* From the University of Illinois System’s Institute of Government and Public Affairs…

At the request of U of I System President Tim Killeen, IGPA assembled more than four dozen interdisciplinary faculty experts from the three system universities to serve on IGPA’s Task Force on the Impact of the COVID-19 pandemic. […]

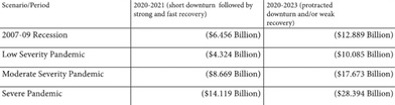

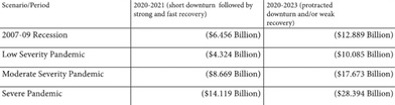

This first report, from the Economic and Fiscal Impact Group, draws comparisons to the 2007 to 2009 recession. The authors also used new, national models of the possible economic outcomes from the COVID-19 pandemic to project the potential impact on the three biggest sources of state revenues: individual income tax, corporate income tax and sales tax.

In all but the best-case scenario, the negative impact on state revenue is projected to be worse than during the Great Recession, from 2007 to 2009. Under the most severe model of a protracted downturn followed by a weak recovery after a severe pandemic, Illinois could lose more than $28 billion between calendar years 2020 and 2023.

Amanda Kass is a faculty leader on this project, so you know it’s good stuff. The full report is here.

* The chart…

Ain’t nothing good in there.

* Back to the release…

The COVID-19 crisis will also likely harm the finances of all local governments: counties, municipalities, school districts, transit agencies and special districts.

Declines in state revenues, which are shared with local governments, are especially concerning because municipalities in Illinois are more reliant on state revenues than municipalities in most other states.

As state revenues drop, spending on public health and human services is expected to increase. The biggest impact on spending is expected to be a several-billion-dollar increase in Medicaid expenditures.

Market volatility could have a negative impact on pension funds, causing state and local governments to see increases in required annual contributions. But these increases will be somewhat delayed.

“It is too early to precisely quantify the fiscal gap that is likely to be created by reductions in state revenue and increases in the cost of delivering state services, but we believe that it will almost certainly cost billions of dollars and possibly cost tens of billions of dollars,” the report says.

The authors note that the recently approved federal stimulus package will likely fall short in some key ways. For instance, the increase in federal matching funds for Medicaid is much smaller than the enhanced match Congress approved as part of the response to the 2007 recession.

The report emphasizes there will be no easy answers, but suggests that policymakers focus on five basic principles: transparency, protection of the vulnerable, economic efficiency, minimizing borrowing for operating purposes and flexibility.

* In other news…

Oy.

* Meanwhile the Federal Reserve today announced a new $500 billion Municipal Liquidity Facility…

Facility: The Municipal Liquidity Facility, which has been authorized under Section 13(3) of the Federal Reserve Act, will support lending to U.S. states and the District of Columbia, U.S. cities with a population exceeding one million residents, and U.S. counties with a population exceeding two million residents. Under the Facility, a Federal Reserve Bank will commit to lend to a special purpose vehicle on a recourse basis. The SPV will purchase Eligible Notes directly from Eligible Issuers at the time of issuance. The Reserve Bank will be secured by all the assets of the SPV. The Department of the Treasury, using funds appropriated to the Exchange Stabilization Fund under section 4027 of the Coronavirus Aid, Relief, and Economic Security Act, will make an initial equity investment of $35 billion in the SPV in connection with the Facility. The SPV will have the ability to purchase up to $500 billion of Eligible Notes.

Eligible Notes: Eligible Notes are tax anticipation notes (TANs), tax and revenue anticipation notes (TRANs), bond anticipation notes (BANs), and other similar short-term notes issued by Eligible Issuers, provided that such notes mature no later than 24 months from the date of issuance. In each case, a note’s eligibility is subject to review by the Federal Reserve. Relevant legal opinions and disclosures will be required as determined by the Federal Reserve prior to purchase.

Eligible Issuer: An Eligible Issuer is a State, City, or County (or an instrumentality thereof that issues on behalf of the State, City, or County for the purpose of managing its cash flows), in each case subject to review and approval by the Federal Reserve. Only one issuer per State, City, or County is eligible.

Limit per State, City, and County: Limit per State, City, and County: The SPV may purchase Eligible Notes issued by or on behalf of a State, City, or County in one or more issuances of up to an aggregate amount of 20% of the general revenue from own sources and utility revenue of the applicable State, City, or County government for fiscal year 2017. States may request that the SPV purchase Eligible Notes in excess of the applicable limit in order to assist political subdivisions and instrumentalities that are not eligible for the Facility.

Pricing: Pricing will be based on an Eligible Issuer’s rating at the time of purchase with details to be provided later.

Origination Fee: Each Eligible Issuer that participates in the Facility must pay an origination fee equal to 10 basis points of the principal amount of the Eligible Issuer’s notes purchased by the SPV. The origination fee may be paid from the proceeds of the issuance.

…Adding… Press release…

Today, Rep. Raja Krishnamoorthi (IL-08) led congressional delegation letters to House Speaker Nancy Pelosi, House Minority Leader Kevin McCarthy, and U.S. Treasury Secretary Steven Mnuchin calling for immediate aid to state, local, tribal, and territorial governments to address surprise revenue shortfalls.

The letters were joined and signed by each Democratic member of the Illinois congressional delegation: Reps. Bobby Rush, Robin Kelly, Dan Lipinski, Jesus “Chuy” Garcia, Mike Quigley, Sean Casten, Danny Davis, Jan Schakowsky, Brad Schneider, Bill Foster, Lauren Underwood, and Cheri Bustos in addition to Rep. Krishnamoorthi.

