Question of the day

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* Bruce Rauner spoke to the Illinois Bankers Association today…

* The Question: Caption?

As always, keep it clean.

102 Comments

|

*** UPDATED x1 *** “We have a half”

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* During today’s debate on a bill to do away with a state commission which can overturn local school board decisions on charter schools, sponsoring Rep. Linda Chapa LaVia was trying to make a point about minority parents.

“So, listen to me minorities,” she said turning toward the Democratic side of the chamber. “I’m over here because we’re all over on this side, right?”

The Republicans erupted. They have an African-American member, Rep. John Anthony.

Responding to the HGOP outburst, Chapa LaVia said, “Wait,” and then, pointing her finger at the other side of the aisle, said “We have a half. We have a half.”

What. The. Heck. Was. That?

Oy.

* Watch…

That’s just awful.

Yes, the debate was contentious. But nothing justifies stuff like that. Ever.

* The Republicans rose to object strongly, as they rightly should have done. I’ll see if I can get video later. Chapa LaVia gave one of those “I apologize if anyone was offended” apologies.

Not enough, Representative. Not nearly enough.

* By the way, the bill failed to achieve a majority. It was put on postponed consideration.

*** UPDATE *** Rep. Reboletti demands an apology…

* The apology..

106 Comments

|

A whole lot of progress on ride sharing

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* The taxi companies have backed way off their outlandish legislative push to all but outlaw ride sharing companies like Uber and Lyft. There is no final agreement yet, however. Word is that insurance details are still to be worked out, but here’s the press release from Rep. Mike Zalewski outlining what’s been put into a bill and will be heard tomorrow…

Local governments can regulate ride-sharing services more strictly than the new state standards, except for chauffeur license requirements and establishing fares

A two-tiered regulation system is provided for ride-sharing systems – for drivers/vehicles participating more than 18 hours per week and those doing it 18 or fewer hours a week

Regulation for more than 18 hours per week

Drivers must secure a chauffeur’s license from the local government where the vehicle is registered or where the ride-sharing arrangement is conducted

Vehicles must have distinctive registration plates to designate them as ride-sharing participants

Vehicle age must be the same as local government requirements for other vehicles transporting passengers commercially

Vehicles must pass the same inspections local governments require of other vehicles transporting passengers commercially

Regulation for 18 or fewer hours per week

Drivers do not need a chauffeur’s license

Dispatchers must conduct background checks on prospective drivers and certify they fall under the 18-hour threshold

No distinctive registration plates are required

Dispatchers must certify that vehicles have passed an annual safety inspection before it can be used in ride-sharing

An IDFPR state commercial ride-sharing dispatcher’s license is required, with annual renewals

Dispatchers must have commercial liability insurance with primary coverage for the dispatcher, driver and vehicle

Ride-sharing arrangements cannot be done by “hailing,” hand gestures or verbal statements

Ride-sharing cannot be done at designated taxi stands, queues or loading zones, nor at any place banned by local governments

Ride-sharing drivers must follow all rules a local government has for licensed chauffeurs for servicing under-served areas and providing wheelchair accessible vehicles

Dispatches can only be made to properly licensed drivers and vehicles that have distinctive registration plates

Violations of ride-sharing requirements are subject to penalties under IDFPR

Anyone injured or in danger of being injured from an actual or imminent violation of this new law can sue in circuit court

Allow taxis to establish a system for “surge pricing” in situations where rider demand is high, as long as the service is contacted by an Internet or smartphone device and drivers clearly agree to higher prices for using the service

Dispatchers must collect records on all commercial ride-sharing vehicles

IDFPR must adopt rules to implement the provisions in this proposed law

All the truly goofy over the top stuff is gone. That’s a good thing.

I also like the idea of taxi companies getting into the online ride share business. It’ll help spur even more competition and force the companies to improve their service.

* Meanwhile, Mayor Emanuel is also continuing to work on a compromise…

Emanuel is still refusing to regulate ride-sharing fares for fear of snuffing out a burgeoning industry on the cutting edge of technology that gives Chicagoans more transportation options.

But he’s reserving the right to “place a cap on surge pricing” during periods of peak demand if increased disclosure requirements fail to “alleviate consumer complaints.”

In the meantime, ride-sharing companies would be required to “publicly announce” when surge pricing periods are in effect and “take steps to ensure that customers clearly agree” to those higher prices. That includes providing customers with a “true fare quote in dollars and cents” instead of a multiplier.

