Question of the day

Thursday, Jan 17, 2013 - Posted by Rich Miller

* My mom and me at the Wisconsin Dells. I think I was eight…

Mom has never liked her picture taken, but her expression probably indicated her exhaustion from the trip. My parents had four sons by then and one or two foster children. Another son would be born two years later.

* The Question: What was going through our minds at the time?

Be kind to my mom or I will hurt you. Thanks.

70 Comments

|

* Mary Mitchell writes about a recent teleconference Sandi Jackson had with her supporters, who were gathered at her former ward office. She believes that Mayor Emanuel will choose her anointed successor, Jackson chief of staff Keiana Barrett, even though Barrett doesn’t live in the ward. And what if the mayor chooses someone else? Well…

Jackson also noted that all of the furnishings for her ward office at 71st and Exchange were bought with campaign dollars.

“That means the city does not own any of the furniture that you are currently sitting on, any of the furniture that is in the campaign office, any of the furniture that is in the aldermanic office. I bought every item personally, and if the mayor upholds my wishes, everything in that office will stay the same. Keiana will inherit everything,” Jackson said.

Words utterly fail me. Perhaps you can do better.

99 Comments

|

Quote of the week

Thursday, Jan 17, 2013 - Posted by Rich Miller

* Dawn Clark Netsch on her thoughts when she was diagnosed with ALS, also known as Lou Gehrig’s Disease…

“And my first reaction was I’m not even a Yankees fan. I’m a White Sox fan,” she said.

She’s one tough woman.

* I have to admit having a bad taste in my mouth for Ms. Netsch for many a year, culminating with her opposition to a state constitutional convention. But then I saw her at the Carlos Hernandez Gomez funeral, sitting alone in a pew. She didn’t work the crowd, or look around to see who was looking at her. Just respectful, dignified silence for our mutual friend. The years of animosity immediately melted away, at least for me. On my way out of the church I leaned down and gave her a hug.

Dawn Clark Netsch has had an enormous impact on Illinois, from her participation in the drafting of our Constitution, to her insistence that the courts badly misinterpreted the Constitution’s “preponderance” of education funding language, to her many years of conscientious legislative and statewide service, to her 1994 education funding plan that was eventually adopted by her opponent Jim Edgar.

She is a founding mother of the modern state. And we all owe her a debt of gratitude.

* More…

ALS robs a person of some of life’s most basic functions and normally can be deadly in three to five years. ALS weakens the nerves and makes it difficult to walk, swallow and speak.

“It’s a tough one,” she said sitting in the kitchen of the near north side home she shared with her late husband, famed architect Walter Netsch.

Asked why it was important to speak of her disease, Netsch did not hesitate.

“Might get more people thinking about what is ALS,’ she said, noting, “I’m going to be straight about this also.”

Let’s all hope for the best.

And it should go without saying that disrespectful comments will be deleted. I don’t care what your politics are, you can be a human being.

45 Comments

|

* Ralph Martire of the pro-union Center for Tax and Budget Accountability has correctly identified the pension funding problem…

The vast majority of the unfunded liability is made up of the third contributing factor: debt. Indeed, for more than 40 years. the state used the pension systems like a credit card, borrowing against what it owed them to cover the cost of providing current services, which effectively allowed constituents to consume public services without having to pay the full cost thereof in taxes.

This irresponsible fiscal practice became such a crutch that it was codified into law in 1994 (P.A. 88-0593). That act implemented such aggressive borrowing against pension contributions to fund services that it grew the unfunded liability by more than 350 percent from 1995 to 2010 — by design. Worse, the repayment schedule it created was so back-loaded that it resembles a ski slope, with payments jumping at annual rates no fiscal system could accommodate. Want proof? This year the total pension payment under the ramp is $5.1 billion — more than $3.5 billion of which is debt service. By 2045, that annual payment is scheduled to exceed $17 billion, with all growth being debt service.

* To solve the problem, Martire wants to reamortize that debt. Basically, it’s a refinancing plan…

Simply re-amortizing $85 billion of the unfunded liability into flat, annual debt payments of around $6.9 billion each through 2057 does the trick. After inflation, this new, flat, annual payment structure creates a financial obligation for the state that decreases in real terms over time, in place of the dramatically increasing structure under current law. Moreover, because some principal would be front- rather than back-loaded, this re-amortization would cost taxpayers $35 billion less than current law.

