* House Speaker Michael Madigan told Jak Tichenor today that he admires Gov. Quinn for his courage in proposing to make the income tax hike permanent.

Madigan also said he supports the governor’s plan and said he hopes to try and pass it by the end of the spring session on May 31st. Watch…

A spring session income tax vote would be a rarity in Springfield. It almost never happens.

* Senate President John Cullerton said after he talked to Tichenor today that he “fully” supports the governor’s plan to keep the tax hike permanent. He said during the Illinois Lawmakers program after the governor’s speech that he wants the House to vote on the tax hike first, just to make sure it passes. Watch…

* House Republican Leader Jim Durkin and Senate Republican Leader Christine Radogno also spoke with Tichenor. This video was processing when I wrote this, so give it a few and it should work…

136 Comments

|

[The following is a paid advertisement.]

In any discussion about treatment of mental illness, the interests of the patients and their families should come first. But Senate Bill 2187 – sometimes called “RxP” – would create a lower-tier health system for people with mental illness.

SB 2187 would allow psychologists who have no medical training to prescribe powerful medications to patients. Current Illinois law allows only people who have medical training – doctors, nurse practitioners and physician assistants – to prescribe drugs.

Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses like diabetes and high blood pressure. Finally, psychiatric drugs are powerful and can create risky side effects. To understand these intricacies, psychiatrists go through four years of medical school plus at least four years of residency. They learn to treat the whole patient – not just the brain.

Maybe that is why the pre-eminent advocacy group for patients and their families – the National Alliance on Mental Illness – opposes this legislation. In announcing its opposition to SB 2187 last year, NAMI’s Illinois chapter said that in treating mental illness, “the best medical expertise must be brought to bear.”

Psychologists who want to prescribe can follow the route taken by nurse practitioners, physician assistants and doctors. They can obtain medical training – instead of insisting on a law that would lower the standard of care. To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

* “Taxis want these guys out of business,” one of the sponsors of the ride-sharing regulatory bill told me yesterday.

The play here is obvious. Taxi companies in Chicago, like pretty much everywhere else in the world, want to put Uber and other companies like it out of business. Period. That’s all that this is about. The companies have tough lobbyists and a pile of cash and they want the government to protect them from a new-age competitor.

* It’s not too hard to read between the lines here…

Rep. Michael Zalewski, D-Riverside, chief sponsor of the legislation in Springfield, said putting in safety mandates on the new companies that can be summoned with a few keystrokes on a smartphone is an “urgent matter.”

“It’s our opinion, and the opinion of those who focus on consumer protection, that in fact regulatory vacuums are not healthy for Illinois citizens,” Zalewski said. “We don’t condone unlicensed, unregulated activity, and in fact it’s our duty to protect the public safety of our constituents.”

If only they’d tackled the budget with the same vigor.

Some of the safety mandates do make sense. For instance, making sure that the vehicles are subjected to safety inspections is a good idea.

* But, I mean, what the heck…

No commercial ridesharing arrangement shall pick up or discharge a passenger at any airport that serves as a base for commercial flights open to the general public, to any convention center

This is all about stifling competition. Pure and simple.

45 Comments

|

Two decrim bills advance

Wednesday, Mar 26, 2014 - Posted by Rich Miller

* A couple of good ideas were advanced out of committee yesterday. But, considering the fact that the medical marijuana law hasn’t even been fully implemented, I don’t expect much movement the rest of the year…

“The war on drugs has not worked,” said Rep. Christian Mitchell, D-Chicago, one of the bill’s sponsors. “Our jails are overcrowded. We need to get smarter on crime, not tougher. Drug addiction is a public health problem, not a public safety problem.”

Under Mitchell’s House Bill 4299, which passed 6-0 in committee, instead of getting a misdemeanor for possessing up to 30 grams — about an ounce — of marijuana, violators would get a fine of no more than $100 with a “petty offense” on their record. […]

Rep. Kelly Cassidy, D-Chicago, passed another pot-ticketing bill 5-2 in committee that would decriminalize marijuana.

Under her legislation, House Bill 5708, possession of less than 30 grams of marijuana would be a “regulatory offense” that would still include a fine of $100 but not exist on someone’s record.

* Anita Bedell is a nice person and she means well, but she always goes so over the top on stuff that she loses credibility…

But Anita Bedell, with Church Action on Alcohol and Addiction Problems, opposed Cassidy’s and Mitchell’s bills. She said she’s worried about the message that lowering marijuana penalties sends to young people. […]

Bedell said the Legislature is “rushing” down the road of legalizing marijuana completely, an outcome that she said would be “disastrous” to the state.

51 Comments

|

Rauner gets “fact checked” over job loss numbers

Wednesday, Mar 26, 2014 - Posted by Rich Miller

* FactCheck.org looks at a claim made in a recent Bruce Rauner TV ad…

Republican Bruce Rauner claims in TV ads that Illinois has lost 90,000 jobs in five years under Democratic Gov. Pat Quinn. But Illinois has lost 3,400 jobs in five years — not 90,000 — by the standard definition of “jobs” used by practically all economists and journalists. […]

But the campaign is using BLS data that are not commonly used to measure jobs gained or lost. Rauner bases his figure on surveys of people in households, rather than on a much larger survey of millions of actual payroll records.

BLS has two sets of monthly employment data: the Local Area Unemployment Statistics program, which is based on the Current Population Survey (commonly known as the household survey), and the Current Employment Statistics program, which is based on payroll surveys of establishments and government agencies (known as the payroll survey). Mike Schrimpf, a spokesman for the Rauner campaign, said the claim is based on the household survey. Quinn took office on Jan. 29, 2009. The household survey data show there were 6,067,701 jobs in January 2009 and 5,982,030 as of January 2014 — a decline of nearly 86,000 jobs.

But the payroll survey — not the household survey — is used by practically all economists, journalists and politicians when measuring jobs. It’s what journalists use when writing stories about job gains or losses and what BLS posts prominently on its website as the prime indicator of job growth or loss. By that measure, Illinois has lost only 3,400 jobs under Quinn, with total nonfarm employment declining from 5,803,600 in January 2009 to 5,800,200 in January 2014.

What’s the difference between household and payroll surveys?

Both are monthly surveys. But the payroll data — technically called “total nonfarm employment, seasonally adjusted” — is projected from payroll records at 144,000 establishments and government agencies at 554,000 work sites nationwide. By contrast, the household survey uses a much smaller sample — about 60,000 households. The household survey is used to calculate the unemployment rate, but the payroll data is “considered to be the more accurate employment indicator,” as the Federal Reserve Bank of San Francisco explains in a Q&A about why the Fed uses payroll data to analyze employment trends. […]

Rauner’s larger point about the performance of the state’s economy is accurate. Illinois has lost jobs under Quinn, even though the U.S. has seen a net gain of 3.7 million jobs since January 2009. The state’s unemployment rate is 8.7 percent, up from 8 percent in January 2009, while the U.S. rate has declined from 7.8 percent to 6.7 percent. But the state’s job losses may not be as large as the Rauner campaign claims.

35 Comments

|

* Bruce Rauner released an Internet video yesterday blasting Gov. Pat Quinn. Rate it…

* Sun-Times…

The minute-long piece, titled “Truth,” juxtaposes statements Quinn made at previous press conferences and public appearances with data that seemingly contradicts the governor’s own words.

“When you hear Pat Quinn’s promise, remember the ones he broke,” the narrator says.

The commercial opens with Quinn vowing to lower taxes, particularly for families with household income of $60,000 or less, and notes how in 2011 he signed off on a 67-percent increase in the state income tax. It goes on to feature Quinn talking in 2011 about the need for a “restraint of spending” but highlights the state’s $6 billion backlog of unpaid bills.

* The Quinn campaign kinda responded today…

Billionaire Bruce Rauner’s Brutal Budget Would Slash Education by More Than $2 Billion

Rauner’s Draconian Cuts Would Lay Off One in Every Six Teachers Across the State, Drastically Hike Property Taxes

CHICAGO - Billionaire Bruce Rauner’s FY2015 brutal budget would decimate education, raise property taxes and stall economic growth. Under Rauner’s plan to “run Illinois like a business” with a 3% tax rate, he would decimate education funding by an estimated $2 billion this year – hitting K-12 schools especially hard. These catastrophic cuts would force local school districts to lay off an estimated one in every six teachers (22,100), crowd our classrooms and rob Illinois’ children of valuable educational opportunities. Property taxes across the state would also skyrocket just to keep schools open.

