* Tribune…

In an unprecedented ruling, an appellate court declared the city of Harvey so severely neglected its firefighters’ pension fund that it was on the verge of insolvency — meaning there might not be any money for retirees or firefighters on the job there today.

The ruling comes as local firefighters complain of equipment in disrepair and manpower cuts. And it follows another embarrassing ruling in which a Cook County judge took away control of Harvey’s water finances from leaders of the scandal-plagued and debt-ridden south suburb.

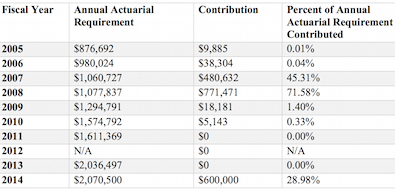

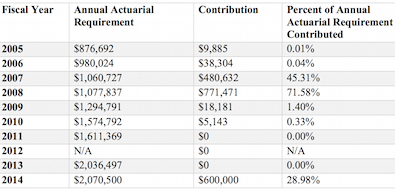

In a scathing opinion filed earlier this month, the 1st District Appellate Court found that for nearly a decade, the city neglected to pay enough money to keep the pension fund solvent, leaving it in danger of running dry in as little as five years. Indeed, the court found that over that period, the city contributed only 17 percent of the amount needed to sustain the pension fund.

“Harvey has set up a collision course over a period of many years where the beneficiaries of their firefighters’ Pension Fund are being paid substantially out of the money that the firefighters have themselves contributed to the Pension Fund and the money the Pension Fund earns from investments…” the court wrote. “In essence, Harvey is robbing Peter to pay Paul, but what happens when Peter retires?”

It is the first time a court has declared a pension fund to be “on the verge of default or bankruptcy,” the ruling said, meaning that the fund now has the right to be funded under a little-known clause in the state constitution.

The ruling is here.

* From that ruling is this chart showing how little Harvey was paying into its pension fund…

- MOON - Tuesday, Aug 22, 17 @ 2:00 pm:

Anybody know what that clause is in the state constitution?

- ChrisB - Tuesday, Aug 22, 17 @ 2:01 pm:

I am in perpetual awe in how Mayor Kellogg both has still not been indited by federal prosecutors for rampant corruption and how he keeps somehow winning elected office after all the shenanigans that occur in Harvey.

- BigDoggie - Tuesday, Aug 22, 17 @ 2:08 pm:

Any more explicit explanation for this snippet?: “the fund now has the right to be funded under a little-known clause in the state constitution.” Please don’t tell me this means that they get bailed out with state funds.

- Archiesmom - Tuesday, Aug 22, 17 @ 2:11 pm:

I am with ChrisB.

- the Cardinal - Tuesday, Aug 22, 17 @ 2:11 pm:

How is the mayor not in the sights of the ILAG office, the USAG office or Cook county? This is just one of numerous malfeasances perpetrated by this administration. Some agency needs to intervene and take over the community.

- Perrid - Tuesday, Aug 22, 17 @ 2:21 pm:

BigDoggie, from the article I think that the constitution just gives courts the power to demand that Harvey pay X amount into the fund because of the declaration of impending insolvency. So Harvey is still on the hook. As to whether or not hey will be able or willing to, who knows…

- Shemp - Tuesday, Aug 22, 17 @ 2:44 pm:

A 45 member FD that doesn’t run EMS for a city of 25,000 is bloated.

- Shemp - Tuesday, Aug 22, 17 @ 2:46 pm:

The pension fund can have the State Comptroller withhold state payments to the City of Harvey and have them sent to the Harvey Fire Pension Fund. Why they haven’t been doing this before is beyond me. http://www.ilga.gov/legislation/ilcs/fulltext.asp?DocName=004000050K3-125

- Anon Downstate - Tuesday, Aug 22, 17 @ 2:46 pm:

I was particularly impressed with the following (Page 13 of the 86 page document):

“(3) Joseph Letke

¶ 48 During his deposition, Joseph Letke, the official comptroller for Harvey starting in 2003,

invoked his Fifth Amendment privilege against self-incrimination 178 times and refused to

answer questions regarding (1) fraudulent and misleading bond offerings, (2) a developer

who collected bond proceedings from Harvey then fled to India, (3) the accusation that Letke

collected fees from both Harvey and the developer, who fled to India, (4) why each Harvey

alderman had an $80,000 unmonitored expense account, (5) why Harvey paid an alderman’s

son $325 an hour for snow removal, and (6) why Harvey paid the mayor’s son $88,000 to

develop a social media website.”

