’ve been having these consistent manufacturing challenges and they need to take action together.”

* CNN…

Boeing has had a series of quality issues that have dogged the aircraft maker for the last five years, ever since two fatal crashes of the 737 Max 8 in late 2018 and early 2019 led to a 20-month grounding of the jet.

* An Atlantic article from 2019…

The isolation [of the headquarters in Chicago] was deliberate. “When the headquarters is located in proximity to a principal business—as ours was in Seattle—the corporate center is inevitably drawn into day-to-day business operations,” Condit explained at the time. And that statement, more than anything, captures a cardinal truth about the aerospace giant. The present 737 Max disaster can be traced back two decades—to the moment Boeing’s leadership decided to divorce itself from the firm’s own culture.

For about 80 years, Boeing basically functioned as an association of engineers. Its executives held patents, designed wings, spoke the language of engineering and safety as a mother tongue. Finance wasn’t a primary language. Even Boeing’s bean counters didn’t act the part. As late as the mid-’90s, the company’s chief financial officer had minimal contact with Wall Street and answered colleagues’ requests for basic financial data with a curt “Tell them not to worry.”

By the time I visited the company—for Fortune, in 2000—that had begun to change. In Condit’s office, overlooking Boeing Field, were 54 white roses to celebrate the day’s closing stock price. The shift had started three years earlier, with Boeing’s “reverse takeover” of McDonnell Douglas—so-called because it was McDonnell executives who perversely ended up in charge of the combined entity, and it was McDonnell’s culture that became ascendant.

11 Comments

|

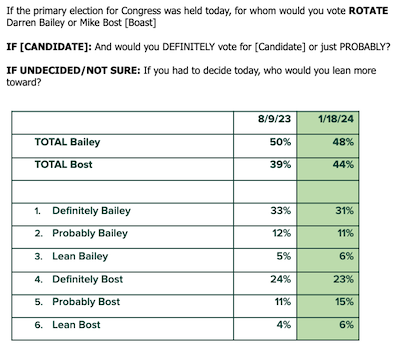

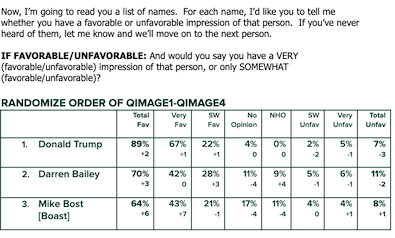

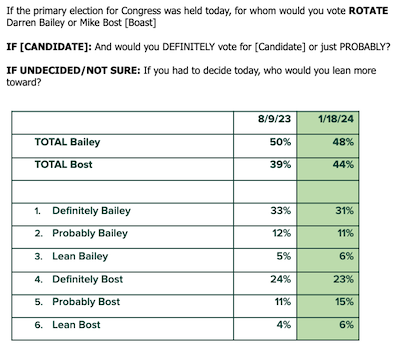

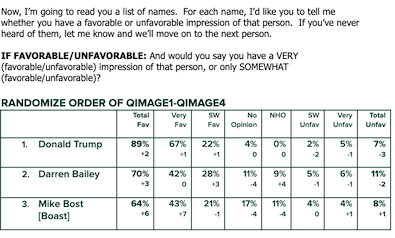

* The sample size of this “brush fire” poll conducted January 16-18 for the Darren Bailey campaign is only 300 likely Republican primary voters, and has a margin of error of +/- 5.66 percent. So, take it for the small snapshot that it is…

Undecideds were 8 percent, compared to 11 percent in the earlier poll.

According to this poll, the race appears to be tightening since August. But, again, small sample size and high MoE.

* Fox News is doing its thing…

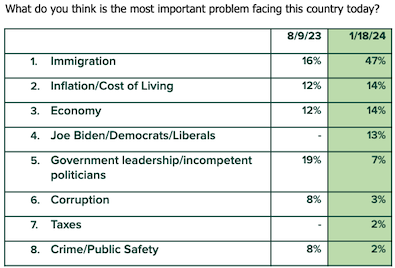

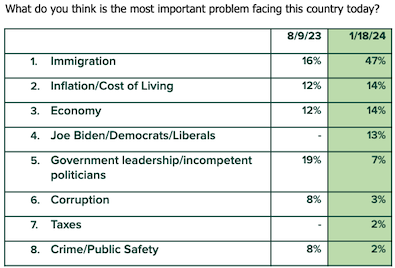

Check out how low the crime issue polls with southern Illinois Republicans.

* No real surprise, considering…

There’s more, so click here.

