|

New PPP poll has Stratton down by two; Another ‘poll’ shows Biss leading

Wednesday, Feb 25, 2026 - Posted by Rich Miller * The Democratic Lt. Governors Association paid for a new PPP poll. I do not have the full poll. Here’s the memo…

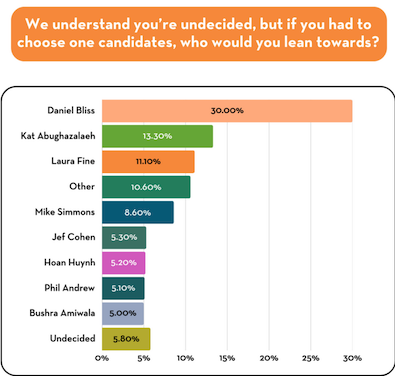

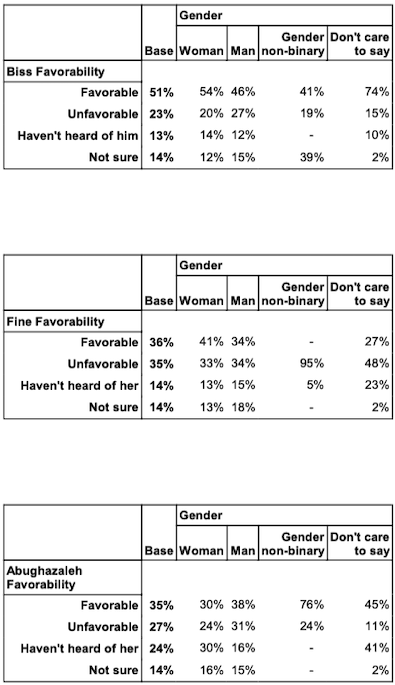

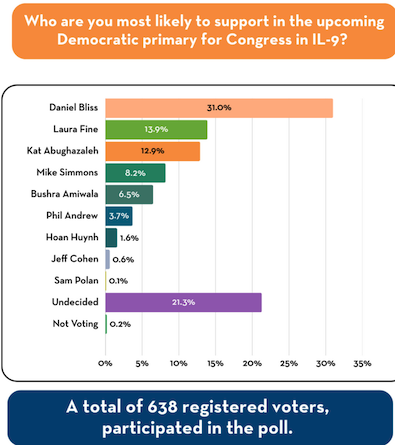

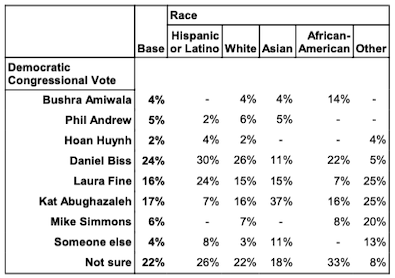

* Meanwhile, CAIR Action paid for a poll conducted by Community Pulse, Molitico. But the numbers are a bit old (February 15th - 20) and it’s a survey of registered voters who are considered by the pollster to be Democratic primary voters, modeled and weighted to the district. So, I dunno about this, but here you go anyway…

More here if you want it. Again, I cannot vouch for the way they conducted this poll, but take it however you like.

|

|

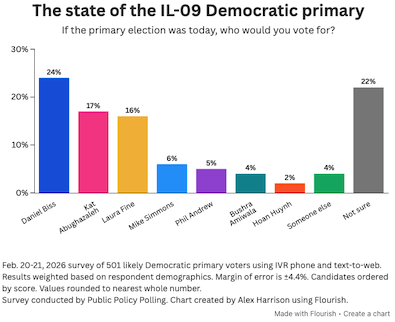

Evanston Roundtable’s PPP poll has Biss over Abughazaleh and Fine 24-17-16; Plus a congressional campaign roundup

