* Jake Griffin…

More than 71,000 people collecting public pensions from six statewide retirement plans have moved out of Illinois, taking more than $2.4 billion annually with them.

That’s roughly 18% of all the pensioners in those systems, according to a Daily Herald analysis of financial data obtained through public records requests with the six pension programs.

Florida leads all migration destinations with 14,030 Illinois pensioners, followed by Arizona and Wisconsin with more than 5,600 Illinois public pension recipients now living in each of those states. […]

All states experience some migration of pensioners to other areas. Although there are no national comparisons, a check of several other states shows Illinois’ departure rate among pension recipients is higher. About 16% of Iowa’s pension recipients have migrated to other states, according to officials at the Iowa Public Employees’ Retirement System. In 2015, California pension officials reported roughly 15% of their public pension recipients relocated to another state. […]

Illinois public pension recipients who leave the state average pensions of $34,053 a year, compared to an average pension of $35,573 for those who stay put.

There’s more, so go check it out.

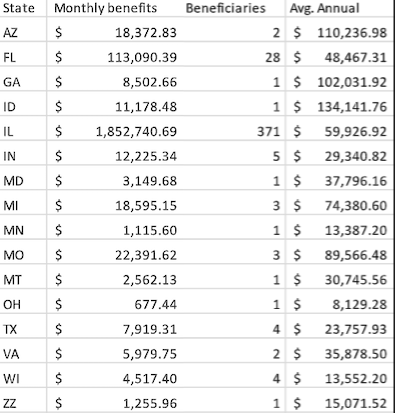

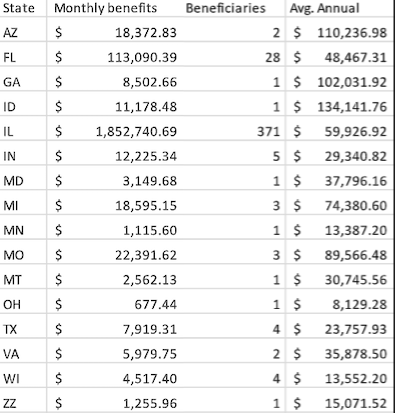

* Cal Skinner used the same data to see where General Assembly Retirement System beneficiaries are currently living. Here’s some of what he found…

So, about 88 percent remain in Illinois. I thought the Arizona and Florida numbers would be higher, by the way.

- d. p. gumby - Monday, Jun 24, 19 @ 11:13 am:

So how does that compare w/ the general population. I agree w/ Rich that the numbers are not as high as expected, but this seems to be a random statistic w/o context.

- Grandson of Man - Monday, Jun 24, 19 @ 11:18 am:

Workers from higher-income states like Illinois are better-positioned to retire in warm Florida than those from the many lower-wage RTWFL red states. Where are they going when they retire and what options do they have, the lower-wage workers with less retirement income?

- Anonymous - Monday, Jun 24, 19 @ 11:18 am:

Should I assume that ZZ means international?

- Ron Burgundy - Monday, Jun 24, 19 @ 11:19 am:

Yeah I would want to know the context as well. For the ex legislators, maybe they stay close to home because their clout means squat out of state?

- Annonin' - Monday, Jun 24, 19 @ 11:20 am:

Nearly gagged when we saw Jake’s work linked to Sweaty Palms

BTW wonder how many pensioners from border states came to IL?

And how about checking to see if the pensioners actually moved?

Then we can all go back to sleep.

- Groucho - Monday, Jun 24, 19 @ 11:21 am:

ZZ may mean federal prison.

- Langhorne - Monday, Jun 24, 19 @ 11:22 am:

Interesting, but, um, so what? Part of the enjoyment of retirement is exploring. A friend told me to retire, “ while you can still get off the porch.”

Re GA numbers, 5 states had averages below the avg $33k pension, and 4 states are over $100k.

- Bourbon Street - Monday, Jun 24, 19 @ 11:24 am:

Apparently, retirees are moving due to factors other than Illinois taxes, since (I believe) Wisconsin taxes retirement income. Florida and Arizona’s warm winter weather makes them obvious destinations for those looking to avoid snow and cold.

- A Jack - Monday, Jun 24, 19 @ 11:24 am:

My cousin who is a retired police officer from Aurora spends his winters in Arizona, but summers in Illinois. So there may be many more like that who claim Illinois as a primary residence since it doesn’t tax retirement.

