* Barring no weather deterioration, the game is still on. 5:30 at Lincoln Park.

8 Comments

|

* Press release excerpt…

In order to prevent more tragic losses of emergency responders and highway workers, Governor JB Pritzker and state lawmakers unveiled legislation Tuesday to strengthen Scott’s Law and understand how to better stop more senseless roadway fatalities.

“Scott’s Law says that drivers approaching a vehicle with their hazard lights on must slow down and move over. The legislation we’re announcing today enhances penalties for those who don’t obey the law and raises awareness for those who don’t even know Scott’s Law exists,” said Gov. JB Pritzker. “No one’s time or convenience is worth more than the lives of our state’s heroes.”

This year, Troopers Christopher Lambert, Brooke Jones-Story and Gerald Ellis paid the ultimate sacrifice while serving in the line of duty. The law was initially passed in memory of Lieutenant Scott Gillen.

The proposal is addressed with two separate pieces of legislation. The first, SB 1862, takes several steps to strengthen Scott’s Law:

Expands Scott’s Law protections to include a stationary authorized vehicle with oscillating lights, first responders, IDOT workers, law enforcement officers and any individual authorized to be on the highway within the scope of their employment or job duties;

Increases the minimum fine to $250 for a first violation of Scott’s Law and to $750 for a second or subsequent violation;

Adds $250 assessment fee for any violation of Scott’s Law to be deposited into a new dedicated fund to produce driver education materials, called the Scott’s Law Fund;

Increases criminal penalty to a Class A misdemeanor, punishable by up to one year in jail, if violation results in damage to another vehicle or a Class 4 felony, punishable by up to one to three years in prison, if violation results in an injury or death of another person;

Amends the Criminal Code of 2012 to include firefighter and emergency medical service personnel while acting within the scope of their official duties;

Adds aggravating factors to reckless homicide charges if Scott’s Law was violated;

Requires the Secretary of State to include written question on Scott’s Law in driver’s license test.

The second piece of legislation, SB 2038, creates a Move Over Task Force to study the issue of violations of Scott’s Law, disabled vehicle law, and stationary authorized emergency vehicle law, with attention to the causes of the violations and ways to protect law enforcement and emergency responders. […]

Members of the Task Force must serve without compensation and must meet no fewer than three times. Additionally, the Task Force must present its report and recommendations to the General Assembly no later than January 1, 2020.

“Enough is enough. Three first responders have lost their lives while working on our roadways this year, and we’re cracking down on reckless drivers to prevent more senseless tragedies,” said Rep. Marcus C. Evans, the chief House sponsor of the package of legislation. “This legislation will keep our brave public servants safe and save lives.”

“As a former police officer, I know the life-threatening situations facing law enforcement every day, and I’m proud this legislation will protect and serve our brave men and women in uniform,” said Sen. Tony Munoz, the chief Senate sponsor of the package of legislation. “We can’t afford to lose any more lives, so I implore all drivers to slow down and move over when you see first responders on the roads.”

“This legislation is one way we’re working to protect the protectors,” said Rep. John Cabello. “Too many first responders have paid the ultimate price, and we are honoring their legacy by preventing even more tragic losses among our state’s heroes.”

“As Moline firefighter and paramedic, keeping our first responders safe is a deeply personal mission for me,” said Sen. Neil Anderson. “To the public servants that work on our roadways, know that we’re doing all we can to keep you safe and ensure you can return home to your families. You deserve nothing less.”

The legislation will be introduced by Rep. Marcus C. Evans Jr. (D-Chicago) and Sen. Tony Munoz (D-Chicago) and will be co-sponsored by Sen. Neil Anderson (R- Andalusia) and Reps. Tim Butler (R-Springfield), John Cabello (R-Machesney Park) and Jay Hoffman (D-Swansea).

Thoughts?

