Did Illinois have a “net loss of tax filers”?

Tuesday, Aug 13, 2019 - Posted by Rich Miller

* Wirepoints…

Wirepoints’ analysis uses national state-by-state migration data compiled by the Internal Revenue Service. The IRS reviews tax returns annually to track when and where people move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

In this first piece, we’ll cover Illinois’ net loss of tax filers and their incomes since 2000.

Losing people and their incomes

Illinois is a national outlier when it comes to losing residents and their taxable income to other states.

In 2016, IRS data shows Illinois gained nearly 165,000 people from other states and they brought with them a combined Adjusted Gross Income (AGI) of about $6.3 billion. Meanwhile, more than 250,000 Illinoisans left the state and they took more than $11 billion with them.

That means Illinois suffered a net loss of about 86,000 residents and a loss of $4.8 billion in taxable income – the equivalent of more than $100 million in state income tax revenues. […]

Illinois has lost tax filers and taxable income, on net, every year since 2000. Between 2000 and 2010, the state averaged net losses of about $1.8 billion in taxable income each year. Since then, the state’s losses have accelerated by about $500 million a year, growing to $4.8 billion by 2016.

* I asked Frank Manzo at the Illinois Economic Policy Institute to take a look. All emphasis is in the original…

Overall, the analysis of IRS numbers is correct. I arrive at the same numbers. However, there are a few problems with the analysis.

First, it’s based on “adjusted gross income (AGI)” but Illinois taxes individuals based on “net income.” Net income is AGI minus Social Security benefits, retirement income, military pay, certain business subtractions, etc. For example, if a retiree with a $100,000 pension moved to Florida, we lost their AGI but we didn’t lose income tax revenue, since retirement income is not taxed in Illinois. But we did lose things like sales tax revenue from their local spending.

Second, the data should be put in context. Clearly, the loss of population is a problem. A growing population from new births, net domestic migration, and net foreign immigration boosts economic activity. However, as the authors point out, Illinois lost about 86,000 residents and $4.8 billion in AGI in 2016. Illinois’ population is estimated at 12.7 million people and we had a total AGI of $664.7 billion in 2016. Net out-migration therefore represented about 0.7% of the population and 0.7% of AGI in Illinois. And 2016 was the worst year in terms of the data, when the state was in the middle of the two-year budget impasse which reduced business confidence, reduced funding for public and nonprofit services, and reduced state investment in higher education (note that the state also had a 3.75% individual income tax rate at this time).

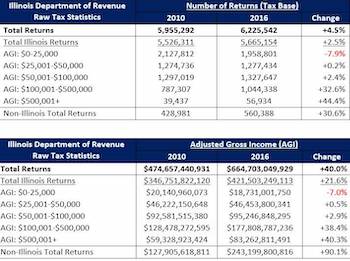

Third, the authors make it seem as though the overall tax base has shrunk over time – but it hasn’t. While we have lost people who would have paid taxes, it is worth noting that both the number of tax filers and total AGI have still increased in Illinois over recent years. Look, for instance, at Illinois Department of Revenue data for 2016 compared to 2010. I’ll stick with AGI since that is what the authors used. Here’s the change over that time:

The number of tax returns filed with the Illinois Department of Revenue (i.e., the tax base) increased by 4.5%. Filers reporting $25,000 or less in AGI did decrease by 7.9%, but that was mainly due to a strengthening economy (other factors like student out-migration and Chicago’s minimum wage hikes, which raised incomes, may also have played roles). Upper middle-class filers reporting $100,001-$500,000 and affluent filers reporting $500,001+ both increased significantly, 32.6% and 44.4%, respectively. The “non-Illinois total” also rose for unknown reasons, probably due to income generated by out-of-state and foreign businesses within Illinois’ borders as the national and global economy expanded. Overall, the point is that the tax base is still increasing, but would have been larger with net in-migration.

All of that said, I’m not dismissing population loss as a non-issue. It is a problem. Illinois needs to boost economic growth, generate more good jobs with family-supporting wages, and improve its financial outlook by paying down debts in order for the tax base to grow substantially.