20 Comments

|

* Rep. Kam Buckner (D-Chicago) writes in the Tribune about asylum-seekers, housing issues and the 2024 Democratic National Convention…

The influx of new arrivals entering Chicago has not and will not break us, but what it has done is reveal to us what is already broken. The housing issue didn’t begin when the first bus was sent from Texas. Tens of thousands of housing-insecure people in Chicago have waited for an answer to this issue for decades, but a sufficient one hasn’t been provided. Even in our political platforms, we have roundly ignored the issues of housing for the poor. The parlance we’ve adopted has generally included only the “middle class” — promising them a better existence — and the “ultrawealthy” — asking them to pay their fair share. But in a country with 43 million people living below the poverty line, we can’t keep pretending that poor and unhoused people don’t exist. […]

The Constitution grants the federal government exclusive power to regulate immigration. The federal government also must deal with housing insecurity in America. These are federal issues. […]

As Democrats prepare to showcase our big, broad, diverse coalition to the world, in this big, broad, diverse city, there is an opportunity to deliver on the promises that are embedded in our platforms. Federal resources need to begin to flow immediately, and the convention should be the impetus to do that. But, if the federal government cannot adequately deal with the housing issue for tenured Chicagoans and our new arrivals, then Chicago and Illinois should be prepared to rescind the offer to host the DNC.

In the coming weeks, I will be working with the Rev. Michael Pfleger and a contingent of concerned Chicagoans from St. Sabina Catholic Church who share these concerns and have begun to mobilize behind them.

I realize this is a bold and unprecedented suggestion, but our situation is also unprecedented. And we must act with that in mind. I am excited about the DNC. I am voting for Joe Biden; I believe the future of our democracy depends on it. I am even running to be a convention delegate. I am elated about having three rock star Black women, Minyon Moore, Christy George and Keiana Barrett, in positions of power to execute this convention for a party under the leadership of its second elected Black chair and a presidential ticket with a Black woman returning as vice president. To me, this is all the more reason for the convention not to be just a party but also proof that the values we espouse matter. At this moment, the full weight of the federal government is required.

I would suggest that Rep. Buckner is not wrong. Your own thoughts?

…Adding… From Natalie Edelstein, the spokesperson for the host committee/convention…

“The Democratic National Convention provides an unparalleled opportunity to invest in communities across Chicago. Previous host cities have enjoyed major economic benefits––upwards of $150 million––in addition to supporting good-paying, local jobs. We look forward to continuing to work with our partners at the city, state, and federal levels to ensure a safe and successful event for all of Chicago’s residents and visiting attendees.”

56 Comments

|

It’s just a bill

Tuesday, Jan 23, 2024 - Posted by Isabel Miller

* Sun-Times…

Five potentially harmful ingredients commonly found in food and drinks would be banned from retail sales in Illinois under proposed legislation that goes further than California’s first-in-the-nation ban on additives.

Senate Bill 2637, introduced by state Sen. Willie Preston, D-Chicago, and backed by Illinois Secretary of State Alexi Giannoulias, would ban brominated vegetable oil, potassium bromate, propylparaben and red dye No. 3 — four additives that California outlawed in October.

Preston said he’ll amend the bill, which was filed in November, to also ban titanium dioxide from foods and beverages. […]

The Illinois measure also would take effect in 2027, but it would exempt manufacturers and instead focus on retail sales.

Giannoulias, a father of three, said it’s “enormously important” for children to steer clear of harmful chemicals in food and beverages. He says he took an interest in the legislation as the official in charge of Illinois’ organ donation registry.

…Adding… The Illinois Manufacturers’ Association…

The Illinois Manufacturers’ Association (IMA) released the following statement regarding SB2637, which sets a dangerous precedent for food regulation:

“Manufacturers oppose this well-intentioned legislation as it would set a dangerous precedent by usurping the role of scientists and experts at the U.S. Food & Drug Administration, which reviews and approves food additives to ensure they are safe,” said Mark Denzler, President & CEO of the Illinois Manufacturers’ Association. “This measure would create a confusing and costly patchwork of regulations for food manufacturing, which is the single largest segment of Illinois’ manufacturing economy, generating more than $135 billion in economic impact each year.”

* Rep. Margaret Croke filed HB4550 yesterday…

Amends the Criminal Code of 2012. Increases from a Class A misdemeanor to a Class 4 felony the penalty for a first violation of the provisions that prohibit the knowing possession, transportation, purchase, or receipt of an unfinished frame or receiver of a firearm unless: (1) the party possessing or receiving the unfinished frame or receiver is a federal firearms importer or federal firearms manufacturer; (2) the unfinished frame or receiver is possessed or transported by a person for transfer to a federal firearms importer or federal firearms manufacturer; or (3) the unfinished frame or receiver has been imprinted with a serial number issued by a federal firearms importer or federal firearms manufacturer.

