|

Isabel’s afternoon roundup

Thursday, Apr 11, 2024 - Posted by Isabel Miller * Tribune…

Press release…

* [From Rich] The Butternut Hut is closing at its current location in a couple of days, so you might want to head over there after session for “Thirsty Thursday.” * Here’s the rest…

* NPR | Why many Illinois speech therapists say it’s hard to see a future in the field they love: “Insurance is really strict on the number of times we can go, especially for speech therapy,” [ Audrey Meyers] explained. “I’ll get a new patient; it says one visit is allowed. I can do an evaluation, sure, but they’re probably going to need therapy if they wanted me to come there in the first place.” * WBEZ | A U.S. Supreme Court case could affect homeless people in Chicago and Illinois: City of Grants Pass, Oregon v. Johnson will determine if municipalities can use local ordinances to ban homeless people from sleeping outside with a blanket or other bedding materials. Illinois advocates say if the high court sides with Grants Pass, it could make it easier for municipalities to criminalize homelessness in the state and throughout the U.S. Oral arguments begin April 22. * Journal Courier | Grants to fund electric vehicle charging ports: Some 20 applicants have been awarded $25.1 million in Driving a Cleaner Illinois grants to fund 643 new direct-current fast-charging ports at 141 sites statewide, according to the Illinois Environmental Protection Agency. * Illinois Times | Making downtown Springfield more marketable: Doubling the Bank of Springfield Center’s size would result in a similar increase in conventions coming to the capital city, and construction of a new 300-bed hotel adjacent to the center would maximize the expanded facility’s potential. Those were two of the major conclusions from a recently completed feasibility study of the potential impact of a newly formed tourism improvement district on downtown Springfield. The district was formed in December by the Sangamon County Board and covers the entire county. * Daily Journal | Bradley pressing the brakes on nepotism ordinance: At Monday’s Bradley Village Board meeting, the administration had proposed the repeal of the law adopted in April 2016 which sharply restricted hiring those who had some type of family relationship with an elected official. The administration sought to have the ordinance removed because of how it hampers the village as it seeks to fill job vacancies. However, the village board, led by Trustee Ryan LeBran, wanted to further explore the matter before voting on its removal. * Beacon-News | With help from its communities, Kane County aims to reduce impact of natural hazards like floods and tornadoes: The draft Kane County 2024 Natural Hazard Mitigation Plan found that floods, windstorms and winter storms were the three biggest natural threats to the county. To protect the county against these and six other natural hazards, the 580-page plan brings together mitigation projects from 27 cities, villages and other communities within Kane County. These projects will now be eligible for federal funding through the Federal Emergency Management Agency, or FEMA. * Daily Herald | ‘Almost have no reason not to vote for it’: Elk Grove mayor defends field light vote — and still supports pickleball: The village board’s vote this week to formally grant the Elk Grove Park District a special use permit for soccer field lighting at Marshall Park was perfunctory, following a much lengthier meeting two weeks before when the mayor and trustees first endorsed the project. But the tally Tuesday night was still followed by a back-and-forth between board members and local real estate agent Lori Christensen, who has led opposition to the park district’s $4 million transformation of the park at 711 Chelmsford Lane. * Bloomberg | Amtrak Station Accessibility Improvements Sought in Senate Bill: Amtrak would need to report to Congress annually on the status of their compliance with the Americans with Disabilities Act at the 385 transit stations it serves and include an action plan on bringing rail cars and stations into compliance, according to the bill, sent to Bloomberg Government. The legislation, which is being announced Thursday, is led by Sens. Tammy Duckworth (D-Ill.) and Shelley Moore Capito (R-W.Va.). * Daily Herald | Will your train station get a makeover? Here’s what Metra is fixing in 2024: Thirty-five stations are slated for improvements with seven on the Metra Electric Line to be completely rebuilt. Platform modernizations are scheduled for Wood Dale on the Milwaukee West, and Cary and Crystal Lake on the UP Northwest lines. Less eye-catching but still significant are thousands