22 Comments

|

Question of the day

Tuesday, May 14, 2019 - Posted by Rich Miller

* Fran Spielman…

Mayor Rahm Emanuel has privately told associates that, if anything in Chicago is ever named after him, he would love it to be the Riverwalk, the embodiment of his vision to create a “second waterfront.”

On Monday, the retiring mayor added to the case for renaming it the Rahm Emanuel Riverwalk.

With just one week to go before he leaves office, Emanuel proudly showcased a newly-transformed “Riverwalk East” from Michigan Avenue to Lake Shore Drive paid for with $12 million from a general obligation bond issue.

The investment includes: 10,000 square feet of recreational spaces; 94 new LED “dark sky compliant” light fixtures; three public restrooms; roughly 150 new tree plantings from 35 different species and public seating for 500.

* The Question: What Chicago landmark would you name for Rahm Emanuel and what would you call it? Keep it clean, please.

36 Comments

|

Our opinion leaders

Tuesday, May 14, 2019 - Posted by Rich Miller

* This Daily Herald editorial comically misidentifies Illinois Department of Revenue Director David Harris as House Majority Leader Greg Harris. The reason it’s so funny is because former Rep. David Harris represented Arlington Heights in the House, and that’s where the paper is based…

House Majority Leader Greg Harris told lawmakers in a letter last week that state government collected 38 percent more from taxpayers in April than it did a year ago. We shudder a little to think about what Gov. J.B. Pritzker might have proposed if he had known before his February budget address that Illinois would collect $4 billion from taxpayers in April, instead of the $2.5 billion or so that was expected.

But with the tax windfall in hand now, the state has a perfect opportunity to focus on the much-troubled control side of Pritzker’s budget rather than the robust spending side. And the chief target of that attention must be the governor’s ill-advised proposal to take a so-called “holiday” from making required pension payments. The surplus announced last week will more than cover the $800 million Pritzker was planning to get by avoiding the pension payments, and that must be the first priority for its use. […]

The governor, who Harris reportedly said leans toward using the surplus to avoid the pension holiday […]

The $1.5 billion tax surplus eliminates any need to succumb to that temptation and leaves hundreds of millions for another systemic issue facing the state — its $650 million backlog of late bill payments.

Just to be sure, I checked with Leader Harris and he said he sent no such letter.

People make mistakes. No biggie. But editorials are supposedly written or at least approved by an editorial board. That would be multiple people.

And there are more problems with this editorial than getting a name wrong.

1) Director Harris didn’t “reportedly” say anything. He said the governor was recommending that the state use the increased revenue projections from Fiscal Year 2020 to pay the full statutory pension payment. I mean, it’s right here in black and, um, tan (or whatever color my website is).

2) The editorial board is apparently confused about the $800 million number. That’s the additional projected revenue increase for next fiscal year. Pritzker was planning to skip $900 million or so in pension payments, which is higher than the revenue spike, not lower, so something else will have to be cut or more revenues will have to be found.

3) A “$650 million backlog of late bill payments” would be great. The actual backlog is currently $5.9 billion. That’s lower than expected, but still high. Instead, the unexpected $1.5 billion April spike will be used to “address most of the $1.6 billion shortfall in the enacted FY19 budget.”

Maybe if the paper hadn’t closed its Statehouse bureau it would have somebody to call before writing stuff like this. Or maybe they could just use the Google. Or Bing. Whatever floats your boat.

13 Comments

|

* Last year…

On January 30, the U.S. federal court overseeing Puerto Rico’s debt restructuring issued a ruling that may weaken the legal support for a subset of municipal securities known as “special revenue” bonds. In general, special revenue bonds are those backed by utility revenues, dedicated taxes or other dedicated payments and issued by a Chapter 9-eligible entity like a city, school district or special district government. Special revenue bonds often receive superior treatment to other bonds in Chapter 9 bankruptcy.