“Rauner’s sales pitch to run Illinois like a business would run our state straight into the ground,” Deputy Press Secretary Izabela Miltko said. “It’s clear his plan would take a sledgehammer to education, lay off tens of thousands of teachers and leave Illinois’ students at a huge disadvantage. His inability to provide real solutions for our state makes it clear he can’t be trusted to run Illinois.”

According to recent legislative testimony by Illinois State Board of Education Superintendent Chris Koch, if the current tax plan was rolled back to the original 3.75%, the potential cuts would mean $967 million less for education, leading to 13,400 teacher layoffs, increased class sizes and cuts to key extra-curricular programs. (”Agency directors describe severity of proposed state budget cuts,” Associated Press, 3/21/14).

If you think these cuts are dangerously deep, Rauner is advocating for a 3% tax rate that would slash education even further, resulting in the lay-off of 22,100 teachers.

With much of Illinois already divided into “have” and “have not” school districts as a result of public education being primarily financed by property taxes, Rauner’s cuts would force districts to raise property taxes just to survive. (Kadner: State board eyes special ed changes,” Southtown Star, 1/20/14)

While Bruce Rauner will do whatever it takes to help himself and his campaign, by contrast Governor Quinn tackles the tough issues and does the right thing to get the job done, even when it’s not politically expedient.

The 2012 election results show that proposed budget cuts were far scarier to voters than the very real income tax hike. But 2014 won’t be as favorable for Quinn as 2012 was to the down-ballot Dems, who also had the benefit of a favorable map.

44 Comments

|

“Conversion therapy” bill advances

Wednesday, Mar 26, 2014 - Posted by Rich Miller

* From a press release…

Equality Illinois is calling on the Illinois House of Representatives to protect minors by passing the Conversion Therapy Prohibition Act this spring after the House Human Services Committee approved it today by a 9 to 6 vote.

Bernard Cherkasov, CEO of Equality Illinois, the state’s oldest and largest advocacy organization for lesbian, gay, bisexual and transgender Illinoisans, said so-called “conversion therapies” for youths pretend to supposedly “cure” people of being gay, but have actually proven to be very harmful and are actively opposed by leading mental health and medical professional groups.

“This bill would ensure that the most vulnerable individuals, those already struggling in the face of homophobia and transphobia, are not targeted and subjected to a practice that medical practitioners deem harmful and inappropriate,” Cherkasov said.

The measure would prohibit mental health providers from engaging in any effort to change the sexual orientation of anyone under the age of 18. The bill’s chief House sponsor is state Rep. Kelly Cassidy.

* An August, 2013 Sun-Times editorial also endorsed the concept…

Conversion therapy — trying to turn gay teenagers straight — is awful in three ways:

◆ It does not work.

◆ It can do considerable harm.

◆ It is unnecessary.

On Monday, New Jersey Gov. Chris Christie signed a bill banning gay conversion therapy in the Garden State, to which we can only say “hallelujah.”

Now when will Illinois do the same?

* The Illinois Family Institute, however, is staunchly opposed…

Lesbian state representative and activist for all things homosexual, Kelly Cassidy (D-Chicago) has introduced yet another terrible piece of legislation that ultimately redounds to the detriment of children.

Rep. Cassidy has proposed “The Conversion Therapy Prohibition Act” (HB 5569), which would prohibit all licensed mental health providers in Illinois from helping minors change their unwanted same-sex attraction. For those who have been paying attention, this is the same kind of pernicious legislation that passed in California and New Jersey but was stopped in Virginia. […]

Here are just a few of the serious problems with this legislation:

It would prevent those children and teens who experience unwanted same-sex attraction as a result of sexual abuse from getting counseling to overcome these unwanted feelings. Some “progressives” argue that homosexuality is not a choice and, therefore, attempts to change one’s “orientation” are exercises in futility and damaging. But arguing that same-sex attraction is not chosen does not mean its cause is benign or the feelings desirable. Some adults experience same-sex attraction because of childhood molestation. For them, same-sex attraction is neither chosen nor wanted.

Several years ago, Oprah Winfrey had a compelling two-part program in which her audience was composed of 200 men who had been sexually molested as children. One of her guests was Dr. Howard Fradkin, a homosexual licensed psychologist who treats clients for sexual orientation confusion resulting from childhood molestation. He stated on the program that children who are sexually molested can, indeed, experience “sexual orientation confusion” as a result. If this legislation passes, children traumatized by abuse will no longer be allowed to receive counseling for unwanted same-sex attraction.

This proposed law is utterly inconsistent with the “progressive” view that children and teens should be allowed to pursue medical means to change their sex if they don’t like it. How do those who claim children and teens should be able to change their unwanted biological sex (i.e., bodies) then argue that children and teens should not be allowed to change their unwanted “sexual orientation”? What, other than hypocrisy and crass political ends, can account for the Left’s sudden lack of respect for teen autonomy? Any minor who experiences unwanted same-sex attraction should be free with their parents’ consent to undergo counseling to change these feelings.

This legislation presumes that same-sex attraction is fixed, a presumption for which the proponents of this kind of legislation provide no evidence and which is disputed by both “Queer Theory” and research. There is research that provides evidence that “sexual orientation” is fluid, particularly among adolescents. If sexual orientation is not fixed and if minors want to receive counseling to reduce or eliminate same-sex attraction, they should be free with their parents’ consent to receive such counseling.

This legislation presumes without evidence that sexual orientation change efforts for unwanted same-sex attraction in adolescence are damaging. There are no outcome-based studies on adolescents undergoing sexual orientation change effort therapy. It is indefensible to ban forms of therapy for which there is no evidence of harm.

This legislation presumes without evidence that homosexuality is biologically determined. The entire “born gay” foundation, dismissed by many homosexual scholars, is crumbling. In a must-read article, David Benkof explains that never in the history of mankind prior to about 150 years ago, was there such a thing as a homosexual person, a claim that even homosexual scholars acknowledge […]

Cassidy’s proposed legislation is destructive, unethical, and dishonest. It depends on unproven, non-factual, non-evidence-based assumptions that even homosexual scholars reject but the public continues to buy hook, line, and sinker. The ultimate motivation behind this legislation is to promote the Leftist assumptions of adult homosexuals who seek to wipe disapproval of homosexual acts from the face of the planet even if doing requires deception, harms children, undermines parental rights, and corrodes fundamental First Amendment speech and religious liberty.

Whew. The world appears to be ending, according to that group.

66 Comments

|

Oberweis reacts to Kirk’s Durbin comment

Wednesday, Mar 26, 2014 - Posted by Rich Miller

* Sen. Mark Kirk, you will recall, said this the other day when asked whether he’d be campaigning for fellow Republican Jim Oberweis’ US Senate bid…

“I’m going to be protecting my relationship with Dick [Durbin] and not launching into a partisan jihad that hurts our partnership to both pull together for Illinois”

* Oberweis reacts…

“Look, Mark is a Republican senator. He’s said he’ll support the entire Republican ticket, and I accept that,” the Sugar Grove Republican told the Chicago Sun-Times during a brief break in the Illinois Senate.

“I think the media was trying to make a lot more out of this than exists,” Oberweis said.

Oberweis insisted he was not disappointed by Kirk publicly distancing himself from the state senator.

“Look, I serve here in the Illinois Senate, and I understand the desire to not irritate people that you’re going to have to work with in the future,” Oberweis said. “But again, I also emphasize he said he’ll support the entire Republican ticket.”

Discuss.

36 Comments

|

* Give him credit for taking a very risky stand…

Gov. Pat Quinn has prepared an election-year spending proposal that would make permanent the 67 percent income tax increase set to expire in 2015 and couple it with property tax relief for homeowners, sources familiar with the plan said Tuesday.

