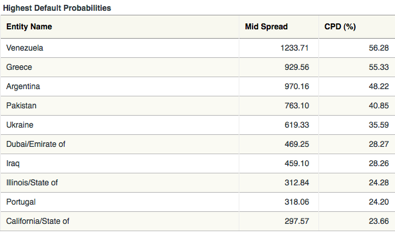

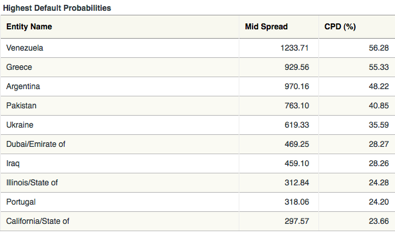

* A couple of graphs have been making the rounds lately and causing some big shocks. From The Economist…

Click the pic for a larger image of this chart from credit info company CMA…

So, we’re worse than Portugal. Great. But, look on the bright side. We’re just slightly better off than Iraq. Whoopee!

From Bloomberg…

The cost of insuring Illinois bonds against default rose to a record as lawmakers sought to close a $13 billion deficit in the state’s proposed budget for the year starting July 1.

The cost of a five-year credit-default swap for the state rose 2 basis points today to 304.64 basis points, or $304,640 per $10 million of debt according to CMA DataVision.

There aren’t a lot of credit default swaps traded on Illinois debt, so this may be an unfair comparison.

* However, the Europeans appear to be interested in our debt. The state just finished a European tour ahead of another bond sale. From the Bond Buyer…

Market participants attribute the fresh foreign interest to the perception that U.S. government credits are relatively safe and have value, especially following this year’s European sovereign debt crisis. Also helping is better marketing by broker-dealers with foreign trading desks like Citi and the generally improving view of BABs as an asset class with federal legislation pending to extend the stimulus program.

For Illinois, the need to expand its universe of buyers is all the more urgent as it has asked domestic buyers to digest a steady flow of paper amid an ongoing deluge of negative fiscal news from rating downgrades to columnists raising the specter of insolvency.

* Illinois’ inability to solve its deficit problems, coupled with all the credit problems around the world is making things worse. There’s also a definite psychological aspect out there…

“A lot of our buy-side customers are reporting fatigue. It’s a saturation issue,” said Matt Fabian, managing director at Municipal Market Advisors. “You have unsophisticated buyers who don’t understand the pledge and sophisticated buyers who understand it but are getting fatigued fighting for it” as they have to answer to risk managers and board members who see the negative news.

Because liquidity is a paramount concern for BAB buyers, some investors also might worry about headline risks and the effect on their ability to trade their holdings, Fabian said.

The market lives on psychology…

Akin to the authorities in Greece, state and local officials in the US lack the luxury of Washington’s electronic printing press and helicopter “money”. And, again like Greek debt, things deteriorate rather rapidly when the market turns nervous and demands significantly higher yields. Meanwhile, the market’s faith is waning with respect to the ability of recovery to cure structural state and local deficits, as well as in the federal government’s capacity to move forward with numerous additional bailouts.

* The governor’s office is doing what it can to soothe the market, but this is a pretty hollow threat…

The bond offering statement notes that if the Senate doesn’t pass the pension issue, the governor’s options include vetoing the budget and calling a special session.

If he does bring them back, the pension borrowing bill probably won’t pass anyway.

* And, fair reporting or not, this story is reverberating widely…

Dale Rosenthal, a former strategist for Long Term Capital Management, the hedge fund known for its epic collapse in 1998, and a proprietary trader for Morgan Stanley, has seen his share of financial complexities.

But when shown a seven-page list of derivatives positions held by the Illinois Teachers Retirement System as of March 31, obtained by Medill News Service through a Freedom of Information Act request, the University of Illinois-Chicago assistant professor of finance expressed disbelief.