The ruling surprised many market participants, and in our view it is the first decision stemming from Puerto Rico’s insolvency that has meaningful implications for mainland credit quality. While the near-term impact of the decision is likely to be modest, it could have long-term implications. Currently, few special revenue issuers exhibit credit stress, and the decision may be overturned on appeal. However, special revenue bonds may constitute up to 35 percent of the $3.8 trillion municipal bond market. If the ruling proves lasting, it could trigger ratings downgrades, alter municipal investment strategy at some firms and compel legislative fixes, among other actions.

* Last month…

The U.S. Court of Appeals for the First Circuit has affirmed a controversial ruling regarding the treatment of municipal revenue debt, leaving investors with lingering questions about the value and significance of a revenue pledge in a municipal bankruptcy.

The original U.S. District Court decision roiled the municipal markets in January 2018, when Judge Laura Taylor Swain, the judge overseeing Puerto Rico’s debt restructuring, ruled that municipal debtors were permitted, but not required, to apply special revenues to pay related bonds. Judge Swain’s ruling reversed long-held conventional wisdom regarding the mandatory application of special revenues following municipal bankruptcy. […]

Although the First Circuit’s ruling covers only Maine, Massachusetts, New Hampshire, Puerto Rico and Rhode Island, commentators and rating agencies have expressed concern that the ruling will have a broader impact on holders of municipal revenue debt, particularly given the relative scarcity of case law interpreting issues of municipal bankruptcy. The First Circuit’s affirmation raises serious concerns about the value of a municipal revenue pledge and creditors’ ability to enforce any lien on such revenues post-bankruptcy or to otherwise protect the revenue stream.

* Last week…

Moody’s Investors Service has placed the Aa3 rating of the Illinois State Toll Highway Authority (ISTHA) under review for downgrade. ISTHA has approximately $6.1 billion of bonds outstanding.

RATINGS RATIONALE

The rating action is driven by the recent US Court of Appeals for the 1st Circuit ruling related to the Puerto Rico Highways and Transportation Authority (PRHTA) bonds, which calls into question the strength of credit separations between a general government and its enterprises and component units. The review will consider economic, governance, and financial interdependencies between ISTHA and the State of Illinois (Baa3 Stable) and the extent that, in light of the afore-mentioned court ruling, and such interdependencies pose risks to ISTHA that could have an impact on its credit quality.

On March 26th, the US Court of Appeals for the 1st Circuit ruled that the Commonwealth of Puerto Rico is not required to pay “special revenue” debt service on PRHTA bonds (C Negative Outlook) during the pendency of bankruptcy-like proceedings. While the Court’s jurisdiction is only the Commonwealth and those states that are within the 1st Circuit (which does not include Illinois), no appellate-level court has addressed the issue of whether pledged special revenues must be paid to bondholders in a municipal bankruptcy or restructuring process until now. In other municipal bankruptcies, utility and other enterprise revenue bonds have offered extremely high recoveries when associated with general government insolvencies, though they have not always been immune from impairment despite falling under the “special revenue” pledge.

Moody’s notes that ISTHA has both authorizing legislation which states that excess revenues in the system reserve account can only be used for tollway purposes and a master indenture with a closed flow of funds. The state also passed a ballot initiative for a transportation lock box within its constitution in November 2016 with nearly 80% voter support, precluding transportation funds from being used for non- transportation uses. Taken together, this had provided sufficient independence to support the wide differential to the state’s rating. During the review period, Moody’s will determine the degree to which the authority’s rating should have a closer linkage to the rating of the state given the 1st Circuit ruling and what it may mean to the relationship between municipal governments with materially higher rated enterprises. The range of potential outcomes include a downgrade of the ISTHA’s credit which may be one or more notches to stabilizing the outlook at the current rating level.

