Chicago Tribune: Same Safety Standards for Ride-Share

Thursday, May 8, 2014 - Posted by Advertising Department

The following is a paid advertisement.

“As we’ve said before, the part-time/full-time distinction is meaningless to the customer ordering a ride. The same safety standard should apply to all ride shares and, yes, to taxis. We’re increasingly wary of leaving it to the ride shares to police themselves when it comes to making those checks, given (Uber’s) unapologetic disregard for rules. UberX just underscored that point.”

Chicago Tribune editorial, “UberX thumbs its nose at the rules,” May 8, 2014

Ride-share companies claim they can regulate themselves, but time and time again they prove they have no interest in following the rule of law or even in protecting their own passengers.

As the Chicago Tribune editorial board points out, the distinction between ride-share drivers is “meaningless.” What’s important is that everyone is held to the same fundamental public safety and consumer protection standards that come with the proper chauffeur licensing.

Instead, multi-billion dollar companies like Uber and Lyft continue to fight the same public safety protections that transportation companies currently follow, including HB 4075, which would provide safety standards for all drivers across the board.

Customers deserve to have the peace of mind knowing that their driver has passed a comprehensive police background check and drug test and carries sufficient insurance in case of an accident.

It’s time for these common sense safety standards for everyone in the transportation industry. Ask Uber why they would want less.

Vote YES on HB 4075 and support ride-share protections for all!

Comments Off

|

Downstate a big winner in Manar plan

Thursday, May 8, 2014 - Posted by Rich Miller

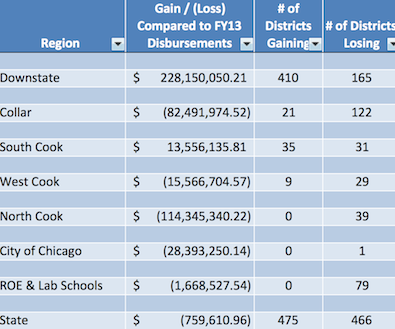

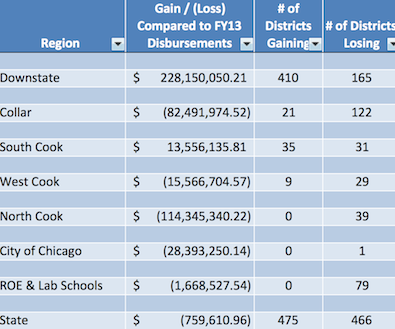

* After Republican outrage that Sen. Andy Manar’s school funding reform plan would provide a windfall to Chicago, it turns out that Chicago wouldn’t do all that well. From the State Board of Education’s analysis of the plan, which weights poverty rates much heavier on school funding…

* Finke…

Manar said the numbers show that the poorer school districts in the state fare better under his revised formula. By poorer, Manar said, that includes both districts with high numbers of students from poverty backgrounds and districts that have lower property values that do not generate enough tax revenue. […]

Manar said that the “most striking thing in the (report) is how far downstate districts lag behind in terms of funding. Downstate is very different than it was in 1997 when the current (funding) law was put in place and we have to account for those things to a better degree than we do today.”

That argument did not necessarily play well with Republicans who represent school districts in the suburban Chicago area. Sen. Matt Murphy, R-Palatine, said school districts in his area already supply 90 percent of their funding from local property taxes. Yet, under Manar’s revised formula, they would lose state assistance, with one district dropping $13 million in state aid.

“If that narrow amount that we get from the state is cut, what do people in my district, who already have high property taxes, do if they want to maintain the current funding level?” Murphy asked Manar at a committee hearing Wednesday. “It sounds like you are telling my constituents to raise their property taxes.”

* AP…

Schools in Palatine, Murphy’s hometown, would see an 87 percent decrease in overall state aid under the funds — about a $13 million dip compared to how much they received in the 2011-12 school year, the year the state board used to make the calculations.

Similarly, schools in Skokie and Evanston in Chicago’s northwest suburbs would lose 85 percent of state aid under the new formula. Meanwhile, Galesburg schools could stand to gain a 30 percent funding boost — about $5 million more a year than they receive now.

Schools in Red Bud, an Illinois suburb of St. Louis, would see an 83 percent decrease.

* Erickson…

State Sen. Dave Luechtefeld, R-Okawville, said many of the schools in his Southern Illinois district would gain under the proposal. He acknowledged it would be a tough vote for lawmakers in areas that would be losing state funds.

