|

Comments Off

|

Question of the day

Friday, May 3, 2019 - Posted by Rich Miller

* Left to right: Former Chicago Bulls star and NBA World Champion Horace Grant, Senate Republican Leader Bill Brady, former Chicago White Sox player and White Sox World Series manager Ozzie Guillen and Chicago Bulls and White Sox Chairman Jerry Reinsdorf…

* The Question: Caption?

25 Comments

|

|

Comments Off

|

Our sorry state

Friday, May 3, 2019 - Posted by Rich Miller

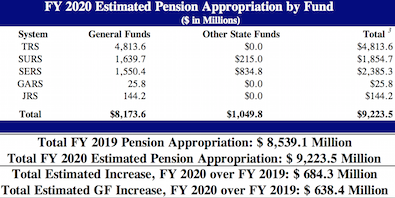

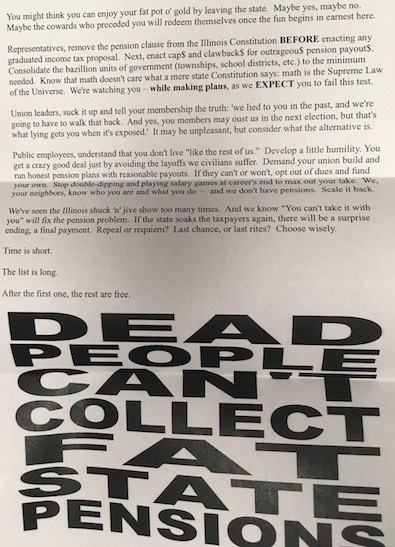

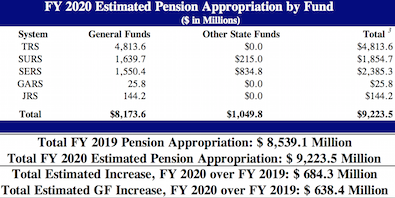

* COGFA looks at the ramp…

If the State continues funding according to Public Act 88-0593, the projected accrued liabilities of the State retirement systems will increase from $229.3 billion at the end of FY 2019 to $331.0 billion at the end of FY 2045. At the same time, the projected actuarial value of assets is projected to increase from $92.5 billion to $297.9 billion. Consequently, the projected unfunded liabilities are projected to decrease from $136.8 billion at the end of FY 2019 to $33.1 billion at the end of FY 2045, and the projected funded ratio is expected to increase from 40.3% in FY 2019 to 90.0% by the end of FY 2045. All of the projected figures in this paragraph come from the various systems’ actuaries and are predicated upon the State making the necessary contributions as required by law.

Remember that last sentence.

* This is based on current statutory requirements…

The governor has proposed lowering that FY20 payment by almost $900 million, but Amanda Kass puts the actual figure at about $1.1 billion. And this is every year for seven years.

* According to COGFA, the pension funds currently have assets totaling $89.8 billion. But…

Over the last 24 years [since fiscal year 1995], the State of Illinois has appropriated $91.8 billion to the five retirement systems

So, the pension funds currently have $2 billion less than the state has put in, and we most definitely didn’t start at zero in 1995.

Ugh.

* And while the unfunded liability percentage dropped a tiny bit over the past fiscal year, the dollar amount increased…

Despite a roaring stock market, combined unfunded liabilities in the state’s five pension funds rose again and hit a record $133.5 billion in the year ended June 30. […]

According to the Commission on Government Forecasting and Accountability, the difference between what the state has set aside for retirement benefits and what it has committed to pay (the unfunded liability) rose $4.8 billion in fiscal 2018, up 3.7 percent from the prior year. […]

There are some small bits of good news in the report.

One is that the funded ratio of the funds actually ticked up from 39.8 percent to 40.2 percent. But it’s still below what it was in 2011, with huge gains in the equity markets since then.

Another dollop of good news is that the amount being paid out by funds in benefits seems to be leveling off. But it’s not clear whether that will continue.

18 Comments

|

Pols behaving badly

Friday, May 3, 2019 - Posted by Rich Miller

* WBEZ…

John Coli Sr., the former Chicago-area union boss who was influential in Democratic politics and was an early backer of Chicago Mayor Rahm Emanuel, is scheduled to change his not guilty plea in his federal corruption case, according to new court records.

Coli’s change of plea hearing in his extortion and tax fraud case is scheduled for June 4 in front of Judge Rebecca Pallmeyer.

It’s not yet clear what the terms of a possible plea deal could be. Neither Coli’s lawyers nor a spokesman for the U.S. Attorney’s Office in Chicago immediately responded to WBEZ’s requests for comment.

Federal prosecutors allege Coli used his former leadership position at Teamsters Joint Council 25 to get $350,000 in kickbacks from two firms. One was the Chicago film studio Cinespace, a one-time state grant recipient where a series of network television programs are filmed, including NBC’s Chicago Fire and Fox’s Empire. The government accused Coli of threatening work stoppages and labor unrest at the studio, which employs Teamsters members, unless Cinespace paid him off.

Prosecutors accuse Coli of then lying on his income taxes and on labor documents to cover up the scheme.

A classic old-style union shakedown.

* Meanwhile…

State Rep. Steven Reick was charged Wednesday with driving under the influence of alcohol in Sangamon County, online court records show.

Reick was charged with driving under the influence of alcohol and driving with a blood-alcohol content greater than 0.08%, according to Sangamon County online court records.

The charges were filed by Illinois State Police, who would not immediately provide further details Thursday evening on Reick’s arrest.

A representative with the Sangamon County Jail said Reick was released about 2:15 a.m. Thursday with a notice to appear in court later this month.

* Looks like he was heading back to his hotel…

State Police also issued tickets alleging that Reick was traveling 15 to 20 mph above the speed limit, and committed a turn-signal violation.

State Police could not immediately be reached for details, but WCIA-TV reported Reick was arrested at the intersection of South Grand Avenue and Eastdale Drive about midnight. […]

Reick issued a one-sentence statement Thursday evening via a spokeswoman: “I made a stupid and regrettable decision last night and accept full responsibility for my actions.”

16 Comments

|

It’s just a bill

Friday, May 3, 2019 - Posted by Rich Miller

* The problem with stories like this (and we see these sorts of stories all the time) is that the quoted “critics” will never be in favor of the legislation no matter what changes are made. They’re not critics who can be swayed or even who want to be swayed.

And while it is important to hear the perspective of “Heck No” votes and addressing some of their concerns could help convince members who haven’t yet come to a conclusion, Rep. Flowers has already made up her own mind about this bill…

The chief sponsor of a Senate bill to tax and regulate adult use of recreational cannabis is answering some of the concerns raised by critics. […]

State Rep. Mary Flowers, D-Chicago, said she has concerns for her community.

“I don’t see where the community is going to benefit and quite frankly I don’t see where the state is going to benefit,” Flowers said. […]

Flowers said she’s worried about the possible social costs.

State Sen. Heather Steans, D-Chicago, said Flowers’ concerns are legitimate. However, she said legalization isn’t an endorsement.

“What it does do is say ‘we know that people are getting a safe product and you know that they’re now going to card people or to make sure that they’re not under 21 [years old], so you’re really limiting it,” Steans said.

* Not mentioned in this column is, right or wrong, the bill passed the Senate unanimously last month…

Illinois gardeners, growers and landscapers are ready for spring.

With the “last frost” date approaching for most of the state, planning, building, tilling and planting will soon be in full swing.

But hold on …

You got a license for that?

A bill passed out of the Illinois Senate would create a new hedge maze for anyone with a green thumb. It’s an unfortunate example of just how confusing and unnecessary new licensing regimes can be. And unsurprisingly, it’s being pushed by a special interest group looking to grow its own bottom line.

Senate Bill 1899 says that anyone working in the field of landscape architecture must obtain a special license from the state. That means passing an exam, and you’ll need to jump through some high hoops just to take it.

* Related…

* Coal, nuclear interests spar at Senate committee hearing: “Illinois ratepayers will be compelled to buy what amounts to be the most expensive megawatt hours under the guise of a clean energy market that isn’t a market at all,” she said, adding that FERC has not yet officially made the capacity market changes Exelon has written the bill to address.

* Sen Plummer sponsors resolution rescinding 1861 Corwin Amendment

15 Comments

|

* Press release…

U.S. Representative Robin Kelly, along with Illinois House Speaker Mike Madigan and 52 south suburban officials, sent a letter to Governor JB Pritzker requesting his support for the South Suburban Airport (SSA) and surrounding infrastructure.

“The time has come to finally build the South Suburban Airport. We know it will create thousands of good-paying jobs, boost our economy and allow Illinois to reclaim its aviation pre-eminence,” said Congresswoman Kelly

The lawmakers wrote: “Just as Midway and O’Hare spearheaded Illinois’ growth for the past century, SSA will be a cornerstone for prosperity in the 21st Century…As proposed, it will create an economic engine south of Chicago that would generate tens of thousands of jobs, hundreds of millions in annual tax revenues, and billions in new economic activity for Illinois.”

