* From the House Democratic budget proposal analysis…

Items mandated for payment under a court order are not appropriated in these bills. As a result, in some instances, entire agencies are absent from this legislation.

That means things like Medicaid expenses aren’t being appropriated, which is what I’ve been warning subscribers about for a while now. Also, no personal service lines are appropriated because employees are being paid via court order. What they intend to do if the courts rule that the employees can’t be paid without an appropriation is another story.

* And speaking of which, the bill also appropriates over $63 million for back pay for state workers as a result of a recent Supreme Court ruling that employees can’t be paid without an appropriation.

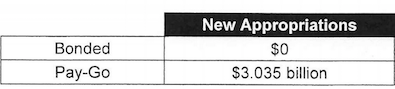

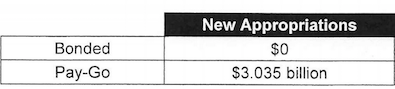

* And then there’s this under the heading “capital projects”…

Yep. $3 billion in new capital spending.

* Watch for updates on this story on our live session coverage post.

*** UPDATE 1 *** Greg Hinz…

But the latest word is, after a top Rauner aide called [Madigan’s budget] plan “the phoniest phony budget in recent Illinois history,” the speaker decided to put it all together in one big bill and dare the GOP governor to veto it, potentially keeping schools from opening this fall.

The original version of the plan, circulated to House members last night, called for a hike in state school aid of $575 million, with $500 million targeted toward high poverty districts.

But in the latest version, I’m told, Madigan raised the ante, boosting the $500 million for high poverty districts to $700 million. And while $700 million is the “number under discussion now,” it could go up further, Madigan spokesman Steve Brown tells me.

While every school district in the state would get more money, CPS would be a particular winner. Sources say it would get 41 percent of the $700 million—about $300 million. Beyond that, it no longer would get the $75 million cut because of lower enrollment that Rauner had proposed. It also may get some additional money for teachers pensions now, up to $50 million.

So, maybe a $400+ million benefit for CPS when compared to Rauner’s proposal.

*** UPDATE 2 *** ILGOP…

House Speaker Mike Madigan is pushing a budget proposal today that creates a $7 billion deficit and requires revenues of nearly $39 billion. Balancing the phoniest of all phony budgets would require the highest tax rate in Illinois history.

“Now we know why Mike Madigan said in December that taking the income tax back to 5% was a ‘good place to begin.’ Apparently, Madigan has long been planning to pass the highest tax rate in Illinois history,” said Illinois Republican Party spokesman Steven Yaffe. “Every single Democrat who votes for this proposal is voting for an unprecedented tax hike on Illinois families, workers and small businesses. The Madigan tax hike would crush Illinois families and lead to more people and businesses leaving the state.”

*** UPDATE 3 *** From a senior administration official…

According to GOMB, this level of spending would force an income tax rate of 5.5% to balance the budget. In essence, a vote for this budget is a vote to force a $1,000 tax hike on the average Illinois family.

- Saluki - Wednesday, May 25, 16 @ 12:47 pm:

Welcome to a new dimension of bizzaro world.

- hisgirlfriday - Wednesday, May 25, 16 @ 12:50 pm:

Very YOLO of them. Almost makes one long for an old-fashioned pension holiday budget.

- Anonymous - Wednesday, May 25, 16 @ 12:53 pm:

Maybe it’s time for the governor to admit that he can’t govern within current revenue.

- Formerly Known As... - Wednesday, May 25, 16 @ 12:55 pm:

Bizarre.

Multiple spending increases proposed in here.

- Oswego Willy - Wednesday, May 25, 16 @ 12:58 pm:

This is the budgetary equivelant of playing chess…

Rauner made a move last “budget”, Madigan put together a phoniest phony budget, based on the parameters that … there will be… no budget.

So, Rauner can veto a capital bill, more school funding, and maybe sign things that arbitrary admit the Judicial Branch is dictating the spending of revenue…

… That’s in a document that will be voted on.

I wouldn’t call this an odd budget kn a good day.

What this is… is the proportion response to last year’s counters, while Madigan runs the same “play”… with counter-measures.

Ugh.

- Abe the Babe - Wednesday, May 25, 16 @ 1:00 pm:

A budget designed for mailers.

