Will gay marriage push begin in 2013?

Wednesday, Jan 11, 2012 - Posted by Rich Miller

* Windy City Times…

A group of Illinois legislators has started meeting with local LGBT groups to strategize on making marriage equality a reality in Illinois.

State representatives Greg Harris, Deb Mell, Ann Williams, Kelly Cassidy, Sara Feigenholtz and Senator Heather Steans are in talks with Illinois organizations about introducing a bill that would allow same-sex partners to marry in Illinois.

According to Harris, the bill will not likely be introduced until at least 2013. Harris believes the fight will be difficult, especially as anti-gay political candidates work to bolster support for upcoming presidential elections.

“I do not delude myself into thinking this will be an easy process,” Harris said. “But we need to take the first step.”

It might take several more years to pass that bill once it’s introduced. Keep in mind that Illinois passed an anti-discrimination bill for gays almost exactly seven years ago after many, many years of work. Organizers started laying the groundwork almost immediately for gay marriage, but it took another six years before the General Assembly passed a civil unions bill. Gay marriage could take a while longer. Then again, maybe it won’t take as long. There really hasn’t been much of a sustained blowback on the civil unions bill. So, we’ll see.

39 Comments

|

* 12:58 pm - The governor’s budget office claims via press release that, despite the recent Moody’s downgrade, interest on the state’s bond sales are actually lower than recent issues…

The Governor’s Office of Management and Budget today is pleased to announce the State successfully has sold $525 million of tax exempt General Obligation Bonds and $275 million of taxable General Obligation Bonds. The bond sale provides funding for the Illinois Jobs Now! Capital plan, which was signed into law by Governor Quinn to help revive the state’s ailing economy by creating and retaining more than 439,000 jobs over six years.

“Positive feedback like we have seen today from investors demonstrates the strong confidence investors have in Illinois,” said David Vaught, Director of the Governor’s Office of Management and Budget. “These bond bids make clear that investors know we are taking steps to correct the decades of fiscal mismanagement in our state, and they understand we continue to take major steps to reform pensions and control skyrocketing Medicaid costs in an effort to return Illinois to sound financial footing.”

In a competitive sale, the $525 million tax exempt issuance priced with an interest rate of 3.9125 percent with Wells Fargo as the successful bidder. This is the lowest rate the State has received on a tax-exempt capital bond issuance in recent history. As a note of comparison, in November of 2011, the states triple A rated Build Illinois Bonds priced with an interest rate of 4.07 percent. The state received 8 bids overall.

The $275 million taxable issuance priced with an interest rate of 5.2992 percent with J.P. Morgan Securities LLC as the successful bidder. The state received 9 bids overall for this issuance. As a basis of comparison, the 2037 maturity has a 5.76 yield which is 277 basis points higher than a comparable U.S. Treasury rate. The most recent General Obligation capital bond issuance in July of 2010 priced similar bonds with a spread of 325 basis points above the comparable U.S. Treasury rate. This equates to a 48 basis point improvement. [Emphasis added]

Discuss.

…Adding… Treasurer Dan Rutherford’s prediction via press release last week apparently didn’t hold up…

“The downgrade will result in Illinois taxpayers paying an estimated additional $60 million to repay the issuance of next week’s scheduled $800 bond sale. In addition, this may impact Illinois institutional bond holders which may have to sell their current Illinois bond holdings because their investment policies require minimum bond ratings greater than our new rating.”

…Adding More… You also have to wonder if Bloomberg and the Tribune editorial board will run corrections…

The sorry result: when it sells these bonds, Illinois may face borrowing costs more than four times as high as the average it has paid over the last 10 years, according to Bloomberg.

Don’t bet on it.

*** UPDATE 1 *** The budget office says they looked at the history of Illinois’ long-term tax exempt capital bonds all the way back to 1984 (the earliest records they have) and didn’t find any at a lower rate than the 3.9 percent from today’s $525 million tax exempt issuance.

Wow.

Of course, interest rates are at historic lows, so that’s obviously helping here. And the rate would’ve been even lower if we were a AAA state. But the hand-wringing about this particular issuance appears to have been way, way off the mark. Let’s see if anybody admits it.

*** UPDATE 2 *** From Treasurer Rutherford…

“Illinois sold $800 million worth of bonds today for important projects such as new roads and schools. I am indeed pleased that we will pay a lower interest rate on these bonds than we did last year, but it’s important to keep these ‘savings’ in perspective.”

“Market conditions – such as the European crisis causing a flight to American quality – were favorable today, but the rates we received would have been considerably better without Moody’s lowering of Illinois’ credit last week. Tens of millions of extra dollars were still taken out of taxpayers’ pockets today because of the financial condition of Illinois as determined by Moody’s.”

