* The National Journal somehow snagged an interview with Fred Eychaner, one of the Democrats’ biggest campaign contributors both nationally and here in Illinois. Eychaner almost never grants interviews, so this is a very rare profile…

Eychaner decided to construct his own heavily funded lobbying and public-relations vehicle [to help pass gay marriage] instead of donating funds to existing gay-rights groups. To do his media, he hired ASGK Public Strategies, a Chicago-based PR firm with ties to Obama, and he enlisted several of the state’s top lobbyists. […]

Eychaner entrusted Mike Madigan—the powerful Democratic speaker of the Illinois House of Representatives and someone to whom he had been a generous donor over the years—to deliver the votes. This did not sit well with other advocates, who wanted to cast a wider lobbying net, as opposed to leaning so heavily on Madigan to round up support.

“I would go on the record with my respect for Mike Madigan, which will probably upset a lot of friends,” Eychaner says now. “He’s enormously skillful at what he does. The only speakers of any House who survive are the ones who can keep their majority and keep everyone going largely in the same direction. Mike Madigan is superb at that.”

When it appeared last summer that they didn’t have the votes, the Legislature’s gay-marriage supporters delayed calling the bill to the floor. The grassroots wing of the LGBT movement was upset, and some began blaming Eychaner. The most obstreperous of these critics, a longtime gay-rights activist named Rick Garcia, publicly chastised Eychaner for being in Madigan’s pocket.

But after a five-month delay, the bill was voted on and passed, marking a historic occasion as well as vindicating Eychaner’s strategy. Eychaner compared the process to 20 mad chefs cooking on 20 different burners. “The person to the left of you by one degree thinks you’re selling out,” he said. “You’ve got to do what you’ve got to do. I don’t think I’ll be in that position again.”

When I asked about his near-term plans, he indicated only his interest in putting money behind the reelection campaign of Illinois Gov. Pat Quinn whose self-funding Republican opponent, Bruce Rauner, busted the individual spending-limits cap in the primary. “I don’t expect to be among the top donors this year, but I will do my share,” he said. “I am not the progressive Koch brother.”

Go read the whole thing.

34 Comments

|

In the eye of the beholder

Monday, May 12, 2014 - Posted by Rich Miller

* OK, I’m gonna give you a hint about how to read news stories. When you don’t see a hard number right away, it’s a tip off that the problem being claimed isn’t as large as the lede might suggest. For instance…

Dozens of state jobs involved in a dispute over whether they should be free of politics were filled by Gov. Pat Quinn’s administration with candidates who were politically connected or gave campaign contributions to the governor’s party, an Associated Press review of state documents shows.

* Four paragraphs in, we see that “dozens” is about two dozen…

In an analysis of about 45 Quinn administration hires described in the government emails, the AP found more than half had connections. For instance, four held jobs in Quinn’s office or worked for another Democrat before moving to IDOT; nine are relatives of officeholders, party officials, union representatives or others who are politically connected; seven are politically active, either as officeholders or party officials; three have donated to campaign committees; and two have served on campaign payrolls, including for legislators.

I’m not trying to minimize this revelation or the reporting at all, but if the administration thought those jobs were exempt, then of course they’d put political hires in there. The only thing that truly surprises me is that it wasn’t 45 out of 45. /snark

Again, it’s clear that those jobs shouldn’t have been classified the way they were. Whether anybody knowingly broke the law is now what’s in question.

* And along those same lines, do we really want to go down this road?…

The Illinois transportation secretary says it would be too difficult to reopen the hiring process for jobs contested in a federal lawsuit. […]

Transportation Secretary Ann Schneider told a Senate appropriations committee Thursday that people in those jobs are union members and repeating the hiring process would lead to costly lawsuits.

Republican state Sen. Matt Murphy of Palatine says taking no action could lead to future illegal patronage hiring.

I can see Murphy’s point, but it’ll cost a whole lot of money to fire these folks, who aren’t really guilty of anything. It was IDOT’s fault they got those jobs, not theirs. But perhaps you disagree and I’m all ears.

* Meanwhile…

An Illinois tollway director appointed by Pat Quinn also heads a union that is a major financial player in the governor’s re-election campaign, most recently giving $250,000 to the cause in January.

The International Union of Operating Engineers Local 150, whose president is tollway Director James Sweeney, has donated more than $450,000 to Quinn’s campaign fund since the 2010 election, state records show. Sweeney also is chairman of the Chicagoland Operators Joint Labor-Management PAC that contributed $150,000 to Taxpayers for Quinn in 2010 and 2011.