Quinn planned to tell lawmakers in his Wednesday budget address that the temporary tax increase he signed into law in 2011 is needed to fund education, said one of the sources who was briefed on his plan but not authorized to reveal the details in advance of the noon speech.

The property tax relief would take the form of a $500 refund, sources said. One source said it would be an annual refund as part of a restructuring of the current property tax break for income tax filers.

Quinn was also expected to tell lawmakers that the alternative is to drop the 5 percent income tax rate to 3.75 as scheduled on Jan. 1, but that would make state programs unsustainable, sources said.

*** UPDATE *** The Sun-Times now has more details…

Quinn’s plan would reconfigure how Illinois homeowners deduct their property taxes by setting up a system in which they would get an automatic $500 tax credit. That change will roughly double the state’s outlay on property tax relief from approximately $650 million to $1.25 billion.

Now, they can deduct 5 percent of their property taxes, which one source called “regressive” because homeowners with more expensive properties get to deduct more than those living in more modest homes.

Since they wouldn’t qualify for the property-tax rebate, low-income renters would draw some benefit from the doubling of the state’s earned income tax credit during the next four years, as Quinn will propose, sources said.

* Related…

* Quinn to tout fiscal successes in budget address: On Tuesday, aides distributed a checklist of upbeat fiscal news Quinn is expected to highlight to a joint session of the House and Senate at noon. Included are reductions in the state’s backlog of bills and cuts in the state’s operating budget because of changes to the Medicaid program, the closure of prisons and savings in state office leases.

* Quinn’s budget may make income tax increase permanent

79 Comments

|

|

Comments Off

|

* With a big hat tip to a commenter, House Speaker Michael Madigan has introduced a new constitutional amendment…

Proposes to amend the Suffrage and Elections Article of the Constitution. Provides that no person shall be denied the right to register to vote or to cast a ballot in an election based on race, color, ethnicity, status as a member of a language minority, sex, sexual orientation, or income. Effective upon being declared adopted.

Driving turnout again?

Discuss.

68 Comments

|

Harmon releases proposed tax rates

Tuesday, Mar 25, 2014 - Posted by Rich Miller

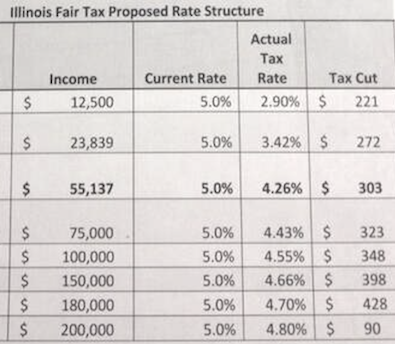

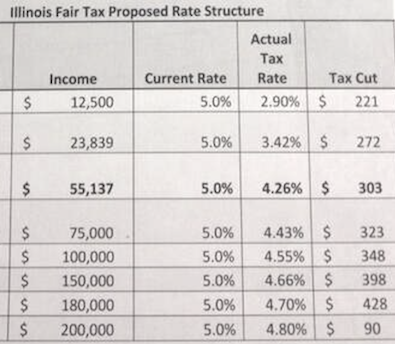

* Sen. Don Harmon unveiled his progressive tax proposal today…

Oy.

Cue the screamers.

* However, that’s not the rate people pay with standard deductions. Here’s the actual tax rates under the new plan and the supposed cuts…

Top rate would be 6.9 percent.

* And speaking of screamers, I haven’t been a big fan of “A Better Illinois” for the way it handled the progressive tax rollout. But a group with ties to the Illinois Policy Institute has created a website to denounce the pro-tax group and uses fake mugshots to drive home its point.

Actually, I’m not sure what the point of the site is except to tell us what we already know. They’re a group of liberals with union ties and funding.

31 Comments

|

Payback is a drag, man

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Mess with the bull, get the horn…

Lake County Circuit Court Clerk and Republican Committeeman for Precinct 205 Keith Brin announced he’s vying to oust Bob Cook as chairman of the Lake County Republican Party in next month’s election. […]

Brin has already received support in his bid for Chairman with endorsements from State Representative and Former Lake County Republican Party Chairman JoAnn Osmond, Lake Villa Township Supervisor and Former Lake County Republican Party Chairman Dan Venturi, Lake County Treasurer Bob Skidmore, Lake County Board Chairman Aaron Lawlor, State Representative Ed Sullivan, and Illinois Comptroller Judy Baar Topinka.

The current chairman led an effort to oust Sullivan in last week’s GOP primary when he supported Bob Bednar, building up to a challenge for Cook’s spot.

Rep. Sullivan, who was opposed because he voted for the gay marriage bill, beat Bednar 59-41.

8 Comments

|

Question of the day

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* There’s a big discussion about this topic on another post, so let’s make it the question…

Two state senators say Illinois needs another Big Ten Conference school.

A bill has been introduced by Lisle Republican Michael Connelly and Palatine Republican Matt Murphy.

The two say their measure would study what’s needed for a public university in the state to join the conference that already includes Northwestern and the University of Illinois.

“The University of Illinois at Urbana-Champaign has become highly competitive to the point where we are seeing students with excellent grades and test scores get shut out of attending our in-state, public Big Ten school,” Murphy said in a statement.

* More…

The commission would comprise a variety of individuals, including Illinois students paying out-of-state tuition to an existing Big Ten school, students who have left the state for another conference university and higher education professionals.

The bill passed the Senate Higher Education Committee March 19. A commission’s report would be presented to the General Assembly by the first of next year.

“We should make it easier for these students to stay in Illinois, not look for greener pastures across state lines,” Murphy said.

Connelly added: “It is my hope this commission can find a way to deliver a higher education system that gives our young people the opportunities they seek at a price they and their parents can afford.”

* The Question: Good idea or goofy? Take the poll and then explain your answer in comments, please.

survey solutions

86 Comments

|

Walking a squiggly line on term limits

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Umm…

Congressman Rodney Davis (IL-13) says he has not yet signed the petition that calls for limiting members of the Illinois General Assembly to eight year terms. But he says that he would.

Davis, a Republican from Taylorville, says he also backs term limits for Congress, at least in concept.

But he says he will not set a self-imposed term limit on his time in Washington.

“Unfortunately, what’s happened is there have been so many good legislators that have had self-imposed term limits and they leave, or they break their pledge,” he said. “The problems in Washington are caused by those who have been there and have no intention of ever leaving.”

He’d sign Rauner’s petition, and he’s for term limits, but not for himself?

24 Comments

|

*** UPDATED x1 *** Lighten up, Françoise

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* From a December 30th Wall Street Journal article on a Parisian tussle over the ride-sharing service Uber…

Paris has been a fertile ground for the new app-based car-service companies, with more than more than 12,000 vehicles now available—compared with nearly zero in 2010. It is one of Uber’s two biggest markets outside the U.S., alongside London. Revenue at Chauffeur-Prive.com is growing 10% week to week, its founder says.

In response, French taxi companies lobbied heavily for new rules, saying that they had been put at a disadvantage since rules created in 2009 allowed a new class of cars to take reservations, but not street hails, with fewer certification requirements.

Taxi drivers say that the new online services, in which a taxi can be ordered via an app and arrive at your GPS coordinates at a prearranged price within five minutes, effectively compete for passengers who would otherwise be hailing taxis. Drivers and taxi companies buy expensive licenses for exclusive rights to offer street-hail trips.

* I was in Paris just days after that article appeared. We stayed at a little, out of the way (read: relatively inexpensive) hotel. No taxis milling about anywhere. Not close to a train.

I was told that a taxi reservation would cost me 5 Euros on top of the normal fare. The wait could be up to an hour.

So, for the first time ever, I tried Uber. It worked great from my hotel (we cabbed everywhere else) and, when you included that taxi reservation fee, it was about the same price as a cab. It was also quicker than ordering a taxi, even with Paris’ goofy regulation requiring at least a 15-minute wait before Uber could pick me up (if I was staying at a 4 or 5-star hotel, however, the mandatory wait would’ve been waived).

Taxi companies everywhere are fighting back against Uber. Some Parisian cab drivers even went on strike over the issue.

Uber isn’t for everyone or for every situation. Some of its “surge pricing” could be seen as downright scandalous. They charge what the market will bear, and that means an Uber “black car” ride from the United Center to the Loop can cost more than a hundred bucks after a game or concert.