- PublicServant - Monday, Jun 24, 19 @ 11:25 am:

I think the slightly higher number in Illinois might have something to do with the demonization of state employees that has been, and is still taking place in this state today. Couple that with SB1 pension theft passage, and Rauner’s attempt to gut their healthcare, I can see those things having an impact on their staying put. Just sayin.

- City Zen - Monday, Jun 24, 19 @ 11:27 am:

Roam, if you want to.

==Where are they going when they retire and what options do they have, the lower-wage workers with less retirement income?==

Not Illinois.

- Grand Avenue - Monday, Jun 24, 19 @ 11:29 am:

The guy in Idaho getting $134K a year is former Lt Gov Bob Kustra, who was the President of Boise State University until last year

- Pick a Name - Monday, Jun 24, 19 @ 11:29 am:

PS, you will likely be wrong. With the ever increasing overall tax burden, those that can leave for another state, will do just that.

- PublicServant - Monday, Jun 24, 19 @ 11:36 am:

Can I have your crystal ball after you’re done making unsubstantiated predictions, Pick a Name?

- Takeaway - Monday, Jun 24, 19 @ 11:37 am:

The takeaway here is that 82 out of 100 retirees stay right here, spending their hard-earned pensions in the state where they worked. Spin that any way you want, but the data is pretty clear.

- Demoralized - Monday, Jun 24, 19 @ 11:38 am:

Retirement income isn’t taxed in Illinois. Regardless of where someone goes income earned in Illinois is taxed (or in this case not taxed) by Illinois. So I would say their tax burden isn’t all that bad.

- Demoralized - Monday, Jun 24, 19 @ 11:40 am:

==those that can leave for another state, will do just that==

This notion that people who pick up and leave are doing it solely because of taxes is ridiculous. That’s a nice way to try and spin it but it simply is not true. While there may be some who do so, when people decide to go somewhere else they are doing it for a variety of reasons.

- Lucky Pierre - Monday, Jun 24, 19 @ 11:41 am:

Hello Democrats, maybe the interests of all powerful public employee retirees (18% of whom don’t even live here anymore) aren’t paramount over all other issues related to the budget deficit.

- Froganon - Monday, Jun 24, 19 @ 11:46 am:

Can’t figure out why anyone cares about this. More statistical noise. Jake G. can’t find any outrageous abuses by public employees so this?!?!?

- Give Me A Break - Monday, Jun 24, 19 @ 11:49 am:

We are getting close to looking at where will spend our retirement years. I can tell you taxes are about Number Four on our list in terms of what we are looking at. I think I’m like others that rank the following in terms of where will land.

Weather, weather and weather. I’m not joking this last winter and this “summer” have ended any talk of staying in Illinois.

- RNUG - Monday, Jun 24, 19 @ 11:50 am:

States like Florida, Texas and Arizona are great in the winter but the heat is a killer in the summer.

Ancedotal but probably spot on.

One couple I know lived in Texas for 20 years, now have all their kids and grandkids in the Austin area, but stay in Illinois because the Texas summers are killers.

Two other couples I know are currently looking at Georgia or the Carolinas for retirement because of the weather; trying to strike a balance between hot and cold, and reasonable cost of living.

I will note a lot of Illinois people have become snowbirds, south in the winter, north in the summer.

Illinois still has the retirement tax exemption going for it. And housing outside the Cook County area is cheap. Yes, property taxes are high. But the other taxes don’t hit retirees that bad, their purchases are more voluntary than most people.

The people moving out of California are, I suspect, looking for lower cost houses, etc. California real estate is ridiculous; I have both relatives and friends there. You can sell a California home, get a better one out of state, and have money left over to fund your retirement.

- a drop in - Monday, Jun 24, 19 @ 11:52 am:

Illinois GDP was $791,608,000,000 in 2016 according to BEA data.

So we are talking about 3% of the state’s GDP?

- Demoralized - Monday, Jun 24, 19 @ 11:54 am:

I would note the average pension numbers quoted in this story. To all of those arguing that state employees receive “overly generous” pensions, $34,000 and $35,000 don’t see overly generous to me.

- Why - Monday, Jun 24, 19 @ 12:00 pm:

Why am I still living in Illinois? Family…Job…that’s it.