4 Comments

|

Correlation or causation?

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* There are two premises for this Chicago Reader article. The most important…

On March 5 the City Council voted 46-3 to approve Mayor Rahm Emanuel’s proposal to spend $55 million in property taxes on a new Marriott hotel in the South Loop—part of his ambitious development plan that also features a basketball arena for DePaul University.

The vote followed a September decision by the Metropolitan Pier and Exposition Authority, a state-city entity, to award Marriott the coveted contract to run the new hotel. […]

However, what the mayor and his aides didn’t mention—and what has gone unreported until now—is that in the year leading up to the lucrative deal for Marriott, the hedge fund of one of Emanuel’s largest campaign contributors bought millions of shares of stock in the hotel chain.

That hedge fund, Citadel LLC, is run by billionaire Kenneth Griffin, whom Forbes last fall deemed the wealthiest man in Illinois. He is famous in the financial world for making a killing in high-frequency trading. […]

According to SEC filings, the firm began buying major portions of Marriott stock in late 2012. By September 2013, SEC filings showed the hedge fund owned 2.3 million shares of Marriott. As of the last SEC filings at the end of 2013, Citadel owned roughly 1.6 million shares of Marriott stock worth an estimated $89 million.

I dunno. Was this whole thing really greased a year in advance? There was, after all, a bidding battle and Mariott in the end wound up beating Hilton for the project…

The board of the Metropolitan Pier and Exposition Authority approved the 10-year contract for hotel operations. Its net value to Marriott, in today’s dollars, is $13.6 million over the life of the deal, according to a spokeswoman for the authority, the state-city agency known as McPier. […]

Marriott’s proposal beat out one by Hilton Worldwide, the other finalist. That deal would have netted Hilton an estimated $15.8 million, McPier officials said.

* And after ten years, McPier will own the hotel…

The $400 million hotel is part of a larger project that will include a multiuse arena that will host DePaul University basketball and a 500-room boutique hotel.

Ultimately, the authority will own the larger convention hotel, financing its construction with bonds backed by hotel revenues.

* Perhaps these stock purchases were just a good investment by Citadel.

As noted above, Citadel sold quite a bit of its stock, but that’s probably because the price has been skyrocketing since last fall. I doubt that increase has a whole lot to do with the Chicago deal.

And revenues are skyrocketing at the company. Take a look at Marriott’s 2013 annual report…

We added 161 properties (25,420 rooms) and 51 properties (10,299 rooms) exited our system in 2013. These figures do not include residential units. During 2013, we also added five residential properties (301 units) and no residential properties or units exited the system.

Total segment financial results increased by $24 million to $1,197 million in 2013 from $1,173 million in 2012, and total segment revenues increased by $992 million to $12,518 million in 2013, a 9 percent increase from revenues of $11,526 million in 2012

While the 1,200 room hotel will be pretty sweet, it’s less than five percent of the total gross rooms added by the company last year alone.

However, taxpayers will pay to build the hotel, bumping up its margins. And a casino could also be built down the street. That wouldn’t be bad, either. It’s a very good deal for Marriott, without a doubt. Courtesy of taxpayers. Hooray!

* Which brings us to the second premise, which is pretty funny…

In speeches and interviews Griffin has lashed out at business executives who put the needs of their companies over Illinois while accepting tax breaks and public subsidies.

“Government being involved in picking winners and losers invariably leads to a loss of economic freedom and encourages corruption,” he told the Tribune last year.

Yet the taxpayer-financed Marriott project is very much a governmentally engineered deal, siphoning public resources into a tax increment financing scheme that will underwrite a private hotel chain.

Yep. But, then again, he’s a stockholder, not a company executive.

…Adding… From Citadel…

“The Reader story is completely irresponsible. It is comprised of nearly equal parts baseless speculation devoid of any real factual grounding and preposterous conclusions.”

20 Comments

|

Today’s number: $1.5 million in RGA cash

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* From yesterday’s twitters…

* Sun-Times…

For the second consecutive month, the Republican Governors Association plowed $750,000 into Bruce Rauner’s gubernatorial bid, for a total of $1.5 million since the political newcomer clinched the GOP nomination in March.

