Pritzker signs SAFE-T Act trailer

Tuesday, Dec 6, 2022 - Posted by Rich Miller

* Press release…

Governor Pritzker today signed HB1095, a series of amendments and clarifications to the landmark SAFE-T Act, originally passed in 2021. The bill addresses misinformation related to the Act, including clarifying the detention net, expanding processes for transitioning to cashless bail on January 1st, and specifying definitions of willful flight and dangerousness, among other changes.

“I’m pleased that the General Assembly has passed clarifications that uphold the principle we fought to protect: to bring an end to a system where wealthy violent offenders can buy their way out of jail, while less fortunate nonviolent offenders wait in jail for trial,” said Governor JB Pritzker. “Advocates and lawmakers came together and put in hours of work to strengthen and clarify this law, uphold our commitment to equity, and keep people safe.”

The bill clarifies multiple aspects of the SAFE-T Act, which ends the cash bail system in Illinois effective January 1st, 2023 and creates a more equitable system where pre-trial detention is based on community risk rather than financial means. The clarifications to the SAFE-T Act are the result of the work of a bi-cameral legislative group who collaborated with advocates, public defenders, state’s attorneys, victim advocates, and law enforcement officials.

Changes to the Act clarify court authority in controlling electronic monitoring and escape, outline specific guidelines for trespassing violations, and create a grant program to aid public defenders with increased caseloads. The amendments strengthen and clarify the main principle of the SAFE-T Act- to ensure that individuals who pose a risk to the community aren’t released from jail just because they are able to pay bail while people without financial means sit in jail regardless of whether they pose a risk at all.

“The SAFE-T Act, including these important clarifications, will help right the wrongs of policies that have disproportionately harmed low-income, marginalized communities while helping to keep Illinoisans safe,” said Lt. Governor Juliana Stratton. “I commend members of the General Assembly for coming together to make these changes and provide us a clear path to ensure both accountability and justice. We must stop criminalizing poverty, and that is our goal as we end cash bail in Illinois and uphold human rights for all in our legal system.”

“We understand that public safety is not a static issue,” said Deputy Majority Leader Jehan Gordon-Booth (D-Peoria). “This legislation strengthens the underlying SAFE-T Act with valuable feedback from survivors, law enforcement, prosecutors and other public safety advocates. If we want to make our communities safer, we have to work together. This update is a step in the right direction.”

“It’s vital the pretrial system in Illinois remains equitable and that all individuals are treated fairly, regardless of financial status,” said State Senator Scott Bennett (D-Champaign). “After collaboration between a diverse group, we were able to create a measure that ensures public safety and maintains the intent of the Pretrial Fairness Act. I am proud of everyone’s collaborative effort and their commitment to make Illinois safe.”

“The SAFE-T Act was the result of hours of testimony and negotiations with domestic violence advocates, proponents of reform, law enforcement and states attorneys at the table working to create a pathway to a better and more equitable criminal legal system,” said State Senator Elgie R. Sims, Jr. (D-Chicago). “However, due to the misinformation campaign led by opponents of the measure, we spent countless hours dispelling falsehoods and working to ensure that the law was not taken out of context. I thank the governor and my colleagues in both chambers for prioritizing a measure that clarifies the language of this transformational law while preserving the protections for crime survivors and ensures we stop criminalizing poverty in this state.”

“To say that I’m proud of all the work and advocacy that went into the passage of this act would be an understatement,” said State Senator Robert Peters (D-Chicago). “My colleagues and I, with input from the Coalition to End Money Bond, the States Attorneys Association, the Sheriff’s Association and survivor advocates, were able to create something that will change lives and reform the criminal justice system for the better. This is our generation carrying the torch for civil and human rights, and Illinois will only become safer and more equitable because of it.”

“This legislation builds on the foundation we set in the SAFE-T Act by making certain that provisions are clearer, more effective, and less difficult to implement,” Representative Eva-Dina Delgado (D-Chicago) said. “Institutional barriers within the criminal justice system have disproportionately affect people in the communities that I represent and this legislation addresses that disparity. I am so proud of the work that my colleagues, stakeholders and I did to engage and collaborate to bring forth this bill.”

“This measure is part of a continued effort to address misconceptions and sincere concerns brought forward by law enforcement, survivors and advocates,” said Rep. Dave Vella (D-Rockford). “It’s a reminder of the need to work together, and of our shared mission to make every community safer for families across our state.”