Your GOP rep voted against…increased funding for schools, providing a lifeline to social service providers, funding higher ed and building new roads, schools and bridges.

- Pelonski - Wednesday, May 25, 16 @ 1:07 pm:

It looks like the Democrats and Republicans are in a race to see who can come up with the most impractical and irresponsible budget proposal. Are there any real statesmen in either party or just self-interested politicians?

- Formerly Known As... - Wednesday, May 25, 16 @ 1:07 pm:

Illinois Herald 2014 =IL ranks Last in Nation again with Record Annual Deficit=

This budget should help the state break its’ own record.

- fka Lester Holt's Mustache - Wednesday, May 25, 16 @ 1:08 pm:

==Also, no personal service lines are appropriated because employees are being paid via court order. What they intend to do if the courts rule that the employees can’t be paid without an appropriation is another story.==

That’s odd, because I specifically remember a guy who looked just like the leader of the house Dems, standing in front of a huge crowd of state employees just last week telling them how vital they were to Illinois. Today the funding for paying the salaries to those vital members of our community is being left to court orders, the same court orders that his daughter is about to challenge in court?

And no Medicaid, but billions in Capitol projects? Has dealing with this governor finally broken the giant political brain of Michael J Madigan? Perhaps there is some quasi-Machiavellian master plan that is too complex for mere mortals like myself to fathom.

- Triple fat - Wednesday, May 25, 16 @ 1:11 pm:

I applaud the Speaker. Well played sir. Well played.

- MOON - Wednesday, May 25, 16 @ 1:12 pm:

FKA

The speakers brain is fine. Its you that does not understand the Speakers motive and desired outcome regarding this proposed budget.

- 47th Ward - Wednesday, May 25, 16 @ 1:14 pm:

===it could go up further, Madigan spokesman Steve Brown tells me.===

Why not make it an even $1 billion? Heck, make it $10 billion. There is no money behind the number, so what’s the point?

- Formerly Known As... - Wednesday, May 25, 16 @ 1:18 pm:

==dare the GOP governor to veto it==

At which point the GOP governor zeroes out everything except education funding, sends it straight back to the GA, and double-dares them to either start from scratch on everything else immediately

or override him and be responsible for another out of balance budget while now =owning= any tax increase.

- MOON - Wednesday, May 25, 16 @ 1:23 pm:

47

The point is the Gov. can use his line item veto to bring the budget in balance.

The Gov. can also admit that not only new revenue is required but he can also go on the record with specifics regarding where this new revenue will come from.

If he is specific regarding the needed new revenue he can then line up some Gop votes in the GA.and then the Dems will also supply some votes.

- Formerly Known As... - Wednesday, May 25, 16 @ 1:23 pm:

Moon - you appear confused. My comment is not the one mentioning the speaker’s brain that you refer to.

- PublicServant - Wednesday, May 25, 16 @ 1:24 pm:

The point is that Rauner doesn’t get to pick his hostages this year. Madigan, as previously stated, is willing to sit down and negotiate a mix of needed revenue increases and spending reductions without reference to the phoniest of phony reforms that Rauner wants. Or, the governor owns the veto.

- fka Lester Holt's Mustache - Wednesday, May 25, 16 @ 1:25 pm:

MOON

You are correct, I certainly do not claim to understand the desires and motives of the speaker. Perhaps you can explain them? As FKA says, this might just be a repeat of last session unless the speaker is all of a sudden confident that he can override vetoes - which the house has so far failed at 60+ times.

- Formerly Known As... - Wednesday, May 25, 16 @ 1:32 pm:

==There is no money behind the number, so what’s the point?==

Bingo. This is an exercise in futility, and it may do more harm than good.

Unless the GRF has suddenly become an infinitely-replenishing $ tree, all this achieves is reminding voters the GA that passed 2 consecutive unbalanced budgets under a Dem governor is now seeking a 3rd under a Republican governor.

- Triple fat - Wednesday, May 25, 16 @ 1:35 pm:

Fka LHM -

Do you think the speaker failed on those override votes? I think that was his plan all along.

- jim - Wednesday, May 25, 16 @ 1:38 pm:

If he ever had any pretense of budget seriousness, Madigan gave it all up with this maneuver. hard to believe people on this blog applaud this kind of political nihilism. shows how lost Illinois is from a political standpoint.