- Just Saying - Monday, Jun 24, 19 @ 12:04 pm:

- a drop in-

Illinois GDP was $791,608,000,000 in 2016 according to BEA data.

So we are talking about 3% of the state’s GDP?

You need to re-look at your math. It is actually 1/10th of 3% or 1/3 of 1% or .003%

- Grandson of Man - Monday, Jun 24, 19 @ 12:04 pm:

We know the former governor can retire anywhere he wants, with all the money he makes from public employee pensions.

- Just Saying - Monday, Jun 24, 19 @ 12:06 pm:

- a drop in-

Actually the number is less than 1%, not 3%. It is really 1/3 of 1% or .003%; slight error on decimal points.

- JS Mill - Monday, Jun 24, 19 @ 12:10 pm:

=PS, you will likely be wrong. With the ever increasing overall tax burden, those that can leave for another state, will do just that.=

Yep, I hear California, Minnesota, and New York will be empty by the year 4000. /s

- Illinois Refugee - Monday, Jun 24, 19 @ 12:11 pm:

ZZ - Which prison is that?

- Name Withheld - Monday, Jun 24, 19 @ 12:11 pm:

Hey Lucky Pierre - according to the article…

“Meanwhile, former state government employees are most likely to stay put. Only 13% of state employee retirees with pensions have left Illinois, accounting for a little more than $300 million in pension money, according to the analysis”

So those public employee retirees you just criticized are mostly sticking around and supporting their respective local economies. Perhaps a “thank” would be in order.

- Name Withheld - Monday, Jun 24, 19 @ 12:12 pm:

[EDIT]

Perhaps a “thanks” would be in order.

- Da Big Bad Wolf - Monday, Jun 24, 19 @ 12:13 pm:

ZZ means whereabouts unknown. https://fcds.med.miami.edu/downloads/DataAcquisitionManual/dam2016/19%20Appendix%20B%20US_Canada_State_Province%20Codes%202015.pdf

- Anyone Remember - Monday, Jun 24, 19 @ 12:20 pm:

File page 77 of the link (SERS 2018 Annual Financial Report) has a map showing which states the retirees are in. 3 hardy souls moved to ND for the “brisk” winters, and 1 soul is in Rhode Island looking for Stewie Griffin. /s

https://www.srs.illinois.gov/PDFILES/oldAnnuals/SERS18.pdf

- City Zen - Monday, Jun 24, 19 @ 12:21 pm:

==To all of those arguing that state employees receive “overly generous” pensions, $34,000 and $35,000 don’t see overly generous to me.==

What’s the number of service years?

- K D - Monday, Jun 24, 19 @ 12:34 pm:

You can count people who left. But what happens to the statistics when that same person comes back? I work with seniors and a lot of retirees that moved to sunbelt states when they were younger move back when they get older and need more care from their adult children.

- Name Withheld - Monday, Jun 24, 19 @ 12:34 pm:

===What’s the number of service years?===

Which system are you talking about? The GA Retirement System, TRS, State Employees Retirement? I’m pretty sure SERS requires 20 years. GA requires 8 years for those under 55.

It might be nice to be specific when we talk about these things as the typically state employee does not receive the same benefits as a member of the General Assembly.

Obviously, ‘fun’ things happen when a member of the GA enters state employment (like when a representative becomes an agency director), but that is not the progression for a typical member of the state workforce.

- Huh? - Monday, Jun 24, 19 @ 12:40 pm:

“What’s the number of service years?”

Probably in to 33+ year range.

The tier 1 SERS pension calculation is 1.67% x years of service x monthly salary. The monthly salary is final average of the 48 highest consecutive months of service within the last 120 months of service.

A tier 1 employee would have to work around 45 years to get 75% of their salary.

- Grandson of Man - Monday, Jun 24, 19 @ 12:41 pm:

It’s brutally cold here. We had some days this past winter that were dangerously cold. Of course many retirees head to Florida after slogging our a career here. Florida is definitely not without its problems (hurricanes).

- City Zen - Monday, Jun 24, 19 @ 12:42 pm:

==Which system are you talking about?==

The comment was an average $35,000 doesn’t seem overly generous. Without knowing the average number of service years equates to that $35,000 average pension, it’s hard to gauge its generosity.

