|

Rival “guesstimate” released

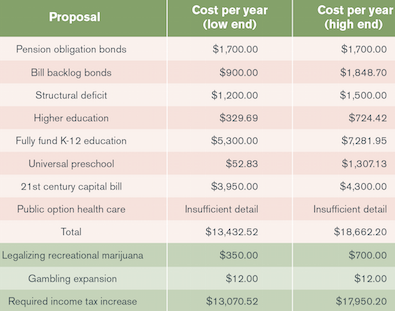

Tuesday, Oct 16, 2018 - Posted by Rich Miller * OK, let’s try this again. I mistakenly published this post yesterday before the embargo was lifted. Sorry about that. Anyway, the Illinois Policy Institute has come up with its own “guesstimate” of JB Pritzker’s revenue needs based on what he’s said and what’s on his website…  I think they’re way too high. Pritzker has backed off his pension bonding plan. He did kinda push the plan forward again during a recent debate, but he’s not settling on it as of yet. You can go either way here. The low-end bill backlog bonding guesstimate was mine. The high end is theirs. I doubt we’ll need to bond that much. The structural deficit is $1.2 billion. But it might go as high as $1.5 billion. So, OK, I suppose. The $5.3 billion for K-12 is mine, but those numbers were admittedly based on somewhat old data. I don’t know what theirs is based on. * Where we really differ is their cost estimate for a capital bill. They have the range of infrastructure needs correct. But they assume the state will pay 100 percent of the costs. Practically speaking, there’s just no way in heck that the state will do this if it has to shoulder the entire burden, or even anywhere near it. So, that guesstimate alone is about, hmmm, say $3 to 3.5 billion a year too high.

|

- Publius - Tuesday, Oct 16, 18 @ 10:01 am:

Can someone tell me what the annual outlay for state employee retirement to pay actual retire pay and administrative costs. Not an estimated total of all years together just each year separately

2019

2020

2021

….

- Lucky Pierre - Tuesday, Oct 16, 18 @ 10:04 am:

Who believes the middle class (which is undefined for obvious reasons) will see their taxes cut as promised and all of these billions in new spending will be magically funded by “millionaires and billionaires” who will gladly pay more and not continue to exit the state in large numbers?

Of course JB is ignoring the pension time bomb that raises the state’s contribution from 7 billion to over 10 billion in the next decade and adding even more unsustainable goodies for his math challenged base.

https://www.chicagobusiness.com/static/section/pensions.html

- 47th Ward - Tuesday, Oct 16, 18 @ 10:12 am:

So IPI cribbed from your work, then put it out under an embargo? Lol.

- Jibba - Tuesday, Oct 16, 18 @ 10:13 am:

I suspect those numbers are available on the individual plans’ web sites, but the question is why. You want to simply pay each pensioner each year, without trying to achieve full funding in advance so the power of compound interest can be used? Maybe an option if the only other option is bankruptcy, but it is kicking a far bigger can down the road than anyone has ever kicked.

- njt16 - Tuesday, Oct 16, 18 @ 10:14 am:

==Who believes the middle class (which is undefined for obvious reasons) will see their taxes cut as promised==

I believe Rauner will raise taxes again, as OW says Governor’s own.

To the post, $3 to $3.5 seems like a large ME, especially since the assumption should be that the state would not shoulder 100% of the cost.

- Anotheretiree - Tuesday, Oct 16, 18 @ 10:16 am:

I’d factor in the next recession. Which we are in terrible shape to face.

- RNUG - Tuesday, Oct 16, 18 @ 10:16 am:

The way I figure it, on the high side IPI is at least $4.6B high and could be as much as $6B or more. Interestingly, that is roughly the difference between the lowest and high estimates. $13B tax increase is significant, but probably possible. A graduated income tax would really make a big difference in who would have to pay for it.

- Honeybear - Tuesday, Oct 16, 18 @ 10:17 am:

Publius- I’ll tell you if you tell me

how much was spent by Rauner on

No bid consulting contracts

or

how many jobs were actually created by the

hundreds of millions

maybe even a billion now

in corporate welfare EDGE and EZ agreements

Sears was even extended one not long ago.

My meager pension ( which now stands at 22k a year, which I contribute to every paycheck)

and Social Security will be all I have

when I can retire in 2034.

Correction: I’ll have to live off my pension till I can collect social security.

It was not my fault that Governors and Legislators skipped payment to my pension.

Don’t make loyal state workers the enemy.

EDGE and EZ zones have

never

been

independently audited

for close to a billion dollars

We have no idea

how many jobs were created

or investment dollars made.

How about you fiscal conservatives

Get on that

not on me

- OneLittleCherry - Tuesday, Oct 16, 18 @ 10:22 am:

Ask Rauner about that structural deficit

I thought he said it was 3 billion.