The contributions don’t breach any ethics laws but they’re troublesome, some government experts say, particularly given past cronyism at the Illinois State Toll Highway Authority.

“It’s worrisome to see so much money coming from one source, especially since the head of (Local 150) is also a member of the tollway board, where so many road construction dollars have been spent,” said Susan Garrett, chair of the Illinois Campaign for Political Reform.

I can also clearly see Garrett’s point, but you can’t deny that Sweeney knows a thing or two about building roads.

45 Comments

|

Question of the day

Monday, May 12, 2014 - Posted by Rich Miller

* Last week, Rep. Mike Bost ran a local bill on the House floor…

Senate Bill 2721 sponsored by Representative Mike Bost and Senator Dave Luechtefeld will authorize Jackson County to generate revenue to repair the Grand Tower Levee by issuing bonds. In 1994, voters in Jackson County approved a referendum for the issuance of bonds needed to repair the Grand Tower Levee. Unfortunately, not enough bonds were sold and the timeline to sell the bonds expired – which led to Bost and Luechtefeld’s legislation to help repair the Grand Tower Levee.

* As it turns out, this was Rep. Bost’s final bill. Bost is running for Congress against Bill Enyart (who also traveled to Springfield to testify for the bill after it was bottled up by the House Democrats). Here’s Bost’s speech on his final bill…

And just in case you can’t watch videos where you are, he didn’t throw any papers in the air this time.

Bost has occasionally been someone of a lightning rod over the years, but he remains quite popular on both sides of the aisle. I covered his first successful race when he won a Democratic district in the 1994 GOP landslide. The HDems targeted him for defeat for years, but he always held on.

* The Question: Your thoughts on Rep. Mike Bost leaving the House this fall?

25 Comments

|

Something has gotta give

Monday, May 12, 2014 - Posted by Rich Miller

* Paul Merrion asks, “Why is Illinois unemployment so high?”…

Illinois always has been one of the last states to suffer from a recession and one of the last states to recover, but this is getting ridiculous.

Nearly five years after the recession ended nationwide, the Illinois unemployment rate is 8.4 percent, third worst in the nation… The rate is now almost 2 percentage points above the national average… Since November 2010, when the Illinois unemployment rate was 9.6 percent—just two-tenths of a point above Indiana and the national average—only New Mexico has seen a smaller decline in its unemployment rate, compared with where it was. Indiana’s rate is down 3.5 percentage points since then, while Michigan, which started higher, is down 4.1 percentage points. […]

Income taxes went up in January 2011, precisely when Illinois started to diverge from most other states that saw steady improvement in their unemployment rates.

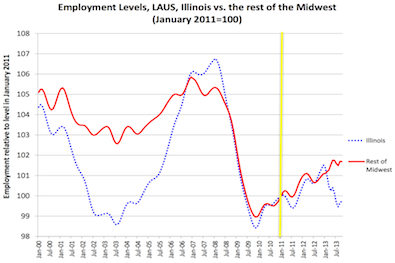

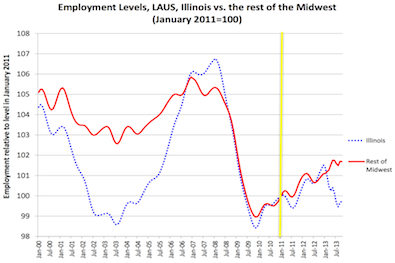

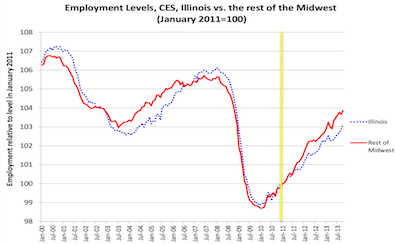

* As Merrion points out, quite a few people believe that the 2011 income tax hike is the main culprit. We’ve all seen charts like this before…

* But there’s also this chart which tracks employment levels…

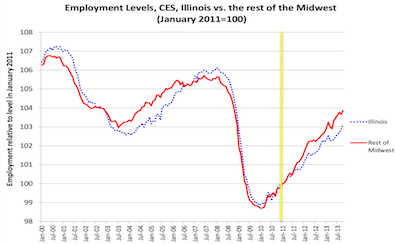

However, as Andrew Crosby and David Merriman of the U of I’s Institute of Government and Public Affairs note…

Illinois still tracks below ROM after January 2011; however, this difference is no longer statistically significant. One of several possible explanations for the diverging trends in employment is noted by Illinois’ Commission on Government Forecasting and Accountability (COGFA). COGFA notes Illinois has a “growing number of part - time workers that now has reached a record high.” If these part - time workers get a second part - time job, they could be double - counted by CES.

