Tobacco 21 easily passes House

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* It now moves to the Senate where it’s expected to pass…

The bill is here…

Raises the age for whom tobacco products, electronic cigarettes, and alternative nicotine products may be sold to and possessed by from at least 18 years of age to at least 21 years of age.

* The legislation received only 61 votes last November…

The failure to override the veto was not unexpected. The bill passed the House in May with only 61 votes, and supporters knew it would be difficult to find an additional 10 votes for an override.

Supporters of the legislation said they will try again next year.

“We are going to come back at this issue until we get it done,” said Rep. Camille Lilly, D-Chicago. “We do not, meaning the state of Illinois, think that this is something we should ever stop working towards.”

That 2018 roll call is here.

* Obviously, some folks changed their minds, including this prominent Republican…

* Context…

Currently, seven states and more than 34 municipalities in Illinois have already passed Tobacco 21 laws, according to the American Lung Association.

53 Comments

|

Question of the day

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* Tax Foundation…

Within a graduated rate structure, inflation can impose a hidden tax, increasing the taxpayer’s liability as a greater share of their income is taxed even if that income has not increased in real terms, since bracket kick-in thresholds are fixed. To avoid this “bracket creep,” most states with graduated-rate structures index bracket widths and other features of the income tax to inflation. Pritzker’s proposal gives no indication of this, meaning that over time, taxpayers will pay an increasing amount of taxes as a percentage of income—even if their income has not increased in real terms.

* The Question: Should the governor’s proposed graduated income tax brackets be indexed to inflation? Take the poll and then explain your answer in comments, please…

survey solutions

30 Comments

|

Teacher shortage worsens

Tuesday, Mar 12, 2019 - Posted by Rich Miller

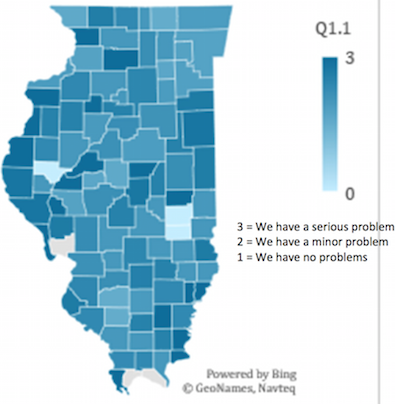

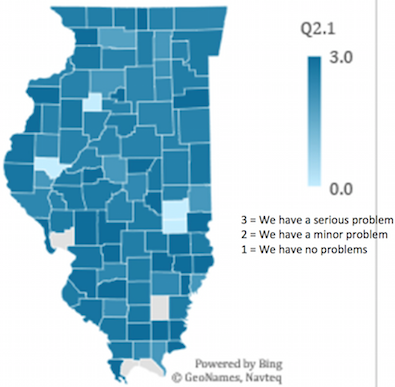

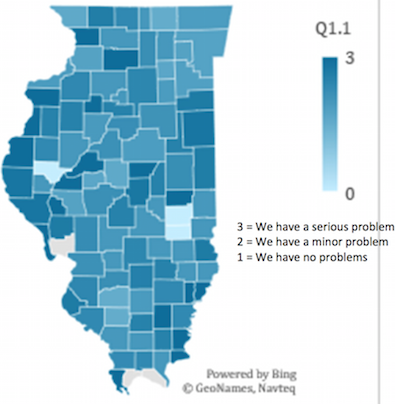

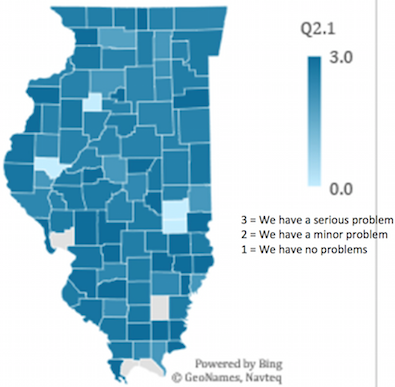

* Illinois Association of Regional Superintendents of Schools survey results of 527 out of 858 district superintendents…

Superintendents in 85% of the districts surveyed believed that they have either a major or a minor problem with teacher shortages, which is up from 78% from the 2017 survey. Substitute teacher shortages continue to be a particular concern for superintendents. About 5 in 8 (63%) indicated that they have a “serious problem” with substitute teacher shortages, while only 3% indicated that they have “no problems” with substitute teacher shortages. Among the 527 responding districts (61%), superintendents reported that 20% of all positions (1,032) listed for fall 2018 remained unfilled or filled by an unqualified professional. This resulted in 225 classes being cancelled.