They continued, “Chicago is the largest US market without three airports;” adding that New York, Washington, Miami, Los Angeles and San Francisco each have three major airports.

Acknowledging that airports take decades to plan and rarely happen, officials wrote: “Thanks to the bipartisan efforts by five governors over decades, Illinois has secured the key components – land assemblage, legislative authority, and broad business, labor and political support.”

The FAA first urged Chicago to build a third airport in 1985. Due to capacity constraints, the city has been losing cargo and passenger market-share to places like Denver and Dallas for 20 years.

Kelly and lawmakers also urge the Governor to “apportion $150 million in the 2020 capital bill for initial off-site improvements—a new interchange on I-57, local road upgrades, and connectivity to utilities.” The actual airport, near Monee, will be financed with private dollars.

The letter was signed by three members of Congress; 14 state legislators, including Speaker Madigan; 29 mayors; four Chicago aldermen; two Cook County commissioners and two mayors-elect who represent Cook, Will and Kankakee counties.

The letter is here.

29 Comments

|

Senate’s gonna Senate

Friday, May 3, 2019 - Posted by Rich Miller

* First up…

OK, that’s just silly, mainly because no rate bill had ever passed in the first place. It was just numbers on a piece of paper and the package was always up for negotiation before passage. Also, the Senate only raised the rates on the highest brackets.

Even so, the Senate Dems walked right into that simplistic rhetorical punch.

* And now this…

The following statement was issued Thursday by Illinois House Progressive Caucus Reps. Ammons (co-chair), Guzzardi (co-chair), Mah (co-chair), Villanueva (treasurer), Ramirez (secretary), Cassidy, Gabel, Harris, Mason, Moeller, Ortiz, Robinson, Stava-Murray, and West.

“We strongly disagree with the passage of SB 689.

“Our state is finally trying to fix its deeply unfair tax policy. We are finally asking the wealthy to pay their fair share in funding the basic operations of government. A $300 million tax cut to the estates of the super-rich is a move in precisely the opposite direction.

“We urge our colleagues to join us in opposing this giveaway to the wealthy few.”

* One Illinois…

Senate Democrats said the estate tax “has increasingly been an issue in agriculture communities across Illinois.” Yet economists, such as Thomas Piketty in his book “Capital in the 21st Century,” have argued that it’s one of the most effective methods of addressing income inequality and leveling the economic playing field between rich and poor. […]

[Representatives in the Progressive Caucus who signed the statement opposing SB689] might well ask whom the compromise is meant to appease. Senate Minority Leader Bill Brady of Bloomington voted against SB689, as did Sen. Chuck Weaver of North Peoria.

Just last month, Weaver joined in a debate with Guzzardi and Sims on the “fair tax” at the City Club of Chicago, and when Guzzardi argued that the rich weren’t fleeing the state because of taxes, and that the state was actually encouraging seniors to move here by not taxing retirement income, Weaver countered that they were leaving Illinois because of its estate tax.

22 Comments

|

* I’m not totally sure what the “smart money” is saying right now, but here’s the Tribune’s take…

The smart money says that if Illinois lawmakers are going to legalize sports betting this spring, it’s going to be part of a larger gambling expansion deal that also includes new casino licenses and expanded betting options at horse tracks.

Democratic Gov. J.B. Pritzker did not want to squander the opportunity to bring in new state revenue through legalized sports betting, made possible by a U.S. Supreme Court ruling last year, by tying the issue to the parochial gambling debates that have failed to produce an agreement for the better part of a decade. The governor is counting on more than $200 million in sports betting revenue in his spending plan for the budget year that begins July 1.

But with their scheduled May 31 adjournment approaching, lawmakers are faced with the reality that winning broad support for a sports betting bill likely will require resolving issues they’ve been kicking around since then-Gov. Pat Quinn in 2013 vetoed the last gambling expansion bill passed by the General Assembly. Because Pritzker has placed such a high priority on sports betting, all sides see it as leverage to achieve their long-sought goals.

* The speculation kicked into high gear yesterday when Mayor Emanuel’s people weighed in. Here’s the take from Tony Arnold at WBEZ…

At a House committee hearing Thursday, a lobbyist for the mayor’s office testified that the city would support Pritzker’s call for legalized sports gambling as part of a bill that would allow for a Chicago-run casino.

“The city of Chicago supports sports wagering and the legalization of it within a comprehensive amendment that provides for a publicly-owned Chicago casino license,” said Derek Blaida, a lobbyist for the city of Chicago.

The city’s request is in line with a controversial speech Emanuel gave in December about solving the city’s underfunded pension crisis. He urged state lawmakers to approve a Chicago casino to help prop up City Hall’s massively underfunded retirement systems. Per state law, any revenue from a Chicago casino is supposed to go toward the police and fire pensions. […]

Pritzker warned against this exact approach less than three months ago in his budget address to lawmakers. Saying previous attempts to expand gambling in Illinois failed because they would “get bogged down in regional disputes and a Christmas tree approach,” Pritzker called sports betting “different” since it was only recently legalized by the U.S. Supreme Court.

It’s unclear if tying a Chicago casino to Pritzker’s legalized sports gambling push has the blessing of Mayor-elect Lori Lightfoot, who takes office May 20. A spokeswoman did not immediately respond to WBEZ’s request for comment. Lightfoot voiced support for a city-run casino during the campaign.

To put this in context, the House and Senate have nine scheduled session days between now and the day Lightfoot is sworn into office at noon on May 20th. And one of those days is a Friday without an official deadline, which are often canceled. There are, on the other hand, 12 session days scheduled starting on May 20th.

In other words, Rahm’s ability to influence the process is waning fast. This deal likely won’t be cut until he’s out of office.

I reached out to Lightfoot’s transition team this morning and haven’t yet heard back.

* But Chicago isn’t the only city pushing for a casino. Rockford and Danville, along with towns in the counties of Lake, Williamson and south suburban Cook all want licenses.

And then there’s the horse racing industry, which wants a slice of the gaming pie…

“Racing will only succeed in those areas where income through gaming coincides with commissions on horse racing,” said Mike Campbell, president of the Illinois Thoroughbred Horsemen’s Association, which represents the labor side of horse racing.

Such revenues could come from a measure proposed in last year’s gambling bill that would have allowed video gambling and table games at racetracks, turning them into racinos. […]

Tony Petrillo, president of Arlington Park, said he’d like to see lawmakers focus on passing sports betting legislation first, because trying to incorporate too many interests in a comprehensive gambling bill might leave racetracks with the same outcome as last year – nothing.

“While [sports betting] is not the answer to our overall problems, we feel it can reach and expand our customer base until those big gaming issues are worked out,” Petrillo said.

Clear as mud.

12 Comments

|

Pension buyouts begin, another in the works

Friday, May 3, 2019 - Posted by Rich Miller

* SJ-R…

“We were surprised at the level of participation,” said Tim Blair, executive director of the State Employees Retirement System that covers state workers. “We thought it would be somewhat lower because we thought the 3 percent compounded COLA was a very attractive part of the benefit package that people would want to keep that.”

Under the COLA buyout plan, participants in the pension fund can agree to give up the 3 percent compounded annual raises they get in their pension benefits. Those people would still receive an increase in their pension benefits, but it would only be 1.5 percent annually and not compounded.

In exchange, those people would be eligible for a cash payment that would be made to them now. The state would calculate the difference in benefits a person would receive with the 3 percent annual increase and the 1.5 percent increase and a person could get 70 percent of that amount placed in an alternative retirement vehicle.

Blair said that since the plan went into effect at SERS Dec. 1, there were 1,700 people who retired. Of those, 402 opted to take the buyout program. The payouts average $100,000 per person, Blair said, although the range ran the gamut from a couple of thousand dollars to $400,000.

The payouts will cost the pension system $37.7 million, although the systems are expected to save money in the long run by paying smaller annual raises. Studies have shown the annual 3 percent compounded raises are the biggest reason for ongoing increases in pension costs. Money for the payments will come from bonds the state is issuing, although not all of the bonds have been issued yet.

* More…

“We offer two buyouts,” state Rep. Robert Martwick, D-Chicago, said. “One is what’s called vested and active and that’s someone who’s worked for a while and just left government service and they just buy out their whole pension. So that’s No. 1. No. 2 is the [cost of living allocation or] COLA buyout where they can sell their three percent compounded COLA for a one and a half percent simple COLA and a lump sum payout.” […]

Martwick said there are plans for an annuity buyout.

“So they could sell a portion of their annuity, so any amount of their annuity which exceeds the maximum Social Security benefit and still keep their compounding COLA so it’s an easier calculation, it would be easier to administer and probably easier to understand for the retiree,” Martwick said. “And it creates an option so they can say, ‘should I keep my annuity and sell a portion of my COLA or keep my COLA and sell a portion of my annuity,’ and again more options means greater participation.”