Correct. That probably isn’t a reliable chart.

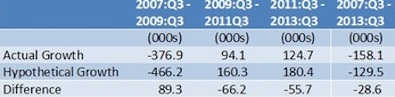

* Bill Testa at the Federal Reserve Bank of Chicago read that U of I report and then tested some theories…

Illinois’s slow recovery may have more to do with its industrial structure. […]

Illinois’s mix of industries, while similar in some respects to those of other Great Lakes states, differs as well. It is possible that the small differences in job growth between Illinois and its neighbors are due to its somewhat different industry mix rather from disinvestment and a reluctance to hire in the state. […]

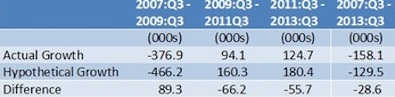

As an analytic exercise, I further ask how the Illinois economy would have fared 1) if it had the same industry composition as the four other Great Lakes states combined and 2) if its industries had the same job growth rates as those in the other states.

The chart…

* So, we’d have been much better overall with that hypothetical. The big difference between Illinois and the rest of the Great Lakes is the prominence of manufacturing and the type of manufacturing…

What are some of the industry mix differences that are notable between Illinois and other Great Lakes states? The large professional and financial services employment base in the Chicago area has already been noted. Further, in relation to other states, Illinois is now much more services oriented overall rather than goods producing. Manufacturing’s share of employment for 2013 clocks in at 11.4 percent of private sector payroll jobs in Illinois, versus 16.4 percent for the other four states. […]

And within manufacturing, Illinois tends to lean more toward food processing and farm, construction, mining machinery relative to the other Great Lakes states. In contrast, while there are important auto assembly operations in the Bloomington–Normal and Rockford areas of Illinois, as well as important links to the automotive supply chain throughout the state, Illinois’s ties to the automotive industry are much less prominent than those of Michigan, Indiana, and Ohio.

We simply need to do better.

* But after all that, Testa buries this extremely important fact…

Nonetheless, even payroll employment trends suggest that Illinois is underperforming when examined on an industry-by-industry basis. Accordingly, recent changes in public policies that influence the investment climate, such as tax rate hikes, cannot be ruled out entirely, though such policy effects are unlikely to be exerting such a large and immediate effect. [Emphasis added.]

Economists are loathe to point to local taxes as being to blame for business decisions. But Illinois’ tax and budget crises are almost universally known and derided here, particularly among the corporate types (hence Rauner). There are other factors as well, including our notoriously high workers’ comp costs.

The underperformance in growth on an industry-by-industry basis is striking. Even if we had the same employment mix here, we’d still be behind.

* Then again, let’s go back to Merrion for two other important points to keep in mind…

“In fact, one could argue that the economy would be in worse shape had the tax hike not occurred, since the reduction in public-sector jobs and subsequent ripple effect would have been much larger,” says Aaron Smith, a regional economist at Moody’s Analytics Inc., an economics consulting firm in West Chester, Pennsylvania. “Of course, consumer spending would also have been stronger due to more discretionary income, but I don’t think the tax hike is a valid cause of the hiring slowdown in other industries.” […]

Despite claims that Illinois employers are freaked out by higher taxes, public-sector job losses account for a significant portion of the unemployment rate. Six of the nine occupations in Illinois losing the most jobs in 2011 were teachers and other government workers, according to Economic Modeling Specialists International, a labor market data analysis firm based in Moscow, Idaho.

Discuss.

102 Comments

|

“An existential angst grips Chicago business”

Monday, May 12, 2014 - Posted by Rich Miller

* Joe Cahill at Crain’s writes “I’ve been following Chicago business for more than 30 years, and I can’t recall a time when so many of our big companies were in such a state of flux.” A few examples…

Walgreen’s deal with Europe’s Alliance Boots brought in a major wild card—Alliance Boots GmbH Chairman Stefano Pessina, now the company’s largest single shareholder—and sparked pressure to move its corporate headquarters to Europe.

United management underestimated the challenge of rationalizing the enormous airline it created by merging United and Continental. Poor first-quarter results all but ensure another round of disruptive cutbacks.