————

I really wonder if the political class fully understands exactly how much “Guilt By Association” is created in the minds of taxpayers for all the other tax districts based upon these incidents (and others) in the City of Harvey.

BTW, here’s your $88,000 website:

http://www.cityofharvey.org/site2/

“No matter how cynical you become, it’s never enough to keep up.”

-Lily Tomlin

- Shemp - Tuesday, Aug 22, 17 @ 2:47 pm:

One more reason there shouldn’t be 600+ local fire and police pension funds around the State….

- A guy - Tuesday, Aug 22, 17 @ 2:47 pm:

Not. Good.

- Lobo - Tuesday, Aug 22, 17 @ 2:49 pm:

Hmmmmmm. from the opinion

“During his deposition, Letke the official comptroller for Harvey starting in 2003 invoked his 5th amendment privilege 178 times…”

- Earnest - Tuesday, Aug 22, 17 @ 2:50 pm:

You’re all missing the point. This is clearly the fault of those greedy firefighters and their platinum-plated pensions bankrupting that poor town. /s

- California Guy - Tuesday, Aug 22, 17 @ 2:56 pm:

I believe the “little known clause” refers to the idea of the State Comptroller diverting State funds from the City to go directly to the firefighter pension fund. What’s not clear is what happens when the amount of State funds is not enough to cover pension payouts. Not sure what the City of Harvey’s sales tax numbers are like, but I think they’re more of an industrial/residential town.

- DuPage Bard - Tuesday, Aug 22, 17 @ 3:02 pm:

Harvey is a mess time for the State to step in. Similar to when school districts screw up and the State steps in.

- Oneman - Tuesday, Aug 22, 17 @ 3:02 pm:

Yeah, good luck getting that from Harvey no matter what funds you try and withhold.

- Dee Lay - Tuesday, Aug 22, 17 @ 3:03 pm:

Shemp - They have four stations which may or may not make sense for the population, but for the coverage area, it may.

From their site:

• 1 Fire Chief

• 1 Deputy Chief

• 3 Captains

• 9 Lieutenants

• 12 Engineers

• 18 Firefighters (full time)

• 1 Fire Prevention Secretary

Four Stations - Each with a single truck with three crews rolling 12/24s

Each truck has 2-3 firefighters/engineers plus one LT or Capt.

Cheif and DC for Admin. Secretary to handle paperwork.

Have a full-time FD is a fair amount of manpower, even for a smaller community.

- Mr B. - Tuesday, Aug 22, 17 @ 3:07 pm:

That city is in a downward spiral. I do business is the surrounding communities so I pass through Harvey frequently. A good chunk of Harvey’s properties end up at the real estate tax auctions. And no one bids for them. I guess a bankruptcy could be a reset. I feel for their fire and police forces who are called to action much more frequently than most suburbs.

- Greg - Tuesday, Aug 22, 17 @ 3:11 pm:

There is no clause in the constitution about “the verge of default or bankruptcy.” It was an off-handed comment made at the constitutional convention which the courts have conveniently decided is binding - even though it is not in the text of the constitution. Really, we’re talking aboutjust the statement of a delegate at the convention.

As to what happens now? In the short run, nothing. The city can (and will) seek an appeal in the Supreme Court. The judgment is stayed automatically because the defendant is a municipality under Rule 305. Even if they think they are certain to lose, Harvey will appeal because it gives them time. Given the magnitude of the issue, there’s probably a pretty decent chance the Supreme Court takes it, but I don’t really think there’s much they can do except affirm really.

What will happen in the long-run? Well, the court declined (I think properly) to issue a writ of mandamus to compel Harvey to raise taxes. That means the plaintiffs get a judgment they have to collect against Harvey on. By almost any definition, Harvey is insolvent. So that judgment is not likely to be easily collected. They may partially succeed - but to no avail. It’s a downward spiral from there. Employees leave, services cut, debt defaults, etc.

Of course, none of this would happen if certain legislators in springfield would allow Harvey to file BK. If that happened, a big battle over priority would ensue. Most likely, bondholders and retirees will both have to take a haircut. They sides would have some incentive to cut a deal - worried that a judge may hadn a victory one way or the other. If there’s no Muni bankruptcy, the bondholders probably have a senior position and the judgment creditors/retirees are going to wind up with nothing.

