Every vote counts

Tuesday, May 20, 2014 - Posted by Rich Miller

* Sun-Times…

With votes tight for keeping a 2011 tax increase in place, the attorney representing indicted state Rep. Derrick Smith has asked a federal judge to delay the start of his May 28th corruption trial by three days.

If a federal judge agrees to the request, House Speaker Michael Madigan stands to get valuable extra time, if he needs it, to round up the necessary votes to pass a tax-extension bill. The speaker is believed to be well short of the necessary 60 votes he needs to send the legislation to the Senate.

“We’re asking the judge if he can be there through the end of session,” defense lawyer Victor Henderson said of his client in an interview with the Chicago Sun-Times on Monday. […]

U.S. District Judge Sharon Johnson Coleman is expected to decide on the motion during a hearing Wednesday morning.

Henderson stated in his motion that prosecutors have no position on the request.

* Tribune…

In a motion filed last week, the West Side legislator asked U.S. District Judge Sharon Johnson Coleman to again reset the trial for June 2 due to “significant pieces of legislation to be voted upon” in the House before the traditional end of the session by May 31.

“Representative Smith is required to attend in order to represent his district,” the motion stated.

House Speaker Michael Madigan, D-Chicago, said Monday that Smith “will vote yes” on the income tax hike vote. But Madigan has acknowledged he is still “significantly” short of the 60 votes necessary to pass the measure in the House. If Smith isn’t available to cast a vote in favor, Madigan said, “It will be one less vote.”

This is mostly snark, but why would you vote to raise your jury’s taxes right before you go on trial for alleged bribery?

33 Comments

|

New job training tax credit pushed

Tuesday, May 20, 2014 - Posted by Rich Miller

* Greg Hinz has some details of a new proposal to help spur hiring…

The proposed Illinois State Employment and Training Program, or I-Step, would give a credit worth as much as $5,000 per job for training net new hires for Illinois operations, after factoring in any job cuts.The credit would apply not only against a company’s state income tax liability but against individual income taxes it withholds from employee paychecks — a much more lucrative deal for many companies. […]

(T)he tax credit would cover training costs in the first year of employment and amount to 75 to 100 percent of costs, the larger figure in the case of jobs that will be particularly long-lived.

The jobs must pay at least 175 percent of the federal minimum wage and be posted for at least two weeks on a state job board… The key change was an agreement that would allow a company to still reduce employment in one location, so long as it was adding jobs in another location at least 60 miles away from the first. […]

By itself, the program probably won’t be enough to lure a company to Illinois, [the IMA’s Mark Denzler] said. But it will be “beneficial” for existing employers considering expanding, particularly since the program will be “automatic” and not require special approval by state bureaucrats in each instance.

Discuss.

6 Comments

|

* From a press release…

Gubernatorial candidate Bruce Rauner today released automated calls to voters in six key state legislative districts where the General Assembly’s vote on making Pat Quinn’s state income tax increase permanent could be decided.

“Pat Quinn thinks you don’t pay enough in taxes – but I disagree,” Rauner says in the calls. “There’s still time to help me fight Pat Quinn’s tax increase – and to let State Representative Deb Conroy know you want her to protect you from higher income taxes.”

The calls come one day after media reported that Quinn and House Speaker Michael Madigan convened a secret backroom meeting with Democratic lawmakers to pressure them to vote for Quinn’s tax hike. Reports indicate the meeting did not go well for Quinn with lawmakers rejecting the governor’s false choice between raising taxes and funding education.

Rauner encouraged voters to stand against Pat Quinn’s tax increase proposal and ensure State Representatives Deb Conroy (LD 46), Marty Moylan (LD 55), Carol Sente (LD 59), Sam Yingling (LD 62), Mike Smiddy (LD 71), Kate Cloonen (LD 79), and Sue Scherer (LD 96) vote against it if Madigan calls a vote.

That’s seven, not six, as the press release says.

And I know Rauner is unfamiliar with the Statehouse, but room 114 isn’t a “backroom.” It’s a hearing room.

* The robocall…

* Script…

Hello, this is Bruce Rauner. Yesterday, Governor Pat Quinn and Mike Madigan held a secret backroom meeting with State Representatives, pressuring them to raise your income taxes. Pat Quinn thinks you don’t pay enough in taxes – but I disagree. There’s still time to help me fight Pat Quinn’s tax increase – and to let State Representative [insert name] know you want [him/her] to protect you from higher income taxes. If you oppose higher income taxes and want to get more involved in my campaign, call me at 312-583-0704. Paid for by Citizens for Rauner, Inc

If you call the number, you’re asked to “dial zero” for an operator. I did so and was put on hold and then transferred into a voicemail account for volunteers.

