Question of the day

Friday, Jul 25, 2014 - Posted by Rich Miller

* How would you rate your own state legislators (House and Senate)? Let’s rate them A through F. Explain.

52 Comments

|

Emanuel blames state for phony school budget

Friday, Jul 25, 2014 - Posted by Rich Miller

* Mayor Rahm Emanuel explains why he signed off on a school budget that uses 14 months of revenue for twelve months of spending…

He argued that he had no choice when Illinois ranks 50th among 50 states in school funding and Chicago Public Schools has a pension crisis that still has not been solved.

“Chicago taxpayers pay for the pensions of suburban and Downstate teachers and their own teachers. We should be part of that system so Chicago taxpayers are not bearing the burden of pension costs twice,” the mayor said.

“So, the solution to this is working with Springfield to get the resources we need….The state has to be part of the solution on the fiscal side.”

Hmm. Barring more state cash (and there isn’t any), could they fold the city’s school pension fund into TRS?

27 Comments

|

AFSCME: Cullerton plan “looks like extortion”

Friday, Jul 25, 2014 - Posted by Rich Miller

* AFSCME has responded to Senate President John Cullerton’s new pension reform idea, which is outlined here. From Council 31…

The latest pension-cutting concept outlined by Senate President John Cullerton looks like extortion—both unconstitutional and blatantly unfair to teachers, police, nurses, caregivers and other public employees.

For years, our union and the We Are One Illinois coalition of which we are a part have stood virtually alone in urging fair and constitutional solutions to the underfunding of Illinois pensions. We demonstrated our commitment last year by working constructively with Senator Cullerton to develop a compromise pension measure.

We also strongly opposed pension-cutting schemes that are clearly unconstitutional, but politicians charged ahead, triggering costly litigation. We will continue to defend the integrity of the Illinois Constitution.

Recently, a near-unanimous bipartisan majority of the state Supreme Court sent a strong signal that the retirement benefits of public employees are inviolable. To suggest that politicians could prevent workers from bargaining for fair wages only if they surrender a protected right is the same kind of thinking that has delayed real solutions to the pension funding problem. It’s long past time for gimmicks.

Public employees earn their modest pensions by teaching kids, caring for the most vulnerable and keeping us safe. They have always paid their share. That’s why it’s so outrageous that the politicians who caused the pension debt—and their corporate allies whose tax loopholes divert billions from the public good—are still seeking ways to force public servants alone to pay the cost.

Discuss.

78 Comments

|

BGA sues IHSA over FOIA

Friday, Jul 25, 2014 - Posted by Rich Miller

* Sun-Times…

The not-for-profit group that oversees high school sports in Illinois should be subject to state open-records law because it “performs a governmental function” and generates income “from events involving predominantly public schools,” a lawsuit filed Wednesday by the Better Government Association contends.

The government watchdog group’s case, filed in Cook County Circuit Court, aims to force the Illinois High School Association to disclose details about its sponsorship deals, vendors, pension expenses and other aspects of its $11-million-a-year budget.

IHSA officials have said they aren’t required to comply with the Illinois Freedom of Information Act because the association doesn’t get money directly from taxpayers and membership is voluntary. […]

The BGA lawsuit, however, notes that IHSA lawyers argued in 2005 that the sports governing body “was organized for the purpose of conducting public business” and is a “state actor.” The IHSA attorneys — who made those statements in an appellate court filing in response to a defamation case the association ultimately won — also described Hickman as a “public employee.”

The IHSA’s own words “make clear IHSA is a public body under FOIA,” according to the BGA complaint, filed by the Loevy & Loevy law firm.

The BGA also provides content for the Sun-Times, so this is an interesting development, partially because the lawsuit might end up helping the Sun-Times’ bottom line by exposing real problems with the organization and possibly forcing a shakeup or more. I’ll get to that in a minute, though.

* The IHSA responded to the lawsuit late yesterday…

The Illinois High School Association (IHSA) released documentation from the Illinois Office of the Attorney General on July 24, 2014 confirming that the Association is not subject to the Freedom of Information Act (FOIA).

