Beiser won’t run again

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* This has been expected for months…

State Rep. Dan Beiser of Alton is not running for another term next year so he can enjoy his retirement, he told The Telegraph on Wednesday.

“I notified the Democratic party, both on the local and state levels, in March that I was seriously considering not running again,” said the 61-year-old Democrat. “I was sitting down and contemplating it in June with my wife, and we made the decision. It was a big decision. I want to enjoy my wife’s retirement with her and I want to enjoy my retirement. It is not because of anybody who’s running against me. I made this decision prior to anybody declaring their interest in running against me.” […]

Also Wednesday, a Republican who tried to unseat Beiser in the General Election last Nov. 8, announced he would make another run for representative of the 111th District in the Nov. 6, 2018 election. Mike Babcock, Wood River Township supervisor, drew 22,285 votes —47.4 percent — against Beiser’s 24,708 votes, or 52.6 percent.

“It’s only been nine months since the election, but it doesn’t surprise me,” Beiser said of Babcock’s announcement. “But he is not going to run against me because I’m not going to run again.”

* The tally…

19 Comments

|

Rep. Bourne disputes Gov. Rauner’s account

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* Rep. Avery Bourne (R-Raymond) was at the governor’s Springfield press conference today. Dusty Rhodes had some questions…

So after [Rauner’s] victory speech, I had a question for Bourne — what would she say was the governor’s main contribution to getting this done?

“You know, I want to commend him for saying: Get a deal,” she said. “And I think that was the charge of the governor’s office.”

When reporters asked Rauner about the most controversial item in the compromise — a new tax credit program for private school scholarship donors — he said the idea had come out of his reform commission, where, he said, it had been a big topic of discussion.

Bourne, who served on that commission, disputed that claim. She said what finally got this contentious issue solved was moving Chicago pension costs into the statewide system, and offering some property tax relief for wealthy districts.

“I think those have been the governor’s priorities, but I think that these negotiations really took place in the legislature,” she said, indicating credit should go to the Republican and Democratic leaders of the House and Senate — Republicans Jim Durkin and Bill Brady, and Democrats John Cullerton and Michael Madigan.

Yikes.

33 Comments

|

* Salon’s deputy politics editor who resides in DC likes what she sees in Gov. Rauner…

One of just five blue-state Republican governors, and the first Republican governor of Illinois in more than a decade, Bruce Rauner finds himself in a precarious political situation. A billionaire with no previous political experience, Rauner might sound at first like a tailor-made perfect political ally for President Donald Trump. Instead, Rauner has managed to avoid even uttering Trump’s name for months — finally breaking his silence following the president’s disdainful response to racist violence in Charlottesville. Now Rauner is moving beyond pushing back on Trump’s rhetoric. He has signed several pieces of legislation that stand in direct contradiction to Trump’s agenda. In so doing, at least arguably, he provides a road map for fellow Republicans desperate to ditch a sinking ship.

At Mi Tierra restaurant in Chicago on Monday, Rauner signed into law a controversial bill that bans local law enforcement from stopping, arresting, searching or detaining anyone based solely on immigration status. Hours later, Trump was defending his controversial pre-sentencing pardon of former Arizona sheriff Joe Arpaio, found guilty of contempt of court by a federal judge after he failed to end racial profiling of people suspecting of being undocumented immigrants. […]

Rauner signed another bill on Monday that is fundamentally at odds with the aims of the Trump administration. After recently vetoing a previous version, Rauner signed one of the farthest-reaching voter access laws in the country. […]

Hours before Trump delivered his directives to dismiss all transgender service members from the U.S. military on Friday, Rauner signed a bill that would make it easier for transgender people to change the sex designation on their birth certificates.

Rauner’s approach probably can’t be understood as a rebuke of Trump rooted in moral principle. More likely it reflects his efforts to walk the line between his conservative base in downstate Illinois and the more moderate Chicagoland constituencies he will need in order to win reelection in 2018. But Rauner still offers Republican lawmakers a pathway out of the mess in which Donald Trump has left their party.

Republicans in blue states are, of course, highly vulnerable to Trump backlash. If unenthused Republicans stay home and angry Democrats come out in larger than expected numbers in 2018, it could spell nationwide disaster for the GOP. While Trump continues to play to the hardcore base with his policies and rhetoric, Rauner’s turn toward moderation may provide Republicans with a workable alternative model — at least for now.