* What we don’t want to do with regulation is to be worse than Paris. A new bill (HB 4075) seems to provide some reasonable requirements, but would step on some Uber business practices as well. From a press release…

House Bill 4075, named the Ridesharing Arrangements and Consumer Protection Act, would require commercial ridesharing companies to have adequate insurance, contract with drivers who are appropriately licensed, use vehicles that are inspected for safety and serve customers with disabilities and in underserved communities.

The statewide standards in House Bill 4075 also:

· Close the insurance gap, requiring $500,000 combined commercial liability insurance;

· Require chauffer licenses for all drivers;

· Eliminate the use of waivers of liability by rideshare companies;

· Require vehicle safety standards, including regular inspections;

· Limit hours drivers can be on the road with a maximum 10 hour driving shift in a 24 hour period;

· Prohibit price gouging;

· Require accessible vehicles for passengers with disabilities;

· Require compliance with local service standards, including service to low-income communities;

· Require vehicle marking and clear posting of a phone number for customer complaints;

· Allow communities to establish and enforce stricter oversight over rideshare companies, but not to ignore the statewide regulatory threshold established by the General Assembly

Requiring vehicle marking seems silly to me. And allowing cities to go all Paris on these companies at willl probably isn’t a great idea, either.

* Let’s go back to the press release…

The Illinois General Assembly passed the Ridesharing Arrangements Act in 1983 to permit carpooling and other similar activities. The legislation was narrowly crafted to prohibit alternative taxi services or “jitney cabs” from operating in the state. Despite the narrow allowance for for-profit ridesharing activities other than those specified in the Ridesharing Arrangements Act, UberX, Lyft and Sidecar have been openly operating in the City of Chicago and the city’s affluent suburbs without abiding by any regulations.

Pretty harsh tone, no?

And think about this for a second: Illinois had to actually change a law to permit carpooling in 1983?

Sheesh.

* And, from the bill, this is a bit silly…

No person participating in a commercial ridesharing arrangement shall collect, and dispatchers shall not charge, any fare that is more than the highest per-mile rate charged by taxicabs within the unit of local government where the commercial ridesharing arrangement is conducted.

If people are willing to pay more and are told in advance of the rate, what’s the problem?

Why is everybody always so afraid of “the new”?

* This company is very aggressive and has fought on several fronts…

“What we did in Chicago, what we do in all these cities, is reach out to all of our users and say, take action–email your councilperson; email the mayor,” Kalanick says. “Uber riders are the most affluent, influential people in their cities. When we get to a critical mass, it becomes impossible to shut us down.”

Denver is a more recent test of the playbook. In January, Colorado’s Public Utilities Commission proposed rules under which the company could be classified as a motor carrier–meaning it would be treated like a taxi company. This issue is at the core of many of Uber’s regulatory challenges. That’s because, city by city and state by state, transportation companies of all sorts–cab, sedan, limo–are heavily regulated in terms of the insurance they carry, the structure of their fares, the background screening of their drivers, and the condition of their vehicles.

Uber neither owns vehicles nor employs drivers; it makes the technology that connects a user to a driver, one who is ostensibly already abiding by all these local regulations. As Kalanick often says, “They need to decide whether we are Orbitz or American Airlines.”

To be classified as a transportation company would amputate from Uber the exact things that make it an exceptionally good business: its ability to scale fast, control how a rider pays, and not be bogged down by owning vehicles.

The future is here. Let’s not blow it.

*** UPDATE *** From ride-sharing company Lyft…

After weeks of working diligently with Mayor Emanuel, we have made significant progress on a proposed city ordinance that prioritizes public safety while protecting innovation. HB 4075 is a backdoor attempt by state legislators to undermine all the work that’s already been done to reach a solution on this issue, and ultimately kill peer-to-peer transportation. HB 4075 would effectively shut down new transportation options in Illinois and eliminate consumer choice for residents who depend on safe and affordable transportation alternatives like Lyft. While safety is often brought up as a reason to apply an old regulatory model to an innovative transportation solution, the truth is that new technology provides an opportunity to increase safety above and beyond what has been done previously, which is why Lyft’s safety criteria are far more strict than what is required of taxis and limos. These proposed regulations have no bearing on public safety, and the motivation behind their development was planned behind closed doors. We hope that the House Committee will listen to its constituents who want more transportation options and vote against HB 4075.

18 Comments

|

Today’s number: $480,000

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Ben Yount…

The now former president of Illinois State University is getting almost a half million dollars to walk away from a job he may have been close to losing.

Tim Flanagan abruptly resigned Saturday, pocketing a $480,000 payout and three months of rent-free living at ISU’s presidential mansion.

“You don’t want to get into an argument about the terms of resignation,” ISU trustee Michael McCuskey said.

McCusky wouldn’t say how close the university was to firing Flanagan for his role in an alleged assault on a university groundskeeper. […]

ISU trustees were to meet Saturday to discuss “personnel matters,” but Flanagan resigned before any action was taken.

* Background…

R. Patrick Murphy, a superintendent of grounds, has said his crew was aerating the lawn outside Flanagan’s home when the president rushed outside to confront him. Flanagan’s spit flew in Murphy’s face and clothes during the dustup, Murphy told police.

“He cuts loose on me. I’ve never seen such a thing happen. I was shocked,” Murphy told The Pantagraph newspaper in Bloomington.

Murphy was fired five days after the incident and is seeking his job back, The Pantagraph reported.

University police have forwarded their case to McLean County prosecutors, who intend to ask a special prosecutor to investigation to avoid a potential conflict because a member of the state’s attorney’s family works at the school in Downstate Normal, according to The Pantagraph. […]

Flanagan was appointed in May to replace Al Bowman, president of the university for a decade. Flanagan received an annual salary of $350,000 plus benefits under his three-year contract. He previously was the president of Framingham State University in Massachusetts.

52 Comments

|

*** UPDATED x1 *** MJM on Rauner

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Speaker Madigan recently talked about how he came to know Bruce Rauner, and how he informed Rauner that quite a few House Republicans were on the other side of Rauner’s education reform push…

“We’ve met over the years, it’s not that we’ve had a recent meeting. We’ve known each other for several years. The first meeting we had was concerned with education. We met concerning a group called Stand For Children which he was involved with, he was involved in fundraising for Stand for Children. When I learned of his interest in education and Stand for Children, I asked for a meeting with him. We had a very lengthy discussion about education, education funding.”

Bruce Rauner, the GOP’s 2014 gubernatorial candidate is credited with bringing the state chapter of Stand for Children to Illinois in 2010. Right away the group became actively involved in Illinois political campaigns. During the 2010 election cycle, the bipartisan group - funded by donors including members of the Lester Crowne family, the Pritzkers and the Chicago Tribune owner Sam Zell - raised nearly $5 million, of which $110,000 went to Madigan-backed candidates. In 2011, the group gave $50,000 directly to the Illinois Democratic Party of Illinois, of which Madigan is chairman.

“I made an effort to explain that there were plenty of Republicans in the Illinois legislature that were interested in the positions of people in the Illinois Education Association, the Illinois Federation of Teachers. I gave him some documents showing that, so he was appreciative of the information,” Madigan said of his meeting with Rauner.

*** UPDATE *** I suppose this passes for informed comment at the Wall Street Journal…

The speaker knows which switches and levers to pull and has grown accustomed to running the machine, even with Republican governors nominally at the helm. No Democratic legislator gets elected without his blessing.

Our sources say that Mr. Madigan is petrified that Mr. Rauner will usurp him. Since Mr. Rauner isn’t beholden to the Democratic boss or labor unions, he wouldn’t be afraid to use his veto pen or as disposed to cut deals. We’re also told that Mr. Rauner knows where the skeletons are buried in Springfield. And unlike past Republican nominees, Mr. Rauner isn’t afraid to play hard ball. While Democrats may portray the businessman as Mitt Romney in training, Mr. Rauner has sharper political instincts more akin to Scott Brown.

“No Democratic legislator gets elected without his blessing”? Maybe somebody should talk to Will Guzzardi.