of rail tie replacements. Workers will install 40,000 new ties on the UP North between Chicago and Highland Park, and 37,000 on the UP Northwest between Chicago and Des Plaines, among other locations. * Ald. Daniel La Spata | A street redesign that skips bike and bus lanes says a lot about the whole city: Unfortunately, the design CDOT is considering for this intersection fails to live up to the values and the vision of Complete Streets. The current iteration offers no bus lanes on Halsted and no bike lanes on Chicago, while new developments propose to open new curb cuts on both streets, further impeding bus, bike and pedestrian safety. The only clear imperatives for these streets seem to be two lanes for car traffic in each direction. * Daily Herald | $127 million transportation construction program announced in Lake County: Fifteen miles of new or widened pavement, 58 miles of resurfacing, eight big intersection improvements, 13 bridge deck repairs and two roundabouts are among the projects in Lake County’s $127 million 2024 construction program. * Tribune | Chicago Bears — amid lakefront infatuation — appeal property taxes on Arlington Heights site: The team filed the request with the Illinois Property Tax Appeal Board, or PTAB, for the site where the Bears had proposed building a $2 billion enclosed stadium. The Cook County Board of Review set its valuation of the property at $125 million. […] But the team still owns the site in Arlington Heights, which it bought last year for $197 million. To reduce the tax bill, the organization razed the grandstand and other buildings, and is continuing to fight over how much taxes it has to pay. * Sun-Times | The Museum of Science and Industry closed for mysterious reasons last week. Here’s why: “The 434th Civil Engineer Squadron from Grissom Joint Air Reserve Base, IN, responded to a call from the museum last Wednesday,” wrote Maj. Sara Greco, public affairs officer at Robins Air Force Base in Georgia. “The items they were asked to assess were free of explosive material and remained at the museum.” A sad day when it’s easier to dig information out of the Pentagon than from a Chicago museum. * AP | Shohei Ohtani’s ex-interpreter charged with stealing $16M from baseball star in sports betting case: Estrada says Mizuhara helped Ohtani set up a bank account for Ohtani’s baseball salary. Estrada says Mizuhara stole more than $16 million from Ohtani’s bank accounts to pay for his own sports betting and lied to the bank to access the account. * NBC Chicago | Farmers’ Almanac predicts hot, muggy summer for Midwest, with all-time record warmth possible: Nearly all of the contiguous U.S. is predicted to have a hot summer, with most areas east of the Mississippi River expected to see wetter than normal summers as well. The Great Lakes region in particular is predicted to see “muggy and stormy” conditions this summer, while much of the Southeast is described as “steamy and thundery” for the upcoming season. * NPR | Why anti-abortion advocates are reviving a 19th century sexual purity law: That is not the stance conservative legal experts take. Josh Craddock, an affiliated scholar at the conservative James Wilson Institute, refers to Comstock as a “national abortion pill trafficking ban.” “A straightforward interpretation of the statute is that it prohibits all interstate shipment or sale of abortion drugs and devices, regardless of whether state law allows abortion,” Craddock says. (There was dispute among legal experts NPR consulted as to whether Comstock’s prohibitions would apply to in-state shipping of abortion pills.) * Rick Kogan | There once was a time when our city was the country music capital: Two relatively young men were sitting in a radio studio a few days ago talking about a radio show that started 100 years ago and one of them was saying, “This part of the city’s history should be better known, the part the city, this radio show, played in popularizing country music. Without Chicago, there would have been no Nashville, no Grand Ole Opry. … This is where the country music genre was born.” * USA Today | Aerosmith to resume farewell tour, including January show in Chicago: The veteran rockers, who postponed their Peace Out farewell tour after only a few shows in September, will return for a 40-date run starting Sept. 20 in Pittsburgh. The tour includes a rescheduled Chicago date on Jan. 19 at the United Center. All previously purchased tickets will be honored for the new dates, while new tickets will go on sale at 10 a.m. Friday via ticketmaster.com. For those who previously purchased tickets and cannot attend the rescheduled concerts, refunds will be available at point of purchase.

