Question of the day

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* Appropriate response by the governor to the NRA or not? Make sure to explain your answer…

80 Comments

|

* Press release…

· Following the end of his congressional campaign in Illinois’ 14th congressional district, Mike Koolidge has been hired as the Communications Director and Chief Spokesman for People Who Play By The Rules PAC, effective immediately. The “PBR” PAC is a political action committee whose mission is to support gubernatorial candidates and candidates for local offices, particularly school boards, committed to ending the fleecing of people who play by the rules and are gamed by a political system they finance. It will focus especially on equal protection and accountability under the law – American ideals increasingly neglected by too many in the modern political world.

· “We are so pleased to have a talent like Mike join our team and bring his wealth of experience and creativity in crafting substantive, engaging content to the work we’re doing at PBR PAC.” – Dan Proft, President, PBR PAC.

· At the end of June, Koolidge lost his race in the Republican primary to unseat Lauren Underwood in the new Illinois 14th congressional district. Before his run for congress Koolidge hosted and owned his highly successful regionally syndicated radio program The Michael Koolidge Show for 14 years, which he retired from of his own accord in November. Prior to that he served as an active duty U.S. Army officer for six years.

· Koolidge: “I’ve been asked repeatedly if I’m coming back on the radio after my run for congress. While I haven’t ruled it out completely in some form in the future, the opportunity offered by the PBR PAC is one I couldn’t pass up. My love for talk radio and its impact on politics has never ceased, but part of why I ran for congress was to move beyond words and into real action. My role at PBR PAC allows me to do just that, and I couldn’t be more excited about it.”

Koolidge finished third with 21 percent of the vote.

* CD13…

Today, Nikki Budzinski, the Democratic nominee for Illinois’ 13th Congressional district, called on the Illinois Environmental Protection Agency to approve the permit for construction of the Lincoln Land Energy Center in Pawnee, Illinois.

The 1,090-megawatt natural gas-fueled facility would generate $1.53 billion in economic output during construction and create over 1,000 jobs in Sangamon County. The project has the unified support of organized labor. The plan would also help to support the stability of the Illinois electric grid by providing consistent and reliable power.

Jeff Clarke, the Mayor of Pawnee, IL made the following statement: “Lincoln Land Energy Center will help stabilize our power grid, create over a thousand jobs in our area, and bring down costs for consumers. As a small-town mayor, I need federal partners that will work across the aisle to deliver results for Pawnee residents. I know Nikki is that candidate and am glad to see her support of LLEC.”

Budzinski made the following statement: “Illinoisians across IL13 are facing the potential of dangerous power brownouts and blackouts this summer along with rising energy costs that are hurting working families. LLEC would help alleviate both problems by acting as a crucial baseload resource, stabilizing the Illinois power grid, creating over 1,000 jobs in our area, and bringing down costs by creating energy right here in Sangamon County.”

“I support the development of this plant and call on the Illinois EPA to cut the red tape and approve the permit for construction immediately.”

* Same candidate yesterday…

This morning, the Police Benevolent & Protective Association of Illinois announced their endorsement of Nikki Budzinski in Illinois’ 13th Congressional District. Founded in 1936, the PBPA is comprised of 189 different units and is the largest downstate police association made up of full-time and retired sworn police officers.

The endorsement comes as Nikki Budzinski enters the general election with over $1,00,000 cash on hand after a decisive win in Illinois’ Democratic primary last week.

Budzinski made the following statement: “I am honored to earn the endorsement of the Police Benevolent & Protective Association of Illinois and their members. I am committed to working with the law enforcement community.”

“I believe we need to make our communities safer by investing in law enforcement and ensuring they have the resources they need to succeed. The PBPA and their members know that I will stand with them and work with them to accomplish everyone’s shared vision of making our communities safer. I look forward to working with them in Congress.”