Usually, these sorts of robocalls offer to connect you to your legislators. So Rauner’s calls aren’t interactive in the traditional sense.

…Adding… If Rauner really wanted to have an impact on the vote itself, he wouldn’t target most of those folks listed above. They’re already solid “No” votes on a tax hike extension. Instead, he’d go after Democrats who aren’t quite decided, or are staying mum.

30 Comments

|

Unclear on the concept

Tuesday, May 20, 2014 - Posted by Rich Miller

* Illinois Review…

On Illinois’ first day of statewide legalized gay marriage Westboro Baptist protesters will be outside the State Capitol, a press release from the church said Monday.

“Each rebel in the IL legislature will stand before God in the judgment and account for eading the people to error in running to this abomination,” the announcement says. Signs saying “Same Sex marriage dooms nations” and “America is doomed,” is featured on the press release, which says the Westboro picket will be held on Monday, June 2 from 8:45 to 9:15 am “in dire warning” to state lawmakers.

The morons, known for their insane anti-gay protests at military funerals, may be screaming outside the Statehouse, but unless something goes horribly wrong with the spring session, nobody but tourists and staff will be inside the building since adjournment is scheduled, as always, for May 31st.

So, their “dire warning” to lawmakers won’t be heard by any lawmakers. The cretins might as well just stay in their bat caves.

* Meanwhile…

Westboro Baptist Church is planning to protest next month’s Chicago Pride Fest, according to a Tweet posted Sunday morning.

In response to an article about the two-day street festival published by On Top Magazine, a content partner of ChicagoPride.com, the Topeka-based hate church tweeted: “@LGBTNewsNow @OnTopMag @WGNNews Westboro Baptist Church to picket @PrideFestChi! #SoExcited.”

Yeah. And I’m sure they’ll all get a nice, warm Chicago welcome, right?

32 Comments

|

Question of the day

Tuesday, May 20, 2014 - Posted by Rich Miller

* The setup…

Tuesday, Republican House member Dennis Reboletti called for voters to have a say in whether the 2011 state income tax increase should remain permanent or sunset at the end of 2014. S

Several Republican General Assembly members stood with Reboletti to support his effort, saying the Democrats have purposely cut Republicans out of budget talks - leaving their constituents with no voice in how taxpayer funds will be spent in 2015.

“We all here have been cut out of the [budget] process,” Reboletti said. “We’re going to ask the people to be citizen soldiers and join us in the fight. And if they think their voice isn’t being heard by the majority, they will have the opportunity to step up and cast a vote. […]

Rep. Ron Sandack pointed out that there are already several referenda on the November ballot, and one more asking the people their opinion on the tax hike is reasonable. A simple majority vote in both chambers before the legislature adjourns next week would put the question before voters.

And just to be clear, there are no limits on the number of non-binding advisory referenda that the General Assembly can put on the ballot.

* The Question: Should there be a statewide referendum on extending the income tax hike? Take the poll and then explain your answer in comments, please.

polls & surveys

81 Comments

|

“It’s not my job”

Tuesday, May 20, 2014 - Posted by Rich Miller

* At about the 2:30 mark in a YouTube video uploaded this morning by the Bruce Rauner campaign, WTTW’s Phil Ponce asks reporter Paris Schutz if Rauner has yet come up with an alternative plan to making the income tax hike permanent. Schutz’s response…

“Phil, he hasn’t. And today he said he wanted to wait for those lawmakers to figure out what they’re going to do before he unveiled the specifics of his [plan].”

Watch…

* So, which is it? Either he doesn’t have a plan or he has one and he’s waiting until after session ends.

I asked Rauner’s spokesman for a clarification…

I just listened to the audio from the gaggle and this is what Bruce said:

“We are going to be coming out with our own plan of spending priorities and tax strategies in the not too distant future.”

* But why wait?

I mean, if the tax hike is so bad, if it hurts the economy so much, then why make Illinoisans wait until next year to get rid of it?

If Rauner really does have some ideas, isn’t now the time to lay them out, before the Legislature has adjourned?

* The Rauner campaign’s response to this notion…

But to your larger point, Pat Quinn, Mike Madigan and John Cullerton are in charge now. It’s up to them to pass a budget during the session. As Bruce said he will put forth a budget plan in the not too distant future.

