It’s just a bill

Tuesday, May 28, 2019 - Posted by Rich Miller

* Capitol News Illinois…

An amendment to a controversial bill to overhaul the state’s Firearm Owner’s Identification Act has a smaller increase in the cost of applications and card renewals but remains firm on proposed fingerprint requirements.

Under the most recent proposal, both new applications for FOID cards and five-year card renewals would cost $20. That price was lowered from the $50 proposed fees in a previous amendment. The current cost for FOID applications and card renewals is $10.

The new amendment also places a cap of $30 on the price vendors can charge to carry out FOID fingerprinting, something that is not now required but would be if the legislation is passed. […]

Todd Vandermyde, on behalf of the Federal Firearms Licensees of Illinois, opposed the bill’s price cap on fingerprinting. He said the average cost for fingerprinting on concealed carry licenses is $65 — more than double the proposed fee for FOID cards — but that fee is still too low for private vendors to continue offering the fingerprinting services.

Vandermyde said another problem with the bill is that it will be difficult, especially for those living in rural areas, to travel to one of the 109 locations approved for fingerprinting by the Illinois Department of Financial and Professional Regulation.

Opponents are threatening a legal challenge should this become law.

* Meanwhile…

The Illinois Secretary of State can suspend your driver’s license over 10 unpaid parking tickets or five unpaid speeding tickets, but lawmakers at the Illinois Capitol are looking to change that.

They want to stop license suspensions over unpaid tickets and fines. State Rep. Carol Ammons, D-Urbana, is driving the plan in the House.

“This legislation is critical legislation that is in line with the national movement to end the practice of suspending driver’s licenses for unpaid fees,” Ammons told reporters at a news conference Tuesday. “In essence, we want to stop the practice of saddling poor people with debt.”

Ammons said it’s easy for a $75 ticket to grow to thousands of dollars.

* Related…

* Illinois rank-and-file lawmakers express frustration over passage of major bills during holiday rush: House Democrats spokesman Steve Brown said the complaints lacked merit. He said the schedule had been out for six months and that “the whining is increasingly lame.”

* Measure to exempt college athletics employees from severance pay caps heads to governor: The existing law ends severance for executives fired for misconduct and limits severance packages to 20 weeks’ salary for others. The pending proposal would exempt from that provision any college athletic department employees who are paid through non-state-appropriated funds.

* Editorial: Governor, sign these good government bills

43 Comments

|

Question of the day

Tuesday, May 28, 2019 - Posted by Rich Miller

* From May 18…

An 87-year-old man crashed his car into the outer brick wall surrounding the Illinois Governor’s Mansion on Friday night. […]

There were no injuries and no citations were issued, according to the Illinois State Police.

Thank goodness nobody was hurt.

* This was sent by a reader today…

* The Question: Caption?

47 Comments

|

RHA bill clears House 64-50-4

Tuesday, May 28, 2019 - Posted by Rich Miller

* Democrats voting “No” included Reps. Bristow, Hoffman, Reitz, Scherer, Walsh and Yednock. Democratic Reps. Kelly Burke, Hurley, Jones and Kalish voted “Present”…

I’ll post react on our live coverage post. Click here. The full legislation is here.

* Also, just because a bill didn’t move at a specific time doesn’t mean the votes aren’t there to pass it, which is why I didn’t post this story earlier today…

It is unclear whether Democrats have enough support in the Illinois House to pass an abortion repeal-and-replace measure. The bill was not called for an expected vote Monday in that chamber. […]

The legislation Cassidy filed Sunday was amended to reflect concerns brought by lawmakers, insurance groups, health care groups and others.

“I do believe that we’ve responded and created that level of comfort for enough of my colleagues that we’re ready to move forward,” Cassidy said Sunday before the panel of legislators met to debate the act.

Demand for action on the bill came after states across the country, including Ohio, Alabama, Missouri and Georgia, passed laws restricting access to abortion. Some of those states did so in the hopes of challenging the 1973 case Roe v. Wade, which legalized abortion across the country.

…Adding… Sun-Times…

The measure would repeal the state’s current abortion law, adopted in 1975. In its place would be language in which certain elements are removed, such as: spousal consent; criminal penalties for doctors who perform abortions; waiting periods; and other restrictions on facilities where abortions are performed. The updated legislation, which passed a House committee on Sunday, also clarifies the definitions of viability and health. […]

The Reproductive Health Act also includes language that treats abortion as health care.