Caterpillar, similarly, is trying to right itself after the spectacularly ill-timed $7.6 billion acquisition of Bucyrus International Inc. Cat’s biggest deal ever dramatically increased its exposure to mining equipment just as the industry nose-dived. Sales have plummeted, forcing Cat to eliminate more than 9,000 jobs.

* I hadn’t really been following the Walgreen’s saga until I spoke with a company representative the other day. I was pretty shocked that the possibility of Walgreen’s moving its headquarters to Switzerland is quite real. The company could save huge money…

According to an analysis by UBS, Walgreen’s U.S. [effective] tax rate is 37.5% — compared with Alliance Boots’ rate in Europe of about 20%.

The state can’t do much about that. If it wants to go, it’ll go.

It’s not an unusual thing…

Aon Corp., one of Chicago’s most prominent businesses, shifted its corporate home to London in 2012. Last month, Deerfield-based Horizon Pharma Inc. said it would move its headquarters to Ireland as part of a merger.

And not just locally…

Michigan’s Perrigo, Pennsylvania’s Endo Health Solutions and New Jersey’s Actavis moved their headquarters to Ireland last year following merger deals. Connecticut’s Alexion Pharmaceuticals moved some of its intellectual property there, as well, to cut taxes.

* Back to Walgreen’s, which was founded in Illinois over one hundred years ago…

Mr. Pessina, a billionaire who resides in Monaco, turned his family’s struggling Naples pharmaceutical wholesaler into the heavyweight Alliance UniChem Group. In 2006, he merged it with U.K. pharmacy chain Boots Group to create Alliance Boots. A year later, the company was taken private in a $22 billion deal that remains Europe’s largest leveraged buyout. The deal was financed by Kohlberg Kravis Roberts & Co., the storied private-equity firm that inspired “Barbarians at the Gate,” a book about the tumultuous 1988 takeover of RJR Nabisco Inc.

“When Walgreens talks about the best interests of their shareholders, they’re talking about Stefano Pessina,” Mr. Fein says. “I don’t know if Walgreens did or did not anticipate his influence, but they’ve negotiated a transaction with one of the most sophisticated and respected businessmen in the world.”

43 Comments

|

Fun with numbers

Monday, May 12, 2014 - Posted by Rich Miller

* From a PQ campaign press release…

A new poll today showing that 99% of Chicagoans don’t want higher property taxes confirmed a key principle of Governor Pat Quinn’s budget: Illinois over-relies on the property tax.

Governor Quinn is pushing a responsible and honest budget plan that would begin to reduce the state’s over-reliance on property taxes by properly funding education and sending every homeowner a guaranteed $500 property tax refund each year.

By contrast, billionaire Bruce Rauner is scheming to shift more of the tax burden to property taxpayers by cutting the state’s investment in education.

“It’s no surprise that Rauner - a self-proclaimed member of the .01% - would be scheming to do something that the 99% are strongly against,” Quinn spokesman Izabela Miltko said. “By cutting the state’s support for education, Rauner would preside over the largest property tax increase in Illinois history.

“It’s time to lower the property tax burden for homeowners across Illinois by properly funding our schools and sending every homeowner a guaranteed $500 property tax refund each year. The governor’s budget plan does just that.”

More than 2.1 million Illinois households would receive an annual $500 property tax refund under the governor’s budget plan, which also provides the largest increase in funding for the classroom in state history. Illinois collects more money in property taxes than the state’s sales tax and income tax combined.

* The poll didn’t say that 99 percent of Chicagoans don’t want a property tax hike. The somewhat oddly worded McKeon & Associates poll [ADDING: McKeon just called to say that the Sun-Times chose the question’s wording] merely allowed Chicagoans to pick their preference of new revenue streams…

Offered four choices on ways Chicago could solve its $20 billion pension crisis, raising property taxes ranked dead-last, chosen by only one percent of the Chicago voters surveyed.

The favorite remedies on the list — both at 25 percent — were a “commuter tax” on suburbanites who work in Chicago and the transaction tax on LaSalle Street exchanges championed by the Chicago Teachers Union.

Running close behind — at 21 percent — was a city income tax. That’s somewhat surprising, since a city income tax would have to be paid by many of those polled.

The transaction tax is dead, as is the city income tax. The commuter tax isn’t going anywhere any time soon. And while the 1 percent favoring a property tax hike is newsworthy, there apparently were no follow-up questions about what voters actually thought of that prospect.

