* Speaker Madigan talked to reporters today. Here’s some of what he said…

We’re attempting to reschedule the meeting that was canceled by Gov. Rauner. We’ve suggested tomorrow at one o’clock. And my office has spoken with the other three leadership offices to reschedule the meeting of the four leaders that Gov. Rauner canceled one or two days ago.

I’ve reached out to the press people for the two Republican leaders to see what their response to this invitation is, but haven’t yet heard back. I’ll let you know.

*** UPDATE *** From Leader Durkin…

“With 6 days remaining in this fiscal year, I once again call upon Speaker Madigan to meet with me immediately to negotiate a resolution to the budget impasse. We are making good progress with workers compensation reform as a result of our Wednesday meeting. I believe we can resolve the unfinished areas in a collective manner. The work needs to be in the House and we should mirror the collaborative efforts performed in the Senate. As Senate President Cullerton told Rick Pearson on WGN Radio last Sunday, ‘Madigan and Durkin should do what Radogno and Cullerton did. Sit down and come up with a plan.’

We are past the point of having these Committees of the Whole. We just need to finish the job.”

* This is raw audio from Madigan’s availability and it doesn’t get going until about the 1:30 mark, so skip ahead. Many thanks to our buddy Dave Dahl for the file.

Madigan starts by sparring with the Illinois News Network’s Statehouse correspondent because the INN is a project of the Illinois Policy Institute…

Just for the record, I have lots of beefs with the Illinois Policy Institute, but their Statehouse guy Greg Bishop works hard and asks tough questions. He’s not a Republican Party operative, as Madigan more than just implied today. If he was, he’d be actively supporting or downplaying the governor’s proposed tax hikes. Instead, he’s one of the only Statehouse reporters who has written some in-depth stories on the governor’s actual proposals. You’d barely know the governor was backing a 33 percent income tax hike by reading most of the stories filed from Springfield this week.

22 Comments

|

* Press release…

Speaker Michael J. Madigan issued the following statement Saturday:

“At the request of Leader Durkin, House Democrats have agreed to postpone a vote on workers’ compensation legislation in the House Labor Committee and will continue working with our Republican colleagues to craft a bipartisan agreement.

“Throughout this budget crisis, Democrats have worked to find common ground and accommodate the requests of Republicans whenever possible. We’ve worked to move discussions forward by advancing legislation addressing the governor’s requests, including measures cutting property taxes, holding workers’ compensation insurers accountable to businesses, helping small and medium-sized employers succeed, reforming state procurement, selling the Thompson Center and improving the management of the Abraham Lincoln Presidential Library and Museum. We’ve also continually urged an ongoing dialogue on the budget and governor’s agenda. We will continue to do so in the hope that our good faith will facilitate the cooperation needed to pass a bipartisan budget.”

4 Comments

|

* Buried way down in today’s Tribune article is this sentence…

Also at risk is accreditation for some state universities after the Higher Learning Commission issued a letter warning that a continued lack of funding “places the higher education system of Illinois at considerable risk and is injurious to the very students the system purports to serve.”

* Here’s the letter…

June 22, 2017

To: The Honorable Governor Rauner Illinois Senate President Cullerton

Illinois House Speaker Madigan

Illinois Senate Leader Radogno

Illinois House Leader Durkin

Members of the Illinois General Assembly

I am writing to you on behalf of the Higher Learning Commission (HLC), the regional accrediting agency responsible for assuring the quality of colleges and universities for students in nineteen states, including Illinois. In this role, HLC also serves as a federally-recognized gatekeeper for student financial aid, including the more than $4 billion distributed to students in Illinois in 2016-17. I am contacting you because of HLC’s preeminent role in protecting students.

In February of 2016, I wrote to you with many of the same concerns about the lack of a state budget that I am going to reiterate today; however, these concerns have grown exponentially since that time. Sixteen months after my initial memo there remains no sustainable funding for higher education in Illinois. The continued lack of such funding places the higher education system of Illinois at considerable risk and is injurious to the very students the system purports to serve. As the accrediting agency tasked with assuring quality, I must warn you about the accreditation consequences of the failure to provide sustainable funding for Illinois higher education.

HLC has closely monitored Illinois institutions of higher education over the past two-and-a-half years and has observed the increasingly dire effects of this budget crisis. These include but are not limited to the following:

• Increased tuition and fees for students and loss of MAP money for needy students;

• Significantly declining student enrollments;

• Loss of faculty and staff and elimination of academic programs and services;

• Canceled capital projects and cuts to plant operations, further diminishing jobs; and,

• Depleted or diminished cash reserves and loss of grant and charitable donation income.

Institutions exhibiting these problems, regardless of cause, are still subject to HLC standards that require the availability of appropriate financial, physical, and human resources. When institutions no longer meet, or are at risk of not meeting these standards, HLC is obligated to implement its system of sanctions and public information to alert the public about the impact on educational quality; some institutions may ultimately face withdrawal of accreditation. Students attending institutions that do not have status with an accrediting agency recognized by the federal government cannot access federal financial aid.

