|

Afternoon briefing

Monday, Nov 28, 2022 - Posted by Isabel Miller * This game went as expected…

* Here’s your roundup… * Crain’s | How dark money helped the only Republican Cook County official win re-election: The official is suburban Commissioner Sean Morrison, who also happens to be the Cook County GOP chair. I wrote in September about how $200,000 mysteriously appeared in Morrison’s campaign fund in September, money that originally was donated by hedge fund mogul Ken Griffin to a group that opposed Gov J.B. Pritzker’s graduated income tax amendment in 2020. … While the Coalition to Cut Taxes isn’t registered with the elections board, it is registered as a not-for-profit with the Illinois Secretary of State’s Office. The group’s registered legal agent is Chicago attorney John Fogarty–the same John Fogarty who is general counsel for the Illinois Republican Party. * Daily Beast | Inside the Billionaire-Backed ‘Hub for Election Denial’: VoteRef has focused its efforts not just in Arizona, but the Midwest. (The Uihleins live in Illinois and have focused much of their giving in Wisconsin.) Over the past year, VoteRef has disclosed the personal information of millions of voters as part of a broader effort to empower members of the public to search for alleged “errors” in voter rolls. (Some states make it illegal to publish voter registration rolls.) * Tribune | Mayor Lori Lightfoot files for reelection: ‘Only rational choice is to return me to office’: “With the filing today, one chapter in the campaign ends and another opens,” she said after submitting a stack of nominating papers that, sitting on the Board of Elections table, almost reached her shoulders. Surrounded by supporters and Chicago first lady Amy Eshleman, Lightfoot quipped that her pile of more-than-40,000 signatures “looks like enough to me” before expressing that the next focus is on telling voters “why the only rational choice is to return me to office.” * Blair Kamin | How do we achieve equity-driven urban design in Chicago? The city’s future depends on it. : We should keep that joyous scene and its intimations of equality in mind as Mayor Lori Lightfoot and multiple challengers battle to determine who runs Chicago and the direction the city takes in the post-pandemic, post-George Floyd era. For while the need to stanch gun violence likely will dominate the campaign, another issue, no less urgent, deserves to be on the agenda: building a more equitable Chicago. * Salon | The postliberal crackup: The GOP’s post-midterm civil war starts with the New Right: Earlier this month, after the midterms failed to deliver a promised “red wave,” those fights spilled into the headlines, as Republicans’ disappointed hopes led to some of the first open shots in what’s been a cold civil war over the party’s future. Partly that fight revolves around whether Donald Trump or Florida Gov. Ron DeSantis will lead the GOP into the 2024 presidential election. But it goes much deeper than that, and the fight also has implications that go well beyond the right. * Telegraph | Illinois receives $14.4M to buy locally produced food: The two-year program will involve direct purchases from eligible farmers and multiple aggregation sites where goods will be consolidated and then distributed to schools, nonprofits and food banks. * ABC 7 | Joliet Amazon workers stage walkout on busy Cyber Monday: The protest took place around 3 a.m. on Monday morning. This is the second walkout in two months. * Illinois Public Media | The pseudoscience spreading to police precincts around Illinois: A phenomenon known as 911 phone call analysis is being used by more and more police departments across the country, including in Illinois. It’s a pseudoscience that claims that what someone says, how they sound and how they act during a 911 phone call, can determine if they are calling for help, or if they are trying to cover for a crime they have committed. * Patch | $200,000 Settlement In Black Joliet Officer’s Discrimination Lawsuit: The city of Joliet has agreed to a $200,000 settlement to resolve retired Joliet Police Officer Lionel Allen’s racial discrimination lawsuit against the city, Joliet Patch has learned. * WGLT | In post-Roe America, pilots take the abortion battle to the skies: The idea for a volunteer organization that would transport women seeking abortion care, and physicians who provide it, to states where it is safe and legal to do so, began with a volunteer stint Mike did at Midwest Access Coalition. “As a pilot, I was looking for some way that I could use my skills to help people,” Mike says. “And being someone who believes in someone’s ability to make their own choices, I thought helping people access abortion could be it.” * Grist | Herschel Walker, South Park, and the Prius: How loving gas-guzzlers became political: When states moved to ban rolling coal, some drivers pushed back, the New York Times reported in 2016. “Why don’t you go live in Sweden and get the heck out of our country,” one diesel truck owner wrote to an Illinois state representative who proposed a $5,000 fine for removing emissions equipment. “I will continue to roll coal anytime I feel like and fog your stupid eco-cars.” * Can a Millstadt Republican represent all of IL House District 114? Black leaders worry: Their concerns became a reality with Republican Kevin Schmidt of Millstadt unofficially taking the House District 114 race over incumbent Democrat LaToya Greenwood of East St. Louis. The Associated Press declared him the winner, though the ballots must still be canvassed and certified. … In 2016, she had 8,195 votes from East St. Louis as part of her 26,029-vote total. Those totals dropped this year to 4,990 in East St. Louis and 17,177 districtwide, according to unofficial election results. Meanwhile, the number of votes that Stuart received in St. Clair County for District 112 increased from 4,495 in 2016 to 6,891 in 2022. Hoffman’s totals in St. Clair County in District 113 decreased from 23,533 in 2016 to 20,621 in 2022. * KMOV | Border protection officers seize counterfeit Super Bowl rings headed for Jerseyville, Illinois, feds say: The shipment arriving from China contained 422 rings with the image of the Lombardi Trophy. An import specialist determined the rings to be counterfeit.