25 Comments

|

*** UPDATED x1 *** Our sorry state

Friday, May 3, 2019 - Posted by Rich Miller

* Gov. Bruce Rauner deliberately slow-walked this process, but the Pritzker administration is in charge now…

As of March 15, more than 112,000 Illinois Medicaid applications remained unprocessed beyond the 45-day limit the federal government puts on those eligibility determinations.

The federal Center for Medicare and Medicaid Services has warned state officials that Illinois is out of compliance with regulations on timely determinations of eligibility for the federally funded program to provide health coverage for low-income people and asked how they plan to fix that, records show.

If a case is delayed past the federal time limit, Illinois Medicaid applicants are supposed to be able to get cards granting them temporary medical benefits. But those also are backlogged. The state’s Medicaid application-processing delays and failure to issue temporary medical benefits have left some of Illinois’ poorest residents without access to health care, in some cases for more than a year.

Illinois provided no temporary medical benefits at all between June 2016 and September 2017, state Department of Human Services records filed in federal court show. […]

Charlotte Brown, who works for Christopher Rural Health in southern Illinois, said most Medicaid applications in her part of the state are processed within two weeks but that it often takes months to get newborns added to their mothers’ Medicaid cases.

That’s just ridiculous. How would a newborn not qualify if their moms already did?

* Promises…

Jordan Abudayyeh, a spokeswoman for Gov. J.B. Pritzker, said: “It is unacceptable that people across the state are waiting for healthcare coverage, and he has directed the administration to take immediate steps to address this problem from the previous administration.”

In a written statement, the heads of the Illinois Department of Healthcare and Family Services and the Department of Human Services said: “Our departments are working together closely to bring on more workers to process applications and redeterminations, as well as training and technical experts to support front-line staff.”

*** UPDATE *** From Meghan Powers at the Illinois Department of Human Services…

We’ve made a lot of progress in the last two months and newborns are now being added to their mothers’ cases in a timely manner. We have eliminated the backlog of more than 26,500 newborn applications.

10 Comments

|

* Rick Pearson takes a look at the Senate’s property tax freeze proposal…

First, it would only happen if voters ratify that proposed graduated-rate income tax amendment to the Illinois Constitution. And, it would only take effect if the state shouldered more of the overall funding for education in Illinois — including funding special education, transportation, free and reduced meal programs and other mandated categorical programs. The state also would have to meet its decadelong commitment to boost funding for the new general state aid formula by $350 million a year.

That means a state price tag of at least $650 million for the state budget that takes effect July 1, 2021. If the state doesn’t meet recommended funding levels, as lawmakers and administrations have failed to do repeatedly over the years, the freeze melts. […]

But a March study by the progressive-leaning Center for Tax and Budget Accountability showed the process of the state assuming a much larger share of funding for schools is still far away, even after enacting a new general state aid funding formula and making the first $350 million deposit last year. The center did not factor in potential new dollars from a graduated-rate tax.

The center cited the State Board of Education in saying the $7.89 billion state appropriation to public schools for the 2018-19 school year was $7.35 billion short of the legislature’s adopted Evidence-Based Funding for Student Success Act. Evidence-based funding is considered the best practice in school funding because it ties the dollar amount taxpayers invest in schools to educational practices that research shows enhance student achievement over time, the center said.

While the new statute commits the state to fully funding the formula by June 30, 2027, the center said the promised $350 million in additional school funding each year will not be enough to meet the full-funding goal.

Categoricals have not been fully funded since… I don’t know when.

11 Comments

|

Mixed bag at biz lobby day

Thursday, May 2, 2019 - Posted by Rich Miller

* Gov. JB Pritzker spoke to the annual IRMA-IMA lobby day yesterday. And while sharp differences exist, they did their best to publicly try and get along…

The governor criticized the former administration for leaving the state in what he called a “dire fiscal situation”.

“After years of neglect, Illinois is finally getting its mojo back and we’re open for business,” he told a room full of business leaders from the Illinois Manufacturer’s Association and the Illinois Retail Merchants Association in Springfield.

Pritzker said his graduated income tax idea is the best solution to dig the state out of a $3.2 billion structural deficit. “There are people here, I know, who disagree with me about this proposal, and that’s in our democracy. But to be clear, doing nothing is not an option.” […]

Despite disagreeing on certain issues, Rob Karr, president and CEO of the Illinois Retail Merchants Association, said he welcomes the communication with Pritzker —something that wasn’t readily available with the previous administration.

“There are clear policy objectives that they [Pritzker’s administration] want to accomplish that we’re just simply not going to agree on – the graduated income tax being one of those. But there are other issues being discussed where we are clearly heard and listened to,” he said.

* Bernie…

MARK DENZLER, president and CEO of the IMA, said the organization has a long history of working with governors from both major parties.

“We didn’t always agree with Governor Rauner,” he said. “We’re not always going to agree with Governor Pritzker.” And while strongly disagreeing with the $15-per-hour minimum wage by 2025 already passed this year, and despite similar opposition to the progressive income tax, Denzler said the group likes Pritzker’s backing of workforce development, research and education.

ROB KARR, IRMA president and CEO, said there is “clear, open communication” with the Pritzker administration.

* But as Brenden Moore reports, it wasn’t all rainbows and unicorns…

“I think he thinks this is the best way to solve the state’s issues,” said Rob Karr, president of the IRMA. “Our problem is that as an association — we have twice in the past supported income tax increases, we have also put forward other ideas that would modernize our tax system and draw in more money from the state — we’re not convinced that the graduated income tax is in fact the way to go.”

IMA president Mark Denzler characterized Pritzker’s position and the Senate’s vote as “yet another sign that Illinois politicians are more concerned with increased spending rather than meaningful solutions to curtail costs, address growing property taxes, tackle ballooning pension debt and adopt reforms that make it easier for businesses to create jobs.”

Members of the business groups immediately following the governor’s address and those listening to a panel discussion on the graduated income tax later that afternoon expressed skepticism of the merits of a progressive tax and frustration with the possibility of having a higher tax burden.

“We cannot go quietly into the night,” said Jim Havey, president of Young’s Security Systems in Springfield. “We must continue to ensure that policymakers understand that there are consequences for their actions, to making Illinois even less job-creator friendly, and that we are a large and diverse state, we’re not just Chicago.”

* And…

SWD Inc. President Rick DeLawder, who is also a board member for the Illinois Manufacturers’ Association, said that will hurt his business.

“My income tax may look like I’m making a whole bunch of money, however, it’s actually flowing through from the business,” DeLawder said. “[Taxing that at higher rates] is a big problem on a personal level that I have.”

26 Comments

|

[The following is a paid advertisement.]

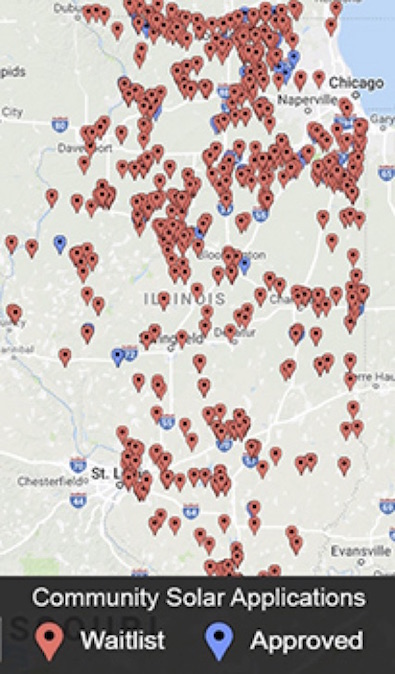

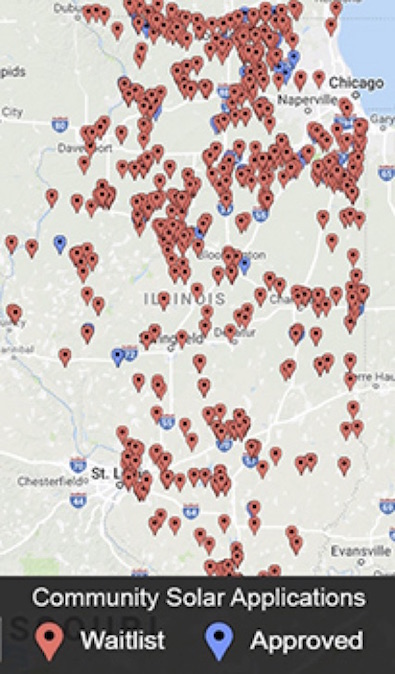

More than 800 solar energy projects are on hold because Illinois’ renewable energy program isn’t adequately funded to meet either current demand or the statutory renewable portfolio standard requirement of 25% by 2025.

The waitlisted, shovel-ready projects could create thousands of jobs, lower consumer electric bills and generate $220 million in property tax revenue for local governments. Funding for new commercial and community solar projects and wind farms will be depleted after 2019.