Sean Smoot, PBPA Chief Legal Counsel and Director, made the following statement: “Nikki Budzinski has earned the support of the PBPA of Illinois because she will be an advocate for the safety and training of law enforcement officers in Washington. Her support of officers in the line of duty and off duty, along with their families, is essential to public safety. She will be a strong voice for law enforcement and the communities they protect.”

* NRCC…

Hi there –

Nancy Pelosi is endorsing Nikki Budzinski.

NRCC Comment: “Nancy Pelosi is endorsing Nikki Budzinski because she knows Budzinski will support Pelosi’s socialist agenda in Congress.” – NRCC Spokeswoman Courtney Parella

* Press release…

Monica Gordon, Democratic Primary winner for 5th District Cook County Commissioner and winner of the Bloom Township Democratic Committeeperson seat issued the following statement after her big win on Tuesday:

“I am extremely humbled by the results of this year’s primary election. I am grateful for the incredible team I have had around me the last several months, who have been tirelessly knocking doors, making phone calls, attending events, and doing so much more. I am so proud of them. I am also very lucky to have the support of the “Keep Bloom Strong” organization. Their guidance, leadership, and strength have made all the difference in the races we have been running.

“I have been fortunate enough to have earned the endorsements of several organizations and leaders in our community. My endorsements from incumbent commissioner Deborah Sims and a host of other local leaders have given me - and the public- confidence in my abilities to lead Cook County District 5. The endorsement I received from SEIU 73 is deeply appreciated and all their hard work in this race has been absolutely incredible.

“Moving forward, I am confident that we will build on the momentum of these recent wins in order to take it all the way home and win the seat of District 5 Cook County Commissioner. The district is in need of strong, ethical leadership that I am ready to provide. I will be unwavering in my support of the people of the district and I will do what it takes to ensure that the 5th district will have equitable representation on the Cook County Board.”

…Adding… Forgot about this one…

* More…

12 Comments

|

* Pritzker said the same thing during my interview last week…

During a June 30 interview with Capitol News Illinois, Pritzker suggested one response [to the influx of people seeking abortions] might be to expand segments of the state’s health care workforce to take on greater demand.

“Again, this is about securing access, making sure we have capacity to handle the needs of people to get procedures,” he said. “We need hospital personnel, health care personnel. Other states, for example, allow certain kinds of professionals to perform these procedures that Illinois doesn’t allow. So we’re going to look at expanding who can do the procedures.”

During that interview, Pritzker also said the state would not consider providing aid for out-of-state travel to Illinois for abortions.

* Financial Times…

“On an average day, we were seeing about 250 calls. Now it’s upwards of 500,” said Melissa Grant, chief operations officer of Carafem, which runs an abortion clinic in the Chicago suburb of Skokie. “We’re already seeing more Wisconsin patients.”

Generally, about 20 per cent of Carafem’s patients come from out of state, though that number increased to 30 per cent last month and is expected to jump further.

Many abortion providers believe the increase in demand is only the beginning, as women become more aware of the options available to them and further state bans elsewhere begin to take effect. There is “a lot of confusion” among patients over what is legal in their states, said Michelle K. […]

Northwestern Medicine, the hospital system of Northwestern University that offers abortion services through its family planning centre, said it would take a similar approach to reallocating resources as it did during the early days of the coronavirus pandemic, should patient volumes increase.

* Wisconsin…

Most Saturday mornings Abby is at work or walking in nature somewhere. But on July 2, the 30-year-old is waiting at her house to be picked up by an acquaintance who will drive her more than two hours to a clinic in Illinois to obtain a medication abortion to end her pregnancy.

Even two weeks ago, Abby — who allowed a reporter to travel with her to Illinois and share her story but requested that her real name not be used — could have obtained what is commonly referred to as the “abortion pill” at the Planned Parenthood of Wisconsin clinic in Madison, where she lives. But when the U.S. Supreme Court issued its June 24 decision in Dobbs v. Jackson Women’s Health Organization, overturning the constitutional right to an abortion that has existed since 1973, Planned Parenthood clinics immediately stopped offering both surgical and medication abortion due to Wisconsin’s 1849 criminal abortion ban, which is still on the books.