Your thoughts?

57 Comments

|

* Mark Brown has an interesting column with some details of the new private (and out of district public) school scholarship income tax credit program…

To qualify for a scholarship, a student’s family income can’t exceed 300 percent of the federal poverty level, which is currently $73,800 for a family of four.

But students from the same size household whose family income is $45,000 or less will get first crack at the scholarship money.

Students in that lowest income category will each be eligible for the maximum scholarship, which will be calculated as the lesser of the statewide average operational expense per public school student — currently about $12,280 — or the actual tuition and fees of the school they choose to attend. […]

The tax credits are to be awarded on a first-come, first-served basis but will be limited by the proportion of private school students in a given geographic area, the details of which remain to be determined.

This provision was intended to prevent the Chicago area from hogging all the tax credits — and consequently all the scholarships.

You really should go read the whole thing.

*** UPDATE *** Greg Hinz…

Pritzker’s campaign confirms to me that, had he been in the General Assembly, he would have voted against [the school funding reform bill] because the measure included a controversial provision providing $75 million a year in tax credits for donors to private and parochial school scholarships. […]

The question: Would the candidate really have risked shutting schools statewide over a $75 million program in a $7 billion bill?

Good question. I’ve asked the campaign.

* Related…

* Zorn: After the rush job to use public money on private schools, now we wait

* Agudath Israel Of Illinois Applauds New School Choice Program

* School funding reform, with private school scholarships, heads to Rauner’s desk

* Illinois will likely become the largest blue state to offer private school choice

* East Moline superintendent “elated” by school funding bill passage

* Editorial: New education funding formula will benefit Illinois’ children

28 Comments

|

* They’re sticking to their guns…

SB 1947 retains elements of SB 1 that, taken together, constitute a Chicago bailout. Largely through eliminating subsidies for economic development zones and property tax caps, the governor’s amendatory veto of SB 1 would have brought additional dollars to 97 percent of Illinois school districts by restoring more fairness to the education funding formula.

The fact that there would be so many winners under the amendatory veto – 831 school districts would receive more state funds – revealed how much districts across the state have been subsidizing Chicago for more than a decade.

32 Comments

|

Question of the day

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* Feder…

Dave McKinney, former Springfield bureau chief and political writer for the Sun-Times, is joining Chicago Public Media WBEZ FM 91.5 to cover state politics. He most recently has been working for the Midwest bureau of Thomson Reuters. “Many news organizations have scaled back their Springfield coverage when more information – not less – is vital,” said McKinney, who starts September 18. “WBEZ’s desire to shine a brighter light on state government shows great commitment to our community, and it’s an endeavor I’m thrilled to join.” In 2014 McKinney quit the Sun-Times after 19 years, citing alleged pressure from management over his coverage of Bruce Rauner, then Republican candidate for governor.

* He’s such a good guy and an old (and I do mean old) buddy of mine and I wish him nothing but the best…

* The Question: Caption?

63 Comments

|

* Daniel Biss’ campaign has been teasing a big announcement…

I’m told by someone close to the campaign that he’s planning to unveil his running mate.

* Our pal Kyle Hillman throws out some names…

I heard it was Carlos Rosa yesterday, but that’s just gossip and I can’t vouch for it.

* Sneed…

Ka-ching! Haul out the abacus: Actor Keegan-Michael Key, who starred in the Comedy Central sketch series “Key & Peele” and co-stars in the USA Network comedy series “Playing House,” is hitting the hustings to help fill the campaign coffers for Dem gubernatorial hopeful Chris Kennedy. A Second City alum and friend of Chris and the Kennedy family — having spent weekends with the family in Hyannis Port and who operated as former President Barack Obama’s hysterical alter-ego at a White House Correspondent’s Dinner — Key will headline the 5:30 to 7 p.m. Kennedy reception Sept. 8 at the Hubbard Inn.

For Kennedy’s sake, I hope he raises some big bucks at that event. In the past two weeks he’s reported just $1,000. And that little contribution was made by the wife of Bill Daley, his campaign finance chairman who was brought in to make some rain.