49 Comments

|

Depressing Quinn’s base

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Sneed on a likely and important piece of Bruce Rauner’s Cook County strategy…

“The black vote in Cook County is paramount for Rauner; especially if they don’t vote,” said a top political strategist. “The strategy is pretty clear. Rauner already blocked out Rev. James Meeks and every black who doesn’t turn out in the November election hurts Gov. Pat Quinn.

“Rauner’s strategists are smart enough to replicate what Republican Gov. Jim Edgar did to defeat Democrat Neil Hartigan by getting the black reverends on his side to make it look like [Edgar] got the base of black support,” the Dem source said.

“That ensured low black voter turnout, which would be disastrous for Pat Quinn.“

All true.

75 Comments

|

* It’s no surprise that the Illinois Policy Institute hates Speaker Madigan’s proposed 3 percent tax surcharge on incomes above a million dollars. But the group has connected the dots to the Chicago Public Schools’ pension problems. The proposal would distributes the billion dollars in projected revenues equally to school districts based on student headcount. Since CPS has the most students, it gets the most money, which the Policy Institute claims is basically just a “Chicago bailout”…

It just so happens that [Madigan’s] home school district is suffering from a collapsing pension fund and pension contributions that are set to triple in 2014.

Chicago Public Schools’ pension contribution spiked to $613 million in 2014, up from $208 million in 2013, and CPS doesn’t have the money to pay for it.

But rather than call for sensible pension reforms, Madigan would rather pour more state tax dollars into CPS’s pensions.

Nearly 20 percent of Madigan’s proposed tax, or $200 million per year, would go to CPS. With nearly 400,000 students, CPS makes up about one-fifth of the entire student population in Illinois.

Sure, all school districts in the state stand to receive more money from Madigan’s short-sighted plan (how much they’ll get depends on how many millionaires decide to leave); but it’s only CPS that’s dealing with such a large contribution spike.

Madigan’s plan makes his tax increase retroactive to January 2014. That means CPS would stand to gain a combined $400 million in new revenues for 2014 and 2015.

That money would help pay CPS’s increased pension contribution, but the district’s pension system is past the point of a quick fix. Which is what Madigan’s plan really is – a bailout with state tax dollars.

Madigan’s proposal can be read by clicking here.

Discuss.

50 Comments

|

[The following is a paid advertisement.]

As not-for-profit financial cooperatives, credit unions exist to help people, not make a profit. With a goal to serve all members well - including those of modest means - every member counts. The movement’s “People Helping People” philosophy causes credit unions and their employees to volunteer in community charitable activities and worthwhile causes. Take for instance SIU Credit Union in Carbondale. They know all too well the damage natural disasters can cause, having seen the impact of tornadoes that have ravaged their nearby communities, including Harrisburg and Brookport. In the immediate wake of those storms, the credit union sent employees, already trained as members of a local Community Emergency Response Team, to assist in the emergency supply relief effort. In addition, the credit union donated numerous cases of water and hosted a pizza lunch for the community. It also utilized all of its branches as places where members could make monetary and other donations of needed items. Credit union members know their credit union will be there for them in bad times, as well as good. And they are fiercely loyal for this reason.

Comments Off

|

A closer look at that Simon poll

Tuesday, Mar 25, 2014 - Posted by Rich Miller

* Let’s get back to that Paul Simon Public Policy Institute poll, shall we? Respondents were asked…

Do you favor or oppose a proposal to make permanent the temporary state income tax increase passed in 2011?

As we’ve already discussed, 60 percent opposed making the tax hike permanent, while a mere 26.5 percent favored making it permanent.

* So, a follow-up question was asked of respondents who said they were opposed to making the tax increase permanent…

The Governor’s budget office estimates that if the temporary tax increase expires, it will add $2 billion dollars a year to the state’s budget deficit. If you were convinced this was the case, would you favor or oppose making permanent the temporary income tax increase?

Even with that information about a $2 billion hit to the budget, 74 percent still opposed making the tax hike permanent and just 17 percent changed their minds. 49 percent of Democrats still opposed making the tax hike permanent, versus just 38 percent who changed their minds and backed it. 47 percent of self-identified liberals remained opposed to making the tax hike permanent, compared to 41 percent who changed their minds.

* Moving along to pensions, respondents were asked…

Last year the legislature passed and the governor signed a pension reform bill. It is designed to save Illinois’ under-funded public employee pension system $100 billion dollars over 30 years, and would eventually fully fund the system. It would decrease the amount workers’ pay into the program, but would also cut cost-of-living increases for state retirees. Generally speaking do you approve or disapprove of the new law?

47 percent approved of the law, while 39 percent disapproved of it. 48 percent of Democrats and Republicans approved of the new law, while 46 percent of independents approved.

Conservatives and Republicans were more likely to strongly disapprove of the new pension law (24 and 23, respectively) than liberals and Democrats (17 and 18). That’s quite an interesting result, considering the firestorm of controversy the bill ignited on the labor left end of the spectrum during the primary season.

36 Comments

|

|

Comments Off

|

* I was driving on I-55 late yesterday afternoon when I saw a guy in my rear-view mirror who was about to pass me. He was holding his cell phone with one hand and gesturing wildly with the other hand. Neither hand was on his steering wheel as he shot by me at about 80 mph. I watched him for as long as I could behind me, alongside and in front of me. He never put either hand on the wheel.

Anyway, IDOT did a study last November of drivers ahead of a statewide ban on hand-held cellphone use…

In Chicago, nearly 18 percent of all drivers who were observed during the study — about 21 percent of female drivers and 15 percent of male drivers — were holding cellphones or other electronic devices close to their ears or faces.

The statewide rate was about 12 percent, the study found. There was a similar gender gap among the smaller portion of violators statewide, with about 14 percent of female drivers and 10 percent of male drivers.

Electronic device use by drivers in Cook County was 12 percent and almost 13 percent in DuPage, Kane, Lake, McHenry and Winnebago counties, the IDOT study found.

Six downstate counties (Champaign, Bureau, Effingham, Rock Island, Madison and St. Clair) had the lowest rate of illegal electronic device use, at 9 percent , the study reported. […]

The campaign comes as newly released research shows virtually no change in the percentage of drivers text-messaging or visibly manipulating hand-held devices in the U.S. The percentage stood at 5 percent in 2012 — which means that at any given time during the day, an estimated 660,000 vehicles are driven by people using hand-held cellphones, according to the latest annual study conducted for the National Highway Traffic Safety Administration.

* In other news…

The chances of being able to legally drive 70 mph on Chicago-area expressways and tollways anytime soon hit a major speed bump Friday after a Senate panel rejected Republican U.S. Senate nominee Jim Oberweis’ push to allow higher speeds in the city and suburbs.

The 2-1 vote along party lines effectively kills legislation the state senator from Sugar Grove is carrying to clarify a law he helped pass last year that allowed 70-mph speed limits — up from 65 miles per hour — on rural interstates.

Oberweis had intended last year’s law, which passed overwhelmingly, to apply to Chicago and suburban expressways and tollways. But Gov. Pat Quinn’s administration interpreted it to apply to less heavily used arteries only outside Cook and the collar counties.

The senator’s new, clean-up legislation wouldn’t have mandated higher limits on city and suburb routes such as the Stevenson Expressway or Jane Addams Tollway, but it would have empowered the Illinois Department of Transportation and Illinois State Toll Highway Authority to impose them if the agencies wished.

* And…

Blue Line service to O’Hare International Airport will be halted for at least until Tuesday as federal authorities investigate what caused a CTA train to jump the platform this morning and injure more than 30 people.

More than 10 hours after the crash, the train remained atop the escalator at the end of the track. Transit officials declined to discuss how or when they would dismantle the wreckage.

“The train is not going to go anywhere for the foreseeable future,” said Tim DePaepe, a railroad accident investigator with the National Transportation Safety Board. “It’s not going anywhere today. We need to examine the train and the position it’s in prior to its movement.”

Trains continue to run between Forest Park and Rosemont, where passengers then can catch a shuttle to the airport. The large, articulated buses are operating on a load-and-go basis instead of a schedule, adding 5 to 10 minutes to the typical airport trip, officials said.