Wisconsin Attorney General Josh Kaul has since filed suit in Dane County Circuit Court to block the 173-year-old statute. But Wisconsin women seeking abortion must currently go to Illinois or Minnesota or one of the other states in the nation where abortion remains legal and accessible. […]

Abby says she spent about four hours that day calling clinics in Illinois, but could not get through or was put on hold — up to two hours at one clinic. She started to feel a bit panicked but then her boyfriend got through immediately to a clinic in the Chicago area. He handed the phone to Abby and within a few minutes she had an appointment for Saturday.

* Rockford…

With expectations that women from Wisconsin will come to Illinois to have an abortion, following the U.S. Supreme Court’s decision to strike down Roe v Wade, an abortion clinic is set to open in Rockford soon.

Abortion is now illegal in Wisconsin and surrounding states. Gov. JB Pritzker has declared Illinois is a pro-choice state, causing patients from neighboring states to come into Illinois for an abortion.

President Biden discusses abortion options with Democrat governors

On Friday, the Rockford Family Initiative held a protest outside a former acupuncture facility, at 611 Auburn Street.

The building was purchased by Dr. Dennis Christensen and is expected to reopen as an abortion clinic as soon as next week.

* Meanwhile…

Lobbyists pressuring Congress on telehealth issues are staying away from abortion matters because they don’t want to jeopardize their chances of extending the pandemic-related rules that have been a boon to the sector, several of them told POLITICO.

The industry consultants and advocates are continuing their approach — even after the Supreme Court ruling overturning Roe v. Wade — because they don’t want to derail their congressional legislative goals to expand access to virtual care or weaken a coalition they’ve built over the last two years.

Eased as a response to the Covid-19 pandemic, the telehealth rules are widely popular and wouldn’t involve abortion care as a vast majority apply to the Medicare program. But advocates fear that abortion politics could find a way into their negotiations to extend the relaxed rules that are tied to the public health emergency — which could end as early as October, though the Biden administration is likely to extend it beyond that date.

“The telehealth industry and telehealth advocates want to maintain our bipartisan support, and this obviously complicates that,” one advocate for the telehealth industry said of the Roe decision. “We, as an industry, are just trying to make as many gains as we can, however we can, while maintaining that bipartisan support and bipartisan credibility.”

* More…

* Inside an Absolutely Slammed Abortion Clinic in a Blue State: As of the Thursday after the decision, anyone who wanted a surgical abortion, which Hope performs up until nearly 24 weeks of pregnancy, would have to wait about two weeks. The clinic was also booked out for three weeks for medication abortions, which Hope will induce, using pills, up until 11 weeks of pregnancy.

* Latino Voices Conversation: Future of Abortion Rights in Illinois and Across the Country

5 Comments

|

Griffin’s Rauneresque gambit

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* Greg Hinz writes about a meeting between the state’s wealthiest then-resident and Illinois’ billionaire governor...

Was there a way for two of Illinois’ richest residents to reach peace and avoid a yearslong war, with Gov. J.B. Pritzker getting the tax revenue he wanted to run the state and Citadel’s Ken Griffin keeping both his residence and his company headquarters in Illinois? […]

In the Pritzker account, Griffin talked mostly about the necessity of cutting the state’s spiraling pension costs by using Pritzker’s political clout to push for an amendment to the Illinois Constitution allowing a cut. There also may have been discussion about moving new state workers to a defined-contribution 401(k)-style retirement plan.

Pritzker said no, on the basis that pensions are a promise that should be maintained and that dumping the Constitution’s pension clause would be rejected by the courts. […]

Griffin told Pritzker he had a rare opportunity to run the state not from the political left but the center, dealing with unaffordable pension costs, such as a 3% compound annual cost-of-living increase for retirees, while stabilizing state finances with additional revenues, the Griffin account goes.