To see projects on the waitlist in your community – visit www.pathto100.net/waitlist

Without a fix to the state’s renewable energy program, waitlisted projects may not be built.

Vote YES on HB 2966/SB 1781 to fix Illinois’ clean energy cliff and let shovel-ready projects move forward.

For more information, please visit pathto100.net

Comments Off

|

Question of the day

Thursday, May 2, 2019 - Posted by Rich Miller

* SJ-R…

For a third time the state-owned James R. Thompson Center government building in downtown Chicago is on Landmarks Illinois’ Most Endangered Historic Places list. […]

“A troubling trend with this year’s Most Endangered sites is the number of historic places that face demolition despite strong and active community support for preservation,” said Bonnie McDonald, Landmarks’ CEO. “People all over Illinois are working to save special places that help tell the unique stories and history of their neighborhoods despite the many challenges that stand in their way.” […]

Preservationists love the design — Landmarks calls the center “Chicago’s best example of grandly-scaled, Postmodern architecture” — but tenants have complained of year-round temperature problems and the building has not been maintained. The building was first put on Landmarks’ endangered list in 2017.

Gov. J.B. Pritzker has signed legislation outlining a two-year plan to sell the Thompson Center. Landmarks says it only supports a sale if the building is reused.

* The Question: Do you have any “unique stories” about the Thompson Center?

57 Comments

|

Hemp applications start to pour in

Thursday, May 2, 2019 - Posted by Rich Miller

* April 30th…

Illinois officials open hemp-growing applications despite having no processing facilities yet

With the growing season just about to begin, applications are now available for Illinois farmers to grow industrial hemp this year, and the state will be following up to make sure farmers are growing what they say they’re growing, but they’re likely going to have to send it out of state for processing for the time being.

Illinois Department of Agriculture Acting Director John Sullivan said applications are open now for what he said will be an addition to Illinois’ array of crops. The application costs $100. Licenses range from one year for $375 to three-year licenses for $1,000. There are no caps, Sullivan said, but there will be checks.

“You’re going to identify where the field is going to be and then our staff, our inspectors will be out there, periodically throughout the year,” Sullivan said. “We will be testing the crop to make sure that as you folks probably know hemp has to be under .03 on the [tetrahydrocannabinol or] THC, and so we’re going to be testing it throughout the year to make sure that it stays under those limits.”

Sullivan said because hemp can be planted in small footprints he expects it to be planted in not just rural areas, but also urban areas. He couldn’t immediately estimate how many jobs would be created from the new industry, but Sullivan said there would be “tremendous opportunities” for Illinois farmers.

There won’t be a cap on how many licenses will be approved to grow it, but Sullivan said Illinois is a bit behind the curve compared to some other states in the region.

* Today…

The Illinois Department of Agriculture received nearly 400 applications to grow or process industrial hemp in the first 24 hours after they became available.

Agriculture officials said Wednesday they received 295 applications to grow the plant on 7,100 acres (2,873 hectares). Another 74 applications to process the harvested crop arrived.

Still pretty small, but this could be big, campers. And processing will likely create jobs and ancillary businesses.

14 Comments

|

Definitely worth a look

Thursday, May 2, 2019 - Posted by Rich Miller

* Sun-Times…

The developer of the One Central site near Soldier Field said Wednesday he is pushing for state legislation to expedite the massive project while leaving its financial risk with him and not the taxpayers.

Robert Dunn, president of Landmark Development Co., said the site is so attractive that he’s willing to pay upfront an estimated $3.8 billion for a transit hub that will improve access and business for adjacent attractions such as the museums and McCormick Place.

The transit hub would connect the CTA’s Orange Line, two Metra lines, Amtrak and a dedicated bus lane, now little used, that shuttles McCormick Place users to and from downtown.

On a deck he would build over the Metra tracks, Dunn foresees a high-rise collection of perhaps 10 buildings covering residential and commercial uses, almost a self-contained city for the Near South Side.

The resulting commerce and tax revenue should earn the project support from the Legislature, government agencies and a public that’s become critical of tax subsidies for developers, Dunn said.

This, in total, is a $20 billion project, which could be the largest in the city’s history…

A consultant’s report prepared for the Chicagoland Chamber of Commerce said One Central could support 70,000 permanent jobs and generate $120 billion in state and local tax revenue over 40 years of operation.

* There is a public funding component…

Under the proposed financing plan, the developer and investors would pay the upfront construction costs for the transit center, which is expected to take three years to build.

Afterward, the developer and the state would together pay off the cost of the station using new tax revenues and income generated from leases of restaurant, retail and entertainment spaces in the multi-level center, as well as parking revenue and other funds. After 20 years, the state would assume ownership of the transit center and would keep all revenues generated, Dunn said.

* Why the push to get this done during spring session?…

Landmark also plans to seek federal funding that could reduce the state’s financial obligation by more than $1 billion over 20 years, Dunn said.

The deadline for applying for those federal dollars is the end of this year, but he can’t do it unless the state is officially on board.

* Crain’s…

Still, asking Governor J.B. Pritzker or other Illinois leaders for anything these days seems like a long shot given the state’s precarious fiscal condition. They are more interested these days in selling properties, like the Thompson Center in the Loop, so they can raise money to balance the state budget.

That’s… not how this would work.

The state’s end would only come out of the new state tax revenues it would receive from the project. The developer told me the state itself would have to certify the actual revenues it realized. No state payments would be made while this massive project was being built over a projected three years, even though the state would likely reap some money from income and sales taxes.

So, the state wouldn’t lose money it would normally expect to receive because nothing exists at that site right now.

The state will eventually give up a chunk of income, sales and other tax revenues from the project in exchange for ownership of the property. And if the development goes bust and doesn’t generate tax revenues, the state wouldn’t have to pay another dime, according to the developer. After 20 years, the state would keep all tax money generated at the site.

* And that state ownership is key. The property would be valued at billions of dollars, and the state could conceivably transfer that value and the resulting income to, for instance, the pension funds.

I’d like to see the fine print first, especially as it pertains to the state’s responsibilities.

But this developer says he will invest billions of dollars of private money upfront into building a massive public transit hub, so he should be taken seriously for that reason alone.

More background on the developer is here. The glossy flier the developer is handing out to legislators is here.

35 Comments

|

Missed It By That Much

Thursday, May 2, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

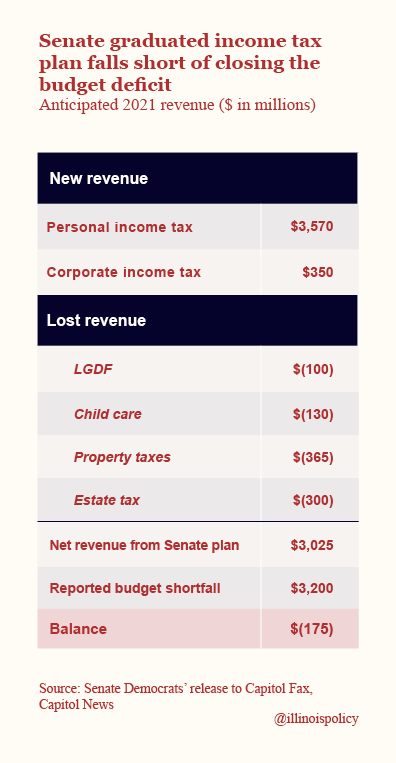

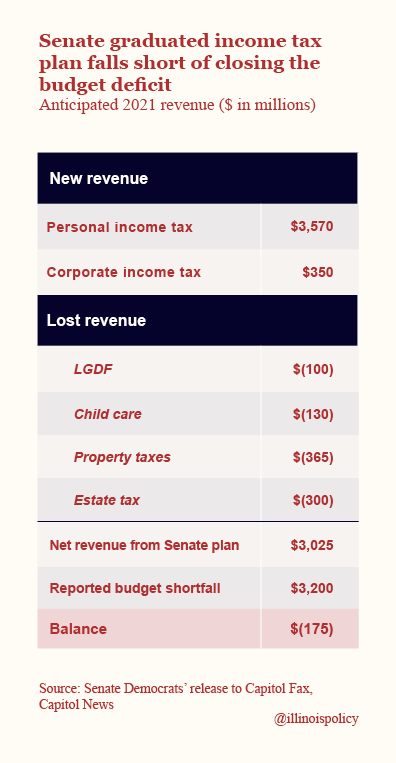

One of the most frequent arguments for enacting a progressive income tax hike in Illinois is to close an anticipated $3.2 billion budget shortfall.

But the progressive tax plan currently moving through the General Assembly would fall $175 million short of this goal, according to Senate Democrats’ own numbers.

The plan’s shortfall is likely much larger due to irresponsible growth assumptions and faulty math. Not only does the plan fall short of closing the budget deficit, it also means that there won’t be revenue to pay for additional spending priorities, like pensions, that Pritzker and others claim the progressive income tax can tackle.

