About that unemployment rate

Friday, May 28, 2010 - Posted by Rich Miller

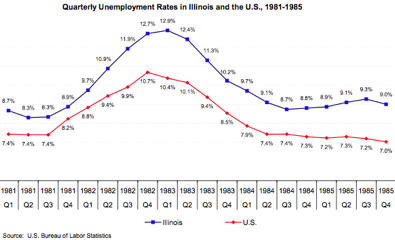

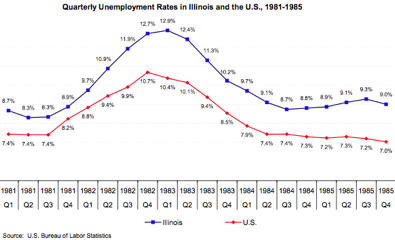

* Voices for Illinois Children has published a graph which shows unemployment rates for Illinois (in blue) and the US (in red) during the deep recession of the early 1980s. Click on the pic for a larger image…

This shows two things:

1) Illinois’ unemployment rate has tracked closely with, but has always hovered above the national rate for decades. Most of us who watch this stuff already know that, but too many people don’t. This has always been a problem here and it’s mainly because we’ve relied so much on manufacturing. During the 1980s, many of those jobs moved to the non-union South. In the 1990s, they went to Mexico. Now, they’re going to China, although a friend of mine is losing his factory job soon because the plant is moving to Mexico.

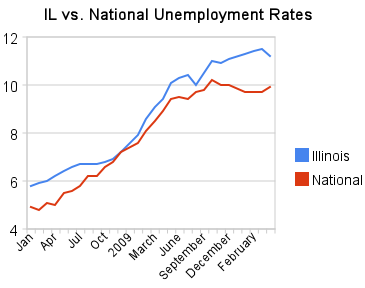

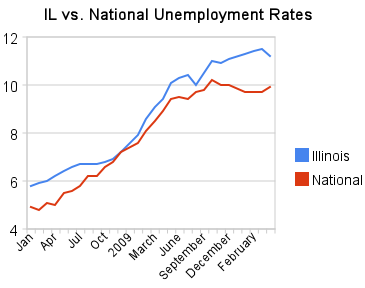

Here’s a more up-to-date graph of Illinois and US unemployment since January of 2008…

Closely tracked, but always above. This is the way it’s always been here.

2) I’ll let Voices for Illinois Children’s Larry Joseph explain this one…

In January 1983, Illinois was in the depths of a severe recession. Unemployment in the state had reached 12.9 percent, substantially higher than the current rate of 11.5 percent.

Nonetheless, the General Assembly and the Governor instituted a temporary 18-month income tax increase to bolster state revenues. The individual income tax was raised from 2.5 percent to 3 percent and the corporate income tax from 4 percent to 4.8 percent.

During the first quarter of 1983, the state’s unemployment rate was 12.9 percent, up from 8.3 percent in mid-1981. By the third quarter of 1984, after the income tax surcharge had expired, unemployment had fallen to 8.7 percent — a drop of more than 4 percentage points. Over the same period of time, nation-wide unemployment declined from 10.4 percent to 7.4 percent.

There is no indication that the tax increase had an adverse impact on the state’s economy. The recovery in Illinois was shaped primarily by macroeconomic conditions, not by changes in state tax policy. [Emphasis added.]

We need to be far less concerned with our income tax rates and far more concerned with doing things that create jobs. With corporations and individuals spending money on debt reduction rather than expansion or purchasing, the government needs to step in and fill the void. [Hat tip: Progress Illinois]

* Related…

The unemployment rate in the Chicago metropolitan area continued to improve in April, falling to 10.7 percent from 11.2 percent in March, the Illinois Department of Employment Security reported today.

The rate was up from 9.8 percent in April 2009 and was above year-ago levels in all 12 metropolitan areas for the 35th straight month, but the increases have been consistently smaller in each of the four most recent months, IDES said. The rate was 11.3 percent in February.

The Chicago metropolitan area lost 84,500 jobs last month from a year earlier.

“Four consecutive months of smaller increases in (the unemployment) rate is encouraging because it offers another measure that indicates this national recession might be nearing an end,” IDES Director Maureen O’Donnell said in a statement. “Knowing that unemployment rates look to the past, and knowing that Illinois has added more than 51,000 jobs so far this year, suggests that we are closer to escaping the pressure that the Great Recession has exerted on our local job markets.”