* More from the report…

Teacher Shortage Intensity by County

Substitute Teacher Shortage Intensity by County

* Peter Hancock at Capitol News Illinois…

The report said shortages were reported in almost every subject area, with foreign languages, various special education fields and computer science leading the list of classroom subjects. There were also significant shortages of school psychologists and library and media specialists.

Shortages were also reported in every region of the state, although they were more severe in southern and central Illinois than in the suburban districts around Chicago.

In southern Illinois, 94 districts reported seeing “significantly fewer qualified applicants” than they did five years ago. That compares with 90 percent of the districts in central Illinois; 78 percent in northwest Illinois; and only 42 percent in the Cook County and surrounding suburbs.

As a result of those shortages, the report said 99 districts reported canceling a total of 225 course offerings due to a lack of qualified teachers, while 86 districts reported converting more than 200 classes to online learning because they lacked a qualified teacher for the subject.

* Back to the report…

Three key policy recommendations are presented. First, to alleviate the substitute teacher shortage, the process of substitute teacher licensing should be “less bureaucratic” and streamlined, especially for retired educators serving in a district of prior employment. Second, Illinois needs to expand programs for developing new teachers including support for Grow Your Own Teacher and Administrator initiatives throughout all of Illinois. Finally, by using existing data and collecting gap data we will have the ability for more confident predictions on shortages long term and identify, by district, the challenges and viable solutions for educator shortages.

47 Comments

|

* Tom Schuba with the Sun-Times…

Empty storefronts and shuttered restaurants line the main drag along Locust Street in Delavan, a sleepy enclave just south of Peoria.

But on the outskirts of town, business is booming — or, rather, blooming. Inside a nondescript warehouse behind a razor wire fence sit thousands of marijuana plants being grown for medical use. […]

Revolution’s 75,000-square foot grow operation cultivates up to 10,000 marijuana plants at any given time and employs 56 people, 10 of whom are natives of either Delavan or the surrounding area. Since the facility opened, the city has created a tax increment financing district to use the company’s property tax dollars to fund infrastructure and redevelopment projects, including the construction of a new public high school.

Scroll down…

To prepare for an expected increase in demand, Revolution is shelling out more than $100 million to build an adjacent facility on a plot of land that’s seven times larger than the current cultivation’s center 10-acre site. The new building will be used to grow recreational weed, while the existing structure will continue to cultivate medical marijuana, de Souza said.

That’s great news for Delavan, but only if this gamble pays off. Some of these growers are assuming that they’ll get licenses when cannabis is legalized. And maybe they will. The CEO of that company did serve on Pritzker’s transition team, after all, and I’m told his grow center is amazing.

* But sudden “massive growth” and a trend toward vertical markets are both worth keeping an eye on…

With Illinois’ marijuana industry gearing up for massive growth as the state considers legalizing the drug for recreational use, a company based in Phoenix is paying $850 million for Chicago-based cannabis operator Verano Holdings.

The deal will give Harvest Health & Recreation the right to operate Verano’s cultivation facility and dispensaries in Illinois, as well as its operations in other states. Verano’s Chicago headquarters is expected to remain an operations hub after the acquisition.

Harvest Health, which owns dispensaries or cultivation facilities in five states and trades on the Canadian Securities Exchange, has been eyeing an entrance into Illinois for a long time, said CEO Steve White. Illinois is an attractive market because it is a heavily populated state and lawmakers are drafting a bill to legalize adult-use marijuana, he said.

“We wanted to make sure we were participating in a meaningful way before those conversations were at a crescendo,” White said. “As that conversation starts moving forward, the price of assets in Illinois goes up.” […]

Its cultivation facility in the southern Illinois city of Albion is undergoing expansion to double grow capacity, said Verano co-founder Sam Dorf. It also has dispensaries in Chicago’s Norwood Park East neighborhood and west suburban St. Charles, and has an ownership stake in a dispensary in Effingham.

I’m all for people making money on this. Illinois definitely needs a shot in the arm. But always be wary of late money jumping into a game. Big money means lots of lobbyists, and that means legislators and the governor will likely have to make extra sure those lobsters don’t try to write their own legislation to benefit their clients and not Illinois.