It’s a sign that there will be no shortage of resources in this gubernatorial race. The RGA was a major player in 2010 and will be again — despite Rauner’s own resources. Rauner, a multi-millionaire, has put $6 million into his own campaign. He far outraised — and outspent — his three opponents in the primary. The Democratic Governors Association is sure to be a major player as well in its efforts to back Gov. Pat Quinn’s reelection.

Hours after Rauner’s victory in March, the RGA wired over a $750,000 donation to Rauner, who has already aired two TV ads, one in Spanish and one elevating his wife, Diana Rauner.

The Tribune’s campaign contribution Twitter feed is really helpful, which is why it’s featured here on the blog. There are days when campaign nuts are just focusing solely on that particular box in our center column. I love it.

11 Comments

|

“Worst public policy in Illinois history”

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* Bob Grey is the president of the Citizens Club of Springfield and sits on the city’s Citizens’ Efficiency Commission. He sent this out today…

An initial finding of the [Citizens’ Efficiency Commission] was the discovery of a 2% tax on out-of-state companies selling fire insurance in Illinois.

This Foreign Fire Insurance Fund, which the state does not call a tax and does not collect, generates dollars that the Illinois Municipal League collects for downstate fire departments and distributes (after taking several thousands in fees) directly to a committee of firemen with no oversight, review or accountability by any public officials.

The [Springfield Fire Department] ’slush fund’ totaled about $1 M over the past 4 years. This would rank with the worst public policy in Illinois history.

* That’s definitely a biased interpretation. But what is the Foreign Fire Insurance tax? The Municipal League explains on its website…

The Illinois Foreign Fire Insurance Fund is distributed by the state of Illinois Muncipal League. The Municipal League collects insurance taxes from companies outside of the State of Illinois. Those funds are distributed to fire departments across the state to provide for the needs of the departments as the department sees fit to compensate for what is not provided by the municipality.

* The firefighters are trying to shed some light on how much is distributed to municipalities each year and how much the Illinois Municipal League’s cut really is, so they have a bill…

Any entity that maintains a website and that is charged with the collection of a tax or license fee and the rendering of the tax or license fee to the treasurer of the foreign fire insurance board or fire protection district secretary must publish to its website by the first day of August of each year the following information for the year ending on the preceding first day of July:

(1) the total amount of the tax or license fee collected on behalf of each municipal fire department or fire protection district;

(2) the total administrative fees, if any, charged to each municipal fire department or fire protection district;

(3) the aggregate amount of taxes or license fees collected on behalf of all municipal fire departments or fire protection districts; and

(4) the aggregate amount of administrative fees, if any, charged to each municipal fire department or fire protection district.

The bill hasn’t moved yet, but it may advance later in the session.

21 Comments

|

Major school funding overhaul advances

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* AP…

A proposal to dramatically overhaul the state’s school funding formula and allocate more money to poorer districts moved ahead in the Illinois Senate on Tuesday. The regionally divisive issue, however, likely faces a tough road in gaining support from both parties in both chambers. […]

After a nearly three-hour subcommittee debate, the issue was sent by a party line vote to another Senate committee, where it must be approved before it can advance to the chamber floor.

Under the plan, 92 percent of total state education funding would be distributed by factoring in districts’ poverty levels, accounting for low-income students using a weighted formula. The legislation also uses the number of students receiving free and reduced-priced lunches to determine who qualifies for additional low income dollars, which Manar says is in practice with most other states.

Only specialized programs for special education and early childhood education would be exempted from the formula. And, for the first time in decades, funding for Chicago Public Schools would be treated under the same formula as the rest of the state.

* Republicans have so far been against the proposal…

Sen. David Luechtefeld, R-Okawville, served as co-chair with Manar on the education funding committee and agrees with the bill’s concept of a single formula that would fund schools more equitably. But he believes Manar’s proposal goes too far and said “it’s debatable whether we should put over 90 percent into the formula.”

Luechtefeld pointed out that some expenditures, such as transportation, are based on factors other than a district’s need.

* Not having numbers is a problem, for sure…

[Sen. Matt Murphy (R-Palatine)] agreed that the system used to fund schools needs to be fixed, but questioned the wisdom of acting on a proposal when school administrators and lawmakers alike don’t know how the proposed overhaul would affect funding levels of individual districts.

“How do we know that this formula in this bill will work better than the current one if we have no idea how it’s going to work because we haven’t run the numbers?” Murphy said. “Why can’t we run the numbers and find out?”