“If you were to have faxed me this balance sheet and asked me to guess who it belonged to, I would have guessed, Citadel, Magnetar or even a proprietary trading desk at a bank,” Rosenthal said. […]

For the quarter ended March 31, according to derivatives experts who studied TRS’ financial documents, the fund lost some $515 million on its derivatives portfolio. Since then, the fund’s derivatives positions have likely soured further, the experts said, due to worsening financial conditions in Europe. […]

In the balance sheet provided to Medill News Service, TRS’s OTC derivatives portfolio showed that in addition to writing CDSs, the pension fund was selling swaptions and shorting international-based interest rate swaps. For each contract written or sold, TRS received a premium.

TRS claims it made money on the derivatives, but that’s hotly disputed in the article.

I asked the Governor’s Office of Management and Budget for a comment, but they declined. Not bright.

* Related…

* Is Illinois the New California?

* U. of I. finds ways to save $60 million on supplies, services

* ‘Culture change’ in UI administration, services could save tens of millions

* Lawmakers cool to graduated income tax plan

- dupage dan - Wednesday, Jun 23, 10 @ 12:29 pm:

I see that we are not as bad off as Greece. Cold comfort. What keeps us from getting that bad? Nothing I read lately reveals a plan to get Illinois off that list. Mostly what I hear leads me to believe that we could match up with that fabled country. Oy.

- Anon - Wednesday, Jun 23, 10 @ 12:31 pm:

Do Illinois bondholders or pensioneers get paid first in the event of a default?

- wordslinger - Wednesday, Jun 23, 10 @ 12:34 pm:

Uh, in a default, no one gets paid.

- Michelle Flaherty - Wednesday, Jun 23, 10 @ 12:34 pm:

I look forward to the English translation of the Medill story. Sure sounds important. And did I just read that a former strategist from a collapsed hedge fund now on the public uni payroll at UIC earning pension credits?

- 47th Ward - Wednesday, Jun 23, 10 @ 12:40 pm:

Thanks Rich, I caught the Economist article this week and was hoping you’d write about it.

The title of that article was “Can pay, won’t pay” which pretty much sums up the situation here in Illinois. We have the means to close the deficit, just not the political will.

- OneMan - Wednesday, Jun 23, 10 @ 12:43 pm:

Yes this is bad…

- MrJM - Wednesday, Jun 23, 10 @ 12:45 pm:

Uh, yeah…

well, umm… sure…

But numbers, graphs, apt comparisons and market valuations alone don’t tell the whole story, do they?

– MrJM

- John Bambenek - Wednesday, Jun 23, 10 @ 12:49 pm:

If I understand correctly, the state signed a “bonds get paid first” contract. Since a state hasn’t defaulted in the modern era, who knows how it’d play out.

What I find telling is that our CDS spread is increasing about twice as fast as California.

- Vole - Wednesday, Jun 23, 10 @ 12:50 pm:

From the Economist article:

“Most troubling of all is the squeeze budgets are facing from their unfunded obligations for civil-service retirement pension and health benefits. The Pew Centre on the States, a research organisation, put these at $1 trillion in 2008. In a report, Joshua Rauh and Robert Novy-Marx, finance professors at Northwestern University and the University of Chicago respectively, note that these liabilities are coming due at an alarming rate. By 2018 Illinois will be paying $14 billion a year in benefits, equal to more than a third of the state’s revenue, compared with $6.5 billion now. Mr Rauh says bondholders should worry because several state constitutions, including those of Illinois and New York, make state pensions senior to bond debt.”

We are in this for a long, long time. The proposals for an independent commission to work on these long term budget problems will surely be gaining more traction in the days ahead. We need to abandon any remaining dreams/hopes that our elected leaders can handle this.

- OneMan - Wednesday, Jun 23, 10 @ 12:58 pm:

The cost for CDS’ for Illinois was $291,000 per $10 million of debt less than two weeks ago.

- OneMan - Wednesday, Jun 23, 10 @ 12:59 pm:

Foreign investors can use google too. I would be interesting to see if Rich’s traffic from Europe goes up.

- Reddbyrd - Wednesday, Jun 23, 10 @ 1:01 pm:

Let’s all try to understand that CDS are really just bets made by those who are not likely to own the paper of the issuing government. It is this action plus the fraud from the so-called rating agencies that undid the mortgage world and led to the bail outs. It is this type of transaction that should be banned as part of the market reforms.

