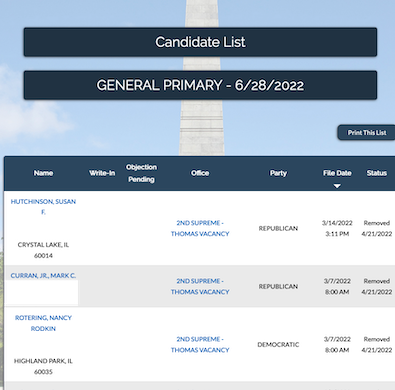

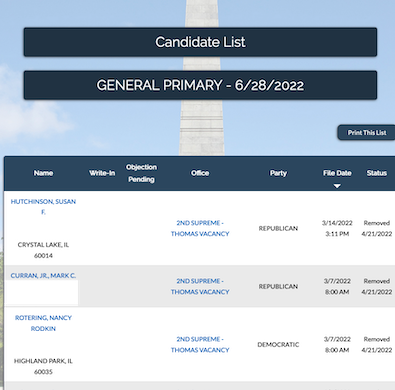

* Background is here (scroll down) and here (/snark) if you need it. Illinois State Board of Elections…

Awaiting reaction.

*** UPDATE *** Rotering campaign yesterday…

Illinois Supreme Court candidate Nancy Rotering and the other candidates affected by yesterday’s Illinois State Board of Elections’ ruling will be filing an appeal in court today. They will request an expedited hearing and stay of the electoral board decision. We are disappointed that the Illinois State Board of Elections acted contrary to its own Candidates’ Guide and the recommendations of its Hearing Officer and General Counsel that Nancy Rotering’s name appear on the ballot as a candidate for Supreme Court Judge. We believe the courts will ultimately support the right of the voters to choose their Supreme Court candidates in the June 28 primary election.

Comments Off

|

|

Comments Off

|

* Moody’s…

Moody’s Investors Service has upgraded the issuer rating of the State of Illinois to Baa1 from Baa2. Moody’s has also upgraded the following: to Baa1 from Baa2 the rating on the state’s outstanding general obligation bonds, and to Baa1 from Baa2 the rating on the state’s outstanding Build Illinois sales tax bonds. Moody’s has affirmed the Baa3 rating on outstanding Metropolitan Pier & Exposition Authority bonds that are partially paid with state appropriations. The outlook is stable.

RATINGS RATIONALE

The upgrade to Baa1 reflects the state’s solid tax revenue growth over the past year, which expanded its capacity to rebuild financial reserves and increase payments towards unfunded liabilities. The state is on track to close the current fiscal 2022 with its strongest fund balance in over a decade, which is net of complete repayment of borrowing from the US Federal Reserve’s Municipal Liquidity Facility and reflects continued progress towards paying down accounts payable. The state is also increasing pension contributions, indicating increased commitment to paying its single-largest long-term liability.

The rating balances the state’s recent financial progress with underlying challenges that will remain in place for some time. These challenges include heavy long-term liability and fixed cost burdens that constrain the state’s financial flexibility and contribute to a weak financial position compared to other states, despite the recent improvement in fund balance. Moreover, the Illinois economy has for the past decade expanded at a slower pace than most states and will likely continue to do so given a weak population trend.

The Baa1 rating on general obligation bonds is the same as the issuer rating and incorporates the availability of the state’s broad revenue base to pay the bonds.

The Baa1 rating on the Build Illinois sales tax bonds primarily reflects the lack of legal and physical separation of the pledged tax revenue from the state’s general financial activities. This lack of separation caps the rating at the level of the state’s issuer rating, despite strong coverage of debt service by pledged sales taxes levied on a very broad economic base.

The Baa3 rating on the Metropolitan Pier & Exposition Authority bonds is two notches lower than the state’s issuer rating. This reflects the moderate legal framework associated with the bonds and the less essential nature of the financed convention center. The moderate legal framework assessment incorporates the subject-to-appropriation nature of funds necessary to meet debt service requirements.

RATING OUTLOOK

The stable outlook balances the financial progress being made by the state with the uncertainty of the present economic climate. The state’s lean financial reserves, and heavy long-term liability and fixed cost burdens make it more vulnerable than other states to a negative shift in the national or global economy, which presently limits the probability of further rating improvement.

FACTORS THAT COULD LEAD TO AN UPGRADE OF THE RATINGS

- Continued improvement in state financial performance as indicated by, for example, growing fund balance

- Accelerated economic expansion, especially as compared to other states, that indicates sustained and strong revenue growth

- Moderation of the state’s long-term liability and fixed cost burdens

- Maintenance of fiscal management practices that support growth in reserves and stronger pension contributions

FACTORS THAT COULD LEAD TO A DOWNGRADE OF THE RATINGS

- Slow revenue growth that intensifies budgetary pressure or weakens fund balance

- Growth in leverage (debt or other unfunded liabilities) or the state’s fixed cost burden

- A material drop in available liquidity

- A departure from fiscal management practices that support growth in reserves and stronger pension contributions

…Adding… Media advisory…

Updated Daily Public Schedule: Thursday, April 21, 2022

What: Gov. Pritzker to host press conference announcing the state’s third credit upgrade.