Plus, the $3.2 billion budget deficit projection itself is likely understated: it doesn’t account for a new AFSCME contract, the costs of the minimum wage increase or additional pension costs.

Faulty assumptions and revenue shortfalls ensure one thing: further tax hikes.

Comments Off

|

Senate income tax roundup

Thursday, May 2, 2019 - Posted by Rich Miller

* The Sun-Times headline was great today…

‘Stairway to Heaven’ longer than Senate debate before historic tax vote

You don’t usually hear much from proponents during a tax vote, but it was kinda weird that the Republicans didn’t put up more of a floor fight.

* From the Tina Sfondeles story…

After just seven minutes of debate, Senate Democrats took the first major step Wednesday in advancing Gov. J.B. Pritzker’s goal of revamping how the state taxes income — seeking the biggest change in the state income tax since it was enacted a half century ago.

The Illinois Senate passed its version of a graduated income tax package on strictly partisan lines — and its fate now lies within the Illinois House, where changes are anticipated. […]

Up next is a battle in the Illinois House, where not all facets of the plan may make it through. Legislators have just weeks to figure out a capital plan, approve a budget and try to pass another one of Pritzker’s priorities: legalizing recreational marijuana. It sets the stage for an action packed home stretch of the spring session.

Steve Brown, spokesman for Illinois House Speaker Mike Madigan, said the speaker will “continue to work with the governor and the Senate supporters to move that all to the governor’s desk.”

“Just a reminder that the speaker has supported it since November,” Brown said of the graduated income tax plan.

It’ll be tougher to pass this constitutional amendment in the House, but I do think it’ll still pass. If it goes down, the whole session will explode.

* Tribune…

House Democratic leader Greg Harris of Chicago said the concept of a graduated tax has broad support among his caucus, but before the House votes, Democratic leaders need to “carefully analyze” the Senate’s changes to Pritzker’s original proposal.

“We need to review them,” Harris said. “It’s very complicated legislation. It has a lot of moving parts.”

Somehow, I just cannot see the House sending a bill to repeal the estate tax to the desk of a billionaire governor who inherited much of his wealth, unless they want to truly mess with the guy.

* Meanwhile, on the one hand, you see rhetoric like this Daily Herald editorial…

Since even before Pritzker won election last November, opponents to a graduated income tax have decried the change as a grand “bait-and-switch” scheme in which lawmakers will get voters to free them from the yoke of a constitutionally mandated flat tax, then run rampant adjusting a graduated income tax schedule however the mood suits them to meet ever-increasing spending goals.

On Wednesday, senators demonstrated that not only is that a legitimate fear but they’re willing to do the switching even before the bait has been taken.

True, the complaint about lawmakers running amok with taxes under a graduated system ignores the fact that they could just as easily run amok with the existing flat tax. And, true, the changes approved Wednesday were not comprehensive; they accounted for only a small fraction of a percentage point in the middle to upper regions of the income scale. But, let’s be real, lawmakers have been playing fast and loose with the flat tax since installing a “temporary” increase in 2011, letting it expire in 2014, then hiking it again in 2017, this time to 4.95% and permanently.

Yeah, those flat tax hikes were soooooo easy to pass. No problems at all. Fast and loose.

* On the other hand, you see this…

Senate Republican Leader Bill Brady of Bloomington said the current flat tax system protects taxpayers because lawmakers are reluctant to raise taxes on everyone and that a graduated tax amendment will be defeated by voters.

“We believe our current Constitution crafted by the 1970 constitutional convention wisely decided that Illinois taxpayers need protections against politicians,” Brady said. “The fact that our Constitution currently calls for a flat tax has given various protections to those individuals and protected, we believe, the middle class.”

He said a graduated tax will open the door to raising taxes on the middle class. Harmon, though, said it is false that a flat tax protects the middle class.

“It does exactly the opposite,” Harmon said. “If you are saying the flat tax is a good idea, you are protecting the uber rich, not the middle class.”

Brady is right. The flat tax has most definitely worked against attempts to raise the rates because they’d have to raise ‘em on everybody. Upper-income earners are right to be wary of this change and Harmon just confirmed it, as did Sen. McConchie…

“With a flat tax, you raise rates on everybody,” said Sen. Dan McConchie, R-Hawthorn Woods. “The changing of rates becomes not an issue of first resort but an issue of last resort. As soon as we implement a graduated tax system, we actually make it structurally and politically easier to change those rates and brackets going forward.”

Yep.

48 Comments

|

Caption contest!

Thursday, May 2, 2019 - Posted by Rich Miller

* Attorney General Kwame Raoul (a former state Senator) takes it to the lane during this week’s House vs. Senate basketball game…

The Senate barely won a low-scoring game, despite having a significant height advantage (Treasurer Michael Frerichs also played). But, nobody was severely injured and money was raised for charity, so it was a good night.

32 Comments

|

“Prevention, diversion and change”

Thursday, May 2, 2019 - Posted by Rich Miller

* Former US Attorney Jim Lewis writing for the Illinois Times…

Four decades ago, we began to create a new problem: mass incarceration. In 1974, Illinois had 6,000 people in prison. Now, Illinois has more than 40,000 people in prison. In the same period, other states and the federal government also grew their prisons at similar rates, so that our country now has more people imprisoned, compared to other countries, by each and every measure.

Our state filled its prisons beyond capacity (32,000), but we continued to add to our prison population. Crime rates began to decline in the early 1990s, but we continued to add to our prison population. Four governors tried to address excessive imprisonment, but we continued to add to our prison population. […]

The Illinois Department of Corrections spends $1.4 billion each year, 4% of the state budget, perhaps $35,000 per inmate. […]

Prevention requires a network of interventions in a community, focusing particularly on young people found by the school system and youth authorities to be headed toward trouble. In Peoria, this is their “Don’t Start” program. These interventions, together with “Don’t Shoot,” which is a deterrence program focused on adults with a history of gun violence, should save lives, families and neighborhoods. And they should prevent crime, while saving the costs of incarceration.

Diversion? Sangamon County has diversion courts for people with limited criminal activity that is traceable to addiction or mental health issues or the impact of military service. If a person completes a program of careful court supervision, there is no incarceration. In Peoria, the federal court has a 20-year-old diversion program for crimes of addiction, and this saves people, saves families and saves several million dollars in costs of incarceration.

Change? In Illinois, Gov. Bruce Rauner’s Commission on Criminal Justice called in 2015 for a 25% reduction in the prison population over 10 years, and put forth 27 steps to reduce this population. The prison population declined from 47,000 in mid-2015 to 43,000 in mid-2017, the latest year reported. Illinois is making positive changes, and the new governor is expected to make further positive changes.

Thoughts?

31 Comments

|

Two Janus-related lawsuits filed

Thursday, May 2, 2019 - Posted by Rich Miller

* Tribune…

Continuing a fight against public employee unions initially spearheaded by former Gov. Bruce Rauner, nine state workers who say they have opted out of union membership are asking to be repaid for past “fair share” fees in a proposed class-action lawsuit.

The lawsuit filed Wednesday argues that more than 2,700 state employees are entitled to money they paid to the American Federation of State, County and Municipal Employees Council 31 from May 1, 2017 — the furthest back they can demand the money under a state statute of limitations — through June 28, 2018, when the U.S. Supreme Court ruled it unconstitutional to make public employees pay union dues. Attorneys for the plaintiffs say they’re seeking close to $2 million from the union. […]

Janus was the plaintiff in a similar lawsuit that was thrown out earlier this year by U.S. District Judge Robert Gettleman, who ruled that AFSCME had followed the law in collecting fair share fees and couldn’t have reasonably anticipated those fees becoming illegal. […]

“We are making the same legal argument and we are appealing the legal argument that was rejected,” [Patrick Hughes, president and co-founder of the Liberty Justice Center] said. “The district judge is not the final say on these issues. We’ll appeal that decision. … Ultimately if we are successful, we’ll see what the unions do. If we are unsuccessful, we’ll appeal that decision to the U.S. Supreme Court and let the justices that decided the Janus decision ultimately decide that case as well.”

* Illinois News Network…

A school employee in Illinois filed a federal lawsuit against a local school district and the state’s largest public sector union, claiming both refused to stop deducting union dues from her paycheck months after she left the union.

Susan Bennett, a janitor at the Moline-Coal Valley School District since 2009, withdrew from her union shortly after the U.S. Supreme Court ruled that forced union dues as a condition of employment violated the First Amendment. The high court’s decision in Janus v. American Federation of State, County and Municipal Employees Council 31 struck down forced union fees as unconstitutional.

Bennett alleged the school district refused to stop deducting union dues from her paychecks in the lawsuit, which was filed in the Central District of U.S. District Court.

“Since November 2018, the union and the school district have been fully aware they do not have permission to collect money from my paycheck,” Bennett said. “I submitted my resignation as soon as I could after learning about the decision. The union did not inform me of my rights after the Janus decision and I should not have to wait months to exercise them.”