* JB Pritzker is on a bus tour this week. Here’s the ILGOP’s take…

J.B. Pritzker Kicks Off “Think Big” Bus Tour with Mike Madigan in the Driver’s Seat

Pritzker “thinks big” by supporting Madigan’s big 32% tax hike and other taxes on Illinois families

“If J.B. Pritzker were an honest politician, he would dub his upcoming road trip the ‘Tax Hike’ tour, but he only has snake oil to sell to Illinois families. Even before Pritzker and Madigan got their 32% tax hike enacted into law, Pritzker supported other big tax hikes on Illinois families. With tax hikes like these, it’s clear Madigan is in the driver’s seat on the Pritzker campaign bus.” - Illinois Republican Party Spokesman Aaron DeGroot

Today, Madigan ally and Democrat candidate for governor J.B. Pritzker plans to kick off his “Think Big” bus tour across Illinois. Just how exactly does Pritzker think big? By supporting Mike Madigan’s big 32% tax hike, of course.

When Pritzker isn’t “[throwing] rose petals in Madigan’s path,” he’s pushing Madigan’s tax hikes and his “pro-Chicago,” no reform agenda,

But even before Pritzker got his big, Madigan-backed, 32% tax hike enacted into law, he supported other big tax hikes.

This past April, Pritzker made it clear that he supports a substantial increase in the state income taxes and said the state income tax should be increased to at least 5 percent, perhaps higher.

Later in May, Pritzker’s campaign backed a plan to “tax all federally-taxable retirement income.”

And while J.B. Pritzker has been pushing tax hikes on Illinois families, he’s cutting deals with crooked Cook County insiders to get his own property taxes lowered, even as he opposes a property tax freeze.

With tax hikes like these, it’s clear Madigan is in the driver’s seat on the Pritzker campaign bus.

Here’s a live look at Madigan and Pritzker departing Chicago:

…Adding… Team Pritzker responded…

* Related…

* As Democratic gubernatorial hopefuls campaign in Cairo, Poshard urges them to gain a deeper understanding: Poshard said he has cautioned all of them to be mindful of the city’s complex history, and to sacrifice political expediency in exchange for a willingness to take a detailed and honest look at the specific issues facing Cairo. Poshard said the attention on the small community of less than 2,500 can be a good thing, but only if the spotlight prompts honest conversation.

* Q and A With Gubernatorial Candidate Ameya Pawar’s Running Mate: Tyrone Coleman

41 Comments

|

* WCIA’s Mark Maxwell never did get an answer to the question he posed to Gov. Rauner today. Or did he?…

MAXWELL: Your chief of staff Kristina Rasmussen of the Illinois Policy Institute has long advocated school choice. How much credit does she get for any of this? Was she instrumental in this process down the stretch?

RAUNER: Um, this is, was done by the legislators in, um, the General Assembly, negotiated on a bipartisan basis. And certainly I personally have been very involved in this for, since I became governor I’ve been an advocate for more school choice since I became governor. But what I mostly strongly advocated is for more equitable funding. And more funding overall. I’ve pushed for more state support since I became governor because we inadequately funded our schools for years and that we’ve inequitably funded. Before I became governor, um, the school funding from the state had been cut four times in the prior ten years* before I became governor. I asked it to be increased every year that I’ve been governor. And I formed, the bipartisan commission was formed at my request to take on the challenge of coming up with a new formula. And I want to compliment the legislators who came together to work out this bill. It’s very challenging. Folks in Illinois have tried to change or fix our funding formula for decades. And this has been achieved now and I think it’s a wonderful achievement for the General Assembly and everyone who advocates for high quality education.

*That claim has been rated “Mostly False” by Politifact.

36 Comments

|

* The Better Government Association has really upped its game lately, smashing or at least challenging some commonly held notions rather than reinforcing them with click-bait pieces. Its latest is a must-read…

In one of those perverse twists of politics, Illinois Republicans hoping to whittle away at Democratic control of Springfield are looking for salvation in an upcoming U.S. Supreme Court case that could undermine GOP might in Wisconsin.

At issue is what could shape up to be a landmark decision on political gerrymandering, a widespread practice dating to the early 19th century in which powerbrokers draw the boundaries of election districts to manipulate the outcome of legislative races.

But a BGA analysis of the statistical underpinnings of the Wisconsin case suggests the Republican minority in Illinois may want to hold off on breaking out the champagne, even if the high court rules against their brethren to the north.

In short, the Justices are being asked to sign off on a lower court ruling that the GOP-controlled Republican legislature in Wisconsin diluted Democratic voting power with surgical precision in drawing a map of new legislative districts after the 2010 Census.