Where: James R. Thompson Center, Blue Room, 15th Floor

When: 1:30 pm

Watch: www.illinois.gov/livevideo

…Adding… Speaker Chris Welch…

Speaker Welch’s Statement on Moody’s Credit Rating Upgrade

“Illinois is well on its way to long term fiscal surety. Moody’s credit rating increase is further affirmation that Democrats are getting Illinois’ finances back on track through steadfast, responsible leadership. We’ve turned Bruce Rauner’s $17 billion debt into a surplus, and now we’re using that financial stability to make historic investments in human services and public safety, and put money back into the pockets of hardworking families. This is the financial responsibility Illinoisans deserve.”

…Adding… Gov. Pritzker…

Governor JB Pritzker celebrated the state’s improved bond rating from Moody’s Investor Service on Thursday, the second such upgrade by Moody’s in less than a year and third overall in two decades. Since taking office, Gov. Pritzker has tirelessly focused on strong and responsible fiscal management, working with the General Assembly to hold the line on spending while making key investments to strengthen Illinois’ outlook.

Moody’s last upgraded the state’s bonds in June of 2021 and today’s upgrade credited the state’s “solid tax revenue growth over the past year” which expanded the state’s ability to rebuild financial reserves and increase payments toward unfunded liabilities. Moody’s noted that Illinois is “on track to close the current fiscal 2022 with its strongest fund balance in over a decade,” its progress in repaying its debts, and its increased pension contributions, taken as an indication of the state’s increased commitment to paying its pension debt.

“Illinois was in a deep hole in the years before I was sworn into the governorship, and together with the General Assembly, step by step, we are putting Illinois on firm fiscal footing,” said Governor JB Pritzker. “This credit upgrade means Illinois will likely pay a lower interest rate, saving taxpayers hundreds of millions of dollars in the coming years. I would like to especially thank Speaker Welch, President Harmon, Leader Greg Harris, Senator Elgie Sims, Comptroller Susana Mendoza and Treasurer Michael Frerichs for their partnership. There’s more work to be done, but step by step, rung by rung, we are steadily climbing the ladder out of a hole that was dug over decades. Illinois’ future is bright.”

The upgrade follows the enactment of the state’s fourth balanced budget in a row, while providing $1.8 billion in tax relief to the working families of Illinois and marked Illinois’ first contribution to a Rainy-Day Fund in 18 years, as well as a $500 million overpayment toward the state’s pensions. The historic budget places Illinois it its strongest financial position in a generation while funding key investments for education, human services, law enforcement and violence prevention.

Moody’s upgraded Illinois’ rating on its General Obligation bonds to Baa1 stable outlook from Baa2 stable outlook, and also upgraded Build Illinois sales tax bonds to Baa1 from Baa2 while maintaining their stable outlook. Moody’s affirmed the Baa3 rating and stable outlook on outstanding Metropolitan Pier and Exposition Authority bonds that are partially paid with state appropriations.

The rating of a state’s bonds is a measure of their credit quality. A higher bond rating generally means the state can borrow at a lower interest rate, saving taxpayers millions of dollars.

Between 2015 and 2017, the State of Illinois suffered eight credit rating downgrades and sat at the top of many analysts’ lists of the worst managed states in the nation. At its worst, Illinois’ bill backlog hit nearly $17 billion.

Key Actions – Responsible Fiscal Management

Fiscally responsible choices over the last three years have resulted in historic progress toward financial stability in Illinois.

Illinois’ FY2023 budget:

• Deposits $1 billion to the Budget Stabilization Fund (BSF) across FY2022 and FY2023 - the first deposits in 18 years. Also creates ongoing, permanent funding for BSF for the first time.

• Contributes an additional $500 million directly towards state unfunded pension liabilities, reducing long-term liabilities by an estimated $1.8 billion

• Pays down $4 billion in debts across FY2022 and FY2023, including eliminating the payment delays in the employee and retiree health insurance program through $898 million in FY2022 supplemental appropriations.

• Keeps pace with payment of the state’s bills, with estimated bill payment delays at the lowest levels since before the Great Recession, saving taxpayers hundreds of millions in unnecessary interest costs

…Adding… Comptroller Mendoza…

For the second time in less than a year, Moody’s Investors Services, one of the “Big Three” credit rating agencies in the United States, announced Thursday that it upgraded Illinois’ credit rating.

Moody’s cited the state’s use of tax revenue growth to rebuild its financial reserves (Rainy Day Fund) and the increase of pension contributions among reasons for the upgrade. Moody’s also noted the state’s shrinking accounts payable, which stands at $2.7 billion today, a massive reduction compared to the $16.7 bill backlog in 2017.