|

|

Sen. Hastings will not chair a committee in new GA, but caucus is divided

Monday, Nov 28, 2022 - Posted by Rich Miller * Dan Mihalopoulos at WBEZ…

Go read the rest for more.

|

|

Pot tax cut pushed, despite continuing growth and huge retail markups

Monday, Nov 28, 2022 - Posted by Rich Miller * Daily Herald…

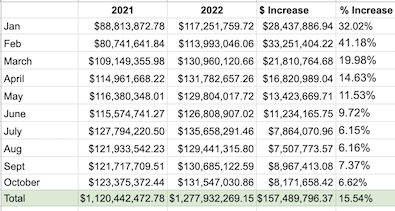

* I asked Isabel to compile some numbers from two state sources and produce this chart…  As you can see, growth is definitely slowing, but a 6-7 percent increase the past several months year-over-year is still pretty darned good, considering the run they’ve had. * Not to mention this tidbit from Crain’s…

If the retailers think prices are too high, maybe cut their own prices first? Hopefully, with more competition coming soonish, they’ll have no choice but to cut prices. * Also, from ABC 7…

Cutting the cannabis tax means reducing those programs unless the tax cut is completely offset by higher sales. But there’s no guarantee of that happening. * Related…

|

|

*** UPDATED x1 *** Question of the day: 2022 Golden Horseshoe Awards

Monday, Nov 28, 2022 - Posted by Rich Miller * The holiday season means two things on this ol’ blog: 1) Fundraising for Lutheran Social Services of Illinois; and 2) our Golden Horseshoe Awards. From Mariah Heinz Wiggins at LSSI…

The thanks should really go to y’all, not me. The kids we buy presents and winter coats and other needs for are served by LSSI’s Foster Care Services. They’re good people doing a great service for children who need it and we get to play a role in that. I quietly opened up the donation page last week and without much fanfare we’ve already raised $1,200. As soon as we hit $2K, I’ll donate a matching amount. So, please, click here and help out the kids. * On to the question. Because of the pandemic, it’s been a while since we’ve voted on these topics…

* Best session tavern/hangout As always, do your very best to vote in both categories and make sure to explain your votes or they will not count. Thanks and have fun! Also, after you’ve cast your ballot, maybe click here and donate to LSSI. Let’s help those kids! *** UPDATE *** Wow, that was quick! I just kicked in my pledged $2,000. Thanks!

|

|

Protected: SUBSCRIBERS ONLY - Fundraiser list

Monday, Nov 28, 2022 - Posted by Rich Miller

|

|

Tony McCombie news coverage roundup

Monday, Nov 28, 2022 - Posted by Isabel Miller * The Tribune…

* WGEM…

* Greg Hinz…

* Shaw Local…

|

|

Protected: SUBSCRIBERS ONLY - A few updates

Monday, Nov 28, 2022 - Posted by Rich Miller

|

|

When literally all else fails, blame the people

Monday, Nov 28, 2022 - Posted by Rich Miller * The collar counties “need to be fixed”…

* Creepy…

* Attacking a guy who took a seat from the Democrats and has held onto it ever since, which are accomplishments that Proft is not exactly known for…

* This sums it up best: The voters are to blame for right-wing losses…

Back in June, Proft called the governor’s contest a “tough but winnable race. A dogfight.” And then his guy got creamed, so he naturally blames voters.

|

|

After election results, a constitutional amendment on abortion appears in the cards

Monday, Nov 28, 2022 - Posted by Rich Miller * My weekly syndicated newspaper column…

Thoughts?

|

|

Protected: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Monday, Nov 28, 2022 - Posted by Rich Miller

|

|

Morning briefing

Monday, Nov 28, 2022 - Posted by Isabel Miller * Do you go all out on Christmas decorations?…