- frustrated GOP - Monday, Jun 24, 19 @ 12:45 pm:

18% compared to Iowa and Calf numbers doesn’t seem to much higher. I’d be curious to see how many people from Iowa moved to Illinois to save on their pension payment by reducing tax burden. Wonder if they would even print that. How many people from the neighbors retire and move to Illinois. and staring 1/1/20 I can see that improving.

- Candy Dogood - Monday, Jun 24, 19 @ 12:49 pm:

===Apparently, retirees are moving due to factors other than Illinois taxes===

There’s solid research that demonstrates pretty clearly generally folks choose where to live in retirement for factors besides taxes.

However, some folks will cite taxes regardless of why they moved, other folks will pretend like taxes are what causes out migration when it’s not which makes it awfully hard to have a discussion about taxing retirement income instead of letting our state’s seniors — who were paying lower tax rates than they should have been — run out on the public debt they created.

- PublicServant - Monday, Jun 24, 19 @ 12:58 pm:

===run out on the public debt they created.===

No one is running anywhere. And your elected representatives created that debt, not Public Employees who never missed a payment.

- Diogenes in DuPage - Monday, Jun 24, 19 @ 1:02 pm:

Jake and the DH crew are making a mountain out of an insignificant statistical molehill here. And $35,000 average pension for 33 years of contributing their own 10%/year — and the state can’t match that? Would rather be forced to contribute to social security & medicare employer rates? Who’s the real problem here?

- Wallinger Dickus - Monday, Jun 24, 19 @ 1:04 pm:

What constitutes “move out?” Does it mean the pensioner sells the house and breaks clean completely with the old homestead? Or does that statistic reflect the percentage of people who have changed residency? Big difference.

Many Illinoisans declare a Florida residence their home and spend six months and a day there. In doing so they save a considerable chunk in real estate tax. Many retain their Illinois homes and forgo the Illinois homestead exemption but still live here up to six months each year.

They’ll tell you Florida weather is terrific in less than full doses but the Midwest helps them cleanse their souls.

- Candy Dogood - Monday, Jun 24, 19 @ 1:08 pm:

===PublicServant - Monday, Jun 24, 19 @ 12:58 pm:===

I’ll clarify my point. I don’t just mean public employee pensions, I mean taxing federally taxed retirement. At this time, all federally taxed retirement from all income sources is 100% excluded from the Illinois Base Income.

This means there are literally millionaires paying zero taxes on their retiree income. More than half of the cost of this tax expenditure is directed to incomes over $75,000.

===And your elected representatives created that debt===

Pray tell, who was voting for these elected representatives in the 1970s, 1980s, and 1990s?

Our unfunded pension liabilities didn’t magically come into existence in the last decade, it’s the result of decades of intentional policy choices and pretending like the folks that voted for those law makers should not only avoid paying high enough taxes in the 1970s, 1980s, and 1990s, 2000s but should now be able to completely exclude their income from taxation is some kind of equitable policy is just as ridiculous as pretending like only elected representatives are responsible for the Illinois’ finances.

- Demoralized - Monday, Jun 24, 19 @ 1:14 pm:

==Without knowing the average number of service years equates to that $35,000 average pension, it’s hard to gauge its generosity.==

Oh please. Based on the average state salary that average pension would be for quite a few years. It’s not overly generous. Period.

- JIbba - Monday, Jun 24, 19 @ 1:38 pm:

===Pray tell, who was voting for these elected representatives in the 1970s, 1980s, and 1990s?===

Both parties, Candy. But Rs deserve a special shout out for their logical inconsistency of voting for services but opposing sufficient taxes to pay for them.

And you may not like it, but our elected officials are literally the only ones responsible for our pension debt mess (other than market performance issues).

- RNUG - Monday, Jun 24, 19 @ 1:51 pm:

Service years can be tricky. For example, under the SERS Tier 1 coordinated formula, you can retire with as little as 8 years if you are age 60. But you won’t get much of a pension, only 13.36% of your final average compensation. Work 35 years, which is more typical, and you get 58.45%.

If you want to dig deeper into service year distribution of retirees, that is detailed derp in the statistics section of each fund’s annual report.

- City Zen - Monday, Jun 24, 19 @ 2:01 pm:

==Work 35 years, which is more typical, and you get 58.45%.==

But that person using the 1.6 service year multiplier would also be eligible for social security.

