* State Rep. Mike Bost was asked during a tele-townhall meeting: “What do you intend to do for the middle class to get this weight off of us?” The GOP congressional candidate’s response…

I know that this might not be a popular statement, but this is the way I feel. You cannot lift up the middle class by continuing to have over-burdensome regulations on the job creators.

As they’ve tried to push forward with a minimum wage, that minimum wage will actually hurt the middle class. We need to make sure that a sensible, we need to make sure that the middle class’ buying power remains at the best possible level and then give them the opportunity to move up from the middle class to whatever class, whatever level that they want to work.

But that can only be done when we start removing government regulations that destroy job growth in this state or in this nation and stop people from being the entrepreneurs that they are naturally and seeking the American dream, whether they want to start their own business or expand their business to provide more jobs for people…

Overburdensomed government has kept us pinned down and it is hurting the middle class.

Full audio is here.

* The Southern Illinoisan followed up after a handful of people protested…

[Bost] said minimum wage was created to be a supplemental income for people working toward better jobs through job training and other programs.

Bost said Illinois suffers with its higher minimum wage of $8.25 per hour compared to the federal level of $7.25 per hour. Jobs around the Illinois borders with neighboring states are lost because of the state’s higher minimum wage level, he said.

He said when the minimum wage level is raised, it hurts middle-class wage earners because the cost of living goes up.

“The problem is the middle income wage earners are punished terribly when minimum wage is raised. Your buying power is reduced,” Bost said.

Discuss.

79 Comments

|

S&P revises Illinois outlook to “negative”

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* Considering the budget and the Supreme Court ruling on retiree health insurance, this news could’ve been much, much worse.

I have no idea whether Bruce Rauner’s openness to raising taxes contributed to only an outlook change rather than a ratings change, but the raters have to be breathing a sigh of relief now that both candidates for governor want new revenues after the income tax partially expires on January 1st…

Standard & Poor’s Ratings Services has revised its outlook on Illinois’ general obligation (GO) bonds outstanding to negative from developing and affirmed the ‘A-’ rating on the state’s GO bonds.

“The outlook revision follows the enactment of Illinois’ fiscal 2015 budget, which in our view is not structurally balanced and will contribute to growing deficits and payables that will likely pressure the state’s liquidity,” said Standard & Poor’s credit analyst Robin Prunty. “The outlook also reflects the implementation risk associated with recent reforms related to post retirement benefits,” Ms. Prunty added.

While legislation to reform pensions and other post employment benefits (OPEB) is considered positive, if the reforms do not move forward as planned we believe the significant fixed cost pressure associated with post retirement benefits will escalate. This risk is highlighted by the recent Illinois Supreme Court decision to reverse the trial court’s dismissal of the suit relating to statutory changes to the state’s health insurance premium subsidies, which was remanded back to the lower courts. It is uncertain what the lower court will ultimately decide but the Illinois Supreme Court was clear in its opinion that the health insurance subsidies paid by the state for retiree health care are a benefit derived from membership in a state pension plan and therefore subject to the Illinois Constitution.

Key factors supporting the ‘A-’ rating include what we view as Illinois’:

· Deep and diverse economy, which is anchored by the Chicago metropolitan statistical area;

· Above-average income levels;

· Substantial flexibility to adjust revenues, expenditures, and disbursements;

· Well-established and tested statutory priority of payment for debt service;

· Ability to adjust disbursements to stabilize cash flow and to access substantial amounts of cash reserves on deposit in other funds for debt service, if needed, and for operations if authorized by statute; and

· Improved alignment of revenues and expenditures for fiscal years 2013 and 2014 with some steady reduction in payables. We expect this situation to reverse in fiscal 2015 absent budget adjustments.

Offsetting these generally positive credit factors are what we consider:

· Sizable and chronic accumulated budget-based deficits despite revenue-enhancement measures implemented in 2011and improved economic trends. While the deficit is reduced significantly, it remains significant relative to the size of the budget;

· A historically large generally accepted accounting principle general fund balance deficit;

· A large and growing unfunded actuarial accrued liability; and

· A moderately high and growing debt burden due to debt issuance for current pension contributions in fiscal years 2010 and 2011 and the approved long-term capital program.

We consider Illinois’ economy to be broad and diverse, and the state’s income levels are well above average.

A negative outlook indicates that we could lower the rating during the two-year outlook horizon. The change reflects the enacted fiscal 2015 budget, which is not structurally aligned and we believe will contribute to growing deficits and weakened liquidity. Also factored into the negative outlook is the implementation risk associated with pension and OPEB reform measures. If the pension reform is declared unconstitutional or invalid, or implementation is delayed and there is a continued lack of consensus and action among policymakers on the structural budget gaps and payables outstanding, we believe there could be a profound and negative effect on Illinois’ budgetary performance and liquidity over the next two years and that this could lead to a downgrade. If pension reform moves forward, and the state takes credible action to achieve structural budget balance over the next two years, we could revise the outlook to stable.

* Budget office react…

Governor Quinn was clear with legislators this year that bond rating agencies would look with disfavor on a budget that did not contain enough revenue to cover a full year of the state’s needs on education, public safety and human services. The legislature passed an incomplete budget and this is the predictable result.

Standard & Poor’s Wednesday maintained its A-minus rating on Illinois bonds but changed its outlook on Illinois from “developing” to “negative.”

Among S&P’s comments:

“Per capita personal income in 2013 was $46,780, or 105% of the U.S. average, ranking Illinois 15th nationally and first among the Great Lakes states.

“Structural budget alignment improved in fiscal years 2013 and 2014 due to economic and revenue recovery, revenue enhancement, and spending restraint and reform. A surplus was generated in fiscal 2013 that lowered the general fund deficit and payables outstanding on a budgetary basis.

“…additional expenditure reductions could be difficult to achieve after several years of cost cutting…”

While expressing concerns about implementing the state’s pension reform law given comments in a recent Supreme Court of Illinois case, S&P reaffirmed its favorable view of the state’s pension reform law: “We view the pension reform as a significant accomplishment that could lead to improved pension funding levels, greater pension plan sustainability, and improved prospects for budget stability.”

When Governor Quinn introduced his budget this Spring, S & P – like the other rating agencies – issued comments looking favorably on the governor’s proposed budget. Governor Quinn shared those comments with the legislature:

“The recommended budget could contribute to enhanced structural alignment due to less severe spending reductions needed to achieve balance…”

8 Comments

|

What’s ahead?

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* Illinois Issues…

Dueling court rulings handed down today put the future of a key piece of Obamacare into question, but for now, nothing will change about the way the law is implemented in Illinois.

A three judge panel in Washington D.C. ruled this morning that under the Patient Protection and Affordable Care Act, federal subsidies to bring down the cost of insurance should only be available to residents of states that operate their own online insurance exchange. Under the decisions, Illinois and 35 other states would lose the subsidies. Illinois partnered with the feds on Getcoveredillinois.gov, but the website still relies on the federal exchange to sign patients up for coverage.

Just hours after the U.S. Court of Appeals for the D.C. Circuit weighed in, The Fourth Circuit Court of Appeals in Virginia issued a diverging opinion on a similar case. That panel of judges said that the wording of the law was unclear, but the majority agreed that the law allows for the subsidies to be dispersed through the federal exchange.

In Illinois, 217,000 people obtained insurance through the exchange. More than three quarters of those qualified for a subsidy. Health officials in Illinois say that those approximately 168,000 will not lose their subsides as an immediate result of the rulings. “We are monitoring today’s appeals court decisions in which two courts have rendered differing rulings. The bottom line for now is that nothing has changed, and the subsidies created under the law to help people cover the cost of their health care remain in effect. Get Covered Illinois is focused on preparing for the enrollment period for year two that will start this fall,” Jennifer Koehler, executive director of Get Covered Illinois, said in a written statement.

* Tribune…

Nearly two-thirds of those who signed up for coverage on the federal marketplace were able to pay $100 or less per month on insurance premiums, according to U.S. Department of Health and Human Services data. The average monthly subsidy for those who qualified for tax credits was $264, government data shows.

In Illinois, the average enrollee received a $202 tax credit, lowering their monthly premium from an average price of $316 to an average of $114, according to government data. […]

Steve Brown, spokesman for House Speaker Michael Madigan, said there “is no consensus in terms of a plan going forward” for an Illinois-run exchange.