Proof of the state’s commitment to shoring up its Rainy Day Fund comes today as Comptroller Susana A. Mendoza transfers the first installment – $400 million from the General Revenue Fund – into the Budget Stabilization Fund (Rainy Day Fund). She is also sending $300 million to the Pension Stabilization Fund. Under the budget passed by the General Assembly and signed by Governor JB Pritzker, the state will commit $1 billion to the Rainy Day Fund, as well as an additional $500 million to the Pension Stabilization Fund, saving Illinois taxpayers $1.8 billion – similar to homeowners making an extra payment to reduce the principal on a mortgage.

This is exactly the kind of responsible budgeting Comptroller Mendoza and the credit rating agencies have called for.

“I knew that through our smart fiscal management, this upgrade was on the horizon,” Comptroller Mendoza said. “This is not by chance. Even before a penny of American Rescue Plan Act (ARPA) federal stimulus dollars came to Illinois, the Illinois Office of Comptroller methodically paid down the state’s bills and shortened the bill payment cycle. I thank Moody’s for continuing to recognize this remarkable progress with their second upgrade in less than a year, and I look forward to more good news ahead as Illinois continues to gain solid financial footing. This is a great day for Illinois.”

Today’s news follows an upgrade from Moody’s on June 29, 2021, which was the first upgrade the state had earned in more than two decades. The next week, on July 8, S&P Global also upgraded the state’s credit rating.

This means the state has now earned three credit rating upgrades in less than a year, all while managing to come back from the 2015-2017 budget impasse and astutely maneuver the financial challenges wrought by the COVID-19 pandemic.

In addition to the transfers into the Rainy Day and Pension Stabilization Funds, Comptroller Mendoza on Thursday also directed $230 million to protect funds invested by families into the College Illinois! pre-paid college tuition program.

All told, within two days of the Governor signing the fiscal year 2023 budget earlier this week, the Illinois Office of Comptroller already made significant movement by making $1 billion of essential payments toward the recovery of Illinois’ finances into the Rainy Day, Pension Stabilization, College Illinois, and Group Health Insurance funds.

Comments Off

|

* Fourth District Illinois Appellate Court. Justice Cavanagh wrote the decision…

According to the complaints in these three appeals, the plaintiffs work for or used to work for public employers in Illinois, either on the local level or the state level. We will refer to the plaintiffs, collectively, as “the employees.” In the circuit court of Sangamon County, the employees petitioned for the issuance of temporary restraining orders that would bar the public employers and Governor Pritzker from enforcing a workplace policy requiring all employees either to be vaccinated against COVID-19 or, alternatively, to undergo regular testing for COVID-19. The court denied the petitions for temporary restraining orders. The employees appeal. We find no abuse of discretion in that ruling. Therefore, we affirm the judgments in these three cases. […]

One of the reasons why the circuit court denied the employees’ petitions for temporary restraining orders was that recently the General Assembly passed an amendment making clear that it was not a violation of the Conscience Act for any employer to take measures calculated to prevent the spread of COVID-19. […]

To quote from Sutherland again, “while the views of a subsequent legislature cannot override the unmistakable intent of the enacting one, such views may be entitled to significant weight, particularly when the precise intent of the enacting legislature is obscure.”

That part’s a no-brainer.

* But here’s where it gets good…

The employees assert that their employers’ vaccination or testing requirement violates section 2 of the Health Act (20 ILCS 2305/2 (West 2020)). The employees do not offer much of an explanation, though, of how that requirement violates the statute.

Section 2(a) of the Health Act provides that the Health Department “has supreme authority in matters of quarantine and isolation.” Id. § 2(a). The employers, however, have not quarantined or isolated any employees, nor have the employers threatened to do so. Because the term “quarantine” is undefined by the Health Act, we give the term its dictionary meaning. See People v. Chapman, 2012 IL 111896, ¶ 24. A “quarantine” is “a state, period, or place of isolation in which people or animals that have arrived from elsewhere or been exposed to infectious or contagious disease are placed.” New Oxford American Dictionary 1393 (2001). To “quarantine” someone means to keep that person isolated from other members of society. Cassell v. Snyders, 458 F. Supp. 3d 981, 1002 (N.D. Ill. 2020). The threatened penalty for noncompliance with the vaccination or testing requirement is merely the loss of employment, not quarantine or isolation. To be fired is not to be quarantined or isolated from the community at large.

Section 2(d) of the Health Act provides that “[t]he [Health] Department may order physical examinations and tests and collect laboratory specimens as necessary for the diagnosis and treatment of individuals in order to prevent the probable spread of a dangerously contagious or infectious disease.” 20 ILCS 2305/2(d) (West 2020). Section 2(d) further provides that if the individual refuses to consent to such testing and if “that refusal results in uncertainty regarding whether he or she has been exposed to or is infected with a dangerously contagious or infectious disease or otherwise poses a danger to the public’s health, the individual may be subject to isolation or quarantine.” Id. Similarly, section 2(e) (id. § 2(e)) provides that “[t]he [Health] Department may order the administration of vaccines *** to persons as necessary in order to prevent the probable spread of dangerously contagious or infectious disease” and that “the [Health] Department may, pursuant to the procedures in [section 2(c) [(id. § 2(c))], isolate or quarantine persons who are unable or unwilling to receive the vaccines.”