- VerySmallRocks - Monday, Jun 24, 19 @ 2:02 pm:

Enjoy Florida while it’s still above a rising sea level. Enjoy Arizona before it heats up and burns up for good. The boring, snowy Midwest won’t look so bad in comparison.

- Demoralized - Monday, Jun 24, 19 @ 2:02 pm:

==would also be eligible for social security.==

What difference does that make?

- Andy S. - Monday, Jun 24, 19 @ 2:14 pm:

Just want to point out that although Illinois pension income is not taxed in Illinois, it is taxed in other states that have income taxes. I am a SURS pensioner and I pay 5.75% on every dollar of pension income I receive here in Virginia. I moved here for the career opportunities, not for lower taxes. The under-funding of higher education In Illinois over the past 18 years has not exactly encouraged pension-eligible faculty participating in SURS to stick around.

- Chichi55 - Monday, Jun 24, 19 @ 2:20 pm:

I would like to see a Teachers Retirement Systems list, of where retired Illinois Teacher Pension recipients are now living. If the state ever starts taxing retirement income, you can count on a whole lot more of out of Illinois pension recipients living out of state.

- Candy Dogood - Monday, Jun 24, 19 @ 2:23 pm:

===And you may not like it, but our elected officials are literally the only ones responsible for our pension debt mess===

JIbba, I think you and I have a different understanding of how elections work and the underlying political thought behind utilizing them as a mechanism for self governance.

Lets not ignore the incumbency rates and unless you care to illuminate me further, I am unaware of any popular movement in the 1980s or 1990s demanding that income taxes be increased so that Illinois could be more like Iowa that our legislators defied.

===Andy S. - Monday, Jun 24, 19 @ 2:14 pm:===

Andy provides a great explanation as to how little taxation plays in out migration.

- City Zen - Monday, Jun 24, 19 @ 2:37 pm:

==What difference does that make?==

Over $20,000 a year, depending on how many years worked. You know, like a pension.

What we have here is an “average” $35,000 pension with no context as to how long that retiree worked, if it’s a survivor benefit, or if that retiree also gets social security. Seems kinda important to the conversation, no?

==I am a SURS pensioner and I pay 5.75% on every dollar of pension income I receive here in Virginia.==

You mean Virginia doesn’t exempt the first $100,000 of your retirement income? How do they get by?

- RNUG - Monday, Jun 24, 19 @ 2:42 pm:

== I would like to see a Teachers Retirement Systems list … ==

Download the annual report and fig into the statistics section

- Stones - Monday, Jun 24, 19 @ 2:46 pm:

Mrs. Stones and I retired from Illinois and moved to Florida after 33 years of service. Everyone has their own reasons but in our case we had very little family remaining in the area and we were definitely tired of the cold weather. For all those complaining about the Florida heat I would say that it can / does definitely get hotter in Illinois from time to time. Coastal breezes max out our temperatures at about 93 degrees. The difference is that it hits that temperature just about every day in the summer.

One think that I found as a pleasant surprise is the lower property taxes in Florida. For comparably valued properties - our property tax was roughly 1/3 of our property tax in the collar county. The roads are always smooth (no freeze / thaw cycles) and the weather means large construction projects seem to move quicker.

- RNUG - Monday, Jun 24, 19 @ 2:46 pm:

== What we have here is an “average” $35,000 pension with no context … ==

Teachers (TRS) in Illinois don’t participate in or collect Social Security. So you can figure about half of all participants in the 5 State funds don’t get SS.

- Demoralized - Monday, Jun 24, 19 @ 3:01 pm:

==Seems kinda important to the conversation, no?==

No, Social Security isn’t important to the conversation. How is it relevant to the conversation of whether or not the state pension is “generous?” This is just more trolling from you.

- Jibba - Monday, Jun 24, 19 @ 3:04 pm:

==I think you and I have a different understanding of how elections work and the underlying political thought behind utilizing them as a mechanism for self governance===

Candy, I’d sure like to hear your theory that absolves our representatives from direct responsibility for their votes, and ourselves from the burden that they assumed on our behalf (whether we agreed with their actions or not). But if you have to go back to 18th century French philosophers, you are missing the more immediate point that Illinoisans of both parties voted again and again for people who told us we can have our cake and eat it too. And I recall several elections where the “responsible” person was advocating a tax increase, only to be beaten by someone peddling cake. And unions suing to have the pensions funded decades ago. Do those make a movement?

