* Expected…

Superstar Kanye West fell short of qualifying for the Illinois ballot as an independent presidential candidate by 1,300 signatures, according to the official review on Friday of the nominating petitions submitted by the Illinois native.

The determination by a hearing officer will be presented to the Illinois State Board of Elections on Aug. 21, when it is set to finalize the Nov. 3 ballot.

To qualify for the ballot, West had to submit at least 2,500 signatures. However, the hearing officer determined he only had 1,200 valid signatures.

Sean Tenner, the 46th Ward Democratic committeeperson, said he was moved to challenge West’s petitions after hearing the rapper and designer tell a crowd in South Carolina on July 19 that Harriet Tubman “never actually freed the slaves.”

Comments Off

|

|

Comments Off

|

*** UPDATED x1 *** Crestwood mayor indicted

Friday, Aug 7, 2020 - Posted by Rich Miller

* Jon Seidel and Robert Herguth…

The mayor of southwest suburban Crestwood faces a federal bribery charge in a new indictment made public Friday that centers on the politically connected red-light camera company SafeSpeed, court records show.

Louis Presta, 69, has also been charged with filing false tax returns and lying to the FBI and IRS, allegedly about whether an envelope Presta took during a March 2018 meeting with a SafeSpeed representative had been stuffed full of $5,000 cash.

Presta’s indictment is the latest public sign of the feds’ ongoing public corruption investigations, which last month led to a bribery charge against the utility company ComEd. However, Presta’s indictment appears to be part of a separate investigation that earlier this year led to a guilty plea by former state Sen. Martin Sandoval.

In the Presta case, prosecutors say Presta sought and received benefits from SafeSpeed representatives while SafeSpeed sought to expand its services in Crestwood. They also say Presta was interviewed by federal authorities in September, around the time of a series of raids by federal agents that included Sandoval’s office at the state capitol in Springfield.

Some background is here.

*** UPDATE *** From the US Attorney…

The mayor of Crestwood has been indicted by a federal grand jury for using an interstate facility in aid of bribery, and lying to federal law enforcement about his request and receipt of benefits from a representative of a red-light camera company that provided services to the southwest suburb.

LOUIS PRESTA, 69, of Crestwood, is charged with three counts of using a facility in interstate commerce in aid of bribery and official misconduct, two counts of willfully filing a false income tax return, one count of willfully failing to file an income tax return, and one count of making false statements to the FBI and IRS. The indictment was returned Thursday in U.S. District Court in Chicago. Arraignment has not yet been scheduled.

The indictment was announced by John R. Lausch, Jr., United States Attorney for the Northern District of Illinois; Emmerson Buie, Jr., Special Agent-in-Charge of the Chicago Field Office of the FBI; and Kathy A. Enstrom, Special Agent-in-Charge of the IRS Criminal Investigation Division in Chicago. The government is represented by Assistant U.S. Attorneys Christopher J. Stetler and James P. Durkin.

According to the indictment, the red-light camera company provided camera services to Crestwood that enabled the municipality to issue tickets to motorists for certain traffic violations. During that time and while the company was attempting to provide additional such services to Crestwood, Presta asked for and accepted benefits from representatives of the company, the indictment states.

The false statement charge pertains to Presta’s September 2019 interview with the FBI and IRS, during which Presta denied receiving gifts, cash, or campaign contributions from the red-light camera company. When shown a recording of a March 7, 2018, meeting at which Presta allegedly accepted from the company representative an envelope containing $5,000 in cash, Presta falsely stated that there was no money in the envelope, the indictment states.

The tax charges in the indictment accuse Presta of willfully filing a false income tax return for the calendar years 2015 and 2018, and willfully failing to file an income tax return for the calendar year 2014.

The public is reminded that an indictment is not evidence of guilt. The defendant is presumed innocent and entitled to a fair trial at which the government has the burden of proving guilt beyond a reasonable doubt.

The bribery and false statement counts are each punishable by up to five years in prison. Filing a false tax return is punishable by up to three years, while failing to file a tax return carries a maximum sentence of one year. If convicted, the Court must impose a reasonable sentence under federal sentencing statutes and the advisory U.S. Sentencing Guidelines.

14 Comments

|

*** UPDATED x1 *** Question of the day

Friday, Aug 7, 2020 - Posted by Rich Miller

* A provision in state law lifting contribution caps when wealthy candidates start spending big money is being gamed by all four legislative leaders to allow them to raise however much they want. From the BGA…

In 2009, with yet another governor ensnared in scandal, Illinois’ Democratic legislative leaders authored a package of laws they promised would begin to reform Illinois’ culture of corruption.

One of the biggest items in the legislative package would finally establish statewide limits on campaign contributions, a measure Illinois was one of the last states to adopt.

House Speaker Michael Madigan, who sponsored the legislation, hailed it as a way to “help restore public confidence in Illinois government.” State Sen. Don Harmon, the Democratic sponsor in the Senate, praised it for enacting “historic contribution caps, real disclosure requirements and strict enforcement measures.”

But years later, Madigan and Harmon are using a controversial loophole written into the reform bill to raise millions of dollars above the limits the legislation set. Their Republican colleagues have also blown past the limits, as all four men have collected a combined $44 million more than the contribution limits allow, a Better Government Association examination shows.

Most of that money was doled out to support favored candidates in their respective chambers, records show, as part of a longstanding tactic to win loyalty and ensure their own status atop their party hierarchy.

“They completely gamed it,” said Cynthia Canary, former executive director of the organization now called Reform for Illinois, who helped negotiate the decade-old reform measure.

At the time, the law limited individual campaign contributions to $5,000 per politician, corporate and union contributions to $10,000 and contributions from political action committees to $50,000.

All four leaders are unapologetic about bypassing the limits as part of a political strategy they say is necessary for their parties to compete in elections.

The stark alternative would be to get rid of the provision. But then one candidate could outspend an opponent at will and candidates cannot be barred from spending as much of their own money as they want, per the US Supreme Court. There’s also the issue of independent expenditure committees, which can raise unlimited funds and could overwhelm candidates who couldn’t raise funds above a certain amount. Raising the threshold to, say, $500K instead of $100K, might be one way to do it, but it would be a simple matter for people like Madigan to just borrow the money from a bank and pay it back the next day with existing campaign funds.

* The Question: Any ideas for addressing this?