- Frank Manzo IV - Tuesday, Aug 13, 19 @ 1:41 pm:

Looks like my 2016 link accidentally links to the 2010 again. Here is the 2016 data from the Illinois Department of Revenue: https://www2.illinois.gov/rev/research/taxstats/IndIncomeStratifications/Documents/Revised_2016_Final_IIT%201040%20IL%20Return.pdf

- Blue Dog Dem - Tuesday, Aug 13, 19 @ 1:52 pm:

Whats that Carpenters song….We’ve Only Just Begun.

- @misterjayem - Tuesday, Aug 13, 19 @ 1:57 pm:

With all due respect to Mr. Manzo, I’d like to emphasize the following:

And the same characters who drilled holes in the bottom of the boat are now bellyaching about their feet getting wet.

– MrJM

- Jibba - Tuesday, Aug 13, 19 @ 1:59 pm:

Connect the dots. We lost a net 30k of returns per year over the period in the $0-25K income bracket. That’s close to the number of college students going out of state, not the number of McDonalds workers moving to Texas. And when they return educated, they make more money. Sounds like a silver lining.

- Grandson of Man - Tuesday, Aug 13, 19 @ 2:03 pm:

Agreed that population loss is not a problem to ignore. It’s a very big problem. However, the solution is not to turn Illinois into a lower-wage RTWFL state and make people who can less afford it take the biggest cuts.

The fair tax will help those with lower incomes by reducing their taxes. Too bad the plan is to not tax upper incomes higher so we can give more relief to lower income folks.

The growth of upper income tax filers is corroborated by the BGA analysis, showing Illinois gained upper income people during 2011-2014, after the state income tax hike. The rich didn’t leave then and there’s no reason to believe they will leave if we get the fair tax, especially in that we’re investing in infrastructure and Chicago metro is perennially tops for corporate real estate deals.

- City Zen - Tuesday, Aug 13, 19 @ 2:15 pm:

==if a retiree with a $100,000 pension moved to Florida, we lost their AGI but we didn’t lose income tax revenue, since retirement income is not taxed in Illinois.==

A friendly reminder that one does not need to move out of state for the state to lose income tax revenue. The fastest growing segment of the state population is people 65 and over and whose primary source of income is tax exempt.

- Da Big Bad Wolf - Tuesday, Aug 13, 19 @ 2:19 pm:

==For example, if a retiree with a $100,000 pension moved to Florida, we lost their AGI but we didn’t lose income tax revenue, since retirement income is not taxed in Illinois. But we did lose things like sales tax revenue from their local spending.==

It does seem like a lot of people who leave, leave to warmer states after they retire.

- City Zen - Tuesday, Aug 13, 19 @ 2:33 pm:

==Look, for instance, at Illinois Department of Revenue data for 2016 compared to 2010.==

Not sure the absolute peak of Illinois’ unemployment curve is an accurate starting point to gauge growth.

==That’s close to the number of college students going out of state==

None of those kids came back to work summer or winter breaks?

- Let’s be realistic - Tuesday, Aug 13, 19 @ 4:29 pm:

Each year Illinois has more debt than the year before and less people to pay it. That will not reverse, but will only increase more each passing year.

- Oswego Willy - Tuesday, Aug 13, 19 @ 4:32 pm:

===That will not reverse…===

Tier one folks won’t live forever.

I bet that felt liberating typing that.

How many folks have missed a pension payment?

How many bond obligations has the state missed?

- City Zen - Tuesday, Aug 13, 19 @ 5:36 pm:

==Tier one folks won’t live forever.==

Couple of decades until the Tier 2 folks start to claim benefits that would be anywhere close to full vesting. Those benefits can be enhanced any time between now and retirement, even post-retirement, just like Tier One was.

Once upon a time, Tier One was 1.5% simple (now 3% compounded) AAI, had a 1.67 (now 2.2) service year multiplier, and used the last 5 (now 4) years of avg salary. Who knows what the future holds.

In a few decades, folks might be saying “Tier Two folks won’t live forever.” Maybe by then, they will.

- Oswego Willy - Tuesday, Aug 13, 19 @ 5:38 pm:

===Who knows what the future holds.===

They still won’t live forever.

===Maybe by then, they will.===

Mary Jane isn’t legal until January. Please hold off until then.

- Morty - Tuesday, Aug 13, 19 @ 10:19 pm:

Wırepoınts.

Nothıng good comes from readıng Wırepoınts. Mark has pretty much gone full mental breakdown on Twıtter..

I thınk the stress of never producıng results ıs gettıng to them.