Sen. Kirk, GOP congressmen get into the act

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

U.S. Reps. Rodney Davis (R-Ill.), Adam Kinzinger (R-Ill.), John Shimkus (R-Ill.), Randy Hultgren (R-Ill.), Aaron Schock (R-Ill.), Peter Roskam (R-Ill.) and U.S. Sen. Mark Kirk (R-Ill.) today sent a letter to Calvin L. Scovel III, Inspector General for the U.S. Department of Transportation, asking for an immediate investigation to determine the extent to which federal funds were used to subsidize or justify the potentially illegal hiring of dozens of patronage workers at the Illinois Department of Transportation.

In the letter, the group states, “We write with extreme concern that federal funds were directly or indirectly involved in a scheme to subvert state hiring practices as mandated by the Court. Federal funds should never be provided to states to subsidize or justify political patronage. If the State of Illinois misused federally appropriated funds in this way, the American people deserve to know.”

Additionally, as Congress looks for ways to use taxpayer money more efficiently to address problems such as the highway trust fund and other infrastructure funding, the group asked Inspector General Scovel to make recommendations to ensure such misuse of federal funds can never happen again.

The full text of the letter is as follows:

Calvin L. Scovel III, Inspector General

United States Department of Transportation

1200 New Jersey Ave SE, West Blding7th Floor

Washington, DC 20590

Mr. Scovel:

Last week, a motion was filed in U.S. District Court against Illinois Governor Pat Quinn alleging illegal hiring practices at the Illinois Department of Transportation (IDOT), including the appointment of dozens of patronage workers to non-policy making positions in violation of a 1989 Supreme Court decision (Rutan).

According to the Associated Press, Governor Quinn “told reporters Monday that there were federal stimulus dollars that had to be spent quickly and efficiently, along with a massive capital bill” and said “the increase in jobs free from hiring rules at the Illinois Department of Transportation were ‘absolutely’ necessary.”

Additionally, according to the Associated Press, in a court proceeding on April 29, Governor Quinn’s office acknowledged “an ongoing investigation by Illinois’ inspector general of hiring practices”.

We write with extreme concern that federal funds were directly or indirectly involved in a scheme to subvert state hiring practices as mandated by the Court. Federal funds should never be provided to states to subsidize or justify political patronage. If the State of Illinois misused federally appropriated funds in this way, the American people deserve to know.

Therefore, we request that you launch an immediate investigation to determine the extent to which federal funds were used to subsidize or justify the potentially illegal hiring of dozens of patronage workers at IDOT and, further, to make recommendations to ensure such misuse of federal funds can never happen again.

31 Comments

|

Question of the day

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Greg Hinz writes about yesterday’s widely expected failure of a constitutional amendment for a graduated income tax…

Mr. Harmon’s problem wasn’t with his proposal. It was with the timing of his proposal, which comes at the very same time that lawmakers are preparing to vote on making permanent the “temporary” Illinois income tax.

Instead of being revenue-neutral overall, Mr. Harmon’s proposal and companion bill would have set rates at a level designed to pull in as much money overall as the pending permanent income tax hike. Thus, only individual income below $12,000 a year would be subject to a 2.9 percent rate. Anything above that would be hit with 4.9 percent or 6.9 percent, this at a time when rates are set to revert to 3.75 percent on Jan. 1 unless the Legislature extends the “temporary” hike.

Bottom line: While Mr. Harmon was trying to sell what advocates dubbed a “fair tax,” his plan was easily dubbed a “tax increase.”

If the senator really wants to pass a graduated income tax, my suggestion is to let lawmakers do what they’re going to do this year — and that’s probably to make the current 5 percent individual tax rate permanent. Then next year, he can come back with a proposal that’s truly revenue neutral and only shifts the burden around from the bottom toward the top.

* The Question: If you could give any unsolicited advice to proponents and opponents of a graduated tax for Illinois, what would it be?

38 Comments

|

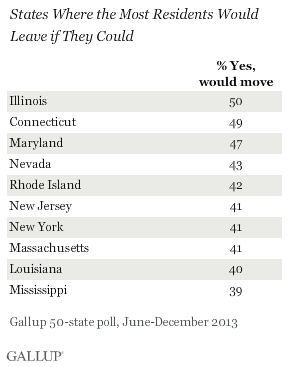

* Holy moly…

Every state has at least some residents who are looking for greener pastures, but nowhere is the desire to move more prevalent than in Illinois and Connecticut. In both of these states, about half of residents say that if given the chance to move to a different state, they would like to do so. Maryland is a close third, at 47%. By contrast, in Montana, Hawaii, and Maine, just 23% say they would like to relocate. Nearly as few — 24% — feel this way in Oregon, New Hampshire, and Texas.