- Fan of the Game - Friday, May 28, 10 @ 11:33 am:

===With corporations and individuals spending money on debt reduction rather than expansion or purchasing, the government needs to step in and fill the void.===

Where will the government get the money to fill the void? From corporations and individuals.

- Greg B. - Friday, May 28, 10 @ 11:36 am:

I recall from my original business plan for the Institute back in 01 looking at long term trends in unemployment. Prior to the70’s, I recall, Illinois was actually ahead of the pack. Something happened right around 1969 to change that. It was a pretty abrupt change, too.

Again, this is from 9 years ago. I may be fuzzy. As far as manufacturing goes. The US manufactures as much or more as it ever did. It just does so more efficiently w/fewer employees. High labor costs as we see with auto industry harms competitiveness.

And I agree w/PI on tax rates and the economy. Steady and predictable (what we don’t have in IL) is better than high or low when it comes to taxes. Low is good but business needs stability in order to predict more accurately and lessen risk.

- Chicago Cynic - Friday, May 28, 10 @ 11:40 am:

Rich, I agree with you that this is a historic problem. But for a variety of reasons (dysfunction, taxes, lack of economic development activity), we have been losing ground as a place to do business. I’ve seen it first hand and it’s becoming a very serious problem. The answers aren’t the simple Dem/Rep taxation questions so won’t be solved by switching parties, but clearly we need to deal with this and soon. While we have historically been a bit above, our bulge is greater this time and there’s a reason for it.

- Rich Miller - Friday, May 28, 10 @ 11:50 am:

===our bulge is greater this time and there’s a reason for it===

Actually, no. At the high point of the previous recession, IL’s unemployment rate was 2.5 percentage points higher than USA’s.

- VanillaMan - Friday, May 28, 10 @ 11:57 am:

We need to be far less concerned with our income tax rates and far more concerned with doing things that create jobs. With corporations and individuals spending money on debt reduction rather than expansion or purchasing, the government needs to step in and fill the void.

This is obsolete Keynesian economic theory that has never worked. We started replacing this kind of thinking during the later quarter of the 20th Century with University of Chicago School of Economic theory as lead by Dr. Milton Friedman. By 1984, these theories produced the largest economic boom in US history.

Returning to Keynesian economics in order to justify a continued growth of taxpayer funded job base isn’t economically sound.

It is time to join the 21st Century, not return to the failed economic policies of the 20th.

- dupage dan - Friday, May 28, 10 @ 12:01 pm:

I like the idea of a temporary tax that targets a specific problem and then sunsets. Coupled with a program to address the structural budget problems (pensions, etc) and austerity measures this could provide the stability needed to encourage business development and employment. I wonder if the tax increase mentioned didn’t impact the state’s economy precisely because it was temporary.

- dupage dan - Friday, May 28, 10 @ 12:04 pm:

I should have been clear that I like a temp tax in the environment that a tax increase is inevitable - better to be temporary than permanent.

- Rich Miller - Friday, May 28, 10 @ 12:06 pm:

VanillaMan, that’s goofy and a total misread. Do you remember the budget deficit in the 80s? Do you remember Reagan’s large tax hikes on the working and middle classes and sole proprietors?

Your ideology doesn’t fit history, dude.

- dupage dan - Friday, May 28, 10 @ 12:09 pm:

This thread will get more interesting when FDR is mentioned.

- Small Town Liberal - Friday, May 28, 10 @ 12:13 pm:

- largest economic boom in US history -

The 60’s were a higher period of sustained growth than any time period in the 80’s. I seem to remember something about income taxes being higher back then…

- dupage dan - Friday, May 28, 10 @ 12:22 pm:

STL,

In 1963, Kennedy proposed tax cuts that were enacted in 1964.

- Small Town Liberal - Friday, May 28, 10 @ 12:45 pm:

dupage dan - So the highest income tax levels now are higher than they were back then? Didn’t think so, but we’re all super impressed with your pointless trivia.

- VanillaMan - Friday, May 28, 10 @ 1:04 pm:

By 1984, these theories produced the largest economic boom in US history.