…Adding… Not a bad idea, but doesn’t include the IE component…

…Adding… As if on cue, Senate President Harmon just filed a $207K A-1, with three labor union contributions totaling $190K.

*** UPDATE *** Scott Kennedy on Twitter…

State contribution limits can either be iron clad but not fair or they can be fair but easy to circumvent, but like the Heisenberg uncertainty principle it is impossible to do both at the same time, given current US Supreme Court rulings.

This piece is well researched and does a good job of explaining the history, mechanics and politics of how this played out. But the context that is missing is the limitations on states’ ability to implement contribution limits that are both fair and effective.

Per US Supreme Court decisions you cannot place contribution limits on an individual who is willing to spend their own money and you cannot place contribution limits on any Superpac (IE) that is willing to independently raise and spend unlimited funds.

There is no law the State of Illinois could have passed that would have limited or prevented JB Pritzker from spending $175 million on his own campaign in 2018.

Given those limitations states can only place contribution limits on any other candidates/committees. Would it be fair to pass iron clad limits on a campaign that couldn’t self fund and faced such an opponent? Of course not.

These fairness provisions exist to lift the restrictions candidates might face in the event of such circumstances. However it does open the door for candidates to find a way to lift the contribution limits in their races.

And that’s why we are where we are. We can make changes to the various provisions to tweak this or that but the core trade off will remain the same: contribution limits can either be iron clad but not fair or they can be fair but easy to circumvent.

I think I’ll withdraw the question unless you insist otherwise.

13 Comments

|

* Illinois Review…

Governor JB Pritzker was ordered to appear before a Clay County judge next Friday at 1:00 PM to explain why he “should not be held in indirect civil contempt.” Failure to appear in court may result in warrant for arrest, the order says.

State Rep. Darren Bailey (R-Xenia) complained to the Clay County judge that Governor Pritzker is ignoring the court’s previous order and is exercising emergency powers concerning the COVID crisis extending beyond state law’s 30-day provision for such powers.

Click here to see the order, which was drafted by attorney Tom DeVore.

*** UPDATE *** Jordan Abudayyeh…

On the same day that the Governor asked the General Assembly to do more to keep Illinoisans safe, the House GOP is instead rejecting science and perpetuating a sideshow to this global pandemic. This motion for contempt is legally baseless, frivolous and a distraction from the serious crisis facing our state. Not a single member of the GOP caucus in the General Assembly has yet to publicly express their rejection of or outrage at this legal maneuvering that creates unnecessary confusion around public health guidance.

The issuance of the Order to Show Cause, without even allowing the Governor an opportunity to respond to the flawed motion for contempt, filed only days ago, is procedurally improper, violating elementary principles of fairness. The State is grappling with its most serious challenge to the lives and health of its residents - a global pandemic - with an increasing number of counties at a warning level today due to outbreaks of cases, and all the while the GOP is playing politics. The Governor will continue to focus on protecting public health and not on the political sideshow in Clay County.

63 Comments

|

Another day, another lawsuit

Friday, Aug 7, 2020 - Posted by Rich Miller

* Edgar County Watchdogs…

Fox Run Restaurant filed a lawsuit in Sangamon County Circuit Court [yesterday] naming the City of Springfield and Mayor James Langfelder as defendants.

The Complaint is against the city’s “Emergency Ordinance(s)” and the Mayor’s statutory authority to extend Executive Orders past 7 days without the consent of the city council, as written in Section 7 of the Emergency Interim Executive Succession Act (also within the Illinois Emergency Management Agency Act), and past the first regular meeting of the city council as written in the Illinois Municipal Code, Section 11-1-6.

Documents here and here. This is a DeVore special.

* Memory lane…

Businesses continue to open up in defiance of the state’s Stay-at-Home order.

The restaurant Fox Run Restaurant and Lounge in Springfield opened on Friday, May 22.

A photo taken inside the restaurant shows Representative Darren Bailey, R-Xenia, got an even early sneak peek with a visit to the business on Thursday.

Pic…

26 Comments

|

IDPH: Cass, Coles, Grundy, Iroquois, Jackson, Monroe, Perry, Saline, St. Clair, Tazewell, Union, Williamson and Winnebago counties at “warning level”

Friday, Aug 7, 2020 - Posted by Rich Miller

* Press release…

The Illinois Department of Public Health (IDPH) today reported 13 counties in Illinois are considered to be at a warning level for novel coronavirus disease (COVID-19). A county enters a warning level when two or more COVID-19 risk indicators that measure the amount of COVID-19 increase.

Thirteen counties are currently reported at a warning level – Cass, Coles, Grundy, Iroquois, Jackson, Monroe, Perry, Saline, St. Clair, Tazewell, Union, Williamson, Winnebago.

These counties saw cases or outbreaks associated with businesses, long-term care facilities, large social gatherings, and out of state travel. There have been several instances of multiple cases among family members in the same, large household. Students returning to universities and colleges are also driving the recent increase in cases in several communities. Many students are not wearing face coverings or social distancing and are gathering in large groups and at bars.

Several counties are taking swift action and implementing mitigation measures to help slow spread of the virus. Examples include working with university administrations for student education and contact tracing, working with county boards of health, and cancelling events and festivals.

IDPH uses numerous indicators when determining if a county is experiencing stable COVID-19 activity, or if there are warning signs of increased COVID-19 risk in the county.

• New cases per 100,000 people. If there are more than 50 new cases per 100,000 people in the county, this triggers a warning.

• Number of deaths. This metric indicates a warning when the weekly number of deaths increases more than 20% for two consecutive weeks.

• Weekly test positivity. This metric indicates a warning when the 7-day test positivity rate rises above 8%.

• ICU availability. If there are fewer than 20% of intensive care units available in the region, this triggers a warning.

• Weekly emergency department visits. This metric indicates a warning when the weekly percent of COVID-19-like-illness emergency department visits increase by more than 20% for two consecutive weeks.

• Weekly hospital admissions. A warning is triggered when the weekly number of hospital admissions for COVID-19-like-illness increases by more than 20% for two consecutive weeks.

• Tests perform. This metric is used to provide context and indicate if more testing is needed in the county.

• Clusters. This metric looks at the percent of COVID-19 cases associated with clusters or outbreaks and is used to understand large increase in cases.