So, cut pension benefits and Griffin won’t challenge the tax hikes. Pritzker would’ve had to completely alienate organized labor and Democratic legislators from the get-go on a no-win proposal, but, no worries, Griffin would have his back if he somehow beat all odds and succeeded.

This is the same sort of deal that Bruce Rauner offered to legislative Democrats: Give me what I want or I’ll cut off the money, albeit likely offered up in a more polite way.

It takes a three-fifths majority in each chamber to put an amendment on the ballot, and that wasn’t gonna happen. Pritzker would’ve been insane to take that offer. He’d have been ruined politically by blatantly flip-flopping (and undoubtedly failing) on a major pledge to one of his party’s most important and powerful constituencies - and in the wake of a four-year war with an anti-union governor, labor unions were still fiercely united and stronger than ever. The rest of Pritzker’s entire agenda would’ve been derailed.

Apparently as a result of Pritzker’s refusal, Griffin stepped in big to help kill the governor’s graduated income tax proposal. He tried to finish the job this year with a candidate against Pritzker, but came up short and then packed his bags for Florida, where Rauner already resides.

45 Comments

|

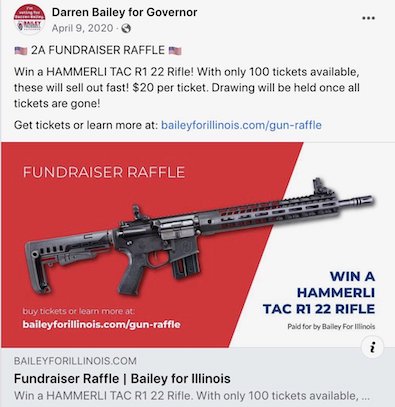

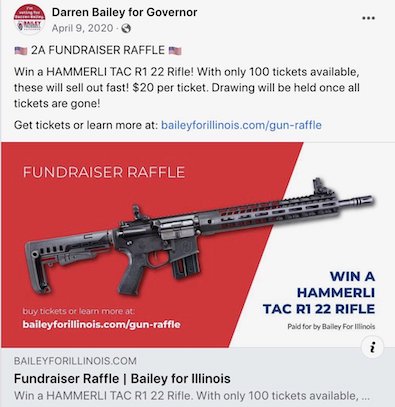

Darren Bailey and his enthusiasm for guns

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* In his own words…

* Patch…

Candidate for Illinois governor and Republican State Sen. Darren Bailey — who previously filed a lawsuit against current Gov. J.B. Pritzker — took to TikTok for the first time on Saturday to share a few thoughts about the recently passed $42.2 billion budget proposal.

In the debut video, Bailey holds thousands of pages of what he says is the Illinois budget proposal in his hands with what appears to be a semiautomatic sporting rifle slung on his back.

While Twisted Sister’s “We’re Not Gonna Take It” plays in the background, Bailey tells viewers he is finally ready to respond to his constituent’s questions about his feelings on the bill.

“Friends, Illinois Republicans had less than six hours to review over 3,800 pages of the budget this year,” he said. “This entire week people have been asking me how I feel about the budget. I’m having a hard time putting it into words.”

Wordlessly, Bailey loads the rifle, takes aim and fires a single shot at the stack of paper, sending pages flying.

The video on his Facebook page…

My Thoughts on the Pork-filled Illinois Democrat Budget

We made our first Tik Tok video to deliver an important message about the pork-filled Democrat budget that increases spending, increases taxes, and makes it harder for Illinoisans to invest, live, work and stay in Illinois. It’s time to turn things around. I support a zero-based budget where every department makes a case for every dollar spent to provide accountability. I also support identifying and eliminating unfunded mandates that increase property taxes and make it harder for working families. As your next Governor, we will get it done. #standingwithyouin2022

Posted by Darren Bailey for Governor on Saturday, June 5, 2021

* Click here to watch this other Bailey TikTok video…

* From his campaign’s online store…

* He’s had several gun raffles…

* SE Illinois News…

* Bailey on The Wilkow Majority…

You know, sharing ideas sometimes if you don’t hear them you don’t think of them. But you know, the concealed carry and how much safer would you be if the mom walking her children was concealed carry and had protection. And I personally think it would make a big difference and that’s sometimes what you have to do in government especially here in Illinois. You have to throw the idea out there and get people thinking because here in Illinois as democrat is the government has been, they’ve continually heard one side and havent had any light shed on other views.