* Here’s your morning roundup…

* Center Square | Illinois lawmakers return this week amid calls for changes in the SAFE-T Act: Illinois lawmakers return to Springfield Tuesday as state’s attorneys and law enforcement officials await changes to the SAFE-T Act. The controversial justice reform package eliminates cash bail on Jan. 1, making Illinois the first state to do so. * Politico | A Progressive Latina Thinks Democrats Are Blowing It with Hispanic Voters: Delia Ramirez won her suburban Chicago district with a strong progressive message. She thinks it’s the key to stemming gains by the GOP. * Politico | How redistricting shaped the midterms: The first election held under new congressional maps reflected both parties’ successes in shaping the House landscape for the next decade. * Sun-Times | Tim Degnan, Daley top gun and state senator, dies at 82: Tim Degnan a trusted point man, was key to Richard M. Daley’s political, policy success. As a lawmaker, he raised funds for the new Comiskey Park to keep the White Sox in Chicago. * WSIU | Democrats made midterm gains in rural areas. Can they keep them?: “I think there’s like a coming to Jesus moment, for lack of a better analogy, around if Democrats are going to like make a more full-throated decision and investment to contest for the rural vote,” said George Goehl, a community organizer with a focus on rural areas. “And I think this election shows what’s possible, even in many cases without resources, and that the rural vote is not static.” * Rolling Stone | Inside the Far-Right’s Fight for College Campuses: With tensions rising around the country, and many progressives experiencing increasing fear and rage at Trump’s presidency, it wasn’t hard to catch an angry assistant professor or usually mild-mannered lefty student driven mad by TPUSA’s more aggressive stunts. And TPUSA chapter leaders and staff members were at the ready, watching for outbursts, provoking them if they could, and capturing them on their iPhones. Their videos were quickly slapped together for maximum impact, given sassy titles, and sent out into the cyberworld, where, if all went as planned, they went viral. Circulating online in late 2017 was the video of an anti-Trump grad student at the University of Illinois who grabbed a TPUSA member’s phone — after the student hollered at him, “No one is scared of you 50-year-old man. Don’t you have kids to look after?” — then threw the phone across the lawn, cracking it. It was, it seemed, designed as a visual reminder that liberals were violent. * Tribune * SJ-R | Wards 5 and 7 will have contested races in 2023 election; filing closes today: The nonpartisan election is April 4. If more than four candidates emerge for a race, a primary will be held on Feb. 28. Also on the ballot are races for District 186 board of education, the Springfield Metropolitan Exposition and Auditorium Authority (SMEAA) board, the Springfield Park District trustees and the Lincoln Land Community College trustees, among others. Those offices file from Dec. 12 to Dec. 19. * Daily Herald | Has interest in recreational marijuana in Illinois peaked?:Last month alone, the 110 recreational dispensaries throughout Illinois collected $131,547,031 in revenue, their fourth-highest monthly tally ever. But those sales figures have remained relatively flat since March, leading some to worry the state’s cannabis cash cow has reached the highest hill in the state’s revenue pasture. * WBEZ | Formerly incarcerated students can now Zoom back into prison to finish their degrees: The pandemic forced prison programs across Illinois to adapt to remote learning. It also paved a path for college students leaving prison. * Tribune | What will Obama center mean for nearby home values on the South Side? Wary of being priced out, groups push for housing benefits and protections: A similar campaign by the same coalition won protections for Woodlawn after a five-year campaign and long negotiations with city housing officials. But organizers in South Shore say they were shut out, and that initial steps announced by the Chicago Department of Housing to help area condo owners did not go far enough. * Sun-Times | Al Capone’s grave in Hillside is defaced: A photo on social media shows the word “Evil” spray-painted in red on Al Capone’s grave marker. * Block Club | Edgewater’s ‘Young Lincoln’ Statue Vandalized On Thanksgiving By Group Advocating Indigenous Rights : An anonymous group of activists poured red paint on the Lincoln statue in Senn Park, tagging the site with slogans including “colonizer” and “land back.” * Sun-Times | White supremacist, Holocaust denier Nick Fuentes, who met with Ye and Trump, raised in suburban Chicago: “Fuentes is among the most prominent and unapologetic antisemites around,” David Goldenberg, the Anti-Defamation League director of the Midwest regional office, told the Chicago Sun-Times on Sunday. * Tribune | An actual game-time decision? Brad Biggs’ 10 thoughts on the Chicago Bears’ Week 12 loss, including that pregame QB chaos.: Leave it to the Bears to have their quarterback situation appear to be in complete chaos Sunday morning. * Tribune | Will Justin Fields start at QB for Chicago Bears vs. Green Bay Packers? ‘It’s about mobility and strength in his left arm.’: The Chicago Bears already had declared Justin Fields inactive because of a left shoulder injury when more quarterback uncertainty popped up Sunday morning. Trevor Siemian, who prepared all week to start if Fields couldn’t play against the New York Jets, also was injured. * Tribune | ‘I thought I would make it’: The strange psychology behind the crashes at Long Grove’s covered bridge: Before them sits a charming covered bridge that would fit right into a Robert James Waller novel. The only difference is the large yellow sign affixed to the wood that reads “8-foot-6,” a height significantly shorter than the average school bus or box truck. More to come!

|

|

Open thread

Monday, Nov 28, 2022 - Posted by Isabel Miller * I hope everyone had a wonderful Thanksgiving and got your rest, because we’re going back to session! What’s on your Illinois-centric mind?

|

|

Live coverage

Monday, Nov 28, 2022 - Posted by Isabel Miller * Follow along with ScribbleLive…

|

| « NEWER POSTS | PREVIOUS POSTS » |