Just because section 2 of the Health Act confers upon the Health Department such authority, it does not logically follow that the employers lack authority over workplace safety, such as the authority to require employees, on pain of loss of employment, to undergo vaccination or testing for infectious diseases such as COVID-19. “Administrative agencies have, in addition to the powers conferred upon them by explicit statutory language, the power to do all which is reasonably necessary to effectuate the powers and authorities explicitly granted to them.” Taylor v. State Universities Retirement System, 203 Ill. App. 3d 513, 522 (1990). “An express grant of power or duty to do a particular thing includes the express grant of power to do all that is reasonably necessary to execute the power or duty.” Owens v. Green, 400 Ill. 380, 400 (1948). The employers surely have the power to lay down workplace safety rules, of which the vaccination or testing requirement is an example—because such power is reasonably necessary to effectuate the powers that the legislature explicitly granted to them.

Citing Austin v. Board of Education of Community Unit School District 300, 2022 IL App (4th) 220090-U, ¶ 15, the employees argue that the Governor lacks authority to “make final decisions on public health.” The vaccination or testing requirement that the employees challenge, however, is not a decision on public health. “Public health” is “[t]he health of the community at large” or “[t]he healthful or sanitary condition of the general body of people or the community en masse; esp[ecially] the methods of maintaining the health of the community, as by preventive medicine and organized care for the sick.” Black’s Law Dictionary (11th ed. 2019) (sub-definition of “public health” in the definition of “health”). The vaccination or testing requirement is not calculated to maintain “the health of the community at large.” Id. Nothing in the employers’ policy prevents an employee, upon testing positive for COVID-19, from circulating in “the general body of people” outside the workplace and thereby spreading the infection. Id. The vaccination or testing requirement is, instead, a workplace safety rule and a workplace rule of considerate conduct toward the public that the agencies serve. [Emphasis added.]

By this reasoning, mask mandates aren’t a form of quarantine either, since the dictionary definition of “a state, period, or place of isolation in which people or animals that have arrived from elsewhere or been exposed to infectious or contagious disease are placed” would obviously not apply. So Sangamon County Circuit Court Judge Raylene Grischow’s ridiculous rulings to the contrary will hopefully and finally be put to rest, as will the lawsuit filed by a handful of Department of Corrections workers that we discussed earlier today.

The dissent didn’t mention the quarantine argument.

*** UPDATE *** Tom DeVore on WMAY today…

(W)hen I saw the language about quarantine, I found that odd because we’re not talking about quarantine or isolation under Subsection C of the Health Act. We’re talking about other specific provisions.

Um, the justices clearly referred to the entire section as well as numerous subsections, not just one subsection. Swing and a miss.

38 Comments

|

More bills heading to Pritzker’s desk

Thursday, Apr 14, 2022 - Posted by Rich Miller

* Capitol News Illinois…

A major initiative of a regional carpenters’ union that aims to end wage theft in private construction projects will head to Gov. JB Pritzker.

The long-debated measure allows a worker with a wage theft or fringe benefit grievance against a subcontractor to sue the primary contractor to rectify the situation. The primary contractor is the entity that deals directly with the customer and hires the subcontractors to complete a project.

The bill also requires the subcontractor to compensate the primary contractor for any wages, damages, interest, penalties or attorney fees should the primary contractor be forced to rectify a wage theft claim.

“Construction jobs are unique in that they often feature various subcontractors under one general contractor whose job it is to make sure all laws, including wage-related ones, are being followed,” the bill’s sponsor, Sen. Cristina Castro, D-Elgin, said in a statement. “This measure will ensure that the hardworking individuals who are employed by subcontractors receive fair compensation should that subcontractor fail to pay them.”

David Roeder at the Sun-Times on the same bill…

The Associated General Contractors of Illinois opposed the measure. That group and the Illinois Chamber of Commerce could not be reached for comment.

The Hispanic American Construction Industry Association fought the bill. In a statement issued in early April, the group cited “the harm it will inflict on up-and-coming construction firms in Illinois and the employees who become victims of wage theft.” It said it contradicts Illinois’ goal of diversifying the construction industry and creates an incentive for cheating.

“Shifting liability for wage theft encourages bad actors to continue stealing from their employees because they know that someone else will be held accountable,” the group said.

A study issued early last year concluded that payroll fraud affects 20% of Illinois construction workers, or about 52,000 people. The study by labor-backed groups, including the Illinois Economic Policy Institute, said some employers skip paying payroll tax, unemployment insurance and workers’ compensation.

* Press release…

The Illinois Education Association (IEA) worked with lawmakers on both sides of the aisle and the governor’s office to ensure the passage of several pieces of pro-public education legislation during the 2021-22 legislative session in Springfield. This legislation will mean stronger K-12 schools and stronger community colleges and universities for our students, and it will help us address the growing teacher and education support staff shortages in our state.