* Yeesh…

* Context…

Thirty-three percent of [US state] residents want to move to another state, according to the average of the 50 state responses. Seventeen states come close to that 50-state average. Another 16 are above the average range, including three showing an especially high desire to move. In fact, in these three — Illinois, Connecticut, and Maryland — roughly as many residents want to leave as want to stay.

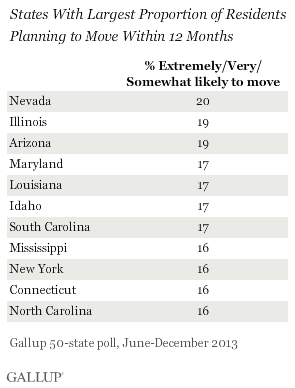

* More…

In the same poll, Gallup asked state residents how likely it is they will move in the next 12 months. On average across all 50 states, 6% of state residents say it is extremely or very likely they will move in the next year, 8% say it is somewhat likely, 14% not too likely, and 73% not likely at all.

* Oy…

* Keep in mind that the follow-up question of why they are planning to move has an extremely small sample size…

In most states, it is not possible to view these answers because there are too few respondents, but in each of the 11 states with the highest percentages wanting to leave, roughly 100 answered the question.

* In Illinois, 8 percent of those who said they were leaving claimed it was because of taxes (versus 14 percent of New York respondents, 8 percent of Marylanders, 6 percent of Connecticut folks, and 2 percent of N. Carolinians.

26 percent of Illinoisans who said they were leaving claimed it was work/business related, 17 percent said weather/location, 15 percent said it was for a quality of life change, 9 percent said cost of living, and 6 percent said it was for family/friends or school related.

79 Comments

|

Overtly political

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* There’s no real mystery behind this bill…

An Illinois House committee is again endorsing Speaker Michael Madigan’s plan to offer a $100 million incentive to lure Barack Obama’s presidential library to Illinois.

The Executive Committee voted 7-4 Wednesday to send the plan to the House floor. […]

Madigan believes the public money would be well spent. But public funds have never been used to build an official presidential library recognized by the National Archives.

Madigan has made it crystal clear that he will do whatever he can this spring to move legislation that will gin up his party’s base voters.

A recent Rasmussen Results poll of Illinoisans found that President Obama has a 96 percent job approval rating among African-Americans, 89 percent job approval rating among liberals, 85 percent with Democrats, 66 percent with voters 18-39 and 57 percent among women.

Madigan wants the Republicans to loudly oppose this bill, regardless of the financial cost to the state. Bet on it.

51 Comments

|

[The following is a paid advertisement.]

Yesterday, the Rockford Register Star became the third Illinois newspaper – joining the Chicago Tribune and the Chicago Sun-Times – to publish an editorial urging legislators to reject Senate Bill 2187. The bill, sometimes called “RxP,” would allow psychologists to prescribe in spite of having no medical training.

“When something as fragile as the human mind is at stake, the utmost care must be taken to ensure the highest quality of those services,” the Register Star editorial stated. “We encourage representatives to vote no.”

Also yesterday, former Congressman Patrick Kennedy (D-RI), a noted advocate for the rights of mental health patients, wrote to members of the General Assembly urging them to reject SB 2187.

“It is out of deep concern for patients and their families that I urge you to oppose Senate Bill 2187,” Kennedy wrote. “This legislation would undermine mental health care in Illinois and put patients at risk.”

Current Illinois law allows only people who have medical training – doctors, nurse practitioners and physician assistants – to prescribe drugs. Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses. Finally, many drugs are powerful and have risky side effects. To understand these complexities, psychiatrists go through four years of medical school and four additional years of residency, on top of their college training in the sciences. They learn to treat the whole patient – not just the brain.

Psychologists should stop insisting on a law that would put patients at risk. To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

A double double standard

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* The Tribune editorialized on two topics today, both of which were directed at Gov. Pat Quinn and one of which was the temporary tax hike…

Keep the promise that the income tax hike would be temporary.

This was the second time since mid-April that the Trib addressed this issue…

Quinn already is hobbled by his flip-flop attempt to make permanent the supposedly temporary Quinncome tax increases that are set to roll back in January.