“This is the result of hundreds of hours and a collaboration of all stakeholders to clarify and strengthen the language from the previous legislation. It’s been an honor to serve my constituents as part of the Public Safety Working Group and create common sense policy solutions that will improve the safety of our communities and the integrity of our justice system,” said Assistant Majority Leader Natalie Manley (D-Joliet). “This is a tremendous step toward a safer, fairer Illinois for all.”

“By strengthening the SAFE-T Act, we are continuing the vital work of keeping Illinoisans safe,” said Rep. Kam Buckner (D-Chicago). “Maintaining a robust justice system will always be an ongoing task, one that we prioritize. Hundreds of hours of consultation with stakeholders from across the ideological spectrum went into producing this bill, which maintains the historic reforms of the SAFE-T Act while ensuring a successful implementation of new policy.”

“The SAFE-T Act was carefully crafted to promote a more equitable criminal justice system while simultaneously keeping our communities safe across Illinois. This legislation takes steps to ensure the SAFE-T reforms are carried out successfully,” said Rep. Jennifer Gong-Gershowitz (D-Glenview). “Our goal was to reinforce the principles we were proud to pass with the SAFE-T Act, which replaces a wealth-based pretrial detention system with one based on a person’s threat to the community. This legislation protects those goals.”

“When we passed the original SAFE-T Act, we did so with the understanding that more work would need to be done to implement these historic reforms. This legislation keeps that promise,” said Rep. Justin Slaughter (D-Chicago). “This legislation clarifies and strengthens the law, reflecting the input and agreement of law enforcement, survivor advocates, and reformers. The work of building a fairer justice system continues, and I am grateful for the partnership of my colleagues in the House Public Safety Working Group, our Senate colleagues, and Governor Pritzker.”

5 Comments

|

Caption contest!

Tuesday, Dec 6, 2022 - Posted by Rich Miller

* Capitol News Illinois…

The Satanic Temple of Illinois debuted a new display in the Illinois Capitol rotunda Tuesday, taking its place next to the annual Christmas and Hanukkah displays. […]

On Tuesday “Minister Adam” of the Satanic Temple of Illinois, who declined to share his last name for security purposes, was joined by about 15 Temple members to dedicate this year’s display. It consists of a crocheted snake sitting on a book and a pile of apples crocheted by Temple members.

“Every year, we do a holiday display and a show of unity and religious pluralism within the state Capitol rotunda,” Adam said. “And this year, we wanted to focus on the book bans that people have been trying to do all over the country.”

A pal of mine took a pic earlier today…

52 Comments

|

Lunchtime briefing

Tuesday, Dec 6, 2022 - Posted by Rich Miller

* Capitol News Illinois…

The final margin of victory for Gov. JB Pritzker over Republican challenger state Sen. Darren Bailey was a resounding one, about 12.54 percentage points. Pritzker notched more than 2.25 million votes to Bailey’s 1.74 million.

The lead vote-getter for Democrats was Comptroller Susana Mendoza in her third successful statewide election. Her 2.33 million votes to nearly 1.68 million votes for Republican candidate Shannon Teresi represented a win of just over 16 percentage points, down from her near 23-point victory total in 2018.

She assumes the mantle of most successful statewide Democrat that has for over two decades been claimed by Secretary of State Jesse White. The 88-year-old who has held that office since 1998 didn’t run again this year, paving the way for Democrat Alexi Giannoulias to win a contentious Democratic primary.

Giannoulias, the former state treasurer, received about 2.2 million votes to just under 1.8 million for state Rep. Dan Brady, of Bloomington, the Republican nominee. Last week, Giannoulias and Brady announced that the vanquished Republican would join the winner’s transition team. The margin of victory was about 10.69 percentage points.

From Comptroller Mendoza…

After the Illinois State Board of Elections certified its election results on Monday, December 5, the final stamp on Illinois’ 2022 General Election Results shows that Illinois Comptroller Susana A. Mendoza received more votes than any other candidate on the ballot throughout the state.

“The State Board of Elections’ newly certified vote totals confirm what we had set out to do and hoped for from the beginning of the campaign. Illinois voters have given me the highest vote total for any statewide candidate on the ticket in Illinois: 2,331,714,” Mendoza stated, “I am honored and humbled that you have once again placed your trust in me.”