FACTORS THAT COULD LEAD TO AN UPGRADE

- Reversal of the ruling by the US Court of Appeals on PRHTA bonds would be supportive of the current rating

- Reduced uncertainty with respect to the breadth of legal implications for special revenue pledges stemming from the 1st Circuit ruling and greater demonstrated independence of ISTHA from the state

FACTORS THAT COULD LEAD TO A DOWNGRADE

- Continued uncertainty with respect to the breadth of legal implications for special revenue pledges stemming from the 1st Circuit ruling

- Attempts by the state to divert ISTHA funds to non-authority purposes

- Deterioration of the state rating

- Traffic and revenues fall short of current projections and DSCRs fall below forecasted levels consistently below two times

This looks like a serious over-reaction by Moody’s. I mean, Illinois can’t declare bankruptcy. We’re a state not a territory.

…Adding… Illinois Tollway…

The Illinois Tollway is a world-class system with quality roadways and facilities and projected revenue of $1.5 billion in fiscal year 2019. While we appreciate Moody’s role in providing credit ratings, its review is predicated on a legal case in Puerto Rico that bears little if any resemblance to the Tollway’s situation. This is a promising time for the State of Illinois with an administration that has made fiscal stability a priority. We look forward to working with the administration to continue to provide a quality experience to all we serve.

* Meanwhile, a bit of good news…

State universities finally are getting a bit of good news from Wall Street—largely due to the state’s improved fiscal situation.

In a series of announcements Monday evening, Moody’s Investors Service said it has adjusted upward from negative to neutral its outlook on debt issued by Eastern, Northern, Northeastern and Southern Illinois universities, as well as Governors State University and Illinois State University.

Eastern, Southern and Illinois State also received even better news, as Moody’s actually raised its ratings on a type of debt known as certificates of participation and, in Eastern’s and Illinois State’s case, some bonds.

The actions at a minimum mean none of the schools now is in imminent danger of a downgrade, something that has been the case since ex-Gov. Bruce Rauner and state lawmakers engaged in a two-year budget feud. The actions also suggest that the schools will pay less interest than they might have should they borrow again.

…Adding… Good point from a reader…

Now here is a question for Moody’s, as my blood pressure rises. What is so different about the ‘special revenue’ standing of the state’s tollway versus the state’s universities regarding “materially higher-rated enterprises?” U of I is rated one notch lower than the toll road, so why is it, for example, not under the same scrutiny? Do they even think before they release this stuff???

…Adding… Bond Buyer…

Illinois paper is gaining ground due to scant supply and a hunger for yield combined with recent fiscal developments that should help the state hold on to its investment grade rating in the near term.

Investor appeal has driven a narrowing of state spreads that remain the highest among states. They fluctuate in tandem with market appetites and state fiscal developments that stand to influence its weak ratings that are just one to two notches above junk. […]

“Presumably yield-hungry investors feel that the sixth-largest state (in terms of population) has an appealing spread that might tighten should its tax structure change,” MMD senior market strategist Dan Berger wrote in a column Friday.

19 Comments

|

The other side of the cigarette tax hike coin

Tuesday, May 14, 2019 - Posted by Rich Miller

* I quit smoking cigarettes years ago because my doctors told me cigarettes almost killed me. Not a fan. But Zorn makes a good point here about Senate President John Cullerton’s proposal to raise cigarette taxes by a dollar a pack, a plan also now supported by Gov. Pritzker…

According to statistics compiled by the U.S. Centers for Disease Control and Prevention, those with annual household income less than $35,000 are nearly three times more likely to smoke than those in households that earn more than $100,000.

Overall, 14 percent of adults smoke. But only about 7 percent of those with a college degree light up regularly, compared to 23 percent of those without a high school diploma.

Among those with private insurance, 10.5 percent smoke, compared to 24.7 percent of the uninsured. And 35.2 percent of those suffering from “serious psychological distress” are smokers, according to the CDC. […]

Piling on them is a particularly regressive way to fund state government.

Discuss.

59 Comments

|

* WBEZ…

Parents and advocates gathered downtown Monday to call on Illinois Senate President John Cullerton to vote on a bill that would make Chicago’s school board elected rather than appointed, but Cullerton’s office says he’s holding the bill at the request of Mayor-elect Lori Lightfoot.