“Moody’s downgrade reinforces my stance: Illinois needs to solve its unfunded public pension crisis and pay all outstanding bills without borrowing additional money.”

*** UPDATE 3 *** The budget office says they’ve found records dating back to 1976, and they still haven’t found a lower interest rate on a similar bond offering.

*** UPDATE 4 *** Bloomberg compares Illinois’ offering to other “top rated debt” and has a negative conclusion…

Illinois’s cost to borrow relative to top-rated issuers tripled from 2009 when it sold $800 million of bonds today, after its credit rating was cut by Moody’s Investors Service to the lowest among U.S. states.

The $525 million tax-exempt part of today’s sale included 10-year general-obligation bonds priced to yield 3.1 percent, according to data compiled by Bloomberg. That’s 110 basis points more than the 2 percent yield of top-rated 10-year debt.

A 10-year bond sold on Sept. 16, 2009, the last time Illinois took competitive bids for tax-exempt general obligations, was priced at 37 basis points above top-rated debt. A basis point is 0.01 percentage point.

*** UPDATE 5 *** Wall Street Journal…

Both Wells and J.P. Morgan reoffered bonds to investors at lower yields than where outstanding Illinois debt currently trades, reflecting how strong the sale was, market participants said.

Wells offered 10-year tax-exempt debt for Illinois with a coupon of 4% and a yield of 3.10%, for instance. That’s around 0.20 percentage point less in yield than where comparable outstanding Illinois debt traded late last year, said Michael Pietronico, chief executive officer of Miller Tabak Asset Management in New York. It’s also around 1.30 percentage point more in yield than what triple-A munis offer on Thomson Reuters Municipal Market Data’s benchmark scale.

“The flavor of the muni market so far in 2012 has been investors reaching for [higher-yielding] product to generate excess total return and income,” said Pietronico, whose firm manages about $625 million in muni assets. He said his firm would buy Illinois debt in the secondary trading market if it came at juicier yields than those offered in the deal Wednesday.

A relative dearth of new bonds in the muni market helped reception of Illinois’ sale, too, said portfolio managers. States, cities and other so-called municipalities have sold $1.6 billion of municipal debt so far this year, according to data provider Thomson Reuters. That’s less than one-third of the volume of a typical week in 2011.

53 Comments

|

Question of the day

Wednesday, Jan 11, 2012 - Posted by Rich Miller

* As you all know by now, the Civic Committee, the Tribune and others are demanding that the General Assembly pass pension reforms that the Senate Democrats have concluded violate the Illinois Constitution…

Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.

* The Question: Should the General Assembly go ahead and pass what very well might be an unconstitutional law and leave it up to the courts, or should the Legislature find another way to reform the pension systems? Or should there be no changes in the benefit structure?

Take the poll and then explain your answer in comments, please. Thanks.

44 Comments

|

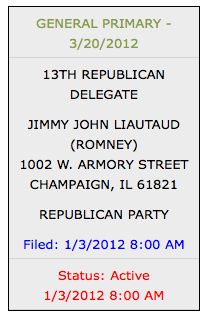

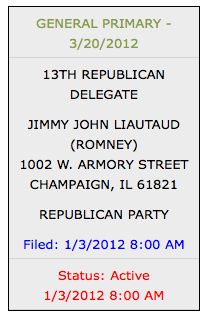

* Champaign News-Gazette political columnist Tom Kacich (not online, so no link) reported today that James Liautaud, the CEO of the Jimmy John’s chain, is running as a Mitt Romney convention delegate, in Champaign.

Sure enough, he’s listed on the State Board of Elections’ website…

* But, wait, I thought Liautaud said he was moving to Florida and had already enrolled his children in school there to avoid Illinois’ higher income taxes? From this past January…

Jimmy John Liautaud told The News-Gazette on Tuesday that he is angry about the moves, which boosted the individual income tax from 3 percent to 5 percent and the corporate income tax from 7.3 percent to 9.5 percent.

“All they do is stick it to us,” he said, adding that the Legislature and governor showed “a clear lack of understanding.”

“I could absorb this and adapt, but it doesn’t feel good in my soul to make it happen,” Liautaud said. […]

As for himself, “my family and I are out of here,” he said.

Liautaud said he has rented a house in south Florida and his children started school there last week. He said he has applied for Florida residency and plans to commute to Champaign.

So, he doesn’t want to live and pay taxes here, but he wants to run as a convention delegate here? Bizarre.