* HB4539 from Rep. Debbie Meyers-Martin…

Amends the Credit Services Organizations Act. Expands the list of prohibitions imposed on a credit services organization to include: (i) charging or receiving any money or other valuable consideration before providing services listed in the contract (rather than charging or receiving any money or other valuable consideration prior to full and complete performance of the services the credit services organization has agreed to perform); (ii) making a guarantee that a buyer’s credit score or credit report will be improved through that buyer contracting with the credit services organization; (iii) adding an authorized user to a credit card account for payment of money or other valuable consideration; (iv) seeking an investigation by a third party of a trade line on a credit report without the authorization of the buyer; (v) failing to allow the buyer to cancel a contract with the credit services organization by phone call, email, text message, or a website; and other prohibitions as specified. In a provision concerning written statements a credit services organization must provide to a buyer before executing a contract or other agreement with the buyer, provides that, if a credit services organization agrees to provide services on a periodic basis, the organization must provide a detailed written description of those services that explains how the buyer will be billed in substantially equal periodic payments at fixed time intervals. In a provision requiring each written contract to include certain statements and information, provides that: (i) a statement alerting the buyer of the cancellation notice form attached to the contract must be written in at least 10-point boldface type; and (ii) the written contract must include a complete and detailed description of the services to be performed by the credit services organization and the total cost to the buyer for such services, including a detailed description on how a buyer will be billed for services provided by the credit services organization on a periodic basis. Requires a credit services organization to obtain a surety bond and adhere to certain procedures. Provides that the surety bond shall be maintained for a period of 5 (rather than 2) years after the date that the credit services organization ceases operations. Makes a change to the definition of “credit services organization”.

* HB4543 from Rep. Jackie Haas…

Amends the Tax Increment Allocation Redevelopment Act of the Illinois Municipal Code. Provides that, if an ordinance is adopted after the effective date of the amendatory Act creating a redevelopment project area, the redevelopment project area will expire the 23rd year after the year in which the first project started using the moneys from the special tax allocation fund (rather than expire the 23rd year after the year in which the ordinance approving the redevelopment project area was adopted if the ordinance). Provides that the start of the 23 years for ordinances adopted after the effective date of the amendatory Act commences no later than 10 years after the year in which the ordinance approving the redevelopment project area was adopted even if no projects have been started using the moneys from the special tax allocation fund. Makes a conforming change in provisions extending the expiration of a redevelopment project area to the 35th calendar year. Provides that no more extensions of redevelopment project areas to the 47th calendar year may occur after January 8, 2025 unless added by a Public Act of the 103rd General Assembly. Effective immediately.

* Rep. Lance Yednock filed HB4551…

Amends the Counties Code. Provides that a county may deny a permit for a commercial solar energy facility or commercial wind energy facility, including the modification or improvement to an existing facility, if the work requested to be performed under the permit is not being performed under a project labor agreement with building trades located in the area where construction, modification, or improvements are to be made.

* Rep. Anna Moeller’s HB4549…

Amends the Illinois Plumbing License Law. Provides that, beginning on July 1, 2024, food service establishments with less than 2,000 square feet may provide one unisex, readily accessible restroom facility for the public. Effective immediately.

8 Comments

|

* Politico…

There’s friction between Gov. JB Pritzker and Mayor Brandon Johnson’s teams about how to manage the migrant crisis — though both sides agree on one thing: More help is needed from the federal government.

What’s causing the split: The city’s plan to stop building new shelters, which we reported Monday, drew a sharp response from Pritzker. “I’m deeply concerned. We do not have enough shelter as it is in the city of Chicago,” he told reporters during a press gaggle.

* WTTW…

In a statement, Johnson spokesman Ronnie Reese indicated that if Pritzker’s so concerned, he could pull the levers at his disposal as the state’s chief executive.

“There are 1,300 municipalities in the State of Illinois, of which Chicago is one. The State has the authority to fund, stand up and operate a shelter in any one of those municipalities at any time that it chooses, including the City of Chicago,” Reese wrote. “Thus far, the City of Chicago has carried the entire weight of the new arrival mission, sheltering nearly every asylum seeker sent to Illinois. We remain committed, however, to ensuring that asylum seekers are housed while also fulfilling our fiduciary responsibilities to the people of Chicago.”

