|

Isabel’s afternoon roundup

Tuesday, Oct 1, 2024 - Posted by Isabel Miller

Click here to read the statement. * The National Conference of State Legislatures on the “6 strategies for recruiting top talent to state legislatures”…

* Governor Pritzker…

* WAND | Lawmakers advocate for life-saving legislation one year after Haz-Mat crash in Teutopolis: On September 29, 2023, people had to rush out immediately after anhydrous ammonia leaked from a tanker truck after it crashed outside the city. The leak caused the death of five people — including two children — and severe injury to nearly a dozen others. In October 2023, WAND reported that State Senator Chapin Rose (R-Mahomet) and State Representative Adam Niemerg (R-Teutopolis) proposed a bill that would require companies providing GPS services to offer detour and routing services provided by emergency services. * She Runs Illinois 2024 | Dagmara “Dee” Avelar, candidate for IL House of Representatives, District 85 : “ As the State Representative for the 85th district, my focus during my third term in office will be to continue advocating for healthcare accessibility, affordable housing, and economic opportunity.” * WAND | State Rep. Stuart calls on IDOC to improve access to Lincoln Developmental Center Cemetery: State Rep. Katie Stuart, D-Edwardsville, has filed a resolution calling on the Illinois Department of Corrections calling for them to improve access for families with loved ones buried at the Lincoln Developmental Center Cemetery. The cemetery shares ground with Logan Correctional Center. “Families need access to the places where their loved ones have been laid to rest so they can honor and celebrate their lives,” Stuart said. “When a cemetery is located on the site of a correctional facility, that is absolutely a situation that needs to be navigated carefully to ensure safety and accountability, but it shouldn’t be the case that the cemetery is effectively off-limits to the families of those interred there.” * WAND | IL served over 85.6M meals, snacks to kids through Child and Adult Care Food Program in FY 2024: The federal program, administered by ISBE and funded by the U.S. Department of Agriculture, helps make sure kids in participating childcare centers, day care homes, after-school programs, and emergency shelters receive healthy meals at no extra cost. Oct. 1 marks the start of the period when CAFCP sponsors renew their applications to continue operating the program for the coming year. * Sun-Times | Chicago police officer with history of misconduct cases could cost taxpayers another $332,500: The City Council’s Finance Committee will be asked Wednesday to authorize that settlement to Jeanette Bass, a former Gold Coast resident who claims she was arrested, physically and emotionally abused and involuntarily admitted to a psychiatric ward because of alleged misconduct by 29-year veteran CPD Lt. Andrew Dakuras. * Tribune | City allocates $75 million in bond funds to market rate housing initiative on South and West sides: The program — officially called the Missing Middle Infill Housing Initiative after originally being named “Come Home Chicago” — will start in North Lawndale with 44 vacant, city-owned lots being offered to developers to purchase for $1 each. The lots have assessed values ranging from around $4,000 to nearly $50,000. Developers can submit applications to purchase the lots through Nov. 15 and can receive up to $150,000 per unit to further subsidize construction costs. Applicants will get a minimum of five lots. Construction costs have skyrocketed since the COVID-19 pandemic due to supply chain issues and elevated labor costs, making it harder for developers to sell new construction homes at more affordable price points. * Crain’s | Anti-gentrification ordinance gives rare power to tenants over building sales: Renters in some North and West Side neighborhoods will soon have the rare power to control who buys the buildings they live in, under the city’s latest tool for cooling off gentrification hot spots. In parts of Humboldt Park, West Town, Logan Square and Avondale, renters in many buildings will have the right of first refusal over any sale contract their building owner signs with a potential buyer. * Block Club | COVID Lab Owner Pleads Guilty To $14 Million Scheme To Defraud Government: The owner of a Chicago COVID-19 testing lab has pleaded guilty to a $14 million scheme where his company provided fake negative results to people getting tested — while billing the government for the tests. Zishan Alvi, 45, of suburban Inverness, pleaded guilty to one count of wire fraud, for which he could face up to 20 years in federal prison, according to a U.S. Attorney’s Office news release. * Crain’s | Two Chicagoans win MacArthur ‘genius grants’: The MacArthur Fellows will each receive an unrestricted $800,000, paid out over five years, to pursue their own creative, intellectual and professional inclinations, according to the foundation. Ling Ma, 41, is a fiction writer whose work blends realism with fantastical elements to reflect on and critique the modern, globalized world we inhabit. Her 2018 