These metrics are intended to be used for local level awareness to help local leaders, businesses, local health departments, and the public make informed decisions about personal and family gatherings, as well as what activities they choose to do. The metrics are updated weekly, from the Sunday-Saturday of the prior week.

13 Comments

|

* Press release…

An independent analysis conducted by Berkeley Research Group in conjunction with Ariel R. Belasen, Professor at SIUE, shows that passage of the graduated income tax on the November ballot would have devastating consequences to Illinois’ economy, consumers and jobs. If passed, the Tax Hike Amendment would shrink Illinois’ economy by nearly $2 billion, increase consumer costs by $332 million, lead to out-migration that would reduce household spending, and result in disproportionately more job losses in hospitals, restaurants and individual and family services that tend to employ more women and minorities.

The authors of the study were granted complete independence to provide an objective analysis of the effects of the proposed Income Tax Hike Amendment.

“This independent study concludes what many of us already knew: this is the worst possible time for a $3.4 billion tax hike on Illinois families and businesses,” said Illinois Chamber of Commerce President and CEO Todd Maisch. “The pandemic has already crushed small business owners, manufacturers and farmers, and this independent study proves that the Tax Hike Amendment would be the last straw for many more.”

“Our report shows that the graduated income tax would be a devastating hit to Illinois’ already struggling economy. And, job losses would disproportionately affect women and minorities,” said Ariel R. Belasen, Ph.D., Professor at SIUE and independent study co-author.

The key findings of the independent analysis include:

Job losses would disproportionately affect women and minorities

Women and minorities are likely to be disproportionately affected by the job losses because three of the four sectors of the economy that the economic model indicates will be hardest hit by the tax increase. Hospitals, Restaurants, and Individual and Family Services – tend to employ relatively more workers from these demographic groups.

• According to the Bureau of Labor Statistics (BLS):

• Hospitals disproportionally employ women (74.9% of jobs in sector vs. 47% of all jobs across all sectors);

• Restaurants disproportionally employ Hispanic or Latino workers (26.8% vs. 17.6% of all jobs across all sectors); and

• The Individual and Family Services sector disproportionately employs women (78.3%) and African Americans (20.7% vs. 12.3% of all jobs across all sectors).

Reduction in GDP

Approval of the proposed Constitutional Amendment will cause up to a $1.8 billion reduction in the income of Illinois residents annually, as measured by the state’s gross domestic product (GDP).

Higher corporate taxes will be passed on to consumers

The corporate tax rate will increase from 9.5% to 10.49% (an increase of 10%), the second highest in the country. Studies show that some portion of revenues arising from an increase in the corporate tax rate ($332 million) would be passed on to suppliers and customers, increasing prices on goods and services, and potentially suppressing worker wages.

Out-migration of thousands of high-income households

Some of the job losses will result from reduced spending on food and services arising from an increase in the rate of out-migration by Illinois residents seeking to escape the relatively heavy tax burden that the state imposes on its residents. Based on the most-recent empirical studies by economists, we estimate that increased out-migration will lead to a reduction in household spending by taxpayers in the affected income brackets of up to 0.8%.

No material income tax relief

The average annual tax relief per filer in the lower income brackets is small, and might be less than a single family meal at a fast food restaurant for many filers.

* Response from Quentin Fulks, Chairman of Vote Yes For Fairness…

It’s not surprising that a study the Illinois Chamber of Commerce paid for in their efforts to protect our broken tax system is trying to mislead voters on the impact of the Fair Tax. The fact is our current tax system is fundamentally unfair, forcing essential workers like our nurses and grocery store clerks to pay the same tax rate as millionaires and billionaires. The Fair Tax will set things right, while keeping taxes the same or less for at least 97% of Illinoisans.

Background provided by the committee…

TAX LIABILITY DOESN’T DRIVE RICH PEOPLE TO MOVE

A Study Found “Elites Are Embedded In The Regions Where They Achieve Success, And They Have Limited Interest In Moving To Procure Tax Advantages.” “The first study is actually not new. The American Sociological Association published a study on ‘Millionaire Migration and the Taxation of the Elite: Evidence From Administrative Data’ in its review periodical in 2016. But it draws extensively on 13 years of tax data from returns filed by million-dollar earners across the nation — 45 million returns — while “tracking the states from which millionaires file their taxes.” […] The study even examines whether some million-dollar earners stay close to home by simply jumping across state lines, but again without finding any proof. ‘When we focus on states’ border regions,’ it says, ‘we do not find compelling evidence that millionaires cluster on the low-tax side of state borders. Elites are embedded in the regions where they achieve success, and they have limited interest in moving to procure tax advantages.’” [One Illinois, 1/16/20]

The Study Found Elites Are Not Willing To Move To Exploit Tax Advantages Across State Lines. “The most striking finding of this research is how little elites seem willing to move to exploit tax advantages across state lines in the United States. Millionaire tax flight is occurring, but only at the margins of statistical and socioeconomic significance.” [Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data, American Sociological Review, Vol. 81(3) 421–446, 2016]

Millionaires Have Lower Migration Rates Than The General Population. “First, millionaires are not very mobile and actually have lower migration rates than the general population. This is in part because family responsibilities and business ownership are higher among top income-earners, which embeds individuals in their local regions. Nevertheless, there is an observable pattern of elite migration from high-income-tax to lowincome-tax states; when millionaires migrate, their relocation decisions are influenced by tax rates, in a way that we do not see for the general population. Yet, because migration flows represent a very small share of top income-earners, the observed patterns of migration have little impact on the millionaire population tax base even over 13 years.” [Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data, American Sociological Review, Vol. 81(3) 421–446, 2016]

The Study Found Because Millionaires Move So Infrequently, “The Revenue-Maximizing Top Marginal Tax Rate On Income Above $1 Million Is Much Higher Than The Current Tax Rate In Any State.” “Our core migration estimate translates into a population elasticity of roughly .1, meaning that a 10 percent increase in the top tax rate leads to a 1 percent loss of the millionaire population. Incorporating this estimate into optimal tax rate models (Mankiw et al. 2009; Piketty and Saez 2013) suggests that the revenue-maximizing top marginal tax rate on income above $1 million is much higher than the current tax rate in any state.” [Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data, American Sociological Review, Vol. 81(3) 421–446, 2016]