Also, I’d personally prefer a tiered system like beer has. Producers, distributors and retailers are all kept separate to prevent one or two producers from dominating.

* There are other considerations to stress as well, including areas hard-hit by the drug war…

In crafting legislation, lawmakers are discussing fairness in distributing marijuana tax revenue to ensure communities in need of public service improvements aren’t overlooked. “We are trying to provide some recommendations that we think would help infuse those dollars in a meaningful way back into those communities,” said Chicago Democratic Rep. Sonya Harper, a leader in the legislature’s cannabis equity work group, The Tribune reported.

22 Comments

|

More Pritzker graduated tax react

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* ILGOP…

“It’s time to end Governor Pritzker’s tax hypocrisy. Pritzker says he ‘chooses fairness’ when it comes to raising taxes, yet Pritzker is the beneficiary of many overseas holdings that allow him to dodge untold millions in state and federal taxes. If Pritzker truly believes that rich people such as himself have an obligation to pay more in taxes to the State of Illinois, Pritzker should take the first step and domesticate his overseas holdings in Illinois so they would be subject to the higher tax rates he has proposed for the people of Illinois.

“As one of Illinois’ richest residents and leading tax hike proponents, it’s time for Governor Pritzker to pay his fair share, before expecting Illinois taxpayers to pay more. Tax fairness should start with our governor.” - Illinois Republican Party Chairman Tim Schneider

Last week, Governor J.B. Pritzker finally released the specific tax rates of his plan to raise taxes on Illinois families and businesses. When you factor in the Personal Property Replacement Tax, Pritzker’s tax hike plan will hit corporations and trusts domiciled in the state of Illinois with a 10.45% and 9.45% tax rate, respectively, making it “one of the highest in the nation.”

During the course of last year’s gubernatorial campaign, Illinois voters learned that Pritzker is the beneficiary of many overseas trusts based in the Bahamas and Cayman Islands. Those trusts are not subject to taxes. Pritzker attempted to skirt the topic by saying there was nothing he could do about the trusts set up by his grandfather in the 1960s, and that all of his money from those trusts go to his charitable foundation.

But a Chicago Tribune investigated found that Pritzker himself utilizes overseas tax havens for his personal business ventures. Several overseas shell corporations were set up by Pritzker and his associates between 2008 and 2011. According to the Tribune, those corporations “are either wholly owned by J.B. Pritzker, his brother and business partner Anthony Pritzker, or list other close associates as controlling executives.”

All told, the Tribune found “35 offshore and domestic trusts and shell companies tied to Pritzker on top of the dozen offshore investment funds.”

Financial experts told the Tribune that the investment tactics used by Pritzker helped him maintain the secrecy of his overseas holdings while minimizing the tax liability.

When the investigation broke, Pritzker tax hike supporter Dan Biss said “J.B. Pritzker set up companies offshore, probably to avoid taxes and spent the entire past year lying about it.”

In 2008, The New York Times said the Pritzker family were “pioneers in using tax loopholes to shelter their holdings from the internal revenue service.” And J.B. Pritzker’s sister, Penny Pritzker, became the subject of media scrutiny after some of her overseas holdings were revealed in the Paradise Papers.

If Pritzker truly believes that rich people such as himself have an obligation to pay more in taxes to the State of Illinois, Pritzker should take the first step and domesticate his overseas holdings in Illinois so they would be subject to the higher tax rates he has proposed for the people of Illinois.

* Think Big Illinois…

After Governor Pritzker’s proposed fair tax rates showed that 97% of Illinoisans would not see a state income tax increase under a fair tax system, opponents have grown increasingly desperate in their false attacks. While these opponents will do or say anything to avoid forcing the wealthy to finally pay their fair share, it’s important to note the truth is not on their side.

A favorite talking point of these opponents is that the wealthiest Illinoisans will leave the state if they’re forced to pay their share, but the facts tell a different story. Research shows that there is no correlation between a state’s tax rates and the likelihood a high-income family leaves the state. Look no further than California, which increased its top marginal income tax rate to 13.3% in 2012, but continues to have a net migration in of millionaires each year.

Additionally, Illinoisans have fled the state for years as the Rauner administration played politics with the budget, leaving our education system decimated and critical services severely underfunded. A Fair Tax will bring in much-needed revenue to help address these issues, yet it’s Rauner’s brand of mismanagement and irresponsible governance that opponents are eager to return to.