The documentation was provided after a lawsuit was filed in Cook County Circuit Court on July 23, 2014 that seeks to force the IHSA to submit to FOIA requests.

The documentation is a letter from the AG’s office written in 2010 which says IHSA is exempt from state FOIA requirements.

* I’ve been lately sorta watching this developing story from afar. I think excellent arguments can be made that the IHSA should be opened up to FOIA. The institution can stop public school kids from playing sports. It has all sorts of rules and regulations, and leaving it is impossible since the IHSA must approve any games between an IHSA team and a non-IHSA team.

But there is another angle, and one of our better commenters summed it up pretty well back in April…

There’s something in the background that NONE of the parties want to get pushed out front.

IT’S MONEY.

The media folks (in particular broadcasters) are seeing local (high school) sports being the last available ‘cash cow’ where they are not having to fork out serious cash for broadcast rights to other parties, like, but not limited to, IHSA.

They (media/broadcasters) want to make sure those payments for broadcasting rights won’t be happening anytime soon.

Part of the reason this whole issue is coming up is that some different high school athletic conferences are looking for new revenue sources, in light of potential future cutbacks in local/high school sports funding.

You have broadcasting groups who are talking about setting up complete multi-position filming of high school games, and then offering copies of game film for license to college athletics - in effect, acting as ‘advance scouting’ for college athletics.

I just wonder if any of this is going to come out in these so-called ‘hearings’.

That’s real money.

* But it isn’t just traditional broadcasters. Wrapports not only owns the Sun-Times, it also owns High School Cube, which broadcasts live high school sporting events. So far, it’s a free service funded by advertisers. From a 2013 article…

The numbers are staggering. Is this how Ray Kroc, Steve Jobs, Bill Gates and Mark Zuckerberg got started? Chicago-based HighSchoolCube.com is to high school sports what McDonald’s is to hamburgers, Apple to the personal computer, Microsoft to computer software and Facebook to social networking.

Founded in January 2011 by two Texas entrepreneurs who wanted to own their own company and were passionate about high school space, HighSchoolCube.com provides a streaming platform for high schools to broadcast their live events — sports, band, concerts, plays, graduation. […]

In December 2011, it attracted 80,000 visits to its website. Last month, the number sky-rocketed to 400,000.

And it’s been going up ever since.

Wrapports also has a site called High School Cube News which features stories about high school sports (including the BGA lawsuit story above).

* To be clear, news is news and the IHSA story is most definitely news. I’m not accusing any reporters of any bias by any means. I have yet to see a single “bad” story at the paper about this particular subject.

It’s just that releasing the IHSA’s tight grip on high school sports could conceivably benefit the corporation which owns a newspaper that has been all over this particular story. It’s an angle that really hasn’t been explored.

14 Comments

|

* FLOTUS…

“Gov. Quinn has been a great friend and a fantastic partner in our work on military families, she said. “And I’m looking forward to doing more work with you in the years to come, because I’m going to be voting for this man. And we’re going to do everything in our power to make sure he gets over the finish line. He is the guy for this state. ”

Discuss.

38 Comments

|

The consequences of budget cuts

Friday, Jul 25, 2014 - Posted by Rich Miller

* April 14, 2011…

The Illinois Medicaid agency recently cut costs by moving numerous medications, including several anti-psychotics, to a non-preferred list. Some mental health advocates are saying the agency’s action will come at a high price for people with chronic conditions such as bipolar disorder and schizophrenia.

The Illinois Department of Healthcare and Family Services, the state Medicaid agency, maintains a list of preferred and non-preferred prescription drugs for patients, with mostly generics left on the preferred list. Effective April 1, the agency re-categorized a number of medications, including several name brand atypical anti-psychotics, as non-preferred. That means doctors who want to prescribe them to patients on Medicaid will have to obtain prior authorization from the department first.

This may result in people with chronic mental disorders not getting the specific medication they need, said Mark Heyrman, a professor at the University of Chicago law school and the facilitator for the Mental Health Summit, a coalition of mental health advocates and providers. As a result of going untreated, they might end up hospitalized or in jail, he said.

“This is a real risk for people with mental illnesses,” he said.