Sounds like you guys don’t like this line - OK - ignor it. The rest however is still correct.

The idea that we can increase government spending to create jobs is obsolete. We now are fully aware that taking water from one side of a swimming pool and adding it to the other side, doesn’t raise the water level.

Borrowing takes from the current supply and merely redistributes it. It doesn’t do anything that would result in a higher growth level. You can only do this if you have a surplus of money to put into the system. Borrowing to spend doesn’t make any sense at any level.

Common sense is right - Keynesian economics doesn’t work. Never has.

- shore - Friday, May 28, 10 @ 1:06 pm:

Thank you but yes I am going to be concerned with my tax dollars and no, your social service group can not have more of them to save a failed springfield regime.

I realize you live in a government town rich, but yes people’s money matters to them and no it’s hard to justify raising taxes to feed a beast down there that has been behaving badly.

- Small Town Liberal - Friday, May 28, 10 @ 1:15 pm:

- Borrowing to spend doesn’t make any sense at any level. -

Do you have no idea how businesses function? If this was true, why would large companies care what their credit rating was? Oh, thats right, because they ALL borrow to spend, and having a lower credit rating makes that even more profitable. But, by all means, keep making these bumper sticker declarations with no supporting evidence.

- dave - Friday, May 28, 10 @ 1:15 pm:

The idea that we can increase government spending to create jobs is obsolete.

If you say so.

http://www.cnbc.com/id/37343761

- Greg B. - Friday, May 28, 10 @ 1:20 pm:

STL I think the point is that the Kennedy marginal rate reductions cuts freed up money for investment which led to economic growth. That marginal rates were higher then than today isn’t really relevant to more capital being available to invest in the economy than was previously available.

Rich, the “large” tax hikes on the working, middle class and sole proprietors is a bit of a stretch. Millions of poor and middle class were taken off the income tax rolls. Indexing income taxes also reduced the burden. Some excise taxes, payroll taxes (I thought SS was good?), and tax simplification. However, the biggest thing the Admin. and the Fed. did was end inflation, which was a far bigger burden on the poor and middle class than any tax raised.

Also Reagan slowed the growth of govt. 4% under Carter to 2.5% under Reagan. That was a burden reduction as well.

I do, however, think Vanilla Man misinterpreted your comments. I see what you are saying and agree. Focus on economic growth and things that create jobs. My prescription, admit we spend too much and ramp down state spending, review regulations and get rid of the ones that hamper growth, and hold the line on tax increases.

And oh… Keynes’ theories were about a specific time and a specific problem in the 30’s. He isn’t so much discredited as he is obsolete. He belongs in the pantheon with Smith, Ricardo, Schumpeter and the other great theorists (Von Hayek).

- Greg B. - Friday, May 28, 10 @ 1:23 pm:

Businesses don’t borrow to spend. The borrow to invest and produce that’s different than consumption which is what govt. does w/money.

- Small Town Liberal - Friday, May 28, 10 @ 1:26 pm:

- Businesses don’t borrow to spend. The borrow to invest -

Well, I work for a very large business, and we borrow to spend. I guess we’re the only one.

- VanillaMan - Friday, May 28, 10 @ 1:31 pm:

You don’t understand the difference between public and private industry jobs. Until you do, you won’t understand why there public job growth doesn’t actually help economic growth.

- 47th Ward - Friday, May 28, 10 @ 1:32 pm:

===Businesses don’t borrow to spend. The borrow to invest and produce that’s different than consumption which is what govt. does w/money.===

That doesn’t make any sense. I think you probably have a point, but it isn’t clear from this post.

And government most certainly spends, in fact, that’s what government is really good at doing. Government payrolls, grants and payments to vendors (or not, in IL’s case) is actual spending, and a huge factor in any modern economy.

Businesses that borrow to invest in production are in fact “spending” the borrowed money on new production. They are betting that increased production will produce revenues beyond the cost of the borrowing. So businesses in fact do borrow to spend.

- Vole - Friday, May 28, 10 @ 1:38 pm:

All stuff that worked in the past may not be applicable to today’s problem. The sustainability of our global capitalist system is in question. The bubbles are gone. We need to edge ourselves back from the limb that brought us here.