SJ-R…

Democrats maintained their super-majority in the Illinois Senate and built on its existing advantage in the Illinois House but had several close calls. The results from ISBE showed Democrats won 78 of the 118 seats in the House and 40 of the 59 seats in the Senate.

In the local Illinois Senate District 48 race featuring state Sen. Doris Turner, D-Springfield, and state Rep. Sandy Hamilton, R-Springfield, the final 50.9% to 49.1% tally favored the Democrat.

Turner distanced herself from Hamilton primarily in Sangamon County by 1,375 votes but also won in Macon County by 945 votes. Hamilton won Christian County by 913 votes although the county only had 2,667 votes of the nearly 77,000 cast in the race.

State Sen. Michael Hastings, D-Frankfort, overcame Republican challenger Patrick Sheehan in the Illinois Senate District 19 race by less than 1,000 votes. The race caught the attention of many as Pritzker called on Hastings to resign from the Senate in September due to allegations of domestic violence from his estranged wife.

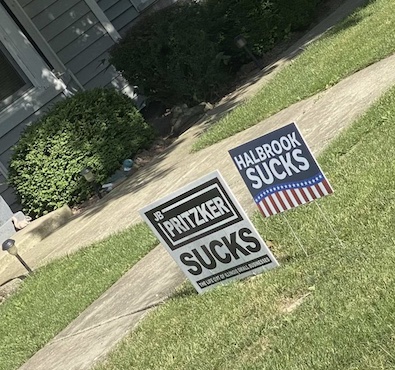

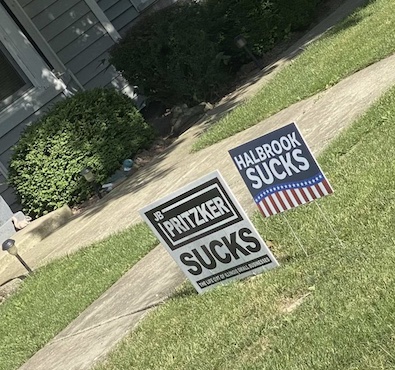

* Apparently, Rep. Brad Halbrook (R-Shelbyville) had some issues in Shelby County this year, even though he was unopposed…

Another one found its way to Reddit.

* WLS Radio’s John Howell…

Retired Chief from Riverside Illinois, Tom Weitzel, is our go-to guy for things law enforcement. We’d like to get his take. He’s had, as they say, boots in the sand. He’s had a lot of years of dealing with law enforcement. He regularly lets people in Springfield know what they should be doing and maybe what they shouldn’t be doing. Chief, welcome back, sir, and happy holidays to you.

Weitzel was then asked about the SAFE-T Act revisions…

Well, there’s some good points in there. And there’s some really bad points that are still left in. And I’m fed up by saying that, you know, it’s a 308-page trailer bill that was adopted on the very last date. I don’t think anybody really read through that in the time that they had. It’s almost you remember when the law was passed to begin with? It was over 700 pages at 5am. It seems to be a pattern here. I don’t know how you can thoroughly go through that. At least the law enforcement people that were supposedly involved in these negotiations to really see what’s in there,

Has this person ever been involved in legislative negotiations? Law enforcement representatives were at the table for weeks.

* Back to Weitzel…

But there are some good things to it. They did add a good amount of felony crimes that at least have to have a bail hearing. I found it kind of interesting, though, that they added aggravated battery to a public official as one of the new pieces of legislation that you have to be at least clear in front of the judge and get a bond set or be released. But they didn’t add aggravated battery to police officer. So you can continue to seriously injure police officers and they didn’t add that to that list.

They didn’t add it to the list because it was already in the original bill…

Upon verified petition by the State, the court shall hold a hearing and may deny a defendant pretrial release only if: […]

(7) the person has a high likelihood of willful flight to avoid prosecution and is charged with:

(A) Any felony described in Sections (a)(1) through (a)(5) of this Section; or

(B) A felony offense other than a Class 4 offense.

That charge qualifies. They also revised the willful flight language to make it more acceptable to law enforcement.

* Isabel’s roundup…

* Tribune | Supreme Court readies to weigh in on ‘most important case’ on democracy: The court is set to hear arguments Wednesday in a case from North Carolina, where Republican efforts to draw congressional districts heavily in their favor were blocked by a Democratic majority on the state Supreme Court because the GOP map violated the state constitution.