The Study Found “Millionaires Do Not Use Their Higher Income To Achieve Greater Mobility Across States, But Rather Are More Grounded In Their States.” “First, the hypothesis incorrectly portrays millionaires as frictionless agents who have little or no social ties to place. Under this assumption, the primary constraints on migration are simply the ‘moving truck’ costs, which seem easy for top earners to absorb. However, our results suggest high social and economic costs of migration, even for the rich. Millionaires do not use their higher income to achieve greater mobility across states, but rather are more grounded in their states. The rich are different from the general population. They more often have family responsibilities—spouses and school-age children that embed them in place. They own businesses that tie them to place. And their elite income itself embeds them in place: millionaires are not searching for economic opportunity—they have found it.” [Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data, American Sociological Review, Vol. 81(3) 421–446, 2016]

The Study Suggested That An Important Portion Of Income Is Place-Specific And Not Portable. “Most millionaires are the ‘working rich,’ and their incomes derive in part from place-based social capital in highly networked industries (Powell et al. 2002; Saez 2015; Saxenian 1994; Varner and Young 2012). Low levels of elite migration and limited responsiveness to top tax rates suggests that an important portion of income is place-specific and not portable.” [Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data, American Sociological Review, Vol. 81(3) 421–446, 2016]

An Analysis By A Stanford Researcher Found Only About 2.4% Of Millionaires In America Change Their State Of Residence In A Given Year. “Only about 2.4% of US-based millionaires change their state of residence in a given year. Interstate migration is actually more common among the US middle class, and almost twice as common among its poorest residents, who have an annual interstate migration rate of 4.5%.” [Cristobal Young, Guardian, 11/20/17]

Only 15% Of Interstate Millionaire Migrations Bring A Net Tax Advantage. “When millionaires do move, they admittedly tend to favour lower-tax states over higher-tax ones – but only marginally so. Around 15% of interstate millionaire migrations bring a net tax advantage. The other 85% have no net tax impact for the movers.” [Cristobal Young, Guardian, 11/20/17]

Alaska Lost More Of Its Residents In 2019 Than Any State Beside West Virginia, Despite Having The Lowest Tax Burden. “Meanwhile, the state with the lowest tax burden, Alaska, is the 48th most populous. It lost more of its residents in the past year than any state besides West Virginia. ‘The kneejerk tax thing doesn’t work because you can find high-tax areas that are growing in the U.S. and you can find low-tax areas that are declining,’ demographer Rob Paral told the Better Government Association. ‘I know that gets lost on people who want to blame taxes on everything.’” [Chicago Magazine, 1/29/20]

STATES WITH A GRADUATED INCOME TAX RATE ARE MORE LIKELY TO CUT TAXES

Center For Tax And Budget Accountability: “States With Graduated Income Taxes Are More Than Twice As Likely To Cut Taxes As To Raise Them.” [Center for Tax and Budget Accountability, 5/7/19]

CTBA Analysis: The Flat Tax In Illinois Ensures Tax Increases Are Borne By Everyone, Rather Than Targeted At The Wealthiest. “This concern, however, is baseless. For one, Illinois’ flat tax has not prevented the state from enacting income tax increases in the last ten years. Instead, the flat tax has ensured that those tax increases have been borne by everyone, rather than targeted to the wealthiest who can most afford them.” [Center for Tax and Budget Accountability, 5/7/19]

A CTBA Analysis Found That Since 2003, States With Graduated Income Taxes Have Cut Taxes Nearly Two And A Half Times More Often Than They Have Raised Them On The Middle Class. “Our key finding: Since 2003, states with graduated income taxes have cut taxes nearly two and a half times more often than they have raised them on the middle class. In any given year, a state with a graduated income tax had a roughly 13 percent likelihood of cutting taxes — versus just a five percent likelihood of increasing them on the middle class.” [Center for Tax and Budget Accountability, 5/7/19]

A CTBA Analysis Found States With Graduated Income Taxes Have Seen Their Average Rates Fall Since 2002. “Another way of looking at this is at the total change in averages rates — just to make sure that, for example, the smaller number of tax increases aren’t larger in size than the more numerous tax cuts. (The post linked above, for its part, shows that a handful of states with graduated income taxes have seen their rates grow — but again, uses years from 1911 to 1936 as a baseline, rather than a more recent period.) The answer: No, they’re not. In fact, states with graduated income taxes have seen their average rates fall — both at the top and the bottom of their brackets — since 2002.” [Center for Tax and Budget Accountability, 5/7/19]

“HIGH RATE” TAX STATES HAVE ECONOMIES THAT ARE BETTER THAN OR COMPARABLE TO STATES WITH NO INCOME TAX

A Study Found Nine High Rate Tax States Have Seen More Economic Growth Per Capita Over The Last Decade Than The Nine States With No Income Tax. “In reality, however, residents of ‘high rate’ income tax states are actually experiencing economic conditions at least as good, if not better, than those living in states lacking a personal income tax.3 As Figure 1 shows, the nine ‘high rate’ states identified by Laffer have actually seen more economic growth per capita over the last decade than the nine states that fail to levy a broad-based personal income tax.” [“High Rate” Income Tax States Are Out-Performing No Tax States, Institute on Taxation and Economic Policy, February 2012]

A 2012 Study Found States With “High Rate” Income Taxes Have Economies That Equal Or Surpass States Lacking An Income Tax. “Whether looking at income levels, unemployment rates, or economic output per person, states with ‘high rate’ income taxes have economies that equal or surpass those in states lacking an income tax. The most commonly cited analysis purporting to show the opposite confuses population growth with economic performance, and fails to acknowledge the natural resource advantages enjoyed by a number of the most successful non-income tax states. There is no reason for states to expect that reducing or repealing their income taxes will improve the performance of their economies.” [“High Rate” Income Tax States Are Out-Performing No Tax States, Institute on Taxation and Economic Policy, February 2012]

WHEN KANSAS DRAMATICALLY CUT TAXES, THE STATE’S ECONOMY TANKED

After Kansas Severely Cut Taxes, Kansas Underperformed Most Neighboring States And The Nation On Economic Growth, Job Creation, And New Business Formation. “In 2012 and 2013, at the urging of Governor Sam Brownback, lawmakers cut the top rate of the state’s income tax by almost 30 percent and the tax rate on certain business profits to zero. Under ‘supply-side’ economic theory, these deep tax cuts should have acted — as Brownback then predicted — like ‘a shot of adrenaline into the heart of the Kansas economy,’ stimulating strong growth in economic output, job creation, and new business formation. But in reality, Kansas underperformed most neighboring states and the nation on all of those measures after the tax cuts.” [Center on Budget and Policy Priorities, 1/22/18]