A Pritzker official said that Illinois has taken on responsibilities ranging from wraparound supports to six months of paying for food in shelters, plus allocating the majority of grant funding to Chicago.

“The idea that they are shouldering all of this on their own is ridiculous,” the official said.

The official also pushed back that the state has the authority to build a shelter anywhere it pleases.

* Tribune…

Asked whether the state would be providing additional funding to address the state’s migration crisis this year, Pritzker said he has encouraged state legislators to ensure they can fulfill the $160 million in additional funding the state has committed to address the issue.

“If you think this problem is going to end when the temperature warms up, it’s not,” he said. “We still need shelter for people.”

Pritzker came up with the $160 million largely by moving money around within the existing Illinois Department of Human Service budget but wants lawmakers to approve using surplus revenue to replenish those line items. Senate President Don Harmon, an Oak Park Democrat, has expressed a reluctance to address migrant funding as a stand-alone issue.

* More…

* WGN | Pritzker critical of Chicago’s plan to handle reduced shelter space for migrants: A tweak to Chicago’s plan for migrants. In closed-door briefings, Chicago Mayor Brandon Johnson informed officials that the city would no longer set up new shelter space. Sources say last Friday, a group of City Council members were told that the city does not plan to add new shelter beds. As residents leave, new arrivals will fill the beds.

* Axios | More migrants receive permits to legally work in Chicago: Nearly 1,000 new arrivals in Chicago have obtained work permits roughly four months after the Biden administration expanded eligibility to nearly a half-million more Venezuelans.

* NYT | 9 Democratic Governors Push Biden and Congress to Address Migrant Crisis: The governors, led by Gov. Kathy Hochul of New York, asked in a letter to the White House and Congress for “a serious commitment” to overhauling the immigration system that would include federal coordination on a strategy to relieve pressure on the southern and northern borders, as well as for more funds for states. “It is clear our national immigration system is outdated and unprepared to respond to this unprecedented global migration,” reads the letter, which is signed by Ms. Hochul and the governors of Arizona, California, Colorado, Illinois, New Mexico, Massachusetts, New Jersey and Maryland.

19 Comments

|

Open thread

Tuesday, Jan 23, 2024 - Posted by Isabel Miller

* What’s going on? Keep it Illinois-centric please…

6 Comments

|

Isabel’s morning briefing

Tuesday, Jan 23, 2024 - Posted by Isabel Miller

* ICYMI: Staffing agencies not exempted from antitrust law, state Supreme Court rules. Capitol News Illinois…

-The decision comes 3 ½ years after Attorney General Kwame Raoul sued a trio of staffing agencies, alleging they used their mutual client to coordinate no-poach agreements, which created a secondary agreement to pay temp staffers less than the market rate.

-In a unanimous 20-page opinion published Friday, the justices quoted a 1979 U.S. Supreme Court opinion that said some agreements “are so plainly anticompetitive that they are conclusively presumed illegal without further examination under the rule of reason generally applied in (antitrust law) cases.”

* Isabel’s top picks…

* Sun-Times | Pritzker joins Democratic governors asking Biden, Congress for migrant aid and to fix ‘outdated’ immigration system: Gov. J.B. Pritzker on Monday joined the Democratic governors of eight other states in asking President Joe Biden and Congress to “quickly negotiate” a border security agreement that includes funding for states and cities that are receiving thousands of migrants. “As Governors representing over 100 million Americans, we write to call on Washington to work together to solve what has become a humanitarian crisis,” the letter, led by New York Gov. Kathy Hochul, reads.

* Chronicle | Petition challenge withdrawn, Greenwood vs. Schmidt rematch back on track: There was no such fanfare in January, however, when objector Wavey T. Lester, a former state senate candidate from Milstadt, backed down and withdrew the objection. In order for the objection to have been sustained, an Illinois State Board of Elections hearing officer would have had to have found that fully two-thirds of the more than 1,600 signatures Greenwood had submitted were fraudulent or otherwise legally defective.

Governor Pritzker will be in Blue Island at 10 am for a ribbon cutting for the new Unlimited Potential DCFS Women’s Transitional House. Click here to watch.

* Here’s the rest of your morning roundup…

* WICS | Illinois private institutions receive $400 million in capital grants from the IBHE: The Illinois Board of Higher Education (IBHE) has awarded $400 million in grants through the Independent Colleges Capital Investment Grant Program to 45 institutions of higher education in Illinois in partnership with the Illinois Capital Development Board.