I don’t think the governor ever specifically “promised” - in public, anyway - that the tax hike would be temporary. He was always pretty vague on that topic until his budget address. Tons of articles were written over the past few years about how Quinn wouldn’t talk about what should happen with the tax. When he finally decided he was for making it permanent, that was really huge news.

And here’s how Quinn responded to a question about whether the tax hike would stay on the books the day after the tax hike bill passed…

“We will deal with this one day at time, one week, one month, one year at a time,” Quinn said then. “I think our job now is to take what was passed last night and carry it out.”

But Bruce Rauner has accused Quinn of breaking his promise, and the Trib has now officially sanctioned that line of attack.

…Adding… The Rauner campaign points to statements Quinn made soon after the bill passed where he called the tax “temporary” several times. But he made no specific promise that the temporary tax wouldn’t be made permanent once it partially expired this coming January. Indeed, he was specifically asked whether he’d support making it permanent that day and that’s when he gave his “We will deal with this one day at a time,” comment from above. Watch the video by clicking here. The question was asked at the about the 15:00 mark.

* The rest of the editorial was about pensions, particularly local pensions. The paper reiterated its demand that Quinn sign the Chicago pension reform bill. This is the third time the paper has made that demand, and it has not opposed a property tax hike…

Given the terrible finances of the city’s pension funds, Gov. Pat Quinn has no responsible choice other than to sign the bill, and the aldermen have little choice but to raise taxes. Barring the miraculous appearance of some substitute plan, the likeliest (and unimaginable) alternative is to let city pension funds deteriorate even further — and to send Chicago’s credit ratings even closer to oblivion.

No, we’re not happy with the prospect of higher taxes. But over the years Springfield and Chicago politicians created huge pension obligations that the funds have nowhere near enough money to pay. The consequence for taxpayers is clear. The consequence for the politicians who promised more in pension payments than Chicago could pay is … yet to be determined by voters increasingly stuck with the cost of all the pols’ retirement giveaways to public employees.

* All that despite repeated and emphatic promises by Rahm Emanuel to never raise property taxes to solve the city’s pension problems. From February, 2011…

Mayor-elect Rahm Emanuel on Wednesday ruled out a property tax increase of any size […]

Emanuel’s pledge not to entertain a property tax increase of any size came in response to a question about how he planned to solve the city’s pension crisis.

A bill approved by the Illinois General Assembly over Mayor Daley’s objections would saddle homeowners and businesses with a $550 million property tax increase in 2015 unless pension concessions are negotiated or another new revenue source is found.

During the campaign, Emanuel ruled out raising property taxes that much, which would amount to a 90 percent increase. On Wednesday, he was asked whether he would entertain a property tax increase of any size. His answer was an emphatic no.

Hmm.

* Keep in mind that just about every penny of the income tax increase has been used to make the state’s pension payments. Whatever was said during the time it was passed, taxes were in reality jacked up so the state could responsibly meet its pension obligations. And just as the Tribune has been warning about what could happen to Chicago’s bond ratings if the pension bill isn’t signed into law and taxes aren’t raised, Wall Street pushed Illinois hard to raise taxes to stop its rapid fiscal decline.

So, an income tax hike to make long-neglected pension payments is a bad thing, while a property tax hike to make long-neglected pension payments is an acceptable thing?

And no specific promise of a temporary tax is labeled as a broken promise, while numerous promises never to raise property taxes to make pension payments is jettisoned into a bottomless memory hole?

I’m confused.

37 Comments

|

Candidates argue over a dead idea

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Sen. Mike Frerichs (D-Champaign) voted to put a constitutional amendment on the ballot in 2011 which would merge the offices of comptroller and treasurer. The measure went nowhere in the House.

But when asked the other day by WBBM’s Craig Dellimore whether he supported merging the office, Frerichs said…

“People have said to me, ‘Wouldn’t it just be a lot more efficient if we just had one financial officer?’ And I’ve said yes, we could become very efficient, efficient like the city of Dixon, Illinois, who just had one chief financial officer and she was able, from this small little town, over several years to take something like $52 million away from them.”

* Rep. Tom Cross’ campaign pounced…

“Mike Frerichs’ opposition to streamlining these offices reveals a troubling lack of consistency and fortitude, which will cost Illinois taxpayers more despite already being victims of the Quinn/Frerichs tax and spend regime,” said Kevin Artl, Campaign Manager for Cross for Treasurer. “After the Quinn/Frerichs team raised taxes, cut funding for education and drove jobs out of Illinois, Frerichs is continuing to punish Illinois taxpayers by opposing one of the most practical, common sense cost-saving measures available to lawmakers.”