“We are about to end our second full school year during the COVID-19 pandemic. These have been the hardest years of most of our educators’ careers and are also likely the most difficult two years of our students’ learning careers. Our lawmakers recognized that. They acknowledged that not with mere words, but with action. We thank you for standing by our teachers, support staff, students and communities,” IEA President Kathi Griffin said. “This legislative session brought positive change to every Illinois student from pre-school through college. The legislative initiatives passed by the General Assembly also help to address some of the problems that are leading to the teacher and support staff shortages that are now at a crisis level. But as much great work as we’ve done, more still needs to be done to keep our outstanding, experienced educators in their schools and higher education institutions and to attract bright, ambitious young minds to the profession. We look forward to continuing this important work.”

Legislation passed by lawmakers this session that will have a positive impact on public education:

• Threat Assessment Law Update (HB 4994) – This bill ensures safe schools for all Illinois students. It’s a collaboration between IEA and lawmakers on both sides of the aisle. The legislation will mean school district administrations are monitored by Regional Offices of Education to make sure they are in compliance with Illinois’ Threat Assessment Law. That law is designed to help prevent active shooter situations and violence in our schools.

• COVID Admin Days and Paycheck Protection (HB 1167) – HB 1167 will provide COVID administrative days to teachers and education support staff who are either vaccinated or who are federally exempt from the vaccine. This ensures teachers and support staff will not have to use sick days for COVID related absences. It also restores any previously used sick days educators may have taken. Included in this legislation is paycheck protection for hourly school employees in the event a school closes for an emergency.

• Special Education Co-Op Bill (HB 3709) - This bill protects collective bargaining rights for special education teachers and support staff by ensuring seniority is maintained when a special education co-op is dissolved or combined with another special education co-op.

• Mental Health Days (HB 4742) – HB 4742 provides education employees can use sick days for mental health related reasons.

• Increased education funding, full pension payment and monies to address teacher shortage (HB 900) -

o Lawmakers allocated an additional $350 million dollars for public education, which means the evidenced-based funding model for K-12 schools was fully funded.

o The legislature approved sending the state’s full payment and additional funding to the Teachers’ Retirement System (TRS).

o After years of nearly stagnant funding for universities and community colleges, lawmakers approved a significant increase in higher education funding.

o Also included is $400,000 for the Educators Rising Program, which is the community-based movement that encourages Illinois high school students to choose to become teachers.

* More on the mental health days from Quincy’s WGEM TV…

QPS personnel director Lisa Otten said anything that can be done to support teachers mental health is worth doing.

She said right now teachers can use sick days as mental health days. She said the district also offers teachers three free counseling sessions through their insurance plans.

Otten said they’re noticing more teachers taking advantage of those services.

“More of our staff members are using this service, probably because of the mental health needs right now with post-COVID,” she said. “Our families and staff have been through a lot so we are noticing an uptick in of the staff that are using the free counseling services.”

…Adding… Partnership for College Completion…

On the last day of a shortened session, the Illinois General Assembly passed a budget that included a historic $122M increase in the Monetary Award Program (MAP), which will allow 24,000 more students to access the state’s primary need-based aid program. Other higher education highlights include a 5% increase in college and university funding and investments in financial aid programs that will help make college more affordable for students seeking careers with high market demand. The FY23 budget, for example, doubles funding to the Minority Teachers of Illinois scholarship, which aims to increase the representation of teachers of color in Illinois.

This budget symbolizes a renewed commitment by the state to make college more affordable and accessible, particularly for students who have been historically left out of higher education. The Partnership applauds Governor Pritzker and the General Assembly for advancing a budget that will help put Illinois on track to a more equitable and prosperous future.

Right now, this investment is particularly important with colleges in Illinois and across the country experiencing significant enrollment declines, particularly among Black students and other marginalized populations. While there are many reasons why college enrollment is down across the country– mental health, increased family responsibilities, and the perceived value of a degree– college affordability is perhaps the number one reason why Illinois students and families are not seeking a postsecondary education in the state.

Getting Illinois on track to a truly affordable higher education system requires a reinvestment that is both substantial and targeted. This is because the state disinvested in colleges and universities between 2002 and 2018, pushing institutions to raise their prices to cover the cost of delivering high-quality education. This priced out students from low-income households and students of color, especially from Illinois’ public universities.

Today, the maximum MAP award covers just 32% and 36% of tuition and fees at public universities and colleges, respectively, and thousands of eligible students are denied awards every year when funding runs out. Reversing this trend will require stable and significant investments in both students and the institutions that serve them and the budget passed by the General Assembly last weekend is a significant down payment toward this goal.

With both the increase in MAP funding and expanded eligibility to students seeking certificates or credentials, roughly 24,000 more students will receive a MAP award. The investment will not only increase the number of students served but also increase the percentage of tuition and fees covered by a maximum award, from 32% to 50% at public universities.