The same calculus used to make that argument for Wisconsin suggests gerrymandering in Illinois is tepid by comparison.

That conclusion flies in the face of the deeply held conviction among many Republicans that mapmaking foul play is the prime reason why powerful Illinois House Speaker Michael Madigan and fellow Democrats have for years remained firmly in control of both the Illinois House and Senate.

To be sure, the analysis of Illinois voting data in no way suggests that majority Democrats who drew the latest legislative maps here did so without putting a thumb on the scale. But the data points to the prime motivation being the protection of incumbents, be they Democrats or Republicans, and a variant of manipulation that the Supreme Court is not being asked to weigh in on.

In recent election cycles, more than 90 percent of races for the Illinois House were either uncontested or involved only token challenges to an incumbent. That phenomenon benefits Democrats in the Chicago area, where the bulk of the state’s population resides, and Republicans Downstate.

“Illinois is really screwed up, but it’s not as screwed up as Wisconsin,” said Cynthia Canary, the former executive director of Change Illinois, which pushed to get a redistricting reform proposal on the November 2016 ballot, only to see it blocked by the Illinois Supreme Court. “There’s a multitude of factors that come into play.”

One of those factors also lies at the heart of the Wisconsin case before the Supreme Court. It is a mathematical formula known as the “efficiency gap,” a measurement of vote distribution developed by Nicholas Stephanopoulos, an assistant professor at the University of Chicago Law School, and Eric McGhee, a research fellow at the nonpartisan Public Policy Institute of California.

Designed to determine whether gerrymandering has enabled one political party to unduly extend its power, the formula compares the difference in so-called wasted votes—either those cast for a losing candidate or those cast for the victor in excess of what was needed to win. The election favors the party with fewer wasted votes, Stephanopoulos and McGhee wrote.

Because each legislative district represents roughly the same number of voters, the calculation can be simplified: The efficiency gap is the difference between the share of seats a party actually wins and the share it should be projected to win based on the average district vote in such contests.

Or mathematically expressed: Efficiency Gap = Actual Seat Share - Projected Seat Share, where Projected Seat Share = 0.5 + 2 × (Vote Share - 0.5)

For example, if the vote math projects that Republicans should win 50 seats in a 100 seat chamber and in reality they snag 57, the efficiency gap is then 7 percent.

Simon Jackman, a professor of political science at Stanford University, analyzed the Wisconsin legislative districts. In his 2015 report, a copy of which was submitted into evidence in the court case, Jackman said the state’s plan drawn by majority Republicans “presents overwhelming evidence of being a pro-Republican gerrymander.”

The efficiency gap for the 2012 and 2014 elections in Wisconsin, the first carried out under the new Republican drawn map, was far greater than the efficiency gap measured in Illinois over the same period.

Prior to the remap, the 99-seat Wisconsin Assembly had 52 Republicans and 47 Democrats. After the remap in 2012, the Republican edge grew to 60 to 38, with one independent.

A host of variables can affect the outcome of individual political races—money, media strategy, name recognition, issues and personalities. In virtually every election there will be some divergence between the share of legislative seats a party wins and the share its collective vote totals indicate it should win.

So Stephanopoulous and McGhee propose an efficiency gap threshold of 8 percent for state house plans. Any map beyond that threshold deserves close scrutiny—including the 2012 maps for Wisconsin, Ohio and Indiana, but not Illinois, according to BGA analysis.

While the Supreme Court’s decision to hear the Wisconsin case has raised hopes that it might provide some legal guidance or clarity in legislative map-making, history suggests there are good reasons to keep expectations in check. The court has shown itself to be more comfortable dealing with racial and voting rights challenges to redistricting, but reluctant to venture into the tricky waters of gerrymandering for purely political ends.

However the ruling comes out, it is likely to attract attention far beyond the political map in Wisconsin. A recent analysis by the Associated Press of the effects of redistricting in hundreds of congressional and state legislative races showed Republicans had a clear advantage in traditional battleground states such as Florida, Michigan, North Carolina, Pennsylvania, Virginia and Wisconsin, where political districts were drawn by Republicans after the 2010 census.