* Washington Post | As fatal police shootings increase, more go unreported: Even though federal records indicate that fatal shootings by police have been declining nationwide since 2015, The Washington Post’s Fatal Force database shows the opposite is true: Officers have shot and killed more people every year, reaching a record high in 2021 with 1,047 deaths. The FBI database contains only about one third of the 7,000 fatal police shootings during this time — down from half when The Post first started tracking.

* CBS Chicago | PepsiCo to cut hundreds of jobs, affecting workers in Illinois, New York and Texas: PepsiCo is reportedly planning to eliminate hundreds of corporate jobs in North America, mostly affecting its beverage unit. The company’s Gatorade, Quaker and Tropicana brands are headquartered in Chicago. According to the Wall Street Journal, along with Illinois, the cuts will affect workers in Texas and New York. Employees were sent a memo saying the company is streamlining to run more efficiently.

* Fox32 | Pritzker joins Gold Star families for Christmas tree lighting in Chicago: Gold Star families in attendance of today’s lighting were able to place a memorial ornament honoring their fallen loved one on the tree. Governor Pritzker is also encouraging families to think of those serving overseas during this holiday season.

* CBS Chicago | Volunteers for rival candidate say Ald. James Gardiner ‘accosted’ them and got in their face on sidewalk: As shown on Ring doorbell camera, three Tomic volunteers were just walking down a Northwest Side street on Saturday, Nov. 26 – collecting a petition signature from a woman on the sidewalk. It was all routine, until a blue truck pulled up out of nowhere. “The gentleman came out of the car and crossing the street, yelling, ‘What are you doing signing their petitions?’ Like, you know, ‘They’re lying about me?’” said Tomic volunteer Andrij Skyba.

* CBS Chicago | James Suh, who says Ald. James Gardiner tried to silence him, plans to run for alderman himself: The feud started more than a year ago. The claims against the alderman that resulted got him in trouble with the city’s Board of Ethics – and the matter is now in court. While that case between Suh and Gardiner is still pending, Suh is planning to file his petition to run for Gardiner’s seat next week.

* Tribune | ‘Chuy’ García gets $1 million from labor union as race for Chicago mayor enters ballot-challenge phase: Powerful labor union IUOE Local 150 is giving U.S. Rep. Jesús “Chuy” García’s campaign a $1 million donation in his bid to unseat Chicago Mayor Lori Lightfoot. The International Union of Operating Engineers Local 150 announced its support for García late last month, giving his candidacy a boost after some of his key backers in his 2015 race against Mayor Rahm Emanuel declared their support for Cook County Commissioner Brandon Johnson.

* Center Square | Two Illinois state lawmakers set to retire after winning new terms: State Sen. Jason Barickman, R-Bloomington, announced Monday he will retire from the position at the end of the term on Jan. 10. He just won an uncontested race in his district. Barickman said in a statement he looks forward to spending time with family and not being taken away by phone calls…Last month, state Rep. Tim Butler, R-Springfield, announced he’ll be stepping down to become the president of the Illinois Railroad Association. He said the opportunity arose only a few weeks before he made the decision.

* Tribune | Gary LaPaille, former state Democratic chair, state senator and Madigan chief of staff, dies at 68: During his tenure as state party chairman, LaPaille played a major role in diversifying party leadership. Also a vice chair in the Democratic National Committee, LaPaille was influential in bringing the 1996 Democratic National Convention to Chicago for the renomination of President Bill Clinton. Four years later, Al Gore, who had become the Democratic presidential nominee, asked LaPaille to serve as DNC national chairman, but he turned down the offer to launch his career as a lobbyist.

* SJ-R | UIS Innovation Center officially has a new home in downtown Springfield, plans 2025 opening: The center will take over the three-story, 24,600-square-foot Illinois Sheriffs’ Association building at 401 E. Washington St. University of Illinois trustees approved $950,000 for the building purchase earlier this summer…Scheduled to open in 2025, the UIS Innovation Center will serve central Illinois as part of the Illinois Innovation Network (IIN) to drive innovation, economic growth, and workforce development across the state.

* Tribune | Chicago casino won’t be a ‘glitzy Las Vegas strip joint’ but a ‘series of experiences,’ developers say: As outlined Monday, the design now includes more greenspace and an additional road connections into the riverfront district to address traffic concerns. That followed an earlier decision to nix a proposed pedestrian bridge over the river following community pushback.