Many provisions of the state’s 1975 abortion law have been enjoined by the courts, including criminal penalties for doctors who offered abortion care. The new law also repeals the Partial Birth Abortion ban, which imposed restrictions on doctors performing abortions on women who were 20 weeks pregnant or later. The ACLU says about 90 percent of all abortions are performed within the first 13 weeks of pregnancy.

Partial-birth abortions remain banned by federal law, except to save the life of the mother. The new measure does not change factors around partial birth abortions, Cassidy said.

Cassidy told lawmakers claims that doctors can perform abortions at any stage of the pregnancy are “medically and factually incorrect.” It allows for doctors to make their own professional decision if a patient’s health is at risk, which is already in current state law.

57 Comments

|

It Is Time To #PasstheRHA

Tuesday, May 28, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

The women of Illinois are waiting.

They’re waiting for lawmakers in Springfield to show that they fully support women’s reproductive rights, free of meddling interference from government.

They’re waiting, and watching, as conservative legislators elsewhere target Roe v. Wade with draconian anti-abortion laws passed by conservative lawmakers who hope to someday get rid of Roe v. Wade.

Some of those laws ban abortions even in cases of rape or incest. Others allow women or their doctors to be prosecuted for undergoing or performing abortions.

Illinois is solidly pro-choice, but we must ensure protections for future generations of women. Should one of those medieval laws land before a conservative Supreme Court that is eager to overturn Roe, it would threaten abortion rights here and elsewhere.

Lawmakers in Illinois need not allow that chance.

They can safeguard the reproductive rights of women in Illinois by moving quickly to pass… the Reproductive Health Act. The bill would keep abortion and reproductive care safe and accessible by repealing decades-old laws that restrict, and in some cases criminalize, abortion.

Chicago Sun Times editorial board

May 21, 2019

For more information on #PasstheRHA click here.

Comments Off

|

Capital bill roundup

Tuesday, May 28, 2019 - Posted by Rich Miller

* I would never advise waiting on DC to do anything. Ever…

A group of Republican state Representatives said Tuesday that Illinois should wait for the federal government to get an infrastructure plan before increasing taxes on Illinoisans to pay for a statewide infrastructure plan. […]

Skillicorn said Illinois should wait for the federal government to get a $2 trillion plan, which he estimates could bring $400 billion for the state. Despite the Trump administration butting heads with House Democrats in Washington D.C., Skillicorn said he trusts the president to get it done and encouraged Illinois to urge its congressional delegation to “do their jobs and to deliver the resources that we need.”

“If we move forward with this now, how can we go to Washington D.C. and say ‘we absolutely need every dollar we can?’” Skillicorn said. “We can’t say that because we moved ahead without them.”

* SJ-R counterpoint…

There is little hope that a federal infrastructure bill might provide some funding anytime soon. It should be easy pass — it would create better infrastructure while also promising jobs and an economic boost — but it’s become one more political football for Democrats and Republicans to fight over. It would be easier for Illinois leaders if they knew what the feds might do, especially because an increase in the federal gasoline tax is probably a given if Congress approves a plan, too. But it seems unlikely that the Washington politicians will come to an agreement on this issue anytime soon. Our roads, bridges and buildings needed attention last year (or five or 10 years ago in many cases). Illinois cannot wait.

* Let’s hope not…

Pritzker’s capital spending plan, which he calls “Rebuild Illinois,” calls for $41.5 billion in infrastructure spending over six years, along with doubling the state’s motor fuel tax, along with other possible increases. [Rep. Jeff Keicher, R-Sycamore] said the capital plan could be the subject of a special session this summer.

* Media advisory…

Citing job creation, economic growth and much-needed new revenue, the Illinois AFL-CIO, representing more than 1.5 million people from union households, supports the effort of the General Assembly and Gov. JB Pritzker to get a gaming/casino expansion bill done by the end of the week.

With gaming negotiations ongoing, Illinois AFL-CIO President Michael T. Carrigan said the return value of getting gaming done makes it an urgent matter. Representatives from labor will discuss the importance of gaming expansion at a news conference scheduled for 12:30 p.m. Tuesday at the Capitol.