- Formerly Known As... - Wednesday, May 25, 16 @ 1:40 pm:

fka Lester Holt’s Mustache - plus, this would not be the Speaker’s first mis-step this session.

Madigan may have just done Rauner a favor by forcing the issue. If Rauner zeros out everything except education and sends it back, the GA is going to have to come up with a balanced budget before July 1 or everything except education loses all funding until they do so.

Either that, or the GA overrides Rauner and they own this budget as well as the tax increase to pay for their budget. He may have just inadvertently let Rauner off the hook.

- an independent - Wednesday, May 25, 16 @ 1:42 pm:

Gentlemen and or Gentle ladies. All this goes back to just one thing. Rauner ran on the improbable platform that no tax hike was needed. He wanted it to expire. So, we are below bare bones and the state is folding. All the anti Madigan hoopla in the world does not change history. He beat Quinn using a lie. The Turn Around is just sand in the eye to cover his improbable claim.

- fka Lester Holt's Mustache - Wednesday, May 25, 16 @ 1:42 pm:

Triple -

You could certainly be correct. As I told MOON, I don’t understand the logic of it as far as actually governing is concerned. Yeah, it helps to create attacks for mailers against Raunerites candidates this fall, but I don’t see where a replay of the last year helps citizens that need a functioning state government. I certainly don’t trust the gov to line item out or reduction veto $7 billion in cuts, since he would not do $4 billion last year.

- Huh? - Wednesday, May 25, 16 @ 1:42 pm:

“the phoniest phony budget in recent Illinois history,”

Phoniest = -1, Phony = -1

One of the things I learned in math class was that a negative multipled by a negative equalled a positive. So by my feeble logic, the budget put forth is a legitimate budget.

- Earnest - Wednesday, May 25, 16 @ 1:44 pm:

Wow, odd indeed. Given that it doesn’t include all expenditures, I rescind my “it’s not phony” comment on the other thread. It doesn’t even feel like a legitimate, affirmative statement on “this is how much we feel Illinois should be spending and this is what we believe it should be spending on.” Now I will attempt humor: pity that the only real math involved in Illinois budgeting is political calculus.

- Annonin' - Wednesday, May 25, 16 @ 1:51 pm:

Good to see Yaffe yackin’ We were afraid Yaffe had been yanked and thre was no one out there to spend the $5 million.

- cgo75 - Wednesday, May 25, 16 @ 1:58 pm:

I’m confident there’s a solid rationale behind this budget and that it fits nicely into whatever the Speaker’s grand plan might be. At the very minimum, kudos for the work that went into this.

- Not It - Wednesday, May 25, 16 @ 1:59 pm:

I think the Speaker just jumped the shark.

- Handle Bar Mustache - Wednesday, May 25, 16 @ 2:08 pm:

Funny how “senior administration officials” don’t want to go on the record. The claim about a 5.5% rate is an inherently false “only option” and shouldn’t go unchallenged. Nuding and others who live in reality have to be cringing.

- Robert the 1st - Wednesday, May 25, 16 @ 2:09 pm:

= force an income tax rate of 5.5% to balance the budget.=

Seems reasonable. Apply it to retirement and exempt the first 30k for those over 65 and we’re set for years to come.

- SAP - Wednesday, May 25, 16 @ 2:09 pm:

==According to GOMB, this level of spending would force an income tax rate of 5.5% to balance the budget.== If my back of the envelope math is correct, a 4.5% rate would balance the budget if the capital portion were dropped, although it would not be enough to begin addressing the massive backlog of unpaid bills.

- Tax Increase for All - Wednesday, May 25, 16 @ 2:10 pm:

Maybe the General Assembly should have passed the constitutional amendment for a graduated income tax so Illinois would have more revenue and so 98 percent of residents would see a tax cut…

- SAP - Wednesday, May 25, 16 @ 2:10 pm:

Sorry, 4.75% rate

- Anonymous - Wednesday, May 25, 16 @ 2:16 pm:

The administration sure can crank numbers out fast when it in their “best” interest.