Wednesday, Feb 25, 2026 - Posted by Rich Miller

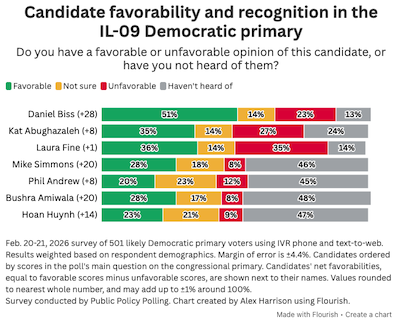

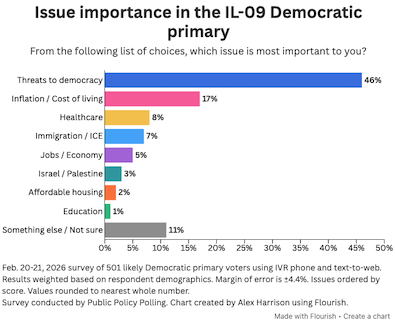

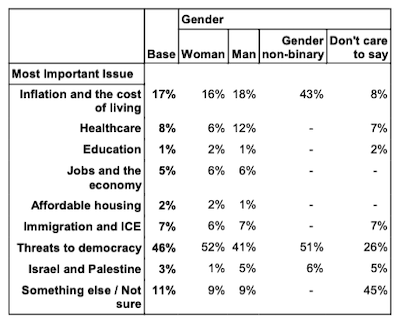

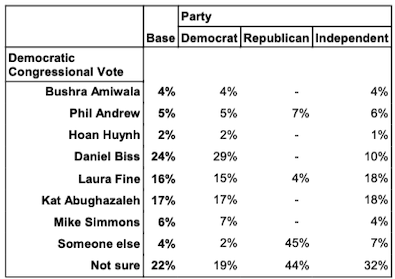

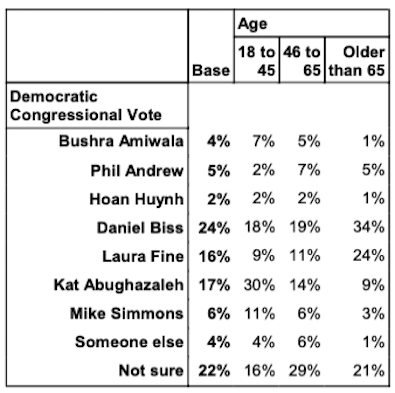

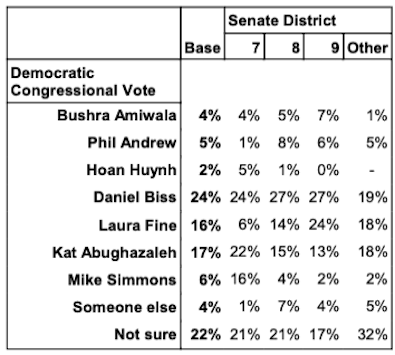

As somebody said yesterday, local Evanston news media has really run circles around the big dogs this cycle. Click here and scroll down to read the full poll.  > > * Biss has strong favorables compared to everyone else. Fine is just +1 after millions…  * “Threats to democracy” far and away the number one issue among voters, according to the poll…  * Let’s look at some crosstabs. Before I do, keep in mind that these responses will have a higher margin of error than the full poll. Also, the smaller demographics have very high MoE’s, so you have to look for the bigger spreads on answers for them. According to the poll, Biss leads among women and is tied with Abughazaleh on men, and women put significantly more emphasis on “Threats to democracy”…

* 21 percent of respondents identified themselves as independents, so take those numbers for what you will. Just 2 percent said they were Republicans, so ignore those responses because there just aren’t enough to evaluate..  * Race/ethnicity...  * Age…  * The crosstabs also show Sen. Fine losing her own 9th Senate district to Biss by three points, but those folks were 30 percent of the full sample…  * OK, let’s move on. This is pretty darned despicable…