In the suit, she said that the district was forcing her to wait until an enrollment period to withdraw based on her union agreement entered into before the Janus decision. Unions have used similar tactics elsewhere to retain members after the 2018 Supreme Court decision.

“Based on your enrollment card with AFSCME, see attached, you have to wait until the enrollment period to withdrawal,” district CFO Dave McDermott wrote in an email response to Bennett. “I believe the next opportunity is August 2019.”

27 Comments

|

|

Comments Off

|

* So, we got this going for us…

Citadel CEO Ken Griffin bought a $238 million penthouse condo in New York City earlier this year and is expanding his Park Avenue offices, but Illinois’ richest man says he’s staying put in Chicago.

Earlier this week during the Milken Institute Global Conference in Beverly Hills, Calif., the hedge fund leader sat for a wide-ranging interview with Bloomberg TV that touched on education, free trade, socialism versus capitalism and millennials. […]

On what it would take for him, his children and Citadel to move to another state:

I have three children and we were talking about tax policies. My 8-year-old is delightfully precocious and she says, “Dad, why won’t we just move?” And I said, “Because we are going to stand and fight. We’re going to stand and fight for the policies and changes that will make this state better.”

59 Comments

|

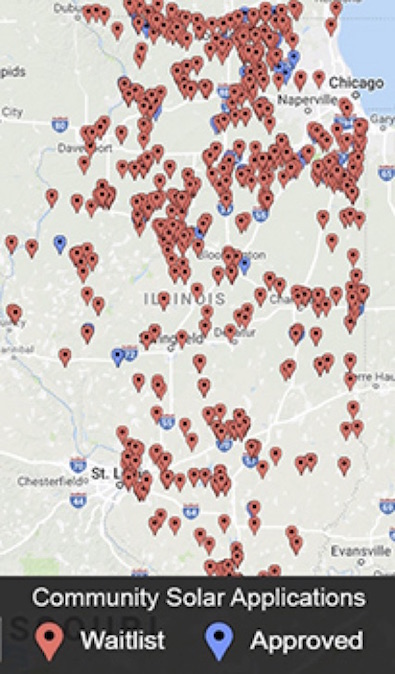

[The following is a paid advertisement.]

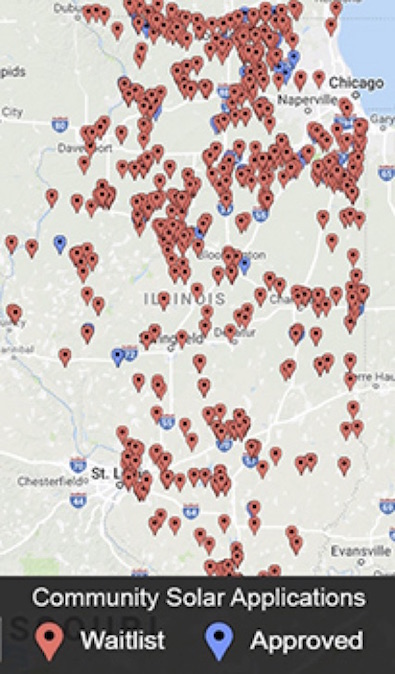

More than 800 solar energy projects are on hold because Illinois’ renewable energy program isn’t adequately funded to meet either current demand or the statutory renewable portfolio standard requirement of 25% by 2025.

The waitlisted, shovel-ready projects could create thousands of jobs, lower consumer electric bills and generate $220 million in property tax revenue for local governments. Funding for new commercial and community solar projects and wind farms will be depleted after 2019.

To see projects on the waitlist in your community – visit www.pathto100.net/waitlist

Without a fix to the state’s renewable energy program, waitlisted projects may not be built.

Vote YES on HB 2966/SB 1781 to fix Illinois’ clean energy cliff and let shovel-ready projects move forward.

For more information, please visit pathto100.net

Comments Off

|

We Need Strong Unions. They Build The Middle Class.

Wednesday, May 1, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Labor unions build more than roads and bridges. Unions build the middle class. Did you know:

● Unions increase individual incomes by lifting hourly wages—particularly for low-income workers.

● Unions increase consumer demand.

● Unions reduce socially inefficient levels of income inequality.

● Unions fight against all forms of discrimination. They believe in equal pay for equal work, no matter your gender, race, religion, or sexual orientation.

● Union workers receive less government assistance.

● Union workers contribute more in income taxes.

● Unions increase productivity in construction, manufacturing, and education.

● Unions reduce employee turnover rates.

● Unions fight against child labor and for public education.

Visit FightBackWithUs.com to learn more about why we need unions.

Illinois needs strong unions. Already, they’re making a big difference for working families in our state, where unions raise worker wages by an average of 10.1 percent.

Illinois’s union wage effect is the 17th-highest in the nation. The union wage differential is higher for the bottom 10 percent of workers (10.4 percent) than the richest 10 percent of workers (8.4 percent).

Comments Off

|

Constitutional amendment clears Senate

Wednesday, May 1, 2019 - Posted by Rich Miller

* All 40 Senate Democrats voted “Yes” on the constitutional amendment…

* But three SDems voted “No” and one skipped the vote on the rate bill…

The three “No” votes were Sens. Jennifer Bertino-Tarrant, Tom Cullerton and Suzy Glowiak. Sen. Rachelle Crowe didn’t vote.

* Meanwhile…

…Adding… Democratic Sens. Aquino, Cunningham, Hutchinson, Murphy, Peters and Villivalam voted “No.” Sen. Munoz did not vote…

…Adding… React…

Today Think Big Illinois Executive Director Quentin Fulks released the following statement after the Senate passed the fair tax resolution:

“Today represents another important step toward ensuring Illinois voters have the opportunity to decide if they want a tax system that lifts the burden off the middle class and forces the wealthy to finally pay their share. Think Big Illinois applauds the members of the Senate who stood up for our middle and working-class families and voted to pass the fair tax resolution.

“Think Big Illinois looks forward to continued discussions in Springfield, and remains committed to being a staunch ally for Illinois families in the fight to implement a fair tax and create a tax system that works for everyone.”

* Americans for Prosperity-Illinois…

This vote is an affront to taxpayers and it is disheartening that the Senate voted to give themselves a blank check paid for by beleaguered Illinois taxpayers. When politicians get more tax power, Illinoisans get higher taxes. We thank those senators who voted against the bill and now urge the House of Representatives to stand up for Illinois taxpayers and reject it.

* Ideas Illinois Chairman Greg Baise…

Today, the insider politicians in Springfield took the first step toward a massive Jobs Tax to punish middle class families.

It is clear that Governor Pritzker and Speaker Madigan will not rest until they have a blank check signed by the hardworking people of Illinois.

* Sen. Don Harmon…

After a decade of work to update Illinois’ outdated tax structure, Senator Don Harmon (D-Oak Park) today earned Senate approval of a constitutional amendment that would allow for a fair tax.

The proposed constitutional amendment would remove language requiring a flat tax and allow the General Assembly to set lower rates for those making less and higher rates for those earning the most.

“We’ve had the same tax structure in our state for nearly 50 years,” Harmon said. “Middle-class and working Illinoisans have been hurt by our inability to modernize our tax structure to reflect a changing economy.”

The proposed amendment does not include specific tax rates, but, under legislation sponsored by Senator Toi Hutchinson (D-Chicago Heights), 97 percent of Illinoisans would get tax relief. Hutchinson’s measure only takes effect if voters approve the constitutional amendment.

“We’ve made great progress in putting our state back on a path to stability after years of chaos,” Harmon said. “We still have work to do, and the only options we have besides the fair tax are to raise taxes dramatically on everyone or enact deep, punishing cuts to state services.”

I’ll post more on the live coverage post.

22 Comments

|

ILGOP stirs up remap questions

Wednesday, May 1, 2019 - Posted by Rich Miller

* ILGOP press release from April 23rd…

“Supporters of fair maps should be concerned that they must now rely on Pritzker’s personal determination of what’s ‘fair’ rather than a concrete pledge to veto gerrymandered legislative maps and enact independent redistricting reform. Pritzker walking back his fair map pledge is unfortunate, yet unsurprising. Voters always knew Pritzker had the support of Speaker Madigan, but now we know why. Pritzker is flip-flopping on fair maps so he can protect Madigan’s grip on power for another decade, overriding the will of Illinois voters. What will Pritzker’s next flip-flop be?” - Illinois Republican Party Spokesman Aaron DeGroot

In an interview yesterday with the State Journal-Register, Governor J.B. Pritzker seemed to walk back a pledge to veto legislative redistricting maps drawn with political considerations. Pritzker said, “I would veto a map that I thought was an unfair one.”

“Unfair” is a far cry from Pritzker’s concrete pledge in 2018 to veto gerrymandered maps drawn by elected officials with political considerations.