“It may not end up a Republican-Democrat issue,” Luechtefeld said.

The measure won approval in the Senate Executive Committee on a 10-3 vote with Luechtefeld voting “present.” He said the overhaul needs more work.

Republicans said the changes might be made more palatable if the state eases back on some of the programs and paperwork it requires of local school districts.

It remains unclear whether the House will take up the proposal if it emerges from the Senate. The plan was developed through a series of hearings in which the House was not involved.

Discuss.

50 Comments

|

The carrot and the stick

Thursday, May 8, 2014 - Posted by Rich Miller

* Let’s revisit yesterday’s Daily Herald story about how some municipal groups were contemplating whether to back an extension of the state income tax in order to possibly get a bigger piece of the revenue sharing pie or to ward off an attack by Democrats.

The story was based on a letter that DuPage Mayors and Managers Executive Director Mark Baloga wrote to his members…

You likely have seen recent news reports of Governor Quinn and Legislative Leaders discussing the opportunity for local governments to secure, or even increase, the local share of state income tax (aka “LGDF”) if the current 5% income tax rate is extended beyond its current sunset date of 2015. Senate President Cullerton directly addressed this topic with DMMC members on April 9 during our Springfield Drive Down. Since that meeting, our lobbyist has been in discussions with legislators and has conveyed the following:

1. Extension of the 5% income tax is almost certain to pass regardless of municipal support, opposition, or neutrality.

2. If municipalities and municipal groups uniformly oppose or fail to support the legislation, then it is also a near certainty that LGDF will be eliminated or severely cut. This would be framed as cutting state expenses to help balance their budget.

3. If municipalities and municipal groups such as DMMC support the tax rate extension, this could secure an increase in the local share of income tax and direct deposit of LGDF revenue—both long- standing DMMC legislative priorities.

4. Support for the tax rate extension would generate ongoing political capital for DMMC, other municipal groups, and municipalities themselves.

5. “Support” can range from a simple statement of organizational support, to individual mayors actively supporting the legislation and the legislators who vote for it, and anything between. More active support would result in even more political leverage on LGDF and other current and future issues.

After extensive discussion, the DMMC Legislative Committee (by unanimous consent, on April 25) and the DMMC Board of Directors (by a 9-4 vote, on May 1) approved DMMC’s conditional support for continuation of the 5% tax rate as long as the bill adequately increases the current 6% LGDF portion of income tax and provides for direct deposit of LGDF revenue to eliminate delays in payments to municipalities. The Board’s motion further specified using this opportunity to pursue additional legislative action including:

A. Stoppage of HB 5485 which would require negotiation of minimum staffing for fire departments and districts.

B. Consideration of additional legislative priorities such as expenditure authority for non-home rule hotel motel tax revenue.

C. Ability to participate actively in development of municipal public safety pension reform legislation.

That’s all really quite fascinating. A grand bargain laid open.

* OK, now back to yesterday’s Daily Herald story…

Cullerton spokeswoman Rikeesha Phelon said she couldn’t confirm the conversations between her boss and municipal leaders.

However, Phelon said Cullerton has said for months that mayors would see a smaller share of state income taxes if the rates don’t get extended.

“That’s not a threat,” she said. “That’s just math.”

In order to cut the municipal share, new legislation would have to be passed.

“This certainly sounds to me like out-and-out extortion,” said Madeleine Doubek, chief operating officer of Chicago-based Reboot Illinois, a voter-advocacy digital media group. “This just pulls back the curtain on the worst of Illinois government in action. Who, in this equation, is looking out for the taxpayers?”

* As I also told you yesterday in an update, Sen. Donne Trotter unveiled legislation yesterday designed to put heat on the mayors…

After facing years of funding cuts, Illinois’ schools could get more than $1 billion in new funding as State Senator Donne Trotter (D-Chicago) is urging his colleagues to truly make education the priority they claim it is.

Currently, mayors and village presidents get a cut of the state’s income tax with no strings attached. Trotter’s proposal ends that giveaway and instead steers the dollars – $1.45 billion in the upcoming budget year – to the state’s public schools in an effort to have the state finally live up to its education funding commitments.

* The bill had a hearing today. Trotter eventually pulled the proposal out of the record, but the SDems tweeted extensively during the debate…

Discuss.