Labor Support for Gaming Expansion

12:30 p.m. Tuesday, May 28

Statehouse Press Room (Blue Room), Springfield

Participants:

· Michael Carrigan – President, Illinois AFL-CIO

· Alan Golden – Business Manager IBEW Local 364, Rockford

· Michael Macellaio – Secretary-Treasurer, Chicago & Cook County Building & Construction Trades

· State Sen. Antonio Munoz (D-Chicago), Assistant Majority Leader

· State Sen. Terry Link (D-Vernon Hills), Assistant Majority Leader

· State Rep. Robert Rita (D-Blue Island)

17 Comments

|

* Daily Herald…

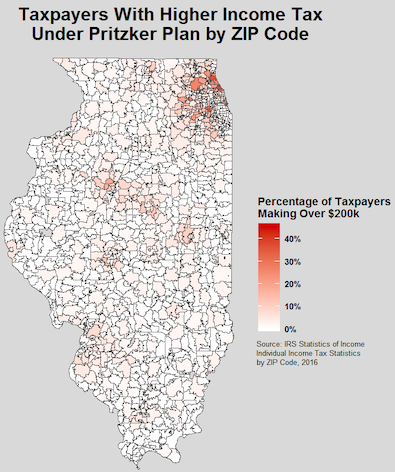

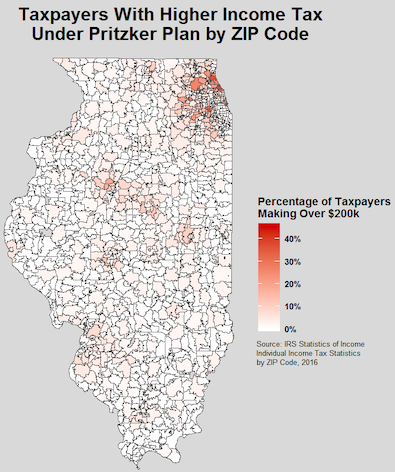

Chicago and the suburbs contribute three-quarters of all income tax revenue collected by the state, and that would increase under a proposed graduated tax.

That’s because 85% of tax filers who would pay higher rates under the two graduated tax proposals live in Chicago and the suburbs, according to a Daily Herald analysis of Illinois Department of Revenue income tax data. […]

Of the 18 Illinois ZIP codes where the average income is high enough to trigger a higher tax rate, 15 are in Chicago and the suburbs. […]

Communities where the average income tops $250,000 are Glencoe, Golf, Highland Park, Kenilworth, Lake Forest, Oak Brook and Winnetka, the analysis of reported income in the state’s 1,450 ZIP codes shows. Some neighborhoods in Chicago and Hinsdale also have average incomes of $250,000 or higher. […]

All of the state’s 13 billionaires live in Chicago and the suburbs, according to a 2018 Forbes magazine report.

Downstate has about 35 percent of the state’s population, but just 15 percent of the pool of taxpayers who would face a tax hike under the current proposal.

* Keep in mind that this Center for Illinois Politics heat map is for taxpayers who make at least $200,000, so some of them will not face higher taxation…

41 Comments

|

Sports betting roundup

Tuesday, May 28, 2019 - Posted by Rich Miller

* Sun-Times…

Also on Friday, state Sen. Emil Jones III, D-Chicago, was among several legislators to send Pritzker and the legislative leaders a letter arguing the sports betting and gaming expansion bills don’t have “any meaningful provision or requirement for minority participation.”

“As our leaders, we look to you to see to it that everyone gets a seat at the table,” the letter says. “Unless the sports betting and gaming legislation includes provisions with some real teeth to ensure minority participation, we are not going to support it and cannot vote for it.”

As I told subscribers the other day, that letter was circulated by a contract lobbyist for Rivers Casino Chairman Neil Bluhm. Bluhm, you will recall, has been attempting to block the fantasy sports companies from entering the online sports betting marketplace for three years. Bluhm’s lobbyist flatly denied any connection between his work for Bluhm and the letter (he has worked for the Black Caucus Foundation in the past).

* But…

State Rep. Bob Rita, a Democrat from Blue Island, who has been leading casino expansion negotiations, said that has been taken into consideration.

“Working through all of the different issues, we’ve always had language that pertain to the minority participation, from day one in whatever versions we have been filing throughout the years,” he said.

* Meanwhile…

[Rep. Mike Zalewski] was pushing for a “penalty box” on FanDuel and DraftKings, due to allegedly pushing their daily fantasy sports offerings illegally in the state. This would see them not being able to offer sports betting in Illinois for a total of three years. […]

As part of the amended bill, Zalewski is trying to now have all online sports betting being part of a penalty box. This would mean that there would be no online sports betting inside of 540 days [18 months] of the bill passage. […]

For casinos and racetracks, there would be 26 licenses up for grabs. These would cost $5m each, or they would pay 5% of their adjusted gross receipts. Those operating online would pay $25m for one of the two available licenses.