* August 15, 2012…

In the past two years, Illinois has done just about everything it could to reduce the amount it spends on prescription drugs for mental health. It has placed restrictions on the availability of 17 medications used to treat depression, psychosis and attention-deficit disorder. Doctors now have to explain to Medicaid why the drugs are necessary before a patient can get access to them. Then in July, as part of an effort to cut overall Medicaid spending by $1.6 billion, the state capped the number of prescriptions for Medicaid recipients to four a month, even if they previously were taking a broader cocktail of behavioral medications.

In financial terms, there is no question that it has worked. Last year, the state’s Medicaid mental health drug spending budget was reduced by $112 million. The new cap on prescription drugs is expected to save another $180 million.

Up until 2011, behavioral health drug spending made up about a quarter of Illinois’ Medicaid prescription drug costs. The state spent about $392 million that year on drugs for treating mental health patients. In fiscal 2012, the state spent $280 million on mental health drugs.

But what are the implications for quality of care? Some physicians argue that they are disastrous. “It’s a mess,” says Dr. Daniel Yohanna, a psychiatrist at the University of Chicago Medical Center. “People who were stable on some drugs have been unable to get them. It has created a significant problem.”

* July 22, 2014…

A team of researchers published data Tuesday in the American Journal of Managed Care showing that prior authorization policies in Medicaid programs have significantly higher rates of severe mental illness in their prison populations.

Schizophrenics living in states with prior authorization requirements in Medicaid were 22 percent more likely to be jailed for a non-violent crime than those in states without those restrictions.

“What’s novel in this paper is documenting a link between Medicaid policy and prison populations that’s never previously been looked at,” says Darius Lakdawalla, a professor at University of Southern California and study co-author says. […]

Another paper Lakdawalla has worked on, published this spring, found that states with prior authorization policies tended to see their spending on hospital spending go up faster. The idea here is that patients who didn’t receive anti-psychotic medication may have ended up having to take more trips to the hospital in order to control their symptoms.”In that respect, Lakdawalla says, “It doesn’t seem like you’re getting a lot of bang for the buck in reducing health care costs. There is collateral damage.”

The researchers don’t claim to prove that prior authorization policies cause higher rates of incarceration among the mentally ill. But what Lakdawalla does see in this study is a space for further exploration, of whether these Medicaid policies are having the unintended consequence of driving up incarceration rates of the mentally ill.

“From a policy perspective, this suggests there may be a link between underfunded mental health systems, criminal activity and cost-shifting onto the prison system,” he says. “It’s probably not all about prior authorization, but could be the larger mental health spending picture.”

…Adding… From Rep. Greg Harris…

Your post on the consequences of budget cuts relating to anti-psychotic meds for Medicaid patients and crime/incarceration and mental illness is one of the major reasons that we removed anti-psychotic drugs from the prior authorization list in SB741 that became effective July 1.

I am still working with providers and DHFS on other issues related to what drugs go on the preferred drug list of the formulary such as Concerta and Abilify, and even a quirk in policy that was brought to my attention by Lurie Childrens hospital yesterday that when Medicaid patients turn 19 there is a problem with continuation of ADHD medications.

23 Comments

|

* From Illinois Public Radio…

As Gov. Pat Quinn battles a lawsuit accusing his administration of political hiring, the state watchdog charged with investigating ethics violations is asking to get involved.

Confidentiality restrictions prevent the Inspector General from saying what he is or isn’t looking into.

But a letter to the Attorney General tiptoes to the very edge of admitting that there’s some sort of investigation relating to hiring Illinois’ Department of Transportation. In the letter, Inspector General Ricardo Meza says the court has been informed of an inspector general investigation that “may be related to, or overlap with” allegations related to an ongoing court case.

Meza writes in the letter that his office may assist the court with “useful information and perspectives” as it decides on a lawsuit brought by Michael Shakman.

* From Meza’s letter…

Although confidentiality provisions in the Ethics Act prevent the OEIG from directly commenting on or confirming the existence of an ongoing investigation, or on a completed but not yet released OEIG Final Summary report, the OEIG understands that the Court has been informed about the status of an OEIG investigation that may be related to, or overlap with, allegations that have been made in this matter.