He and John Patterson, the communications director for Senate President John Cullerton, said the two offices will continue to monitor the court cases as litigation continues.

* AP…

State Rep. Robyn Gabel, D-Evanston, said the rulings could inject new urgency into legislative efforts by her and others to create a state-based exchange for Illinois.

“There’s a more compelling reason to look at it,” she said, adding that she is considering calling for a vote on her proposal in the fall veto session, which begins Nov. 11.

Steve Brown, spokesman for House Speaker Michael Madigan, D-Chicago, said a lack of consensus on the matter in the Democratic-controlled Illinois General Assembly has prevented a state exchange from moving forward.

He said he doesn’t know whether Tuesday’s rulings will change any minds.

“It seems like there’s a ways to go in the court process,” Brown said. “Time will tell.”

That’s the power of the insurance lobby in Illinois, for you.

25 Comments

|

Question of the day

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* Republican US Senate nominee Jim Oberweis…

“When I first ran, which was 12 years ago, I was very green,” he told your shorter columnist during the visit. “I had no idea about how to run a campaign, and I made plenty of mistakes. Certainly the ads that we ran on illegal immigration. While the point of the seriousness of the issue was correct, the ads that we ran were very bad and did not communicate the issue very well.”

He also copped to having “made plenty of mistakes in business” over the years.

But here’s the key: “As I’ve made those mistakes in business, I’ve learned and I’ve certainly done a better job in growing our businesses with experience.”

Contrast that to Bruce Rauner’s claim that he’s been successful at everything he’s ever done.

* More from Oberweis…

Oberweis said his views have changed slightly on children brought here by illegal immigrant parents.

“Those kids should be given a path to citizenship. I don’t believe that in this country we believe in punishing kids for the sins of their parents,” he said. “The parents, however, who broke the law and entered the country illegally, should not be given a path to citizenship, they should not be given amnesty. If they want to become citizens they should apply like anybody else and follow the rules like anybody else.

“But we don’t want to break up families. So I believe they should be issued a nonimmigrant visa that would allow them to work, to pay taxes, to return to their homes and come back again. But no amnesty and if they want to become citizens they should apply like anybody else and go to the back of the line.”

* The Question: Jim Oberweis 2002 is to Jim Oberweis 2014 as _____ is to _____?

35 Comments

|

Teh crazy

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* From Facebook…

The accompanying video is here.

* Phil Kadner…

“The immigrants are coming! They’re bringing children from Central America here!”

That was the cry that arose from some panicked Southland residents this week after more than 100 military vehicles suddenly appeared on the campus of Cook County’s Oak Forest Health Center, 159th Street and Cicero Avenue.

“I’m almost 100 percent positive they will be shipping all the illegals from Mexico by the hundreds of thousands there …” one man emailed, sending a photo of the vehicles to illustrate his point.

Others called the SouthtownStar convinced that teenage immigrants from Central America soon would be camped out on the grounds of what used to be Oak Forest Hospital.

* Illinois Review…

Earlier this week, Illinois Review received several queries about military vehicles suddenly showing up at the now-closed Oak Forest Hospital at 159th and Cicero Avenue. Speculations were running wild, as some thought the National Guard was preparing for a citizen uprising, while others suggested that the federal government was transferring unaccompanied minors from the southern border to house in Oak Forest.

The hospital, deemed as an emergency shelter by Homeland Security, was used to house homeless victims after the Katrina hurricane.

Actually, those Katrina refugees were housed in Tinley Park.

* As it turns out, the vehicles were moved to make way for parking lot improvements. From the Illinois National Guard…

Parking Lot Improvements Underway at Crestwood Armory

Vehicles temporarily parked at nearby health center

Crestwood, Ill. – Construction is scheduled to begin this week at the Illinois Army National Guard’s Crestwood armory parking lot, 13838 S. Springfield Ave in Robbins, Ill.

The $1.5 million project will upgrade and rehabilitate the current parking lot. Construction includes drainage improvements, on-site storm-water management and improvements to the current loading ramp. It will also include new lighting, paved concrete areas and an additional gravel lot for parking.

The project will last four to six months. Throughout the project, military vehicles will park at the Oak Forrest Health Center in parking spots leased by Cook County.

Additional construction at the Crestwood armory includes improvements to the Field Maintenance Shop’s driveway approaches. A future construction project will include interior improvements to the armory.

The Crestwood armory is home to multiple Illinois Army National Guard units including Company B, 405th Brigade Support Battalion; Battery B, 2nd Battalion, 122nd Field Artillery Regiment; Company G, 634th Brigade Support Battalion; Company F, Recruit Sustainment Program; 1744th Transportation Company; 108th Signal Company and Joint Force Headquarters Medical Detachment.

* Back to Kadner…

As for the sight of military vehicles scaring people, imagine what life would be like in a country where those vehicles are manned by hostile government forces intent on doing harm to anyone considered a threat to those in power. There are a lot of nations like that in the world right now.

We’re lucky. And sharing some of that good fortune, or at least showing people a little kindness, might not be the worst thing that ever happened to this country.

Why there’s so much fear among so many in a nation that has so much (even in the aftermath of the Great Recession) is both baffling and troubling.

76 Comments

|

Lawyers want expedited pension ruling

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* Judge John Belz, who’s presiding over the pension law case, held a status hearing yesterday…

Lawyers challenging last year’s pension reform law said they will make another attempt to get an expedited ruling in the case in the wake of the Illinois Supreme Court’s decision in the retiree health insurance case.

Lawyers said they believe the ruling in the health insurance case — called the Kanerva decision after one of the plaintiffs — effectively nullifies the state’s argument that Illinois’ severe financial problems allow pensions to be changed, despite the pension protection clause of the state Constitution.

At a hearing Tuesday, the lawyers said they will be filing new motions that will bring the issue before Sangamon County Circuit Judge John Belz.

“In the health care (case) and in this case, the change in pension is clearly a diminishment and impairment protected by the Constitution,” said Don Craven, who brought one of the five lawsuits challenging the pension reform law.

Before the Kanerva decision, Judge Belz’s proceedings looked like they could drag on for months and months. The only thing really left unsettled by Kanerva is the police powers argument. And even that was undermined…

In light of the constitutional debates, we have concluded that the provision was aimed at protecting the right to receive the promised retirement benefits, not the adequacy of the funding to pay for them.

45 Comments

|

Briefing schedule, threats issued

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* The appellate court has issued a briefing schedule on Bruce Rauner’s term limits/etc. constitutional amendment…

The case will proceed in accordance with the following briefing schedule:

a. Intervenor-appellants will tile their appellate brief on or before July 29, 2014.

b. Plaintiffs-appellees will .file tl!eir response brief on or before August 7, 2014.

c. Intervenor-appellants will file their reply brief on or before August 11, 2014.

And then the court has to write the opinion. And then it’ll go to the Supremes. As I’ve been saying for a while now, the state ballot needs to be certified by August 22nd.

* Meanwhile…

Sources tell Illinois Review that Howard Rich, founder and president of U.S. Term Limits, has decided to take on Illinois, and may be targeting the Illinois Supreme Court, district by district, as each judicial retention vote comes up.

This doesn’t seem an idle threat. Rich is a veteran political activist who has given and raised millions of dollars, and bats close to 1,000 when it comes to exacting a price on those he targets. He’s taken out state Supreme Court justices in Nebraska, Missouri, and Wisconsin. And the Illinois judges who failed to grant the appeal seem ripe targets for Rich.

Sources tell IR that Rich is already evaluating Judge Mikva’s district and has begun assembling a team to wage a retention vote against her in 2016. Mikva bounced both the term limits and fair maps amendments from the ballot at the district court level, invalidating millions of voter signatures. The type of judicial action for which Rich has successfully unseated judges before.

In addition to Mikva, sources say Rich is eyeing Illinois Supreme Court retentions as well.

The only Supreme Court justice up for retention this year is Lloyd Karmeier, a Republican. It’s also possible that the Supremes could just issue an opinion after the election if the appellate branch sides with the circuit court.

The next member of the high court isn’t up until 2018 (Ann Burke). Judge Mikva isn’t up for retention until 2016.