Municipal Bankruptcy is not a solution to bad management. It can resolve a debt overhang problem, but it can’t fire incompetent city councils. The federal BK court doesn’t get to run the city. But an important takeaway from this ruling is that State court doesn’t get to do that either. Mandamus isn’t really an option, so just let Harvey file bankruptcy and stop the pain for people who can’t afford to leave before things get really horrible.

- City Zen - Tuesday, Aug 22, 17 @ 3:11 pm:

In 2010 Harvey owed a $1.5M pension payment and paid only $5,143. At that point, why not just skip the entire payment? Was that a fee perhaps?

- Chicagonk - Tuesday, Aug 22, 17 @ 3:27 pm:

Muni bankruptcy plus an emergency city administrator should be an option in Illinois.

- Demoralized - Tuesday, Aug 22, 17 @ 3:39 pm:

==he bondholders probably have a senior position and the judgment creditors/retirees are going to wind up with nothing.==

How do the bondholders overcome the state constitutional retirement guarantee?

- Rich Miller - Tuesday, Aug 22, 17 @ 3:39 pm:

Demoralized is right. Look at Detroit.

- DJDfire - Tuesday, Aug 22, 17 @ 4:04 pm:

Shemp….if you have never fought a fire, you have no idea what you are talking about….if you have fought a fire, you would know that a 45 member dept. is NOT bloated, especially for the amount of fires in Harvey. Plus, minus the chiefs and secretary, it fives you a firefighting force of 42.

- 37B - Tuesday, Aug 22, 17 @ 4:18 pm:

I think the reporter might be referring to the S.Ct. opinion rejecting the call to order the State to make payments into the pension funds. My hazy memory is that the Court held that there was no right to have the pension funds funded at a certain level but rather the right was to receive the promised benefits, regardless of where the money comes from. The Court, though, left open the question of how that pension guarantee clause is applied where, as with Harvey, underfunding is so severe as to imperil the payment of the earned benefits.

- Deputy Registrar - Tuesday, Aug 22, 17 @ 4:32 pm:

Earnest at 2:50 –

You’re all missing the point. This is clearly the fault of those greedy firefighters and their platinum-plated pensions bankrupting that poor town. /s

This is exactly the situation with the Teacher’s Retirement System pension fund.

Thanks for pointing it out.

- Rod - Tuesday, Aug 22, 17 @ 4:49 pm:

I believe Illinois does have a voluntary dissolution law, so Harvey could vote for disincorporation. I believe in Illinois there are provisions to levy taxes to pay for a dissolved municipality’s indebtedness that specify that only territory within the geographical limits of the extinct entity may be taxed to provide funds to pay off the disincorporated city’s liabilities. That would mean all existing City services and expenses would end, policing would be taken over by the Cook County sheriff’s office. I do not believe unincorporated areas of Cook County are required to be in a fire protection district.

Cook County spends nearly $43 million annually to serve 126,034 residents in unincorporated areas — 2.4 percent of Cook county’s total population and receives $24 million in revenue from them. While Harvey can’t file for bankruptcy it could fold none the less, the people there could well be better off just paying off debt and not incurring more debt. The majority of unincorporated areas in Cook County are supplied with potable water and sanitary sewer service by public and private utility companies that receive their water from Lake Michigan or other water sources. A few use wells for their water, I have a hard time believing that ground water in Harvey drinkable.

Harvey could also form a voluntary fire department by the way if they want protection.

- Anon Downstate - Tuesday, Aug 22, 17 @ 4:52 pm:

“==he bondholders probably have a senior position and the judgment creditors/retirees are going to wind up with nothing.==

How do the bondholders overcome the state constitutional retirement guarantee?”

————–

First off, IF any of the bonds in question were sold into the Municipal Bond market (in other words, both offered and sold to bond buyers located outside of Illinois), then it’s likely to be a federal issue.

The holders of those bonds will have a case for filing in federal court because in their view, applying the State constitutional provisions would diminish the value of their assets (bonds), in direct contradiction (in their view) to federal law.

Also, let’s not forget the Detroit municipal bankruptcy - which was handled by the federal bankruptcy court. At that point you are in federal court, and a federal bankruptcy court is not required to follow a state constitutional retirement guarantee.

That’s one of those currently unanswered questions, even at the federal level.