The OEIG therefore believes that appearance as amicus curiae may assist the Court with useful information and perspectives that may aid the Court in determining whether any relief should be granted and, if so, what form any such relief should take.

* Sun-Times…

A Madigan spokesman said the attorney general’s office has confirmed with Meza that it will represent him.

A Quinn spokesman indicated the governor’s office would respond to the letter later Thursday afternoon .

Shakman, meanwhile, said he does not view Meza’s request as being “inconsistent with what we’re doing.”

“I read the letter saying the inspector general has statutory duties that include some of the same subject matter we’re dealing with at the federal courthouse and through our request for a federal monotiror so he’d like to have a chance to appear before the court and address what should be done,” Shakman told Early & Often, the Chicago Sun-Times’ online political portal. “That’s fine. Maybe we’ll agree with him. Maybe we won’t.”

There’s no update with the Quinn response. Imagine that.

* From the Illinois Republican Party…

In case you haven’t been following the story, here’s a brief summary:

The Better Government Association found one of the biggest agencies under Gov. Pat Quinn’s control – the Illinois Department of Transportation, or IDOT – has been skirting federal hiring guidelines.

IDOT jobs under Pat Quinn have gone to political insiders over qualified workers.

Michael Shakman is suing for access to documents and a federal hiring monitor to prevent more Quinn patronage.

Pat Quinn refuses to turn over thousands of hiring documents and won’t allow a federal hiring monitor.

Bruce Rauner has called on Quinn to withdraw his motion in federal court and allow a federal hiring monitor at IDOT.

4 Comments

|

“Instant responders”

Friday, Jul 25, 2014 - Posted by Rich Miller

* Phil Bradley…

Instant Responders

Driving up to Chicago we were the car behind the semi which slammed into a line of stopped cars, killing four people, including a young girl, and injured others. Had we been in front of him rather than behind, i am sure we would be dead.

This leaves images that are hard to shake. Thankfully, first responders arrived in droves, ambulances, seven fire engines, a dozen police cars and two Med-evac heliocopters.

But before all that, another image that, happily, stays as well.

After the crash there was a moment of total stillness and silence.

And then it happened. Suddenly there were guys running to the wreckage. The doors on truck cabs opened and guys jumped down and ran to the wreck. Guys got out of their cars and ran toward the diaster. Guys even stopped on the other side of the highway, climbed the divider fence and ran.

They all ran toward a tangle of cars that might explode and burn, and that was certain to be an horrific thing to see close up.

But all those wonderful guys just ran to it, to see if they could help, because it was the right, human thing to do.

When Sylvia’s Jeep flipped on 55 years ago, the same thing happened. Truckers rushed up and freed them from the vehicle long before anyone else arrived at the scene.

They are everywhere. Guys who take care of their neighbors because it is right. Guys whose first impulse is help because they see a need. The Instant Responders. God Bless them!

18 Comments

|

* After snidely whacking the “conservative savants” on his own newspaper’s editorial board, the Tribune’s always thoughtful John McCarron turns to Senate President John Cullerton for answers about how to deal with pension reform going forward…

His idea is to present them with a stark choice as their contracts come due for renewal: Workers could agree to a scaling back of the COLA they’ve been promised in retirement or forgo any pay raises while they’re still working.

“The state constitution,” said Cullerton, “does not guarantee pay raises.”

Cullerton predicts most workers nearing retirement will opt to keep their 3 percent COLA. But enough younger and middle-age workers will choose continued pay raises that will achieve more substantial long-term savings. Current retiree benefits wouldn’t be touched, and since 2011, new “Tier 2″ hires already have had their promised benefits reduced.

That’s actually brilliant. He’s done it again. Whether the state could get the union to agree to such a change without a strike is another story, but it’s probably worth a shot.

* And whether you agree with Cullerton or not, he’s offering up more insight and thought than we’ll ever possibly get from those afore-mentioned “savants,” one of whom throws up her hands in the Tribune today about the future of pension reform and Illinois…

Anyone want to go halvsies on a moving van? Last one out of Illinois, hit the lights.

Whatever.