- RNUG - Wednesday, May 25, 16 @ 2:17 pm:

2:16pm was I

- Dee Lay - Wednesday, May 25, 16 @ 2:22 pm:

“Madigan tax hike”

That becomes the Rauner Tax Hike once he signs it.

- Formerly Known As... - Wednesday, May 25, 16 @ 2:22 pm:

==All the anti Madigan hoopla in the world does not change history.==

The tax increase rolled back on January 1, 2015, as it was drafted, passed and signed to do by Quinn, Madigan and Cullerton. Even so, the income tax rate remains 25% higher now than in 2010.

Rauner also offered to two options in his budget presentation, both of which Democrats rejected. =Rauner told the members of the General Assembly that they could fill it either by acceding to certain, unspecified elements of his “turnaround agenda” that would “accompany a negotiated balance of spending reductions and revenue” — the demand Democrats have been rejecting all along — or by giving him “the flexibility to reallocate resources and make reductions to state spending as necessary”= through =the Unbalanced Budget Response Act (Senate Bill 2789)=.

- Storm Cloud - Wednesday, May 25, 16 @ 2:26 pm:

SAP,

Capital is not GRF. Doesn’t count. You are right about the bills owed.

- Oswego Willy - Wednesday, May 25, 16 @ 2:28 pm:

Yaffe blew it up with #TaxHikeMike

Madigan won’t raise taxes now without Rauner, but we already knew that, I guess.

Raunerites… Ugh.

- Oswego Willy - Wednesday, May 25, 16 @ 2:30 pm:

Madigan will run his Approps, get the GOP “Red”, and leave town.

#TaxHikeMike won’t get Ounce of Prevention it’s $7 million owed any quicker

- hisgirlfriday - Wednesday, May 25, 16 @ 2:35 pm:

So we get to watch the Rauner Cuts-Madigan Tax Hike suicide pact play out until at least November. Lovely.

- Triple fat - Wednesday, May 25, 16 @ 2:35 pm:

Fna - turn around agenda = no way

Giving this Governor the right to reallocate resources would require a great deal of trust in his honesty, abilities and character. The GA needs some other choice. Preferably one that is measured and responsible.

- Andy S - Wednesday, May 25, 16 @ 2:49 pm:

“…would force an income tax rate of 5.5%…”

Guess what, folks, most places in the country have higher income tax rates than that. I moved to Virginia in 2001 - my income tax rate has been 5.75% for the past 15 years, and I am paying that on my entire Illinois pension income. Technically we have a graduated tax system, but since its 5.75% on all income over $17,000 it effectively is pretty much a flat rate, just like in Illinois. If Virginia can have a 5.75% income tax rate yet be considered a business-friendly state in virtually every survey that has been conducted, why is 5.5% in Illinois considered outlandish or preposterous?

- steve schnorf - Wednesday, May 25, 16 @ 2:54 pm:

SC, this capital lookslike GRF to me

- thunderspirit - Wednesday, May 25, 16 @ 2:56 pm:

== Madigan will run his Approps, get the GOP “Red”, and leave town. ==

Which is unquestionably the plan.

- anon - Wednesday, May 25, 16 @ 2:57 pm:

5.5% is what the State needs to fund core services and pay its debts. Many legislators won’t admit it, and most don’t want to vote for it.

- north shore cynic - Wednesday, May 25, 16 @ 3:01 pm:

this budget proposal would immediately result in a downgrade of the State’s rating and probably every other local government in the State.

At some point, the credit markets will say No More.

Puerto Illinois

- Corporate - Wednesday, May 25, 16 @ 3:03 pm:

And would kick the corporate rate to 7.77%

- Ghost - Wednesday, May 25, 16 @ 3:16 pm:

5.5% required because the GOP let the prior tax rate decline. we went from a surplus paying down debt to this mess.

seems though tou could do 5% and other rev sources plus take more the. one year to pay down the GOP created debt.

- Robert the 1st - Wednesday, May 25, 16 @ 3:20 pm:

=the GOP let the prior tax rate decline=

They did?

- Delimma - Wednesday, May 25, 16 @ 3:23 pm:

Yes, they did. The governor specifically requested the higher rate be allowed to expire because he didn’t need the extra revenue to balance the budget.