* As did the Illinois GOP…

Why did Mike Frerichs switch his position on merging the office of comptroller and treasurer? In 2011, Frerichs voted to support the measure. In January 2014, he answered the Daily Herald Treasurer candidate questionnaire by touting his support of the merger. But now in April 2014, he opposes the merger. Why the change in position?

* Frerichs held a press conference yesterday and was asked about this…

“What I said that I think he misconstrued—or his team that they probably misconstrued—is that we need to make sure that we have proper internal control in place, and checks and balances.”

* More…

“I think you can combine the offices if you have strong controls in place,” Frerichs, of Champaign, told reporters.

“If we can get those strong internal controls and checks and balances, then yes, I think we should take action to save money for the people of the state of Illinois,” he said.

Past corruption led to the creation of separate fiscal offices as part of the 1970 Illinois Constitution.

But the reality is, this idea is going nowhere as long as House Speaker Michael Madigan remains opposed.

* By the way, Cross reported raising $232K last quarter, spent $410K and had $210K cash on hand.

Frerichs raised $375K, spent $127K and had just under $1.1 million on hand.

20 Comments

|

HB 4075: Support Ride-share Protections for All

Wednesday, Apr 30, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

You know those ride-share companies that operate like taxis?

Well, should those ride-share companies follow the same consumer protection rules as other transportation companies, like police background checks, drug testing and proper insurance requirements?

You can already see what’s happening in the absence of these protections: recently, NBC 5 Chicago investigated an ex-convict on probation with a list of felonies spanning over twenty years who became a ride-share driver almost immediately after she applied, even after her so-called “background check.” And another ride-share driver in San Francisco hit and killed a 6-year-old girl, only to have the ride-share company deny liability and the family proper insurance.

Your elected officials are soon going to decide if you deserve these consumer protections or not.

How do you want them to vote?

Support Ride-share Protections for All. Vote YES on HB 4075.

Comments Off

|

Rauner files over 591,000 term limits signatures

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

The Committee for Legislative Reform and Term Limits, chaired by Bruce Rauner, filed petitions today containing 591,092 signatures, nearly twice the statutory minimum, with representatives from the Secretary of State’s office at the Illinois State Board of Elections.

Term Limits and Reform has been collecting signatures in a statewide petition drive since September in order to place the Term Limits and Reform constitutional amendment on the ballot in November. Because of an outdated requirement for filing a petition with the State Board of Elections, left over from when petitions were divided by county instead of a single statewide filing, the 36-foot long, 67,976 page, 1,600-pound Term Limits and Reform petition was delivered to the Board of Elections by semi truck and required a team of over 20 to deliver.

The amendment limits state lawmakers to 8 years in the general assembly, while also making other structural and procedural changes to the legislature, including raising the threshold to override a gubernatorial veto to bring Illinois in line with 36 other states, and changing the number of state house and senate districts, saving taxpayers millions and bringing house members closer to home.

“All these reforms, especially term limits, will go a long way towards changing the insider culture of Springfield and send a message that power belongs in the hands of the people, not the career politicians and special interests,” Bruce Rauner said.

* From the Tribune…

Rauner has made support for legislative term limits a major plank in his run for governor, his first bid for public office, and the wealthy Winnetka equity investor has given $600,000 of the more than $1.6 million raised by the term-limit committee.

All told, Rauner, national term-limits advocate Howard Rich, conservative donor Richard Uihlein and real estate mogul Sam Zell have donated 76.5 percent of the money raised by the term-limit group.

After the petitions are filed, the State Board of Elections will conduct a random check of 5 percent of the signatures to determine if the proposal has enough valid registered voter names to be submitted to voters for ratification.

The proposal still is likely to face a legal challenge before the Illinois Supreme Court over whether it meets the constitutional requirement to appear before the voters.

* Meanwhile…

Wednesday in Springfield, Senate GOP Leader Christine Radogno argued that limiting the Governor and other top officials to two terms in office would allow for fresh ideas.

“Sometimes we have good and useful people who feel they cannot possibly overcome the disadvantage of incumbency,” said Radogno. “and, this discourages people who are well qualified from running.”

But Democrats on the Senate subcommittee voted down the proposal 2-1.

The proposal never had a chance.

* More…

Senate Minority Leader Christine Radogno, R-Lemont, said 35 other states place term limits on their statewide officials, and most of them are in better shape than Illinois. She said the overwhelming power of incumbency has scared away qualified candidates who might challenge the status quo. She also said voters are ready to “tear their hair out” over the lack of options at the ballot box.