Sports facilities could pay $10m to obtain one of the seven available licenses. Finally, lottery retailers could obtain a license, with a central provider having to pay a license fee of $20m.

Each of these licenses would be valid for five years. The renewal cost would then be only $1m going forward.

* Other stuff…

* House Democrats plan link casino expansion to sports betting

* Riverboat Casinos Could Be Allowed in Rockford if Illinois Lawmakers Pass “Omnibus” Gambling Bill

12 Comments

|

[The following is a paid advertisement.]

When your car breaks down or the furnace stops bringing the heat, paying for repairs can cause a serious strain on family finances in addition to emotional stress. Credit unions are a trusted ally who will guide you through life’s tough financial situations and provide you with a financial solution. The credit union difference is embodied in the strong relationships credit unions build with their members. Credit unions go the extra mile for their members and their community. Whether it is small random act of kindness, volunteering their time, donating to a charitable non-profit, or creating a scholarship opportunity, credit unions continuously go above and beyond for the benefit of the community.

Alphonse Desjardins, a founder of the credit union movement, helped build the industry under the idea that, “the credit union is above all, an institution aiming at the betterment of its members, rather than profits.” Credit unions were founded with the principle of bettering society, and continue to exist as a fair financial alternative for the people of Illinois.

Comments Off

|

|

Comments Off

|

* As the Sun-Times noted at the time, the Senate’s graduated income tax debate was shorter than “Stairway to Heaven.” The House’s debate was almost the length of Andy Warhol’s “Sleep” movie. Let’s start with the Sun-Times…

The amendment’s sponsor, state Rep. Robert Martwick, D-Chicago, called the state’s current system “a very unfair tax system.” He countered opponents’ claims about Illinoisans and businesses leaving the state: “This is reform. This is an opportunity to fix the problems of Illinois.”

“The fair tax, if approved by the voters, if they choose this tax reform, this path forward for Illinois, we will be in a position where we can eliminate those deficits,” Martwick said. “And when we eliminate those deficits, we stop accumulating debts and we begin to pay them down. And when we pay down those debts we relieve the pressure for future tax increases.”

All 44 House Republicans put their lights on to speak during a lengthy debate on the floor on Monday afternoon, which began about 1 p.m and lasted until 4:30 p.m. The debate was much, much longer than the Senate debate — which clocked in at seven minutes. […]

“Please think about how repeating the same foolish tax-and-spend policies will not change anything about our future,” state Rep. Margo McDermed, R-Mokena, said. “We need to address the underlying drivers and we need to get our financial house in order, and this amendment does none of those things.”

I think some Republicans spoke for the very first time yesterday. I’ve never seen anything like it.

* It just went on and on and on…

During a three-hour Memorial Day debate in the House, state Rep. Delia Ramirez, D-Chicago, said the progressive income tax will be more equitable than the existing 4.95 percent flat income tax by reducing tax rates for 97 percent of taxpayers.

“Folks, I wish we would have been taxing at a higher rate,” Ramirez said. “I wish we would have been able to go to $1 million and [tax them at] 10 percent. We’re not there. We’re at 7.95 percent.” […]

State Rep. Andrew Chesney, R-Freeport, said the proposal would lower taxes for the working poor by less than $7 a year, not enough to buy a sandwich at a restaurant. For those making less than $100,000, Chesney said they’d save less than $38.

“That’s a heck of a negotiation, but the $37.38 will be erased when the Democratic majority passes the gas tax,” Chesney said.

* And on…

“The Democrats of Illinois have an insatiable taste for spending,” said Rep. Mark Batinick, R-Plainfield.

“I carry a simple message from southeast Illinois. We don’t trust you with our money,” said Rep. Darren Bailey, R-Xenia.

“This is more of the same, taxes, taxes and more taxes,” said Rep. David McSweeney, R-Barrington Hills. “This bill will kill jobs and drive more people out of the state.” […]

Rep. Tim Butler, R-Springfield, said Illinois already has a fair tax in the flat tax system.

“It impacts everyone equally,” he said.

* More…

Republican Rep. Margo McDermed of Mokena called the rates proposal awaiting a House vote “teaser rates, fake rates, lying rates.”

“If you think that this doesn’t hit you, you’re wrong,” McDermed warned middle-class taxpayers.