* Buffalo Grove | Father grew volatile, erratic leading up to Buffalo Grove family’s deaths: ‘So many red flags’: The five people found dead in a Buffalo Grove home Wednesday were likely killed in a murder-suicide carried out by Andrei Kisliak, police said Monday, as court records showed Kisliak growing more volatile and erratic in the weeks leading up to his family’s deaths.

* AP | Farmers of color sue government for promised federal aid: The federal government has illegally broken a promise to pay off the debts of a group of Black farmers, according to a class-action lawsuit. The group hopes to put pressure on officials to keep their word and to restore funding that was dropped after a group of white farmers filed legal challenges arguing their exclusion was a violation of their constitutional rights. The lawsuit filed in October remains active even as the U.S. Department of Agriculture moves forward with another effort to help farmers in financial distress in addition to paying farmers who the agency discriminated against.

19 Comments

|

* Some background is here if you need it. I gave subscribers a brief heads up about this today…

Protect Illinois Communities launched today in support of efforts to pass much needed gun reform in Illinois that will make our communities safer. The newly formed organization will provide resources to engage voters across the state as well as members of the state legislature as they consider the Protect Illinois Communities Act, which was introduced last week by Representative Bob Morgan (D-Deerfield).

The Protect Illinois Communities Act includes common sense measures to keep guns out of the wrong hands, starting with an assault weapons ban. Additionally, the bill would raise the minimum age to obtain a FOID card to 21, and increase resources to enforce red-flag laws and stop the influx of illegal weapons into Illinois. Illinoisans are too familiar with the devastating toll of gun violence, and voters across zip codes and political affiliations know that now is the time to take action.

“Complacency and inaction leave the door open for bad actors to obtain weapons with only one purpose: to kill as many people as possible as quickly as possible. Communities across our state can’t afford to wait any longer to act on gun reform,” said Becky Carroll, Chair and President of Protect Illinois Communities. “Protect Illinois Communities is proud to join the efforts of lawmakers around our state as they work on passing this lifesaving legislation, and we will provide significant resources to communicate with communities across Illinois to ensure a successful outcome in January.”

Statistics and data overwhelmingly support a need for passing the Protect Illinois Communities Act immediately. Mass shootings using assault weapons result in nearly 22 times as many people wounded per incident on average. These excessively lethal weapons are capable of firing 30 rounds in 10 seconds and can hit bystanders one-quarter mile away. 18 to 20-year-olds commit gun homicides at triple the rate of adults 21 years or older, and current gun laws make it too easy for disturbed young people to access guns. The strength of our gun laws are undermined by weak laws in neighboring states, and we must empower the Illinois State Police to combat the influx of illegal guns into Illinois. Restricting who can access deadly weapons is crucial to protecting our communities.

Protect Illinois Communities is an Illinois not-for-profit corporation operating as a 501(c)(4) organization. To learn more or receive updates from the organization please visit www.protectillinoiscommunities.com.

The phrase “significant resources” jumps out.

42 Comments

|

* The 2022 Golden Horseshoe Award for Best Campaign Staffer - Illinois Senate Republicans is a tie. Brent Ellis…

The Beast of the Metro East, Brent Ellis. As someone who has observed and worked in IL politics for quite some time, his experience there has paid off. He got Erica Conway Harriss elected in a district that hasn’t elected a Republican in decades. As the ONLY SRO operative with a flip this cycle, Brent Ellis has more than earned the Golden Horseshoe award.

Brent has now won this award two cycles in a row.

* And Matt Butcher…

Matt Butcher - a great operative who was outspent by a large margin and still came very close. Always runs a great operation and is always willing to help everyone out. Matt also does a fantastic job of mentoring younger people who want to get involved and is always willing to show them how to do things. He is a team player and the senate is lucky to have him.

* The 2022 Golden Horseshoe Award for Best Campaign Staffer - Illinois House Republicans goes to Mark Revis…

He ran and won a county board seat in Will County while managing several races for HRM. Was in the fight himself and did a solid job for the organization.

Zach Emberton wins runner-up based on this outstanding nomination…

(W)hat can I say…anyone who can sit in the clerk’s basement for three weeks with Rep. Mazzochi and watch ballots being opened…well…he deserves something more than a Golden Horseshoe.

Zach is a mechanic turned attorney. He knows what makes DuPage tick and he is one of the last guys who can run a race…nothing is below him. Putting up signs, taking midnight candidate calls, or rallying volunteers to phones…Zach is Golden.