Illinois State Board of Education legislative liaison Amanda Elliot said the agency is working on compiling that data, but cautioned that the figures span “multiple divisions.” According to ISBE public information director Matt Vanover, it could be at least a month before the numbers are available.

“We’re looking at having (the data) by mid-May,” he said.

David Lett, superintendent of Unit 8 schools in Pana, told the subcommittee he’s run some of the numbers internally on his own to see whether his ailing district would see relief under the proposed new formula and found they would do better than they do currently.

* But having numbers could also be a big problem…

[Bloom Township Schools Treasurer Rob Grossi] said districts like D.167, which receives nearly a third of its funding from the state, are at the mercy of state government financial woes. More wealthy districts that take in more in property taxes and need less state money can weather the fiscal problems in Springfield easier, Grossi said. Most districts in Cook County have low property tax values per pupil.

Once the calculations are done for individual school districts, it will be difficult for senators and representatives of districts who will lose funding to vote for the bill, Grossi said.

“The changes in this bill are so significant that it changes the entire model (for education spending),” Grossi said Tuesday. “Once the numbers determine the winners and losers, it will be hard for some of them to support it.”

6 Comments

|

* The House overwhelmingly passed House Speaker Michael Madigan’s proposal to prohibit voter discrimination…

House Speaker Michael Madigan’s proposed constitutional amendment, which would be placed on the Nov. 4 ballot, says no person should be denied registration and voting rights based on race, color, ethnicity, gender, sexual orientation, religion, language or income.

The House sent the measure to the Senate on a 109-5 vote.

The measure seeks to counter a June 2013 U.S. Supreme Court ruling that dislodged part of the 1960s-era federal Voting Rights Act and prompted eight states to attempt to restrict access to polling booths, Madigan said.

”That has brought on legislation in other states that some of us would consider voter suppression,” Madigan said, pointing to how voter photo identification laws have disproportionately impacted minorities and the poor.

* This argument against the idea was totally bogus…

State Rep. David Reis, R-Willow Hill, voiced concern that the push by Madigan was merely an attempt to short-circuit a move by GOP gubernatorial nominee Bruce Rauner to get his signature-driven, term-limits constitutional amendment on the fall ballot.

Some commenters have also repeatedly brought up this issue even though I’ve pointed out to them that they’re wrong. Nowhere in the Illinois Constitution are there limits to the number of popular initiatives. Legislative initiatives are limited…

The General Assembly shall not submit proposed amendments to more than three Articles of the Constitution at any one election.

But that has zero impact on how many popular initiatives can be submitted to voters.

* Anyway, back to the debate…

“The intent of this constitutional amendment is to provide in Illinois, constitutionally, that voter-suppression laws would not be permitted,” said Madigan, D-Chicago. “Some might say, ‘Well, today in Illinois, you don’t need this. Voter suppression wouldn’t happen in Illinois.’

“We don’t know that,” Madigan continued. “We don’t know what the future holds. What we do know is we can constitutionalize the protection of the right to vote.” […]

Reis, who voted against Madigan’s plan, also said there is no evidence Illinois is currently engaging in any form of voter suppression.

“This is a constitutional amendment in search of a problem,” Reis said.

On that point, Rep. Reis is probably more accurate.

* AP…

Jim Durkin told The Associated Press on Tuesday the state party has “had an identity crisis for many years now.” He said he believes it’s important for people to know Republicans believe Illinois residents who are citizens should not denied the right to vote.

“Republicans, we’re going to win with addition,” Durkin said. “We need to dispel some of the notions that have been hanging over the GOP for years, that we’re a party of white suburban men. For me this was an easy decision.”

Discuss.

30 Comments

|

Rahm’s self-made rough road

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* Gov. Pat Quinn isn’t at all pleased with the way Mayor Rahm Emanuel handled the pension reform bill…

Quinn chided Emanuel Tuesday for not consulting with him before proposing the pension reform plan, which would have hiked Chicago property taxes.

And he said the mayor and his allies apparently “got the message” about his concerns.

“I learned about this kind of after the fact,” Quinn said of the original proposal. “I think collaboration is always a good way to go in life – whether in politics, government or getting along with people. It’s always good to touch base with as many people as you can.”

* And that silly idea last week to insert language into the bill requiring the Chicago City Council to raise property taxes is still a very big problem…

Even though Madigan moved Monday to remove language authorizing the City Council to impose that property-tax hike, some Republicans still voiced worries that the legislation being voted on amounted to a huge new property-tax burden on city taxpayers.