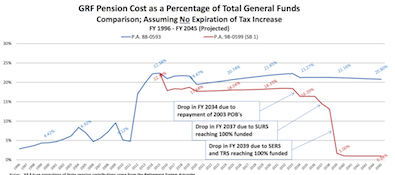

* From a March, 2014 report by the Commission on Government Forecasting and Accountability…

As I’ve been telling subscribers, we’re at the top of the Jim Edgar “ramp.” There is another significant bump up next year because the three biggest systems adjusted their ROI percentages after COGFA released its report, but then that’s pretty much it.

And, as is obvious by the chart, most of the pension reform law’s savings occur decades from now.

But the “savants” at the Trib (or anywhere else) will never tell you that. They’d rather just scare you into believing the worst without any actual facts. It’s utterly and despicably shameful. Not to mention that nobody will ever give up a sweet gig at the Mother Ship and move to Hoosierland or the equivalent because pension reform is in peril. The Trib loves its victimhood.

134 Comments

|

Here comes teh crazy - for real

Friday, Jul 25, 2014 - Posted by Rich Miller

* From Gov. Pat Quinn…

“Like so many Americans, I am deeply concerned about the welfare of the unaccompanied children who cross our nation’s southern border – especially those escaping violence, abuse, abandonment and human trafficking.

“Last week in Washington D.C., I met with U.S. Department of Health and Human Services Secretary Sylvia Burwell and let her know that the state of Illinois is prepared to help in whatever way necessary to preserve the well-being of these children. My administration will continue to discuss this important subject with other federal, state and local elected officials.

“I commend the Obama Administration for working with governors across our country toward a solution, and I join the President in calling on Congress to act.

“In times of trouble, we cannot forget that kindness to strangers and trusting in our faith will always help lead us to do the right thing.

“Leaders of conscience must cooperate to protect the vulnerable. Now and always, we have a responsibility to ensure all children are treated with respect, compassion and dignity.”

Bruce Rauner hasn’t yet issued a response. I’ll let you know what he says when I know.

76 Comments

|

Today’s quotable

Friday, Jul 25, 2014 - Posted by Rich Miller

* Wordslinger…

Here’s what I’ve come to believe: politicians claim so much credit for the good times, some people believe it. So when the bad times come, people blame them for that.

The poster boy is Daley. He was given an enormous amount of credit, locally and nationally, for economic growth that he had nothing to do with.

Meanwhile, he neglected or screwed up some of his core responsibilities, including fiscal stewardship.

Illinois was booming during most of Blago’s one-and-a-half terms. Does anyone believe that he had anything to do with it? The guy who sat around at home all day in his jogging suits, watching cartoons and dreaming up crooked scores?

North Dakota ain’t booming because of the governor there, whoever it is. Texas ain’t booming because of Rick Perry’s policies. If it was, MIssissippi would be booming, too.

It’s important to hold politicians to their core responsibilities of human services — something we neglect to do when we pretend they’re Big Daddies who can make everyone rich.

Don’t believe the hype of governors, or mayors, when they say they are creating jobs. Consumers create jobs, risk-takers create jobs, and the job of politicians is to do their limited-jobs and get out of the way.

Exactamundo.

33 Comments

|

Adventures in state-funded stupidity

Friday, Jul 25, 2014 - Posted by Rich Miller

* We’ve gotten so caught up in attempting to find “criminal” behavior in the governor’s botched anti-violence initiative that we’ve tended to ignore how ridiculous some aspects of the program actually were. From the BND…

One component of the program involved training residents of the communities, both parents and youths, to serve as “mentors” to their peers. The individuals were paid to provide mentoring to their peers, but the audit found that time-keeping records in many cases were non-existent or poorly maintained.

The advice given by the mentors also has been questioned. In one instance, a mentor gave advice to a mother about how to deal with a child who violated curfew.

“I told her to tell him that night is the prime time that youth get harassed and killed by the police,” the mentor wrote in his report.

The same mentor gave similar advice to another mother: “We talked about speaking with child about danger of being out on streets late, such as shootings, police brutality, influence of bad things from other peers,” the mentor wrote in his report.

Oy.

25 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|