debut novel, “Severance,” won a Kirkus Prize for fiction, and her second book, a short-story collection titled “Bliss Montage,” won the 2022 National Book Critics Circle Award for fiction. * Daily Herald | Work set to begin on $21 million expansion of Elgin Sports Complex: A ceremonial groundbreaking will take place at 11 a.m. Friday at the complex, located just south of U.S. Route 20 and east of McLean Boulevard. The project will add three new synthetic turf fields, lighting, a concession plaza, maintenance building, restrooms, shade pavilion, bike path and additional parking for 270 vehicles, to 87 acres on the east side of the property that were acquired from the state. * Naperville Sun | Houlihan’s shutters Naperville location, Wayfair outlet to open Thursday: The 23,000-square-foot outlet will sell returns from online purchases and discounted items in good condition across a large number of product categories. Customers will be able to browse the outlet inventory online, but products will only be available for purchase in-store. Naperville’s inventory is coming soon, the spokesperson said. * WCIA | Massey Commission names new members, workgroup rosters: Shadia Massey, one of Sonya’s cousins, said over 200 people submitted their names and indicated a willingness to serve on the commission. “This is a true citizens’ commission with people from all walks of life and with diverse professional and personal experiences,” Dr. Kruse said. “The collective wisdom developed through those experiences will give the commission a broad view of the community’s needs and opportunities for change.” * WICS | Western Illinois University waives $30 fee for domestic undergrad applicants in October: Western Illinois University is offering an exciting opportunity for prospective students by waiving the $30 application fee throughout October for all undergraduate, domestic applicants. This waiver applies exclusively to domestic undergraduate students. * Casino | Hard Rock Rockford Delivers New Tax Revenue, but Also Competition: A growing concern, however, is how the Hard Rock Casino, which features a 23,000-square-foot concert venue with accommodation for up to 2,000 guests, will impact the city-owned Coronado Theatre and BMO Center. The Rockford Area Venues & Entertainment Authority (RAVE) owns and operates the 2,300-seat Coronado, dubbed the Crown Jewel of Rockford, as well as the multipurpose BMO Arena that can be configured to accommodate nearly 6,000 patrons for concerts.[…] RAVE officials told the city council this week that the Coronado is losing about half of the shows it would typically book to Hard Rock. However, larger shows like the ones earlier this year for A-list comedians Shane Gillis and Nate Bargatze, which respectively played at the BMO Center in February and May 2024, will likely remain at the RAVE arena because those audiences numbered more than 5,000 per show. * WAND | Giannoulias awards $1.5M to Greater Peoria Auto Crimes Task Force: Secretary of State Alexi Giannoulias has announced $1.5 million will be awarded to the Greater Peoria Auto Crimes Task Force. The funds will go to support operations and expand specialized investigations into carjackings and vehicle thefts. The grant funding will allow GPACT to expand operations and specialized investigations into crimes related to vehicular hijacking, auto theft, insurance fraud and recyclable metal theft. * KWQC | ‘American Pickers’ star Frank Fritz dies: According to a close family friend, Fritz died peacefully Monday evening in Davenport surrounded by friends, including “American Pickers” co-star Mike Wolfe who traveled from Tennessee to be there. […] Fritz, born in Davenport, worked across the Quad Cities Area and owned his own shop in Savanna, Ill., called “Frank Fritz Finds”. * The Athletic | How fast could a human being throw a fastball? 106 mph, 110 mph — even 125 mph?: “When you build up a simple physics model that is essentially a series of collisions between body parts, you get a max fastball velocity of about 125 mph,” said Jimmy Buffi, who has a PhD in biomedical engineering. Buffi is a former Los Angeles Dodgers analyst and is a co-founder of Reboot Motion, a player development consultancy firm. “We’ll need to use new methods,” said Kyle Boddy, current Boston Red Sox consultant and the founder of Driveline Baseball, a player development lab and consultancy company. “If there is a way to continue on, it won’t be with current methods. Using the best mechanics from elite pitchers, piecemeal, is unlikely to be the way we can create the 110 mph pitcher.” * STL Mag | Hawley calls out KSDK’s Mark Maxwell, but his allegation appears to be fake news: U.S. Senator Josh Hawley came after a St. Louis TV reporter on Friday, accusing him of having been fired from a previous journalism job for unethical behavior. But the journalist’s former boss tells SLM that’s simply not true. “I have a lot of respect for Mark,” says Andy Miller, who was the news director of WCIA when it employed Mark Maxwell, who is now the political editor at KSDK. “I didn’t fire him. When his contract expired with our television station, he departed.”