“Let’s not kid anybody. What we’re talking about today is a massive property-tax increase,” said Rep. David McSweeney, R-Barrington Hills. “This is not a comprehensive solution.” […]

The legislation is deeply steeped in the gubernatorial campaign, where Republican Bruce Rauner shares McSweeney’s stance and has called for the legislation to move city employees into a 401(k)-style retirement program and eliminate future pension benefits.

* And why did the mayor even bother putting this thing in?…

Removed from the bill Tuesday was a provision some unions balked at that would have dissolved the municipal and laborers funds and replaced them “as provided by the General Assembly” with recommendations made by the city.

Madigan Spokesman Steve Brown said that provision was added “because the mayor’s office thought that was a component.” The Emanuel administration had no comment.

Keep in mind that Madigan didn’t write the bill or the amendments. Rahm did. This is on him.

* OK, so he passed the bill anyway. But this was the “easy” one. Teachers, coppers and, most importantly, firefighters are next on the list. They will be far more difficult to negotiate with and/or steamroll. He can’t keep making these easily avoidable mistakes. He has to start including more people in his discussion, including the governor and the minority leaders.

The General Assembly ain’t the city council.

* Roundup…

* CTU chief hits pension bill as ‘theft,’ calls for Quinn veto

* Illinois Legislature Passes Emanuel’s Pension Bill

* Mayor Emanuel’s pension fix passes Illinois House and Senate (with rollcalls)

* Chicago pension overhaul OK’d by House, Senate

* House, Senate pass Rahm’s pension bill — now it’s up to Quinn

* Pension reform bill passes Springfield with some GOP support: During debate, House Republican leader Jim Durkin was statesmanlike. “I want to make sure that we do the best we can to ensure that the City of Chicago will be vibrant, that it will be a place where we will feel safe and secure about sending out children, encouraging our international friends and our friends from out of the state to come visit, spend your money in the City of Chicago,” Durkin said. “Everyone in this chamber, we spend time in the City of Chicago. They’ve got a hospitality industry that is better than anywhere else in the United States. It’s a jewel. But I don’t want to see the City of Chicago fall in line with Detroit.”

13 Comments

|

Today’s quote

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* From the SJ-R’s story on Bruce Rauner’s Springfield visit…

Asked by a reporter why he has not seemed to use the phrase “government union bosses,” which he often mentioned in the primary campaign, after he won the nomination, Rauner said he is “very pro-worker.”

“I’m not anti-union at all,” he said. “Unions to me are fine if you want to join ’em or not join ’em. That’s not the issue. Conflict of interest inside the government is. I don’t like folks who are in contract negotiations using political cash from taxpayers to influence politicians. That I’m against.”

He also said he wanted people in Springfield to know he doesn’t want to take away pension benefits already earned.

“I’m the one person in this race who doesn’t want to modify” pensions already earned, he said. “I want to freeze the current pension system … and for future work, create a second pension system that’s a defined contribution plan, more of a 401k-style plan.

OK, first of all, he totally sidestepped the question.

Secondly, ““Unions to me are fine if you want to join ’em or not join ’em” is a major rhetorical twist, since he wants counties to be able to institute their own so-called “right to work” ordinances.

And lastly, he most certainly does want to “take away pension benefits already earned.” Rauner would freeze all pension benefit payments forever. No protection at all from inflation. Period. That’s far harsher than anything else on the table.

40 Comments

|

* Bill Cellini attended Bruce Rauner’s Sangamon County Republican event last night…

“The first time I heard him tonight,” Cellini said when asked his thoughts about Rauner so far in the governor’s race and whether he was supporting him. “He was very impressive.”

“I’ve been a Republican all my life, and he’s the Republican candidate,” Cellini said of Rauner. […]

When told that Cellini described him as “very impressive,” Rauner sidestepped a question about whether he welcomed an endorsement from Cellini, who sat near the front of the room during one of Rauner’s two speeches.

“I don’t know,” Rauner answered. “I didn’t even know he was here. I don’t really know him. I can’t comment on that.”

* Gov. Quinn’s campaign e-mailed this hyperbolic missive today…

As first reported by the Chicago Sun-Times, while in Springfield last night Billionaire Bruce Rauner met up with infamous corrupt insider Bill Cellini, who proceeded to endorse Rauner. Instead of immediately renouncing Cellini, a convicted felon, Rauner told the Chicago Sun-Times he “couldn’t comment on that.”