6 Comments

|

* As I told subscribers on Monday morning, the Commission on Governmental Forecasting and Accountability has revised its Fiscal Year 2014 revenue estimate upwards by $588 million. Most of this is considered to be a one-time income tax windfall, so next fiscal year’s estimate was revised up by just $167 million.

Anyway, some Senate Republicans have a plan for spending some of that found money…

Thousands of state workers are owed an estimated 112 million dollars in back wages. Governor Pat Quinn negotiated raises with members of AFSCME back before the 2010 elections, but lawmakers never came through with the money to pay them. […]

“We’re not calling for any new spending, any new spending proposals here. We’re just asking for commitments to be honored. Bottom line,” [GOP Sen. Sam McCann] said.

Under McCann’s proposal, the rest of the extra revenue would be used to pay down the state’s backlog of bills. Illinois owes schools, hospitals, and many other service providers nearly five billion dollars.

Sounds like a good idea to me.

* Related…

* McCann still open to keeping current tax rates: “I don’t think the people of the 50th District sent me here, just like the people of everyone’s respective districts back home sent them here, to stick their fingers in their ears and not listen to what people have to say,” said Carlinville Republican Sen. Sam McCann. “They don’t send us here not to roll up our sleeves and go to work on their behalf. They send us here to engage.”

16 Comments

|

Today’s numbers are lousy

Thursday, May 8, 2014 - Posted by Rich Miller

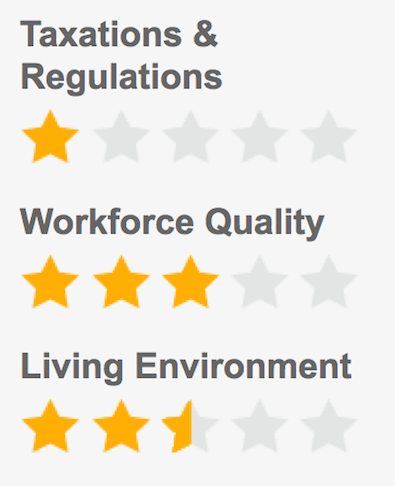

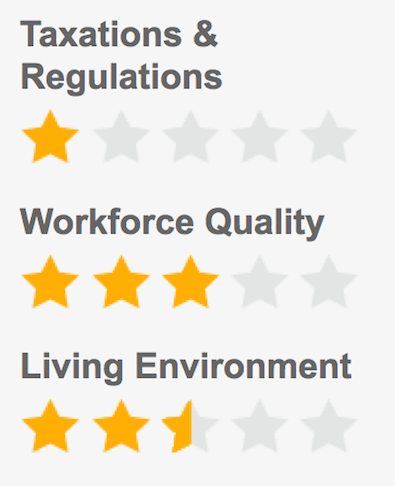

* Chief Executive Magazine ranked Illinois 48th in the nation for business…

Anti-growth hot mess can only coast on Chicago’s economic engine for so long.

And…

Oof.

* Numbers…

State GDP

% Growth ’11-’12: 1.9

% Growth ’11-’12 v. Nat’l Avg. (2.5%): -0.6

Unemployment

Unemployment Rate Dec. 2013 %: 8.6

Comparison with Nat’l Rate (6.70%): 1.9

Domestic Migration

Domestic Net Migration 2013: -67,313

Rank: 49

State Government

State Debt per Capita Fiscal Year ’13 ($): 5,569

State & Local Gov’t Employees per 10k Residents: 503.1

Oy.

* But considering all the screaming about taxes, our state/local tax burden is pretty average…

State-Local Tax Burden

Rate (%): 10.2%

Compared to Nat’l Avg. (9.9%): 0.34%

74 Comments

|

Rauner: “Step down” the tax hike

Thursday, May 8, 2014 - Posted by Rich Miller

* I thought about putting this in the post below about another temporary tax hike extension but wanted to wait until I heard back from the Bruce Rauner campaign about his statement yesterday regarding the tax hike. Sun-Times…

“I’m very much against keeping the tax hike permanent,” Rauner said. “They promised it would be temporary. We’re going to have a plan we’ll be coming out with soon on how to step that back down, all the way down.”

So, does “step that back down” mean a phaseout? That would be more like what Toni Preckwinkle did with the hugely unpopular sales tax hike - phased it out over a period of years.

I’m pretty sure he’s said this before, but if Rauner was being accurate about his position yesterday, phasing it out is actually a far more fiscally responsible approach than just eliminating the tax hike outright in January.