43 Comments

|

Fun with numbers

Wednesday, Jan 11, 2012 - Posted by Rich Miller

* The Tribune editorialized again on pension reform today and noted this factoid in the process…

The sorry result: when it sells these bonds, Illinois may face borrowing costs more than four times as high as the average it has paid over the last 10 years, according to Bloomberg.

The Trib does go on to explain that Illinois “is expected to pay 1.82 percentage points more than what top-rated states pay for comparable bonds, Bloomberg said.” But what does this “four times as high” thing mean?

* The answer is in the Bloomberg story…

Illinois state and local general-obligation bonds yielded 182 basis points more than top-rated debt yesterday, according to data compiled by Bloomberg. That’s more than four times the 10-year average of 43 basis points and about triple the 66 points over five years. A basis point is 0.01 percentage point.

So, when compared to AAA ratings, the extra amount Illinois has paid will rise from .43 percentage points above AAA ten years ago to an “expected” 1.82 percentage points above AAA this month. But nobody really knows for sure because these are competitively bid. Nine states had Moody’s highest rating in 2010.

* Back to that same Bloomberg story…

Illinois ended last fiscal year with a $6 billion gap even after the largest tax increase in its history.

Actually, no. Illinois had about that much in long overdue bills, but the structural deficit wasn’t nearly that high.

* Meanwhile, Gov. Pat Quinn pointed out again yesterday that over half the state’s pension costs were for local school districts. He’d like to reduce that amount. House GOP Leader Tom Cross counters…

Cross warned that shifting costs to school districts and universities alone won’t solve the problem.

“That’s not reform,” Cross said. “It’ll result in perhaps a local property tax increase. It’s a different way to pay for it,” Cross said.

But cost-shifting could be an element of any reform package, he said.

“The school of thought would be that it gives school districts a little skin in the game … they will have to analyze what they do for pay raises, both during and at the end of (teachers’) careers,” Cross said.

The very real constitutional problems with pension reform means that cost-shifting will likely be attempted. But you can expect school districts and teachers’ unions to scream bloody murder if this is tried. It won’t be easy, either.

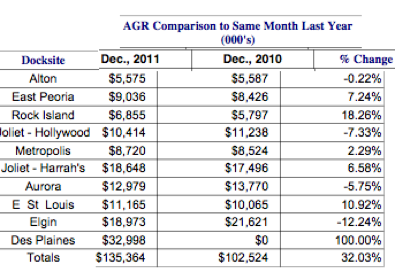

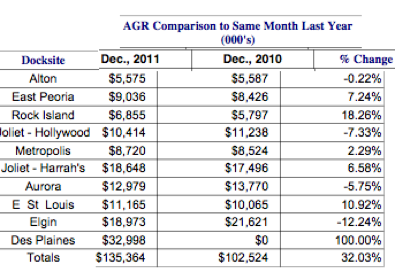

* On to gaming. From the Illinois Gaming Board’s December revenue report…

It’s not too difficult to see why they fight so hard against competition in the legislative arena. Des Plaines has had a huge impact on the Elgin casino. [Fixed chart. Previously posted chart was the wrong one.]

…Adding… A brief roundup…

* Officials report drop in Chicago-area tollway usage: Illinois State Toll Highway Authority officials say the number of cars using the state’s toll roads dipped by 4.5 percent since fees for users nearly doubled on Jan. 1. Spokeswoman Wendy Abrams says the decrease was not as great as the 5.9 percent drop forecast by the agency’s engineers. Despite the expected decrease in auto traffic, tollway officials say they expect a 41.9 percent increase in revenue in 2012. Abrams says during the first week, revenue increased 45.7 percent.

* Quinn Calls for Pension Reform

* Quinn signs earned-income tax credit bill

* Report: Illinois hospitals’ charity care growing

* Funding squabble could kill coal-to-gas plant in IL

47 Comments

|

“Signs don’t vote”

Wednesday, Jan 11, 2012 - Posted by Rich Miller

* Slate takes a look at some studies of yard signs and finds that nobody has really figured out yet if they really work…

In 2008, Ohio State’s Todd Makse and the University of Colorado’s Anand Edward Sokhey set out to see if they could identify a link between candidate signs and support. They went to Franklin County, a celebrated Ohio swing county that includes Columbus, and drove the streets of 30 precincts on two weekends, one just after the conventions and one just before the election. Each time they saw a candidate sign displayed at a single-family home, the academics marked it with a GIS locator and then linked each address to its residents’ voting records and sent a survey to each household, asking the resident “most responsible” for the sign to complete it.

