Fitch downgrades Illinois

Monday, Oct 19, 2015 - Posted by Rich Miller

* Reuters…

Illinois’ credit standing took another hit on Monday as Fitch Ratings downgraded the state’s rating for the first time on Governor Bruce Rauner’s watch, citing the deterioration of state finances during its four-month budget impasse.

The downgrade is the most potent sign yet that the stalemate between Republican Rauner and Democrats who run the legislature - which has taken a bite out of state services - is making Illinois’ already-precarious standing on Wall Street worse.

The one-notch downgrade from A-minus to BBB-plus, affecting $26.8 billion of general obligation bonds, leaves Illinois as the only U.S. state with a rating in the low investment grade triple-B level. Fitch has previously dropped only California to that level in 2003 and 2009, according to Karen Krop, a Fitch analyst.

* The AP’s she-said, she-said…

Catherine Kelly is spokeswoman for Republican Gov. Bruce Rauner. She says Rauner is fighting to “put the state on the path to fiscal health,” but the Democrat-led Legislature is standing in his way.

Rikeesha Phelon is spokeswoman for Democratic Senate President John Cullerton. She says Illinois can’t afford for Rauner “to prioritize his corporate class agenda over basic budget math and governing.”

* Full statement from Speaker Madigan…

“As I’ve been telling Governor Rauner for several months, the number one problem facing Illinois is the state budget. The lack of a resolution on the state budget and today’s downgrade are direct results of the governor’s continued focus on issues other than solving our budget crisis. It’s time we put aside the governor’s list of issues that Democrats and Republicans believe will hurt middle-class families and instead focus on a budget that helps all Illinoisans.

“Fitch Ratings agrees with my view. Nowhere in Fitch’s statement does it suggest that the state needs to follow the governor’s agenda by weakening collective bargaining rights, reducing workers’ wages and hurting the middle class.

“I continue telling the governor we need to take a balanced approach to the state’s financial challenges, one that includes some cuts, like those included in the budget passed by the Legislature in May, and new revenue. Today’s news is another reminder to the governor that it’s time to focus on our budget.”

* From Fitch…

Fitch Ratings has downgraded the rating on $26.8 billion in outstanding Illinois general obligation (GO) bonds to ‘BBB+’ from ‘A-’.

In addition, the ratings on bonds related to the state based on its appropriation have been downgraded to ‘BBB’ from ‘BBB+’ as detailed at the end of this release.

The Rating Outlook has been revised to Stable from Negative.

SECURITY

Direct general obligation, full faith and credit of the state of Illinois

KEY RATING DRIVERS

REDUCED FLEXIBILITY: The downgrade reflects the continued deterioration of the state’s financial flexibility during its extended budget impasse. Illinois’s inability to balance its operations, eliminate accumulated liabilities, and grow reserves during a period of economic expansion leaves it far more vulnerable to the next economic downturn.

ONGOING BUDGET GAPS: After four years of nominally balanced operations that benefitted from temporary tax increases, the fiscal 2015 budget was only balanced through extensive one-time action and a budget has not been enacted for fiscal 2016, which began on July 1. The state continues to spend in most areas at the fiscal 2015 rate, which is expected to lead to a sizeable deficit. As was the case during the most recent recession, this deficit spending is likely to be addressed by deferring state payments and increasing accumulated liabilities.

LONG TERM LIABILITIES HIGH: The state’s debt burden is above average and unfunded pension liabilities are exceptionally high. The state has limited flexibility with regard to pension obligations following the May 2015 Illinois Supreme Court decision that found the 2013 pension reform unconstitutional. Pensions remain an acute pressure on the state’s fiscal operations.

ECONOMY A CREDIT STRENGTH BUT RECOVERY WEAK: The state benefits from a large, diverse economy centered on the Chicago metropolitan area, which is the nation’s third largest and is a nationally important business and transportation center. Economic growth through the current expansion has lagged that of the U.S. as a whole.

RATING SENSITIVITIES

The Stable Outlook incorporates the expectation that the state of Illinois will use one-time solutions to nominally balance the fiscal 2016 budget, but will not achieve more permanent, structural solutions in a time frame that will have a significant impact on fiscal 2016.

Failure to enact measures that lead to ongoing budget balance beyond fiscal 2016 could lead to negative rating action.