If the decision is upheld, that could directly affect the drawing of individual state political boundaries after the 2020 Census is completed—or not. It’s difficult to speculate on the possible impact of the Supreme Court’s decision, Canary said, stressing that it could be crafted to apply broadly or written narrowly to just impact Wisconsin. And there’s always the possibility as well that the court could overturn the lower court ruling, effectively siding with the status quo and giving the green light to politically motivated gerrymanders.

Whatever the court rules will be thrust, for Illinois, into the political reality of Democratic Party dominance, especially in the metropolitan Chicago area. The party’s advantage may have less to do with lines on a map than with voter behavior that increasingly defines the state as a Democratic Party behemoth in the mold of New York and California.

“You’re not going to change the demographic and political culture of Illinois just by changing the lines,” said David Yepsen, the former director of the Paul Simon Public Policy Institute at Southern Illinois University Carbondale.

While all the Midwestern states surrounding Illinois went for Republican Donald Trump in the 2016 presidential election—some by double-digit margins—Hillary Clinton carried the Prairie State by almost 17 percentage points.

Clinton prevailed in all but one of the six counties that make up metro Chicago, grabbing 58 percent of the combined vote. Meanwhile, Democratic U.S. Senate candidate Tammy Duckworth trounced Republican incumbent Mark Kirk by 15 percentage points.

The political might of Chicago and the surrounding counties holds huge sway over the remainder of Illinois. Sixty-three percent of the votes cast in the 2016 election came from metro Chicago. No other Midwestern state in the area has a metropolitan area with comparable political influence, and the Chicago region—not just the city itself—is tacking ever more Democratic.

That reflects a national urban-rural divide, where Democratic candidates draw from major population centers while Republicans like Trump, draw from rural and small town America.

The disadvantage to Illinois Republicans is that the vast majority of Downstate counties are losing population while Chicago and its environs become a “super urban metro area,” said Charles Franklin, a professor of law and public policy at Marquette University Law School in Milwaukee.

“It’s hard to design districts that break into that urban bloc, that shatter that large population,” Franklin said.

The degree of the partisan benefit from district maps is in dispute. Jackman found that President Obama won 53.5 percent of the two-party Wisconsin presidential vote in 2012, yet Democrats won only 39.4 percent of that state’s 99-seat legislature.

By contrast in Illinois, the share of state house seats won by Democrats roughly mirrored the share of the presidential vote that Obama got that year. Obama captured nearly 58 percent of the Illinois vote in 2012 and Democrats won 60 percent of house seats.

By the 2014 elections, according to a study done by Canary and University of Illinois Springfield political scientist Kent Redfield, “partisan bias” in the legislative maps was more clearly benefiting Democrats.

All 118 seats in the house were up for election that year and the combined votes cast in those races was almost evenly split between Republican and Democratic candidates, Redfield and Canary noted in a report released in 2015. Even so, Democrats won 71 house seats to 47 for Republicans.

Political partisans—usually those out of power—have complained about gerrymandering since the early 19th century, after a salamander-shaped district was part of a mapping plan approved by then Massachusetts Governor Elbridge Gerry. Complaints have been remarkably consistent.

“It is an elaborate and rigged system that is failing the people of Illinois. It only works for the political insiders,” complained Republican Gov. Bruce Rauner, whose agenda has run into a brick wall of resistance from legislative Democrats.

What redistricting has clearly done in Illinois is preserve the careers of incumbents of both parties. That report by Canary and Redfield found that from 1992 through 2014 the percentage of uncontested or non-competitive primaries in both parties ranged between 85 percent to 95 percent in state House races.

“The problem is we’re not looking at maps drawn to represent neighborhoods or communities but to protect incumbents and still be in compliance with the Voting Rights Act,” Canary said. “Protecting incumbency has been the dominant imperative.”

For Illinois Republicans, a decision in the Wisconsin case holds the potential of being unsatisfactory, regardless of the outcome.

If the high court affirms the federal panel’s decision, it could have a significant impact on Wisconsin, and perhaps several other states with maps skewed to favor Republicans, while leaving Illinois unaffected. That would be because Illinois maps appear less partisan according to the standard under court review.

And if the court decides to leave the Wisconsin map in place, the status quo would also be preserved in Illinois.

“There are a lot of expectations, but this is not likely to be a solution necessarily writ large across the board,” Canary said. Depending on the outcome of the case, she said, it could encourage lawsuits in other states alleging improper political gerrymandering.

“But it won’t turn Democrats into Republicans and Republicans into Democrats,” Canary said.