|

|

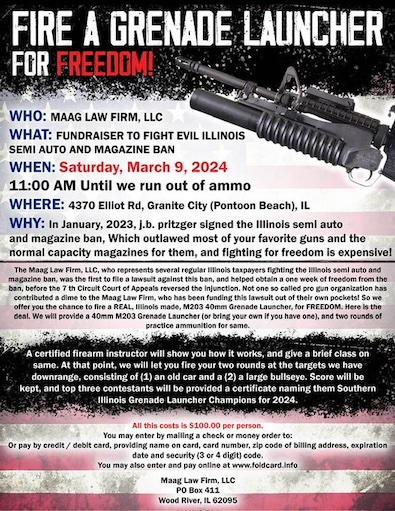

ARDC hearing board recommends two-year suspension for attorney in assault weapons case

Tuesday, Oct 1, 2024 - Posted by Rich Miller * You may remember this…  * Thomas Maag is also the attorney suing over the state’s assault weapons ban. Maag also sued the state over its law limiting constitutional challenges to courts in Sangamon and Cook counties. And he recently lost a case at the Supreme Court over a constitutional challenge to the FOID law. * Anyway, from the Attorney Registration and Disciplinary Commission…

I reached out to Maag today asking for a response and to see how this could impact his ongoing caseload. I’ll let you know what he says. Also, click here for his written response to the ARDC beef.

|

|

Judge ridicules anti-Gotion lawsuit: ‘The complaint reads like a novel’

Tuesday, Oct 1, 2024 - Posted by Rich Miller * Crain’s on a lawsuit filed in Kankakee County to stop the Gotion plan…

* More from Judge Lindsay Parkhurst via the Kankakee Daily Journal…

Judge Parkhurst, a former Republican state legislator, did leave the door open to file an amended lawsuit, but that new complaint will have to look totally different than the one originally filed…

|

|

Showcasing The Retailers Who Make Illinois Work

Tuesday, Oct 1, 2024 - Posted by Advertising Department [The following is a paid advertisement.] Retail provides one out of every five Illinois jobs, generates the second largest amount of tax revenue for the state, and is the largest source of revenue for local governments. But retail is also so much more, with retailers serving as the trusted contributors to life’s moments, big and small. We Are Retail and IRMA are dedicated to sharing the stories of retailers like David, who serve their communities with dedication and pride.

|

|

Quinn explains how property tax relief proposal could work

Tuesday, Oct 1, 2024 - Posted by Rich Miller * Some background…

The phrase “property tax relief” is not defined. * Former Gov. Pat Quinn is a big proponent of the advisory referendum, and he has an idea on implementation, if it eventually comes to a constitutional amendment vote…

From that law…

* Gov. Pritzker has not yet said whether he’ll be voting for the proposal. He was asked about his thoughts yesterday…

Lots of words.

|

|

The Importance Of Energy Storage

Tuesday, Oct 1, 2024 - Posted by Advertising Department [The following is a paid advertisement.] Recent polling shows 72% of Illinoisans support incentives for energy storage, and a majority of Illinoisans would be likely to for a candidate that supports building more energy storage in the state. But it’s not just popular. It’s urgent — Building more storage today is the best way to save Illinois families and businesses from rapidly rising energy costs. By guaranteeing a backup of affordable energy at times when heat waves, storms, or cold snaps threaten Save families money and make energy more reliable. With energy costs set to rise, we need energy storage now. Learn more about energy storage and outstanding bills about it here.

|

|

‘We believe we are in compliance with the law’

Tuesday, Oct 1, 2024 - Posted by Rich Miller * I noticed this week that the Chicago Teachers Union used both of its political action committees to each contribute the maximum amount allowed by state law ($68,500) to a recently formed committee with no other known contributors…  Hmm. Are they using two committees to get around the contribution caps? * State law limits union locals to one committee each, so I reached out to Matt Dietrich at the Illinois State Board of Elections…

I looked around and couldn’t find evidence of two different CTU entities. * I then reached out to the CTU’s H Klapp-Kote and asked: “Are the Chicago Teachers Union and CTU Local 1 somehow separate entities? If so, how can that be?” The response…

I followed up, but haven’t heard back. Such transparency. /s * In somewhat related news, Gov. JB Pritzker was asked today about this story…

Pritzker’s response…

Emphasis added. * And, finally…

That one made me chuckle.