Successful implementation of measures to enact a structurally balanced budget and reduce accumulated budget liabilities may lead to positive rating action.

CREDIT PROFILE

The downgrade on the GO bonds of the state of Illinois to ‘BBB+’ from ‘A-’ reflects the deterioration of the state’s financial flexibility as its budget stalemate continues deep into the current fiscal year. With the national economic expansion now extending into a sixth year, Illinois has failed to capitalize on economic growth to restore flexibility utilized during the last recession or to find a solution to its chronic mismatch of revenues and expenditures. Once again, the state has displayed an unwillingness to address numerous fiscal challenges, which are now again increasing in magnitude as a result.

Temporary increases in personal and corporate income tax rates in place for four years, from January 1, 2011 through December 31, 2014, closed or partially closed the budget gap across five fiscal years. However, with their expiration, and the failure to enact a spending plan within expected revenues, the budget gap has ballooned. As a result, the state finds itself with a current operating deficit, structural budget deficit, cash crunch that is now causing a delay in pension system contributions, and accumulation of accounts payable that approaches its highest level at the depth of the recession. As the fiscal year progresses, fewer options remain for closing the gap on a current year basis, pushing the potential solutions into fiscal 2017.

ONE-TIME SOLUTIONS CLOSED 2015 GAP

The current budget stalemate follows a fiscal 2015 when a significant gap was closed primarily through the use of one-time fund sweeps rather than on-going spending or revenue action. The enacted budget for fiscal 2015 relied on approximately $2 billion in one-time revenues to achieve balance, given the anticipated expiration of the temporary taxes half-way through the fiscal year. These included interfund borrowing, use of prior year surplus to prepay fiscal 2015 Medicaid expenses, underfunding of specific budget line-items, and an increase in anticipated accounts payable.

Upon taking office in January 2015, and finding a budget gap that was larger than expected, the current administration proposed, and the legislature enacted, an additional $1.3 billion in fund sweeps and approximately $300 million in budget reductions. However, the lack of a structural solution in fiscal 2015 left the state in a weak fiscal position in developing the fiscal 2016 budget.

FISCAL 2016 SPENDING SUBSTANTIALLY ABOVE EXPECTED REVENUES

The governor and state legislature have not come to agreement on a spending and revenue plan for the current fiscal year, which began July 1, 2015, for which there is a large projected deficit that reflects the full-year impact of the temporary tax expirations.

Despite the absence of an enacted budget, due to continuing and permanent appropriations, court orders and consent decrees, and an enacted appropriation for schools, the state is spending approximately 85% of its budget at the fiscal 2015 enacted rate during the budget impasse. Continuing to spend at this rate, without further appropriations or other changes, is forecast to lead to an annual operating deficit of approximately $2.1 billion, or 6.8% of forecast revenues. This deficit would most likely be addressed by an increase to the accumulated accounts payable balance.

Fitch believes that this deficit figure is likely to be higher, as it incorporates the state withholding $5.9 billion in spending for universities, the group health insurance program, and a variety of other programs, some of which would ultimately have to be covered with state revenue. The state notes that it has already taken approximately $1 billion in actions to reduce spending and reallocate funds to the general fund.

Emphasis added.

85 Comments

|

Question of the day

Monday, Oct 19, 2015 - Posted by Rich Miller

* AP…

The Illinois Gaming Board plans to seek a legal opinion on whether daily fantasy sports websites like those ordered shut down in Nevada violate state law.

Spokesman Gene O’Shea said Friday the board believes sites like DraftKings and FanDuel are illegal in Illinois. He says the board will likely send a letter next week asking Attorney General Lisa Madigan for an opinion because it doesn’t have authority to take action.

Nevada regulators on Thursday ordered the sites to shut down, saying they can’t operate in the state without a gambling license.

The sites insist they’re skill-based — not chance-based — wagers and therefore not subject to gambling regulations.

* The Question: Should those ubiquitous fantasy sports betting sites be banned in Illinois? Take the poll and then explain your answer in comments, please.

picture polls

57 Comments

|

|

Comments Off

|

* Reboot…

In its Oct. 19 Credit Outlook report, Moody’s focuses on last week’s announcement by Comptroller Leslie Geissler Munger that cash flow problems due to the state budget impasse will force the state to delay its scheduled November payment to the state’s five public pension systems. Moody’s deems that action as a “credit negative” — meaning it could negatively affect the state’s credit rating if not corrected.