Lightfoot supports an elected school board but expressed deep reservations about the bill pending in the State House, calling the large board called for in the legislation a “recipe for disaster.” She did not respond to WBEZ’s request for comment on Monday.

That bill, which would create a 21-member board, passed the House in early April. Since then, advocates have been demanding a Senate vote before the legislative session ends May 31.

“For years, the people of Chicago have been fighting for an elected school board,” said Karina Martinez, a member of the Brighton Park Neighborhood Council. “Yet, here I am standing three years later, still demanding and still waiting for an elected school board in the city.”

* Sun-Times…

In an interview with WBEZ, Lightfoot said she was familiar with Martwick’s bill, but did not think a board of 20 members and a president was a good idea.

Martwick told the gathering Monday: “With 20 of them, now you have an opportunity for every group to be represented at the table, and you put more of an emphasis on grassroots organizing and you limit the influence of outside money. This structure will work. … It has been heavily vetted over the course of the last 3 1/2 years by the House of Representatives and it has passed three times with overwhelming majorities.”

The activists urged Lightfoot to push for an elected school board and for Cullerton to get the bill moving in the Senate. But John Patterson, Cullerton’s spokesman, confirmed that Lightfoot asked the Senate president to hold the measure so she could look into the issue.

Under Martwick’s proposal, the board would be comprised of 20 members elected in individual districts from around the city, compared to the seven appointed members currently on the Chicago Board of Education. And a board president would be elected citywide.

* Chalkbeat…

The measure passed the Illinois House in April but has yet to make its way through the state Senate amid Lightfoot’s reticence, according to the office of State Senate President John Cullerton.

“The mayor-elect did ask the Senate president to hold onto the bill so she can look into the issue more, so that’s the current status of the bill,” Cullerton’s spokesman, John Patterson, said Monday evening. […]

As for the timing, [Jeanette Taylor, alderman-elect in the 20th Ward] acknowledged that Lightfoot might need some time to weigh all these issues and others. However, dragging her feet could hold consequences for the mayor-elect, Taylor warned.

“She has four years in her term like everybody else,” Taylor said. “Chicago will make her answer.”

One of the reasons Lightfoot traveled to Springfield was to put a brick on Martwick’s bill (among others). She probably could’ve done that with a phone call or a meeting in Chicago, but it was a good idea to make the trip anyway.

…Adding… It’s important to remember that Rep. Martwick’s bill doesn’t take effect until 2023. That’s four years from now. There’s no reason that it absolutely must pass this month, just a few days after Lightfoot is sworn in. People really need to take a breath here.

29 Comments

|

#Taxsplaining

Tuesday, May 14, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

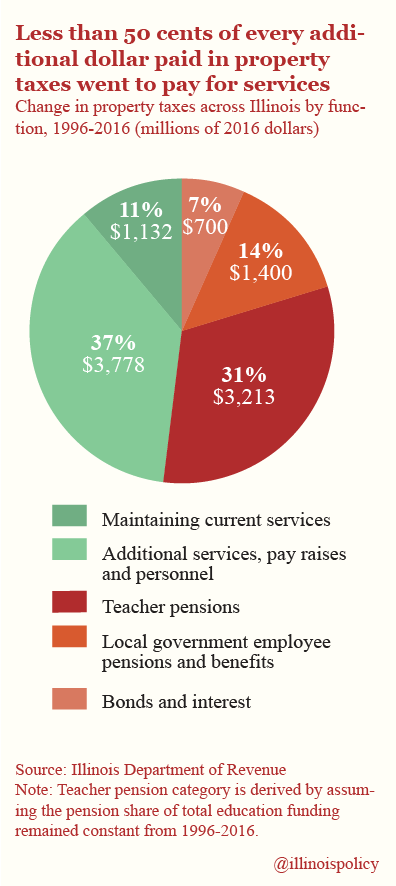

Discussion of Gov. J.B. Pritzker’s progressive income tax amendment has turned to the largest tax Illinoisans pay: property taxes.