39 Comments

|

* Lynn Sweet…

Sen. Mark Kirk R-Ill. ruled out on Monday campaigning for GOP Illinois U.S. Senate nominee Jim Oberweis, saying he would rather “protect” his relationship with Sen. Dick Durbin D-Ill. and not launch a “partisan jihad.”

I asked Kirk and Sen. John Cornyn R-Texas, in Chicago on Monday, if they would be seeing or campaigning for Oberweis, the newly minted GOP nominee who beat businessman Doug Truax in the Illinois primary last Tuesday. Oberweis, a state senator from Sugar Grove—who comes to the November race with some baggage–is given little chance to beat Durbin.

“I’m going to be protecting my relationship with Dick and not launching into a partisan jihad that hurts our partnership to both pull together for Illinois,” Kirk said.

Left unsaid, of course, is that Kirk is up for reelection himself in two years and will undoubtedly expect the same “partnership” with the senior Senator.

*** UPDATE *** Twitterville…

85 Comments

|

Cynicism versus reality

Monday, Mar 24, 2014 - Posted by Rich Miller

* From a blast e-mail sent by John Bouman, the President of the Sargent Shriver National Center on Poverty Law, which backs the “Fair Tax” proposal…

One Springfield blogger voiced his opinion that [House Speaker Michael Madigan] made the [millionaire’s tax] proposal because the A Better Illinois proposal will have a hard time passing. That opinion is cynical “insider” conventional wisdom — always one of the main enemies of an ambitious and unusual effort like A Better Illinois that is driven by outside people power. If you follow the cynics, nothing of value ever gets done.

“Outside people power” can be a very good thing. But there’s a big difference between cynicism and reality, and between optimism and hopeless naivete.

* The harsh reality is the progressive tax proposal doesn’t have the votes to pass and I seriously doubt it will ever get enough votes to pass. The House Republicans are unanimously against it and Democratic state Rep. Jack Franks has signed on to a House resolution opposing it. That means, at most, it has 70 votes, which is one vote shy of passage. That might not mean much except Rep. Franks is just the tip of the iceberg on that side of the aisle.

Until I see any evidence at all that the A Better Illinois coalition has found significant House Republican votes for this thing, I’ll happily stick with life in the real world.

22 Comments

|

Question of the day

Monday, Mar 24, 2014 - Posted by Rich Miller

* Chuck Todd of MSNBC says these are Illinois’ rising stars…

* Chicago Ald. Will Burns “A serious contender for Congress.”

* Cook County Commissioner Bridget Gainer “Talk she could be the first female mayor since Jane Byrne.”

* State Rep.-elect Will Guzzardi “Big endorsements from several unions.”

* Lake County Board Chairman Aaron Lawlor “the type of younger Republican that the GOP is desperately seeking on fiscal issues instead of social issues.”

* Rep. Darlene Senger “Hopes she is on her way to DC”

* Doug Truax “Lost to a better known and better funded rival by just 12 percentage points and that’s got national Republicans taking notes.”

* The Question: Who are your picks for Illinois’ rising political stars?

104 Comments

|

* I told subscribers a bit about this poll earlier today…

The Paul Simon Public Policy Institute survey showing that 60 percent of those polled favor rolling back the tax comes as Gov. Pat Quinn plans to deliver his 2015 budget address Wednesday. Nearly 27 percent favored making the tax hike permanent. […]

An overwhelming majority of 79 percent oppose raising the state sales tax.

The next most popular revenue alternative to the income tax was extending the state sales tax to include goods and services not taxed. Nearly 44 percent favored that option, while 53 percent were opposed, the poll found.

And taxing retirement income, as one government watchdog group – the Civic Federation – proposed recently, was opposed by 72 percent of those surveyed.

However, the numbers shifted when pollsters questioned respondents about applying a retirement tax to those earning $50,000 or more during their golden years. Nearly 43 percent approved of that concept, while 50 percent were opposed, the poll found.

The Civic Federation honchos aren’t the only ones talking about imposing taxes on retirement income. Bruce Rauner says he’s open to it. Not a good position to have when 72 percent oppose the idea.

The poll results are here.

* The poll also asked voters what should be cut. Here are the answers for those favoring and opposing, respectively, cuts in various areas…

K-12 - 17.7%-78.8%

University - 36.7%-56.6%

Public Safety - 24.1%-71.0%

Natural Resources - 31.4%-61.1%

Poor People - 26.2%-64.8%

Disabled - 14.8%-82.1%

Pensions - 41.5%-51.1%

Pensions highlighted above for obvious reasons. From the Institute…

Republicans and conservatives were more likely to favor cuts to university budgets and state pensions than Democrats and Independents were. Independents were more likely to support and less likely to oppose cuts to Public Safety than either Democrats or Republicans.

* When asked how they would handle the state’s budget problems a majority, 52.3 percent, said “cut waste.” I really wish they’d drop that choice. From the Institute…

Conservatives and Republicans were significantly more likely to choose the “cut waste” option (61.2 percent for the conservatives and 62.6 percent for the Republicans) than were liberals and Democrats (38.5 percent for the liberals and 42.9 percent for Democrats), with the moderates and Independents falling between the two partisan groups (52.1 percent for moderates and 57.1 percent for Independents).

Likewise, liberals and Democrats were far more likely to choose the “increase revenue” and the “combination of both” approaches than were conservatives and Republicans: 16.9 percent of the liberals and 13.6 percent of the Democrats chose the increase revenue option compared to 8.0 percent of the conservatives and 6.5 percent of the Republicans who chose that option. The moderates and Independents were much closer to the conservative and Republican position on increasing revenue.

On the “combination of both” option, 35.5 percent of the liberals chose that option compared to 21.1 percent of the conservatives. Also, 33.5 percent of the Democrats chose the combination of approaches compared to 24.7 percent of the Republicans and 25.4 percent of the Independents who chose that option.

41 Comments

|

* The African-American publisher of Ndigo.com took a Republican ballot last week, but not to vote for Kirk Dillard…

“We’ve got a one-party system in Chicago and Illinois. We’ve got to break it up,” said Hermene Hartman, Ndigo.com publisher.

Online publisher Hartman says the black community’s high unemployment and total lack of economic development caused her this week to vote Republican for the first time.

“We’ve got to bring about some change. And you’re not going to change, if you don’t change,” he said.

Major Chicago black church leaders, all one-time Democrats, have endorsed Rauner, including the Reverend and former State Senator James Meeks, West Sider the Reverend Marshall Hatch and the South Side’s Reverend Stephen Thurston.

* And Laura Washington takes a look at a nascent political wing…

Chicago’s organizing community is restless. They actually agree with Rauner on one thing: The Democratic Party establishment is not working in their best interests.

So they are looking past November, to 2015.

Four major Chicago progressive operations have been in quiet but intensive planning for a brand-new political organization that will identify, train and run candidates for the 2015 citywide elections.

They aim “to build an infrastructure that allows community folks to act political and exercise political power in a way that doesn’t exist right now,” a top member of the planning team told me late last week. As Bill de Blasio did in New York City, this group thinks the time is ripe to move Chicago to the left. They will formally announce and launch the new organization this summer.

“This is the moment to be bold,” the activist said.

One of those organizations is the Chicago Teachers Union, I’m told.

*** UPDATE *** SEIU is also part of the “progressive” Chicago community, but the union went with the governor today. From a press release…

Governor Pat Quinn today received the endorsement of the Illinois State Council of the Service Employees International Union, a major labor union that represents more than 150,000 workers across Illinois.

Today’s endorsement adds to the growing momentum for the Governor’s re-election in 2014.

“I am extremely honored to have the support of the hard-working women and men of SEIU,” Governor Quinn said. “We know how to work hard and we know how to organize. Together we will continue to bring more families into the middle class and continue to move Illinois forward.”

“The clear choice for residents of Illinois in the upcoming November election is between a future in which we all have access to a quality standard of living, or one in which workers are increasingly stuck in low-wage jobs with a widening income inequality gap,” said Flora Johnson, Chair, SEIU Healthcare Illinois Executive Board. “That’s why SEIU is proud to endorse Governor Pat Quinn for another four-year term so he can continue his fight to eradicate the economic and social inequality that currently thrives in the state.”