“The delay, which was made because the state’s cash on hand is insufficient to meet all of its payment obligations, reflects Illinois’ outsize unfunded pension obligations, the lapse of an existing tax package that would have yielded roughly $5 billion in the current fiscal year, and the continued failure of the state’s political leadership to enact a fiscal 2016 budget. The underpayment also ensures the continued deterioration of Illinois’ pension plans’ funding status,” says Moody’s spokesman David Jacobson. […]

In its Oct. 19 Credit Outlook report, Moody’s focuses on last week’s announcement by Comptroller Leslie Geissler Munger that cash flow problems due to the state budget impasse will force the state to delay its scheduled November payment to the state’s five public pension systems. Moody’s deems that action as a “credit negative” — meaning it could negatively affect the state’s credit rating if not corrected.

“The delay, which was made because the state’s cash on hand is insufficient to meet all of its payment obligations, reflects Illinois’ outsize unfunded pension obligations, the lapse of an existing tax package that would have yielded roughly $5 billion in the current fiscal year, and the continued failure of the state’s political leadership to enact a fiscal 2016 budget. The underpayment also ensures the continued deterioration of Illinois’ pension plans’ funding status,” says Moody’s spokesman David Jacobson. […]

“The state’s $6.7 billion pension contribution for the fiscal year that ended June 2014 was more than 10% of its total governmental revenues, but still short of the $7.8 billion that would have met its actuarial required contribution, a minimum standard needed to achieve full funding. The underpayment ensures the continued deterioration of Illinois’ pension plans’ funding status. Furthermore, the gap between the state’s statutory contribution and the amount that would reasonably amortize its pension liability is only a portion of the state’s structural imbalance, which has resulted in repeated and large payable balances at fiscal year-ends.”

* Gov. Rauner has a new plan, according to the Illinois Policy Institute’s news service…

During a town hall meeting in Decatur, Illinois’ Governor repeated his call for structural reforms and a balanced budget and also laid out a few details about how he wants to reform pensions. Governor Bruce Rauner said there must be changes to the pension system and said he has a constitutional fix. His idea includes a new deal moving forward.

“People can keep their old deal if they want but then their salary increases don’t go into the pension. Or they can have their salary increases count towards their pension if they get into a new deal.”

To encourage workers to enter a potential new tier, the Governor said there would be incentives offered. If the plan is passed by the General Assembly and implemented, Rauner said there would be big savings.

“And if we do that we can save $2 billion for you as taxpayers.”

The Governor said his administration has researched the proposal and said it is constitutional.

It’s not exactly a new idea, but whatevs.

123 Comments

|

* Press release…

Chicago business and labor leaders have joined United Way of Metropolitan Chicago in calling for an end to the months-long state budget impasse.

In a press event on October 19, Paul La Schiazza, President of AT&T Illinois and Jorge Ramirez, President of the Chicago Federation of Labor, joined United Way President and CEO, Wendy DuBoe, in calling for a resolution to the now 4-month long budget stalemate. New results from a survey of more than 500 human service agencies conducted by United Way of Illinois show the further deterioration of the human services sector and the citizens it serves. The event was held at Access Living, one of the many human service agencies in the region that has been impacted as a result of the state budget impasse.

“These survey results highlight the impact of the budget stalemate on children, families and entire communities,” said Wendy DuBoe, President and CEO of United Way of Metropolitan Chicago, “As the largest private funder of human services in the region, United Way of Metropolitan Chicago has a responsibility to bring people from across sectors together to urge Illinois lawmakers to come to a resolution.”

Key findings from the survey show that children, low-income families and the mentally ill continue to suffer the effects of inaction in Springfield.

• 84% of respondents have cut the number of clients they serve (up from 34% in July)

• 79% of respondents have cut programs, most impacting children and working adults

“The labor movement works every day through organizations like the United Way and its partners to help those in need, but it’s no substitute for the safety net our government is morally obligated to provide through the social contract,” said Jorge Ramirez, President of the Chicago Federation of Labor, “The delay in resolving the state budget marginalizes the most vulnerable segment of our society. Irreparable harm is being done to programs that support adult education and employment. It threatens our state’s economic viability and is counterproductive to the state’s economic interests.”