“State and local balance sheets across the country are dipping into the red as billions of dollars are being lost from unexpected revenue shortfalls,” said Congressman Raja Krishnamoorthi. “The $150 billion provided to state and local governments in the CARES Act was a good start, but more needs to be allocated for places that are hit hardest by the public health and economic impacts of this crisis. This is an issue that is harming the physical and financial health and safety of state and local governments, their employees, and their constituents, and one that must be addressed in our next COVID-19 legislative package.”

Forcing states and cities to accommodate dramatic budget shortfalls, which are exacerbated in part by lost tax revenues due to halting economic activity, could lead to widespread, disruptive reductions in public services, delayed improvement projects, and a slower economic recovery. Below are some examples of cities and states across the country that are expecting revenue shortfalls:

· New York Governor Andrew Cuomo recently predicted a state revenue shortfall of up to $15 billion.

· Ohio Governor Mike DeWine recently told his cabinet members to prepare for up to 20 percent cuts to agencies for the next 15 months.

· Illinois’ Commission on Government Finance and Accountability recently predicted a potential 20 percent decrease in state revenues over the next few fiscal years.

· Cities across the country, from Phoenix to Houston to Philadelphia, are similarly grappling with difficult budget decisions unforeseen just a few short months ago.

In the letters, the undersigned Members of Congress asked that the “State and Local Coronavirus Expenditures Relief Fund” within the CARES Act be expanded to allow state and local governments to replenish lost revenue as a qualifying expenditure, or that Congress authorize the creation of a new fund to provide direct aid to state and local governments with fewer restrictions. They express that either option must allow greater flexibility in how the funds are spent and include robust funding at a level that will meaningfully alleviate the fiscal problems faced by state, local, tribal, and territorial governments across the country.

- OpentoDiscussion - Thursday, Apr 9, 20 @ 12:54 pm:

Yes, the Medicaid budget has the potential to destroy all other state programs.

Over the past several decades it has been the leading reason for ever rising state in state expenditures- until the last decade when pensions costs have also been huge.

The Medicaid program was began as joint state/federal program. That was a big mistake.

Such federal legislation should have made it a strictly federal program. It has been an albatross for states from the beginning and has escalated over time. And it is the real reason that State budgets across the nation have struggled even with ever greater tax increases.

You would think the Governors would have noticed this at some point in the last five decades and have insisted that this program be 100% federal. But so far they are quite ‘mum’ about an issue that has swamped their budgets.

- Socially DIstant Watcher - Thursday, Apr 9, 20 @ 12:57 pm:

@ Open: There is certainly a discussion to be had about how the feds can fund programs more. Medicaid, health care, education, you name it, the feds have more spending capacity than the states do, and spending is what we all need to get us through this.

- OpentoDiscussion - Thursday, Apr 9, 20 @ 1:16 pm:

Socially DIstant Worker,

Thank yo for your comment.

I would like it to be made clear that I do not advocate an expansion of federal spending on many government duties.

Education is a State responsibility. The FEDS role should be extraordinarily limited. As to overall “health”, and if that you mean a national takeover of all health care in the nation, again, that has not been a federal program although there is certainly debate about that issue.

But when there is federal legislation for programs it should be be funded by them. This filter down to states, often with prescribed mandates, must stop!

- City Zen - Thursday, Apr 9, 20 @ 1:27 pm:

How do we re-amortize our way outta this one?

- Former Peorian - Thursday, Apr 9, 20 @ 1:33 pm:

>

I think you mean “paper money printing capacity” - the Feds can just print money. States cannot.

- CapnCrunch - Thursday, Apr 9, 20 @ 1:34 pm:

Money really does grow on trees.

- Bubble Popper - Thursday, Apr 9, 20 @ 1:36 pm:

Every state will be in this position. There’s no way to fix it except a massive federal bailout funded by aggressive taxation of the rich.

- JB13 - Thursday, Apr 9, 20 @ 2:40 pm:

The need for sacrifice is coming. How much will be shared, and by whom?

- Mr. K. - Thursday, Apr 9, 20 @ 2:46 pm:

I imagine Rauner is smiling. This is what he expected, what he (possibily?) wanted, and what he knows “Illinois needs” — especially if it means unions folks out of work.

My question: where is Rauner’s charity now that we need it? I assume he’s donating anonymously — and we’ll never know. And that’s fine.

But please don’t tell me he’s in his Randolph St. penthouse — or in Montana — hiding out, sipping wine, and waiting this out.

Tell me, please, he’s engaged — and helping his beloved state.

- filmmaker prof - Thursday, Apr 9, 20 @ 3:14 pm:

Amanda Kass is not a member of the faculty. Therefore, it is incorrect to refer to her as a faculty leader. Just saying.

- Steve - Thursday, Apr 9, 20 @ 3:16 pm:

If Illinois is $28 billion short in the coming years: it’s hard to make an argument that anyone’s taxes can be cut.

- Rich Miller - Thursday, Apr 9, 20 @ 3:49 pm:

=== Therefore, it is incorrect===

It is correct. Don’t be that actually guy.

From the study…

Faculty Leads: Amanda Kass, IGPA Affiliate; Associate Director, Government Finance Research Center, University of Illinois at Chicago

Now, go take a nap.

- ArchPundit - Thursday, Apr 9, 20 @ 4:29 pm:

A faculty meeting breaks out in comments. Outstanding.

Public universities are reporting very low FAFSA completion–down something like 30 percent. That’s a fairly good proxy for applications and such. This is going to hit colleges and universities hard.