* Vermillion County First | Schweizer Touched by Friendliness of Fellow Legislators During First Week in Springfield: I just kind of assumed it was, like in high school you had your own cliques that you were hanging out with. But, it was not that. Everybody there was really nice. I spoke with a lot of folks on the other side of the aisle, great individuals. And I really look forward to getting back down there, and introducing my own legislation that fits into by own core values.

* IPM | One in 10 students skips or reduces meals to save money. Some Illinois lawmakers want to help: Champaign-Urbana State Representative Carol Ammons says she’s trying to free up state funding for students who can’t afford their meal plans. “They would have a gift card for that store down the street from the campus. We’re trying to shape this to make it flexible enough so students have a way to access these dollars,” Ammons said.

* Crain’s | Johnson in no hurry to replace Ramirez-Rosa as zoning chair: The committee’s vice-chair, freshman Ald. Bennett Lawson, 44th, has chaired two meetings of the body in his place and will run a third on Jan. 23. The City Council must vote on a new chair, so the position is going to remain vacant until at least the February meeting of the body.

* Crain’s | Feds order city to promote, pay Midway whistleblower: The U.S. Department of Labor found that Michael Conway, an airfield-operations employee, was protected by whistleblower rules six years ago when he complained that a supervisor wrongly pressured him to report that a runway was dry, rather than wet, at the request of Southwest Airlines.

* Tribune | Mayor Brandon Johnson’s ‘better deal’ with NASCAR is a handshake agreement to pay city an extra $2 million: The additional $2 million is still short of the more than $3.5 million in overtime and construction costs various city departments spent on the inaugural race last summer. Those costs included $2.16 million from the city’s Transportation Department on road improvements and extra pay, $1.4 million in police OT and $50,000 in OT for city emergency management workers.

* Daily-Journal | Schroeder, former Iroquois Co. board chair, dies: Schroeder died Jan. 10 at Loyola University Medical Center following an extended illness. He was 80. The former 24-year Iroquois County Board member, who represented the Papineau Township region, which bumped up against the Kankakee County line, also served the final nearly 11 years as board chairman.

* WREX | Rockford kicks off Barbershop Project offering free haircuts and mental health talks: Organized by Rockford Mayor Tom McNamara’s Office of Domestic and Community Violence Prevention, the Barbershop Project kicked off its support for community mental health. The project utilizes local barbers and beauticians trained by the city for mental health conversations by the city. Helpers like Jermane Robinson packed the Comprehensive Community Solutions building for the free haircut event.

* Pantagraph | Seasoned meats, seafood and Southern hospitality at Wesley’s Grill: Owned by head chef Wesley Knight, the restaurant began offering carryout and delivery in February 2021 before expanding to dine-in service in November. “I think customers enjoy the experience and the hospitality; they know I’m trying to take care of them,” Knight said. “I want to make them happy and give them an experience they haven’t had before.”

* Tribune | Suspect wanted in fatal shooting of 8 in Joliet found dead after confrontation with US Marshals in Texas, police say: Medina County Sheriff officials received a call that Romeo Nance was heading into their county, according to a post on their social media page around 10 p.m. After a standoff at Chubby’s gas station in Natalia, Nance sustained “self inflicted gunshot wounds,” officials wrote in the post. He died around 8:30 p.m., Joliet police said.

* Daily Herald | Hall of Fame second baseman Ryne Sandberg says he has metastatic prostate cancer: The 64-year-old Sandberg said Monday in a release put out by the Baseball Hall of Fame that he has started treatment. “I am surrounded by my loving wife Margaret, our incredibly supportive family, the best medical care team, and our dear friends,” Sandberg said. “We will continue to be positive, strong, and fight to beat this. Please keep us in your thoughts and prayers during this difficult time for me and my family.”

* Crain’s | ‘Great Lakes Fish Pledge’ pushes companies to grow revenue, reduce waste: Kendall College culinary students spent an afternoon turning Great Lakes walleye into the kind of fare you might find at a fancy restaurant rather than at a church basement fish fry. They served up walleye fish cakes, walleye croquettes and walleye served with rice pilaf and coconut curry. These dishes were on the menu during a Jan. 22 cook-off challenge designed to come up with creative uses for the whole fish — head to tail. Student chefs couldn’t use filets and were encouraged to use the 60% of the fish that’s usually discarded or used for cheap animal feed. The event promoted reducing waste and wringing more revenue from each fish caught in the Great Lakes.

* Daily-Journal | Quakes alive: Frost quakes grab attention from Limestone to St. Anne: The recent extreme cold led to what was likely a series of frost quakes in the Kankakee County region. Unique weather and ground conditions cause some to hear extreme loud booming sounds one week ago.

1 Comment

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|