36 Comments

|

Frerichs blasts Rauner’s AV

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* Treasurer Frerichs’ office has some big problems with the governor’s amendatory veto of Frerichs’ life insurance bill, HB302…

* When trying to prohibit the use of contingent fee auditors by the Treasurer, the Governor proposes to amend the wrong Act.

* The existing unclaimed property law is scheduled to be repealed and replace by a new law on January 1, 2018. HB 302 would also become effective on January 1, 2018.

* So, the Governor is proposing to amend a law that will no longer exist.

* In support of his amendment to shorten the period that insurers must review to see if they owe benefits because their insured died, the Governor relies on 1) an Illinois insurance regulation; 2) a US Supreme Court case; 3) the unfairness of distinguishing between insurers

* The insurance regulation was put in place in 2016 by the Rauner administration in order to help insurers destroy records; but, the underlying portion of the Insurance Code still provides for criminal penalties for insurers that destroy records. Further, the regulation still requires maintaining records with “legal or fiscal” value.

* The US Supreme Court case cited does not say that you cannot distinguish between companies based on the condition of their records. The case is about artists who unsuccessfully challenged the NEA’s community standards for grants. It is about First Amendment rights – not due process rights. And, the government actually won the case by an 8 to 1 margin.

* Further, the bill the Governor signed last year actually allows his Department of Insurance to differentiate between insurers based on their electronically searchable records. So, this wasn’t an issue for him last year.

Oops. BTIA™.

If you click here you’ll see the governor’s full AV language with commentary by the treasurer’s office. Click here for raw audio of Frerichs’ press conference.

* From Treasurer Frerichs’ press release…

Currently, some life insurance companies do not pay death benefits when they know, or should have known, a customer died. Between 2011 and 2015, treasurer office audits found more than $550 million in death benefits that were not paid to grieving families in Illinois. Nationally, the figure is more than $7.4 billion, according to the Wall Street Journal.

Rauner’s veto outlaws the audits. Without this enforcement tool, life insurers can act with impunity. “This is clear evidence that Gov. Rauner is lining corporate pockets with this veto,” Frerichs said.

There are three commonsense reasons why Rauner’s veto is wrong and his focus on contingency-fee auditors is misplaced.

1) Rauner’s amendatory veto makes Illinois the only state in the country to prohibit contingency-fee auditors and eliminates any hope that an unscrupulous company will pay 100 percent of what they owe to Illinois residents.

2) Audits would not be necessary if life insurance companies made it a priority to pay death benefits when they know or should have known that a customer has died.

3) Signing the legislation and requiring life insurance companies to review their records would move compliance away from the treasurer and into the Governor’s Department of Insurance, which has stronger enforcement tools, including the ability to suspend a company’s license to do business in Illinois. […]

Using contingency-fee auditors is a best-practice approach because it leverages expertise to maximize efficiency. Families receive every cent they are owed. Without the audits, insurance companies keep 100 percent of the death benefits.

“Rauner vetoed this bill because he wants to stop auditors who have successfully found hundreds of millions of dollars in unpaid life insurance benefits. However, auditors never get a penny of your loved one’s life insurance policy,” Frerichs said. “All Rauner did was take away the tool that allowed us to return $550 million to grieving families.”

More is at stake than just unpaid life insurance policies.

For example, without a veto override, the treasurer’s office would lose its ability to effectively look at the books of large banks, such as Wells Fargo, to confirm it did not inappropriately keep funds from bank customers. Or the ability to look at Sprint and Radio Shack to confirm each has paid out all rebate checks issued as an incentive to make a purchase.

15 Comments

|

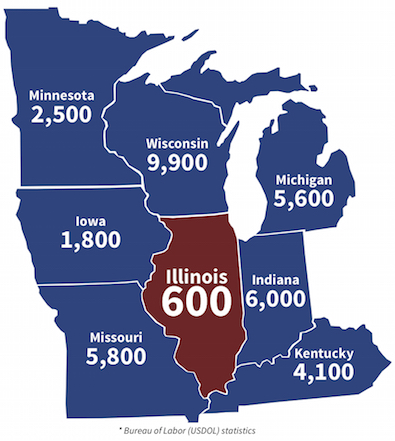

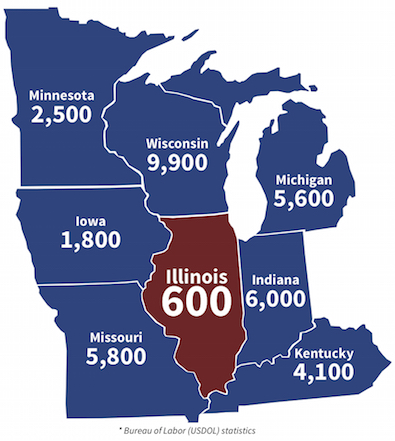

* This IMA graphic shows manufacturing job growth from August, 2016-July, 2017…

Oof.