* Look, I totally get the politics here. There’s no good political reason to jump into a self-made train wreck like this Democrats-only tax hike debate.

And it is their job, not his at the moment, to craft a solution to this vexing problem.

But he is a life-long citizen of Illinois. And he has loudly and bitterly complained for well over a year about how the tax hike is killing Illinois and driving away businesses and families. If he has some ideas for dealing with this awful mess, shouldn’t he try to help his state?

/rant

46 Comments

|

Chicago a “dystopian nightmare” for business

Tuesday, May 20, 2014 - Posted by Rich Miller

* Matthew Yglesias…

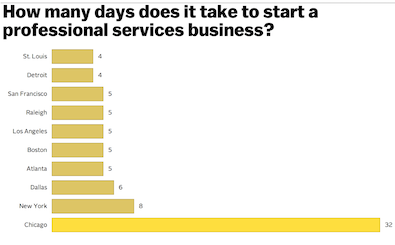

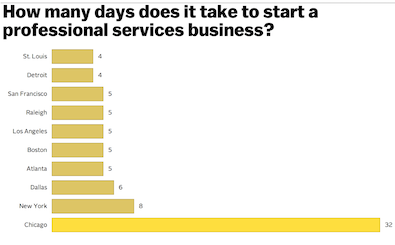

The US Chamber of Commerce Foundation put together a little pamphlet looking at municipal business regulations in 10 major American cities. They combine all the information into a somewhat arbitrary aggregate index, but some of the specific findings are striking.

For example, if you want to start a professional services business in Chicago you are basically facing a dystopian nightmare:

* If the accompanying chart doesn’t make you sick to your stomach, I don’t know what will…

32 days compared to five in heavily regulated San Francisco?

42 Comments

|

Stuff you may not know

Tuesday, May 20, 2014 - Posted by Rich Miller

* From a Sun-Times editorial…

Two years ago, 30,000 Illinoisans thought they’d voted on Election Day, but in fact their ballots were tossed out because those would-be voters weren’t properly registered. […]

They are allowed to cast provisional ballots, but if they are not properly registered or at in the wrong precinct, those votes won’t count. That’s what happened to those 30,000 voters two years ago. […]

Cook County Clerk David Orr estimates that 25 percent of eligible Illinois voters aren’t registered. It happens for a variety of reasons. Some people, of course, are lazy or uninterested. But others have moved and simply haven’t kept up their registrations. Each year, half a million people move from one address to another in Cook County alone, and in 2012, more than 13 percent of Illinoisans changed addresses.

To put it into a little perspective, 30,000 is about the same as Gov. Pat Quinn’s winning margin four years ago.

* Crain’s has a very informative piece on the difficulties manufacturers have recruiting employees, despite job openings…

Crain’s conducted its own analysis of state manufacturing wages for this story. Over the past decade, they grew by 29 percent overall, according to figures provided by the Illinois Department of Employment Security. But consider this: Over the same period, wages in construction grew by 42 percent, in education by 43 percent and in finance by 61 percent.

Basically, if you’re a young grad following the money trail, why go into manufacturing? “It boils down to our view of the trade fields,” says Maciek Nowak, associate professor of supply-chain management at Loyola University Chicago’s Quinlan School of Business. “Dad says to son, ‘You can do better.’ “ […]

After receiving $13 million in federal money in 2012, a consortium of 21 Illinois community colleges has moved quickly to implement degree programs and apprenticeships for advanced manufacturing. Even Peoria-based Caterpillar Inc. chose to partner with colleges and universities around the country to help form a pipeline of skilled workers. In the meantime, however, Cat has spent the past decade laying off employees and freezing pensions and wages. It has also steadily shifted work from union strongholds in the North to right-to-work states in the South.

* Daily Herald…

On the second night of the NFL draft, an Oakland Raiders pick from 40 years ago sat in a one-story house in Des Plaines with a wheelchair ramp out front, a home he’s both lived and worked in for 12 years.

Dozens of millionaires would be newly minted via the draft.

But on that Friday evening, Gregory Mathis, the Raiders’ 15th pick in 1974, planned to watch the Chicago Blackhawks playoff hockey game with the residents of the house as part of his $10.70-an-hour job.

Six people with disabilities live at the home, called Cambridge House for the quiet Des Plaines street where it sits. Mathis is charged with taking care of them for the afternoon, overnight and early the next morning. He charts their progress, prepares meals, cleans up, and helps them bathe and use the bathroom.