23 Comments

|

* Eric Zorn looks at Bruce Rauner’s property tax proposal…

But the “Bring Back Blueprint” also contains some stinkers, notably the call for a property tax freeze. With the freeze in place, according to the campaign’s explanation of the vague passage on Page 10, the annual amount individual property owners pay could not be increased until voters OK’d the hike at the polls.

First, this proposal glosses over the complexity of the property tax system, in which your bill is your share, based on the value of your property, of the combined requirements of local taxing bodies, such as parks, libraries and schools. But even if the law froze or lowered those requirements — called levies — your share would go up if your property value rose more quickly than average.

Second, it would require a three-fifths vote of the General Assembly to impose a property tax freeze on home-rule communities, according to the Illinois Department of Revenue, making it close to politically impossible.

Third, it would plunge every affected community into perpetual (and expensive) referendum hell, with every incremental initiative effectively put to a popular vote.

Finally, as time and inflation took their toll, a freeze would inevitably starve not only police, fire and other essential services, but also education, which already relies too heavily on local property taxes and which Rauner has pledged, somehow, to bolster.

* As does Mark Brown, who wrote “don’t fall for this illusion that the rich man has the secret pain-free formula to save us all”…

Nobody likes to pay property taxes. Nobody likes higher property taxes. But property taxes are the primary method by which we fund our schools in Illinois.

If you reduce the state income tax while freezing the local property tax, the effect is to put a chokehold on the public school system in your community.

That’s why there had been a push for many years to increase the state income tax: to get more money to schools and in the process take pressure off property taxes.

Unfortunately, because of the state’s financial mismanagement [feel free to blame the Democrats although Republicans played a role, too] and the recession, we dug ourselves such a deep hole that too little of the increased revenue has made it to the schools.

* As does Phil Kadner…

Rauner also recently has said he wants to freeze property taxes.

I don’t even know what that means.

Does he want to freeze property tax rates? Does he want to freeze the levies of local school districts, library boards and municipalities?

I mention this because it’s all of apiece.

Even Republicans, who want to cut budgets, understand that you need money to pay for important programs that provide valuable services for people.

Even Democrats, who advocate increased government spending on social service programs, complain about their taxes.

What people really want, it seems to me, is lots of stuff at no cost.

Yep. We’ve all been spoiled by three and a half decades of almost constant and huge federal budget deficits. The feds have magic money powers, so folks assume everybody else does too. They’re wrong, but politicians and way too many editorial boards think magic is a plan.

50 Comments

|

* From Gov. Pat Quinn’s campaign…

As gun violence continues to plague many communities, Bruce Rauner’s continued support for the proliferation of semi-automatic, military-style assault weapons was highlighted in a new Web video from the Quinn for Illinois campaign.

The hard-hitting new video shows Rauner’s response at a Republican gubernatorial debate earlier this year, where Rauner voiced strong support for assault weapon ownership, and merely shrugged when an incredulous host asked, “When it would make sense to use an assault weapon?”

* Rate the YouTube video…

This is mostly about the all-important suburban female vote. It worked well against Bill Brady in 2010. We’ll see how it does this time.

68 Comments

|

Cross turns thumbs down on Rauner service tax

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* Eric Timmons…

Republican candidate for treasurer Tom Cross says he opposes Bruce Rauner’s plan to tax 32 different services.

Mr. Rauner, the Republican candidate for governor, released a plan last week to freeze property taxes and gradually lower the state’s income tax rate. He also proposes new taxes on attorneys’ fees, warehousing and storage, advertising sales, golf club memberships, debt collection, security guards and residential sewer and refuse.

“Sometimes Republicans disagree,” Rep. Cross said of his opposition to the Rauner tax plan. “I don’t support any of the service taxes.”

The former Illinois House minority leader, Rep. Cross said he wanted it on record that he supports “everything else” in Mr. Rauner’s plan for the state.

Cross’ opponent Michael Frerichs was a co-sponsor of the service tax bill that Quinn supported. So, this move is no surprise.

* But it most certainly is the easy way out…

“We have been a state that has just seen people spend money that we don’t have,” [Cross] said. “And we need to learn to live within our means. We’ve got $35 billion. That’s more money than we’ve ever had as a state. And there’s this continuous discussion and thirst for more money and more money and more money. I think the service tax is a mistake.”

He also said this…

“I think it’s important for people to articulate what they’re going to do. Sometimes we say, as Republicans we say, ‘The Democrats have done such a bad job, you’re going to vote for us. We’re not Democrats.’

“Now, I think they have done a bad job, but I think we also have to say what we’re going to do.”

OK, well, Tom, let’s hear how you’d solve the problem without new revenues.

28 Comments

|

Define “regularly”

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* The I-Team picked up our Rauner tracker ejected from Quinn event story last night. The only new thing in the piece…

Rauner campaign officials deny any wrongdoing and say they regularly allow Quinn trackers into events, although the governor’s people say that isn’t true.

A Rauner event was also held Tuesday night in Downers Grove, and attendees were requested not to post the information to social media because it said Quinn trackers might find out and show up to disrupt the event.

I was actually saving that little tidbit for today.

* From a July 11th fundraising e-mail sent by former GOP Congresscritter Judy Biggert…

Thank you again for all you did to help my candidacy for Congress over the years. It was a great run, thanks to wonderful people like you.

Today I’m writing to invite you to meet our Republican candidate for Governor, Bruce Rauner. On Tuesday, July 22, Women For Rauner will host a free town hall meeting at 5:00 p.m. at the Doubletree Suites in Downers Grove. Doors will open at 4:30 p.m.

But check out the postscript…

P.S. Rauner for Governor has asked you NOT to post this event information on your FB/Twitter or organization website. Trackers from the opposition are constantly searching for opportunities to disrupt events— so this is a point of extra caution. You are strongly encouraged to take pictures and post on the day of the event.

Heh.

27 Comments

|

* Sun-Times…

Newly released emails from Gov. Pat Quinn’s office show politics appeared to trump credentials when deciding how big a serving some nonprofits should get from his now-tarnished $54.5 million Neighborhood Recovery Initiative anti-violence grant program.

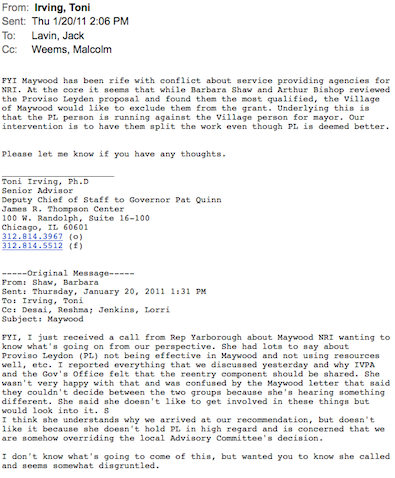

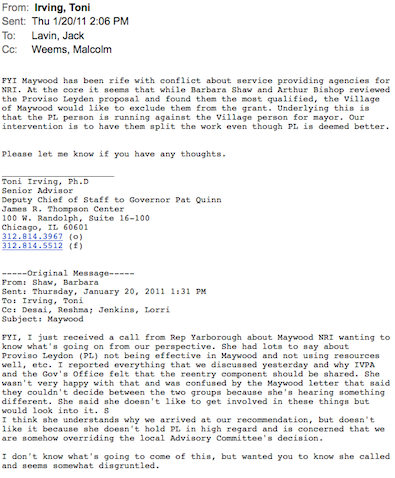

* The e-mail exchange…

* Back to the story…

Quinn’s administration put Maywood in charge of divvying up $2 million in NRI money for that western suburb in 2011 and 2012. A month into the program, Proviso Leyden had been shut out of funding by the village, prompting a December 2010 complaint to the administration by the organization.

Proviso Leyden eventually wound up receiving $117,715 of the Maywood allotment for re-entry work under NRI.

Maywood allotted a larger, $255,724 chunk of NRI re-entry funds to another nonprofit, Vision of Restoration.

Vision of Restoration’s founder, Marvin E. Wiley, donated $250 to Henderson Yarbrough’s campaign fund and board member Richard Boykin gave a total of $5,000 to political funds of Karen and Henderson Yarbrough. Boykin is a former chief of staff to U.S. Rep. Danny Davis, D-Ill., and he ran successfully last spring for the Cook County board with Karen Yarbrough’s backing.