But right now, it’s not important because most municipalities (like Harvey) can’t file for federal bankruptcy. But if a state court diminished the bond holders ‘rights’ in favor of the state constitutional retirement guarantee, well, then there’s a real potential for federal court filings by the bond holders.

Just saying…..

- Greg - Tuesday, Aug 22, 17 @ 4:53 pm:

@Demoralized and Rich,

Most General Obligation bonds include a pledge to levy property tax to meet the debt service. That creates a protected revenue stream for bondholders - Otherwise the bondholders would’t have leant the money. Likewise, many revenue bonds are protected by a statutory lien that is going to have priority over subordinate judgment creditors. The pensioners in this case are not going to be able to leap ahead of these claims. Their judgments will have to be paid after these bonds. While the Constitution might protect the right to receive the pension, it says nothing about priority. These Pension claimants can’t just send the judgment down to springfield and they can’t just force a city to paying the bonds.

Pension funds in Detroit took haircuts. So did bondholders. The US Federal Government is supreme to even state constitutions. We’ve seen this before. In 2005, the US Supreme court wiped out a state claim of sovereign immunity for something as minor as a bankruptcy preference action (WV CC v. Katz). I am sorry to say that this is the ultimate fate of Harvey and North Chicago and (gulp) CPS.

- wordslinger - Tuesday, Aug 22, 17 @ 5:02 pm:

–It is the first time a court has declared a pension fund to be “on the verge of default or bankruptcy,” the ruling said, meaning that the fund now has the right to be funded under a little-known clause in the state constitution.–

Yeah, that’s just hanging out there. Explain it or take it out.

Who wrote the story, Dean Wormer (seriously, the wording is that close)?

- MyTwoCents - Tuesday, Aug 22, 17 @ 5:12 pm:

And all of this pension discussion could have been avoided if all police and fire pensions were put into a statewide fund under IMRF and IMRF forced payments like what they do for other employees. This raises the question of why this change isn’t being made.

- City Zen - Tuesday, Aug 22, 17 @ 5:16 pm:

So where is Harvey going to make the necessary cuts? All the city’s top salaries are in the Fire Dept. You have to go pretty far down the list to get to any non safety personnel.

- Ron - Tuesday, Aug 22, 17 @ 5:25 pm:

Illinois’ future?

- Anonymous - Tuesday, Aug 22, 17 @ 5:53 pm:

The real question is why does Illinois provide or allow defined benefit pensions anywhere?

- ChrisB - Tuesday, Aug 22, 17 @ 5:57 pm:

@Rod == A few use wells for their water, I have a hard time believing that ground water in Harvey drinkable.==

They get Lake Michigan water from Chicago.

Funny story, as recently as a few weeks ago, they used to buy it from Chicago, and then sell it to Homewood, Hazel Crest and a few other municipalities downstream. But because its Harvey, they never paid Chicago back, and squandered the payments received, using them instead on payments to Kay jewelers, Kohl’s, and someone’s college savings accounts. $26 million unaccounted for.

http://www.chicagotribune.com/news/ct-harvey-water-receiver-met-20170720-story.html

Same administration, too. Again, I’m constantly amazed the good mayor Kellogg is not in jail.

- Anon - Tuesday, Aug 22, 17 @ 6:07 pm:

Paging Lisa Madigan…Paging Lisa Madigan…

- California Guy - Tuesday, Aug 22, 17 @ 6:17 pm:

@ Demoralized. BK process happens in Federal court - not State court. In Detroit, bond holders were actually whacked harder than pensioners, but both saw cuts. Detroit was actually set for a showdown between the financial firms that were creditors to the existing pension debt vs pensioners. The bond holders submitted an argument that they unfairly received deeper cuts than City retirees under the City’s proposed BK plan. However, the emergency manager brokered a deal that settled the dispute out of court.

At this time, we don’t know if deeper cuts to bond holders vs pensioners are “legal.” The bond holders had an argument that was legally and technically sound, but municipal BK is a notoriously political animal. The bondholders probably came in and settled because they didn’t want to roll the dice on what would definitely be an emotional BK process that would officially pit bond holders vs pensioners.

- Shemp - Tuesday, Aug 22, 17 @ 6:19 pm:

===

- MyTwoCents - Tuesday, Aug 22, 17 @ 5:12 pm:

And all of this pension discussion could have been avoided if all police and fire pensions were put into a statewide fund under IMRF and IMRF forced payments like what they do for other employees. This raises the question of why this change isn’t being made.===

Seems logical, I know. But, because Illinois has screwed up every pension fund not named IMRF, all the police officers and firefighters panic at the thought of losing their local funds. And if there is one group legislators don’t want to anger, it is fire and police.