Kansas’ 4.2 Percent Private-Sector Job Growth From December 2012 To May 2017 Was Less Than Half Of The 9.4 Percent Job Growth In The United States. “Kansas’ 4.2 percent private-sector job growth from December 2012 (the month before the tax cuts took effect) to May 2017 (the month before they were repealed) was lower than all of its neighbors except Oklahoma and less than half of the 9.4 percent job growth in the United States.” [Center on Budget and Policy Priorities, 1/22/18]

Kansas’ Tax Experiment Resulted In Downgrades In The State’s Bond Rating. “Moreover, Kansas revenues plunged, leading to cuts to education and other vital services and downgrades in the state’s bond rating. On June 6, 2017, the legislature terminated what Brownback had termed a ‘real live experiment’ in supply-side tax policy, repealing the business profits exemption and moving income tax rates back toward where they had started.” [Center on Budget and Policy Priorities, 1/22/18]

27 Comments

|

COVID-19 roundup

Friday, Aug 7, 2020 - Posted by Rich Miller

* Ugh…

The United States has recorded more than 2,000 coronavirus deaths in 24 hours, the highest number of daily fatalities in three months, Johns Hopkins University’s real-time tally showed Thursday.

The country, which has seen a major resurgence in coronavirus since the end of June, added 2,060 deaths in one day as well as more than 58,000 new cases, the Baltimore-based university showed at 8:30 pm (0030 GMT Friday).

The last time the US recorded more than 2,000 deaths in 24 hours was on May 7.

* Capitol News Illinois…

The Illinois Department of Employment Security announced Thursday that 20 weeks of state extended benefits are available to those who exhaust the allotted 26 weeks of regular state unemployment and the additional 13 weeks of federal Pandemic Emergency Unemployment Compensation benefits.

IDES encouraged those with unemployment questions to visit IDES.Illinois.gov first before calling the unemployment hotlines, which continue to receive a high volume of calls.

* Jake Griffin…

The only tax revenue categories that experienced gains over July 2019 were those with tax rates that had increased since last year.

The motor fuel tax doubled since July 2019, but revenues from the tax in July 2020 were only 61.7% higher, according to revenue department figures.

Taxes from cigarettes, private vehicle sales and corporate income were the only other categories to see increases above July 2019. Cigarette and private vehicle sales tax rates were both increased in the last year. Corporate income tax filings were also delayed three months.

Sales tax revenues were down almost $100 million from the previous July, usually one of the state’s stronger months.

* The Southern…

A second inmate diagnosed with COVID-19 at the federal prison in Marion has died amid a coronavirus outbreak that has affected dozens of inmates and a handful of employees.

The Federal Bureau of Prisons said Taiwan Davis, 39, died Wednesday at a local hospital where he was receiving treatment for the disease.

Davis tested positive for COVID-19 on July 29, one week prior to his death. He was transported to a local hospital three days after receiving his diagnosis.

In a news release, the federal agency said that Davis had “pre-existing medical conditions, which the CDC lists as risk factors for developing more severe COVID-19 disease.”

More from KFVS…

As of Friday, Aug. 7, at least 80 inmates and four staff members at USP Marion have active COVID-19 cases.

BOP reports 57 inmates and four staff members have recovered from the virus.

USP Marion is a medium security facility, which also operates a minimum security prison camp.

In total, the federal prison complex houses 1,213 male offenders.

* ABC 7…

Alderman Michael Scott Jr. of Chicago’s 24th Ward has tested positive for COVID-19 and appeared at a press conference this week with Mayor Lori Lightfoot.

Mayor Lightfoot appeared with Alderman Scott on Wednesday. Since then, she has tested negative for the virus and has no plans to self-quarantine. […]

The mayor’s office says all participants were wearing masks and practicing proper social distancing for the duration of Wednesday’s news conference.

Gov. Pritzker was asked today if he agreed with Lightfoot’s decision not to self-quarantine…

I’m not going to advise, she has a doctor. I’m not going to make advice here about that. Look, I just want people to do the right thing and keep everybody around them safe and healthy and of course, the mayor to be safe and healthy. So whatever the best advice is that she’s been given I know she will follow.

* Herald-Whig…

Amid an uptick in the number of COVID-19 cases in the county and on the advice of the Adams County Health Department, city officials said on Thursday that all city meetings will again include an option for officials to participate virtually.

The policy applies to both the Quincy City Council weekly meetings and committee meetings.

All meetings will be closed to the public, but those who wish to view the meeting will be able to do so online.

* Tribune live blog…

Gov. J.B. Pritzker issues rule to penalize businesses that don’t enforce mask requirements with fines up to $2,500

Drug and alcohol use has spiked during pandemic, prompting Chicago’s recovery community to find new ways to reach out

Chicago Urban League to hand out $100,000 to Black-owned businesses after Ford Fund grant

Some lakefront restaurants reopening Friday

Preckwinkle to announce new coronavirus-related rental assistance program

* Sun-Times live blog…

How the pandemic is reshaping the way we date

State unemployment extended as claims remain historically high

Loyola University Chicago closes all dorms for fall semester due to COVID-19

Men have long shunned protective gear

Ohio Gov. Mike DeWine tests negative for virus after earlier positive test.

4 Comments

|

* Press release…

Illinois House Republican Leader Jim Durkin released the following statement regarding Governor Pritzker’s proposal of new emergency rules regarding mask wearing:

“Today, I am calling on Governor Pritzker to abandon his ‘mask rule’ and work with the legislature on this issue. I am committed to respecting his priorities while recognizing the undue hardship his current rule places on businesses that are already struggling across Illinois. To do this, the Governor should immediately call the legislature into special session where we can also address the urgent need for ethics reform and the controversies surrounding the Democratic Party and Speaker of the Illinois House of Representatives.”

Again, it’s already in state statute that violating any IDPH rule is a misdemeanor. The only difference with this newly proposed rule is that it exempts individuals and creates a three-step process before an entity can be charged if the local state’s attorney even goes along.

Thoughts?