* From the Illinois Republican Party…

ICYMI: Secret emails trip up Quinn as guv cancels planned Q & A

This morning, the Chicago Sun-Times broke a major front page story revealing emails that show Quinn’s top aides used political calculations to make NRI anti-violence funding decisions.

Shortly thereafter, the Governor alerted the media he would no longer take questions at a public event scheduled for 12pm today at Harker Pumping Station, 5300 W. 105th Street in Oak Lawn.

Quinn did indeed cancel his Q&A.

70 Comments

|

*** UPDATED x1 *** Rate Rauner’s new TV ad

Wednesday, Jul 23, 2014 - Posted by Rich Miller

* From a press release…

Bruce Rauner’s campaign for governor launched a new television advertisement this week outlining the bad news that has marked Pat Quinn’s time as governor.

The ad, titled “Headlines,” underscores Quinn’s record of job losses, tax hikes and education cuts and also highlights the federal, criminal investigation into Quinn’s anti-violence program as well as questions about pay-to-play issues in Quinn’s administration.

“From a 67% tax hike and $500 million in cuts to education to becoming the latest governor to find himself in the middle of a federal criminal investigation, Pat Quinn’s meant nothing but bad news for Illinois,” Rauner spokesman Mike Schrimpf said. “It’s time for a fresh start in Springfield. Bruce Rauner is the change agent needed to bring back Illinois.”

* Rate it…

*** UPDATE *** From the Quinn campaign….

Paid for by vast riches he built using elite methods to dodge taxes, another Bruce Rauner bit of propaganda hit the airwaves today.

Marked by more dishonesty and distortion, the ad is remarkable for totally ignoring the $8 billion hole that the reckless Rauner Tax Plan blows in the budget, as well as the deadly negligence and abuse at long-term care facilities he owned and from which he profited that were supposed to care for people with disabilities and the most vulnerable.

Rauner makes more false claims about jobs, education and anti-violence programs.

Here are some simple facts about the records of Governor Pat Quinn and billionaire Bruce Rauner:

Jobs.

Unemployment is at its lowest point since October 2008 and more people are working today in Illinois than when Governor Quinn took office.

Meanwhile, Rauner built his riches by acquiring companies, stripping their value, massive layoffs, outsourcing and shipping jobs overseas.

Education

The Governor has increased funding for education, including making teacher pension payments and has proposed the largest investment in the classroom in Illinois history. He also has increased funding for job-creating vocational and technical programs.

Rauner, meanwhile, has introduced a Tax Plan that would blow an eight billion dollar hole in the budget and require massive cuts to schools.

Anti-violence program

As Mr. Rauner surely knows, there is no investigation of the Governor and to deceptively suggest otherwise is nothing but a political smear tactic by Rauner and the Republicans. While the Governor took action to fix problems with this now-defunct program and signed a new law to increase oversight of state grants, Mr. Rauner is hoping voters won’t notice all of his companies that were under investigation under his watch for everything from Medicaid fraud to criminal negligence to accounting fraud. Rauner has declined to take any responsibility for these disturbing revelations, but he has taken the money.

In addition, the Governor continues to fight against violence and is pushing to ban military-style assault weapons. Rauner supports military-style assault weapons and said he believes people should be able to use them “as they see fit.”

39 Comments

|

Frerichs has new idea

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* Greg Hinz followed up on our post yesterday and this morning’s Capitol Fax with a piece on the dustup over the state treasurer’s investments in Israeli government bonds.

Sen. Mike Frerichs then volunteered another idea…

But — without prompting — he then went on to say that the state should divest itself of any pension investments in companies “that move jobs overseas out of Illinois.”

Mr. Frerichs gave no examples, but as treasurer he would be a voting member of the Illinois State Board of Investments, which handles money management for some of the state’s pension funds.

Asked whether he would divest shares of Deerfield-based Walgreen if it indeed moves its headquarters to Switzerland, Mr. Frerichs said he’d wait for a while “to see how they manage this…what is the number of jobs they move out of the state.”

Mr. Cross countered that the treasurer’s job is to “maximize returns and minimize risks.” In the case of Walgreen, “you have to have the basic philosophy to get the best return,” he said.

Your thoughts?

64 Comments

|

*** UPDATED x1 *** Rauner sides with Uber

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* Bruce Rauner staged an event today designed to put pressure on Gov. Pat Quinn to veto the ride-sharing regulation bill…

“Our kids use it a lot,” Rauner said Tuesday morning while about to step into an Uber car – a 2005 Toyota Camry with 200,000 miles on it — whisking him to 5044 S. Wabash for a campaign stop about early childhood education. “There are a lot of neighborhoods in Chicago where there aren’t cabs.” […]

He said some level of background checks for ride-sharing drivers “probably does make sense.” So does a certain level of insurance, though he didn’t have any coverage minimums in mind. […]

Rauner’s Uber driver was Schaumburg resident Mohammed Meghani, 43. He has been driving an Uber car since December and bought a used Camry in 2013 for $5,500 for strictly that purpose. He has 20 to 30 Uber customers a day, and it’s his primary way of making a living for him, his wife, a stay-at-home mom, and their three children, ages 14, 11 and 7. Meghani said he had most recently worked in the banking industry, for Chase and earlier for Bank of America and LaSalle Bank and Bank of Lincolnwood. […]

[The bill] requires chauffeur licenses for drivers who work more than 18 hours a week, Rauner said.

“That’s just a restraint of competition,” Rauner said. “That shouldn’t be necessary.”

I’m not sure that’s a “restraint of competition” because taxi drivers have to obtain the same license.

And one of the main hangups is the insurance coverage requirement. Uber doesn’t insure drivers very much in between rides.

Also, an old Camry with 200,000 miles on it isn’t exactly what one thinks of when one thinks of Uber. That’s gotta be UberX.

The campaign also posted a brief video to Instagram and is planning to send an e-mail to supporters.

…Adding… The blast email…

I am running for governor to bring back a booming economy to Illinois. We need to encourage job growth by giving innovative companies greater opportunities – not restricting them.

Uber is an innovative, growing company that provides ride-share services to millions of people across the country and wants to create 425 more jobs right here in Illinois. Yet, Governor Pat Quinn may sign a bill that will hamper this fast growing company with burdensome regulations and impede job creation.

Illinois should encourage companies like Uber to grow here, but this bill does the opposite. I’d veto it. Ride-share drivers should have insurance and background checks. But Pat Quinn shouldn’t sign this bill – it sends another signal that Illinois is closed to innovation.

I love Uber. And we need a state that supports job creation — not runs it off. Tweet Pat Quinn — tell him to veto the anti-Uber bill.

*** UPDATE *** From Mara Georges, Illinois Transportation Trade Association…

“This legislation is simply focused on making sure all Illinoisans have basic consumer protections when they step into a car for hire. Customers have the right to know their driver has passed a comprehensive police background check and drug test and carries sufficient insurance in case of an accident.

Ride-share companies claim they can regulate themselves, but time and time again they have proven that they cannot protect their drivers or passengers. It is unfortunate that Bruce Rauner would side with Silicon Valley multi-billionaires and venture capitalists, rather than Illinois consumers.”

They’ve released a second version of the statement…

“This legislation was passed by the Illinois General Assembly with overwhelming bipartisan support and is simply focused on making sure all Illinoisans have basic consumer protections when they step into a car for hire. Customers have the right to know their driver has passed a comprehensive police background check and drug test and carries sufficient insurance in case of an accident. It is unfortunate that Bruce Rauner would side with Silicon Valley multi-billionaires and venture capitalists, rather than Illinois consumers.”

61 Comments

|

* From Chip Englander, Bruce Rauner’s campaign manager…

Campaign videographers are commonplace, especially at public events on public property. We treat the governor’s campaign videographers with respect and we expect nothing less from the governor.

Earlier today, a member of Governor Quinn’s taxpayer funded security verbally assaulted and physically removed a young member of the Rauner team from a public event being held on public property. The stress of multiple criminal investigations does not excuse the behavior of Governor Quinn and his staff.

I’m told by the governor’s campaign that Rauner’s trackers “have become somewhat of a security issue lately as their tactics have been more aggressive.” One tracker was recently found “hiding in a bathroom” the gov’s campaign says. Today, I’m told, Rauner had 3 trackers, 2 clowns and 3 staffers at the Quinn event.