Mathis, 62, has received $1.70 in raises in a dozen years for his work. His pay reflects stagnant state funding for agencies like his employer, Avenues to Independence, an issue that demonstrates how the political give and take in this month’s state budget battle can hang over daily life.

Go read the whole thing.

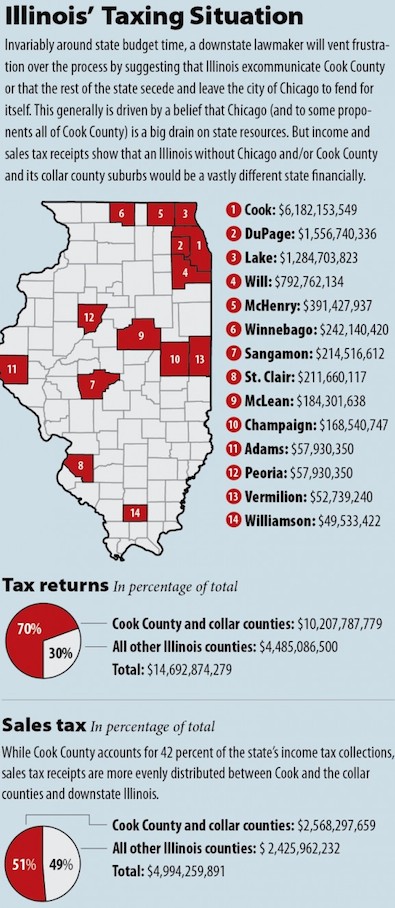

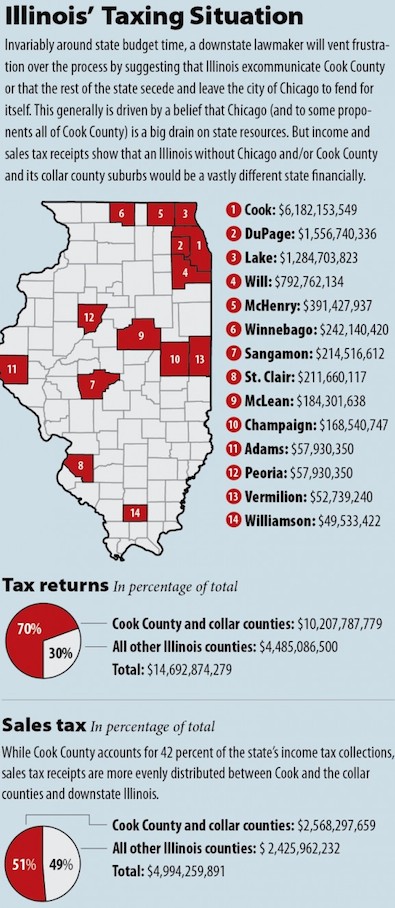

* And, finally, a Reboot infographic…

37 Comments

|

[The following is a paid advertisement.]

In an overwhelming show of support last Thursday, the Illinois Senate approved HB 4075 and trailer bill HB 5331 and paved the way for this legislation to be signed by Governor Quinn. This important public safety law would provide police background checks, drug tests and proper insurance requirements for all drivers and vehicles in transportation industry.

The remarkable support in both chambers of the Illinois legislature shows that this legislation strikes the right balance between protecting Illinois consumers and promoting new transportation options in Illinois.

Thank you to the Illinois General Assembly for their diligent work in crafting sensible statewide standards that will allow everyone in the transportation industry to prosper, including the thousands of jobs and families the taxi industry supports throughout Illinois.

Special thanks goes to Illinois’ legislative leaders: House Speaker Michael Madigan, Senate President John Cullerton, House Republican Leader Jim Durkin and Senate Republican Leader Christine Radogno.

As well as the bills’ sponsors in the Illinois Senate: Senators Antonio Munoz, Martin A. Sandoval, Karen McConnaughay, John M. Sullivan, Emil Jones III, Steven M. Landek, Melinda Bush, Jacqueline Collins and Linda Holmes.

And to the bills’ sponsors in the Illinois House: Representatives Michael J. Zalewski, Arthur Turner, Marcus C. Evans Jr., Dennis M. Reboletti, Edward J. Acevedo, Camille Y. Lilly, Ann Williams, Elizabeth Hernandez and Derrick Smith.

Now it’s time to tell Governor Quinn to sign HB 4075 and support common sense public safety protections for all.