Congrats!

* OK, let’s move on to today’s categories…

Spokespersons can be for federal, state and local offices/campaigns, but keep the nominations Illinois-centric, of course. Please do your best to nominate in both categories and make sure to explain your nominations or your votes won’t count.

* And after you’ve voted, please consider clicking here and donating to Lutheran Social Services of Illinois to help them purchase presents for foster children. Here are some of those very kids making Christmas crafts…

We are just a few hundred dollars below matching last year’s online record, without factoring in inflation (I factored that amount into our newly stated goal). So, please, click here and give if you can. Thanks!

…Adding… That was quick. Thanks!…

30 Comments

|

* Cook County Record…

A pair of longtime government reform advocates are pushing back against an attempt by Gov. JB Pritzker and Illinois Attorney General Kwame Raoul to force them to pay the state $1.5 million, alleging they are being punished for opposing Pritzker’s bid to end decades of federal court oversight of corrupt state government hiring practices.

On Dec. 1, attorneys Michael Shakman and Paul Lurie filed a motion in Chicago federal court, opposing Pritzker’s efforts to force them to repay fees the court awarded them from the state as Pritzker argued in court that continued federal oversight of state hiring practices was no longer warranted.

“Granting the Governor’s request … would unjustly punish two civil rights champions who achieved massive reforms,” Shakman and Lurie wrote.

“It would set a dangerous precedent chilling civil rights plaintiffs from seeking appointment of masters to bring governmental bodies into compliance with the requirements of the Constitution.” […]

They noted Pritzker’s fee demand is essentially an ambush, as neither Pritzker nor Raoul gave any indication in the past two years of their intention to demand such a fee award from their opponents.

Shakman and Lurie said they reasonably opposed Pritzker’s attempt to vacate the decree, as they only backed the position of the special master, using information from her reports.

Shakman lost his appeal in August.

* From the state’s filing…

(U)nder black letter law and binding Seventh Circuit precedent, Plaintiffs no longer are prevailing parties with respect to the competing termination and expansion motions, and must shoulder their own fees for opposing the State’s termination motion and requesting expansion of the special master’s duties.

Similarly, Federal Rule of Civil Procedure 53 requires the court to allocate payment for a special master’s services based on the “extent to which any party is more responsible than other parties for the reference to a master,” and allows reassessment of the allocation of special master payments between the parties “to reflect a decision on the merits.” The costs of the special master’s expanded duties and monitoring after Rule 60(b) was satisfied should be borne by Plaintiffs who sought the now-reversed order expanding her responsibilities over the State’s objection. In the wake of the Seventh Circuit’s repudiation of Plaintiffs’ arguments, there is no reason in law or equity that the State as opposed to the Plaintiffs should bear the cost of Plaintiffs advancing them and continuing special master monitoring and litigation past when it should have ended.

Thoughts?

30 Comments

|

The two sides of Rep. Tarver

Tuesday, Dec 6, 2022 - Posted by Rich Miller

* Block Club Chicago…

Activist Will Calloway spent months securing state funding for a violence prevention program in South Shore — but now it’s taking so long to access the money, he’s worried it will come too late for the group to effectively do anything with it.

The Passports for Peace violence prevention program, announced in May, will offer out-of-town trips, job training, mentorship and social media monitoring to people at risk of being victimized by or perpetrating gun violence.

Usually, area legislators are quoted in stories like this one criticizing the state agency or governor and siding with their local groups. Or you’ll see reporters gloss over eye-popping things like in this unrelated story by the BGA’s Illinois Answers Project…

The future of a program aimed at helping formerly incarcerated Chicago residents hangs in the balance after the company that was supposed to pay for it, cryptocurrency giant FTX, has imploded amid accusations of fraud before paying most of its promised $1 million grant. […]

The nonprofit, also known as EAT, got the first installment of the grant — just over $393,000 — to support administrative costs. But, without the second payment — more than $600,000 — the program can’t be launched, according to Richard Wallace, EAT’s co-founder and executive director.

A 40 percent administrative overhead? Whoa. Are you kidding me?

* Anyway, let’s get back to the Block Club Chicago story and our original point…

Rep. Curtis Tarver, who represents the area, shares Calloway’s frustration with the process, as “funds aren’t hitting our communities as quickly as we want them to,” he said.