* From the twitters…

* Rauner tracker video…

Tense.

Currently awaiting formal responses and counter-responses.

…Adding… Just as an FYI, according to the governor’s public schedule, the press conference was held today at the…

Circle Interchange

Intersection of W. Harrison St. & S. Des Plaines St.

Chicago

Looks like a public event to me.

…Adding More… Rauner’s Blagojevich impersonator was, according to the Quinnsters, “repeatedly asked to move” away from the governor’s car by the cop in this pic…

The Rauner folks say the guy was just standing in a parking lot.

…Adding More… The Quinnsters insist that the Blagojevich clown was “standing in front of the governor’s car” which isn’t pictured.

*** UPDATE *** From a buddy of mine who was at the event. Some sentences were deleted to protect the person’s identity…

As it happens I was standing next to the young man when security escorted him away. I can tell you that the kid was videotaping the podium area and the group that was invited to attend the bill signing event. I didn’t notice him, much, since the area was filled with real media. The kid had a puny video camera, and that did catch my attention. The security guy in question did ask him to leave, the young guy refused, security said (right before the beginning of this clip), “I’m not going to take this anymore.” Sounds like this wasn’t their first rodeo. He grabbed the videographer by the arm and hustled him away.

I will tell you that when I went to park, I pulled in front of security’s car. The same guy got out before I exited my vehicle and politely asked me to move my car. Which I did, of course. There were several Rauner supporters there, one with the Blago mask carrying a sign, and the ubiquitous “Quinnocio.” They stayed behind the barricades to the event at all times. I don’t quite get why the young guy was videotaping anything since the Governor had yet to arrive. Security being what it is, the officer seems to have exercised his duties out of an abundant caution for the Governor’s safety. My two cents.

187 Comments

|

Judge rules state can close Murray Center

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* Illinois Review…

Parents and loved ones of profoundly disabled residents of the Downstate Murray Center failed to prove their family members would suffer irreparable harm if the facility closed, federal Judge Marvin Aspen ruled Monday.

The state’s emphasis is on downsizing, but parents fighting the Murray Center closing warn that if Murray Center closes, all the state’s other similar facilities will close as well.

Murray Center families represent the most organized opposition to disability centers closing statewide. With that obstacle out of the way, all of the state’s five remaining centers are likely to close.

The state argued that putting the disabled in group settings would save the state $100,000 per person annually, part of their argument that the state budget could potentially improve if the center closed.

This has become quite a major cause down there. One of my own aunts is involved with keeping the facility open. Bruce Rauner has sided with AFSCME, local GOP lawmakers and the parents and said he’d keep the facility open if elected.

* But…

Judge Marvin Aspen, in a 55-page ruling, said the plaintiffs did not prove they would suffer irreparable harm if Murray Center closes. Aspen said the state, in closing Murray Center, is trying to “improve efficiency by serving more citizens, to effectuate public policy favoring the integration of the disabled when feasible, and to potentially improve the state budget.”

He added: “We are not unsympathetic to the real human concerns raised by plaintiffs in their diligent and highly professional advocacy as guardians, on behalf of their loved ones as well as other families facing this predicament. We recognize that Murray’s closure may cause distress and disruption for plaintiffs, their wards, and their families. In the end, however, we cannot grant them legal relief on the record before us, which does not permit us to conclude that plaintiffs’ interests outweigh defendants’ interests…” […]

Aspen, in his ruling, noted that 11 states have quit operating institutions for people who have developmental disabiltiies. “Community programs have been developing for at least 50 years and are not a fad,” the judge wrote.

Aspen also noted that Illinois currently serves about 1,800 residents in institutional developmental centers, and about 22,000 people in community-based settings such as group homes. But, the judge added, “an estimated 23,000 people with developmental disabilities in Illinois are on a waiting list to receive services, of whom 6,000 are considered to be in emergency situations. The (state) lacks funding to offer services to these individuals.”

22 Comments

|

Griffin talks about what he’s up to here

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* Ken Griffin says he has no interest in running for office. From a hedge fund newsletter…

The Citadel Investment Group founder has played an outsized role in this year’s gubernatorial campaign in Illinois, donating more than $3.5 million to Republican challenger Bruce Rauner. The contributions include the state’s single-largest ever, a $2.5 million check cut last month. But Griffin said he expects that giving—and giving generously—is as far as he’ll go in politics.

Griffin told CNBC at last week’s Delivering Alpha conference in New York that the “can’t see” a run for office in his future. Pressed by CNBC’s Kate Kelly, he wouldn’t rule it out, but did not sound enthusiastic, either.

“Never say never, but I can’t see it in my future,” he said.

Griffin said he’s digging deep because Illinois under Gov. Pat Quinn is in trouble.

“Americans talk about the need for change in Washington. I can tell you the need for change in Springfield is far greater than the need for change in Washington. I know it’s hard to believe.”

* More…

“So Illinois has historically been a great state to do business in. Unfortunately over the last 20 years, we’ve moved from being at the top of the list of places to do business to, frankly, the bottom of the list,” Griffin said when asked about the Rauner contribution. […]

“The difference between Republicans and Democrats on most issues is actually pretty small,” he said. “We make a big deal about very modest differences as a country, and yet the extremes on both sides have a disproportionate … voice in Washington, and that undermines the ability for us to move our country forward.”

Griffin is putting his money behind his words by contributing to national campaigns. Large political contributions made in 2014 include $32,000 to the National Republican Senatorial Committee, $100,000 to USA Super PAC, $150,000 to America Rising PAC and $250,000 to American Crossroads, among other political action committee donations, according to filings with the Federal Election Commission.

18 Comments

|

* The NFIB’s Kim Clarke Maisch argued forcefully against a sales tax on services in a 2012 Crain’s op-ed…

Advocates for higher taxes seem not to have learned from experience. Lawmakers and activists in Springfield have been pushing for years to expand the state sales tax to include services. And with another gaping hole in the budget, the temptation is getting stronger. Crain’s columnist Joe Cahill argued, based on various studies, that the state’s fiscal problems are the result of a “narrow” tax base that exempts “half of the state’s economy” from taxation.

There are two problems with this view: First, it fails to consider the relationship between taxes and economic activity. It is basic economics that higher prices result in lower demand. Higher taxes increase prices and therefore consumer behavior. Even President Barack Obama seems to understand. He thinks that higher energy prices will discourage the consumption of fossil fuels, and that subsidies for green energy that reduce its cost artificially will make it more attractive for consumers. It’s the same theory behind higher cigarette taxes, higher alcohol taxes and higher taxes for people who don’t buy insurance.

The point is that even the cheerleaders for higher taxes know that they change consumer behavior. Where conservatives want lower taxes to encourage consumption, liberals want higher taxes to dampen the demand for products and behaviors they don’t like. Whether that’s the proper role for government — to use the tax code to manipulate personal behavior — is a debate for another day. But there’s really no debate that higher taxes on the service economy will weaken the demand for services.

Mr. Cahill seems to dismiss this theory by stating, “Sorry, but I just don’t believe that Illinoisans will start cutting their own hair if they have to pay sales tax at the barbershop.” He may be right about haircuts, but many border communities for years have complained that folks are going across the state line to buy cheaper gas, cheaper alcohol and cheaper cigarettes. Isn’t it likely that if a service tax comes to Illinois, consumers will seek lower prices where they can find them, including across the border? […]

More than half of all of the jobs in Illinois are provided by small businesses. They can’t wave a magic wand and increase their sales by 6.5 percent, and their customers can’t give themselves a raise. Expanding the sales tax would hurt both groups precisely when we need more consumer activity.

* Joe Cahill followed up after Bruce Rauner unveiled his service tax plan…

Mr. Rauner’s proposal to extend the state’s sales tax to services is a common-sense idea that would raise revenue while making the tax base broader and fairer. As I’ve written before, there’s no rational justification for levying sales tax on nail polish but not manicures. […]

A substantial segment of Illinois business, I should add, disagrees with me on this point. They’ll be no more pleased with Mr. Rauner’s stand. Here’s what Kim Maisch, Illinois director of the National Federation of Independent Business, has to say:

“The NFIB and our 11,000 small-business members have long been opposed to a service tax here in Illinois . . . no matter who is pursuing the idea. As we look at Mr. Rauner’s proposal in its entirety, there are certainly items we can also support. However, no matter who the next governor is, NFIB will lead the fight against any legislative effort to bring a service tax to Illinois.”