|

|

*** UPDATED x1 *** Some Native American activists caught off guard by possible Starved Rock name change

Thursday, Apr 11, 2024 - Posted by Rich Miller * Wikipedia entry on Starved Rock State Park…

* Tom Collins on Friday…

* Tom Collins today…

I’ve asked IDNR for comment and will let you know if I hear back. *** UPDATE *** From IDNR…

|

|

IDPH awards $2 million in grants from the Abortion Provider Capacity Building Grant Program

Thursday, Apr 11, 2024 - Posted by Rich Miller * Press release…

Discuss.

|

|

Showcasing The Retailers Who Make Illinois Work

Thursday, Apr 11, 2024 - Posted by Advertising Department [The following is a paid advertisement.] Retail provides one out of every five Illinois jobs, generates the second largest amount of tax revenue for the state, and is the largest source of revenue for local governments. But retail is also so much more, with retailers serving as the trusted contributors to life’s moments, big and small. We Are Retail and IRMA are dedicated to sharing the stories of retailers like Edwin, who serve their communities with dedication and pride. Click here to learn more.

|

|

A fiscal cliff of their own making

Thursday, Apr 11, 2024 - Posted by Rich Miller * One smart thing state leaders did during and since the pandemic is to not put much one-time federal money into ongoing base spending. Not so with Chicago Public Schools. From Chalkbeat…

While those last two paragraphs are very positive news, it’s just not sustainable.

|

|

Protect Illinois Hospitality - Vote No On House Bill 5345

Thursday, Apr 11, 2024 - Posted by Advertising Department [The following is a paid advertisement.]  Getting rid of tipped wages in Illinois would be the final blow to many restaurants “Unfortunately, eliminating the tip credit is not the answer. Not for me as a mayor and not as a small business owner. I hope Springfield legislators vote no on this proposal so our communities can remain a place where employees, businesses and residents thrive.” George D. Alpogianis is mayor of Niles and part of the third generation of several family-owned and operated local restaurants.

|

|

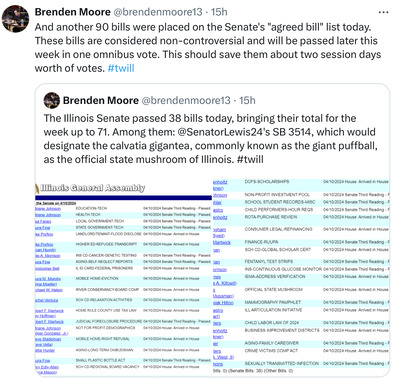

It’s just a bill

Thursday, Apr 11, 2024 - Posted by Isabel Miller * Crain’s…

* WSIU…

* WAND…

* Fox Chicago…

HB4677’s Third Reading deadline has been extended to May 24. * WCBU…

* WAND…

* SJ-R…

|

|

Pritzker administration split

Thursday, Apr 11, 2024 - Posted by Rich Miller

|

|

Open thread

Thursday, Apr 11, 2024 - Posted by Isabel Miller * What’s going on? Keep it Illinois-centric please…

|

|

Isabel’s morning briefing

Thursday, Apr 11, 2024 - Posted by Isabel Miller * ICYMI: After balking earlier, Johnson to ask City Council to spend $70M on migrant services. Tribune…

-Sources familiar with the briefings said his team hopes to allocate the $70 million from previous city surpluses -Johnson’s budget chair Ald. Jason Ervin, 28th, confirmed the likelihood of the spending item facing a vote next week. * Related stories…

∙ WGN: Chicago mayor to ask city council for $70 million for migrant aid * Isabel’s top picks…

* Crain’s | Springfield bill takes aim at racial disparities in CPS teacher evaluations: The proposal would give the Illinois State Board of Education the ability to examine teacher evaluation procedures and determine if racial, ethnic, socioeconomic or geographical factors undercut how CPS teachers are rated. Then, the Chicago Board of Education and the Chicago Teachers Union would negotiate to create a new evaluation system to remedy those disparities. If passed, the new evaluation would be implemented by Aug. 15, 2025. * WTAX | State legislative leaders give IL Chamber contrasting views: Welch has made “The Infinite Game” his theme for 2024, saying, “I can guarantee you there will be a 71st speaker, there will be another Black speaker. Illinois will go on for another 200-plus years. […] Senate President Don Harmon (D-Oak Park), saying state government should be boring (“I want it to model itself after me!”) and get out of the way, praised Gov. JB Pritzker’s cheerleading for Illinois, but Senate Minority Leader John Curran (R-Downers Grove) said Democrats are messing everything up: “The recent announcement that a large (Quaker Oats) plant in Danville will be closing its doors, resulting in more than 500 lost jobs in an area of the state that has a higher than average unemployment rate already, is a prime example of how we have to do a better job of taking care of our current employers here.” * April 10th is now Lee Milner day in illinois…  * Here’s the rest…