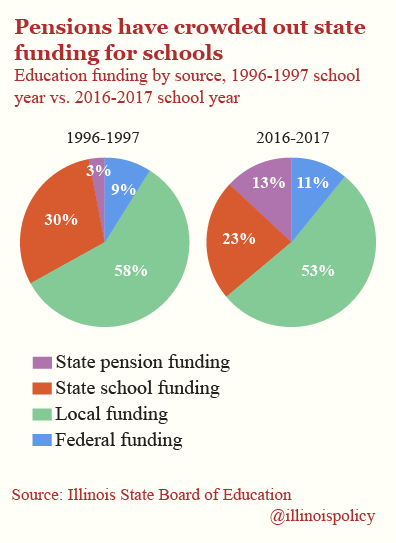

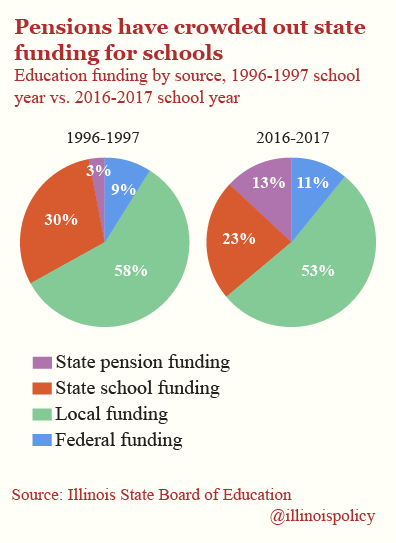

Illinoisans’ property tax burdens in 1996 hovered around the national average. By 2016, they had skyrocketed to among the highest in the nation. It’s true that state funding for schools explains much of residents’ high property tax burden, but the key question to consider is: Where is that money going?

Illinois state government actually contributes a larger share of funding toward public schools today than it did 20 years ago, when factoring in pension spending. The problem is that pensions now take up more than a third of the state’s contribution to education, compared with just over 8% in the 1996 school year.

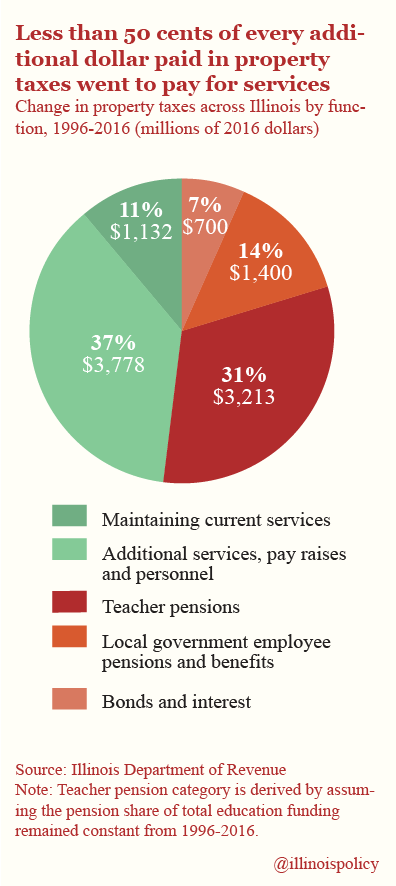

This explains why from 1996-2016, Illinoisans saw less than 50 cents of every additional property tax dollar go toward services. The primary drivers of the rise in property tax bills were pensions, other benefits and debt.

Any promises of property tax relief without pension reform are illusory.

If state lawmakers don’t address this core cost driver, they’ll face continued pressured to enact income tax hikes that do little to solve the problem.