Since taking office in the worst recession since the Great Depression, Governor Quinn has fought to create jobs and build a brighter future for working families, driving unemployment down to its lowest point in five years. Quinn championed and signed into law the largest capital construction program in state history, supporting more than 400,000 jobs to update Illinois’ roads, schools and bridges.

Throughout his time in office, the Governor has always worked to make sure Illinois workers are safe and treated fairly in the workplace. He has enacted more Project Labor Agreements than any other governor in the country and is leading the nation in fighting worker misclassification to ensure employees receive the pay they have earned.

* Other stuff…

* Zell, Emanuel to appear at Forbes summit

* And Now for the Further Adventures of Rahm the Impaler - “Trending toward insolvency.” “The country’s worst school system.” “The murder capital of America.” This is Rahm Emanuel’s third year as mayor of Chicago, and everything is under control.

* Neil Steinberg’s ‘Esquire’ Profile Of Emanuel Pulls Few Punches

* Englewood Students Satirize Mayor Emanuel’s School Closings With ‘Wreck-it Rahm’ Poem

41 Comments

|

Today’s constitutional amendment quotables

Monday, Mar 24, 2014 - Posted by Rich Miller

* David Yepsen on Speaker Madigan’s proposed income tax surcharge on income over a million dollars and Bruce Rauner’s term limits proposal…

Rauner’s term-limit push reinforces his theme that Illinois government is in shambles because it is overrun with career politicians. Madigan’s plan, however, may provide a way for disillusioned Democrats to come home despite their frustration with the Democratic-sponsored, Quinn-signed law to curb public employee pension benefits.

“I can see people voting for both (proposed amendments) — screw the rich people and throw the bums out,” Yepsen said. “But this is a way Democrats can get a piece of that anger.”

* From the Tribune editorial board…

House Speaker Michael Madigan, who helped create the Quinncome tax hike, now wants to change the subject. On Thursday he said he’ll ask lawmakers to put on the November ballot an income tax increase of 3 percentage points on personal income that exceeds $1 million. Seven weeks earlier, though, Madigan proposed to cut in half the state income tax on corporations. But a month before that, he complained that some companies “don’t pay their fair share.”

Go figure. If Madigan hasn’t yet offered a tax policy you like, give him time. Will he and other Quinncome taxers now raise rates or cut spending?

* Mark Brown on Rauner’s term limits proposal…

Based on the emails I’m receiving, I think many voters will be surprised to learn it wouldn’t bring the immediate end of Madigan’s reign, but would immediately give more power to Illinois’ next governor. (Now, who might that be?) […]

The other provision would make it more difficult for legislators to override a governor’s veto by increasing the required 3/5 majority vote of both chambers to a 2/3 majority. The obvious purpose is to strengthen Rauner’s hand against Madigan, which isn’t a good reason to tinker with the state Constitution.

Did any of you feel Rod Blagojevich wasn’t given enough power? Do you think Illinois would be better off today if only Blago could have kept the Legislature in better check with his veto? See what I mean.

The strangest part is that neither of these proposals were the result of public clamoring or offered by some good government think tank. Instead, both were dreamed up by Rauner and his lawyers in hopes of cobbling something together that would help the term limits amendment pass muster with the Supreme Court.

Discuss.

26 Comments

|

Vintage Pat Quinn

Monday, Mar 24, 2014 - Posted by Rich Miller

* The Sun-Times sat down with Gov. Pat Quinn, who showed more fire than he has in a very long while. Here’s Quinn on Bruce Rauner’s minimum wage flip-flop….

He got caught red-handed calling for a cut in the minimum wage. I think that’s the bottom line. That’s the real Bruce Rauner, a billionaire who doesn’t have any understanding of what it’s like to live from paycheck to paycheck. Folks who do hard jobs, who don’t want to live in poverty, who are following all the rules, working 40 hours a week. We ought to raise their pay to help our economy if we want to be competitive, we should make sure that those literally hundreds of thousands of folks who would benefit from a wage increase, they should come first. Billionaires like Bruce Rauner should move to the back of the line. We’re not going to let him get away with what he said in the primary. He’s trying to duck that issue.

* On Rauner claiming he’s in the 0.01 percent…

Well, I have one home, I don’t have nine mansions. I will never be part of the 1 percent. Matter of fact, I’ll be about 102 before I pay back my kid’s college loan.

I think it’s important to understand it isn’t going to be about who has the most money who wins this election, it’s who connects to everyday people who are the heart and soul of Illinois. I believe in government of the many; he believes in government of the money. I think there will be a real contest of values here … he’s just going around bragging about his abundance of money, I don’t think that connects you to the real lives of every day people. We want a government that is fair to all, not just the billionaires.

* On Rauner’s contention that taking campaign contributions from public employee unions is the same as accepting a bribe…

I think it’s a lot of baloney. People have a right to form organizations, unions to bargain for their wages and their working conditions. That’s as American as apple pie. That’s good for America. It helps our economy to make sure that people have a decent wage and decent health care and decent benefits. I just don’t know what he’s driving at. First of all, he’s against minimum-wage workers, he wants to drive them down and literally take $2,000 out of their pockets. And then for folks who vote for a union, he wants to attack those unions and make it hard for people to have that ability at the bargaining table.

These plutocrats at the top of the power heap, they may have a lot of money, but they don’t have any understanding of everyday people and what they go through.

Go read the whole thing.

37 Comments

|

Rate the new cable TV ad

Monday, Mar 24, 2014 - Posted by Rich Miller

* As I told subscribers this morning, Illinois Policy Action, which is run by the folks at the Illinois Policy Institute, has a new cable TV ad blasting the proposed progressive tax, calling it a “wolf in sheep’s clothing.” Rate it…

Subscribers have the specific ad buy data, but it’s about $94K and targeted at specific House districts. The ad is in addition to another ad buy by Americans for Prosperity Illinois which I told you about last week. Both ads target specific rates that have not yet been formally proposed and probably won’t ever be. Also, this idea, as we talked about last week, is pretty much dead.

30 Comments

|

Today’s number: 20,100

Monday, Mar 24, 2014 - Posted by Rich Miller

* Bernie…

According to figures from comprehensive annual financial reports of the State Employees’ Retirement System, the number of employees covered by that system was 81,680 as of June 30, 2002. That would be during the final year of Republican Gov. George Ryan’s single term. Back in 1994, when Republican Gov. Jim Edgar was on the way to winning his second term, the number was 78,440.

The big drop came by the summer of 2003, when the number fell nearly 11,500 from the previous year to 70,192. Most left under an early retirement initiative that thousands decided to take as Democratic Gov. Rod Blagojevich came into office.

The reported figure as of June 30, 2013 — which generally includes state workers other than legislators and judges in executive, legislative and judicial branches, but doesn’t include higher education institutions — was 61,545.

Thus, the number of state employees dropped by more than 20,100 people — nearly 25 percent of the workforce — from 2002 to 2013.

70 Comments

|

* Daily Herald…

A warrant for the search of former state Rep. Keith Farnham’s Elgin legislative office shows authorities were looking for evidence of the possession of child pornography.

The warrant, released by the Illinois House in response to a Freedom of Information Act request by the Chicago Tribune, was executed by U.S. Immigration and Customs Enforcement’s Homeland Security Investigations officials at the Democrat’s office last week.

Advertisement

First in its list of items to be looked for are “documents in any format or medium pertaining to the possession, receipt, or distribution of child pornography.”

The federal warrant is here.

* Tribune…

In addition, a federal agent on Thursday took a laptop computer that Farnham used in the Illinois House chamber, and last week agents removed a computer from a legislative office building next to the Capitol, according to the documents and an interview with a state technology official. […]

Farnham has not been accused of any wrongdoing. Randall Samborn, a spokesman for the U.S. attorney’s office in Chicago, said no charges have been filed and refused further comment. […]

The Thursday request for the laptop Farnham used in the House chamber came from an agent with the U.S. Immigration and Customs Enforcement, part of the federal Department of Homeland Security, said Tim Rice, who oversees information technology for the General Assembly.