Though lawmakers filed a bill proposing the tax credit, lawmakers would pass it through the state budget. To qualify for the full $300 credit, joint filers would need to make less than $75,000 the previous year, $50,000 for single filers. Families who make slightly above the threshold could still be eligible for the tax credit on a sliding scale meaning their credit would be smaller. * Fox Chicago | AARP pushes for Illinois Caregiving Portal legislation: The portal would be managed by the Illinois Department of Aging in coordination with other state agencies. Supporters say it would help keep people from having to turn to Google to find what they need. * Shaw Local | Regulators weigh future of gas industry in Illinois, while clamping down on Chicago utility: The ICC launched a process dubbed the “Future of Gas” last week that will inform the governor, legislature and other policymakers on potential policy changes. The process was initiated by the ICC after they tamped down requests for rate increases from all of the state’s major gas utilities. * Capitol News Illinois | Komatsu mining truck named 2024 ‘coolest thing made in Illinois’: The truck was one of more than 200 entries in the 5th annual contest hosted by the Illinois Manufacturers’ Association and sponsored by Comcast Business. The bracket-style contest lasted eight weeks and collected almost 315,000 votes for the products entered, narrowing them down to the top 16, then to the final four, which were recognized Wednesday. The truck, made by Komatsu in Peoria, has a hauling capacity of up to 400 tons and has “new innovations in suspension transmission, electric drive technology and autonomous operation,” according to Komatsu. The 980E-5 truck weighs more than 1.3 million pounds. * Oak Park Journal | Cosgrove edges out Przekota in race for judge: According to final, uncertified results Cosgrove defeated prosecutor Kim Przekota by the razor thin margin of 338 votes. Cosgrove has 13,468 votes, or 50.6% of ballots cast, to 13,130 for Przekota, who comes in 49.4% of the vote. * Shaw Local | Keep pressing on full costs of proposed new early childhood agency: When revisiting an Oct. 26 column on Gov. JB Pritzker’s plans for a new state agency that would administer every service under the umbrella of early childhood, my main concern was whether consolidation would further eradicate local control and how the agencies that stand to lose responsibilities would adjust. There is appeal in “a more equitable, integrated, and holistic system of services for young children and families,” as the governor’s office pledged, but Pritzker still bears a burden of proof: that a new agency is up to the task and that those currently overburdened actually end up more efficient. * WCIA | Danville’s Village Mall set to be auctioned off, leaving locals concerned: Mayor Rickey Williams Jr. said he’s frustrated with the situation and doesn’t know why the owners of the decades-old mall are selling, and communication with them has been difficult. […] Mayor Williams said they offered a $100,000 market study to explore possible options for the mall but the owners were not interested. WCIA 3 reached out to the company, but has not received a response. * Elgin Courier-News | Bartlett High School principal removed from post but allowed to return as teacher: Demovsky was placed on administrative leave in March during the probe, the details of which have not been made public. “I just want to say to the community that I understand it seems like a lot of things happen in private,” board member Dawn Martin, a Bartlett resident, said during the meeting. “I want to remind the community that personnel matters are discussed in closed (sessions). It’s not about hiding things from our community or not being transparent. * Sun-Times | Killing of Dexter Reed raises questions about Chicago police reform. ‘The message is, go in guns blazing.: Alexandra Block, an attorney with the American Civil Liberties Union of Illinois, said the Chicago police department’s approach to reform has amounted to “a box-checking exercise,” and the promises of overhauling the culture haven’t been kept. * Chalkbeat | From ‘winning the lottery’ to ‘leaner schools’: How the end of federal COVID money could impact Chicago schools: At one school, where nearly all of the students came from low-income households, the additional money meant more after-school programs for everyone, tutoring for struggling students, open gym, and even a staff-created crafting class where students could get additional social-emotional support. Test scores went up and staff noticed fewer fights, said a former school administrator who requested anonymity in order to speak candidly. * Sun-Times | Amazon owes Chicago-based tech company $525 million for patent infringement, jury rules: Kove is a Chicago-based company that specializes in computer storage and data management technologies. The West Loop firm owns three data storage patents and accused cloud computing platform Amazon Web Services of infringement, filing a lawsuit against the Amazon-subsidiary in December 2018. The three patents — invented by Kove CEO John Overton and