One of the most powerful insiders in Springfield, King of Clout Bill Cellini was caught in an extortion plot to shake down Oscar-winning producer and investment mogul Thomas Rosenberg for a major campaign contribution. Cellini was released from federal prison last November for his role in the political fundraising scheme.

“Clearly Billionaire Bruce Rauner is afraid to alienate the King of Clout,” said Quinn for Illinois Deputy Press Secretary Izabela Miltko. “Mr. Rauner claims to want to root out corruption and ‘shake up Springfield,’ yet when faced with an endorsement from the King of Shakedowns, mum’s the word.

“Instead of saying no to the King of Clout, Mr. Rauner said he ‘can’t comment on that’ – and that’s the real Bruce Rauner.”

This is not the first time Rauner has partnered with corrupt insiders who have conspired to cheat taxpayers, in order to gain political support. Currently imprisoned Stuart Levine – whom Cellini conspired with in the shake down scandal – was making $25,000 a month on Rauner’s payroll while sitting on the board of the Teachers Retirement System and voting to give Rauner’s investment firm GTCR a $50 million contract to manage it. Rauner failed to disclose the conflict of interest and still hasn’t returned the hundreds of thousands of dollars in fees he collected from the deal.

When he served as state treasurer, Governor Quinn took on Cellini on behalf of Illinois taxpayers regarding the financing of the Abraham Lincoln Hotel.

Rauner didn’t “meet up” with Cellini. C’mon, already.

But Rauner’s refusal to reject the “endorsement” does show his inexperience on the campaign trail. This ain’t the primary, Bruce. Up your game.

*** UPDATE 1 *** Cellini and Kjellander? John Kass’ head might very well explode…

Bob Kjellander of Springfield, a former member of the Republican National Committee, said after participating in a small-group discussion with Rauner that the candidate “did an outstanding job. He said Rauner is picking up support with African-American ministers, and there will be “some major Hispanic players in the city of Chicago as well.”

*** UPDATE 2 *** From the Rauner campaign…

Bruce is running against the corrupt, insider ways of doing things in Springfield and obviously renounces Cellini.

While you can’t control who endorses you, you can control who you endorse - and that’s why Pat Quinn is making another ridiculous attack. Pat knew about Rod Blagojevich’s corrupt dealings and vouched for him anyway, calling Blago ‘honest’ and ‘ethical’ and someone who ‘always does the right thing.’

This is the biggest lie yet from Quinnocchio. Quinn should have resigned and helped expose Blagojevich, instead Quinn stood by him.

54 Comments

|

A city lease tax?

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* Sneed has the scoop…

Sneed hears rumbles that a City Council proposal to levy a lease tax on office buildings may be in the mix of suggestions to restore two of the city’s pension funds to fiscal health. […]

“The downtown real estate interests lobbied long and hard against it and won [during the Jane Byrne years], but it could bring in tens of millions of dollars to offset the upcoming $600 million bill to stabilize police and fire pension funds, which don’t have enough assets to cover their liabilities,” the source added.

Mayor Rahm Emanuel’s pitch for a City Council ordinance to levy an additional $250 million in property taxes is going to be a tough vote with anticipated artillery pointed at Emanuel by Aldermen Bob Fioretti (2nd), Scott Waguespack (32nd) and Brendan Reilly (42nd).

“The mayor needs to get the tax to solve the city’s fiscal problems off the back of property owners and figure out a mix of non-property tax revenue sources to get this ordinance passed,” the source said.

* I kinda doubt that this idea will bear much fruit…

The governor acknowledged the need for additional revenue to bolster the city’s pension system. But the kind of revenue Quinn discussed Tuesday may not be music to Emanuel’s ears.

“I think it should be a focus on the tax code and giving a full review of all these loopholes,” Quinn said, while declining to offer specifics. “I said yesterday, very clearly, we need to relieve the property tax burden, and I’m committed to that.”

The Tribune’s article called the idea “an old standby that has failed to get traction.” Correct.

9 Comments

|

About those property taxes

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* Greg Hinz wrote this before the Senate voted on the city’s pension reform bill. Only one Senate Republican voted for the measure…

Why are the Senate Rs balking when half of the House Rs voted yes? As answered by Sen. Matt Murphy, who usually speaks for Senate Rs on budget and financial matters, they want to see what else Mr. Emanuel will be asking for when he comes back with deals covering police, firefighters and city teachers. And they want to know if the state will have to pony up then.