Last year, Pritzker told Capitol Fax’s Rich Miller he would veto a map that was drawn “in any way” by legislators, political leaders, or their staffs. At the time, Miller asked gubernatorial candidates:

“Will you pledge as governor to veto any state legislative redistricting map proposal that is in any way drafted or created by legislators, political party leaders and/or their staffs or allies? The exception, of course, would be the final official draft by LRB.”

Pritzker replied:

“Yes, I will pledge to veto. We should amend the constitution to create an independent commission to draw legislative maps, but in the meantime, I would urge Democrats and Republicans to agree to an independent commission to handle creating a new legislative map…”

A bipartisan, bicameral coalition of lawmakers in the General Assembly support fair maps. The only people standing in the way of redistricting reform are Mike Madigan, John Cullerton, and now, J.B. Pritzker. It only took Pritzker 100 days in office to flip-flop on fair maps and side with Speaker Madigan over the people of Illinois.

* An eerily similar SJ-R editorial from three days later…

Thumbs Down: To Gov. J.B. Pritzker for walking back his support for a fair legislative map drawing process.

The maps that determine districts for the General Assembly and Congress are redrawn every decade after the decennial census, which is next scheduled to happen in 2020. Many — including this editorial board — want an independent commission to draw the map, removing legislators from the process.

In March 2018, Rich Miller of the Capitol Fax political blog asked the gubernatorial candidates the following: “Will you pledge as governor to veto any state legislative redistricting map proposal that is in any way drafted or created by legislators, political party leaders and/or their staffs or allies? The exception, of course, would be the final official draft by LRB.”

Then-candidate Pritzker replied: “Yes, I will pledge to veto. We should amend the constitution to create an independent commission to draw legislative maps, but in the meantime, I would urge Democrats and Republicans to agree to an independent commission to handle creating a new legislative map. That designated body should reflect the gender, racial, and geographic diversity of the state and look to preserve the Voting Rights Act decisions to ensure racial and language minorities are fully represented in the electoral process.”

That was a strong answer. But as he marked 100 days as governor, Pritzker’s tune changed.

“Certainly I continue to believe that maps should be drawn fairly,” Pritzker told the SJ-R earlier this week. “I would veto a map that I thought was an unfair one.” But he said there are “a lot of priorities that I’ve moved forward with. … Suffice to say drawing the map fairly in congressional and legislative races is important.”

There is no doubt that the drawing of legislative maps needs to be done in a more fair manner. That only happens if lawmakers are removed from the process. Pritzker has said he wants to bring forth a different Illinois. Throwing his support behind a fair map-making process would be a good start.

* Change Illinois put out a press release today headlined “Is Pritzker back-tracking on fair maps?” The group excerpted the SJ-R editorial and ended with this…

Contact your state legislators and Gov. Pritzker to demand they support reform today and call a vote for the Fair Maps Amendment.

I didn’t post the ILGOP press release because I checked in with a Pritzker spokesperson who told me the governor has not changed his position at all from his answer to me last year. He was apparently just using shorthand.

Inquiries from the SJ-R editorial board and Change Illinois would likely have elicited the same response.

18 Comments

|

It’s just a bill

Wednesday, May 1, 2019 - Posted by Rich Miller

* Cash bail is a very complicated and emotional issue and Downstate law enforcement is up in arms about it…

Two years after passing a significant bail bond reform law, some Illinois lawmakers are now considering doing away with cash bail altogether.

Supporters of that idea say it would bring greater fairness to the system, especially for low-income people charged with relatively minor offenses.

But prosecutors and law enforcement officials warn that such a move could have far-reaching consequences, including putting victims of domestic violence at risk and taking away the ability of local courts to fund services for crime victims. […]

Cook County State’s Attorney Kim Foxx, who supports eliminating cash bail, said that before the 2017 reforms, the system of requiring people to post cash bonds was not keeping violent felons off the street.

“One of the costs of doing business in some of these violent enterprises is going to jail,” she said. […]

“In our county, we take in roughly about a half million dollars in bond a year, and that money fuels our criminal justice system,” [McDonough County Sheriff Nick Petitgout] said. “Things like victims services, court appointed special advocates, teen court, diversion programs, the treasurer’s office, the circuit clerk’s office, the sheriff’s office.”

* This House bill passed the Senate Executive Committee yesterday on a partisan roll call and now heads to the floor for what’s likely to be final action…

A bill sponsored by State Senator Robert Peters (D-Chicago) would ban state agencies or units of local government from conducting business with privately owned civil detention centers.

The bill is an initiative of the Illinois Coalition for Immigrant and Refugee rights in response to a March vote by the Board of Trustees in Dwight approving plans to build a 1,200 bed privately owned detention facility. Once built, the Immigration and Customs Enforcement Agency could potentially contract with this facility. The bill would prevent this from happening.

“Privately owned detention centers are run with a profit motive, which creates an incentive for people to become bad actors as a way to cut costs and save money at the expense of living conditions,” Peters said. “These cruel institutions have no place in our modern society.”

A civil detention center is an institution used to detain people for reasons other than having been charged with or convicted of a crime, including immigration detention centers, juvenile detention centers and mental health facilities. They differ from criminal detention centers in that they are neither a jail nor a prison.

* The 3rd Reading deadline was extended to tomorrow on this bill…

Under legislation expected to receive a vote this week, contractors on state capital projects would be forced to pay their suppliers and subcontractors on a tighter schedule.

“This is to help our small businesses grow,” state Sen. Ram Villivalam, D-Chicago, said during a news conference Tuesday at the Capitol.

Villivalam’s legislation, Senate Bill 104, shortens from 15 calendar days to seven business days the payment deadline for a construction project’s prime contractor to pay the smaller subcontractors and material suppliers of a project.

* Other bills…

* Sun-Times Editorial: Let the public, not a law, push corporate boards to be more diverse: If ever there were a case where public and shareholder pressure makes more sense than another law, this is it.

* Keep private, for-profit detention facilities for immigrants out of Illinois

12 Comments

|

* A new report suggests that ramping up child abuse and neglect investigations and removing more children from their homes may not have the intended effect…

In 2017, Indiana had the third-highest rate of investigations for child abuse and neglect in the country, with at least one investigation for every 10 kids, according to the U.S. Department of Health and Human Services’ 2019 Child Maltreatment report. The state also had the second-highest rate of victims of abuse and neglect, 18.6 out of every 1,000 kids, behind only Kentucky. […]

In Indiana, courts are involved in 75.4% of child abuse and neglect cases, which is more than twice the U.S. average of 29% and the most of the 41 states that reported that data for 2017. The state also removes kids at twice the national rate, with 12 children per 1,000 in foster care in 2016, the fourth most of states, according to data reported to the federal government. […]

Despite this aggressive approach, the number of deaths from abuse and neglect in Indiana grew from 34 in 2008 to 78 in 2017, when the state had the third-highest reported rate of child fatalities, the federal data shows.

Interesting.

Go read the rest if you have time. Lots of fascinating lessons to be learned.

21 Comments

|

Rep. Chris Welch: “Gov. Pritzker let us down”

Wednesday, May 1, 2019 - Posted by Rich Miller

* WGN…

A suburban hospital’s closing was approved by a unanimous vote by the state review board.

The Illinois Health Facilities and Services Review Board voted 7 to 0 in favor of Westlake Hospital’s closure on Tuesday.

* ABC 7…

Last week, a judge let a temporary restraining order stand against Pipeline Health that prevented the 230-bed hospital in Melrose Park from closing.

The new hospital owners are accused of promising to keep the hospital open for two years, then after purchasing it, quickly moved to sell it.

Community outrage prompted the village of Melrose Park to file a lawsuit accusing Pipeline of acquiring the hospital under false pretenses. Several elected officials are now calling on the Illinois attorney general to get involved.

* Crain’s…

Though the board voted 4-3 to defer the matter until all related litigation is complete, five votes are needed to achieve a majority. The board is comprised of nine voting members; however, one member is absent and one seat is vacant.

Board members Deanna Demuzio, Barbara Hemme, Marianne Eterno Murphy and Ronald McNeil all voted to defer the matter. Two of the three members who voted not to defer, citing the need for “health care transformation,” were recently appointed to the board by Gov. J.B. Pritzker: Julie Hamos and Michael Gelder. John McGlasson also voted in favor of hearing Pipeline’s application today.

Following the decision, Democratic state Rep. Emanuel Chris Welch of Westchester, who is also a member of Westlake’s board of trustees, said: “Gov. Pritzker let us down. We went to bat for him, and his appointees went to bat for billionaires from California.”

* Tribune…

Board member Julie Hamos said Tuesday that losing hospitals is tough for communities, but she expects to see more hospitals closing in coming years as advances in medicine make inpatient care less necessary.

“We are really on the cusp of a very significant change in our health care system,” said Hamos, who was recently appointed to the board by Gov. J.B. Pritzker and is a former lawmaker. She said deferring the application would simply have shifted a decision on the matter to the courts.

* NBC 5…

Melrose Park Mayor Ron Serpico said the village will continue to fight the hospital’s planned closure.