- Oswego Willy - Wednesday, May 25, 16 @ 3:24 pm:

- Robert the 1st -

Gov-Elect Rauner in a Rookie Mistake asked and pleaded for it to sunset, instead of allowing it to sunset and pivot buff that.

You know better. You’ve been around here.

You know Rauner asked for the rate to sunset, the Democrats obliged.

- Robert the 1st - Wednesday, May 25, 16 @ 3:27 pm:

=the Democrats obliged.=

So nice of them. Sure don’t see any of that anymore. I got it, since Rauner asked for it, it’s all on him and not the people in office at the time.

- AC - Wednesday, May 25, 16 @ 3:28 pm:

I moved here from another state. 5.5% would still be less than I previously paid, my property taxes were identical, sales tax was a little lower, but overall that reflects a slightly lower tax burden for me personally. Actually, I’m surprised they could close the budget hole with a 5.5% flat tax, I’d have expected a higher percentage.

- Oswego Willy - Wednesday, May 25, 16 @ 3:31 pm:

===So nice of them. Sure don’t see any of that anymore.===

Rauner made a rookie mistake asking for something that on its face seem ridiculous, and Rauner thinking #TaxHikeMike and leverage were going to get decimating unions.

Rookie mistake, so of course they obliged…

===I got it, since Rauner asked for it, it’s all on him and not the people in office at the time.===

… because sometimes getting what you asked for… backfires.

This isn’t difficult.

- Robert the 1st - Wednesday, May 25, 16 @ 3:35 pm:

I’m not sure if it backfired. I know lots of people enjoying the lower tax rate. Eventually the rates will go up, but with politics, tomorrow doesn’t matter.

- Oswego Willy - Wednesday, May 25, 16 @ 3:38 pm:

It backfired that Rauner can’t pivot off Democrats needing and requiring revenue.

- A Modest Proposal - Wednesday, May 25, 16 @ 3:38 pm:

- Andy S - Wednesday, May 25, 16 @ 2:49 pm:

“…would force an income tax rate of 5.5%…”

Guess what, folks, most places in the country have higher income tax rates than that. I moved to Virginia in 2001 - my income tax rate has been 5.75% for the past 15 years, and I am paying that on my entire Illinois pension income. Technically we have a graduated tax system, but since its 5.75% on all income over $17,000 it effectively is pretty much a flat rate, just like in Illinois. If Virginia can have a 5.75% income tax rate yet be considered a business-friendly state in virtually every survey that has been conducted, why is 5.5% in Illinois considered outlandish or preposterous?

Whats your property tax rate in Virginia?

- wordslinger - Wednesday, May 25, 16 @ 3:51 pm:

What an opportunity for the governor to offer a statesmanlike, responsible, balanced counter-proposal.

Not even the all-powerful Madigan can stop him from doing that. And as RNUG has pointed out peeps, his peeps can churn out the numbers lickety-split when they want to.

Should be any minute now.

- wordslinger - Wednesday, May 25, 16 @ 3:53 pm:

–House Speaker Mike Madigan is pushing a budget proposal today that creates a $7 billion deficit and requires revenues of nearly $39 billion. Balancing the phoniest of all phony budgets would require the highest tax rate in Illinois history.–

Actually, it’s almost dollar-for-dollar what the current, de facto FY16 budget is due to the governor’s blanket vetoes.

- Arthur Andersen - Wednesday, May 25, 16 @ 4:07 pm:

Just remember folks, it’s gonna be harder to stiff the pensions when they’re (as they should be) left outta the bill as continuing approps. Not too many folks would want to sponsor that “friendly amendment.”

- AC - Wednesday, May 25, 16 @ 4:14 pm:

A Modest Proposal - since I had a similar post, I’ll answer, here’s an example from Wisconsin for a modest home on the east side of Madison:

https://www.cityofmadison.com/assessor/property/additionalpropertydata.cfm?ParcelN=071005405066&Type=T

So, about 2.3% of fair market value, they don’t use 1/3 valuation like Illinois. If my Illinois house were there, my property taxes would be $400/yr higher. Income taxes start at 5.84% in Wisconsin and go up from there, also higher than 5.5%. Sales taxes are lower in Wisconsin, 5.5% in Madison and 5.6% in Milwaukee.

