* From the Illinois Teachers’ Retirement System…

The Teachers’ Retirement System Board of Trustees today approved revisions to a number of assumptions contained in its actuarial model, including a reduction in the System’s long-term assumed rate of return on its $36 billion investment portfolio from 8.5 percent to 8 percent.

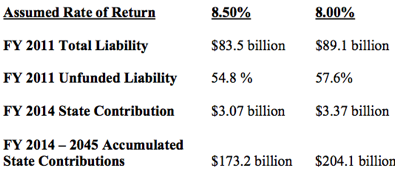

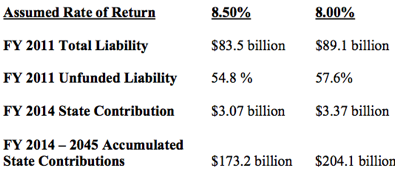

The major effect of the new assumed rate of return will be to increase the System’s long-term unfunded liability ratio from the current 54.8 percent to 57.6 percent. The lower rate of return also will increase the state’s required annual contribution to TRS in fiscal year 2014 and after. This contribution covers the annual cost of pensions as they are earned as well as the unfunded liability that has accumulated over time. The state contribution in FY 2014 is expected to rise from $3.07 billion with an 8.5 percent rate of return to $3.37 billion with an 8 percent rate of return. […]

In August, the System’s actuaries, Buck Consultants of Chicago, recommended reducing the assumed rate of return from 8.5 percent and outlined three options for a revised number – 7.75 percent, 8 percent and 8.25 percent. The Trustees delayed a final decision until September in order to allow further analysis by TRS staff and to ensure that all TRS trustees had a say in the final decision. On September 14 Gov. Pat Quinn named two new trustees to the Board, bringing the number of members to 13 for the first time in more than a year. [Emphasis added.]

That $300 million is a big jump for such a small decrease.

A chart…

* React from the Republican leaders…

“The Teachers Retirement System’s board decision today to adjust its estimated rates of return will drive our pension unfunded liability up by billions of dollars and the state’s obligation to pay into the systems each year by hundreds of millions. This is yet another reason that comprehensive pension reform has to be addressed now. We are disappointed in the Governor and democrat leaders for taking a pass on pension reform until January. We believe that is irresponsible. The more time they delay–the harder it will be to put together a comprehensive plan that tackles our crisis in a meaningful way. Today’s board action underlines the fact that our pension systems’ realities keep getting worse, not better. Even though TRS lowered its average rate of return to 8 percent, some financial groups such as Moody’s believe the rate should have been lowered even further to match current market conditions, which would have an even more detrimental effect on our state’s finances.”

*** UPDATE *** Senate President John Cullerton’s office responds to the Republican statement…

The last thing we need right now is more press releases and posturing on pensions. Until the political rhetoric and blame is replaced with a commitment and compromise from both parties, pension costs will continue to crowd out essential state services. A constitutional template for reform has already been put in place by the Senate. So when Republicans are ready to return to Springfield to vote on plan that reforms the system and addresses fairness, we will not delay to schedule a vote.

- wordslinger - Friday, Sep 21, 12 @ 3:22 pm:

– This is yet another reason that comprehensive pension reform has to be addressed now.–

What’s the bill number on that?

- Yellow Dog Democrat - Friday, Sep 21, 12 @ 3:27 pm:

1. “Democratic.” Not “Democrat” and certainly not “democrat.”

2. If you think 8% is to high, and the unfunded liability is much bigger, atleast have the guts to say what you think the number should be. Moving the goal posts is getting old.

3. Call your bill, Leader Cross. Or atleast get more than a handful of Republicans to co-sponsor it with you.

- Demoralized - Friday, Sep 21, 12 @ 3:45 pm:

Empty rhetoric from the Republican “leaders.” They have done nothing but complain. No solutions. Heck, Radogno even backpeddled on the bill her members voted for. That’s a great way to be part of the solution. They are a joke.

And @word is right. It’s DEMOCRATIC leaders. But I do love that little word game that Republicans play with that term.

- K - Friday, Sep 21, 12 @ 3:47 pm:

Springfield must keep its promises.

- walkinfool - Friday, Sep 21, 12 @ 3:56 pm:

TRS made the right choice. Forecasting financial markets thirty and more years out is always highly suspect,and TRS has made a fairly conservative choice based on a long history of actual results. I would have gone to 8.25, so I am more than comfortable with this level of risk.

The GOP leaders are politically motivated to make the unfunded liability, and resultant cash flow impact, as high as possible. The TRS board, as usual, sticks to their fiduciary responsibility.

The situation is horrible enough. We shouldn’t wish it to be overstated.

- Money Walks - Friday, Sep 21, 12 @ 3:57 pm:

Four comments in a row deflecting the responsibility from the majority party to the minority party. It is without a doubt a shared responsibility, but let’s not pretend that republicans have a lot of chips at the negotiating table. And if I recall correctly, there was a last minute change to the pension reform bill that ended up being a deal-breaker unraveling an entire session of negotiations. Whose amendment was that again?

The only answer I have seen from democrats was to raise taxes and close prisons and state hospitals and kick the proverbial can down the road.

- State Rep Mike Fortner - Friday, Sep 21, 12 @ 4:02 pm:

Due to the effect of the compounding it’s not surprising that a 0.5% change in the assumed rate of return would translate to a 5.6 billion dollar increase in liability. The framework I proposed in HB6204 could handle that change with slight adjustments. For example, by making an initial transfer that was 100 million higher than in HB6204 and changing the rate of increase of the transfer payment by 0.5% the unfunded liability could still be 100% covered by 2045. That 100 million increase from HB6204 is still 100 million less than the previously anticipated FY 2014 transfer and 400 million less than the new state contribution. The change in ramp rate to 2% is still below the average rate of revenue growth and well below the 5% that the state typically sees under current law.

- soccermom - Friday, Sep 21, 12 @ 4:03 pm:

How much would we save in overhead if we consolidated all of the public pension systems?