Survey findings also highlight the measures that human service agencies reported taking to maintain operations and serve clients during the stalemate.

• 31% of respondents have one month or less of cash reserves

o 8% of agencies have already utilized their full cash reserves

• 25% of agencies have tapped into lines of credit, and of those, 58% are more than $50,000 in debt as a result of the impasse

• 22% of agencies have been forced to layoff staff

“Without a budget resolution, human service organizations are tapping into cash reserves, exhausting their reserves in some cases and finding it necessary to take out lines of credit. Further, the impasse is forcing them to layoff staff and reduce hours,” said Paul La Schiazza, president, AT&T Illinois, “I’m not picking sides or casting any blame. However, to help people and families in need – and the human service agencies that are struggling to support them—Illinois needs a state budget resolution soon.”

This is the second survey conducted by United Way of Illinois on the state budget stalemate. The survey was conducted September 28-October 2 2015, and responses were received from 544 human services agencies across every county in Illinois. Survey respondents represented a range of service categories including youth development, early childhood education, mental health, emergency housing, senior services and employment training, and varied in budget size from less than $500,000 to more than $15 million.

30 Comments

|

* As if that building isn’t in bad enough shape…

* From CMS…

Notice Type: Emergency Procurement

Published: 10/19/2015

Notice Expiration Date: 10/30/2015

Emergency Justification: The current vendor chose to stop working under the current contract becase a lack of payment from the State. The emergency contract is necessary until a competitive bid can be completed

Accordance with Admin Rule: Minimize serious disruption to critical state services that affect health, safety, or collection of substantial state revenues, Protect against further damage to state property

57 Comments

|

The waiting game

Monday, Oct 19, 2015 - Posted by Rich Miller

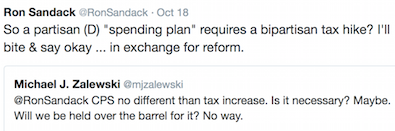

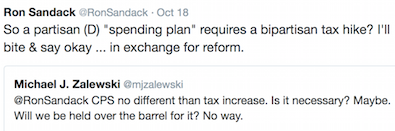

* I’m not sure that Rep. Sandack understood what Rep. Zed was saying here…

To my eyes, anyway, Zed was saying, “Hey, Ron, you may think we’re dying to vote for a tax hike and to bail out the City, but we’re not really crazy about doing it, so maybe we should try something else besides this Turnaround Agenda.”

Rep. Sandack, however, is apparently of the belief that the City’s problems will force Statehouse action to his guy’s favor. He could be right. It’s gonna get pretty darned awful.

* Rep. Sandack is not alone. Tribune editorial board…

Rauner has tried to compromise. He put the option of new taxes on the table to help balance the budget. He is asking for common-sense reforms, including giving voters a greater voice in their government — the chance to vote for term limits and redistricting reform — and labor-rule changes that would attract employers.

But Madigan and Cullerton refuse to meet him halfway. On anything.

In September we urged Rauner to set a deadline for a budget deal. Enough with the nonsense. Declare that after a certain date, the offer of higher taxes vanishes: “If there’s no deal by a date certain — how about Nov. 1? — then set the rest of your agenda aside for another day, another year. But make it clear to Democrats that their failure to reach a deal with you by that date locks in how much money Illinois will have to spend.”

Nov. 1 is two weeks from Sunday.

Taking taxes off the table would disappoint those who think state government is well-run and can’t economize.

I would love to see the governor finally introduce a balanced budget without gigantic pension gimmicks and tax hikes. Really, I would. Do it, man.

* And speaking of Chicago…

Determined to bite the bullet and get it over with, aldermen on Monday questioned why Mayor Rahm Emanuel is not proposing an even bigger property tax increase instead of assuming that Gov. Bruce Rauner will sign a bill that gives Chicago more time to shore up police and fire pensions.

“What I’m detecting here is an appetite to get this over with one way or the other and not keep coming back and doing it again and again,” said Ald. Edward Burke (14th), chairman of the City Council’s Finance Committee.