Rep. Avery Bourne, a Republican from downstate Raymond, added, “There simply aren’t enough rich people in this state to pay for the insatiable appetite of spending that we see here in Springfield.” […]

“We put too much of the burden of funding our government on the backs of the people who can least afford to pay it,” said Rep. Robert Martwick, a Chicago Democrat who sponsored the proposed amendment.

* More…

“We’ve made year-after-year cuts to budgets like DCFS (Department of Children and Family Services), and now you have children dying because you have case workers that are overburdened and underpaid,” Rep. Rob Martwick, a Chicago Democrat and the bill’s sponsor, said. “So what are the solutions to these problems? The solutions are to eliminate our deficits, eliminate that structural deficit. When you do that, you start to right the ship. You can fund education, you can pay down debts.”

The options to do so, Martwick said, were to raise the state’s flat tax from 4.95 percent to 6.5 percent or higher, or to raise the $3.5 billion anticipated to come from the graduated rates.

Republicans said the bill more likely provided incentive for the state’s wealthiest taxpayers and job creators to leave, and warned that no matter what rates are approved by this Legislature, they can be raised in the future.

“The graduated tax will give Springfield the ability to raise taxes on whoever they want by manipulating rates and brackets,” Rep. Lindsay Parkhurst, a Kankakee Republican, said. “The result will be an increase on the middle class. We cannot trust Springfield with any more of our money without real structural reforms to our state government and our political system.”

* And…

“Every time we turn around, an oppressive government sits like a vulture on a high line, ready to take more money out of your pocket. The American dream has become the American nightmare,” Rep. Chris Miller, R-Oakland, said.

Miller, a farmer, said promoting a graduated tax as “fair” is akin to putting “lipstick on a pig.”

“There couldn’t be anything more unfair,” Miller said, given that it will take “$3.4 billion from responsible citizens’ hands and puts it in the hands of irresponsible bureaucrats.” […]

Various GOP legislators say that Democrats’ focus is on taxes is a sign of their “insatiable” spending habits.

“I am willing, and in fact proud to stand here and say that I believe in government spending. I believe in government spending on food for the hungry, on shelter for the homeless, and on health care for the sick, on education for our children,” said state Rep. Will Guzzardi, D-Chicago. “I don’t think that’s a spending problem. I think that is our job. That is the job of government.”

One point I didn’t see mentioned anywhere was the indignation by some Republicans when the Democrats chided them for wanting to spend government money without voting to pay for the programs.

* Biggest applause line on the Dem side…

55 Comments

|

* Greg Hinz…

Pritzker had to do some bargaining. Two Democratic reps who had signaled opposition, Northbrook’s Jonathan Carroll and Sam Yingling of Round Lake, in the end got a promise the House this summer will consider steps to guarantee some property tax relief as part of a graduated income hike, which under current plans would hit only taxpayers with income of more than $250,000 a year.

The governor also had to engage in some Illinois-style finagling, as one Democratic rep who was opposed to the bill, Jerry Costello, miraculously left the General Assembly to take a job with—surprise!—the Pritzker administration and was replaced by someone with a different view.

Rauner did that I don’t know how many times. Quinn did it the opposite way: Vote for his tax hike and then get handed a sweet government gig.

* Capitol News Illinois…

While Democratic Gov. J.B. Pritzker played no formal role in the legislative process to put the amendment on the ballot, at least one Democrat who previously said he would vote against the bill credited the governor for his sudden switch.

“I was a very vocal critic about this, obviously, I came out with some concerns,” said Rep. Jonathan Carroll, D-Northbrook. “… Governor Pritzker reached out to me right away, had some conversations with me and heard that my issue is property taxes.

“Along with his help and the help of my colleagues in the House and the Senate, we’re going to form a property tax task force to review how we tax in Illinois for property taxes and make sure that we do it better and we do it right.”

The state does not levy or collect property taxes in Illinois; only local taxing bodies such as school boards, municipal governments and counties have that authority. The largest contributor to most local tax bills are K-12 schools, which for years have faced funding shortfalls and proration from insufficient revenues provided by the state.

Still, Carroll and Rep. Sam Yingling — a Grayslake Democrat who also said at one time he would vote against the graduated tax — said state action is needed to overhaul the property tax system and the graduated tax is part of that process.

Another task force.

* Will this be any different than all previous task forces? From a press release…

The Property Tax Relief Task Force would be created through an amendment to the fair tax rate legislation that passed the Senate earlier this month, and the group would be required to report back to the Governor and the General Assembly by Dec. 31, 2019. An initial report will be due 90 days after the law takes effect.