You have the power to stop this spiral of diminishing quality of higher education in Illinois and the resulting accreditation consequences. I urge you to act immediately to fund higher education in Illinois. You have the future of thousands of Illinois college students in your hands. Do what is needed to ensure that they have a strong education in Illinois.

As you deliberate this most consequential decision, please contact me with any questions or concerns. Sincerely,

Barbara Gellman-Danley, Ph.D. President, Higher Learning Commission

Emphasis added.

25 Comments

|

Question of the day

Saturday, Jun 24, 2017 - Posted by Rich Miller

* We’ll get to the rest of this Sneed column tomorrow, so let’s just focus on this today…

(H)ow does Madigan handle stress?

“He handles it with . . . experience,” said Steve Brown, Madigan’s spokesman.

“Sure, there’s stress. But he always handles the rigors of the day by exercising on a regular basis. He keeps a stationary bike in his apartment in Springfield, just like he does at home. He has always had a very health-oriented diet. Chicken and fish. That sort of thing.

“Besides that, he does not go into a panic when someone on television lobs criticism at him!”

* The Question: How do you think Speaker Madigan “really” handles stress? Be creative, but follow the rules.

40 Comments

|

Your overtime session roundup

Saturday, Jun 24, 2017 - Posted by Rich Miller

* Tribune…

To some extent, what’s unfolding at the Capitol is following the same script as in years past. The governor and legislative leaders spend a few days both calling for compromise and accusing the other side of not being interested in negotiating one. Political messages are sent, daily news cycles tended to and pressure has to build before they sit down and reach a deal, even a temporary one. […]

Rauner put the blame on Democrats, declaring the majority party is operating in “bad faith.” Democrats, meanwhile, said it’s Rauner who’s playing games, contending that summoning lawmakers back to Springfield was a stunt designed to “deflect from his efforts to really not work on reaching an agreement.”

* Deb Robinson, the editor of the Canton Daily Ledger, speaks for many of us…

What is the solution?

I don’t know, but it’s not my job to untangle this mess and the people responsible for undoing the monstrosity aren’t doing it.

* And Bernie talked to some Statehouse tourists. I particularly enjoyed this take…

[Marvin Williamson] said he’s Republican, and wasn’t expecting a budget deal would get done this week.

Why?

“Because I don’t think they’re willing to get together,” he said. He didn’t think House Speaker Michael Madigan, D-Chicago, wants a compromise – which Madigan and Rauner both say they want.

“He’s had plenty of chances to get something done,” Williamson said.

But he also didn’t think anti-Madigan TV ads being run by Rauner’s campaign are helpful.

“I know he’s spending his own money, which is his right,” Williamson said. “But it seems to me that instead of spending money belittling the other side,” he could have spent “a lot more of his effort trying to get together with the other side rather than being obstinate to it.”

“They need to get their act together – start listening to each other,” he said.

* Related…

* Illinois in ‘Dire Straits’ and Leaders, Governor Can’t Even Agree to Meet

* Cullerton Calls Budget Special Session a ‘Political Stunt’

* Day 3 In Springfield: ‘Time For An Intervention,’ One Leader Says

* Gun Bill Bipartisanship But Far Apart on Budget

* Illinois Lawmakers Say Stakes Are High To Pass Budget In Special Session; Note Lack Of Activity

* Senate Democrats Urge Republicans To Compromise On Budget Deal

* Republicans propose new school funding plan: “The spring legislative session ended more than three weeks ago. Senator Barickman missed the deadline,” Manar said. “If his latest proposal was a final project, he’d earn an F because not only did he turn it in late, he showed up looking for his teacher after everyone had gone home and the school doors were locked for the summer.”

* Reeder: Yes, I’ve seen this before

2 Comments

|

Pritzker in the mailboxes

Saturday, Jun 24, 2017 - Posted by Rich Miller

* JB Pritzker isn’t just on TV now, he’s also sending campaign mailers. This one is apparently being targeted at women, according to people who’ve received it. Click the pics for larger images…

* And here’s the other one…

21 Comments

|

A junk bond rating won’t just hurt the state

Saturday, Jun 24, 2017 - Posted by Rich Miller

* Mark Brown warns of the coming junk bond rating for Illinois if nothing is done to end this impasse…

With junk-rated Chicago Public Schools now paying the state’s legal maximum of 9 percent interest on a portion of the borrowing it has relied on to keep the doors open, the school system’s options for further fiscal juggling keep shrinking.

Sadly, that’s always been what this fight was about: whether Rauner could leverage the worsening financial problems of the city’s schools to win political concessions from the Democrats who control the Legislature before the state’s own problems caught up with him.