Comments Off

|

Cannabis roundup

Tuesday, May 14, 2019 - Posted by Rich Miller

* Dean Olsen at the SJ-R…

A key component of a bill that would legalize possession and sale of marijuana for recreational use in Illinois — erasing pot-related convictions for potentially hundreds of thousands of people — may violate the state Constitution, according to the group representing county prosecutors statewide.

The bill essentially would create legislative pardons, which are illegal, said Robert Berlin, president of the Illinois State’s Attorneys Association.

Under the Illinois Constitution, only the governor can issue pardons, Berlin, the DuPage County state’s attorney, told The State Journal-Register. […]

[Rep. Kelly Cassidy, D-Chicago] said automatic expungements provided for in the bill would affect only past convictions.

However, the bill’s section on “future offenses” says circuit court clerks, arresting agencies and the Illinois State Police “shall expunge” twice a year the records of people found to have committed the outlined offenses as long as the cases have been closed.

Some law enforcement officials have questioned whether the bill is attempting a back-door revision of Illinois criminal law by providing for expungement of convictions for crimes that remain on the books.

I’m told the expungement section has been changed countless times and will likely be changed again. One tactic often used by opponents is to nitpick everything they possibly can. Remain calm.

Lots more in that story, by the way, so try to read the whole thing.

…Adding… Rep. Cassidy…

Expungement is a critical part of this. We’ve always said that the language about how this gets done is a work in progress. We have been talking to the prosecutors & law enforcement from Day One. It would be more productive to stay at the table and discuss process than to do this. One thing we’re finding is that some folks are just against expungement but need a fig leaf – any fig leaf – to hide their objection to the idea.

Agreed on that last sentence.

* Meanwhile, we’ve already talked about the very real possibility that home grow will be limited only to medical cannabis patients. The Trib talked to NORML’s guy…

The executive director of the longtime cannabis activist group Illinois NORML, Dan Linn, said he would have to consult with his advisory board on how to react to such a change.

“We’d have to look at whether we’re still able to support the legislation,” he said.

NORML did support the legalization of marijuana in the state of Washington, which prohibits homegrown pot for the general population, but many other states do allow homegrown, Linn said.

“People say to pass the best bill you can and come back later to try and make it better,” Linn said. “But we’ve had significant problems with the (existing) medical cannabis program that we still have not been able to fix.”

Vigorous advocacy is a good thing. It helps keep the stakeholders honest. But, in the end, it comes down to 60-30-signature. Remember the lessons of the past four years.

* Where’s the money going?…

After regulatory costs are covered, 25 percent of proceeds from taxes and other revenue generated from recreational marijuana would be deposited in an account dubbed the Restoring Our Communities fund, a new pot of money that would provide grants aimed at reducing violence, particularly gun violence, and increasing economic development in communities ravaged by violence, poverty and high incarceration rates. A board including legislators, former inmates, experts in violence reduction, members of community groups, officials with several state agencies and representatives from the governor’s office and attorney general’s office would decide how the money is spent.

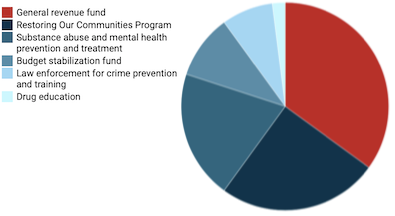

In addition to money for the new fund, 35 percent of recreational pot revenue would go to the state general fund, 20 percent would be allocated for substance abuse and mental health treatment, 10 percent would go toward paying the state’s overdue bills, 8 percent would be sent to the state Law Enforcement Standards and Training Board and 2 percent would be spent on drug education and substance abuse awareness.

Pie chart…

* Related…

* Not too long ago, a marijuana supplier was a drug dealer. Now it’s a ‘creditworthy tenant,’ as Chicago weed companies grow: At least half a dozen marijuana companies in Chicago have moved or expanded their headquarters in the past several months. Some doubled their space or more. A couple moved downtown from the suburbs, a tactic deployed by companies in many industries to better woo talent.