* The campaign offered no further insight today…

Bruce has always said he wants to get rid of the Quinn-Madigan tax hike and comprehensively reform the tax code so it is pro-growth and fair to all taxpayers. That is still the plan.

* Related…

* Quinn, Rauner address Illinois business leaders

* Quinn, Rauner paint different pictures of Illinois at business lunch

* Quinn, Rauner trade jabs in separate talks with business leaders

22 Comments

|

Under the bus he goes

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

One of the people behind Gov. Pat Quinn’s troubled anti-violence program is now heading a new initiative to reduce Chicago violence that’s backed by major businesses and Mayor Rahm Emanuel.

The Chicago Sun-Times reports that Toni Irving was a deputy chief of staff for Quinn when his Neighborhood Recovery Initiative was formed in 2010. […]

She told the newspaper she had no role in implementing Quinn’s program, but the newspaper says she chose grant recipients.

The Sun-Times reports that Irving helped steer the choice of the Chicago Area Project as “the main conduit for state anti-violence grants in West Garfield Park.” CAP then hired Dorothy Brown’s husband.

* There’s an interesting little political development in the Sun-Times story as well. Mayor Emanuel kinda threw Gov. Quinn under the bus…

At an unrelated news conference Wednesday, Emanuel sought to distinguish Get In Chicago from Quinn’s troubled Neighborhood Recovery Initiative, which was launched during the governor’s closely contested campaign in 2010. Republican critics have blasted the Quinn initiative as a political “slush fund” created to generate support for Quinn.

“First of all, this is private money. Totally different,” Emanuel said.

“If you were doing it only one-year and around the campaign season, I understand why people would get cynical. But given that it’s also in the years that there is no campaign, but it’s about safety, I would say look at the consistency over the four-year time.”

13 Comments

|

Today’s quotable

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Baise from the Illinois Manufacturers Association….

“I think business owners in this state have really gotten to the point that they want to see a change. … I think the business community’s perception of this state (is) if we don’t make a drastic change of some sort, a lot of my members who can will move, and I hear that lament over and over again.”

Baise has told me this more than once and he’s pretty darned adamant about it. Whether he’s right or wrong is beside the point. The guy who runs one of the most influential biz groups in the state truly believes an exodus is coming. And Baise is not someone who regularly engages in hyperbole.

64 Comments

|

SURS to re-interpret pension language

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

The State Universities Retirement System now says a troublesome piece of last year’s state pension-reform law may not cut retirees’ pensions after all.

William Mabe is the executive director of the retirement system. He said the language in law that would cost retirees’ a year of pension should be interpreted as if it didn’t – because it wasn’t intended to.

That’s based on the interpretation the Teachers Retirement System has been using when it looks at the law. Now SURS plans to follow suit.

* The News-Gazette broke the story…

Teachers also have a money-purchase option when they retire, and that annuity calculation was changed in the new pension bill as well. But the Teachers Retirement System chose to interpret the “legislative intent” of the added provision, preserving members benefits earned through June 30, 2014.

“From the get-go the way we read the law, the legislative intent was designed to hold members harmless,” said spokesman Dave Urbanek. “Our interpretation was fiscal year 2014 all along.”

The state pension code says that whenever a statute’s language is ambiguous, the interpretation must favor the employee, he said.

Only about 14 percent of teachers use that option when they retire, as opposed to approximately 60 percent of SURS retirees, officials said.

Mabe said SURS had been trying to get the problem fixed legislatively for months, and had been considering adopting the approach used by the teachers’ retirement system anyway when he received [House Speaker Michael Madigan’s] letter. There is legal precedent to support that approach, he said, and Madigan’s letter provided evidence of “clear evidence of intent.”

* From Madigan’s letter to Mabe…

With respect to the money purchase benefit, SURS is the only pension system interpreting the language in a manner that is inconsistent with the intent of the General Assembly. It is my understanding that SURS and the University of Illinois were directly involved in the development of the money purchase benefit language, and reviewed several drafts of the legislation prior to the General Assembly taking final action. At no point did SURS, University of Illinois, or any other pension system indicate there was a technical error with the language that would cause it to be inconsistent with the intent of the Conference Committee Report.