* Also, the governor’s proposed property tax rebate isn’t really a property tax rebate. It’s a $500 check to all Illinois homeowners - at a net new cost to income taxpayers of $700 million.

* And, as Rauner has noted before, education funding hasn’t been protected by Quinn in the past. So, is the governor, then, responsible for large numbers of school-related property tax hikes? And since the governor pushed the original income tax hike, which didn’t include money for local government revenue sharing, is he also responsible for their tax hikes?

27 Comments

|

Taxing issues

Monday, May 12, 2014 - Posted by Rich Miller

* As I told you Friday, eleven House Democrats co-sponsored a bill to completely roll back the 2011 income tax hike. One of those House members was Rep. Willis, who now says she’s undecided about making the tax hike permanent…

State Rep. Kathleen Willis is “totally on the fence.”

“I’m totally undecided still. I’m talking to the people in my district to see,” the Addison Democrat said.

“I’m talking to the people in my district” more likely means “I’m waiting to hear from the Speaker.”

Freshman Rep. Willis is currently unopposed.

* Rep. Marty Moylan was the bill’s chief sponsor...

“Right now I’m leaning ‘no’ unless there’s some major reason or change of my mind on it,” Moylan said.

Moylan is most probably a “No.” But what he said is still pretty interesting.

* Rep. Carol Sente is still a solid “No” vote…

“I was a firm ‘no’ in 2011, and I continue to be a firm ‘no’ on making the temporary income tax permanent. What we really need is bipartisan, long-term economic development plans and major budget reform,” said Sente, who has outlined such plans in a proposal that’s been stagnant in the legislature since March.

* Meanwhile, Kurt Erickson had this to say over the weekend…

One theory for how this will all play out began emerging last week. Rather than take the tough vote, Madigan will ask his members to vote for Quinn’s preferred budget — one that doesn’t include the drastic cuts — but not take a vote on making the income tax permanent.

State government operations would continue as they are now. But, come January when income tax rates roll back from 5 percent to 3.75 percent, the state won’t have enough money to continue on its current track.

Such a move would turn the race for governor into a referendum on whether voters want the tax hike to stay permanent.

A vote for Quinn would be a vote for keeping the tax intact, thus avoiding the doomsday budget scenario he and his agency heads have been laying out this spring.

A vote for Republican businessman Bruce Rauner would be a vote for allowing the tax to roll back and the possibility of major cuts in state spending.

Subscribers know my take on that.

* An insightful take…

Rep. Elaine Nekritz, a leading Democrat, says members are split on the best approach.

“I’m not making any predictions right now, it’s all in such a state of flux and every legislator I talk to about the budget and what they’d like to see, how they’d like to see it resolved, has a different idea,” Nekritz says. “Until we get 60 that are on the same page, it’s going to be a real challenge.”

* Related…

* Cullerton: Downstate should be wary of political posturing over tax rates: I don’t believe decimating downstate Illinois will make our state stronger. I can only hope others share my view.

26 Comments

|

Today’s Rauner-related quotables

Monday, May 12, 2014 - Posted by Rich Miller

* We once again quote Illinois Manufacturers’ Association chief Greg Baise. This time it’s about Bruce Rauner…

“He’s a transaction guy. He knows he can’t do this all alone. He knows he is going to have to come in here and work with” the legislative leaders, two of whom are powerful Democrats who currently hold supermajorities in their respective chambers.

* And speaking of Rauner, the Sun-Times ran a story over the weekend about how disgraced former Democratic US Senate candidate Blair Hull had given $5K to Rauner’s campaign…

“I admire wealthy people who want to serve,” Hull told the Sun-Times in an interview last week. “I admire people like Michael Bloomberg, and I think he did a great job. People who are wealthy can really do what they believe, they can push for the right reforms.” […]

When asked if more financial backing was on the way, Hull laughed.

“He doesn’t need my money. He’s got a lot more money than I do,” Hull said. As for the $5,000 check he wrote to Rauner: “It was emotional support.”

* And one more. Winnebago County GOP Chairman Jim Thompson recently made a bit of news by writing this in his party’s newsletter…

“Media update for the week: saw on the news this week the offspring of a donkey and a zebra, black and white legs, rest all donkey. Not sure why this is news. Now if we can teach him to read a teleprompter, we could have two living creatures the media will fawn over that is part white, part black and all a**!”