|

|

State completes $73 million project to protect Illinois’ only undeveloped Lake Michigan shoreline

Tuesday, Oct 1, 2024 - Posted by Isabel Miller * The Tribune in March…

* Yesterday, Governor Pritzker cut the ribbon to celebrate the project’s completion. From the press release…

|

|

Sean Grayson wasn’t the only Sangamon County deputy hired with a DUI on his record

Tuesday, Oct 1, 2024 - Posted by Isabel Miller * Here’s some background if you need it. Beth Hundsdorfer for Capitol News Illinois…

Go read the rest.

|

|

Open thread

Tuesday, Oct 1, 2024 - Posted by Isabel Miller * What’s going on in your part of Illinois?…

|

|

Isabel’s morning briefing

Tuesday, Oct 1, 2024 - Posted by Isabel Miller * ICYMI: Illinois residents racing to help in the aftermath of Helene. Tribune…

- The manager opened the venue to the community, and the band pitched in to make food for a line of hungry residents. - Illinois Mutual Aid Box Alarm System, a statewide response team for natural disasters, deployed two 12-person crews to the Asheville area Wednesday evening * Related stories…

∙ WSIL: Hundreds from Ameren respond to east coast with Hurricane Helene recovery efforts At 10:30 Governor Pritzker will launch a new statewide manufacturing training initiative. Click here to watch. * Crain’s | Michael Sacks, Richard Price leave World Business Chicago board: Michael Sacks and Richard Price, two high-profile veterans of Chicago’s corporate community, have left the board of World Business Chicago. Sacks, CEO of investment firm GCM Grosvenor, was vice chairman, or the top private-sector leader of World Business Chicago, when Rahm Emanuel was mayor. Price is the longtime chairman of investment firm Mesirow. * Sun-Times | Spending time? Mayor Johnson’s budget address pushed back two weeks in face of nearly $1 billion deficit: The original budget speech was expected for Oct. 16, officials from the city’s budget office told WBEZ, but is now slated for the day before Halloween on Oct. 30. The Council will then hold two weeks of budget hearings from Nov. 6 through Nov. 20 before a Thanksgiving break. That leaves two weeks for City Council members to consider amendments to the proposed budget. The mayor’s office hopes for a final vote on Dec. 4. * Daily Herald | 47th District rivals for state representative debate effectiveness of current gun laws: The effectiveness of current gun legislation in Illinois, including an assault weapons ban, was among the topics debated by Republican incumbent state Rep. Amy Grant of Wheaton and her crosstown Democratic challenger Jackie Williamson in a recent interview with the Daily Herald. Grant is running for her third term in Springfield. The current race is a rematch from 2022.