Given that members of the General Assembly have received numerous letters and emails regarding this issue, it is worth addressing the timeline related to the development of the language. The concept of changing the money purchase benefit was introduced on April 30, 2013, in House Amendment #1 to Senate Bill 1, and approved by the House on May 2, 2013. When the Conference Committee was appointed, the members of the Committee met with representatives from SURS and the University of Illinois, and together they drafted the language that ultimately became law. The pension systems were provided with copies of draft legislation throughout the fall and prior to the General Assembly taking action in December 2013. On November 26, 2013, legislative staff specifically asked each of the pension systems if there were any technical concerns with the language. At this time, SURS did not present this objection.

Legislative staff was advised that SURS preferred a hard date for the provision, but that this request was simply to ease administrative burden and would not impact the intent of the provision.

With respect to your concerns regarding the effective date of the bill and the method used to determine the effective rate of interest, again, SURS reviewed this language over the course of many months and did not present any objections. After passage, legislative staff was advised that these provisions could be difficult, but would not be impossible to administer.

While I support efforts to correct the technical error, I urge SURS to consider that its interpretation is inconsistent with the intent of the General Assembly, and also inconsistent with the way TRS has interpreted the same language. A similar reading by SURS may help ease the concerns of university faculty and personnel impacted by the language and assist with avoiding unintended consequences for our universities.

With kindest personal regards, I remain

Sincerely yours,

MICHAEL J. MADIGAN

Speaker of the House

30 Comments

|

CTU peace gesture on pension reform

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Hinz has an important story about a pension reform peace gesture by CTU President Karen Lewis…

During an appearance yesterday afternoon before the Crain’s editorial board, Ms. Lewis specifically said the union is willing to consider reducing benefits for those who still are working, although she emphatically ruled out changes for members who already have retired.

“There could be some modification (for current workers),” said Ms. Lewis, who has a reputation as a firebrand and who on May 5 opened the door to a second teachers strike in three years. “We’re interested in talking about modifications, yes.”

* Lewis said she wouldn’t talk about specific cuts until revenue had been negotiated. She’s generally opposed to raising property taxes and has floated things like a financial transaction tax (which was shot down by Mayor Emanuel yesterday) and a commuter tax, which is going nowhere. However, there’s another idea out there…

Ms. Lewis said Chicago Public Schools officials lately have been “more open to discussion [about revenue] than in the past.”

She didn’t say what they’re “open” to. A source who should know says a plan to dedicate revenue from expiring tax-increment financing districts is picking up steam because it would provide a revenue stream for pension bonds without raising the overall property tax rate above today’s level.

* On to Mayor Emanuel…

What he has ruled out — pointedly and specifically — is a transaction tax, a city income tax increase, and a commercial lease tax like the one championed by Mayor Harold Washington during the mid-1980’s. A Circuit Court judge overturned the six percent lease tax in 1986. The city appealed that decision, but the City Council repealed the tax before the city’s appeal was heard.

The mayor has also nixed the idea of using the jackpot of revenue from a Chicago casino to solve the pension crisis.

“I don’t think you should go to the roulette table with somebody’s retirement check. I’m not gonna do that,” the mayor said last month.

“How long has it been laying out there?… A lot of the credit agencies want something that’s reliable that they count on. I’m trying to stop the city from going to a place that I don’t think it can if we…do the morally responsible thing to ensure that every workers, every retiree gets a pension.”

14 Comments

|

Make it temporary again?

Thursday, May 8, 2014 - Posted by Rich Miller

* Rep. Jerry Costello is against making the tax hike permanent, or even extending it a few years, but suggests another temporary extension might be an alternate way forward…

There might not be enough votes in the House to make Illinois’ temporary tax hike permanent, so a one-year extension of the increase might be sought instead, according to a local lawmaker.

“They’re having problems — leadership in the Democratic Party — coming up with enough votes to pass a permanent extension of the tax,” said Rep. Jerry Costello II, D-Smithton. […]

“I think for some of the people on the fence, if they could say it was a finite situation, it would be easier for them. For me, it doesn’t change my position — I’m a ‘no,’” Costello said.

Steve Brown, a spokesman for Madigan, said he’s not aware of any plan to back away from the permanent increase, in favor of another temporary one.

“That’s news to me,” Brown said. “I know the speaker is supporting what the governor has proposed. The speaker has told the press in recent days that he’s continuing to work on that roll call.”

As subscribers know, the House Speaker is, indeed, having some problems with that permanent tax hike. But another temporary tax hike would mean yet another politically contentious tax vote in a few years, and the Speaker isn’t loving that idea.

Your thoughts?

48 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|