This makes a lot of sense on numerous levels. It’s like refinancing a mortgage that had been stupidly rigged with expensive balloon payments.

* However, Wall Street will hate it. Why? Because as soon as you move back the payoff date, the total unfunded liability will skyrocket. And Wall St. is concentrating almost solely right now on that unfunded liability number. If Illinois does this, a big credit rating cut will likely happen.

The Tribune and some big business groups will also hate it. Why? Because it causes no real pain for public employees and retirees. And that’s really what they want.

And others who depend on the state budget will probably hate it, at least in the short term. Why? Because the Martire plan requires a big increase in current pension spending, from $5.1 billion to $6.9 billion. And, remember, the income tax hike is scheduled to sunset two years from now.

* On the other hand, if policy makers could incorporate Martire’s refinancing idea with some other cost-cutting and revenue (requiring higher employee contributions, cost shift, etc.) moves, it might just work.

92 Comments

|

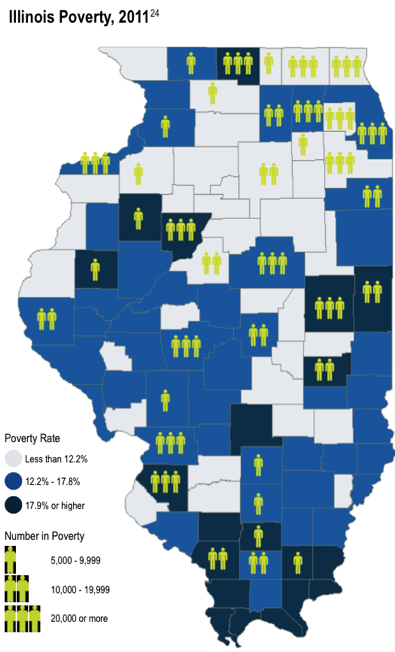

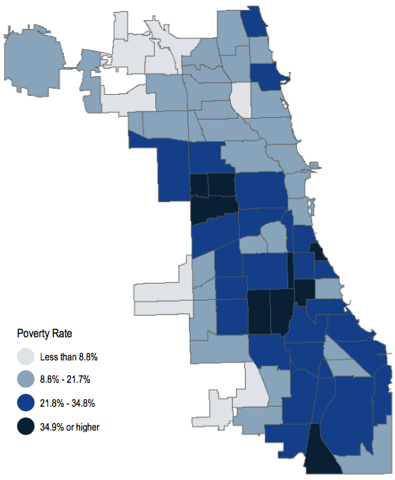

Today’s maps: Illinois poverty

Thursday, Jan 17, 2013 - Posted by Rich Miller

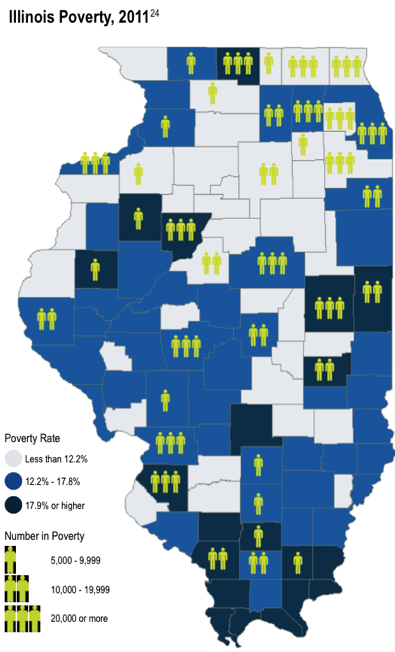

* From a new Heartland Alliance study of Illinois poverty…

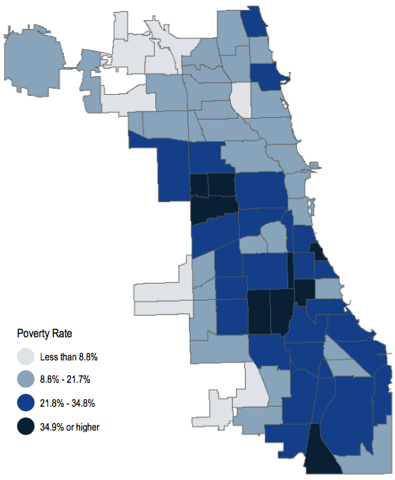

* Chicago neighborhood poverty rates…

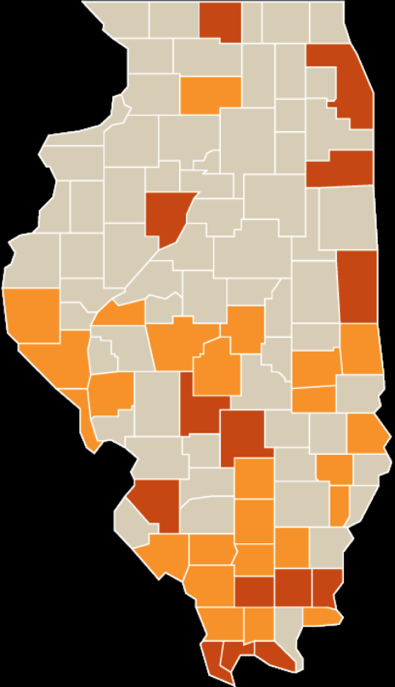

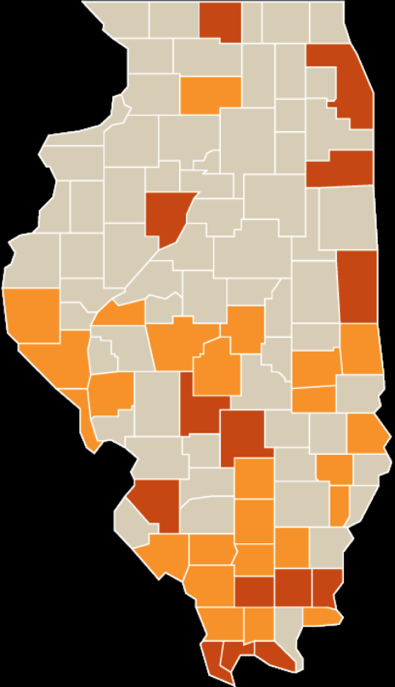

* And then there’s the County Well-Being Index…

The County Well-Being Index highlights counties that are experiencing particularly negative conditions and trends on four key indicators: poverty, unemployment, teen births, and high school graduation.