In proposing a four-year, $543 million increase for police and fire pensions, Emanuel is making a rosy and risky assumption that, if he’s wrong, would make the financial hit absorbed by Chicago taxpayers significantly worse.

The mayor is assuming that Gov. Bruce Rauner will sign legislation — approved by the Illinois House and Senate, but not yet on the governor’s desk — giving Chicago 15 more years to ramp up to 90 percent funding level for the police and fire pension funds. […]

“Would it not be more intelligent to levy at that amount — $220 million or whatever it is — and then abate … when the governor signs it?” Burke said.

45 Comments

|

Kirk lauded by gun control group

Monday, Oct 19, 2015 - Posted by Rich Miller

* Illinois Review…

Those that are promoting stringent federal and state gun control will be honored Monday by the Illinois Council Against Handgun Violence, their website says.

Among those receiving awards from the group are Republican U.S. Senator Mark Kirk, Democrat state Representative Kelly Cassidy and former Illinois Council Against Handgun Violence executive director, Democrat former State Senator Dan Kotowski.

Senator Kirk is the only Republican in the U.S. Senate that received an “F” from the National Rifle Association and an “F-” from the Gun Owners for his support of gun control measures.

* According to Kirk’s office, he’s the first GOP Senator to ever get the award…

Kirk Is First Republican Senator to Receive Illinois Coalition Against Handgun Violence Lincoln Award for Leadership in Confronting Gun Violence

Kirk, Gillibrand Introduced S.1760 to Make Gun Trafficking a Federal Crime

Sixty Percent of Illegal Guns in Chicago Come From Out of State

CHICAGO – U.S. Senator Mark Kirk (R-Ill.) today received the Abraham Lincoln Award from the Illinois Coalition Against Handgun Violence (ICHV) in recognition of his leadership on legislation to make gun trafficking a federal crime and strengthen background checks. Senator Kirk is the first Republican U.S. Senator to receive the award.

“Illinois families shouldn’t have to live in fear of armed gangs and criminals,” Senator Kirk said. “The Gillibrand-Kirk bill would make it illegal to bring guns used for criminal activity into Chicago - where Indiana, Wisconsin and Mississippi alone are responsible for 30 percent of guns at crime scenes.”

“Senator Kirk was there for us when we needed him most, and crossed party lines to support universal background checks. His courage and leadership truly symbolize the purpose of the Lincoln Award,” said ICHV Executive Director Colleen Daley. “As much as we fight at the local level for common sense gun laws, the fact remains that more than 60 percent of all crime guns in Chicago are illegally trafficked from states with weaker gun laws, like Indiana and Mississippi. The Senator’s support on this issue is critical to public safety, and we are incredibly grateful to him.”

The Illinois Council Against Handgun Violence is a statewide, non-profit organization that works to reduce death and injury caused by guns. Previous winners of the Lincoln Award include New York Mayor Michael Bloomberg, President Bill Clinton, Chicago Mayor Rahm Emanuel, U.S. Senators Dick Durbin (D-Ill.) and Dianne Feinstein (D-Calif.), and Education Secretary Arne Duncan.

Illinois’ last Republican US Senator, Peter Fitzgerald, was no fan of the NRA, but Kirk has taken it further.

23 Comments

|

Putting human faces on rule changes

Monday, Oct 19, 2015 - Posted by Rich Miller

* Erickson…

A hearing Tuesday will focus on the Rauner administration’s attempt to roll back an increase in the personal allowances received by developmentally disabled residents.

In 2014, the Legislature boosted the allowance to $60 per month. It returned to its previous levels of $30 and $50 on July 1.

After reading about the upcoming hearing, Barbara Thomas of Charleston got in touch.

Here’s what she wrote:

“Whether it’s $30 or $60, it’s not enough to cover personal expenses of anyone, whether the person has a disability or not. That so-called allowance is supposed to pay for much more than snacks, toiletries and entertainment. Individuals with disabilities must pay for clothing, dental care, podiatry, medication co-pays, psychiatric visits, and if there is money left (seriously), they will have money for snacks and entertainment.

“I have a son receiving residential services… I pay for my son’s dental care, give him spending money, buy his clothing, buy his bedding, etc. I do it willingly and with love. He is my son and deserves a quality of life that is more than ‘eats and sheets.’ The real question is what happens to the individuals who don’t have anyone to subsidize their care.”