Odd…. he didn’t laugh before he said

3 billion

Que the quote in 3,2,1

- Demoralized - Tuesday, Oct 16, 18 @ 10:39 am:

==JB is ignoring the pension time bomb==

Though he hasn’t been crystal clear he hasn’t ignored it. He’s suggested pension bonds. He’s actually addressing the reality of the situation which is the costs has to be paid instead of wasting time on unconstitutional proposals like some of you.

- Lucky Pierre - Tuesday, Oct 16, 18 @ 10:42 am:

A $13 billion tax increase is significant, but probably possible?

Quite and understatement and overstatement wrapped in the same sentence.

“In all, the state will collect more than $33 billion in 2017, or about $3 billion less than the peak $36 billion when Illinois’ temporary tax hike was in place.”

The state just permanently raised income taxes 32% last year raising $5 billion but you see another $13 billion increase “significant and possible”?

JB wants to add to this number because he thinks that state can afford more than the $10 billion required for pensions towards the end of the decade.

https://www.illinoispolicy.org/39-billion-where-does-illinois-tax-revenue-come-from/

- anon - Tuesday, Oct 16, 18 @ 10:47 am:

Rich how about setting out the opposing view as well? If IPI and the Governor think they can balance the budget while lowering taxes how about taking a stab at where the cuts have to come from?

- Anon - Tuesday, Oct 16, 18 @ 11:02 am:

Anotheretiree -

Thank you for bringing up the unspoken.

We have had the longest expansion in post war history.

There is going to be another recession, and probably before JB’s first term is over. With all the new spending proposals and no rainy day fund it just makes you wonder what exactly the plan is for when it hits.

Illinois will be borderline ungovernable if a recession hits at the same time the ramp really kicks in and pension payments really start eating into the general fund.

We will look at these past few years as the glory days compared to the misery that is coming.

Also not ever acknowledged is the large tax increase coming by way of the SALT cap on people’s tax returns next year.

The very same people that are going to be the backbone of the progressive tax are going to get hit with a big tax increase next year at the same time JB is proposing another one.

There will be no appetite in this state for it. The professional class is going to get hit hard by it, and without reaching deep into that group’s pockets the progressive tax doesn’t raise enough to tangibly change our fiscal course.

There will be no SALT work around until at least 2021 if at all, so again the tax increase is coming next year and it won’t benefit Illinois one bit.

Timing actually couldn’t be worse for trying to make a progressive tax happen.

- don the legend - Tuesday, Oct 16, 18 @ 11:10 am:

What about the line item for Rauner’s 13 wrongful death settlements?

- OneMan - Tuesday, Oct 16, 18 @ 11:12 am:

Does there number include a ‘middle class tax cut’? I don’t see that, but I might be missing something.

- JS Mill - Tuesday, Oct 16, 18 @ 11:13 am:

=I think they’re way too high.=

The IPI trying to put more shade on Pritzker? Say it isn’t so.

The IPI is as reliable as LP, they both live in a fantasy world.

- Whatever - Tuesday, Oct 16, 18 @ 11:45 am:

==“In all, the state will collect more than $33 billion in 2017, or about $3 billion less than the peak $36 billion when Illinois’ temporary tax hike was in place.”

The state just permanently raised income taxes 32% last year raising $5 billion but you see another $13 billion increase “significant and possible”?==

The new income tax rates apply only to income earned after June 30, 2017, so the full effect doesn’t show up in 2017.

- supplied_demand - Tuesday, Oct 16, 18 @ 11:45 am:

==Of course JB is ignoring the pension time bomb that raises the state’s contribution from 7 billion to over 10 billion in the next decade and adding even more unsustainable goodies for his math challenged base.==

The contribution goes from $6.9 billion in 2015 to about $10 billion in 2027, a compound annual growth rate of 3.1%. Not really a “time bomb” as inflation has been running 2-3% for over a year now.

Maybe don’t call others math-challenged when you don’t understand compound interest.

- Demoralized - Tuesday, Oct 16, 18 @ 11:45 am:

== If IPI and the Governor think they can balance the budget while lowering taxes==

You’re right. That question is just as important. As with JB’s pie in the sky promises, the notion that taxes can be cut is also ludicrous.

- Angry Republican - Tuesday, Oct 16, 18 @ 11:47 am:

Even if the state froze spending for three years, it would still need another $13B/year in revenue just to get on a sound financial footing. All that pension debt (>$100B) isn’t going pay for itself.

Maybe JB’s real plan is to spend the state into oblivion

- City Zen - Tuesday, Oct 16, 18 @ 12:23 pm:

==A $13 billion tax increase is significant, but probably possible?==

How do you do, fellow seniors?