Counties in Illinois are evaluated using a point system, with a higher number of points indicating a worse score. A county receives a point if its rate is worse than the state average and/or if it has worsened since the previous year.

Light orange counties are on the Poverty Watch List. Dark Orange are on the Poverty Warning List…

* Other stats from the report…

Nearly half of all private sector employees in Illinois don’t have access to paid sick leave, which poses particular challenges for women with caregiving responsibilities.

Since the recession began, the number of homeless students enrolled in Illinois public schools has increased 48%.

Over half of all private sector workers in Illinois lack access to an employment-based retirement plan, and lower-wage workers are the least likely to have access.

* Coverage…

* One in three Illinois residents in or near poverty, according to Heartland Alliance report

* Illinois Poverty Rate 2012: One-Third Of State’s Residents Considered Poor According To New Report

* 1 in 3 Illinoisans lives in or near poverty level: report

15 Comments

|

Trestman for governor?

Thursday, Jan 17, 2013 - Posted by Rich Miller

* Tribune…

[Gov. Pat Quinn’s] governing style is often puzzling: He declares deadlines for lawmakers to act, setting himself up for failure when the date comes and goes and nothing happens. He publicly switches positions multiple times on major issues, leaving his allies wondering if they can trust him. And he seems to lack the political skills of past Illinois governors who were able to get stakeholders in a room, find common ground and seal the deal.

“He’s not constitutionally cut out, I don’t think, to be a manager,” said Charles N. Wheeler III, who teaches how to cover state government at the University of Illinois at Springfield. “He is more a rabble-rouser, a populist, a bomb thrower out there stirring the pot. But when it comes to actually figuring out how to get things done, that is not his strong suit.”