Comments Off

|

|

Comments Off

|

Today’s numbers are harsh

Tuesday, May 20, 2014 - Posted by Rich Miller

* From an op-ed by David M.A. Jensen, president and chief operations officer of Lutheran Social Services of Illinois…

Lutheran Social Services of Illinois is the largest statewide provider of social services, and last year we served more than 96,000 residents. Approximately 80 percent of the people we served are below the poverty level.

The demand for our services continues to grow, as poverty and its associated hardships impact almost 2 million people in our great state. Poverty exists in every corner of Illinois, leaving many communities finding it difficult to address necessary resources to the human services infrastructure. Should the personal income tax not be extended, we estimate the following impact on our citizens based on our own research and that of the Fiscal Policy Center at Voices for Illinois Children:

• 21,000 seniors would not receive the help they need from in-home caretakers

• 140,000 people with mental illness would be denied medication and/or therapy

• 35,000 people with mental illness would no longer receive any services

• 25,000 adults with developmental disabilities would lose community-based services

• 13,600 people would have supportive housing and homeless services

Behind each of these statistics are very real people, in need of hope and a future. The most vulnerable people in our society are at risk for not finding the services they need. Even with generous support from private donors, as a community-based agency we depend on government funding to help our most vulnerable citizens.

* The Voices for Children’s Fiscal Policy Center’s research paper is here. The numbers look pretty sound…

There has been some dispute among legislators about the size of the budget shortfall that would result from the loss of income tax revenue in FY 2015. The revenue-collapse budget submitted by the Governor would reduce “discretionary” spending from the General Funds by about $2 billion. Some critics claim that this figure exaggerates the problem and that the shortfall is much smaller. But independent analysis by the Fiscal Policy Center (FPC), using somewhat different assumptions than the Governor’s Office of Management and Budget (GOMB), produces a similar estimate.

To estimate the shortfall, the FPC begins with projected FY 2015 revenue and then subtracts “mandatory” spending at projected FY 2015 levels and “discretionary” spending at FY 2014 levels. The difference is the projected budget shortfall (see Appendix 2).

The FPC uses revenue estimates from the Commission on Government Forecasting and Accountability (CGFA), a legislative support agency that has statutory responsibility for preparing revenue estimates for the General Assembly. CGFA’s updated projections for FY 2015 are $272 million lower than GOMB’s estimates.

The FPC revenue estimate also includes $402 million from two new special state funds — the Fund for the Advancement of Education and the Commitment to Human Services Fund. Beginning in calendar year 2015, each of these funds will receive 1/30 of revenue from individual income taxes. While the authorizing statute (Public Act 96-1496) stipulates that resources in each fund “shall supplement and not supplant” current levels of funding, there is no way of enforcing this provision.

In regard to “mandatory” spending, the FPC estimate reduces pension contributions from the General Funds by $150 million, based on offsetting revenue generated from unclaimed property. Otherwise, the FPC uses the same estimates as GOMB. In regard to “discretionary” spending, this comparative analysis assumes that appropriations remain at the FY 2014 level.

The GOMB spending estimate subtracts $234 million for unspent appropriations, while the FPC estimate omits this item. For decades, Illinois governors and legislatures have used estimates of unspent appropriations in formulating balanced budgets. This practice is contrary to sound fiscal policy and should be discontinued. Given the state’s current financial situation, unspent appropriations should be used to pay outstanding bills. If the backlog is eliminated, any unanticipated surplus should go into a rainy day fund.

In short, the FPC analysis indicates that the shortfall in the revenue-collapse budget — and the resulting cuts in “discretionary” spending — would still total about $2 billion (see Appendix 2). Any substantially smaller figure would have to involve questionable policy choices such as underfunding “mandatory” spending or ignoring the backlog of unpaid bills.

45 Comments

|

In other revenue and spending developments…

Tuesday, May 20, 2014 - Posted by Rich Miller

* Tribune…

Madigan filed legislation Monday that would keep the 2011 income tax hike in place and send homeowners a $500 property tax refund.

* More on the refund plan…

Under the proposal, refunds could be issued for 2013 property taxes as soon as September. That’s just weeks before the November election, when Quinn and many other lawmakers face re-election.

The idea behind this isn’t difficult to discern. They want to send voters a check before the election.