The resulting impasse has wreaked havoc on the state’s universities and social service delivery system. But, as bad as things have been, they’re on the verge of getting even worse. […]

The state’s falling bond rating, coupled with its long-running structural deficit, are causing problems for governments across Illinois.

“This negative contagion means all cities, counties, school districts and universities throughout the state see lower ratings and higher borrowing costs,” John Miller, managing director of Nuveen Asset Management, told a legislative committee last month.

This so-called “Illinois penalty” is costing those governments an estimated $930 million a year in added debt service, Miller said.

And it’s only going to get much worse if the state falls further.

* Related…

* AP: Illinois could be 1st state with ‘junk’ credit due to budget

12 Comments

|

“Best case scenario” is a big August crisis

Saturday, Jun 24, 2017 - Posted by Rich Miller

* Vinicky…

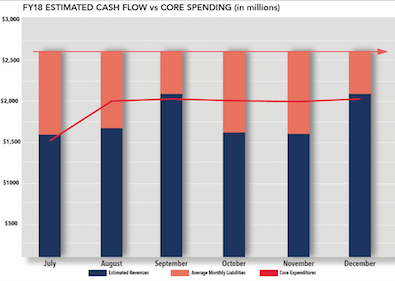

An updated “doomsday” picture offered by Comptroller Susana Mendoza warns that without a budget in place soon, come August she won’t be able to write checks to pay for the most basic of services, including state employee payroll, school funding and requirement debt service.

Illinois is already $15 billion behind on paying its bills, as payments for other services have been pushed aside for those and other core priorities as established by law and court orders.

“This has never happened before,” Mendoza said Friday after she privately briefed legislators on the scenario. “The situation couldn’t be more critical.”

* Finke…

[Comptroller Susana Mendoza] said Friday that in a “best-case scenario,” the state will fall $185 million short of what it needs to meet payments required by various court orders, consent decrees and state laws that have been responsible for the state to continue paying some bills in the absence of a full state budget [in August].

“We will no longer be able to fully comply with all of the court orders that determine payments in our core priority sectors,” Mendoza said. “This has never happened before.” […]

“In August, I will have zero flexibility,” Mendoza said. “I guarantee you nursing homes will close. I won’t be able to help them. I won’t even have enough money to make the core priorities that are mandated by the courts.”

Courts have ordered continued payments for some human services programs and for the state employee payroll. State law requires payments to pension systems and debt service. The state has also managed to keep current with state aid payments to schools, although reimbursements for things like transportation costs have fallen behind.

However, Mendoza said that in August, if nothing is done to resolve the budget stalemate, even school aid payments could be in jeopardy, not to mention what might happen if the state can’t make payments decreed by the courts.

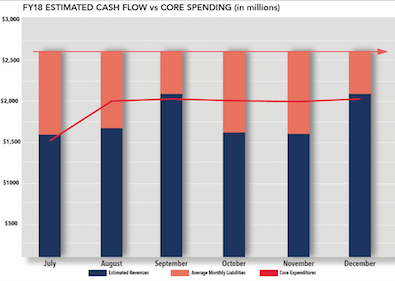

* Mendoza distributed this to House Democrats yesterday. That squiggly red line represents mandated core expenditures…

Click here for the full handout. Mendoza also gave it to Leader Durkin.

9 Comments

|

The Tribune editorial board rides to the rescue

Saturday, Jun 24, 2017 - Posted by Rich Miller

* Oy…

So: Has state government’s fiscal condition worsened under Rauner? Yes, it has, largely because he won’t go along with budget gimmicks and because he wants reforms that would give employers confidence in Illinois’ economic climate and future governance.

He won’t go along with budget gimmicks?

C’mon.

* For crying out loud, go back to his very first proposed budget. This is from the spring of 2015…

In a scathing report being released this morning, the Civic Federation, a Chicago watchdog group largely funded with corporate cash, says the new governor’s $31.5 billion operating budget does not add up and asserts that it could leave the state in worse shape than it was under former Gov. Pat Quinn. […]

For instance, it says Rauner’s budget assumes $2.2 billion in immediate pension savings from changes that have not yet even been introduced to the General Assembly, much less approved or run through a gantlet of probable legal challenges. “It is unlikely that the governor’s new reform proposal could be implemented in FY 2016, and the state’s fiscal condition would worsen if the savings were budgeted but not achieved,” it says. And passage of a possible constitutional amendment to clear the legal path is “not feasible” next year.

Also “unrealistic,” the report says, is a projected $655 million cut in spending on group health insurance for state workers—a reduction of about one-third. Similarly, cuts of hundreds of millions of dollars in Medicaid and other social welfare programs will require the approval of federal officials or federal judges. For instance, it says, a proposed $167 million reduction in support for young adults who were in the foster care system could run afoul of a 1991 consent decree requiring the state to provide such coverage.

And then, year after year, it only got worse. And his current budget proposal is full of things like magical pension savings and one-time fund transfers.

22 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|