In 2008, 14 percent of homes displayed a sign for a candidate, and 65 percent of them were for Democrats. A few traits were consistent across party lines: Young people, generally less politically active than older folks, were more likely to display a sign. (In the survey, young people indicated that signs were one of the forms of activism with which they were most comfortable.) The act of putting a sign in a window seems as contagious as leaving one of its panes broken: Those whose neighbors had signs were more likely to have one themselves, regardless of whether they supported the same party or different ones. Those whose houses were exposed to greater levels of car traffic—Makse and Sokhey coded every thoroughfare in their precincts into one of six categories, from “dead end” and “main artery”—were more likely to put out signs, suggesting that the motivation to put one out was more “strategic” (to reach as many people as possible) than “expressive” (a need to be public about one’s allegiances).

Voters decorate their lawns. In 2006, Auburn agricultural economist David N. Laband, who had previously conducted studies showing that people who wore campaign buttons and checked the Federal Election Commission contribution box on their tax returns were more likely to vote, started looking at signs. Along with colleagues Ram Pandit and John P. Sophocleus, they mapped Auburn, Ala., neighborhoods south of Interstate 85 and marked which houses displayed an American flag on Memorial Day and July 4. Once football season kicked off in the fall, they documented expressions of support for the Auburn Tigers with a flag, sign, pom-pom sticker, or an inflated figure of Aubie, the school’s mascot. Just before the elections they went back to the same neighborhood with an eye out for candidate signs. Seventeen percent of houses had a flag, 7 percent had football paraphernalia, and 12 percent had a political sign.

After the November 2006 elections, Laband matched the addresses up against the voting histories of the people who lived there. Households that displayed either an American flag, football insignia, or campaign sign were 2.4 times more likely to have a resident who voted in the elections than houses which had none of the three. While campaign signs were the most strongly predictive of having cast a vote, just sporting an American flag made a household twice as likely to have a voter, and even Auburn football gear made it 1.6 times more likely. (The authors don’t account for whether they’re really measuring a mediating variable, like whether Auburn fanhood is a proxy for having a college degree.) The same sense of expressiveness that inspired people to publicly project their patriotism or fandom seemed to be driving them to vote.

Go read the whole thing.

Essentially, people who put up political signs do so because they are the type who put up signs. And they may be a bit more likely to put up signs if their neighbors already do.

* Campaigns spend a lot of time on yard and window signs, so candidates must think they do some good. I’ve come to regard them as an indication that a candidate has a decent organization (unless, of course, the signs are placed in public rights of way, which often indicates a less-organized campaign).

I was driving through the Pontiac area around Thanksgiving and noticed a ton of yard signs from legislative and local candidates - five full months before election day. I wondered aloud what those campaigns would do when winter weather struck. Would they replace the signs or let them rot in lawns? Since we’ve had an incredibly mild winter so far, I wasn’t able to see what happened when I returned to the area at Christmas/New Year.

* Anyway, I’d like to hear what you think about this topic. Do signs work? And if so, how do they work? If not, why don’t they work?

61 Comments

|

* Some people just don’t know when to shut up…

CBOE Holdings Inc. CEO Bill Brodsky derided the State of Illinois for financial problems, such as underfunding of state pensions, just weeks after the state passed a new law that will reduce the taxes that his Chicago-based options exchange pays.

“I’m embarrassed to live here,” Mr. Brodsky said in answer to a reporter’s question at an annual CBOE media lunch Tuesday. His remark was in reference to a bond-rating downgrade by Moody’s Investors Service Inc. last week to A2, that agency’s lowest for any state. “We need people to come together and recognize the gravity of the situation and work together to a solution.”

His comments follow the passage last month by the Illinois legislature of a bill that revamps the state’s tax rates for CBOE and futures exchange CME Group Inc. by sharply reducing the number of trades taxed as Illinois sales because many trades are transacted over electronic systems by parties outside the state. […]

Mr. Brodsky noted that he’s a member of the Commercial Club of Chicago executive group that has been pushing for reform of the state’s pensions. The state has fallen short on addressing its financial troubles while the City of Chicago and Cook County have made progress, he said.

“The city is taking serious steps to deal with its financial problems,” Mr. Brodsky said. “I think the county is taking serious steps to deal with its financial problems. The state has yet to take serious steps to deal with its financial problems.”

If he was so concerned about Illinois’ budget problems, then perhaps he shouldn’t have threatened to move his company out of state unless he received a big tax cut.

Brodsky is a member of the Civic Committee, along with several other corporate chieftains who have received Illinois handouts. The Civic Committee is behind the Illinois is Broke campaign, which has put up billboards and run radio ads announcing that the state is, well, broke.

Discuss.

[For some reason, the comment link wasn’t working. I think I fixed it.]

51 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|