* Other stuff…

* Legislation classifying Illinois dispatchers as first responders clears legislature

19 Comments

|

*** UPDATED x1 *** Oopsie

Thursday, Apr 14, 2022 - Posted by Rich Miller

* Tribune editorial…

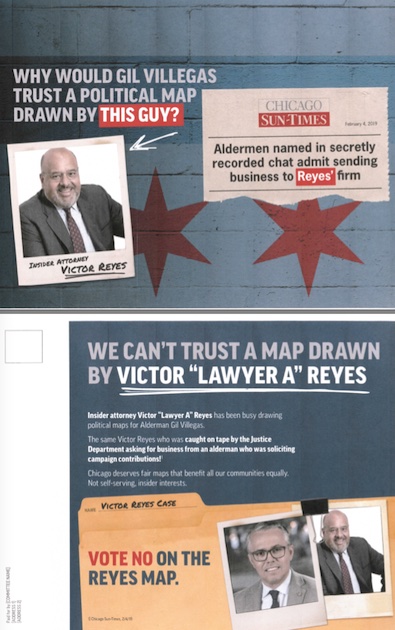

Unless both sides can reach an agreement before May 19, voters will get to decide in a June 28 referendum which map will become the city’s new ward boundaries — the one proposed by the Black caucus or the offer from the Latino caucus. A remap needs 41 votes to become law, and neither side likely has enough votes. We have always thought that letting voters decide is the best route to take, especially since Chicagoans are the one group routinely shut out of the remap process.

There’s a hitch, however, to the potential for a referendum.

Both the Black and Latino caucuses have submitted their versions of a remap for placement on the June 28 referendum ballot. But the Latino caucus now wants to submit a new and improved map for the ballot. The caucus has teamed up with Change Illinois, a civic advocacy group behind an advisory redistricting commission that crafted its own map. That document, known as the “People’s Map,” has merit because it was produced with the input of voters — the same voters that City Hall has ignored during remap talks.Like Change Illinois, members of the Latino caucus believe the process is fairer when it includes citizen input.

But 15 aldermen with the Latino caucus already signed onto putting their original map on the referendum ballot. The Black caucus map has been signed by 33 aldermen. Aldermen can only sign onto one map. A minimum of 10 aldermen are needed to put a map on the ballot, which makes it impossible for the Latino caucus to swap out its old map for a new “People’s Map.”

Change Illinois leaders tell us there is a wonky workaround, though. If at least 26 of the council’s 50 aldermen vote to approve one of the maps, then the whole process starts anew and each caucus can revamp their maps and resubmit them for placement on the ballot. A vote of 41 or more for a map would negate the need for a referendum, but given how far apart both sides have been, that’s not likely.

Considering how the reformers have been bad-mouthing the majority with “Because Madigan!” insults, I’m kinda thinking that the majority is probably in no mood to cooperate. But, hey, we’ll see.

