|

Reader comments closed until Monday

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Happy Thanksgiving, everybody! I’m officially outta here…

|

|

TrackBill update

Wednesday, Nov 26, 2014 - Posted by Advertising Department [The following is a paid advertisement.] I checked in today with the crew over at TrackBill, and they told me they’re getting some new Illinois subscribers through our referral arrangement. For this, I thank you. Now, you know I wouldn’t endorse a product if I didn’t believe in it, and I can tell you this TrackBill is the real deal. Once you subscribe to the service, your legislative tracking life will definitely get easier. Among the many features, they send immediate updates to your email or phone when legislation you’re tracking moves. Oh, and need to attend a hearing? TrackBill will let you know as soon as the time or location changes. You can also set it up to alert you when a bill you should know about is introduced or amended. They call this feature “keyword alerts,” others call it “job security.” So, if you want to take a closer look, click here to sign up for a demo or click the banner ad to the right. If you like what you see and buy a subscription, then yours truly gets a small taste. Thanks!

|

|

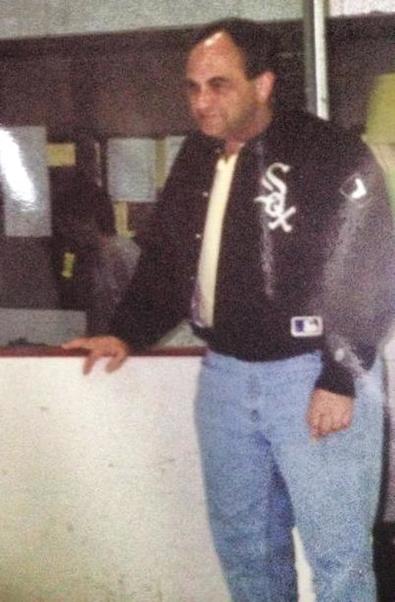

Caption contest!

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Man, there’s hardly any news at all today. I’ll be shutting the blog down early today, so comment early because you won’t wanna miss your chance to say “Happy 65th birthday, Rep. Lou Lang!” via our caption contest. From Lou’s Facebook page…

|

|

It’s worse than we thought

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Sneed writes about the Executive Mansion and curator Dave Bourland…

Oy.

|

|

Question of the day

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Your reason(s) to be thankful this year? Explain.

|

|

Long-term debt is not short-term debt

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Math is, indeed, simple…

The $110 billion in unfunded liability is long-term debt. It can be paid off over time because everybody isn’t gonna retire all at once. * So, to put it in simpler terms, if you think of that liability as a 30-year home mortgage, you can see that it’s not an existential crisis with current revenues in place. Most people who have mortgages couldn’t pay them off in three years if they diverted all their income to just their homes. It’s why they take out loans in the first place. And nobody has a mortgage which reinvests what’s being paid every month to help pay off the balance. That gives the state an advantage. We’re just about at the top of the Edgar ramp. Payments will rise another $800 million or so next fiscal year and then essentially even out as a percentage of revenues. It can be managed, but the budget will be very tight for a very, very long time. * The bigger problem is with our revenues, which start to collapse at the end of this year. If you buy the nicest house you can afford while earning $100,000 a year and your income suddenly drops by $25K, then that mortgage becomes far less affordable. So, that’s really what this debate is about. People are trying to find a way to cut pension payments so they can cut the income tax rate. If they can’t do that, then other programs will have to be slashed or other taxes raised so the income tax rate can be lowered. There are no easy solutions. A homeowner in the same situation could go out and find another part-time job, cut way back on expenses, or even sell the house. That last option probably isn’t available to the state.

|

|

Today’s quotable

Wednesday, Nov 26, 2014 - Posted by Rich Miller * Tribune…

As do I.

|

| « NEWER POSTS | PREVIOUS POSTS » |