The greatest potential source of employment for the US and the world is in the much needed area of ecological restoration. There will be potentially work for millions in the Gulf states. This is just the beginning. The big question is how much do we value the preservation of life on earth.

GDP is dead.

- Rich Miller - Friday, May 28, 10 @ 1:46 pm:

VanillaMan, you don’t understand the problem caused when businesses and consumers spend profits/income on debt paydown. It’s a great thing to do, absolutely, but it means that money isn’t being put back into the jobs economy.

- Small Town Liberal - Friday, May 28, 10 @ 1:51 pm:

- You don’t understand the difference between public and private industry jobs. -

Ok vannie, you’re so much smarter than the rest of us mortals. I work for a large company that provides a service to couple million customers every day. We charge a fee for this service, and we still borrow to spend. Explain to me, oh god of economics, what I’m not understanding? You’re the one who said “Borrowing to spend doesn’t make any sense at any level.” anyway, are you retracting that?

- Greg B. - Friday, May 28, 10 @ 1:53 pm:

GDP consists of individual consumption + biz investment + govt. spending.

The major things that biz. do, invest in plant, equipment personnel etc. are investment. You spend money and you get a return. Govt. spending doesn’t have an ROI. That’s the diff.

Obviously that’s very basic. And yes, I’m sure money is spent and wasted in a business. Biz. isn’t perfectly efficient, the successful ones are just more efficient.

- Rich Miller - Friday, May 28, 10 @ 1:53 pm:

Ford Motor Co. borrowed billions a few years ago. That’s why it was able to ride out this storm and avoid the government subsidy.

- D.P. Gumby - Friday, May 28, 10 @ 1:58 pm:

Further, VM, when government spending goes toward infrastructure, that money expands through the economy. You can ignore its Keynesian roots, but the impact still exists and the benefit is broadbased. Indeed the problem w/ pork is that much of the pork is infrastructure related.

- dupage dan - Friday, May 28, 10 @ 2:05 pm:

STL,

So, yesterday I point out a fact and back it up with explanation and real life examples and you accuse me of a diatribe. Today, I point out that you are wrong about the tax situation in the ’60’s without adding all the excess banter and you accuse me of posting trivia.

There is just no pleasing you, is there?

- Axis Bold As Love - Friday, May 28, 10 @ 2:22 pm:

Here is the problem.

The unemployment AND inflation rate was calculated more accurately back in previous decades. It has since been changed for political reasons to mask the true nature of our problems.

Don’t believe me. Read John Williams shadow statistics. A renowned economist, Williams publishes a blog that shows you what these stats would be using the old labor departments own former math. Unemployment is actually closer to 20 percent when you include underemployed, given up workers, and those that will be soon laid off by the census. How many people do you and I know personally who are without jobs ? It’s FAR more than 11%. Maybe double. Second - the cost of food and other commodity items have been going up due to devaluation of the dollar over time due to excessive issuance of government debt. So this hidden tax is hitting all us. More government debt equals more inflation. It’s a deadly spiral.

- Small Town Liberal - Friday, May 28, 10 @ 2:38 pm:

dupage dan - No, you’re wrong, once again. I was not wrong about income taxes in the 60’s, they were substantially higher for higher earners before Reagen reduced them. And yesterday you launched into a diatribe that was irrelevant to what I said. So try to understand before you make accusations pal.

- dupage dan - Friday, May 28, 10 @ 2:45 pm:

STL,

Doesn’t matter how high the taxes are - lowering them spurs investment and growth. It’s all about proportionality.

You need to lighten up a bit. Perhaps cut out the caffeine.

- wordslinger - Friday, May 28, 10 @ 2:51 pm:

–It is time to join the 21st Century, not return to the failed economic policies of the 20th.–

Yeah, the American way of life in the 20th Century was really bad. No progress at all, in anything. Everyone lived the same in 1901 as they did in 1999.

Dude, don’t you guys have support groups or something?

- Cougar - Friday, May 28, 10 @ 3:01 pm:

A broken window is not additive to an economy. This is a fallacy. Look not at what is the immediate impact, but the unseen impact. Increased taxes takes money AWAY from the consumer, always and forever.