Democrats, though, criticized Radogno for waiting until the last minute to introduce the amendment. Even if the Senate had approved the measure, the House would have had to add additional session days in order to take up the measure before Monday’s deadline. They also noted that a statewide official can pledge not to serve more than two terms without the amendment. Republican gubernatorial candidate Bruce Rauner has said he will not serve more than eight years. Gov. Pat Quinn has also said he will not run again if he is re-elected in November.

* And…

“If you believe in it, you should practice what you believe,” Clayborne told Radogno, trying unsuccessfully to extract a promise from her that should wouldn’t run for re-election as a symbolic show of support for her concept.

Radogno said she would adhere to whatever voters decide on a separate amendment aiming to limit legislators’ terms, assuming it makes it onto the fall ballot.

* The group pushing to change the way the General Assembly draws state legislative district maps is filing its petitions tomorrow.

41 Comments

|

Illinois lagging behind again

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Pot is really going mainstream in Colorado…

The Colorado Symphony is giving new meaning to hitting a high note, announcing on Tuesday a bring-your-own marijuana concert series, the first of which features its chamber ensemble and South-of-the-border food and booze.

The U.S. states of Colorado and Washington became the first to legalize the possession and use of recreational cannabis in 2012, and the first retail pot shops opened in Colorado in January.

The orchestra’s “Classically Cannabis: The High Note Series” seeks to tap the blossoming market in a series of summer fundraising concerts, at a time when more than half of Colorado voters believe legalizing recreational marijuana has been good for the state, a recent poll showed.

The Denver Post newspaper reported the events are aimed at boosting attendance, including drawing younger concert-goers, at a time when the Colorado Symphony has struggled financially.

* Illinois is nowhere near legalization as of yet, but some folks are hoping to at least get a study going…

The group [of four Chicago-area Democrats] held a press conference Monday at the Cook County building, calling for the state to decriminalize marijuana possession and — eventually — legalize recreational use of the leafy plant.

“The main difference between the War on Drugs and Prohibition is that, after 40 years, this country still hasn’t acknowledged that the War on Drugs is a failure,” Cook County Commissioner John Fritchey said, drawing a parallel with the outlawing of booze in the early 20th Century. […]

The group has yet to drop a bill in Springfield to legalize the drug and, in reality, substantive change is likely a ways off, the group acknowledged. At this point they just want fellow Democrats in the General Assembly to green-light a task force to study the issue. The hope, they say, is that Illinois will eventually develop a more laissez-faire approach to pot, which for now is classified a “dangerous” Schedule I narcotic by the federal government.

* Two bills have been introduced to decriminalize weed, and another would lower penalties. A poll taken in late March found that 63 percent of Illinoisans support a $100 non-criminal fine for possessing an ounce or less.

* From an ACLU study…

The national marijuana possession arrest rate in 2010 was 256 per 100,000 people. The jurisdictions with the highest overall marijuana possession arrest rates per 100,000 residents were:

D.C. 846

New York 535

Nebraska 417

Maryland 409

Illinois 389

• Cook County, IL (includes Chicago) made the most marijuana possession arrests in 2010 with over 33,000, or 91 per day. [Emphasis added.]

Sheesh.

But I’m not really a fan of decriminalization for two big reasons. First, criminals would still be controlling the cultivation and distribution of the drug. Second, decriminalization means no tax revenues. If it’s a step toward legalization, then fine. But only like civil unions were a step toward gay marriage. Decrim is not the final answer here.

Just legalize it already and let’s have a concert.

34 Comments

|

* Tribune…

Cook County State’s Attorney Anita Alvarez has launched a probe of a troubled $55 million anti-violence program Democratic Gov. Pat Quinn put in place in 2010 amid a tough election battle.

A grand jury issued a subpoena seeking documents related to the Neighborhood Recovery Initiative Program, which funneled money to various community groups in what Quinn billed as an effort to target crime in some of Chicago’s most dangerous neighborhoods.

Republican critics contend the program was a slush fund designed to shore up support for Quinn in heavily Democratic Cook County, while a recent scathing state audit found the initiative was “hastily implemented” and failed to track how taxpayer dollars were spent.

Alvarez sought documents pertaining to the names and identities of those who received grants under the program, as well as copies of all payment invoices and related audits and compliance reports.