*** UPDATE 1 *** Jordan Abudayyeh in the governor’s office…

As I’m sure Leader Durkin is aware, Illinois reported a high number of new COVID cases again today, similar to numbers we saw near the height of the wave of cases last spring. We have learned that quick and decisive action needs to be taken to stop the spread of this deadly virus. In the spring session the administration withdrew emergency rules after the General Assembly said they would take up this critical issue during session. Leader Durkin and his colleagues in the General Assembly failed to vote on any enforcement that protects the health and safety of Illinoisans, indeed many of his caucus members railed against any legal measures to curtail the spread of COVID-19. So as promised, the administration has introduced a new rule incorporating feedback from lawmakers and stakeholders like the Illinois Retail Merchants Association and the Illinois Restaurant Association. Existing public health rules allow the State to take action to stop the spread of infectious diseases like whooping cough, measles and many others and should include COVID-19. The only difference now is that there is a loud super-minority playing politics with public health. We can only prevent the spread of COVID-19 by working together to do what’s right, and the Governor urges the members of JCAR to protect the health and safety of the public.

…Adding… The administration may have incorporated “feedback” from IRMA, but the group is opposed to this rule…

The Illinois Retail Merchants Association says the state’s enforcement actions should target individuals who do not comply with mask mandates and other public health guidelines… rather than, quote, “demonizing innocent businesses.”

*** UPDATE 2 *** Rob Karr with IRMA told me the Abudayyeh statement is “not accurate.” He did get a call yesterday, but he was never actually given any language by the governor’s office and was never asked for any input from them.

…Adding… I’m told the input the governor’s office received from IRMA came via two JCAR members.

13 Comments

|

* Late May since we’ve seen this many cases and the average positivity rate is still rising…

The Illinois Department of Public Health (IDPH) today announced 2,084 new confirmed cases of coronavirus disease (COVID-19) in Illinois, including 21 additional confirmed deaths.

Clark County: 1 male 60s

Cook County: 1 male 30s, 1 male 40s, 2 males 60s, 1 female 70s, 1 male 70s, 2 females 80s, 2 females 90s,

Ford County: 1 male 80s

Iroquois County: 1 male 60s, 1 male 70s

Lake County: 1 female 80s

LaSalle County: 1 female 90s, 2 males 90s

Madison County: 1 male 90s

St. Clair County: 1 male 80s

Winnebago County: 1 female 90s

Currently, IDPH is reporting a total of 190,508 cases, including 7,613 deaths, in 102 counties in Illinois. The age of cases ranges from younger than one to older than 100 years. Within the past 24 hours, laboratories have reported 46,869 specimens for a total of 2,984,618. The preliminary seven-day statewide positivity for cases as a percent of total test from July 31 – August 6 is 4.1%. As of last night, 1,486 people in Illinois were reported to be in the hospital with COVID-19. Of those, 333 patients were in the ICU and 125 patients with COVID-19 were on ventilators.

Following guidance from the Centers for Disease Control and Prevention, IDPH is now reporting both confirmed and probable cases and deaths on its website. Reporting probable cases will help show the potential burden of COVID-19 illness and efficacy of population-based non-pharmaceutical interventions. IDPH will update these data once a week.

1 Comment

|

|

Comments Off

|

* Filed by the attorney general in Clay County late yesterday…

It has been more than a month since Plaintiff Darren Bailey received precisely what his pleadings sought—a declaration by this Court that the Governor’s authority to respond to the Covid-19 pandemic under the Illinois Emergency Management Agency Act, 20 ILCS 3305 et seq. (“Emergency Management Act”) ceased to exist as of April 8. Order ¶ 3 (July 2, 2020) (“July 2 Order”). But even as Bailey championed this lawsuit as “freeing business and the people of Illinois” from “one-person rule” and a “tyrannical government,” in the real world nothing changed. The Court’s nonfinal, interlocutory order granting Bailey’s request for declaratory relief does not prevent the Governor from continuing to exercise his powers under the Emergency Management Act to protect the people of this State from the Covid-19 pandemic.

Public rhetoric notwithstanding, Bailey has made every effort to prevent this Court from issuing either an injunction that would bar the Governor from exercising Emergency Management Act powers, July 2 Order ¶ 5 (granting motion to withdraw request for injunction), or a final judgment that would resolve the parties’ dispute in this Court once and for all, Response to Defendants [sic] Motion to Dismiss ¶¶ 3–11 (July 22, 2020) (“July 22 Response”). The July 2 Order is neither final nor enforceable because it involves fewer than all issues and does not include “a finding that there is no just reason for delaying enforcement or appeal.” Reed v. City of Belleville, 13 Ill. App. 3d 1093, 1094 (5th Dist. 1973).

For his latest effort to keep this case in this Court and abuse the judicial process for political gain, Bailey now moves to add an additional count disputing whether a disaster currently exists in Clay County within the meaning of the Emergency Management Act. There is no reason why the Court should entertain the matter. This Court already determined that the Governor’s authority under the Emergency Management Act is limited to 30 days per disaster— regardless of whether a Covid-19 disaster continues to exist in Clay County (or anywhere else in the State). Bailey’s current motion to add a new count is just another maneuver to thwart appellate review of the Court’s ruling. The proposed additional count is also defective as a matter of law and fails to plead sufficient facts to state a cause of action. The motion to add it should be denied.

* More…

The Court should deny Bailey’s motion to add an additional count for four independent reasons:

First, Bailey’s proposed additional count fails to state a cause of action because the Emergency Management Act does not require the Governor to make disaster determinations on a county-by-county basis.

Second, Bailey’s proposed additional count fails to state a cause of action because he does not plead facts sufficient to show that there is currently no “public health emergency” in Clay County.

Third, Bailey lacks standing to pursue his proposed additional count because a decision in his favor will not redress his claimed injury. This is because Bailey fails to challenge an independent basis for the Governor’s authority to exercise emergency powers—the existence of an “epidemic” in Clay County.

Fourth, Bailey’s proposed additional count is untimely and, in the context of his many other gambits designed to delay the conclusion of these proceedings, reflects an ongoing bad-faith effort to abuse the judicial process for political gain.

* Brutal…

According to Bailey, the fact that no one has yet to die in Clay County from Covid-19, and only 9 people to date have contracted it, means there is, in his opinion, no “high probability” that “a large number of deaths” will occur—and likewise no “high probability” of “widespread exposure” to a virus “that poses a significant risk of future harm to a large number of people.”