- 47th Ward - Friday, May 28, 10 @ 3:11 pm:

===Increased taxes takes money AWAY from the consumer, always and forever.===

Not sure what you’re trying to say Cougar, but where do you think that money goes once it gets taken AWAY from the “consumer”?

- wordslinger - Friday, May 28, 10 @ 3:15 pm:

- Businesses don’t borrow to spend. The borrow to invest -

I didn’t know you could invest without spending. VMan, tell me more about your interpretation of the U of C crowd. Sounds like Coronado’s City of Gold.

You analysis of public sector vs. private sector would be hilarious, as well. Write about what you know, right?

- dupage dan - Friday, May 28, 10 @ 3:18 pm:

47th Ward,

You are focused on the wrong end of the equation. The broken window represents lost resources. A drag on the economy. Sure, someone benefits from replacing the glass (glass factory, shipping & glazer) but that is a one time expenditure. Had the window not been broken the money could have been spent investing in a business that would provide employment for many over time. I’m sure you have heard of the “money multiplier” principle.

- dupage dan - Friday, May 28, 10 @ 3:24 pm:

Really - To those of you who post here about Keynesian theory as opposed to the theories of Friedman, et al, perhaps you should review Friedman’s work before writing. It’s quite refreshing.

Focusing in on short hand posting that could have been more elegant if more time had been spent misses the point and the facts. Your arguments lose ooompf when all you do is quibble about semantics and phrasing. Just sayin

- Chicago Cynic - Friday, May 28, 10 @ 3:24 pm:

This is another great example of “don’t let the facts get in the way of your theory.” A couple of data points:

1) The greatest economic growth (including job growth) in recent history, and the only one BTW that did not include deficit spending, was in the 90s and set in motion by Bill Clinton’s 1993 budget deal and tax hikes on the wealthy.

2) Federal taxes are at their lowest level since 1950. http://www.usatoday.com/money/perfi/taxes/2010-05-10-taxes_N.htm And Illinois is the 46th lowest tax state in the nation.

Happy Friday.

- AXIS BOLD AS LOVE - Friday, May 28, 10 @ 3:29 pm:

I was a life long liberal left wing Democrat from a trade union household. I didn’t like the Republican party due to their big defense spending war on drugs radical religious and corporate welfare ways. I always have held my nose to vote for Dems due to social positions and falsely believing most were for the little guy. However this last couple years, I really have come to the conclusion that most Democrats are no different. Their special interests - govt employee unions, teachers unions, and trial lawyers, along with super big business such as big pharma, insurance, and banks, are just as bad for our country as GOP’s big backers. All want more govt interference in the market to create monopolies, bailouts, and guaranteed profits for their companies or unions. Govt is just about transferring wealth from the middle class and poor to the rich and creating legally sanctioned monopolies and funding self perpetuating corporate and union welfare. I believe that in the long run Govt. creates poverty, not wealth. Govt is starving the private economy (the real creator of real long term wealth) of capital due to its need to have investors buy all of its bonds. These same investors would instead be investing in the business sector if so much govt debt wasn’t available with a guaranteed tax base to support it. It’s individuals and business that have to support that excessive debt burden robbing them through more taxes of the ability to reinvest in their own companies and hire more people. Milton Friedman said that for every govt employee, you could create two in the private sector. I believe it’s actually three you could create for each one due to the cost of govt benefits. We’re on an unsustainable course and govt needs to be downsized everywhere, not just in the USA but in Europe as well as we are seeing with the PIIGS crisis (Portugal, Ireland, Italy, Greece and Spain). Don’t you realize that this could come to the US ? and we’re not immune ? Now is the time to tighten belts, not when it’s already in crisis mode. We need grown ups to level with the public about how bad the debt crisis is everywhere in the US. Or be prepared for terrible inflation.

- dupage dan - Friday, May 28, 10 @ 3:31 pm:

CC,

As has been posted here many times, the bump that you refer to that occured during Clinton’s terms had more to do with the tech bubble than anything else. The collapse of that bull run wasn’t pretty.

Using “USA Today” (news lite) as a reference is problematic for so many reasons. Illinois as a low tax state - please include ALL taxing bodies in the state when comparing (include townships, forest preserves, etc). That changes the ranking some, no?