“The legislature will have the same power if the Fair Tax is passed as they do now, and wealthy families will not leave the state at increased rates. These are just desperate false claims from Governor Rauner’s former allies who will do or say anything to keep a system in place that works for the wealthy while hurting working families,” said Quentin Fulks, Executive Director of Think Big Illinois. “The only difference is Illinois would finally have a tax structure where the burden is lifted off the middle class and the wealthiest pay their fair share. That’s why Think Big Illinois is committed to continue fighting for a Fair Tax in our state.”

Discuss.

62 Comments

|

Unclear on the concept

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* Gov. Pritzker was asked by reporters today why he doesn’t support expanding the sales tax to cover services. He talked about his general opposition to flat taxes and how, although it may be necessary to increase them in some instances, he prefers progressive taxation.

He also said that some of the folks arguing for an increase in flat taxes are the same people who are advocating for the “3 percent.” You’ll recall that Pritkzer’s proposed graduated income tax would only raise taxes on the top 3 percent of earners, so he’s got a new catch-phrase.

“The bulk of a flat tax increase falls on the middle class and the working class and people that are striving to get to the middle class,” Pritzker said.

* A reporter then chimed in…

I was asking about a tax on services. Is that a flat tax?

“Those are flat taxes. What do you think?” an incredulous Pritzker responded. “Everybody gets taxed at the same rate.”

Maybe the reporter just got confused for a moment. Stuff happens and he’s a bright guy, so whatever. And always remember the old saying about how there are no bad questions, just bad answers.

But what you’re seeing here is how difficult it’s going to be to explain this stuff when even experienced political reporters seem to have trouble following the thread.

…Adding… Come to think of it, a graduated sales tax might not be a bad idea. Slap an extra tax on First Class airfare, or $600+ per night hotel rooms or $70,000 cars or whatever.

…Adding… The raw audio is here.

55 Comments

|

Pritzker Comes Up Short

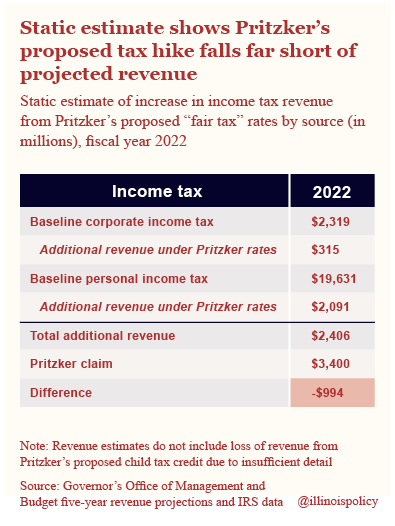

Tuesday, Mar 12, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

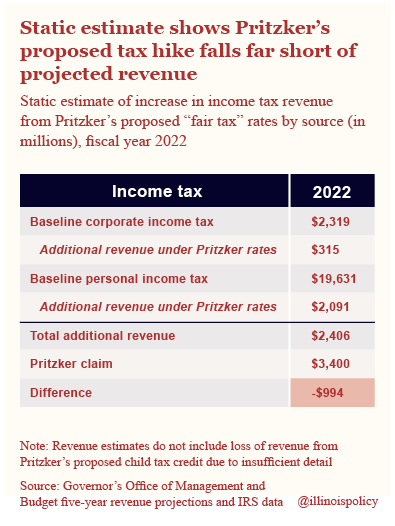

Gov. J.B. Pritzker’s “fair tax” plan hinges on a promise to raise $3.4 billion in new revenue. But a simple, static revenue estimate shows the governor’s proposed rate structure falls nearly $1 billion short of that number – even without taking into account the economic effects of a tax hike. And the governor is refusing to show his math.

Pritzker’s questionable revenue estimate raises a point echoed by Center for Tax and Budget Accountability Executive Director Ralph Martire in the Chicago Tribune – $3.4 billion isn’t enough to fund what Pritzker has proposed in new spending:

“It wouldn’t be enough to do all that,” said Ralph Martire, executive director of the Center for Tax and Budget Accountability, a union-backed bipartisan research group. Martire said the state needs to look for other sources of new revenue, including a possible extension of its sales tax.

In other words, more tax hikes are just around the corner.

It’s important to remember that Illinois policymakers are often motivated to reach certain revenue estimates that support their policy preferences. Pritzker should release the full methodology behind his revenue estimate before asking Illinoisans to trust his numbers on a multibillion-dollar tax hike.