* The Sun-Times broke the story and shares what may be the most important part of the grand jury probe…

The request was issued to the Illinois Department of Commerce and Economic Opportunity on March 19 and sought records tied to the Neighborhood Recovery Initiative — including those for the Chicago Area Project, a program tied to the husband of Cook County Circuit Court Clerk Dorothy Brown.

The Sun-Times previously reported that almost seven percent of the $2.1 million in funds given to the Chicago Area Project meant to combat crime in West Garfield Park went to Brown’s husband, Benton Cook III.

Actually, the state’s attorney went out of her way to point in Brown’s and Cook’s direction…

Correspondence from Alvarez’s office asked for “names and identities of all grantees participating in the Neighborhood Recovery Initiative, including, but not limited to Chicago Area Project.”

* From that earlier Sun-Times story…

In 2011 and 2012, the West Side [Garfield Park] neighborhood got more than $2.1 million from Gov. Pat Quinn’s administration through his Neighborhood Recovery Initiative anti-violence program, state records show.

But instead of all that public money going toward quelling the shooting and other violence there, a substantial chunk of it — almost 7 percent — appears to have gone into the pocket of the husband of Cook County Circuit Court Clerk Dorothy Brown.

Benton Cook, Brown’s spouse, was paid more than $146,401 in salary and fringe benefits from state grant funds to serve as the program coordinator with the Chicago Area Project, the agency the Quinn administration put in charge of doling out anti-violence funding to West Garfield Park, state records show. […]

Separately, Cook is at the center of a newly opened investigation by Cook County’s inspector general into a June 2011 deal in which he was given land on the South Side for free by a campaign donor to his wife.

A Better Government Association/Fox 32 investigation published in the Sun-Times found that Cook, once he’d obtained the land, added his wife’s name to the property’s deed, conveyed it to a corporation they both own, then sold it for $100,000. Brown never disclosed the transaction on her county economic interest statement.

51 Comments

|

Group launches $310K radio buy against Durbin

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

Americas PAC has just completed a $310,000 radio ad buy opposing Dick Durbin’s reelection to the US Senate. The ads will begin running in late April.

“I fully anticipate Americas PAC, and myself personally, to be attacked by the full force of the Federal Government and given the full Al Salvi/Tea Party treatment,” Chairman of Americas PAC Tom Donelson said. “I expect to be audited by the IRS, to have my tax returns leaked to the media, to be investigated by multiple government agencies and be raided late at night.”

Donelson was referring to the letter Senator Dick Durbin sent to the IRS asking the agency to investigate a particular conservative group and the comments made by Mr. Salvi about his US Senate campaign against Durbin in 1996.

“I should probably just turn over my passport to a judge now,” Donelson continued.

The state-wide radio advertising campaign by Americas PAC will highlight many of Durbin’s shortcomings and liabilities including, but not limited to, the pay discrepancy between women and men on his US Senate Staff, his worthless guarantee that people could keep their health insurance plan under the Affordable Care Act and his desire to bring back pork spending.

“Durbin is only polling around 50%. That is a pretty weak number for a member of leadership who has not faced a strong campaign in nearly two decades,” Donelson said. “Rather than sit on the sidelines and see what happens, Americas PAC is proactively framing the debate about Durbin.”

A recent Rasmussen poll had Durbin leading JIm Oberweis 51-37.

* The spot he sent me deals with Obamacare…

Rate it.

36 Comments

|

Credit Unions – Paying it Forward in their Communities

Wednesday, Apr 30, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

Credit unions have a well-recognized reputation for providing exemplary service in meeting their members’ daily financial needs. A “People Helping People” philosophy also motivates credit unions to support countless community charitable activities on a continual basis. Financial Plus Credit Union is no exception, having raised and donated tens of thousands of dollars for many worthwhile causes throughout north central Illinois. This includes serving as the main sponsor and co-host of the local Easter Seals telethon, conducting food drives for local food pantries, collecting supplies during times of disaster such as last year’s flooding, and much more. Members are also seeing new donation canisters in the credit union’s lobbies this year that facilitate collections for a different local organization each quarter. Staff members has also come to the aid of the community via donating individual funds to help families facing significant medical crises, and purchasing holiday gifts on a private basis for foster children. Credit unions are able to wholly serve their communities because of their not-for-profit cooperative structure and leadership of a volunteer board elected by and from the local membership. Financial Plus has been family managed since its inception in 1951 and for the past 38 years under the leadership of Jack Teausant. Credit unions– locally owned, voluntarily led, and Paying it Forward in your community.

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|