- wordslinger - Friday, May 28, 10 @ 3:35 pm:

== Govt is starving the private economy (the real creator of real long term wealth) of capital due to its need to have investors buy all of its bond–

Last I checked, government was underwriting the failed business practices of the financial sector, and begging private business to pony up to the Fed’s discount window and borrow money to lend to businesses and consumer.

But maybe that doesn’t fit your abstract theories. You don’t work for the state, too, do you?

By the way, you have an unusual handle that I really don’t want to know anything more about.

- Rich Miller - Friday, May 28, 10 @ 3:35 pm:

===the bump that you refer to that occured during Clinton’s terms had more to do with the tech bubble than anything else.===

The economy boomed to the point that we witnessed the greatest expansion of the black middle class in history. It wasn’t all tech. And the tax hikes didn’t stop it, either.

- 47th Ward - Friday, May 28, 10 @ 3:37 pm:

===Really - To those of you who post here about Keynesian theory as opposed to the theories of Friedman, et al, perhaps you should review Friedman’s work before writing. It’s quite refreshing.===

Dan, it seems like you and VanillaMan think Keynes is obsolete. Maybe, maybe not. Friedman is the most influential economist since Keynes, but neither can be said to hold definitive positions. Economics is a social science, not a physical science.

I would say it is useful to consider the theories of both and apply them to the ever changing circumstances. Since Keynes accepted and championed a role for government to play in managing the economy, and this blog focuses on government (and both you and VM are government employees), Keynes is going to have some support here. Friedman had an open disdain for government. His idea of free markets without government regulation is the recipe that led to the BP disaster.

On the other hand, his ideas on money supply are clearly an advancement over Keynes, but much has changed in terms of the global economy and currencies in the decades between Keynes and Friedman.

When you consider the role of government in managing the economy, it is helpful to understand both Keynes and Friedman. If you think this is an “either/or” question, you’ll never find a good solution.

- dupage dan - Friday, May 28, 10 @ 3:39 pm:

Word - just to help you out, “Axis: Bold as Love” is the name of an early Jimi Hendrix album. Great tunes, Dude.

- dupage dan - Friday, May 28, 10 @ 3:46 pm:

Just to be clear, tax hikes during a boom may not stop the boom. The boom ended at some point. Who’s to say the tax hike didn’t hasten it?

Rich, are you saying that the tax hikes are the reason for the greatest expansion of the black middle class in history? Was the expansion caused by increased gov’t spending? Which gov’t program can we identify caused the expansion? Or was it just plain capitalism?

Tax hikes during a recession will dampen recovery.

- Rich Miller - Friday, May 28, 10 @ 3:52 pm:

===are you saying that the tax hikes are the reason for the greatest expansion of the black middle class in history===

No. I’m saying the hikes didn’t stop that.

- 47th Ward - Friday, May 28, 10 @ 3:56 pm:

===Rich, are you saying that the tax hikes are the reason for the greatest expansion of the black middle class in history? Was the expansion caused by increased gov’t spending? Which gov’t program can we identify caused the expansion? Or was it just plain capitalism?===

Far be it from to speak for Rich, but here is my answer: the Bush (41) and Clinton tax hikes of the early 1990s were dedicated to defict reduction. Deficit reduction led to sharply lower interest rates. Lower interest rates provided easier access to capital, enabling many people to afford mortgages. Homeownership is the ticket to the middle class, ergo, lower interest rates are the key factor in access to the middle class.

In 2010, the deficits are back and worse than ever, and so we’ve probably taken the low interest rates too far. The housing market collapse was in part due to too much money available too cheaply. The PIIGS problem (and Illinois’ problem) also stems from cheap money.

The Fed is going to have to raise the interest rate. If you think taxes are the biggest drain on economic growth, wait until your mortgage interest is 10%. Capitalism in a democracy requires a balanced regulatory role for government. Finding the proper balance in the right circumstances is difficult, but always easier in hindsight.