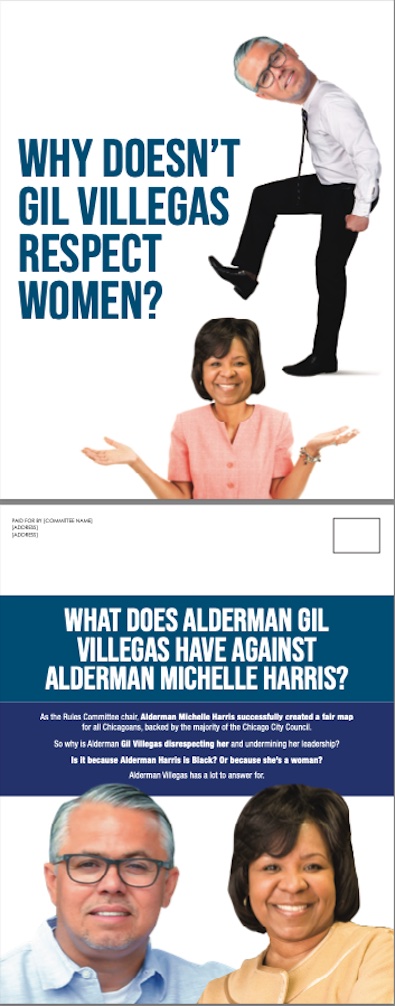

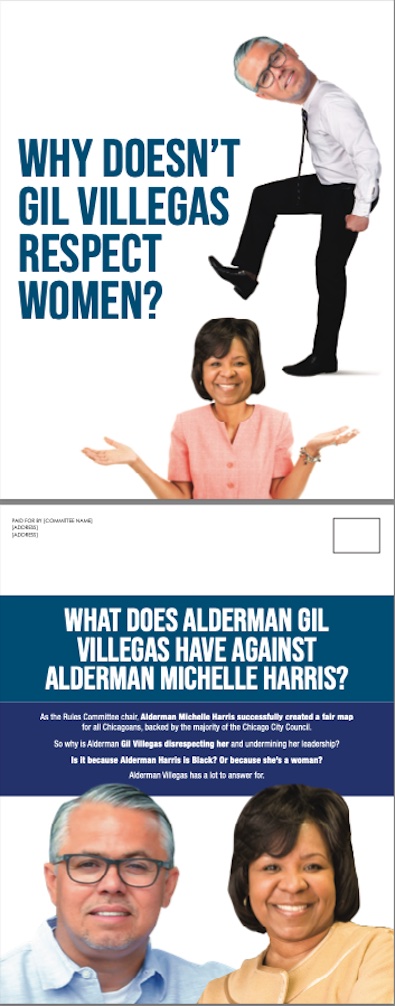

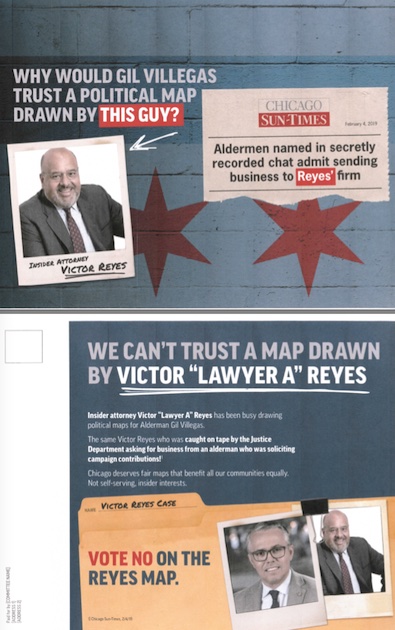

*** UPDATE *** Like I said, the city council majority ain’t exactly happy right now. Check out their new mailers…

Oof.

30 Comments

|

* Press release…

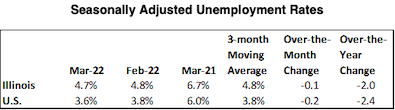

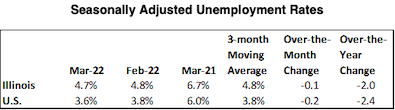

The Illinois Department of Employment Security (IDES) announced today that the unemployment rate fell -0.1 percentage point to 4.7 percent, while nonfarm payrolls increased by +18,300 in March, based on preliminary data provided by the U.S. Bureau of Labor Statistics (BLS) and released by IDES. The February monthly change in payrolls was revised from the preliminary report, from +19,600 to +25,100 jobs. The February unemployment rate was unchanged from the preliminary report, remaining at 4.8 percent. The March payroll jobs estimate and unemployment rate reflects activity for the week including the 12th.

In March, the industry sectors with the largest over-the-month gains in employment were: Professional and Business (+9,700), Financial Activities (+3,800), and Leisure and Hospitality (+3,500). The industry sectors that reported monthly payroll declines were: Trade, Transportation and Utilities (-3,500), Other Services (-1,200) and Mining (-100).

“We are pleased to see another positive sign of Illinois’ continued economic growth,” said Deputy Governor Andy Manar. “IDES and the Pritzker Administration are committed to innovating and building an even stronger workforce system. Workers and businesses across Illinois can leverage the latest resources by visiting Get Hired Illinois or IllinoisJobLink.com today.”

“With the unemployment rate falling and thousands of jobs being added in key industries, such as hospitality and professional services, Illinois continues on a positive economic trajectory,” said DCEO Director Sylvia I. Garcia. “DCEO remains laser-focused on prioritizing efforts to attract job creators while supporting an equitable economic recovery for all Illinoisans.”

The state’s unemployment rate was +1.1 percentage points higher than the national unemployment rate reported for March, which was 3.6 percent, down -0.2 percentage point from the previous month. The Illinois unemployment rate was down -2.0 percentage points from a year ago when it was at 6.7 percent.

Compared to a year ago, nonfarm payroll employment increased by +238,300 jobs, with gains across nearly all major industries. The industry groups with the largest jobs increases were: Leisure and Hospitality (+87,600), Professional and Business Services (+55,000), and Trade, Transportation and Utilities (+40,200). Construction was the only industry that reported a decrease (-700). In March, total nonfarm payrolls were up +4.1 percent over-the-year in Illinois and up +4.5 percent in the nation.

The number of unemployed workers was down from the prior month, a -3.0 percent decrease to +299,300 and was down -29.4 percent over the same month for one year ago. The labor force was up +0.4 percent over-the-month and up +2.2 percent over-the-year. The unemployment rate identifies those individuals who are out of work and seeking employment. An individual who exhausts or is ineligible for benefits is still reflected in the unemployment rate if they actively seek work.

* Comparison…

…Adding… Jesse Sullivan…

“Illinois should be leading America’s economy, not trailing – and we can again with new leadership.

“Unfortunately, the legacy of J.B. Pritzker’s economy is that he closed our businesses, told workers to stay home, and raised our taxes. The result: Illinois just received an ‘F’ grade for economic outcomes during COVID. Temporary election-year gimmicks won’t undo the damage he’s caused, and the voters know it.