“For far too long, families across Illinois have struggled under too-high property tax burdens and an unfair income tax system that protects the wealthiest,” Gov. JB Pritzker said. “This task force is a commonsense addition to the fair tax, which aims to protect the middle class and those striving to get there while those making $250,000 and above pay more.”

The Property Task Relief Task Force will be charged with using a racial and economic equity lens to identify the causes of increasingly burdensome property taxes across Illinois, review best practices in public policy strategies that create short- and long-term property tax relief for homeowners, and make recommendations to assist in the development of short- and long-term administrative, electoral, and legislative changes to create short- and long-term property tax relief for homeowners.

The group will include two appointees from the Office of the Governor, as well as members of the House and Senate appointed by their chambers’ leaders. An overview of the measure is attached.

So, if you were wondering if the House was going to take up the Senate’s rate bill, there’s your answer. It’s going to be paired with the task force language.

* Another idea was also floated this week…

State Senators Terry Link and Julie Morrison, & State Representatives Daniel Didech, Rita Mayfield, and Bob Morgan introduced HB 3845 to address the crippling effects of Illinois’ property taxes. To enact a tax system that is truly fair for all Illinois residents, the adoption of a graduated income tax structure should be accompanied with reform that will lower property tax bills for every homeowner in Illinois.

Proposal:

* In the event that the Governor’s Fair Tax proposal is approved by Illinois voters in 2020, create the Illinois Property Tax Rebate Fund which will receive money appropriated by the General Assembly.

* Begin with initial allocation of at least $400 million in 2021. This allocation will provide an estimated $200 in property tax relief for every Illinois resident claiming a Homestead exemption.

* Establish dedicated funding streams growing the Fund to $1 billion by 2023. This funding will provide approximately $500 in annual property tax relief to each homeowner.

* Money will flow from the Fund through county treasurers, who will reduce homeowners’ property tax bills and lower each homeowners’ property tax bill.

* This proposal will not impact local government levies or school funding.

* This Fund will help stabilize the property tax burden being felt throughout the State of Illinois.

* Every region of Illinois will benefit from the Fund, reducing each homeowners’ property tax bill equally regardless of property values.

* This Fund creates structural change in our property tax system - relieving the burden on homeowners without impacting funding for education or other critical local services.

I’m thinking that idea to lower everybody’s property tax bills equally may not go over too well in some quarters. We’ll see.

32 Comments

|

* There is a lot of sizzle in this piece (the need for video gaming revenue is described as “desperate” even though it’s only projected to be about $90 million next fiscal year, for example), but there is some meat to chew on…

With the Illinois General Assembly poised to consider a tax hike on video gambling, some key lawmakers and their family members have developed previously undisclosed financial connections to the industry, meaning the fate of any proposal could lie in part on votes of legislators with a stake in the outcome.

They include two of the General Assembly’s most powerful figures, Senate Minority Leader Bill Brady, a Republican from Bloomington, and Chicago Democrat Antonio Muñoz, the Senate assistant majority leader, according to Illinois Gaming Board records obtained by ProPublica Illinois and WBEZ. […]

Brady is listed in internal gaming board records as a “person with significant influence or control,” or PSIC, for Midwest Electronics Gaming, one of the state’s largest video gambling companies. Midwest, operating primarily in central Illinois, made $16 million from video gambling last year and $80 million between 2012 and 2018.

Brady’s designation as a PSIC means he receives a percentage of the proceeds from video slot and poker machines under a revenue-sharing agreement with Midwest. Although the terms and the locations of the machines are not disclosed, any tax increase on video gambling revenue would have a direct financial impact on him.

Yet required disclosure statements filed with the Illinois Gaming Board and available online do not list Brady as a PSIC. Instead, he’s listed as a sales agent, a middleman who contracts with video gambling operators to sign contracts with bars, restaurants and other alcohol-pouring establishments to install video slot and poker machines.

Sen. Munoz’s son is also a sales agent who works (or worked, it’s not totally clear) for former Sen. Michael Bond’s highly successful video gaming company. Sen. Tom Cullerton is listed as a sales agent for Global Gaming Industries, which only has one small client…

In November, the gaming board voted to revoke Global Gaming’s license because of its ties to a man with “an extensive criminal record,” though Global Gaming has continued to operate while it appeals the decision. Separately, Cullerton has been the subject of subpoenas from federal investigators seeking records related to an ongoing criminal investigation of Teamsters boss John Coli Sr., who allegedly extorted $100,000 in cash from a local business.

18 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|