- Axis Bold As Love - Friday, May 28, 10 @ 3:58 pm:

Isn’t it funny that the tech boom which was a MASSIVe asset bubble where insiders reaped fortunes and the masses got creamed also preceded the housing bubble which also popped and the common denominator was that Alan Greenspan had the spigots turned on full blast allowing for tons of cheap credit and money to flood the country ? Credit was EVERYWHERE. But it didn’t create lasting wealth. Eventually the debt bubbles popped, and there were huge losses. Those losses though have been socialized through more govt debt issuance for favored insiders such as AIG, Goldman, big banks, fannie mae, freddie mac, etc. That is what govt does the best - it guarantees profits and socializes losses for the elite few that get to eat

NOW we have another asset bubble . It’s called GOVERNMENT DEBT. And pretty soon, all this newly created debt, will pop also, as all bubbles do.

Govt debt does not create wealth. All we have done is transfer wall streets losses to the taxpayers credit card balance making them our losses.

- dupage dan - Friday, May 28, 10 @ 4:01 pm:

=No. I’m saying the hikes didn’t stop that. =

I guess I’m wonderin’ - was there someone who said the hikes did stop the expansion?

There seems to be a disconnect between the cause and action.

- Rich Miller - Friday, May 28, 10 @ 4:07 pm:

===I guess I’m wonderin’ - was there someone who said the hikes did stop the expansion?===

That was the argument when the tax hikes were passed.

- dupage dan - Friday, May 28, 10 @ 4:16 pm:

47th Ward,

I find myself agreeing with you again, today. Weird.

Given the current massive expansion of the fed gov’t (and the same for Illinois, but with different impact) leading to massive deficits, along with the likely increase in inflation (some people claim that because we figure inflation different today, it is actually about 9% right now) we could see real devastation in our economy. Not pretty.

In this climate, do you think any tax increase (I would favor a temp tax increase, as mentioned elsewhere) to lower the deficit would be believed and embraced? Frankly, I don’t think our current Pres and Gov would apply much increased revenue to lowering the deficit but that’s just my opinion.

- wordslinger - Friday, May 28, 10 @ 4:20 pm:

–We started replacing this kind of thinking during the later quarter of the 20th Century with University of Chicago School of Economic theory as lead by Dr. Milton Friedman. By 1984, these theories produced the largest economic boom in US history.–

You mean Reagan? He was the king of deficit financing.

Keynes said you can go into deficit financing, but you have to pay it back at some point. Reagan borrowed, Clinton paid it back. You can look it up.

What does Friedman have to do with the American economy? The only buyers he ever found were Pinochet and the Argentine generals.

- dupage dan - Friday, May 28, 10 @ 4:20 pm:

BTW,

I would also add that in a climate where unsustainable gov’t spending could be curtailed and a drop in taxes would be implemented, causing the kind of historic economic expansion described earlier, that, too, would bring about a drop in the deficit since the resulting expansion would result in increased revenues. Just sayin’.

- dupage dan - Friday, May 28, 10 @ 4:24 pm:

Readan’s deficit financing, as you call it, was related to a vastly increased defense budget which hastened the demise of the Soviet Union. A worthwhile endeavor. Maybe you’all think that was accomplished by Gorbachev but you can look that up, too.

- Axis Bold As Love - Friday, May 28, 10 @ 4:27 pm:

Word - I am friends with a guy who survived Pinochet and fled Chile because he was a student activist in college and leftist. Pinochet, a puppet of Kissinger, was pure evil. As were all the other latin american dictators at that time period doing similar evils in Brazil, Uruguay, Argentina. All supported with your tax dollars that left wing liberals love to pay so much of.

However Chile did the right things economically in the 70s bt bringing in the Chicago boys for economic advice ecause right now Chile has the most stable economy and currency in all of latin america. It’s the safest country also, has the best infrastructure, and most peaceful prosperous economy. It’s a remarkably stable country while Venezuela has 40% annual inflation.

I am for drastic cuts in government spending to reduce the deficits. Republicans, politically, learned that cutting deficits does not win elections, but cutting taxes does.

I am ok with tax hikes if they are coupled with greater expenditure cuts.

- Rich Miller - Friday, May 28, 10 @ 4:39 pm:

DD, you’re right, but it boosted the economy with spending when the economy needed it.

- dupage dan - Friday, May 28, 10 @ 4:42 pm:

ABAL,

=Republicans, politically, learned that cutting deficits does not win elections, but cutting taxes does.=

How true. But in all cases, staying in power (the elected official as well as the party) frequently depends on the economy, something elected officials have less control over.