* From a press release…

Gov. Rauner is making it official: His administration is amending the Illinois Administrative Code to slash the personal needs allowance for persons in developmental disability group homes from $60 a month to $50. A hearing is scheduled Tuesday.

Disability consultant Ed McManus today called the move “outrageous” and issued a plea to families, provider agencies and the public to oppose it.

“Is this what we have come to?” said McManus. “Our people with intellectual and developmental disabilities have no money of their own to take care of their personal needs. We’re talking here about shampoo, deodorant, a haircut, a movie, a cup of coffee. So the state for years has at least been allotting them $50 a month; in intermediate care facilities it has only been $30.

“Last year, the legislature increased the allotment to $60 for both group homes and intermediate care facilities; the statutory increase was for Fiscal Year 2015 only, with the expectation that the Administrative Code would be amended. And in March, Rauner’s Department of Healthcare and Family Services did just that—they revised the code to make the increase permanent—or so we thought. The increase had a cost of only $3 million a year out of a $30-billion-plus state budget. The allowance goes to 16,000 people.

“In late June, the Division of Developmental Disabilities issued an information bulletin stating that the allowance was being rolled back to the previous levels, effective June 30, the end of the fiscal year. This was clearly illegal, in view of the increases enacted in March. Now, four months later, the administration is finally at least following proper procedure for proposing an amendment to the code.

“Unfortunately, the governor and his staff have provided no coherent explanation for why they don’t think people with disabilities deserve the extra few dollars. Frankly, I didn’t think they’d stoop this low.”

The public hearing on the proposal will be held at 1 p.m. Tuesday at the Prescott E. Bloom Bldg., 1st floor conference room, Springfield.

44 Comments

|

Today’s number: $57.5 million

Monday, Oct 19, 2015 - Posted by Rich Miller

* Friday afternoon press release…

Governor Bruce Rauner released his 2014 federal and state 1040’s, reflecting income and tax rates, while detailing the Rauner family’s charitable and community giving last year.

Last year, the Rauners paid more than $18 million in federal and state taxes on income of $58.3 million for a total effective tax rate on income of more than 31%. Their federal effective tax rate on income exceeded 26%.

In addition, the Rauners and their family foundation made charitable contributions totaling more than $3.3 million.

Rauner 2014 Tax Summary:

Income on Federal Return: $58.3 million

Adjusted Gross Income on Federal Return: $57.5 million

Federal Income Taxes Paid: $15.2 million

Federal Effective Tax Rate on Income: 26.1%

Federal Effective Tax Rate on Adjusted Gross Income: 26.4%

Illinois Net Income on State Return: $58.7 million

Illinois Income Taxes Paid: $2.8 million

If you’re keeping track, he paid a 26.4 percent effective federal rate on his income last year. That’s well below the 39.6 percent top federal rate that quite a few folks with much, much smaller incomes pay, but that’s because much of his income is from capital gains.

* Tribune…

Even so, a bare-bones version of such information can be gleaned from the 1040s. It shows, as it has in prior years for Rauner, that the bulk of his income comes from revenue categories that qualify for tax rates discounted well below the 39.6 percent top federal tax bracket for high earners. As such, the $15.2 million in federal taxes paid by Rauner were equivalent to just 26 percent of his income.

More than 60 percent of Rauner’s income — $35.4 million — was listed as coming from capital gains, a preferential tax category on which he would owe a 20 percent rate. At the same time, Rauner reported more than $7.6 million in losses in a different business related income category where the top 39.6 percent tax rate would apply if had reported making money.

He also reported paying $151 in the tax imposed on the self-employed as a substitute for Medicare and Social Security taxes. For most wage earners, those taxes are deducted routinely from their paychecks.

Rauner also released the cover sheets for his Illinois tax return. They showed he paid $2.8 million in state taxes in 2014, the last year for which the flat state income tax rate stood at 5 percent.

The tax returns are here.

77 Comments

|

Symbolism rampant in Thompson Center sale

Monday, Oct 19, 2015 - Posted by Rich Miller

* My weekly syndicated newspaper column…

Last week, Governor Bruce Rauner said that he had spoken with both Senate President John Cullerton and House Speaker Michael Madigan about his proposed sale of the state’s Thompson Center building in Chicago, and that both men were “forward leaning and positive” about the plan.