By opposing a powerful, Republican-leaning interest group on a contentious issue, Mr. Rauner shows a willingness to put the state’s overall welfare ahead of his own short-term political interests. That’s a rare thing in Illinois politics, and he deserves kudos for it.

That NFIB endorsement will be a must watch event. The group has fought tooth and nail against a service tax for decades and now Rauner has opened the door wide.

* By the way, the Illinois Chamber has also fought hard against a service tax over the years. That group is run by Ms. Maisch’s husband Todd Maisch. So far, he’s been very quiet about this Rauner plan, and his group is also in the midst of formulating its endorsements.

16 Comments

|

|

Comments Off

|

A silly Koch poke

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* The DCCC tried to get me to write about this the other day. I passed…

The Koch Brothers have their eyes on Illinois. Republican candidates running in four of the state’s competitive congressional races received campaign contributions last quarter from the political action committee of Koch Industries Inc., a Kansas-based energy and manufacturing conglomerate run by the conservative billionaire brothers Charles and David Koch.

Oh, c’mon. It’s a pittance…

From April 1 through June 30, the Koch Industries Inc. Political Action Committee, or KochPAC, gave a collective $17,500 to the Illinois GOP candidates in 11th, 12th, 13th and 17th congressional districts, according to second-quarter reports filed with the Federal Election Commission

That’s an average of $4,375 per candidate. Not even lunch money for those guys.

Look, I get the Democrats’ obsession with the Koch brothers. But trying to make a big deal out of a few bucks is getting really close to McCarthyism.

67 Comments

|

|

Comments Off

|

* Illinois Review…

Although the term limits state constitutional amendment was rejected by the Illinois Supreme Court last week, GOP gubernatorial candidate Bruce Rauner told reporters Monday his legal team expects to return to the state’s highest court again.

The first step was going back to the state’s First District Appellate Court, which said Monday it would hear the case and expedite its ruling. Either way the appellate court decides, the case will be appealed back the state’s highest court. With ballot printing deadlines less than a month away, timing will be crucial.

“We’re asking this court to make an expedited decision, we think they owe it to you, they owe it to the voters of our state to make a prompt decision on this and then let the voters decide the issue,” Rauner said at a news conference.

Expedited appeal is basically a three-week turnaround. A week each for briefs and motions and then a week to formulate the opinion. That puts them at August 11th or so for the opinion - just ten days before the ballot is scheduled to be certified.

Tick tock.

25 Comments

|

What do they do now?

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* Last week’s most interesting reaction to Bruce Rauner’s service tax proposal…

Senate Republican Leader Christine Radogno (R-Lemont):

“The contrast in this election has never been more clear. Bruce Rauner wants to lower your income taxes while Pat Quinn wants to raise them 67%. Bruce Rauner wants to freeze your property taxes while Pat Quinn lets them rise. There’s only one candidate who has a vision to create jobs and turn Illinois into a growth economy, and that’s Bruce Rauner.”

House Republican Leader Jim Durkin (R-Western Springs):

“Middle-class families across Illinois are struggling under the Quinn-Madigan policies of higher income taxes, higher property taxes, and burdensome regulations. Bruce Rauner’s plan offers the citizens of Illinois a new direction of lower taxes, high-paying jobs and real opportunities for growth.”

That’s the first time those two have supported a tax hike since the little-remembered candy tax, which funded part of the 2009 capital bill.

And they didn’t just support a service tax. As Rauner has said, he wants to step down the 5 percent income tax to 3 percent in four years.

And as we’ve discussed before, the problem is that the tax hike is scheduled to roll back to 3.75 percent on January 1st - before he’s inaugurated (assuming he is, that is). So, to avoid the huge fiscal cliff created by the current state budget, those tax rates are gonna have to go up. Maybe not all the way up to 5 percent, but up, nonetheless.

It’s tough to implement something as big as a new service tax right away. It takes time to ramp up to that sort of thing. Income taxes are a different matter. Businesses already have the software and personnel in place to handle changes to that rate. Service companies have never paid sales tax, though, so that couldn’t be imposed immediately. So, you can’t count on a service tax to replace any income tax revenue during the final six months of the current fiscal year.

* Rauner made it pretty clear yesterday that rates will have to go up after he’s inaugurated. Our commenter 47th Ward showed once again the other day why he won the Golden Horseshoe award last year...

Has he told Durkin and Radogno yet? Because he’s going to need an awful lot of GOP votes to raise the income tax back up to 5%.

* I expect that the Democrats will cooperate with Rauner if he’s elected, but only so far. After years of going it alone, they’re gonna want a substantial number of Republican votes on any tax bill.

And after complaining bitterly about the tax hike for years and basing their members’ campaigns on opposition to the 5 percent rate, and with their caucuses full of people who’ve been able to avoid hard votes on actual governance, the two GOP legislative leaders are now in quite an interesting little box here.

* Meanwhile, Rep. David Harris (R-Arlington Heights) sent out a helpful press release yesterday…

State Representative David Harris (R-Arlington Heights) today introduced House Bill 6289. HB 6289 makes two key changes related to state revenue and fees.

First, the bill includes corporate income generated in the outer continental shelf. This income is currently excluded from corporate income, and this exclusion is often called the “Big Oil Loophole.” Governor Quinn proposed making this change back in the 2013 legislative session, and GOP gubernatorial candidate Bruce Rauner has made it part of his campaign’s “Corporate Welfare Reform” agenda.

The second key change in the bill is to reduce the filing fee for a new Limited Liability Company (LLC) to $75 from the current $500 fee, which is the highest in the nation. HB 6289 also reduces the fee for a series LLC to $125 from the current $750. Governor Quinn made reducing the LLC fee part of his 2014 Budget Message, and Mr. Rauner called for reduction of the LLC fees in his campaign’s “Jobs and Growth” agenda.

“The State of Illinois has serious financial problems facing it, and it needs to encourage job growth within our State,” said Harris. “HB 6289 raises revenue by closing what many perceive to be a tax loophole, and it significantly lessens the financial burden that companies bear in starting a company in our State.

“Even though the legislature is currently out of session, I hope that the two gubernatorial candidates can agree that HB 6289 moves our State’s tax and fee policies in the right direction and that each of them can support HB 6289 or a similar bill in the 2015 session no matter who wins in November.”

Good idea by Harris.

42 Comments

|

Today’s oppo dump

Tuesday, Jul 22, 2014 - Posted by Rich Miller

* You can see all of the digital materials on the governor’s anti-violence initiative which were collected by the Auditor General by clicking here.

Many thanks to Andrew Garrett for the link.

…Adding… We killed the link with too much traffic.

Heh.

Working on a solution.

6 Comments

|

|

Comments Off

|

“Rauner opens door to higher income tax rate”

Monday, Jul 21, 2014 - Posted by Rich Miller

* Way to go, Rick Pearson…

Republican governor candidate Bruce Rauner today opened the door to a potential income-tax hike, saying the 3.75 percent personal rate he would inherit if he wins this fall would be subject to negotiations with a General Assembly that’s expected to remain in Democratic hands.

Rauner, elaborating on the tax plan he unveiled last week, said voters shouldn’t get hung up on short-term budget issues and tax rates. Instead, he said, the overall goal is to make structural changes in state government that would lead to a rollback of the income tax to 3 percent by the end of his first term in office.

In releasing his proposal, Rauner called for a four-year phase out of the 2011 state income tax increase approved by Democrats and signed into law by his general election challenger, Democratic Gov. Pat Quinn. That increase, which bumped the personal rate from 3 percent to 5 percent, is scheduled to roll back to 3.75 percent on Jan. 1, before the next governor is inaugurated.

“Well, I think we’ll work out the specific rate with the General Assembly like we’re going to work out the entire budget with the General Assembly. My personal goal, (the) 3.75 (personal rate) I think is good, but we need to work out the overall plan and how we transition,” Rauner said during a campaign event at a River North restaurant.