* Tribune | Climate change can alter the vibrancy and timing of fall foliage. How will the recent drought affect Illinois?: Recent dry weather — the whole state was at least abnormally dry by the second week of September — caused some trees in parts of Illinois to start turning yellow and even shedding some leaves earlier than usual throughout September, including honey locusts, walnut trees and some birch trees. In its most recent update Thursday, the U.S. Drought Monitor indicated a small recovery with approximately 93% of the state being at least abnormally dry. * KSDK | FEMA urges Illinois residents to apply for assistance after severe July flooding: So far, the federal government has provided over $9.4 million to help survivors across seven Illinois counties. The Illinois counties that FEMA crews are canvassing in connection to July storm damage are St. Clair, Washington, Fulton, Henry, Winnebago, Cook, and Will. […] FEMA will be in the area for the next few weeks, assisting homeowners impacted by July’s storms. Residents are urged to apply before the November 19 deadline. * NBC Chicago | Mayor Brandon Johnson denies he asked CPS CEO Pedro Martinez to resign: Tension between Chicago Public Schools CEO Pedro Martinez and Mayor Brandon Johnson continued to grow for yet another day on Monday, with the mayor denying he ever asked Martinez to resign. […] Multiple sources, as well as Chicago aldermen, told NBC Chicago they’re expecting several members appointed by Johnson to the Chicago Board of Education to resign rather than carry out the mayor’s plans to oust Martinez and approve a $300 million loan to pay for teacher raises. * Sun-Times | Board walk? Potential resignations of Board of Education members could mean more CPS upheaval: No resignations had been handed in to the mayor’s office as of Monday afternoon, but a source close to the board confirmed conversations are ongoing about the makeup of the board for the next few months. […] No matter the reasons, any mass resignations could be viewed as a rejection of Johnson’s handling of the tension with CPS leadership. It would be an astonishing outcome for this board that has worked hand-in-hand with the mayor to usher in his progressive vision ahead of the city’s first school board elections. A new board will be seated in January. * CBS Chicago | Chicago Board of Elections explains how voting process is secure and transparent: The final accuracy and logic tests were under way Monday at the Supersite, at 191 N. Clark St. The printers and computers there are never connected to the internet, and once a voting machine passes a series of tests, it is secured with a tamperproof seal.”If those tags are ever broken, that machine is going to be taken off the floor,” said Max Bever, director of public information for the Chicago Board of Elections. * Sun-Times | Homeless camp to stay in Gompers Park until 2025, city tells Northwest Side neighbors: City officials told the Sun-Times last week that they have spent $70 million in federal money on programs related to homelessness, and “based on funding availability” there is no plan for a rapid response to the Gompers situation this year. * Sun-Times | Drones called ‘game-changer’ for policing — but is CPD late to the game?: The Illinois State Police has 75 drones. New York City has 55, with one just to monitor beaches. San Diego has 47. But CPD has just five, getting its first ones only last year. They’ve been used mainly for surveillance at special events, including the Democratic National Convention, Lollapalooza and the Pride Parade. * Tribune | From Lollapalooza to the DNC, summer events boost Chicago hotels to record revenue: Visitors to Chicago booked 3.4 million hotel rooms from June through August, up 5% over last summer, according to data released Tuesday by Choose Chicago, the city’s tourism arm. The increased demand generated $942 million in revenue for Chicago hotels and $54 million in city tax revenue, both up 13% over last summer to all-time highs, according to Choose Chicago. * Daily Herald | Naperville eyes utility hikes to help keep up with system maintenance needs: The city’s preliminary capital improvement plan budget for 2025 includes $183 million for major projects, including continued work replacing aging water mains and underground electric cables, and the proposed utility rate hikes. City council members are expected to vote this month on the proposed increases, which could add $8 to the average monthly electric bill and $9 to the average water bill in 2025. * ABC Chicago | Lake County planting hundreds of trees to fight rising temperatures, diminished air quality: “Trees are the best infrastructure you can do for stormwater management,” Lake County Sustainability Director Robin Grooms said. The trees they are planting are expected to absorb thousands of gallons of water during storms, saving the county from much more costly alternatives to handle that water. * Press Release | State’s Attorney’s Office Welcomes Newest Member - Duo Dog Crew: DuPage County State’s Attorney Robert Berlin and his entire office warmly welcomed its newest team member, Duo Dog “Crew”, to the Office this afternoon. DuPage County Clerk of the Circuit Court Candice Adams administered Crew’s oath of office at his official swearing in ceremony in the State’s Attorney’s Office attended by dozens of Crew’s newest co-workers. Following the ceremony, Crew, a twenty-month-old Labrador Retriever, took some time before getting to work to introduce himself to his fellow employees and even posed for several photographs. * WCIA | U of I, service workers reach tentative deal on new contract: Robin Kaler, Associate Chancellor for Strategic Communications and Marketing, said the university and SEIU Local 73 reached the deal on Monday. Union negotiators are recommending it for ratification, Kaler said, and if union members agree to the contract, they would return to work tomorrow. * Intelligencer | Illinois state police officer, wife charged in Edwardsville child abuse case: “The ISP Division of Internal Investigation is investigating charges against Special Agent Hatley,” ISP spokesperson Melaney Arnold said in a written statement. “He is being placed on administrative leave without pay and his police powers suspended. ISP does not tolerate any criminal conduct within its ranks. As we do with any alleged crime, ISP will move swiftly towards justice and accountability.” * Politico | California bans legacy admissions at all colleges: California’s law, which will take effect Sept. 1, 2025, is the nation’s fifth legacy admissions ban, but only the second that will apply to private colleges. […] Like other states, California won’t financially penalize violators, but it will post the names of violators on the state Department of Justice’s website.

|

|

Protected: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Tuesday, Oct 1, 2024 - Posted by Rich Miller

|

|

Live coverage

Tuesday, Oct 1, 2024 - Posted by Isabel Miller * You can click here or here to follow breaking news. It’s the best we can do unless or until Twitter gets its act together.

|

|

Selected press releases (Live updates)

Tuesday, Oct 1, 2024 - Posted by Isabel Miller

|

| « NEWER POSTS | PREVIOUS POSTS » |