* Press release…

– Illinois has passed a budget which includes tax hikes on job creators and yet, it is not balanced. Illinois has passed so-called education reforms that do not include property tax reform, comprehensive mandate relief or any effort to address the ever-increasing pension debt our state faces. But, when it comes to pro-growth plans to secure the economic future of our state’s middle class, Springfield has failed. Today, August 30, 2017, marks exactly one year since Greg Baise, president and CEO of the Illinois Manufacturers’ Association addressed the City Club of Chicago and made a passionate call to Illinois lawmakers. In that address, he warned that Illinois government is closing business one day at a time. Baise spoke to the hemorrhaging of manufacturing jobs in Illinois – more than 300,000 jobs lost since 2000.

Baise’s message one year ago was clear: the revitalization of our middle class and manufacturing job economy directly correlates to public policy that encourages pro-growth policies, a stable economy and creating a more friendly business climate. Yet, lawmakers failed to heed this warning or enact reforms. Despite repeated calls for compromise, Illinois lawmakers passed a massive $5 billion tax hike that failed to include any meaningful reforms that could revitalize the economy and send a strong signal that Illinois is a good place to do business. Every major business group labeled the 2017 legislative session as one of the worst for employers.

It comes as no surprise that the failure of the legislature to act has resulted in Illinois continuing to lag behind neighboring states. From August 2016 to July 2017, Illinois has only added 600 manufacturing jobs while neighboring states have added: 9,900 in Wisconsin, 5,600 in Michigan, 6,000 in Indiana, 5,800 in Missouri and 1,800 in Iowa.

“Illinois lawmakers failed job creators again while continuing to protect wealthy trial lawyers and labor union bosses. Since last year, the General Assembly imposed a massive $5 billion tax hike while threatening a whopping 82 percent spike in the minimum wage and a new paid leave mandate on every Illinois business. We trail nearly every state in key indicators such as unemployment rate, GDP growth, and manufacturing job loss not to mention leading the country in the outmigration of residents who are fleeing our state,” said Baise. “At what point will legislators wake up to the reality that is looking them in the mirror? Lawmakers need to stop passing job crushing taxes and regulations to stop the bleeding and start restoring stability and predictability. Economic reforms must be a number one priority during veto session or we will continue to see manufacturing job numbers that pale in comparison to our neighbors and a middle class population that continues to struggle without well-paying manufacturing jobs.”

The IMA will continue to champion the immediate and long-term solutions put forward in the Middle Class Manufacturing Agenda which includes meaningful and permanent workers compensation reform, tax code reform, fiscal reform, property tax reform, and a strengthened education and workforce development system.

The IMA urges lawmakers to prioritize a manufacturing rebirth in Illinois in order to revitalize the middle-class and help jumpstart the state’s economy.

Not one mention of the governor.

*** UPDATE *** Wordslinger ran the numbers for this year and found a far different result…

I understand IMAs cherry picking short-term stats for propaganda, but you can take the very same BLS stats and write a press release and design a graphic with this headline:

“Manufacturing Giant Illinois Leads Midwest in New Jobs in 2017″

Total new manufacturing jobs since Jan. 2017 and overall totals, according to BLS.

IL — 6,600/ 574,400

MO — 5,900 / 269,300

WI — 4,400 / 473,500

IA — 4,000 / 215,200

MN — 3,400 / 320,400

IN — 900 / 528,000

KY — 300 / 253,000

MI — 200 / 604,400

You’re kidding yourself if you think long-term manufacturing trends are being decided in state capitals — or with corporate welfare handouts.