So I checked in with the legislative leaders, and that’s not exactly what I heard.

“The governor and President Cullerton spoke,” said the Senate President’s spokesperson Rikeesha Phelon. Okay, so far so good. At least these weren’t “phantom” phone conversations like the ones Governor-elect Rauner claimed he had with those two on election night last November, but didn’t.

“We will take a look at the specifics of the plan in light of state statutes regarding property control and facility closures,” Phelon continued.

Um, wait. That doesn’t sound all too “forward leaning and positive.” I asked Phelon: Is Cullerton positive about this at all?

“I would say the word is ‘open,’ but under review,” she replied.

Speaker Madigan’s spokesman Steve Brown said afterward that he’d allow Phelon’s comments to stand for his guy.

So what’s going on? I’m not totally sure, but the governor now has yet another new “ask” for the Democratic leaders, and as we’ve seen during this excruciatingly long state-government impasse, they’re not in much of a giving mood – and he isn’t either.

The Thompson Center has become a symbol for much that has gone wrong with this state. The skyscraper was a grandiose design with numerous flaws. Its construction heralded the beginning of the move of much of the state’s governmental business from Springfield to Chicago.

Despite its architect’s claim last week that it was designed to represent the “openness and transparency” of state government, it was harshly criticized from the start for including a “private elevator” for the governor’s personal use. Like seemingly everything else in this state, the building was then allowed to deteriorate over the years. It’s infested with cockroaches and had to be sprayed for bed bugs not long ago.

Architecture often involves clashes over ideals, and this proposed Thompson Center sale feels like one more attempt at a dramatic break with the past.

The building’s legendary namesake, 14-year Governor James R. Thompson, actively sought organized labor’s political support – including from the state government union AFSCME – and was the most memorable purveyor of this state’s “Republicrat” politics that our current anti-union governor is now attempting to demolish along with his building.

It’s also fitting that Rauner’s move would get caught up in the current gridlock.

Check out the joint statement released last week by the House and Senate Republican leaders regarding the proposed sale.

“We filed House Bill 4313 and Senate Bill 2187 at the request of Governor Rauner. The James R. Thompson Center is in complete disarray due to years of neglect by previous administrations and better utilizing this asset would benefit Illinois taxpayers tremendously. It has become a white elephant for the State of Illinois. This legislation will enable us to review all of our options to maximize the overall value of the property and secure the greatest savings for taxpayers.”

Notice anything missing? How about a pledge to work cooperatively with others in the General Assembly to achieve the governor’s goal?

For their part, the Democrats are reluctant partly because they see this as a media-motivated sideshow – a way for the governor to show he’s making progress when the government is in reality mired in stagnation.

However, the Democrats have produced more than their share of sideshows this year, with the endless committees of the whole and the staged votes on bills designed to go nowhere.

Governor Rauner also stopped in Quincy last week and claimed he was “negotiating” with the Speaker and the Senate president and making some progress on ending the months-long stalemate.

But I’m told he met personally with the Senate President a couple of weeks earlier and it apparently went nowhere. The governor reportedly brushed off legal questions about the Thompson Center sale during a subsequent phone call with Cullerton as a pesky matter for the lawyers to figure out. Then, of course, Rauner had two bills introduced without asking for assistance.

Governor Thompson had his faults, and he didn’t always get his way. But he never would’ve let a political stalemate hurt this state like we’re seeing now.

I never much cared for the Thompson Center, but in my mind it’s become a sad, dilapidated symbol of a government that, like the man the building was named after, used to work.

45 Comments

|

* My Crain’s Chicago Business column…

Former Chicago Public Schools CEO Barbara Byrd-Bennett and her indicted pals apparently were quite a group of grifters.

If the U.S. attorney’s office is right, they successfully concealed their graft from some pretty important and powerful people, including a mayor, a financial titan, a future governor and a future U.S. Senate candidate.

How could so many well-educated, successful people drop the ball so badly?