Comments Off

|

* Student out-migration has been a problem for decades, but, like with just about everything else, Bruce Rauner inherited a serious problem and made it worse…

The Illinois Board of Higher Education released its annual student out-migration report Tuesday. In 2017, 48.4 percent of students who graduated from a public school in Illinois that enrolled in a four-year college chose one outside of the state. That’s up nearly two percentage points from the fall of 2016.

The breakdown of the numbers shows an increase of more than 2,000 students attending two-year schools, meaning that there was a proportional loss of students to four-year universities even though the 53,000 student enrollment at four-year institutions was similar what it was in 2016.

Of all the graduating students, one in five chose to attend universities in other states.

Eric Lichtenberger, deputy director for information management and research with IBHE, said the two years of the state’s budget impasse, which resulted in limited school and grant funding because lawmakers couldn’t come to terms with freshman Gov. Bruce Rauner on a budget deal showed increases in students going out of state.

“Since the budget impasse, we’ve been experiencing annual increases of at least 3.5 percent, which is somewhat surprising,” he said.

95 Comments

|

IDOT takes signage to the next level

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* You may have noticed that IDOT has been putting clever messages on some of its electronic billboards lately…

* But then all of a sudden this billboard appeared all over the place. I saw it twice on Interstate 57 during the weekend…

* I reached out to IDOT and received this reply from Jessie Decker…

Hi, Rich-

We’ve seen a recent increase in social media posts including pictures of our signs taken from the driver’s perspective. We love that people are interested in helping spread the word about safety on our roads. However, taking pictures while driving is obviously dangerous – and it’s also illegal to use a handheld device while driving.

We are finding new ways, sometimes tongue-in-cheek, to bring attention to serious issues. Anything we can do to get people to stop and consider NOT using their phones while behind the wheel is a message we support.

Thanks,

Jessie

* Not everyone is convinced, however…

Thoughts?

42 Comments

|

* Wirepoints…

Oh, the places they’ll go: The impact of Pritzker’s progressive tax on wealthy Illinoisans

You have to wonder if Gov. J.B. Pritzker ever saw the top marginal tax rates of other states before he released his new progressive tax plan. If he gets his way, he’ll give wealthy Illinoisans another big reason to leave the state. […]

His new tax hike will be just another huge incentive for the wealthy to take up residence elsewhere. They’ll get a far better deal on their income taxes if they do. […]

Pritzker says Illinois is an outlier because it remains a flat tax state even though 30-plus other states have a progressive tax structure. But with his tax plan, Illinois will become an outlier among progressive tax states for how much it taxes residents with $250,000 incomes and above.

North Dakota, Arizona, New Mexico, Ohio, Alabama, Mississippi, Oklahoma, Kansas, Maryland, Virginia, Missouri, Rhode Island, Georgia, Louisiana, West Virginia, Iowa (by 2023), Delaware, Nebraska, Arkansas, Montana, Connecticut, South Carolina, Maine, Idaho and Wisconsin all have progressive structures with lower tax rates on $250,000-plus incomes compared to Illinois under the Pritzker plan.

Even New Jersey and New York’s rates, which are some of the highest in the nation, would be less painful for residents earning $250,000 to $500,000 ($250,000 to $1 million in New York’s case).

* OK, so I used the Tribune’s new online calculator for Pritzker’s proposed graduated tax (as I mentioned earlier today, the Trib tells you what you will owe, while the governor’s calculator only tells you how much less or more you’d pay) and plugged in an income of $251,000 for a single person with no exemptions and got $12,387 in income taxes owed, not including the increased property tax credit.

Next, I used the SmartAsset.com calculator and plugged in that same $251,000 income for the states listed above (excluding Iowa).