- Oswego Willy - Tuesday, Oct 16, 18 @ 12:25 pm:

===How do you do, fellow seniors?===

So… get a progressive tax done, and start taxing retirement income?

I don’t see the stomach for both in one 4-year term.

- DuPage - Tuesday, Oct 16, 18 @ 12:30 pm:

Pritzker has mentioned paying down pension debt, I hope he follows through on it. Paying off high-interest pension debt with lower interest bonds is a no-brainer. Otherwise the high interest debt keeps compounding and growing much faster then lower interest debt, costing more in the long run.

- City Zen - Tuesday, Oct 16, 18 @ 12:35 pm:

==I don’t see the stomach for both in one 4-year term.==

Agree, probably not logistically feasible. Figure two years to get a progressive tax and let it simmer two years. Then when they realize it wasn’t enough and come begging for more, will they go to the rate structure first (pretty big failure) or tax the un-taxed masses (almost as big)?

- Oswego Willy - Tuesday, Oct 16, 18 @ 12:39 pm:

===Agree, probably not logistically feasible.===

Then, you’re looking at 6 years for retirement tax to be considered.

So… I’d probably stop the drumbeat. It’s not happening in a four year term, heck, let’s see if that progressive tax makes the 2020 ballot.

- Thomas Paine - Tuesday, Oct 16, 18 @ 12:39 pm:

First, the earliest there might be any income tax increase is 2021.

That means funding to erase the structural deficit, restore higher education cuts, and for pre-school will have to come from somewhere else.

Whatever the final number, no one thinks that funding for the capital bill should come from income tax.

The bill backlog is down to a manageable $7 billion, i do not think the state is going to borrow $7 billion on the market to pay that off.

Pension bonding makes a lot of sense, which explains why the GOP is against it. It is not happening without GOP votes, so we should forget about it now.

Fully funding K-12 is scalable: under the new funding formula, the neediest schools get funded first. The advantage is that the GOP is no longer allowed to be a free-rider. If they want more money for their schools, they vote for the revenue. Otherwise the size of the approp is reduced until your school gets $0 in new money.

Probably 2/3 of Republicans won’t back the revenue anyway. So, reduce the education costs by 30%, and then figure you will need to ramp it up across 5 years.

Figure in a little cost of living, you need to adjust the rates to bring in another $4 billion in 2021.

- Anon1 - Tuesday, Oct 16, 18 @ 12:54 pm:

A rainy day fund should be a higher priority than new spending programs.

When the next recession comes it will be cataclysmic on state finances at exactly the time we are facing the pension funding surge from the general fund.

Depending on when it happens it might torpedo a progressive tax because there won’t be the support to raise taxes in the midst of a recession and increased SALT taxes that will be burdening people who make a decent buck.

The State essentially lives paycheck to paycheck with no savings and yet all anyone can think to do is take on more debt.

We are so unprepared for any semblance of an economic downturn it is frightening.

- City Zen - Tuesday, Oct 16, 18 @ 12:57 pm:

==So… I’d probably stop the drumbeat.==

Fairness and equity never miss a beat.

==Pension bonding makes a lot of sense==

Except to everyone who actually understands it.

- Oswego Willy - Tuesday, Oct 16, 18 @ 1:00 pm:

===Fairness and equity never miss a beat.===

You go with that, after admitting in a four year term both tax proposals are unlikely to happen and the progressive income tax is the one that will, arguably, be tried first… in 2020.

Beat the drum, but don’t hold your breath?

- Jibba - Tuesday, Oct 16, 18 @ 2:07 pm:

Hey CZ, wanna take a stab at why bonding for pensions is a bad idea? I suspect you will find little agreement.

- 17% Solution - Tuesday, Oct 16, 18 @ 3:13 pm:

Public option healthcare would be zero, not “to be determined”. People would pay what the state pays for Medicaid.

- Ebenezer - Tuesday, Oct 16, 18 @ 3:16 pm:

@Jibba

Would you borrow several years salary to invest it all in the market? It’s the same principal.

If you were guaranteed to pay mortgage-type rates of ~5% and earn historical market returns, it i a no brainer.

But there is no guarantee, and the debt doesn’t go away if the returns don’t materialize.

I understand why people propose bonding. Its a gamble, and if it pays off, you can fund a chunk of the deficit without raising taxes. If it fails, you might be retired from politics by then anyway. (vs. being retired for certain if you tried to force a reckoning with the fiscal realities now.)

- Ebenezer - Tuesday, Oct 16, 18 @ 3:18 pm:

PS. If I was going to take a long-term leveraged bet on the the equity markets, I’m not sure I’d start 10 years into a bull market.