At the same time, a thorough vetting process is needed when spending state funds, Tarver said. […]

“There is a process” to vetting grant funding, Tarver wrote to Calloway in an email obtained by Block Club. “It seems to be being followed, and I do not want any suggestion otherwise by my email being included.” […]

Tarver’s support of the violence prevention program doesn’t mean the state has to “speed up the process, or do anything outside of what the normal process is,” he said. “I want to let the process play itself out.”

That’s really a model for how legislators should react. The state obviously needs to reexamine its contracting laws, but, if the agency is following the rules and nothing is untoward, then legislators shouldn’t pile on to score cheap news media points.

* On to Part 2. Rep. Tarver also wrote an op-ed this week in the Hyde Park Herald about why he didn’t vote on the SAFE-T Act trailer bill after having voted for the original bill in 2021…

On December 1, 2022 only after ensuring that there were enough votes in the Illinois House of Representatives to pass the latest purported “trailer bill” to the SAFE-T Act, I decided not to vote in favor or against the bill.

OK, right off the bat there’s a contradiction. He’s basically saying he would’ve voted for the bill if it was short. Not to mention that it was other people who were out there making sure the bill had enough votes. Rep. Tarver wasn’t even in the building last Thursday during the roll call.

And then he threw his colleagues under the bus…

To have voted in favor of the bill would have been to support those individuals who profess to care about the rights and needs of Black and Brown Illinoisans but at the first site of political pressure are willing to fold. The rights and needs of Black and Brown Illinoisans cannot only be important when wooing us for votes but then discarding us a few weeks later.

Ouch.

…Adding… From Rep. Tarver…

I did not throw my colleagues under the bus. My statement was more general than about this specific vote. It certainly was not to suggest that every colleague that voted in favor of the bill feigns concern about Black and Brown communities. Some people are genuine - others are not. That transcends the Illinois House of Representatives.

18 Comments

|

|

Comments Off

|

Morning briefing

Tuesday, Dec 6, 2022 - Posted by Isabel Miller

* Some interesting data…

* Here’s the roundup…

* Capitol News Illinois | State elections board certifies 2022 results: The Illinois State Board of Elections certified its election results Monday, putting the final stamp on another Democratic sweep of statewide offices. The board reported that 4,142,642 out of 8,115,751 registered voters cast ballots in the election, a turnout of roughly 51 percent. That’s down from a turnout of more than 57 percent in 2018, but up from a 49 percent turnout in 2014, according to ISBE.

* Center Square | Hearing on challenge to ending cash bail in Illinois delayed after amendments: Sources tell The Center Square the lawsuit dozens of state’s attorneys and sheriffs from both political parties have filed against the measure’s implementation continues. It’s now expected to be heard Dec. 20 in Kankakee County, instead of Wednesday as was previously scheduled. Amended briefs are due at the end of the week. A ruling is expected Dec. 28, just three days before no cash bail goes into effect.

* WGN | Rep. Bob Morgan addresses the assault weapon problem: Illinois State Rep. (58th) Bob Morgan joins Lisa Dent to comment on the new bill that aims to address ease of access to assault weapons, the urgency to ban them and raise the buying age of all weapons to 21.

* CBS Chicago | Illinois Supreme Court swears in new justice: Elizabeth Rochford was sworn in Monday morning to represent the second district. Rochford will serve the court for 10 years, representing DeKalb, Kendall, Kane, Lake and McHenry counties.

* WILL100 | Rep.-Elect Nabeela Syed talks identity, generational change, and more: In the 2022 midterms, not only did 18-to-29-year-olds turn out at a rate only outpaced by 2018’s midterms, many members of Gen Z also won seats in political offices across the country. 23-year-old Nabeela Syed is among them. She joined The 21st to discuss the intersection of politics and her identities as a member of Gen Z and an Indian-American, plus what it was like to win her seat and flip her district in the Illinois House of Representatives.

* Axios | Worst flu outbreak in more than a decade spikes hospitalizations: The worst flu outbreak in more than a decade has left nearly every state with high or very high levels of flu activity, underscoring how pandemic precautions may have left us more vulnerable to seasonal respiratory diseases.

* Tribune | 5 candidates for Chicago mayor — but not Lightfoot — face challenges that could knock them off the February ballot: Sawyer released a statement in response, saying in part: “Willie Wilson talks about being denied access to voting in his life, but now that he’s a wealthy man, he’s doing the exact same thing — denying people their choice of candidate by means of his wealth. That’s the height of hypocrisy.” Sawyer called it a “real insult” to the thousands who signed his petitions and to his volunteers.