- City Zen - Monday, Jun 24, 19 @ 3:11 pm:

Actually, we don’t need to debate this as the most recent SERS report (link posted in the comments above) actually lists the average pension on page 76:

Period 7/1/17 to 6/30/18

Average monthly benefit = $3,006 ($36,000/yr)

Years Credited Service = 20-25

So for SERS retirees, at least, that “average” pension equates to maybe 22 years of service.

- Jibba - Monday, Jun 24, 19 @ 3:24 pm:

CZ, while I understand your desire to put the average service into perspective, it is pretty likely that means don’t describe the population well, likely skewed right by much higher salaries at higher administrative levels (meaning the distribution of salaries is not bell shaped, which I know you already understand but I’m just being specific for others). Median salary and years of service would be much better, if we had those. However, in the end, someone will be judging whether a pension is reasonable or not, using their own expectations, and that judgment is likely predetermined anyway, so why bother with details.

- Danville's Finest - Monday, Jun 24, 19 @ 3:28 pm:

Did they account for employees that came from other states, and then just moved back home? Thinking of university hires, in particular.

- Enviro - Monday, Jun 24, 19 @ 3:30 pm:

= an “average” $35,000 pension with no context as to how long that retiree worked…or if that retiree also gets social security. =

Maybe you should learn more about the social security offset. Some people pay into social security but do not receive benefits if they receive a pension.

- Morty - Monday, Jun 24, 19 @ 3:31 pm:

City Zen,

Let’s be honest- there isn’t a fact or number or story that will satisfy you.

Ever.

- Nonbeliever - Monday, Jun 24, 19 @ 3:38 pm:

Tax retirement and that percentage will skyrocket. Particularly for those with other investmentincome that is not tied to pensions.

However, I do not believe that Pritzker plans to do that- at least that is my impression.

- Grandson of Man - Monday, Jun 24, 19 @ 3:41 pm:

Florida, a RTWFL state, is ranked much lower in median household income and per capita income than Illinois. Many who work and live in Florida have to be worse off in retirement than many who’ve moved there to retire but lived in higher-income states.

- Beth - Monday, Jun 24, 19 @ 3:45 pm:

City

22 years at 3000/mo pension equates to almost 100 k / year

35 years at 3000/mo pension equates to almost 62 k / year

I would tend to believe there were more people in the 62 k range with 35 yos. Than people in the 100 k range with only 22 yos

- Across the Street - Monday, Jun 24, 19 @ 3:56 pm:

People will move because they want to follow their kids. Grandparents want to be close to their grandkids when they can, especially when the grandkids are small. When the kids make a second move for a job, as an example, grandparents many times come back to Illinois. Their friends are here and so is their healthcare. No one talks about those who return. People also want to experience another part of the country for a bit. It isn’t all negative. 18% isn’t a huge number.

- Blue Dog Dem - Monday, Jun 24, 19 @ 4:42 pm:

Grandson. Did you ever think Floridas median income was lower because of all the retirees?

- Grandson of Man - Monday, Jun 24, 19 @ 4:51 pm:

“Did you ever think Floridas median income was lower because of all the retirees?”

Florida has lower wages than Illinois.

https://www.bls.gov/oes/current/oes_il.htm

- ajjacksson - Monday, Jun 24, 19 @ 5:46 pm:

The statistic “18%” is meaningless without context. My mom was a nurse. Her husband was a tax accountant. They live in Florida for half the year, because it’s cold up here. It has everything to do with the weather and nothing to do with a pension. This seems to me to be a classic straw man argument.

My mom and her husband, by the way, are from Indiana.

- Suburban Mom - Monday, Jun 24, 19 @ 9:21 pm:

My mom is among that 18%; she’s a retired public school teacher. She had to move to follow my father’s job; his employer took huge tax relief from the state to “create jobs” and promptly laid off everyone over 50. There were no consequences for the age-discriminating company (who got to keep all their job-creation tax breaks), but my dad had to take a job out of state, so now my mom’s pension follows them out of state.

- Da Big Bad Wolf - Tuesday, Jun 25, 19 @ 11:04 am:

==No one talks about those who return.==

Amen, across the Street. Jake Griffin’s hand wringing about the lost 2.4 billion annually is silly. When the pensioners come back some of that $2.4 billion comes back too.