Stephen Bailey — relate to systems and methods for managing the storage, search and retrieval of information across a computer network, according to the lawsuit. * AP | Internet providers must now be more transparent about fees, pricing, FCC says: Following the design of FDA food labels, these broadband labels will provide easy-to-understand, accurate information about the cost and performance of high-speed internet service to help consumers avoid junk fees, price hikes, and other unexpected costs. Internet service providers selling home access or mobile broadband plans will be required to have a label for each plan beginning April 10. * Sun-Times | Northwestern to play most home football games in temporary on-campus stadium the next 2 years: The school announced Wednesday that it will build a temporary structure attached to Lanny and Sharon Martin Stadium, the home of its lacrosse and soccer teams, on the shores of Lake Michigan. Northwestern is working with InProduction, which built seating for last summer’s NASCAR race downtown as well as at Hawaii and Florida State. Construction will start this summer, and the facility will be open for the next two football seasons. * WTTW | CTA Says Red Line Extension a ‘Top Priority’ for Biden Administration, on Track to Begin Construction Next Year: Carter told the board he met with the head of the FTA on a recent trip to Washington, D.C., who assured him the Red Line Extension is a “top priority project” for President Joe Biden’s administration. The president’s fiscal year 2025 budget proposal includes an initial round of $350 million in funding for the ambitious effort. FTA officials are “very upbeat about our project and very upbeat about the timeline for getting the full funding grant agreement … in place by the end of this year,” Carter said. “By all accounts, we’re on target to accomplish that.” * Crain’s | Uber is adding taxis to its app in Chicago. Yes, you read that right: Why is Uber giving its customers the chance to take a traditional cab? “We continue to believe that there is no world in which taxis and Uber exist separately — there is simply too much to gain for both sides,” the company said in a statement. * Tribune | The most infamous serial killers all seem to have something in common — they’re from around here: What is it about the Midwest that breeds so many serial killers? What is in the soil that grows the sort of grisly murderers who launch a million headlines? Adam Rapp has wondered for a long time. He was born in Chicago and raised in Joliet in the 1970s, when Joliet was not the best place to grow up. Gangs proliferated. There were rumors of white vans whose drivers offered neighborhood boys a peek at a Playboy. You couldn’t escape to Chicago — killer clown John Wayne Gacy and nurse killer Richard Speck came out of there. * Tribune | University of Illinois, citing insufficient evidence, closes internal probe of basketball player Terrence Shannon Jr: In a notice dated Friday, the director of the university’s Office for Student Conflict Resolution wrote that the investigator in the probe did not have access to the complainant, the complainant’s witness or the complete file from the police department in Lawrence, Kansas. “The complainant has not indicated an intent to participate in a hearing before a hearing panel at this time,” the director, Robert Wilczynski, wrote in the letter. “As a result, the process has concluded.” No disciplinary action will be taken at this time, he added. * Tribune | Yoán Moncada — out 3-6 months — joins Luis Robert Jr. and Eloy Jiménez on the IL for Chicago White Sox: The Chicago White Sox third baseman’s 2024 took a dramatic turn for the worse when he suffered a left adductor strain during Tuesday’s game against the Cleveland Guardians. Wednesday, he learned he would be out an estimated three to six months as the Sox placed him on the 10-day injured list. * Chicago Mag | The Sox’s New Voice: The biggest thing it takes is belief. Because there’s only 30 jobs in Major League Baseball, and there’s so many people telling you it’s not possible. So you need confidence in yourself — and good people in your corner. When I was at Dartmouth, my middle sister was at Howard, and she told me to come there for a transfer semester. I studied journalism in their school of communication, then got an internship at [Pardon the Interruption] at ESPN. It just snowballed from there. * >WSIL | Some businesses in Cairo, Illinois say saw more sales from the Solar Eclipse: Businesses on Route 51 had a front-row seat to the action, including the Smokey Hill BBQ food truck. “There started to be a Jam from Kentucky to the center of Cairo,” owner Tim Koch said. […] The owners of G&L Clothing told us in a phone call that they saw a 75% jump in sales during the eclipse weekend.

|

|

Protected: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Thursday, Apr 11, 2024 - Posted by Rich Miller

|

|

Live coverage

Thursday, Apr 11, 2024 - Posted by Rich Miller * You can click here or here to follow breaking news. It’s the best we can do unless or until Twitter gets its act together.

|

| « NEWER POSTS | PREVIOUS POSTS » |