* Sun-Times | Petition challenges could narrow field of Black candidates for Chicago mayor: Millionaire businessman Willie Wilson is trying to knock retiring Ald. Roderick Sawyer off the ballot. Community activist Ja’Mal Green is challenging Wilson. And former state Sen. Rickey Hendon, a top Wilson adviser, is challenging Green.

* WTTW | CTA Overtime Spikes as Agency Hit By Departures; Dozens of Bus and Train Operators Paid for Average Weeks of 80 Hours or More: A WTTW News analysis of CTA bus and train operator work records from 2015 to 2021 shows a growing number of employees paid for long average workweeks, which experts say raises questions about worker and passenger safety and the agency’s bottom line

* Crain’s | Warning of a looming ‘fiscal cliff,’ the RTA seeks more tax aid: A draft of the five-year regional strategic plan includes all sorts of things, from a call to its operating agencies—Metra, CTA and Pace—to work together to boost rider security, proposals to improve communication with passengers and to begin a pilot program of free or expanded reduced fares for low-income commuters. The RTA distributes tax subsidies to those operating agencies.

* Daily Southtown | Amtrak resumes full service on line that includes Homewood stop: Amtrak said Monday it has restored all services at its Homewood station, including on-site ticketing and the resumption of two daily round-trip trains on the Illini and Saluki line.

* Block Club Chicago | Howard Brown Health Workers, Protesters Blast Planned Layoffs: ‘I’m Fighting For My Job Because I Love This Work’: The health care center’s leaders say they must cut jobs to help reduce costs, but union members say they want proof layoffs are financially necessary.

* Daily Herald | Conroy sworn in, securing her place in DuPage County history and presiding over diverse board: Deb Conroy was sworn in as county board chair, a feat accomplished by no other woman before her. Conroy acknowledged the milestone in her inauguration speech but pledged to make history on multiple fronts, not just because she happens “to be the first woman elected to lead the county board.”

* WGLT | Inspector General slams Pontiac prison workplace culture: A scathing report from the State Executive Inspector General show a climate of hazing and sexual discrimination created a hostile work environment at the state prison in Pontiac, including stating there is reason for disciplinary action against 10 employees for discriminating against a guard who was perceived to be gay.

* Tribune | Sexual harassment allegations led to leadership shake-up at Pontiac prison, inspector general report shows: After the employee, who no longer works for the department, reported the incident to Corrections Department officials, he continued to be harassed based on his “perceived sexual orientation,” and higher-ups at the prison, including the warden, two assistant wardens and the department’s Office of Affirmative Action, failed to responded adequately, according to the inspector general’s report.

* WMBD | Bloomington Sen. Barickman announces retirement: Barickman won reelection in the Nov. 8 general election. Now, the next person to fill the seat will be appointed by the McLean County GOP.

* WGLT | ‘Timing is right’: Barickman leaving Illinois Senate in January: “Your kids develop so quickly. One year is quite different than another. I have really struggled with this for the better part of a couple of years, thinking when the timing is right,” said Barickman. He said his other work obligations have increased. He is a practicing attorney and a partner in a real estate development and management firm.

* ABC7 | ‘My time had come’: IL Secretary of State Jesse White hopes to help young people during retirement: “I felt as though my time had come. So, I’m going to devote the rest of my life to helping young people,” White said. The name on his door is going to change very soon, but White plans to meet with incoming Secretary Alexi Giannoulias next week to help with his transition into the office.

* Tribune | Uber to pay millions to Chicago restaurants in settlement agreement with city: Uber must pay millions in cash and provide free services to Chicago restaurants as part of a $10 million settlement with the city resolving claims the ride-share company listed restaurants on its UberEats and Postmates platforms without their consent and charged excess commission fees.

* Sun-Times | The Field’s Sue lends a hand to paleontologists studying why T. Rex arms are so short: Sue’s right arm was removed Monday so it can be CT scanned at the University of Chicago and used to create computer models that will give scientists a better understanding of Sue’s muscles and joints.

15 Comments

|

Open thread

Tuesday, Dec 6, 2022 - Posted by Rich Miller

* A little off-topic, but fun…

What’s up by you?

39 Comments

|

Live coverage

Tuesday, Dec 6, 2022 - Posted by Isabel Miller

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|