States with significantly lower effective graduated rates…

North Dakota: $5,047

States with somewhat lower effective graduated rates…

Alabama: $9,443

Louisiana: $9,920

Arizona: $9,988

New Mexico: $11,510

Rhode Island: $11,896

Mississippi: $11,985

Oklahoma: $11,994

* The rest…

Illinois: $12,387

Kansas: $13,550

Missouri: $13,582

New Jersey: $13,799

Virginia: $13,949

Connecticut: $14,369

Georgia: $14,432

West Virginia: $15,060

Delaware: $15,335

Ohio: $9,842 (plus $5,499 in local income tax for Cincinnati)

Wisconsin: $15,385

Nebraska: $15,825

Maine: $15,885

Montana: $15,952

Arkansas: $16,253

South Carolina: $16,330

Idaho: $16,402

Maryland: $12,705 (plus $6,374 local income tax for Annapolis)

California: $20,187

New York: $15,536 (plus $9,294 in local income tax for NYC)

As far as flat tax states go, if you live in North Carolina, your tax bill would be $13,321 (higher than Illinois). In Frankfort, Kentucky, your effective income tax would be $12,424 (higher than Illinois) plus another $7,405 in local income taxes. If you live in Detroit, Michigan, you’d pay $10,495 and then another $6,010 in local income taxes. In Utah, your income tax bill would be $12,425 (higher than Illinois). In Massachusetts, it’s $12,577 (higher than Illinois). Indianapolis residents pay $8,075 state income tax and $4,050 local income tax. Philadelphia, PA residents pay $7,706 to the state and $9,849 to Philly. Coloradans pay $11,621 (about $800 less than they’ll pay here if this passes muster).

* Now, you could plug in higher incomes and you might get some different results, but I didn’t set the parameters of this “debate,” they did. Also, I’m done crunching numbers for a bit.

Point being, nobody who bases any sort of intelligent decision on whether to move is gonna look at marginal tax rates. And, frankly, most people don’t move based on this topic in the first place. Click here for just one example.

59 Comments

|

The Credit Union Difference

Tuesday, Mar 12, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Comments Off

|

Pritzker unveils tax calculator

Tuesday, Mar 12, 2019 - Posted by Rich Miller

* Gov. Pritzker’s office has a new online calculator to help you figure out what your taxes would be under his progressive tax proposal. Click here to see it.

The Tribune also has a new online calculator, but its calculations don’t include the new $100 per child tax credit or the increased property tax credit, so it’s less useful. However, the Tribune’s calculator gives you your total bill (although flawed), while the governor’s calculator only tells you how much less or more you’ll pay.

…Adding… Press release…

After unveiling his fair tax proposal that gives relief to 97 percent of taxpayers, Gov. Pritzker launched a Fair Tax Calculator today to let Illinoisans see how the fair tax will affect their families.

The Fair Tax Calculator is available at www.illinois.gov/FairTaxCalculator.

“As I said throughout the campaign, Illinois’ flat tax system is regressive and unfair to the middle class and those striving to get there,” said Gov. JB Pritzker. “People like me should pay more and people like you should pay less. Simple. That’s what the fair tax will do.

“As we negotiate this proposal with the General Assembly and ultimately ask the people of Illinois to decide, my administration is committed to being fully transparent and giving residents the tools they need to understand this proposal. To that end, I’m proud to introduce the Fair Tax Calculator. This calculator will allow every taxpayer in Illinois to calculate exactly what the fair tax will mean for them and their family.”

In addition to shifting from a regressive flat tax to a fair tax, Governor Pritzker’s proposal would increase the property tax credit by 20 percent and institute a new $100 per child tax credit.

Users can input their income, filing status, exemptions, dependents, property tax paid and K-12 expenses to calculate how the fair tax compares to the current flat income tax.

Using that information, the calculator determines how much the total tax bill changes. For 97 percent of Illinois taxpayers, the amount will go down. In some cases the reduction will be nominal; in others, it will result in several hundred dollars.

“Illinois’ unfair tax structure forces the lowest earners to shoulder a greater tax burden than higher earners, but Gov. Pritzker’s plan will make the wealthy pay their fair share,” said William McNary, c0-director of Citizen Action/Illinois. “When the top 1 percent who make more than $537,800 a year pay just 7.4 percent of their income in taxes while the lowest 20 percent of earners making less than $21,800 a year pay 14.4 percent, the time for change is now.”

“Working families across the state will benefit from Gov. Pritzker’s fair tax plan that gives 97 percent of taxpayers relief and returns fiscal stability to Illinois,” said Bob Reiter, president of the Chicago Federation of Labor. “We must put the days of governing by crisis behind us and institute a fair income tax that ensures state government can adequately serve the people.”

“Gov. Pritzker is making good on his promise to make our state a better place to live for working families,” said Carole Pollitz, a business agent with IBEW Local 134. “Raising wages and reducing taxes on the middle class gives the average Illinoisan a break and benefits our entire state in the process.”

32 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|