Then, you add in the whole industry that supports these 600+ funds and you have specialized attorneys, money managers, actuaries, accountants, trainers, conferences etc. that all make coin off this crazy system and they all tell the police and fire folks that consolidating is bad. Trustees get whisked away to training and conferences for their mandatory hours at places like Lake Geneva and is it any wonder why?

- RNUG - Tuesday, Aug 22, 17 @ 6:38 pm:

Just a few observations about Detroit.

Pensioners walked away with about 90% of what they were promised.

Bondholders took a haircut and got a lot less.

Michigan’s pension protection is/ was at a lower level than NY, AZ and IL where it is written into a Constitution approved by the voters.

Coming back to Illinois, yes, Federal courts can and do overrule State laws. But they also defer to State law at times, especially in cases where the issue is directly between the State itself and the state’s employees. (I realize that is not the case in Harvey.)

I can’t predict where SCOTUS would land on a case involving one of the 5 actual State level pension funds (SERS, JRS, GARS, SURS & TRS), but I do believe they will give some consideration to the Pension Clause that was recently (in legal precedent terms) approved by the voters. I don’t want to see such a case, but I have to admit it would be legally interesting to watch.

- Pelonski - Tuesday, Aug 22, 17 @ 6:57 pm:

To follow up on what RNUG said, bankruptcy courts tend to pay retirees more than bondholders. The thought is that the bondholders only have a small portion of their total investments in the bonds, but the pensioner has the majority of their investments in the pension.

- striketoo - Tuesday, Aug 22, 17 @ 8:16 pm:

Harvey (my hometown) = Illinois (my home state) in miniature.

- Perrid - Tuesday, Aug 22, 17 @ 8:18 pm:

To the discussion about whether or not Harvey’s FD is bloated, I found this article

(http://www.ufoa.org/researchfiles/file00000009.pdf)

that says the median ratio for the 40 biggest cities in the nation is 1.3 firefighters for every 1,000 residents, meaning that Harvey should have 33 fighters. 45, or 42 if we do as DJDFire suggests and cut out the admin staff, isn’t that far off, especially when you consider that the 1.3 ratio is for very large, and thus dense, cities. Basically, I don’t think there is that much to cut as to staff size. Either way, that’s really, really not the problem here.

- Arthur Andersen - Tuesday, Aug 22, 17 @ 8:24 pm:

Where was the Department of Insurance, the alleged “regulator” of local pension funds, while Harvey was contributing the change jar to the pension fund?

Probably at the conference in Lake Geneva.

Someone needs a good bu**-kicking over this mess.

- blue dog dem - Tuesday, Aug 22, 17 @ 9:04 pm:

Greg@3:11. Nice work.

- Demoralized - Wednesday, Aug 23, 17 @ 7:39 am:

Greg:

With respect, Illinois isn’t Detroit. The protections for retirement are stronger in Illinois than in Detroit.

As for those of you who are emphasizing the federal court aspect of this, federal courts can and do take into account state constitutions. I don’t know if they would in this case but to simply dismiss the state constitutional guarantee because a federal court is considering it I think is wrong.

I don’t know what the courts would do but it would seem to me they might put quite a bit of weight on the state’s absolute guarantee of pensions. I would bet that pensioners make out far better than any bondholder.

- California Guy - Wednesday, Aug 23, 17 @ 11:31 am:

The pensioners would only make out better than bond holders if the bondholders didn’t object to the BK plan presented as such. In previous muni BK’s, bondholders have willingly agreed to taking more cuts than pensioners. I’d bet that the same will happen in Illinois. Bondholders would rather mitigate their losses and recoup a majority of their original investment vs. rolling the dice on a federal BK judge in uncharted water.

In the San Bernardino case, pensioners got out practically unscathed. However, the CalPERS system is a political gorilla and Illinois has no equivalent. The judge offered the option to the City to cut pensions payments to CalPERS and the City declined.

At the end of the day, many public safety pension funds in Illinois will indeed become insolvent. It’s just a matter of time. Labor groups would be smart to advocate for increased pensions funding BEFORE any pension sweeteners. If not, they’re rolling the dice.