|

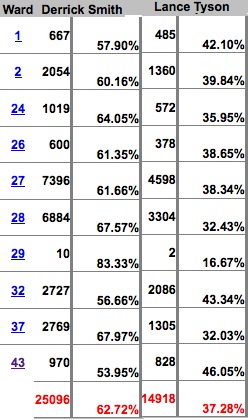

Today’s number: 61.66%

Thursday, Nov 15, 2012 - Posted by Rich Miller * Indicted and ousted state Representative-elect Derrick Smith received almost 62 percent of the vote in Secretary of State Jesse White’s 27th Ward. White had Smith appointed to the House, but has since turned completely against him and backed third party candidate Lance Tyson in the general election. White is the 27th Ward’s Democratic Committeeman, but he failed miserably. Here are the ward-by-ward results for the Smith-Tyson race…  Smith, by the way, won every single precinct in Secretary White’s ward. Thoughts?

|

|

Protected: SUBSCRIBERS ONLY: Veto session update

Thursday, Nov 15, 2012 - Posted by Rich Miller

|

|

Question of the day

Thursday, Nov 15, 2012 - Posted by Rich Miller * I was at the Prairietown “World’s Fair” over the summer and ran into Republican congressional candidate Rodney Davis and Democratic state Senate candidate Andy Manar. I’ve known both men for years and asked them to pose together for a bipartisan photo, on the condition that it not be published until after the election…  Both went on to win their respective elections. * The Question: Caption?

|

|

Credit Union (noun) – not-for-profit, consumer-focused cooperative

Thursday, Nov 15, 2012 - Posted by Advertising Department [The following is a paid advertisement.] Credit unions are not-for-profit financial cooperatives. They were first exempted from federal income taxes in 1917 to fulfill a special mission as valuable and affordable cooperative alternatives to for-profit banks. Even though credit unions are exempt from income tax, they still are subject to, and pay, property, payroll, and sales taxes, and a host of governmental regulatory supervision fees. Since their inception, credit unions have more than fulfilled their mission, as evidenced by Congressional codification of the credit union tax exemption in 1951 and 1998. Though the range of services has evolved to effectively serve their members in an increasingly competitive financial marketplace, the cooperative structure, which is the reason for their tax exempt status, has remained constant. Nationally, consumers benefit to the tune of $10 billion annually because credit unions are tax-exempt. In Illinois, by most recent estimates credit unions annually provide more than $198 million in direct financial benefits to almost three million members. In an era that continuously poses economic and financial challenges, credit unions remain true to one principle - people before profits - and represent a highly valued resource by consumers during these uncertain economic times.

|

|

*** UPDATED x1 *** Quinn to push borrowing for old bills again

Thursday, Nov 15, 2012 - Posted by Rich Miller * From Monique Garcia’s Twitter feed…

That’s not a surprise, considering that both chambers now have Democratic super-majorities. The Republicans in both chambers have been dead-set against a borrowing proposal and it requires a three-fifths vote to borrow money, so nothing has been done. The Senate came one vote shy of passing a borrowing bill when it had 37 members, so it’s probably a good bet that the chamber will be able to pass it if it comes up again. The House may be a different story. Lots of conservative Dems oppose borrowing, so even with 71 votes they’ll probably need at least a small handful of Republicans. By the way, a bill has already been introduced by Rep. Esther Golar to borrow $4 billion for old bills. *** UPDATE *** From the governor’s office…

|

|

*** UPDATED x1 - Cullerton responds to Fahner *** Report: Unfunded liabilities rise by $11 billion

Thursday, Nov 15, 2012 - Posted by Rich Miller *** UPDATE *** Senate President John Cullerton’s response to the Civic Committee’s over the top rant from yesterday…

Cullerton’s chief legal counsel also sent a letter to Ty Fahner saying the Civic Committee’s statements yesterday “generated more heat than light.” Read it here. * From the Bond Buyer…

Please, don’t confuse the Civic Federation with the Civic Committee of the Commercial Club, which went wildly over the top yesterday in its projections of imminent demise without revealing its actual data. Despite that refusal, its angry howls of doom were taken quite seriously by the AP…

I’m not saying they’re wrong. I’m just saying I’d like to see their homework first.

|

|

STOP THE SATELLITE TV TAX!

Thursday, Nov 15, 2012 - Posted by Advertising Department [The following is a paid advertisement.] The cable industry is asking lawmakers to place a NEW 5% tax on satellite TV service. HB 5440 is not about fairness, equity or parity – it’s a tax increase on the 1.3 million Illinois families and businesses who subscribe to satellite TV. They cannot afford another NEW tax – not now and not in this economy! HB 5440 Will Hurt Illinois Families and Small Businesses

• This tax will impact every bar, restaurant and hotel that subscribes to satellite TV service, which will translate into higher prices, decreased revenues, and fewer jobs. • Rural Illinois has no choice: In many parts of Illinois, cable refuses to provide TV service to rural communities. Satellite TV is their only option. HB 5440 Is Not About Parity or Fairness

• Satellite companies don’t pay franchise fees for one simple reason: We use satellites—unlike cable, we don’t need to dig up streets and sidewalks to deliver our TV service. • Making satellite subscribers pay franchise fees—or, in this case, an equivalent amount in taxes—would be like taxing the air It’s no different than making airline passengers pay a fee for laying railroad tracks. Vote NO on HB 5440

|

|

The JJJ saga gets weirder by the day

Thursday, Nov 15, 2012 - Posted by Rich Miller * It just gets weirder…

* And weirder…

* Related…

|

|

*** UPDATED x1 *** *** LIVE *** House committee takes up Madigan’s proposal to cap union contract wages

Thursday, Nov 15, 2012 - Posted by Rich Miller *** UPDATE *** The committee has recessed to the call of the chair without taking a vote. They’ll return Monday, November 26. * We’re coming a little late to this, but the House Revenue Committee is holding a hearing this morning on HJR 45…

The measure is sponsored by House Speaker Michael Madigan. * And here’s a ScribbleLive thingy…

|

|

Caption contest!

Thursday, Nov 15, 2012 - Posted by Rich Miller * Sorry, kids. I’ve been a bit under the weather this morning. Have fun with this while I get myself together. Former Gov. Jim Edgar and my former intern Barton Lorimor posed for a pic at my election night party last week… Be kind to Barton, please.

|

| « NEWER POSTS | PREVIOUS POSTS » |