“If we’re going to be partners in the process, If would make some sense to cut us in on the whole,” Mr. Murphy said.

Particularly sticking in the Senate R’s craw is Mr. Quinn’s budget proposal to send every home owner a $500 property-tax refund. That would help city taxpayers more than suburban ones, Mr. Murphy said, since suburban home values are higher. “So it looks like we’re pouring money into Chicago just at the time when Chicago’s talking about raising property taxes.”

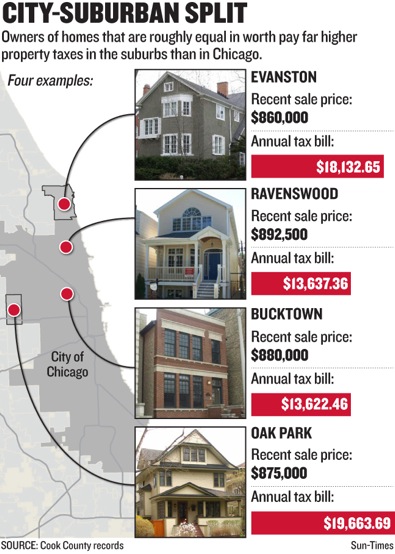

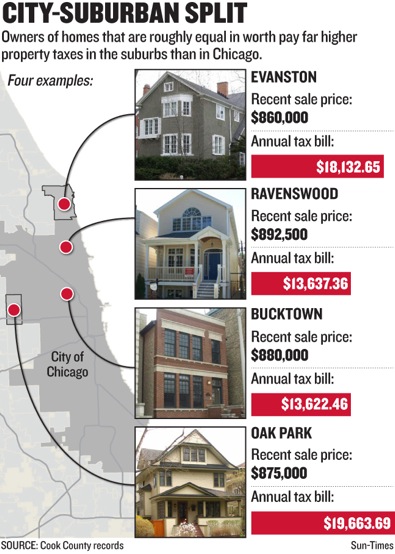

* Murphy does have a point. This graphic produced by the Sun-Times compares city property taxes to some Cook County suburban taxes…

They could’ve looked at the south suburbs and seen even more of a discrepancy, or even Downstate, where property taxes are almost twice as high.

* To the article…

Emanuel aides say the plan would cost the owner of a $250,000 home an additional $58 a year on top of a $4,000 property tax bill for each of the next five years. That works out to $290 per homeowner, to raise a total of $250 million.

Those numbers may prove dramatically low, as some suggest. But Ameya Pawar, the first-term alderman who represents Emanuel’s home 47th Ward, says he’s ready to support a tax increase.

“I will take the tough vote,” he said Tuesday. “I understood when I ran that this term was going to be about pensions. But at some point Chicago has to think about K-12 education.”

Pawar said many homeowners move from his ward to the suburbs when their children are on the cusp of going to high school, unless the kids test into the best public high schools. He says they often tell him, “I’m willing to pay more taxes if you’re willing to give us some stability and equity” in the Chicago Public Schools system.

“The taxes where they move to are higher, but let’s not forget what they get in the suburbs — a complete K-12 system,” Pawar says.

36 Comments

|

Quinn, Rauner to share the same IEA stage

Wednesday, Apr 9, 2014 - Posted by Rich Miller

* From the Illinois Education Association…

Illinois Gov. Pat Quinn and businessman Bruce Rauner, his opponent in the November election for governor, will make their first joint appearance on Friday, April 11th, at the Illinois Education Association’s (IEA) 160th Representative Assembly (RA) and Annual Meeting in Chicago.

The two have accepted the union’s invitation to sit together and answer education policy questions posed by IEA President Cinda Klickna in front of the more than 1,200 teachers, education support professionals, higher education faculty and staff and retired educators who make up the delegation for the meeting.

The union did the same thing four years ago. I’ll see if we can get a live video feed out of there. Should be fascinating.

* Sun-Times…

“I don’t know if Bruce Rauner is really willing to sit and talk with me or talk with our unions,” [IEA President Cinda Klickna] said in March. “This campaign has characterized me in a way that I never characterized myself nor do our members. I guess we’ll just have to see.”

32 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|