How Venezuela can have such high inflation what with all that liquid gold is a puzzle. Probably Bush’s fault.

- wordslinger - Friday, May 28, 10 @ 4:42 pm:

–Republicans, politically, learned that cutting deficits does not win elections, but cutting taxes does.–

We’re gong down memory lane here. In his first year, Reagan cut marginal income tax rates and increased spending and borrowing.

In 1982, TEFRA was passed to increase taxes and recapture the revenue that was lost from the previous tax cuts that, miraculously, did not increase government collections.

DD, Reagan’s deficit spending didn’t beat the commies. The American people, in many ways and for many years before him, wore down that backwards regime til it collapsed under it’s own stupid weight. That was containment, and it was bipartisan.

- wordslinger - Friday, May 28, 10 @ 4:46 pm:

–However Chile did the right things economically in the 70s bt bringing in the Chicago boys for economic advice ecause right now Chile has the most stable economy and currency in all of latin america. It’s the safest country also, has the best infrastructure, and most peaceful prosperous economy.–

LOL, it’s easier to run things when you have the option of dropping your opponents out of a helicopter over the Pacific.

By the way — government fiscal policy isn’t the end-all and be-all of an economy. But if you want to run an empire and have a social safety net — guns and butter — it’s going to cost you.

- dupage dan - Friday, May 28, 10 @ 4:51 pm:

I would say, Rich, that the boost was a bubble much like the one during Clinton’s terms. Real sustained growth come from business investment, not gov’t investment. Reagan’s defense spending was a necessary thing but had little long term impact on the economy. His tax simplification program engineered with Senator Bill Bradley, was the kind of structural change that brings about lasting impact on an economy. Too bad we messed it up.

People love those short term bumps, tho. The kind of thing that wins elections. Just like tax cuts!

Hope you feel better. Happy Memorial Day. We should all honor those who have served our country, and paid the last, full measure of devotion.

- VanillaMan - Friday, May 28, 10 @ 4:52 pm:

We are trillions in debt and the economy is still hanging by a thread. Yeah - you guys got it all figured out.

Have a nice weekend.

- dupage dan - Friday, May 28, 10 @ 4:55 pm:

Word,

My comments didn’t short those who had come before Reagan’s last push. There is only so much time in the day to type. I clearly said, “hastened the demise of the Soviet Union”. I didn’t say he beat the commies. Big difference.

- wordslinger - Friday, May 28, 10 @ 4:59 pm:

I doubt it I do, but I’m absolutely certain you don’t.

Beautiful weekend up here. Visit Chicago, where the Byfuglien roam.

- Axis Bold As Love - Friday, May 28, 10 @ 5:15 pm:

Word - check out New Zealand’s government sector size relative to the private sector and how over a decade ago they had a campaign to reduce government by half and eliminate non vital and non essential functions and privatize them. They accomplished this drastically downsizing govt when times were good. Now their debt to GDP is far lower, their economy is doing far better than most, and when they do borrow money, there is appetite for their bonds. In contrast socialist Greece, Spain, Portugal, are screwed and in for a decade long depression. No one wants to buy their debt at a reasonable interest rate. Govt spending as a percent of the economy does matter but it is not the end all be all. Fortunately people and business’s often succeed in spite. However in the US govt spending is out of control and the cheap credit to our government will come to an end just like it did for home buyers and for small business. When that happens our interest payments on govt and private debt will skyrocket and the percent of our taxes going to simply pay interest will become unsustainable and something will give and it won’t be pretty. Usually the middle class ends up getting hurt the worst in these circumstances. The middle class is being impoverished in the USA. Offshoring, something Clinton, Rahm, and Bill Daley pushed for, is also a huge culprit .

- RhamRulesClinton - Friday, May 28, 10 @ 11:08 pm:

The US and IL can borrow to spend, but it can only borrow to spend so much before it becomes unsustainable. At this point in time we have reached a point where it is unsustainable to borrow anymore money.

- Anonymous - Saturday, May 29, 10 @ 2:34 pm:

The macro economy has a big impact on unemployment, but micro economies are not irrelevant.

Is creating more government bureaucracy and long-term perpetual costs to create more jobs the most efficient way to reduce unemployment and create the most sustainable jobs for the future?