“What we need to do is make major structural change over time so we become a growth state again. That’s the critical thing. And here’s what my commitment is. We need to roll the (personal) income tax rate back from 5 percent back to 3 percent where it started within a four-year period and I think 3.75 is a good place to step to next but we’ll work out those details with the General Assembly,” he said. [Emphasis added]

It’s just not possible to immediately get a brand new service tax up and running. No way could businesses comply right away. So you can’t use money from the service tax to plug the second half of this fiscal year’s budget. He’s gotta raise that rate from 3.75 percent. And he all but admitted he’d have to start at five. And that means a post-inaugural vote. And a bipartisan vote at that.

That’ll be fun to watch.

27 Comments

|

* From a Tom Cross press release. Pay special attention to the last two paragraphs…

Over the last five months, State Senator and candidate for Illinois State Treasurer Mike Frerichs has delivered stinging criticism directed at the office of the Treasurer’s investment portfolio, specifically Illinois’ investment in other states and overseas. Frerichs has countered with his own plan of investing exclusively in Illinois investments, although he has not outlined how that plan would work or how it would meet the statutes restricting investments by the office of the Treasurer.

Yesterday on WGN Radio’s “Sunday Spin with Rick Pearson”, Republican candidate for Illinois State Treasurer Tom Cross outlined the perils of Frerichs’ “insiders only” investment strategy, pointing out that it would likely result in lower returns for Illinois taxpayers as there will be limited competition and a closed market for over $13 billion of investment. In addition, Cross added that with Illinois’ past record of corruption and graft, particularly within the role of state investments, limiting Illinois’ $13 billion exclusively to investments within the state greatly increases the potential for fraud and corruption.

“We need to be working for taxpayers to receive the greatest return for their hard-earned tax dollars while minimizing risk,” said Cross. “Like every other person who has a 401k, we are going to look across the US and even globally to secure a good return and a safe return for every tax dollar we invest.”

Frerichs’ criticism of overseas investments also is at odds with his past voting record. As a Senator, Frerichs has supported overseas investments , but now as a candidate for Treasurer, Frerichs is leveling harsh criticism at the Treasurer’s global investment strategy.

One country that would be singled out under Frerichs’ plan is Israel. The office of Treasurer currently has $25 million invested in foreign bonds, all with the country of Israel.

More than 80 states and municipalities in the United States currently invest in Israel bonds. Last month the state of Ohio invested over $47 million in Israel bonds. Today, an Israel Bond with a 10 year maturity pays nearly 1.4% above the U.S. Treasury rate for the same length. Since the introduction of the bonds in 1951, Israel has never missed or defaulted on a payment.

The North Shore is a crucial battleground area. Mark Kirk did well there and won statewide. Bill Brady fared poorly and lost. The area’s 10th Congressional District always features candidates attempting to outdo each other on pro-Israeli policies.

We’ll see how Frerichs reacts to this, but right now I’d say it’s a smart political move by Cross.

However, I personally would rather see more of the state’s money invested right here, even if it brings a slightly lower immediate return.

Discuss.

…Adding… There seems to be some confusion or deliberate spin in comments. Frerichs wants a blanket policy. He didn’t “single out” Israel. That’s just Cross’ rhetoric. It works, though, as comments clearly show.

*** UPDATE *** From the Frerichs campaign…

- Yesterday the Tom Cross campaign launched an untrue and unfounded attack on Sen. Frerichs and his support for continued Illinois investment in Israel Bonds.

See the statement below from state Sens. Daniel Biss and Ira Silverstein and state Reps. Lou Lang and Sara Feigenholz on behalf of Treasurer Candidate Mike Frerichs, in response to a release yesterday from the Cross campaign that erroneously suggested Mike wants to end state investments in Israel. Here is the full audio clip from the radio interview, where it’s clear Mike said nothing like that. The relevant section starts at about 7:30:

In fact, Mike supported I-Bonds as chief co-sponsor of this bill with his Jewish colleagues last year: http://ilga.gov/legislation/billstatus.asp?DocNum=1571&GAID=12&GA=98&DocTypeID=HB&LegID=72631&SessionID=85

“Mike Frerichs is among the most outspoken and vocal advocates for the State of Israel in the Illinois General Assembly. He was a strong supporter of the bill that would allow for significant new investment in Israel Bonds, and supports the policy that keeps Illinois pension funds from investing in businesses that adhere to the economic boycott of Israel. As State Treasurer, he will work to strengthen the economic ties of the State of Illinois to Israel. This policy will create jobs here and advance the interests of our chief ally in the Mideast.

At a time when the State of Israel is in armed conflict, fighting for its survival and its security, it is unfortunate that Tom Cross has decided to use Israel as a political pawn in the race for State Treasurer. Not only is he wrong about Mike Frerichs, but Mr. Cross has degraded the political process by resorting to twisting of facts for his own personal political gain.”

…Adding More… The breakdown of Treasurer Rutherford’s investment portfolio is here.

37 Comments

|

* Stu Rothenberg has moved the 10th CD from Toss-up/Tilt Democrat to Pure Toss-Up…

IL 10 (Schneider, D). Brad Schneider squeaked out a win over Republican incumbent Bob Dold by just over a percentage point (fewer than 3,500 votes) in 2012. Now, Dold has a re-match, figuring that in an off-year, and without President Obama on the ballot, he has a better chance to win. Dold ran a strong race before and he appears to have a small advantage right now. Democrats have reason to worry about that Democratic Governor Pat Quinn will meltdown outside of Chicago and affect the party’s chances in House races. This contest should be very close once again and we’re moving it from Toss-Up/Tilt Democrat to Pure Toss-Up

It’s tough to beat an incumbent, as evidenced by Schneider barely eking out a win against a Republican freshman in a huge Democratic year. This will obviously not be a huge Democratic year. And Quinn is under-performing most of the rest of the ticket pretty much everywhere else. He could turn out to be a significant drag.

Your thoughts on this race?

20 Comments

|

Lisa Madigan’s end game

Monday, Jul 21, 2014 - Posted by Rich Miller

* The attorney general’s office has been spending an enormous amount of time and money defending the state in this deluge of cases. So, the Illinois State Police’s new rules appear to have been essentially designed to get these cases out of the courts and back to the review board…

There are about 200 concealed carry denials before Illinois courts, brought by people who say they shouldn’t have been deemed dangerous or a threat to public safety by Illinois’ Concealed Carry Licensing Review Board.

Until recently, applicants didn’t actually know why they were rejected.

In response to the swarm of lawsuits, the State Police just issued new rules. From here on out, the review board must tell applicants why they were denied; those applicants also have a ten-day window to write a written objection.

Rather than continue fight it out in court, Illinois’ Attorney General is going to ask that all of the ongoing lawsuits be tossed back to the licensing board.

“The reasoning for that is based on the concerns that the applicants have raised, one of those being an opportunity to respond to the board’s reasoning for objecting, or questioning, an applicant for concealed carry license,” says the Attorney General’s spokeswoman, Natalie Bauer.

As I’ve pointed out before, these new rules are hardly adequate. Ten days to respond? Ludicrous.

15 Comments

|

Mo’ money

Monday, Jul 21, 2014 - Posted by Rich Miller

* From the Tribune’s indispensable Twitter app…

Illinois Freedom PAC is backed mainly by the DGA and labor unions.

8 Comments

|

*** UPDATE 1 *** The Rauner folks just found some new audio of Quinn debating Democratic primary opponent Dan Hynes in January of 2010, months after Quinn testified on that Senate bill. Here’s what Quinn said about the Senate’s revenue bill that included the new service tax…

Transcript…

Quinn: “Rev. Sen. Meeks, who’s my friend and who’s supporting me, feels the same way I do and he got a bill passed through the Illinois Senate that I support and I testified for it in the Illinois House… We don’t forget people in need. If they need education, then we invest in it. And I think the only way to do it is to do it the right way, the way Sen. Meeks has proposed… I called up Mike Madigan that night, one minute after Rev. Meeks got that bill passed, and I said ‘Mike, how about tomorrow let’s go vote for that’ and he said ‘No.’ But I went and testified for it for two hours with David Miller.”

I’m tempted to withdraw the question. Your thoughts?

*** UPDATE 2 *** I’ve given it some thought and I’m withdrawing the question. Quinn obviously worked to pass this bill, which included a service tax, then months later touted his support for the bill.