* From Isabel… * Politico IL | Some numbers: We got a list of ad buy spending by super PACS. * Sun-Times | Crowded primary for Krishnamoorthi’s suburban House seat underscores Democrats’ generational divide: “People of the district want someone who would stand up to Donald Trump,” said Junaid Ahmed, who’s making a comeback bid of his own after being soundly defeated by Krishnamoorthi in a 2022 primary challenge. Ahmed, a South Barrington tech entrepreneur who organized protests against the use of the McHenry County Jail as a federal Immigration and Customs Enforcement detention center under the Biden administration, closed 2025 with more than $835,000 in his campaign fund. “People have seen me standing shoulder-to-shoulder with them,” said Ahmed, who’s endorsed by progressive Vermont Sen. Bernie Sanders. “That’s what differentiates me.” * Laura Washington | Will Black voters care about AIPAC’s role in Chicago congressional races?: Will Black voters care about AIPAC’s role in these races? The issue of Israel support, I suspect, won’t resonate in districts that are grappling with far more salient concerns, such as the dire need for economic development, adequate health care and affordable housing, for starters. Yet hundreds of thousands of dollars in dark money can buy a powerful perch in Congress, regardless of those concerns, and add a deep fracture to the historic Black-Jewish alliance. * Oak Park Journal | Defiant Ford responds to misleading crypto PAC attack ads: Ford, the video intones, “was indicted on 17 counts.” Waiting a moment for effect, they repeat, “17 counts” over a graphic of “17 counts” handwritten on a piece of cardboard. “The verdict? Ford convicted of tax fraud.” But Ford was not charged with tax fraud in the 17-count indictment. That single charge was in a superseding indictment. […] “I am not a felon,” Ford said. “I am a state legislator, I am a real estate broker, I am licensed to be a teacher.” Had he been convicted of any felony, he said he would not be able to be any of those things. * Fox Chicago | US House 9th Dist. primary debate: Multiple candidates for the Democratic nomination in the 9th Congressional District in Illinois will participate in Fox Chicago’s debate on Wednesday night. Evanston Mayor Daniel Biss, State Sen. Laura Fine, Kat Abughazaleh, State Sen. Mike Simmons, Phil Andrew, and Bushra Amiwala are slated to appear. * Evanston RoundTable | Biss leads by single digits over Abughazaleh, Fine in congressional primary: Biss’ campaign manager George Lundgren wrote to the RoundTable that the mayor’s lead “reflects what we’re hearing from voters every day” and argued that Biss is “in the best position to win undecided voters” over the rest of the campaign. “With three weeks to go until Election Day, we’ll keep fighting to expand our grassroots-powered movement and ensure right-wing special interests don’t buy this seat.” Abughazaleh spokesperson Ramiro Sarmiento argued in a separate statement that she and her campaign still “have the momentum” after entering the race as an underdog last March. * Phil Andrew | Phil Andrew, Candidate for Congress, on How Crisis Shaped His Approach to Public Service: I, Phil Andrew, am running for Congress because I know, firsthand, the cost of violence and the power of prevention. Gun violence is more than a statistic. It’s a moment that can destroy a life, a family, a community. And I know this because on a sunny May morning in 1988, that moment found me. I was just 20 years old, a student athlete home for the summer, when Laurie Dann, a shooter who had just attacked a nearby elementary school and killed an 8-year-old boy, fled into my family’s home. She took my parents and me hostage at gunpoint. I negotiated my parents’ safe release, but when I moved to disarm her, she shot me in the chest at point-blank range. The bullet pierced both my lungs and grazed my heart. * Sun-Times | Crowded field of 15 Democrats jockey to succeed U.S. Rep. Jan Schakowsky: Voters in one of the most Democratic districts in the state will see 16 names on the March 17 ballot. Bruce Leon’s name will be on there too, although he dropped out of the race and endorsed another candidate: former FBI agent Phil Andrew. Leon, a pro-Israel Democrat, blamed “tremendous political pressure from Washington, D.C., interests” — referring to the American Israel Public Affairs Committee — for dropping out. AIPAC is indeed playing a role in the race — with Fine accepting donations associated with the pro-Israel lobbying group. AIPAC hasn’t endorsed Fine, but an AIPAC-affiliated super PAC is running ads to support her bid. * Loyola Phoenix | Congressional Catch-Up: Daniel Biss: Biss said the Democratic party has poorly communicated in a broadcast television way suited to older audiences. To attract young voters, Biss said his campaign focuses on communication online. He said he doesn’t want to communicate “at” people online, but rather listen, organize and lift up the voices of others. He said having an agenda which responds to the realities faced by young voters is critical. * Press release | Queer Union Vet Keturah Johnson Endorses Mike Simmons for Congress: State Senator Mike Simmons’ campaign for Congress in Illinois’ 9th District has been endorsed by Keturah Johnson in her personal capacity. Johnson is a combat veteran, flight attendant, and International Vice President of the Association of Flight Attendants (AFA-CWA). As the first queer woman of color and veteran to be elected to this role, her voice is a uniquely powerful one that advocates for workers’ rights, trans rights, and dignity for our veterans. “It’s simple: we need leaders who show up for workers. That’s who Mike is, and who he’ll be in Congress: I am proud to stand with him on the picket line and in this race.” said Johnson. * Press release | Want to Run as an Independent to Replace Congressman Chuy García? You’ll Need 10,816 Signatures vs. the 697 His Anointed Successor Needed: In the state’s 4th Congressional District, Chicago City Council Alderman, 25th Ward Democratic Committeeman, and Democratic Socialist Byron Sigcho-Lopez is running as an Independent to replace current Congressman Jesús “Chuy” García, who made a deal with his chief of staff to hide his retirement until the last minute possible so she could run unopposed in the Democratic primary. “True democracy means people get a choice in our elections – not a backroom deal, a handpicked successor, and a political system that shuts them out of the decisions that shape their lives,” Sigcho-Lopez said. “We need someone in Congress who takes our fight from the streets to the halls of government so we can finally stop Trump’s destruction of our civil rights, hold the Epstein class accountable, and give working families relief by ending tax breaks for corporations and billionaires on both sides of the aisle.” * Press release | Independent Candidate Mayra Macías Kicks Off Petition Drive to Put Her Name On November Ballot: Mayra Macías, independent candidate for Illinois’s 4th Congressional District, will host an event on Saturday, February 28, for the official petition launch to put her name on the election ballot in November. Despite being a lifelong Democrat, Macías launched her congressional campaign in December as an independent candidate after outgoing-Congressman Chuy García cleared the way for his Chief of Staff, Patty García, to be the only Democrat on the ballot. While those in power have tried to decide who should represent the district in Congress instead of allowing Chicagoans to choose for themselves, Macías aims to push back by providing voters with a choice.

|

| « NEWER POSTS | PREVIOUS POSTS » |