“We can do better. I’ve invested in job creators around the world, bringing prosperity and purpose in the toughest of circumstances. It can be done here in Illinois, but only if we make a real change.

“Businesses and workers in Illinois are dealing with much more than profits and losses. They’re scared and held back because of rising crime, corruption in Springfield, and high taxes. I’m the only candidate who’s signed the Taxpayer Protection Pledge, I’m the only candidate who has a Safe Streets Plan to crack down on crime, and I’m the only candidate with a Clean Up Illinois agenda to end corruption in Springfield.

“It’s going to take a real change from a real outsider, not another politician, to grow Illinois’s economy to the front of the pack where we belong.”

3 Comments

|

* Sun-Times…

The Democratic governor, facing a reelection battle in November, was also asked whether the state would consider another indoor mask mandate, as other U.S. cities respond to rising cases caused by the highly transmissible Omicron subvariant known as BA.2.

The city of Philadelphia on Monday announced a reinstatement of its mandate after lifting it a little over a month ago. Other states in the Northeast are also reporting an uptick in cases.

The U.S. Centers for Disease Control and Prevention on Wednesday also announced a two-week extension of a mask requirement for airplanes and public transportation. The New York Times reported Dr. Ashish K. Jha, the new White House COVID response coordinator, said additional time would allow the CDC to assess whether the subvariant is going to become a “ripple or a wave” in the country. The federal requirement was set to expire in five days. […]

Last week, four southern Illinois counties hit the “high transmission” threshold set by the CDC, meaning masks are recommended for people gathering indoors in Saline, Gallatin, Hardin and Pope counties.

* The governor’s full response to the question…

Well, we’re watching these numbers very closely, as you know. And the numbers that we really pay very, very close attention to are hospitalizations. Because Omicron has had varying effects different than Delta. And so now we’re in a series of infections that people are getting where not only people are less sick as a result of the fact that we have many more people who are vaccinated, and who are taking care of themselves. But also, we have therapeutics that are helping people who do get sick to recover more easily. And so we are seeing hospitalizations very far down from where they were at the height of Omicron, and stabilized at a relatively low rate. And again, we’re watching those numbers very closely. Look, I think that towns, cities across Illinois, not to mention across the country should do what they feel is necessary in their communities to keep people safe. But I feel like, right now, and listening to the IDPH and our experts on the outside of IDPH, that we’re in a pretty good place.

*** UPDATE *** IDPH…

The Illinois Department of Public Health (IDPH) issued a warning today that COVID-19 case rates are slowly rising in many areas of the state and that members of the public should be paying close attention to conditions in their local communities and staying up-to-date on their vaccination status.

“While hospitalizations and deaths tied to COVID-19 remain stable at this time, we are seeing a slow increase in cases in many areas of the State,” said Acting IDPH Director Amaal Tokars. “This is a reminder that we all need to remain vigilant and remain up to date on our vaccination status. This is especially important for those who are at higher risk for serious outcomes.”

Tokars stressed that vaccination is the most effective tool we have to fight the virus – and that it is easy to find a COVID-19 vaccination location near you by either calling your local health provider or going to www.vaccines.gov.

The State of Illinois remains strongly positioned to respond in the event of a new COVID-19 surge. The State stockpile of tests has been replenished, with more than 1.5 million rapid tests on hand, and a half a million more on the way. In addition, hospitals, schools, and long term care facilities have been urged take steps to increase their current testing capacity.

The State is also supporting pharmacies and healthcare providers in efforts to increase their inventories of the various FDA-authorized treatments in case of another surge. IDPH is advising providers to assess their patients quickly, within five days of the onset of symptoms, after a COVID-19 diagnosis to determine if they are eligible for treatment.

IDPH is also reminding the public about the recent guidance from the CDC that authorized a second booster dose for certain segments of the population at least four months after the first booster dose. This includes adults over 50 years of age, and people who are immunocompromised - those with a poor ability to fight infections - over 12 years old.

State health officials are stressing the following precautions, which are critically important for those who are at high risk for serious illness:

• Get vaccinated and stay up-to-date on recommended booster shots to protect yourself, your loved ones and friends.

• If you are in an area with rising COVID-19 infections, wear a mask if entering indoor spaces with other people present and consider avoiding large gatherings.

• Stick to well-ventilated areas if you are not wearing a mask indoors around other people.

• If you feel flu-like symptoms, self-isolate and stay home from work as well as social gatherings; and obtain a test as quickly as possible.

• If you test positive, talk to your provider immediately so you can get COVID-19 treatment within five days of starting to feel sick. Also, communicate about the positive result with any persons you have been in close contact within two days of falling sick or testing positive.

• Continue to frequently wash your hands and cover coughs and sneezes.

For more information, go to: https://dph.illinois.gov/covid19.html.

The federal government recently established a new website that provides an all-purpose toolkit that provides information on how to obtain masks, treatment, vaccines and testing resources for all areas of the country at: https://www.covid.gov/.

3 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|