- atsuishin - Wednesday, May 25, 16 @ 4:22 pm:

Very frustrating to see my taxes have to be raised to support this bizarre and incompetent style of governance.

- Formerly Known As... - Wednesday, May 25, 16 @ 4:24 pm:

==I got it, since Rauner asked for it, it’s all on him and not the people in office at the time.==

Especially seeing as Rauner wasn’t around when the tax increase was created, passed and signed with clear language that it would roll back on January 1, 2015. And that when Rauner offered in 2016 to balance the budget if Democrats gave him temporary freedom to manage state money, Democrats refused.

They won’t support a balanced budget. They won’t support compromise or reform. They won’t support giving the governor temporary, one-year powers to manage state funds. Yeah, that sounds like it is all Rauner’s fault because he supported the tax hike doing what Quinn, Cullerton and Madigan drafted it to do.

- Rabid - Wednesday, May 25, 16 @ 4:25 pm:

The speaker is giving the govenor his grand compromise,everyone pays a grand

- Formerly Known As... - Wednesday, May 25, 16 @ 4:33 pm:

==Guess what, folks, most places in the country have higher income tax rates than that.==

Illinois has the highest effective tax rate in the country. That is for property, income, vehicle, sales and excise taxes combined.

- Tone - Wednesday, May 25, 16 @ 4:52 pm:

Illinois has the fourth highest tax burden in the country right now. State is roast. Bail as many are while you can.

- AC - Wednesday, May 25, 16 @ 4:54 pm:

==Illinois has the highest effective tax rate in the country==

Really?

http://www.forbes.com/pictures/emeg45efhjf/no-38illinois/

- Angry Chicagoan - Wednesday, May 25, 16 @ 6:11 pm:

If we had reelected Pat Quinn, we’d be at five percent, in surplus and continuing to catch up.

The Madigan budget essentially restores where were at, but the past two years have cost another half percent.

Much more of this and we’ll be at 5.5 percent with Rauner starvation spending levels.

Illinois had the easy option. It blew it when turkeys voted for Christmas in 2014. There’s now the awkward option presented by the speaker or the cataclysm of further delay. People still don’t seem to realize that the pension crisis is contractually obligated and therefore not escapable except by leaving the state. Let’s do something before we enter a death spiral and cause a national constitutional crisis.

- Norseman - Wednesday, May 25, 16 @ 6:30 pm:

Looks to me that Madigan is doing a little OODA looping himself.

- cgo75 - Wednesday, May 25, 16 @ 6:35 pm:

Good points angry Chicagoan. I hadn’t thought about it that way, makes total sense.

- Mama - Wednesday, May 25, 16 @ 6:43 pm:

Did the governor propose a budget for FY17? Is it balanced?

- Anonymous - Wednesday, May 25, 16 @ 6:59 pm:

==not escapable except by leaving the state.==

I am being driven out all this tax and spend. If it were not for family i would be in a low tax competently manged state.

- James Knell - Wednesday, May 25, 16 @ 7:11 pm:

Gee.. 38th is sorta like 4th except for the 33 other state between them.

- Triple fat - Wednesday, May 25, 16 @ 9:26 pm:

Anonymous - I’d say we’ll miss you but we have no idea who you are.

- Anonymous - Wednesday, May 25, 16 @ 10:30 pm:

Gentlemen and or Gentle ladies. All this goes back to just one thing. Rauner ran on the improbable platform that no tax hike was needed. He wanted it to expire. So, we are below bare bones and the state is folding. All the anti Madigan hoopla in the world does not change history. He beat Quinn using a lie. The Turn Around is just sand in the eye to cover his improbable claim. An independent, the people that got us in this mess and lied to us are MJM, JC and Gov. Quin. In 2011 they all told us we would only need to raise taxes for 4 years at 5% and our problems would be solved. This joke is on the Ill. taxpayers. The speaker and the senate president are the problem.

- Robert the 1st - Wednesday, May 25, 16 @ 10:41 pm:

I really think a lot you are wrong. Rauner doesn’t care about his political future. He doesn’t care about the backlog of bills. He’s glad the tax hike expired. He’s an ideologue… but not a conservative or necessarily a Republican one. He has a very real list of goals and re-election isn’t toward the top.