* Meanwhile, Montreal Alouettes play-by-play radio announcer Charles-Andre Marchand talked to the Sun-Times about new Bears head coach Marc Trestman…

“He’s a guy who is a leader. He’s charismatic. The players really buy into his system. They really love it. Definitely for a quarterback, he’s a great mastermind. […]

“Every detail for him counts. He’s got a sense of detail that is really something. […]

“I’ve covered pro sports for 33 years. I’ve never seen practices so well organized, so drilled. Not a minute was wasted. I’ve seen practices in football, hockey and soccer, you name it. I’ve never seen that. It was like they were practicing their practices before we could see their practice. To the most extreme detail, he will be very thorough. […]

“He really figured out the subtleties of Canadian football, where you can have movement before the snap. As a play-by-play guy, he was really making my life miserable because one minute I look at S.J. Green on the right side, and whoops he was hooking to the left, while [Jamel] Richardson was doing the opposite. You know those guys in New York City, who play with the nuts and shells, where you try to figure out where is the nut under the shell. That was basically the offense that Trestman was putting on the field.”

* Related…

* Quinn: Pension reform before gambling expansion

* Quinn stands by ‘Squeezy’ despite pension inaction

20 Comments

|

Outlook: Horrible

Thursday, Jan 17, 2013 - Posted by Rich Miller

* This Tribune story doesn’t even begin to tell the coming budget problems…

Gov. Pat Quinn’s administration is projecting a $400 million reduction in education spending in the next budget after the state failed to rein in government worker pension costs.

If that holds up, the governor would unveil a financial blueprint that would result in state education funding going down for the third consecutive year. The move also would be part of a broad-based, across-the-board slice made throughout most of state government. Among major exceptions would be health care spending for the poor, which is expected to rise after cuts last year, and public safety, an area projected to be mostly flat after the recent closure of two prisons, according to new preliminary figures.

“The explosive growth in the state pension payments means every other part of the budget has less money,” said Abdon Pallasch, Quinn’s budget spokesman. “The pain’s going to get worse and worse every year before we fix this pension problem.”

The money pressure is intensifying at a fast clip. The standard annual pension costs are expected to rise from about $5.2 billion this year to $6.2 billion in the new budget that begins July 1, but the overall cost is even higher. The total pension drain could hit almost $7.9 billion — about one-fourth of the state’s operating budget. The higher figure includes $1.66 billion in repayments of loans taken out to cover annual pension costs in previous years.

* And neither does this Lee story…

The General Assembly’s inability to overhaul the state’s pension mess has universities looking at a cut in state aid next year of about 4.6 percent.

That possible reduction, just the latest in a decade-long decline in state assistance for the state’s institutions of higher education, could again mean a new round of tuition hikes, hiring freezes or larger class sizes.

The number was included as part of a budget projection released by Gov. Pat Quinn, who says without action by the legislature, the state’s rising pension costs will mean less spending in other areas of government in the fiscal year beginning July 1.

* The new budget projection is here. By law, the Quinn administration is forced to make these budget projections based on current statutes. So, the projection includes no pension reform and the sunsetting of the tax hike.

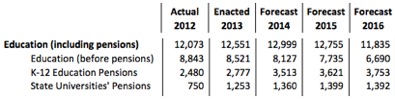

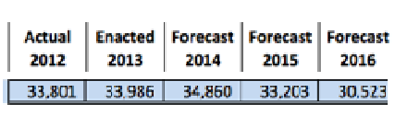

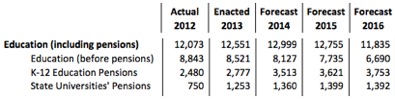

With that in mind, here’s what education spending will look like…

But we can’t do the cost shift because that would raise local property taxes. Whatever. Property taxes are going up without the cost shift, campers. Bet on it.