* McLean County Sheriff Says No To Recreational Cannabis Bill, Home Growing

57 Comments

|

* Lynn Sweet…

Someone is paying for a poll to test how former state Sen. Jeanne Ives, R-Wheaton, would do against freshman Rep. Sean Casten, D-Ill., who represents the swing suburban sixth congressional district.

Ives, a conservative, almost defeated former Gov. Bruce Rauner and Lt. Gov. Evelyn Sanguinetti in the March, 2018 GOP primary, with Rauner struggling to attract Republicans while also keeping a distance from President Donald Trump.

In April, Sanguinetti announced a March, 2020 GOP primary bid in the sixth. […]

Ives was asked, “Are you interested or thinking about running for Congress in the 6th district?” and she replied, “We’ve you know, this for me it’s always been a team decision. I don’t do anything without my team supporting it and we’ve not made a decision on any race at all.”

Asked about the origins of the survey, she said, “You know, I don’t control that,” adding that she was one of the people getting a call from the polling firm.

An Ives run has long been expected by several folks in the area.

* Somebody tweeted at me about the poll the other day…

* DCCC…

“Whether it’s Evelyn Sanguinetti or Jeanne Ives, it’s clear that Republicans will be running a rubber stamp in the 6th District for President Trump’s disastrous agenda of higher health care costs and higher taxes,” said DCCC spokesperson Mike Gwin. “Illinoisans want someone like Sean Casten who will stand up to President Trump when he hurts Illinois and threatens our values – not someone like Sanguinetti or Ives who will back him every step of the way.”

President Trump lost the 6th CD by 7 points in 2016. This is a formerly reliable GOP bastion, but it’s now a swing district for the near-term at least. Casten won by 7 points last year and Gov. Bruce Rauner won by 5. Rauner won by 33 points four years earlier. Obama lost it by 8 in 2012.

* Related…

* Former Illinois congressman Bobby Schilling eyeing run in Iowa’s 2nd District

33 Comments

|

* GateHouse is such an awful company…

* Bruce Rushton with the story…

The entire State Journal-Register newsroom walked out today in support of now former editor Angie Muhs, who was walked out of the building this afternoon by the paper’s general manager after submitting her resignation on Friday.

In an impromptu show of solidarity, the staff accompanied Muhs as she left the building for the final time. “Everyone walked out with her as a show of respect,” reporter Dean Olsen said. “We all gave her a hug and applauded for her and thanked her for the stand that she was taking. … People are crying.”

Olsen said Muhs told her staff on Friday that she was leaving partly in hopes of avoiding more layoffs at a paper that has been decimated by staff cuts. “I think her hope was, by not having her salary to pay, her hope would be that there would be no layoffs,” said Olsen, who wasn’t present when Muhs announced her departure last week. “She was a very good editor, and she tried to promote good journalism in Springfield, despite some pretty trying circumstances that she had to deal with from GateHouse Media (the paper’s corporate owner).”

Muhs declined to say what she told her staff, but she said she wasn’t expecting colleagues to walk out of the building with her. “I was very touched,” Muhs said. “I didn’t expect that. … I have tremendous respect and admiration for the State Journal-Register staff. They’re dedicated. They’re hard working. They care about doing quality local journalism, and they persevered under some really tough conditions.”

Muhs lasted five years as editor of the State Journal-Register, coming to Springfield from a media company in Maine. For the second year in a row, the SJ-R this spring was named GateHouse Newspaper of the Year for its circulation division. In 2017, Muhs was named Editor of the Year in the SJ-R’s circulation division in a company-wide contest. GateHouse Media, which bought the SJ-R in 2007 and promised “hyperlocal” coverage, publishes more than 150 daily papers and is one of the nation’s biggest newspaper companies.

The paper is down to five news reporters. Ownership laid off the longtime photo editor a couple of weeks ago.

…Adding… The company makes money, it just spends it on the top dogs…

The company’s stock price is down 30 percent since February.

42 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|