But the same interests who tried to some any mortgage reform in Illinois — the predatory lenders and their allies (i.e. people who accept their advertising) make money here too.

So don’t expect much.

Describing this junk as insurance or a hedge is really fantasy in most cases

- OneMan - Wednesday, Jun 23, 10 @ 1:07 pm:

Well Reddbyrd it’s a real market with real money where very sophisticated investors (you can’t get these from e-trade) are evaluating risk and making markets based on this risk.

You can blame the messengers all you want on this but it says a lot about Illinois debt and the risk associated with it.

Or even if you look at the last bonds Illinois issued that were rated AAA and AA+ (because they were backed by sales tax revenue) they sold at a significant premium (a higher interest rate, so therefore costing the state more) that debt with the same rating. Why, because the markets recognize the same thing most folks who read this blog do.

This states fiances are in the toilet.

- John Bambenek - Wednesday, Jun 23, 10 @ 1:10 pm:

The states finances were in the toilet 2 years ago. Now they’re sinking in the sewage.

- Anon - Wednesday, Jun 23, 10 @ 1:17 pm:

Is a constitutional convention coming?

- The Doc - Wednesday, Jun 23, 10 @ 1:18 pm:

==Mostly what I hear leads me to believe that we could match up with that fabled country==

I call BS, Dan. Without taking away from the sorry state of affairs here, Greece’s debt problem is on an entirely different level.

Entirely.

- John Bambenek - Wednesday, Jun 23, 10 @ 1:32 pm:

No… apparently if we would have had delegate races this year, only Blagojevich-appointed corrupt hacks would be elected.

/snark

- Angry Republican - Wednesday, Jun 23, 10 @ 1:47 pm:

I posted this a few weeks ago, and will say it again the CDS municipal debt market is completely unregulated. Investors buying these are betting the municipalities will default on their debt, and the more bets placed on default, the higher the cost of insurance for the debtor. I recall reading somewhere if Illinois were to default on it’s debt, the pension holders are first in line to get paid something.

If you read the entire article in the Economist, they also point out the US Government will most likely bailout the states to prevent an avalanche of municipal defaults. In the scheme of things, adding an extra $1T to our already massive total debt isn’t really that much money (percentage wise).

One can only assume that folks running IL realize this and are betting they can kick the can down the road enough times that uncle Sam will bail them out before they have to make any tough decisions.

- OneMan - Wednesday, Jun 23, 10 @ 1:50 pm:

== Investors buying these are betting the municipalities will default on their debt, and the more bets placed on default, the higher the cost of insurance for the debtor ==

So more investors think that there is going to be a default, that is not a good thing. Period, full stop.

Also with the Rod trial and everything else getting the feds to step in is going to be really tough. We have been kicking this can down the road for 6+ years, we have hit the end of the road.

- Judgment Day Is On The Way - Wednesday, Jun 23, 10 @ 2:20 pm:

“But numbers, graphs, apt comparisons and market valuations alone don’t tell the whole story, do they?”

Nope. They don’t. But the Bond market itself will write the ending. And it’s not looking favorable.

- Louis G. Atsaves - Wednesday, Jun 23, 10 @ 5:44 pm:

You know, everyone has to stop running down the State of Illinois, all that doom and gloom stuff!

Sorry, I was channelling Pat Quinn for a moment there!

- HatShopGirl - Wednesday, Jun 23, 10 @ 6:33 pm:

Angry Republcan, we are the government, it’s our money that they are giving back to us. We sent the money to DC. Now, we need some help. I see nothing wrong with the Feds giving us OUR money back.

- Do legislators know that economics and finance exist - Thursday, Jun 24, 10 @ 9:57 am:

The State NEEDS to be run like a business. No more pushing debt into the next fiscal year and expecting tax revenues to jump 30%. The sooner we can stop accepting massive shortfalls in the budget and drastically cut expenses the better. When will legislators see this and begin to finally get the picture? Also LTCM was the beginning of the Asian default and world financial crisis. It was just coupled with the sub-prime loans from Fannie and Freddie. Start holding people accountable for poor financial decisions like LTCM. $515 million! Are we serious here?