Bailey’s argument reduces to the proposition that an event has no probability of occurring until it has occurred. Or to put it another way, a highly contagious and deadly virus has no probability of causing widespread harm until it does. This reasoning is stunningly illogical, and the Court should not accept it. […]

Ordinarily, a litigant who had convinced a court to rule in his favor on the merits of his case would take immediate action to effectuate that result. Here, Bailey did the opposite. He resisted every effort to dismiss his one outstanding count and transform the Court’s interlocutory order into a final judgment. July 22 Response ¶¶ 3–11. To this day, the July 2 Order binds no one and has no legal effect because Bailey apparently prefers it to remain a meaningless piece of paper—in stark distinction to the far-reaching consequences he ascribes to it in the public eye.

Bailey’s proposed additional count is designed to further his strategy to drag out this case without an appealable order. Bailey intends for this Court not to resolve his dispute but rather to amplify it. This is an abuse of the judicial process.

…Adding… Rep. Darren Bailey speaking live on Facebook yesterday…

Its no surprise that our numbers even as the governor suggested yesterday in southern Illinois are increasing you know per capita, per our population. I personally still do not feel threatened by those numbers and statistics. When we see we’re testing, tests are up and so obviously so are potential positive results. What is good is that I am hearing, I have heard so far nothing but success – trying to get some doctors online eventually – regarding the use of hydroxychloroquine and the z pack process. Several area hospitals, doctors, are prescribing that and its working. I have friends who have tested positive. I have people who I have known whose family members are in the hospital. I’ve talked anyone I can get in contact with and that I can talk to locally and just kind of understand and hear and so far the people that I’ve talked to would not have changed anything. The one gentleman the we’re praying for, that is in the hospital, an older man, he had the choice to make whether or not to be in and out. And he just simply didn’t want to live as restricted because we don’t know when this is going to end if it is ever going to end. […]

But regarding the older gentleman that’s in St. Louis in ICU, the family, it just, it is what it is.

21 Comments

|

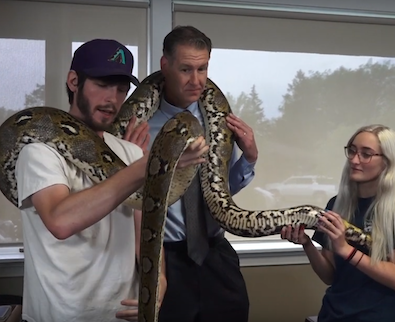

Caption contest!

Friday, Aug 7, 2020 - Posted by Rich Miller

* From YouTube…

Representative Jim Durkin and Senator John Curran host a two-part virtual reptile show with the Traveling World of Reptiles called, ‘Reptiles Go Virtual!’

Leader Durkin made a brief appearance at the start of the first video, but it’s all Sen. Curran after that. I asked Durkin’s spokesperson why he wasn’t around. Her text…

Yeah unfortunately something came up on the filming day so he barely got to be there.

“Sorry, John, but something has definitely come up and I really gotta split. I feel so bad for leaving you like this. Toodles!”

* Screen cap…

30 Comments

|

* I’ve been telling subscribers about this for a few days now…

Building on efforts to protect Illinois’ workers and communities in response to the ongoing COVID-19 pandemic, Governor JB Pritzker announced that the Illinois Department of Public Health (IDPH) will file emergency rules for businesses, schools, and child care establishments regarding the use of face coverings and the size of gatherings. The governor also signed SB471 to help protect workers who continue to serve on the frontlines of the fight against COVID-19.

“As I’ve visited with and listened to mayors and health departments all across our state, it’s clear there is still an even greater need to get people to wear masks – especially to protect frontline workers, whether they’re at the front of a store asking you to put on your mask or whether they’re responding to 911 calls to save those in distress,” said Governor JB Pritzker. “These rules, which provide multiple opportunities for compliance before any penalty is issued, are a commonsense way to enforce public health guidelines. Illinois has made substantial progress in our fight against COVID-19 because the vast majority of communities and business owners have done the right thing. These rules will help ensure that the minority of people who refuse to act responsibly won’t take our state backward.”

“We know that face coverings are key to helping prevent the spread of COVID-19, but it only works if everyone wears them,” said IDPH Director Dr. Ngozi Ezike. “We are seeing cases increasing each day and hearing about people not complying with the masking mandate. This rule is an effort to help keep all of us healthy and decrease the risk of contracting COVID-19.”

NEW IDPH COVID-19 EMERGENCY RULES

In an effort to maintain the progress we have made in Illinois’ COVID-19 pandemic response, the Pritzker administration is filing emergency rules for businesses, schools, and child care establishments regarding the use of face coverings and the size of gatherings.

These rules provide multiple opportunities for compliance before any penalty is issued, giving local health departments and local law enforcement more leeway to support community public health in a productive manner. While existing, pre-pandemic enforcement laws, like revoking a license, are stringent and severe, these rules provide flexibility for local communities and a measured process to help keep people safe.

That process is as follows:

• First, businesses will be given a warning in the form of written notice and encouraged to voluntarily comply with public health guidance.

• Second, businesses that do not voluntarily comply will be given an order to have some or all of their patrons leave the premises as needed to comply with public health guidance and reduce risks.

• Third, if the business continues to refuse to comply, the business can receive a class A misdemeanor and be subject to a fine ranging from $75-$2,500.

These rules do not apply to individuals and penalties will not exceed a misdemeanor and a $75-$2,500 fine.

The emergency rules also reinforce the authority of IDPH and local health departments to investigate COVID-19 cases and reaffirm that businesses have a responsibility to cooperate with those investigations.

The proposal now goes before JCAR, which is scheduled to meet next week. Again, subscribers know more.

* SB471…

As Illinois’ essential workers continue to serve on the frontlines of the fight against COVID-19, Governor Pritzker signed SB 471 to expand workplace protections. To directly protect workers in retail, the law adds a penalty for assaulting or battering a retail worker who is conveying public health guidance, such as requiring patrons to wear face-coverings or promoting social distancing. This provision sends the message that it’s vitally important for workers to be both respected and protected while serving on the front lines.

“As we continue to adapt to the changes forced on us by the current pandemic, we have to also create a response that addresses the long-time issues it has exacerbated,” said Senate Majority Leader Kimberly A. Lightford. “Our essential workers put their lives at risk for us to stay safe, and it is clear that we have to continue to do better to protect working class people with a renewed commitment to providing basic rights for everyone.”