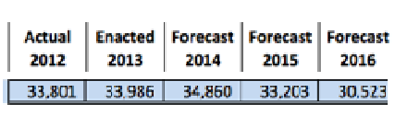

* Now, look what happens to total projected state Fiscal Year 2016 spending. FY 2016 will be the first full fiscal year without the income tax hike revenues, but with additional mandated spending of $2.2 billion on pensions and group health insurance…

* From the governor’s narrative…

The budget will be balanced with across-the-board spending reductions of 5.7 percent and 13.6 percent in fiscal years 2015 and 2016, respectively.

Ugh.

55 Comments

|

Money

Thursday, Jan 17, 2013 - Posted by Rich Miller

* Gov. Pat Quinn’s campaign fund has about $1 million in the bank. More from the Chicago Tribune…

Campaign finance reports filed with the state this week showed Quinn raised nearly $300,000 during the last three months of 2012, including $50,000 donations in December from the pipe trades and the Teamsters. He also got $25,000 contributions from the United Auto Workers and the plumbers.

He’ll obviously have to rely on private sector unions for his cash from here on out, unless he wins the primary and is up against a totally anti-union Republican. In that case, it’ll be the devil you know, etc.

Lisa Madigan has about $3.6 million in the bank. She raised $10K from the IEA, and some from other public worker unions. Bill Daley has not started raising money.

* More money…

Among potential Republican candidates, state Treasurer Dan Rutherford reported $593,710 to start the year and has raised another $11,400 since Jan. 1, campaign reports show. Rutherford reported raising almost $218,000 in the final three months of the year.

State Sen. Bill Brady of Bloomington, the unsuccessful 2010 GOP nominee for governor who is considering another run, took in $52,948 over the quarter and had $77,140 to start the year.

State Sen. Kirk Dillard of Hinsdale, who narrowly lost to Brady in the 2010 primary, got $10,000 in seed money for his still-active gubernatorial campaign fund from horse racing impresario Richard Duchossois and his wife. But Dillard’s governor fund still shows debts of more than $360,000. Dillard’s state Senate campaign fund showed $12,569 available after raising $105,000 in the last quarter of the year. […]

U.S. Rep. Aaron Schock of Peoria, who also is mulling a Republican run for governor, did not file a state campaign report. But his last federal campaign report showed he had nearly $2.2 million in his congressional campaign fund through Nov. 26. Generally, federal campaign funds can be used for a state contest.

Bruce Rauner hasn’t opened a campaign account as of yet.

* Speaking of Schock and Rauner, the TV ad whacking Schock for his fiscal cliff deal vote is still resonating. Breitbart News…

Many conservative organizations sharply disagree with Schock’s and Shearer’s rationale for this and consider the deal a tax hike. Barney Keller, the spokesman for the Club for Growth–a powerful conservative group whose support or opposition is often the difference-maker in elections–told Breitbart News that Schock can’t spin his way out of this vote for the fiscal cliff deal.

“In 2012, the American people paid lower taxes, on income, on payroll, and on capital gains and dividends than in 2013,” Keller said. “He can spin it out however he wants, but he still voted for legislation that created higher taxes than last year. The evidence can be found right on the paychecks of his constituents.”

Heritage Action, another grassroots group with swagger in elections, considered the deal a tax increase too. “To be clear, this is a tax increase,” Heritage Action said when urging members of Congress to oppose the deal. “In 2013, the top marginal rate, death tax, and taxes on long-term capital gains and dividends will all be higher than in 2012. Comparing tax rates to hypothetical rates that have hardly any support is nothing more than misleading Washington spin.”

FreedomWorks opposed it as well. The group’s president Matt Kibbe signed a letter to its millions of nationwide members, asking them to push legislators to vote against the deal because the deal contained “tax hikes” and postponed the sequester.

Asked to respond to the conservative criticism of the deal from places like the Club for Growth, FreedomWorks, and Heritage Action, Shearer told Breitbart News, “no doubt you are aware that [the Club for Growth’s] former leader, Pat Toomey, now a U.S. Senator also voted for the same bill.”

19 Comments

|

*** UPDATED x1 *** Caption contest!

Thursday, Jan 17, 2013 - Posted by Rich Miller

* These signs are all over Springfield. I took this pic before I went inside a restaurant last night…

*** UPDATE *** Finke…

AFSCME says it’s behind “We Support State Employees” signs in businesses. Signs going up around state, it says.

58 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|