“It’s a shame that the Health Facilities Review Board couldn’t find the courage to do the right thing for the most vulnerable people,” Serpico said in a statement. “It’s also puzzling that the board would so flagrantly disregard their own rules. As a result of their action we are calling today on Attorney General Kwame Raoul to investigate the Health Facilities Services and Review Board decision to approve Pipeline Health’s fraudulent purchase and closing of Westlake Hospital. Was there a nod and a wink between Pipeline and members of the Health Facilities Review Board? We call on the Attorney General to get to the bottom of this scandalous action.”

Discuss.

22 Comments

|

Vertical construction backers make their case

Wednesday, May 1, 2019 - Posted by Rich Miller

* Press release…

At a press conference Wednesday, lawmakers and organization leaders unveiled Build Up Illinois, a coalition advocating for building projects, also known as “vertical construction”, as part of a comprehensive capital plan.

The coalition is composed of groups and associations representing P-20 education – including k-12 school districts and both private and public colleges – the Illinois hospital system and the Illinois AFL-CIO and affiliated building trades.

“Capital projects put thousands of people to work in every corner of our state while making much needed investments to our aging infrastructure,” said Michael Carrigan, President of the Illinois AFL-CIO. “The 900,000 union members across the state are willing partners in support of a capital plan that addresses needed repairs and upgrades as well as new construction. The coalition is ready to support both lawmakers and the administration in moving a comprehensive plan forward.”

The state is facing billions of dollars in repairs and new construction requests for schools, public universities, sewer and water systems, roads, bridges and state facilities. Illinois’ state facilities occupy over 8,700 buildings and 101 million square feet of floor space. They serve diverse needs, ranging from prisons to universities, mental health hospitals, and state parks.

The Capital Development Board estimates for repairs to state facilities are projected to be $7.8 billion, just under $6.7 billion for public universities and $9.4 billion for preK-12 schools.

“We know there has been a lot of discussion about the need to repair our roads and bridges,” said AJ Wilhelmi, President and CEO of the Illinois Health and Hospital Association. “But it is critical that the state invest in its healthcare infrastructure – specifically, the hospitals that are the economic anchors of our communities.”

IHA is proposing the Hospital Transformation Capital Program – to invest $500 million in state capital funds in hospitals that need to transform their aging facilities to build a coordinated, person-centered system of health and human services that will serve their communities for today and tomorrow.

“The healthcare landscape is changing dramatically from an inpatient-based system to an outpatient-focused system,” said Wilhelmi. “This means that hospital buildings constructed over the past century to provide inpatient care need to be modernized, and in some cases, repurposed to fit today’s healthcare model.”

With a rising backlog of deferred maintenance, the state’s public universities and community colleges are using money meant for their daily operations to pay for maintenance projects on buildings.

“Over the past five years, we have invested between $4 million and $6 million annually of our own resources in general revenue on construction of facilities to ensure that they remain safe and functioning,” ISU President Larry Dietz said. “Had capital funds been available, that money could have been used for scholarships, additional faculty and support staff or new technologies.”

“Illinois needs cranes on campuses and bulldozers at building sites. Construction projects signal that Illinois is open for business,” said State Senator Andy Manar, a Bunker Hill Democrat who is leading conversations in the Senate about statewide construction priorities. “Highway and bridge repairs are vitally important, but any statewide infrastructure plan has to balance those priorities with our need for new schools, modern hospitals and 21st century college facilities. There has to be a healthy mix.”

“The list of construction needs continues to grow by the day, which is why it is imperative that we get a capital bill done sooner rather than later,” said Assistant Majority Leader Jay Hoffman (D-Belleville). “But any plan must balance the need for transportation-related projects with new building construction and repair, which is what this coalition is calling for.”

State colleges and universities have asked for around $2 billion in capital funds for the next fiscal year.

“Our needs are great. It’s been ten years since the state last approved a capital bill and during that time, our colleges and universities weathered a budget stalemate,” said Dr. Sam, President of Elgin Community College. “An infusion of capital funding for buildings and repairs will certainly help in our ability to attract students to our campuses.”.

Whew, that’s a lot of needs.

23 Comments

|

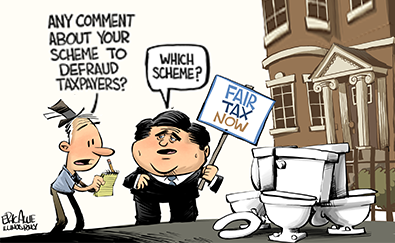

* Let’s start with a relatively mild critique via the Illinois News Network…

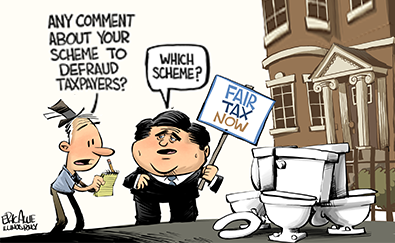

Despite paying back the $331,000 he got in property tax breaks, Gov. J.B. Pritzker insisted his family did nothing wrong when it had toilets removed from a spare mansion to have it deemed uninhabitable.

When WBEZ radio broke the story last week that Pritzker and his wife were under federal criminal investigation for removing toilets from the Gold Coast mansion to get a tax break, the governor was asked whether he thought it was political, or if it would derail his push for a progressive income. He explained Tuesday in Springfield why he paid the money back last year even though he followed the rules.

“We simply wanted to avoid distraction during the course of the campaign,” Pritzker said in his office. “As I say, any review of this will show the rules were followed. During the campaign, it was clear that people were trying to make this a political issue, so we just wanted to get it out of the way.”

State Sen. Jason Plummer, R-Edwardsville, said the explanation didn’t make sense.

“I don’t know many people, even billionaires, that would write three-hundred-plus-thousand dollar checks if they felt like they didn’t do anything wrong,” Plummer said. […]

“You’re going to have people talking about ‘other folks need to pay their fair share, other folks need to carry and even heavier tax burden,’ but then there’s these various schemes to avoid taxes and I find that somewhat hypocritical and very concerning,” Plummer said.

* Here’s Plummer in the Metro East Sun, a Proft paper…

“I find the hypocrisy to be stunning,” he said. “I mean you have the governor, a multi-billionaire, under federal investigation in a case the inspector general has characterized as a scheme to skip out on tax payments at the same time he wants to preach about paying more taxes to everyone else.”

To the question of whether or not the ongoing scandal will impact Pritzker’s ability to govern, Plummer thinks it’s too early to know.

“I think everyone needs to wait and let the investigation play itself out, but I think the governor really needs to rethink his habit of preaching on taxes,” he said. “The hard-working people of Illinois are already paying more than their fair share. It’s people like him that are scheming to get out of paying at all.”

* From the same outlet…

Illinois State Rep. Charlie Meier (R-Okawville) sees the list of potential victims in the property tax scandal now dogging Gov. J.B. Pritzker as being endless.

“Everyone and their budgets, including our fire and policemen, are impacted by this because it’s our tax revenue that pays for everything,” Meier, the longtime representative for the 108th District, told Metro East Sun. “If it turns out that he’s been trying not to pay taxes of his own while trying to raise them on everyone else, it would really be sad.”

* Same network, different paper…

State Rep. Chris Miller (R-Oakland) fails to see how Gov. J.B. Pritzker can continue to have the nerve to ask Illinois voters for a blank check under the present circumstances.

“You would think his being under federal investigation would significantly reduce the trust of an already skeptical electorate,” Miller told the East Central Reporter. “Anytime you have criminal liability hanging over your head, it can’t be seen as a good thing, even among the people that are your strongest supporters.” […]

“It just seems like justice doesn’t get meted out very often when it comes to people with money, power and prestige like the governor,” said Miller, elected last November to represent the 110th District. “Truthfully, I would be shocked if anything comes of this on a legal front. That’s why it’s so important that voters step up and be the checks and balances we need to protect the system.”

* Ramping it up a notch in the same publishing network…

“We knew about this a year ago and Democrats wanted to ignore it,” [Rep. Dan Caulkins, R-Decatur] said. “It speaks to the governor’s character that he would knowingly participate in something like that. I think it’s a very unseemly thing to do and further makes Illinois the laughingstock of the country.”

* A bit more fire from another Eastern Bloc member…

Newly elected Illinois State Rep. Darren Bailey (R-Xenia) has a hard time believing some of the things that pass for normalcy in Springfield.

“This news should absolutely impact the way Gov. Pritzker governs,” Bailey told the SE Illinois News of reports that Gov. J.B. Pritzker and several family members including his wife remain under federal probe stemming from alleged acts taken in an attempt to lower their property tax bill. “Instead, you’ve got the whole Democratic party still supporting him as if nothing’s happened and this corruption is all part of the lifestyle they live.”

Hey, at least he said “Democratic” party, although I figure he was probably misquoted /s

* They even talked to former Rep. Jeanne Ives (R-Wheaton)…