“They basically made a request, and I consented to it,” said Rice, executive director of the Legislative Information System, which oversees electronics in the House.

* Irony…

Farnham, who took office in 2009, is listed as the co-sponsor on two state bills that sought to increase the penalties on individuals who possess child pornography in certain circumstances.

One bill states that child pornography or aggravated child pornography that does not involve mere possession shall be deemed crimes of violence. The other increases the penalties for individuals that film child porn.

28 Comments

|

Behind Dillard’s late surge and a look ahead

Monday, Mar 24, 2014 - Posted by Rich Miller

* My weekly syndicated newspaper column…

It didn’t take long for Republican gubernatorial nominee Bruce Rauner to drop the word “unions” from his vocabulary.

After bashing public employee union leaders for months as corrupt bosses who buy votes in order to control Springfield, Rauner and his campaign have assiduously avoided the use of the “U-word” since his victory last Tuesday. Instead, he’s switched to a line about how “our government is run by lobbyists, for special interests, and the career politicians in both parties let it happen.”

Rauner’s campaign manager said on primary night that his boss is “pro-union.” Rauner himself insisted last week that he’s not anti-union and never has been.

The candidate’s record clearly shows otherwise however. Rauner kicked off his campaign with a widely published newspaper op-ed in which he called for legislation to allow individual counties to approve their own so-called “right to work” laws. Rauner has also repeatedly demanded that Illinois follow the lead of states like Michigan, Indiana and Wisconsin, which have all passed anti-union laws.

And Rauner’s only personal and extended interaction he’s had with an Illinois labor leader went horribly wrong. Rauner reportedly marched into the office of the president of Operating Engineers Local 150 late last year to pledge to the president that if he was with Rauner, then the candidate would go all the way with him, but warned that if the president was against Rauner, the candidate would essentially work to destroy him once elected. That message didn’t exactly go over too well.

Weeks ago, some folks in the higher echelons of Rauner’s campaign assured me that their candidate believed there was an opening with unions and he would try to exploit it. But that was when Rauner enjoyed a double-digit lead in the polls.

I think the expectation at the time was that at least some unions would consider a rapprochement with Rauner if he won the primary big. Better to cut a deal with an almost surefire winner than be crushed after he became governor.

But Rauner didn’t win big. His 2.8 percent winning margin fell infinitely short of almost all expectations. And that’s mainly because the unions appeared to have convinced lots of their Republican members to vote for Sen. Kirk Dillard and persuaded lots of non-Republicans to take GOP ballots.

If you look at Sangamon County, the home of the Illinois capital and lots of state workers, you’ll see stark and convincing evidence of just how effective the union push was.

In 2010 and in 2006, total Republican gubernatorial votes cast in the county were very similar, averaging just under 16.000.

This year, the county’s turnout was abysmal, with under 20 percent of registered voters participating overall. But Republican votes for governor shot way up to almost 25,000. Sen. Dillard, the union favorite, won Sangamon with about 15,000 votes, almost equal to the total GOP turnout in the previous two primaries.

Democratic votes for governor in 2010 and 2006 were both 34 percent of the total gubernatorial votes cast in Sangamon County. This year, that number fell to just 15 percent, with Republican percentages rising from 66 percent in the two previous primaries to a whopping 85 percent this year. Some of that can be attributed to the lack of interest by all Democrats everywhere due to a dearth of contested races, but most of it was related to the unions’ strong GOP ballot push.

These numbers can’t be extrapolated statewide because AFSCME is so influential in Sangamon, but it doesn’t take a genius to see that something unprecedented happened in Illinois on Tuesday. The polls and prognosticators were wrong because tens of thousands of union members and their loved ones took GOP ballots for the first time. Changing the landscape of a party primary is almost impossible, but the unions did just that.

And because they almost beat Rauner I doubt that few if any unions will be at all interested in cutting a deal with him. There could be an odd straggler that Rauner can parade as “proof” that he’s not anti-union. But the overwhelming attitude will be “We almost beat him once, so we’ll just ramp it up in the fall.”

The question then becomes how long it will take the public employee unions to forgive Quinn, who pushed hard to cut their members’ pension benefits. They simply don’t trust the man, and they truly wanted to nominate an alternative last week.

And the danger for Quinn is that the public employee unions do what they did in the primary with Dillard - wait too long to finally make a decision.

84 Comments

|

|

Comments Off

|

|

Comments Off

|

AFL-CIO executive committee backs Quinn

Friday, Mar 21, 2014 - Posted by Rich Miller

* The Illinois AFL-CIO’s executive committee met at noon today and voted to endorse Gov. Pat Quinn.

There was “no opposition” to the motion, I’m told. Some folks (I’m betting AFSCME and others) didn’t say a word either way. So, not unanimous, but no stated opposition.

No other endorsement votes on other candidates were taken.

…Adding… Sun-Times…

There were no votes of opposition, though the union representing about 35,000 state employees, AFSCME Council 31, abstained from the vote.

AFSCME is suing Quinn in a bid to undo changes to state pension laws that the governor backed that would cut back on post-retirement benefits for its members. The case is being heard in Sangamon County and is expected to eventually go before the Illinois Supreme Court.

Another public-sector union trying to get that law tossed, the Illinois Federation of Teachers, was absent from the meeting.

14 Comments

|

* I don’t see how these horse race numbers released by Lt. Gov. Sheila Simon prove much of anything…

One survey, taken by Lake Research Partners in late January, show that Sheila Simon, who’s giving up her spot as lieutenant governor to run for comptroller, trails veteran GOP incumbent Judy Baar Topinka by a fairly narrow 39 percent to 32 percent among likely general election voters. 29 percent were undecided or not answering.

* And this finding assumes that Simon will have the money to deliver such a punch…

Team Simon also points to a finding that just 35 percent give Ms. Topinka a “good” or “excellent” job rating, while 46 percent rate it “fair” or “poor.” And, when voters were asked about Ms. Topinka’s drawing of a large pension, those surveyed were heavily negative. Look for that to crop up as a line of attack by Ms. Simon against Ms. Topinka this fall.

The survey also found that 44 percent of those surveyed want a change in the comptroller’s office, while 27 percent want to continue current policies. It has an error margin of plus or minus 4 percent.

Simon was using the results of that poll to fundraise in February. We’ll see how she did soon.

* And this is kind of interesting…

The survey found Mr. Cross ahead 34 percent to 30 percent over the Democratic nominee, state Sen. Michael Frerichs, with Mr. Cross getting an impressive 21 percent of the vote in heavily Democratic Chicago.

That poll was taken March 6 and 7 and had an error margin of plus or minus 4.8 percent.

34 Comments

|

[The following is a paid advertisement.]

In any discussion about treatment of mental illness, the interests of the patients and their families should come first. In considering Senate Bill 2187 – sometimes called “RxP” – members of the General Assembly should keep that in mind.

SB 2187 would allow psychologists who have no medical training to prescribe powerful medications to patients. Current Illinois law allows only people who have medical training – doctors, nurse practitioners and physician assistants – to prescribe drugs.

Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses. Finally, many drugs are powerful and can create risky side effects. To understand these complexities, psychiatrists go through four years of medical school and four additional years of residency, on top of their college training in the sciences. They learn to treat the whole patient – not just the brain.

The most recent version of the “RxP” bill would require about 30 semester hours, or 10 college courses, plus 10 weeks of supervision by a psychologist to prescribe medication. The course work could be completed online. Would you allow someone trained online to repair your brakes? Fly a plane? Work as a lifeguard? Treat the family dog?

Psychologists who want to prescribe can follow the route taken by Illinois nurse practitioners, physician assistants and doctors. They can obtain medical training – instead of insisting on a law that would put patients at risk. To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

Question of the day

Friday, Mar 21, 2014 - Posted by Rich Miller

* A letter to the editor by Nicole Chen, Western Springs, Illinois chapter leader, Moms Demand Action for Gun Sense in America…

The new concealed-carry law in Illinois requires businesses to post a standardized 4-by-6-inch picture of a semiautomatic handgun with a red line through it at their entrances if they wish to prohibit guns in their establishments. […]

Members of the business community need to know about Illinois Senate Bill 2669, which would change the signage requirement.