“As our state faces the challenges created by the ongoing global pandemic, we are doing all we can to support and protect our front line and essential workers,” said State Representative Jay Hoffman. “This legislation allows front line workers that have been impacted by COVID-19 to focus on recovering while sending a clear message to all our essential workers that we are behind them and will do all we can to protect their safety and well-being.”

The law also increases paid disability leave for any injury that occurs after March 9, 2020 by 60 days for firefighters, law enforcement and paramedics whose recovery was hindered by COVID-19.

More specifically, eligible employees include:

• Any part-time or full-time State correctional officer or any other full or part-time employee of the Department of Corrections

• Any full or part-time employee of the Prisoner Review Board

• Any full or part-time employee of the Department of Human Services working within a penal institution or a State mental health or developmental disabilities facility operated by the Department of Human Services

• Any full-time law enforcement officer or full-time firefighter

These measure build upon the Pritzker administration’s efforts to protect the safety and livelihood of Illinois residents by continuing to enforce all labor laws during the pandemic.

SB 471 takes effect immediately.

…Adding… Center Square…

A member of the Joint Commission on Administrative Rules who has seen a draft copy of the rule expected to be addressed Tuesday in Springfield said a special session of the legislature is needed to debate the issues, rather than unilateral rules.

“I am very skeptical and uncomfortable with the administration setting up new criminal enforcement regulation outside of the legislative process,” said state Sen. Paul Shcimpf, R-Waterloo. […]

Schimpf said the legislature needed to make state laws, not the governor.

State statutes have long made any violation of an IDPH rule a Class A Misdemeanor. There’s absolutely nothing new here except for the procedure outlined above to narrow the scope and the downright harmful politics of this pandemic.

34 Comments

|

* Whoa…

WGN Investigates found between March 1 and July 1, there were about 78.5 million calls to IDES. Of those, 393,000 were answered. That doesn’t even reach 1% of the calls coming in.

It’s actually about one-half of one percent.

45 Comments

|

* Some background is here and here. From the Wall St. Journal…

An appeals court in Illinois has reinstated litigation seeking to block payments on $14.3 billion in municipal debt, saying the attempt to restrain borrowing in the country’s worst-rated state isn’t frivolous or malicious.

The appellate court said John Tillman, chief executive of the right-leaning Illinois Policy Institute, had put forth a legitimate claim in support of his theory that past bond sales by the state were impermissible.

* Law360…

An Illinois appellate court on Thursday resurrected a challenge to $14.3 billion in state bonds that a conservative think tank CEO claims were issued unconstitutionally, ruling that his complaint wasn’t frivolous or malicious and that a trial court shouldn’t have denied his petition to file it.

According to his petition for leave to file a taxpayers’ suit, Illinois Policy Institute CEO John Tillman claimed that bonds issued in 2003 and 2017 to purportedly help address massive pension and bill backlog obligations were not put toward a “specific purpose” for which the Illinois constitution allows it to enter into new long-term debt.

* From the opinion…

We repeat that we express no opinion on the merits of Tillman’s claims. We merely conclude for the purpose of this proceeding that Tillman should be permitted to file the complaint.

* From the governor’s office…

As has been noted previously, the bond issuance process under Illinois law includes several layers of review and sign off by bond counsel and Attorney General Lisa Madigan. The result is bonds that meet stringent legal standards, and these offerings met those standards. This lawsuit continues to be a tired tactic of the extreme right who continue to push their ideology over sound fiscal policy. This administration will continue to focus on the important work of acting responsibly to keep the state on stable fiscal footing.

Background…

Unlike other lawsuits, there is an extra step to file a taxpayer suit.

A plaintiff seeking to file a taxpayer suit must first file a Petition for Leave to File the lawsuit. Normally, that is a non-event and most suits are allowed to be filed.

Here the lower court ruled against Tillman and refused to allow the suit to even be filed. The Appellate Court disagreed. What that means is the suit can be filed — and will start at the first first step.

* Comptroller Susana Mendoza…

I strongly disagree with the ruling of the appellate court that reinstated former Governor Bruce Rauner’s #1 advisor and the Illinois Policy Institute CEO John Tillman’s irresponsible lawsuit, aimed at tanking Illinois’ finances - for the profit of named or unnamed hedge funds.

Bond counsel and the state Attorney General signed off on all these bonds. They were constitutional and we are confident Tillman will ultimately lose. While the fiscally responsible 2017 bond offering I championed saved taxpayers $4-$6 billion and served as a lifeline to businesses across Illinois, it hurt the profit margins of those who chose to bet against Illinois. Never bet against Illinois. Shame on them then, and shame on them today. This lawsuit is nothing more than garbage.

13 Comments

|

* Sinclair…

It might not be happening the way activists imagined, but calls to defund the police are becoming a reality as law enforcement agencies face the dual pressures of coronavirus-related budget shortfalls and nationwide protests.

According to a new survey by the Police Executive Research Forum (PERF), police agencies across the country could be facing some of the deepest cuts in a decade, even worse than during the Great Recession.

Roughly half of the 258 police agencies surveyed reported their funding has been cut or they expect it to be cut this year. Most said they are seeing reductions of 5-10% of their budgets. Others reported cuts exceeding 15%. […]

According to PERF respondents, the resources to implement those reforms are evaporating. Police agencies reported the deepest cuts in spending on equipment, personnel and training. That will make it more difficult to attract and hire new officers, purchase equipment like body cameras and train officers in de-escalation and implicit bias.

* USA Today…

Chuck Wexler, executive director of the D.C.-based think tank that authored the report, said police operations have not confronted such a threat since the financial crisis of 2008, when operations and force numbers were cut dramatically to account for the steep decline in available public funds. […]

Even smaller cities facing less pressure from the social justice movement have not been able to escape an unfolding financial crisis driven by the COVID-19 pandemic.

In Steamboat Springs, a ski-resort town in northwest Colorado largely supported by tourism-driven sales tax dollars, the police department is cutting its budget by 28% or nearly $1.5 million. It means that vacant positions will go unfilled and civilian employees are taking a 10% pay cut, Police Chief Cory Christensen said.

The police department’s training and recruiting budgets already have been zeroed out.

If Congress doesn’t act, these cuts are only going to get worse. The earlier package does not allow the federal money to replace lost revenues. It can only be spent on unanticipated COVID-related expenses.

20 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|