[ *** End Of Updates *** ]

* From the AP…

Republican gubernatorial candidate Bruce Rauner said Thursday he wants to lower Illinois’ income tax rate, freeze property taxes and impose a new sales tax on some services, a plan he said would help improve the economy and grow jobs but that Gov. Pat Quinn dismissed as “a dumb idea.” […]

“This is a dumb idea and I don’t believe people in Illinois are going to buy it whatsoever,” the Chicago Democrat said […]

[Rauner’s] campaign also raised an eyebrow at Quinn’s criticism, saying the governor testified in favor of a 2009 budget proposal that included a tax on services, including dry cleaning. But Quinn spokeswoman Brooke Anderson said that testimony was part of budget negotiations. The governor only favored part of the proposal, and not the tax on services, she said.

The Rauner campaign is doing its level best to connect Quinn to Rauner’s service sales tax proposal. But Quinn’s campaign has pushed back hard against this notion that Quinn testified on behalf of the service tax, and they point to his budget address this year, during which he forcefully opposed a service tax. Quinn likely did so because Rauner long ago signaled that he was open to the tax.

* Gov. Quinn was asked specifically about the service tax during that 2009 testimony. This audio was sent to me on background…

Transcript…

Question: “Governor, there’s…we’ve had conversations talking about Illinois’ competitiveness and I know you’re concerned about that issue. But, raising taxes…income tax, and sales tax the way this bill does, what is that going to do to our competitiveness?

Quinn: “Well, I think our biggest problem when you talk about taxation and business job creation is the property tax system. We have to address that. The Illinois property tax system is antiquated, it was written in the 19th century, it’s hundreds of pages long. This is an opportunity to address property taxes and reforming them, and reducing them. I think that we have to deal with that if we want to have a good job climate and that to me is one of the features of this bill that is a very good one. It is a strong effort to get the state of Illinois pay at least half the cost of education and to reduce the property tax burden on families and businesses.”

* Brooke Anderson’s complete response, slightly edited for style…

The Governor clearly stated his position on service tax this year in his budget address.

Re 2009, the bill HB 174 was based on a long-standing proposal known as SB 750. Among key components, the bill did the following, all of which the Governor has long supported:

-raised the income tax from 3-5%

-provided signficcant new property tax relief

-provided an increase in the personal exemption

-increased the earned income tax credit

At the time, this was the last day of session and it was a comprehensive package designed to address the State’s fiscal challenges, avert the cliff and impending bond downgrades, and to reduce reliance on property taxes for funding eduction, one of the Governor’s top priorities– it was also the vehicle for revenue and a work in progress like so many things in Springfield. This is pretty obvious when you watch the clips.

The sales tax to services piece was a minor component and advocated by Senate Democrats - not the Governor- the above-listed were the key parts and sought by the Governor

When asked if he supports the bill in Q&A, the Governor says it is worthy of debate and stresses the need to reduce property taxes and balance the budget. He urges consideration and further dialogue.

The clip rauner’s camp sent is consistent with all this - the Governor makes no reference to sales taxes on services and clearly speaks to the need to reduce property taxes. Also I can’t even confirm it’s from the same committee hearing where the Governor testified because there are no details available, date, etc. - just sketchy freeze frame & audio.

Here’s more video:

* The Question: Is this a fair hit by Quinn on Rauner’s “dumb” plan, or is it a fair retort by Rauner that Quinn supported a similar “dumb” plan, or is it both or is it neither? Withdrawn.

27 Comments

|

Save the date!

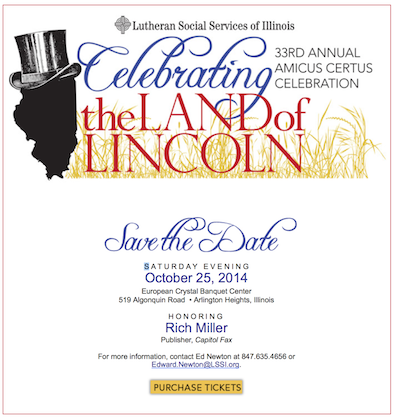

Monday, Jul 21, 2014 - Posted by Rich Miller

* I actually teared up a little when the folks from Lutheran Social Services of Illinois approached me about giving me their “Amicus Certus” award, but I was reluctant to the point of wanting to find a way to say “No.” Sure, we’ve helped raised them a few bucks, but is that really worth an award?

On the other hand, the awards dinner is another way to help raise some more money for one of the best social service organizations in the entire state, if not the nation. If they thought it would work, who am I to turn them down? Plus, Orion Samuelson got the award a while ago and I’ve been a huge fan of his ever since I was a kid riding on a tractor and listening to every word of his farm report. That man has the best voice in all of radio. So, buy your tickets now…

Amicus Certus means “True Friend.” Some award background…

A true friend is one soul in two bodies. That was Aristotle’s idea of amicus certus.

For Lutheran Social Services of Illinois (LSSI), Amicus Certus (“true friend”) is the name of the award given at our annual fall celebration, presented to a person who has made significant contributions to the human community.

Some LSSI background…

Founded in 1867, Lutheran Social Services of Illinois (LSSI) is a statewide, not-for-profit social service agency of the Evangelical Lutheran Church in America. LSSI is committed to caring for people in need, regardless of religion, age or national origin, helping them to make important changes that lead to better lives and stronger communities. Each year, tens of thousands of people receive assistance from LSSI through a broad array of children’s services, older adult care, senior housing, behavioral health and development disabilities services, and services for prisoners and their families.

* As you may recall, we donated all profits from both of my 50th birthday parties (Springfield and Chicago) to LSSI, then donated a large number of toys at my Christmas-time City Club speech last year, plus raised some cash. We’ll be doing the toy collection thing again this year as well.

Like I said, that really isn’t all that much. But I’m still honored that they think this highly of me. So buy some tickets and sponsor some tables.

/fullcourtpress

11 Comments

|

Go, go White Sox!

Monday, Jul 21, 2014 - Posted by Rich Miller

* I think I told you this already, but years ago I turned down one of Pat Quinn’s White Sox tickets. Some of his lieutenant governor staffers were going to a game and they offered one of his tix to me.

Call me a snob, but I hate the upper deck and that’s where Quinn’s season tickets are. Dan Proft and I went to a game years ago and we sat in the upper deck and I vowed I wouldn’t ever do that again.

* Anyway, Steve Bogira at the Reader was surprised that Quinn would sit there…

I leaned down to him. “Governor—what are you doing in the upper deck?”

He turned and said, “I’ve got season tickets here. Had ‘em ten, 11 years.”

“But why in the upper deck?”

He shrugged. “You can see the game.”

Quinn doesn’t ordinarily look down on Chicagoans, but he does at Sox games.

I know what he means: the height offers a nice perspective. But this benefit is mostly canceled out by the yawning span between you and the field. Even Adam Dunn looks small. And the sound delay is disconcerting—the crack of the bat you hear in the second inning was the double in the first.

Bogira writes later in the story that Quinn was going over fundraising schedules. I asked Quinn about that when the story came out and he said he wasn’t doing fundraising stuff. He told me what he was actually doing, but it was a couple of months ago and I’ve since forgotten. I think it was bill lists.

* Anyway, that brings us to this Kurt Erickson column…

Quinn’s campaign manager Lou Bertuca sent out a fundraising appeal in which a lucky donor could win an afternoon at a Chicago White Sox game sitting in the stands with Illinois’ chief executive.

“This isn’t just a handshake and a photo op – this is a real opportunity to hang out with the governor of Illinois,” Bertuca wrote.

The letter noted that anyone who chips in $5 or more is automatically entered in the contest.

Because reporters don’t give money to politicians, I was about to close out the email.

Then I read the small print. It said, “No purchase, payment or contribution necessary to enter or win. Contributing will not improve chances of winning.”

Excellent, right? I clicked the link to enter and got this message: “Page not found.”

Oops.

Then again, I clicked the same link last week and it worked for me.

* And that brings us to the new Quinn campaign video…

Simon’s back on his game.

* And that brings us to this from Rep. Jeanne Ives…

Representative Ives is organizing a Health and Fitness Boot Camp for children in her district, ages 8-12.

Last year, the event was a great success! This year Ives has expanded the program to promote fitness throughout the summer.