85 Comments

|

McCann explains his vote

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* From Sen. Sam McCann…

“There have been many pieces of legislation that have advanced over the last several years in the Illinois General Assembly that sought to bring equity and balance to the way in which we fund our schools and I have voted for most of them. I didn’t vote for them because I thought they were perfect bills, but because I knew how important the subject matter was. And because I knew it would take years for it all to come together, I wanted to be a part of advancing the conversation and the cause,” said State Senator Sam McCann (R-Plainview).

Senate Bill 1947 not only includes what many refer to as a “Chicago Bailout,” it also now introduces a brand new tax credit for the wealthy who donate to scholarship funds for private schools. It is not a voucher system, but it is rather more of a pay-to-play opportunity for the state’s most well-connected. Sen. McCann is concerned that this compromise was crafted over a matter of a few days with only four members of the General Assembly in the room, and not all 177 members of the House and Senate at the table voicing the concerns of their constituents.

“I voted for a measure a couple of weeks ago that would have accomplished more at less cost to the taxpayer. When I took that vote, I admitted that the bill wasn’t perfect, but it was a bridge to get us where we need to go. But this new bill is simply a bridge too far,” Sen. McCann stated.

The amendment to Senate Bill 1947 (Amendment 5) that passed the House of Representatives yesterday and the Senate today had no public hearings and legislators were given little time to digest the contents of the bill. Worse yet, there was no legitimate amount of time or opportunity for the public to learn about the bill and weigh in with their elected representatives.

“This bill represents one of the worst aspects of the Illinois lawmaking process. Something this important deserved sunlight, instead, it was cobbled together in the back room by a handful of people and pushed down the throats of the rank-and-file legislators,” said Sen. McCann.

“The people didn’t send me here to be a part of the status quo. They have entrusted me to use wisdom and discernment when voting on their behalf, and voting yes on a bill that spends money that we don’t have, institutes a tax credit that could very easily become abused and doing that all without any public hearings is continuing the failures of the past. We have to stop repeating these same failures over and over. I felt I had to vote No,” said Sen. McCann.

Senate Bill 1947 passed the Senate and House and now awaits the Governor’s signature. The Governor is expected to sign the bill into law in Chicago on Wednesday.

Um, he calls it a “Chicago Bailout” even though he voted to override the governor’s veto of SB1, which provided almost the same amount of state cash for CPS.

25 Comments

|

Sun-Times has a tax hike freak-out

Wednesday, Aug 30, 2017 - Posted by Rich Miller

* The adults need to intervene at the Sun-Times. Check out this lede…

Tapped-out Chicago property owners would face yet another tax hit for teacher pensions — but their aldermen would escape another difficult vote — under a historic new statewide school funding deal now headed to Gov. Bruce Rauner’s desk.

Tapped-out? Right. Chicagoans should ask their suburban and Downstate friends about their property tax bills.

* The screaming front page…

* Thankfully, the editorial board put things into perspective…

But it is not unexpected news. Mayor Rahm Emanuel had hinted all along that another tax hike for the city’s public schools was likely, once he finished squeezing Springfield for more school money. And, regrettably, the hike is largely necessary. It is the price Chicago must pay for decades of past financial mismanagement. It is the price the city must pay for its future.

As unwelcome as higher taxes are, worse yet for Chicago and its public schools has been the damage done by constant borrowing and allowing unpaid pension obligations to pile up. A city that borrows to pay basic bills — spending money on interest payments instead of hiring cops or teachers — is a city living on borrowed time.

Mayor Daley and, for his first term Rahm Emanuel, allowed Chicagoans to live in a fantasy world where they didn’t have to pay for the services they received. And they were enabled by the city’s media and, particularly, its editorial boards which endorsed those guys at every turn.

55 Comments

|

|

Comments Off

|

* Usually, when daily public schedules are silent about media availability it means the governor will be taking questions…

Daily Public Schedule: Wednesday, August 30, 2017

What: Gov. Rauner speaks with students at Springfield Ball Charter School

Where: 2530 E. Ash St., Springfield

Date: Wednesday, August 30, 2017

Time: 8:40 a.m.

What: Gov. Rauner speaks with students at Ida J. Russell Elementary School

Where: 705 N. Jefferson St., Litchfield

Date: Wednesday, August 30, 2017

Time: 11:00 a.m.

What: Gov. Rauner speaks with students at Mater Dei Catholic High School

Where: 900 Mater Dei Dr., Breese

Date: Wednesday, August 30, 2017

Time: 1:30 p.m.

79 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|