Rauner eventually reacted, saying Thompson should resign…

“Bruce believes the comments in the newsletter were wholly inappropriate and don’t have a place in the Republican Party. It would be best if he resigned,” said Mike Schrimpf, Rauner spokesman.

State Sen. Dave Syverson, R-Rockford, confirmed that Rauner called him Friday afternoon and said it would be best for the party if Thompson stepped down. Syverson has been one of Thompson’s supporters, saying he should stay in his position because he apologized for the “joke.”

“He’s not racist and he apologized and if somebody took it the wrong way, he apologized and that’s all he can do,” said Syverson.

Thoughts?

33 Comments

|

Obama library money is a very unpopular idea

Monday, May 12, 2014 - Posted by Rich Miller

* My weekly syndicated newspaper column…

It’s been assumed all along that Illinois House Speaker Michael Madigan’s proposal to spend $100 million to help build Barack Obama’s presidential library was designed to put the Republicans on the spot and perhaps provoke an over the top, maybe even racial response, which would help gin up Democratic turnout a bit this November.

President Obama has put the library’s location out to bid, so Madigan’s proposal is ostensibly designed to help Chicago attract what will likely be a pretty big tourist destination.

But politics is just about everything in Springfield. Democrats are hoping to crowd the November ballot with enough measures to help gin up their party base and get them out to vote. A constitutional amendment to forbid any voter discrimination along racial, ethnic, gender, etc. grounds was already approved for the ballot. A non-binding referendum on whether voters want to increase the minimum wage to $10 an hour is being prepared.

So, this was mainly seen as just another in a series of ploys to fire up the base.

But the Republicans have so far played it quite well, publicly pledging their own support for the library and focusing on the cost. No Republican legislator has yet crossed the line. President Obama may not be all that popular elsewhere, but polling has consistently shown he remains popular here. There’s no sense attacking him and risk a backlash.

Plus, the Republicans make a good point. Obama has proved to be an incredible fundraiser. He still has a lot of very wealthy supporters and he just doesn’t need any help raising money. The government doesn’t really need to be involved.

Illinoisans overwhelmingly agree with the GOP.

“As you may know,” 1,029 likely voters were told May 7th in a Capitol Fax/We Ask America poll, “some lawmakers in Springfield want the state to commit $100 million to help pay for the construction of the future Presidential Library for Barack Obama, if it is located in Illinois. We’d like to know whether or not you generally approve or disapprove of that $100 million proposal?”

Just a scant 29 percent approved, while an overwhelming 67 percent disapproved. A mere 4 percent were unsure.

The only demographic support for the project wasn’t even majority support. A plurality of Chicagoans supported the idea 48-43, as well as a slim plurality of African-Americans, 45-44.

But a plurality of Democrats actually was against the plan, 48-44. And the idea is hugely unpopular with everybody else. A whopping 68 percent of women, 66 percent of men, 75 percent of independents, 80 percent of Republicans, 74 percent of both Latinos and whites, 65 percent of suburban Cook residents, 72 percent of collar county residents and 77 percent of Downstaters opposed the Obama presidential library idea. The poll’s margin of error was ±3.1 percent. 23 percent were cellphone users.

But even more said the state couldn’t afford to help build the library.

“No matter how you feel about the Presidential Library,” respondents were asked, “do you believe the state can afford to support it?”

Only 21 percent said the state could afford it, while an overwhelming 71 percent said it couldn’t. Another 8 percent were unsure.

Not a single demographic category said the state could afford the project. Chicagoans said it was unaffordable 43-42, a 53 percent majority of Democrats said it was unaffordable and African-Americans said it was unaffordable 54-35,

Everybody else’s responses were almost off the charts. 71 percent of women, 70 percent of men, 83 percent of Republicans, 79 percent of independents, 78 percent of whites, 69 percent of suburban Cook and 80 percent of both collar county residents and Downstaters said the state can’t afford it.

Speaker Madigan has had a few misfires this year. He wanted to put a constitutional amendment on the ballot to levy a surcharge on income over a million dollars, but he couldn’t round up enough votes.

Madigan said in March that he wanted to make the income tax increase permanent, but last year eleven of his members - many of whom are his most politically vulnerable - introduced a bill to roll the tax hike all the way back. He has 71 Democrats and he needs 60 to pass the permanent extension measure. That gives him no wiggle room at all.

And, as the poll makes clear, Madigan badly miscalculated with this Obama library thing, both with Republican legislators and the voting public.

Subscribers have full crosstabs.

Discuss.

32 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|