Mayor Rahm Emanuel, former investment banker and chief of staff to President Barack Obama, flat out denies knowing anything about Byrd-Bennett’s nefarious activities. The Northwestern University alum says he never met her alleged benefactor, Gary Solomon, a high-flying education consultant who allegedly promised to pay “B-3,” as Emanuel affectionately called her, hundreds of thousands of dollars under the table for feeding him school contracts. Emanuel’s denials came after the Chicago Sun-Times reported that Solomon was involved in the hiring of both B-3 and her predecessor, Jean-Claude Brizard, by the mayor’s handpicked school board.

Solomon’s infamous Supes Academy training program for principals was started at CPS with seed money from the Chicago Public Education Fund, which has been heavily financed and even at one time was chaired by former private-equity investor Bruce Rauner. Rauner, who received his MBA from Harvard University and helped make Emanuel a millionaire, denied to the Chicago Tribune in April that the fund had a role in getting Supes the schools contract, saying that the fund was merely a “facilitator for what the mayor or the schools or the leadership wanted to do.”

Click here to read the rest before commenting, please. Thanks.

22 Comments

|

An evolving statement

Monday, Oct 19, 2015 - Posted by Rich Miller

* Gov. Rauner was in Quincy last Thursday around noon…

The governor on Thursday said Chicago’s financial problems will push a budget deal in Springfield.

“I’m cautiously optimistic that we’re going to get (a budget) in the next 60 to 90 days, frankly, if for no other reason than Chicago needs help and I said I’m willing — I’m not going to do a bailout, but I’ll help Chicago solve its own problems by giving them the power to do it, but only if Chicago is helping us get reforms at the state. This is a two-way partnership … and Chicago needs help in December and January, big, big help,” Rauner said during an appearance in Quincy.

* Rauner spoke in Decatur at 11 o’clock Friday morning…

An opening in the state budget stalemate may come in the form of financial problems for the city of Chicago.

Speaking a town hall-style meeting in Decatur, Rauner hinted he may be able to use Chicago’s demands of the General Assembly—including $480 million in pension assistance needed by the beginning of 2016 to avoid large teacher layoffs at Chicago Public Schools—to get Democratic support on some of his own proposals.

“I’m cautiously optimistic because of Chicago’s financial challenges,” Rauner said. “They need some help in December. Maybe in December or January, maybe they’ll be enough incentive to compromise and we’ll be able to get something done, but I don’t know, it could be longer.”

* And the governor spoke in Springfield Friday afternoon at 1 o’clock…

Pressed on Friday whether [his Quincy remarks] meant Emanuel had promised to push his agenda in Springfield, Rauner was more cautious.

“I don’t want to over-commit on the time frame, we should have had a budget in May,” Rauner told reporters gathered in his Capitol office for an announcement on a Springfield high-speed rail issue. “I believe that there’s a lot of pressure, a lot of incentive to get something done given Chicago’s issues, in December. That’s true.

“Will we get it done in December or early January? I hope that it’s before then. But it could well last a lot longer,” he said. […]

“As I’ve said before to the governor, I’m not going to agree to right-to-work, I fundamentally, on principle, don’t agree with that, so I won’t support you,” Emanuel said in Chicago. “Having supported workers’ comp before, in 2011 when we passed the last major reform of workers’ comp, there’s a place I’ll work with you. And I want to see a municipal part of that because, as one of the largest employers in the state, we have a vested interest in reform to workers’ comp.”

40 Comments

|

“He might want to”

Monday, Oct 19, 2015 - Posted by Rich Miller

* Former Gov. Jim Edgar on Gov. Bruce Rauner...

“He does not come from government,” Edgar said of the governor, who was a venture capitalist. “He doesn’t even really come from mainstream business. He comes from (being an) entrepreneur where you buy a business, you tear it apart and you sell it. … I don’t think you’re going to tear apart the state and sell it. He might want to, but you can’t do that.”

Oof.

* More…

If Rauner thinks Democrats will “cave” under pressure, Edgar added, “I don’t know if they are. … There’s some basic things that he’s trying to get that I’m not sure they will ever give up.”

Rauner ran television ads against Madigan in June. He also told reporters that month that he thought Madigan and Cullerton had a “conflict of interest with taxpayers” because they work for law firms that handle property tax appeals.

“I don’t think those comments help,” Edgar said. He said he doesn’t think the ads “softened up the Democrats any. I think, if anything, they probably got a little more dug in.”

84 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|