* From a recent AP story…

The temporary income tax hike Illinois lawmakers are considering extending is costing the typical taxpayer about $1,100 more this year, according to calculations by the Governor’s Office of Management and Budget.

he 67 percent increase on individuals approved in 2011 is producing about $6.6 billion in additional revenue for the state this year. Democrats promised when they raised the individual rate from 3 percent to 5 percent that it would roll back to 3.75 percent in January 2015. Now Gov. Pat Quinn and legislative Democrats want to make the 5 percent rate permanent.

The AP also calculated that rolling back the reduction on schedule to 3.75 percent would save the average taxpayer $688.

Instead, the state is planning to give every homeowner $500. And, by the way, those homeowners will very likely be liable for state and federal taxes on their election year bonus checks.

That’s kinda goofy, if you ask me.

How about rolling back the income tax hike by $700 million, which is the net new cost of this property tax “rebate” plan?

Sheesh.

51 Comments

|

* House Speaker Michael Madigan talked to reporters after yesterday’s marathon meeting with House Democrats and Gov. Pat Quinn…

Madigan said that Quinn worked hard to present his case, but he doesn’t know yet if any minds were changed. “I thought he did an excellent job of presenting his position, arguing for his position, taking questions. He took every question. He answered every question. He got very animated on a lot of his answers because, at times, he wasn’t hearing what he wanted to hear,” Madigan said.

“I think it’s significant that there was opposition expressed from all sectors of our caucus. I’m going to continue to work to find 60 Democrats to vote for the governor’s bill. We are significantly away from 60 today.” When asked how he would get the votes, Madigan said, “It’s going to take a great deal of persuasion.” He refused to answer questions about possible alternative revenue sources or what would happen with the budget if he cannot get the votes for the extension.

Opposition was, indeed, expressed from “all sectors” of the caucus. As I tweeted yesterday during the meeting…

Subscribers have more details.

* The governor tried to be more upbeat…

“It was really enjoyable. Everybody had a good chance to speak their minds,” the governor said afterward.

Quinn declined to talk in specifics about how much support he thinks there is for the tax issue. […]

Quinn centered his presentation Monday on the state’s responsibility to fund education, even carrying a copy of the state Constitution into the meeting to emphasize that it says the state is primarily responsible for education.

So, it was an “up day”?

Sigh.

* But he did demonstrate that he understands the reality of his situation…

“I think we need to make sure that we properly invest in our schools. Our state over relies right now on property tax to fund education. I think we have to do better. We have to use a tax based on ability to pay, the income tax, to properly fund our schools. I spoke about that quite a bit in the caucus,” Quinn said after he addressed the Democrats. […]

“You’re always building a majority on any issue; it’s a building of a majority to get to 60. I think we’re doing our very best to get that majority. I think my philosophy in life is hope for the best and work for it. So, we’re working real hard on getting those 60 votes in the House of Representatives. Obviously, we have to keep on working until we get there.”

* The reaction from Bruce Rauner was expected…

Monday’s meeting between the governor and his erstwhile House Democratic allies came after he endured another withering day of being beaten up by Republican gubernatorial rival Bruce Rauner, who labeled Quinn a “tax-and-spend” politician and failed leader who can’t move Democratic supermajorities in the House and Senate to do his bidding.

“They’re playing political games and showing a lack of leadership and unfortunately in Springfield, that’s been the status quo,” Rauner said after a campaign event in Northbrook.

“Right now, they’re trying to portray themselves as just doing whatever the voters want. They’re saying voters like more spending so we’re gonna give them more spending. Voters don’t like taxes so we’re just not going to vote on taxes,” Rauner charged.

“That’s political gamesmanship. That’s playing political football with our financial health. It’s a huge mistake. It’s a failure of leadership. It’s a failure of the General Assembly and the governor down there,” Rauner said.

It’s not that I disagree, it’s just that I’d kinda like to see a plan from Rauner. It doesn’t have to be a 500-page line item appropriations bill. Just sketch something out on a napkin or something. Anything.

* More…

If Madigan is “determined and he needs his 60 votes, he finds a way to get there,” [House GOP Leader Jim Durkin] said. “But he’s not going to get it with Republican participation.”

Madigan and Quinn both dismissed remarks from Durkin and Republican governor candidate Bruce Rauner, who was critical of Democrats for pushing a tax hike that he says is not needed. Rauner has contended the high taxes are causing businesses and people to leave Illinois.

Madigan shot back: “People are leaving because they’re looking at the prospect of Rauner as the governor.”

Nice pivot, but I kinda doubt that.

* Watch the raw video of both Quinn and Madigan via our good friends at BlueRoomStream.com…

77 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|