* Bailey on WGN Radio…

Q: You and your wife are the founders of Full Armor Christian Academy. Is there a sign at the door of that school that reads: ‘Staff heavily armed and trained in any attempt to harm children will be met with deadly force’?

A: Well, you’ve done your research. There actually is, yes. We believe that the children are our most precious asset. And it’s interesting, when you go into a Target, or certainly a high-end fashion or jewelry store, you’ll usually see an armed guard there protecting that and in this day and age and climate, we believe that we need to do everything possible to protect our children.

Q: So you have guns throughout the school. Would you advocate that Chicago schools have guns easily available for teachers or others to use?

A: Well, I would certainly advocate under the current climate that is a plausible solution if the local school so chose. Obviously, lots of training, you know, handling the the gun itself, and then that training with local law enforcement agencies of which we do at Full Armor would be obviously mandatory. And I believe that that would, yeah, I believe that would certainly help be a step if a school so chose to use it to make schools and safer and protect our children.

* Bailey on WCMY Radio…

Guns are not the problem. Guns can be part of the solution as a part of protection.

From the station…

Bailey says it’s an important, God given right.

84 Comments

|

* Press release…

The Illinois Supreme Court announced today the creation of the Supreme Court Committee on Judicial Security and Safety (the Committee).

The Order announcing the creation of the Committee is available on the Court website by clicking here.

“The Supreme Court is committed to ensuring the safety of our judges and justices,” Chief Justice Anne M. Burke said. “Threats to the judiciary continue to increase and the Committee will help us address them.”

The Committee is tasked with providing the Court with developments and recommendations related to the judicial threat environment and protective operations, intelligence, and information. The committee will also coordinate with the Court’s judicial and law enforcement partners to monitor and review current and anticipated future judicial security needs and make appropriate recommendations to the Court.

The Chair of the Committee will be Jim Cimarossa, the Marshal of the Supreme Court of Illinois. Appointed as members of the Committee are First District Appellate Court Justice Mathias W. Delort, Second District Appellate Court Justice George Bridges, Twelfth Circuit Court Judge Susan T. O’Leary, Cook County Circuit Judge E. Kenneth Wright, Twenty-Second Circuit Court Michael J. Chmiel, and the Hon. Mark A. VandeWiele (ret.).

Additional appointed members will include the Executive Director of the Attorney Registration and Discipline Commission (ARDC), a representative of the Illinois State Police, a representative of the Illinois Sheriffs’ Association, and a representative of the Illinois Association of Chiefs of Police.

6 Comments

|

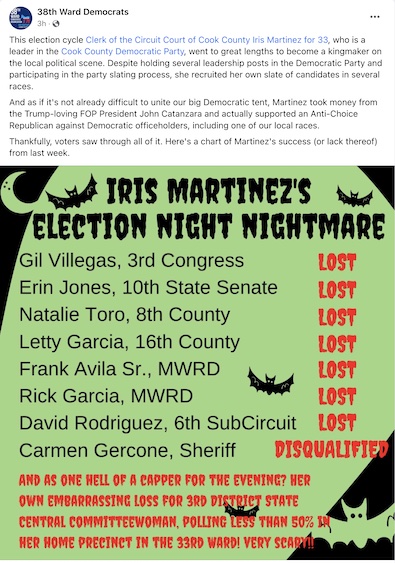

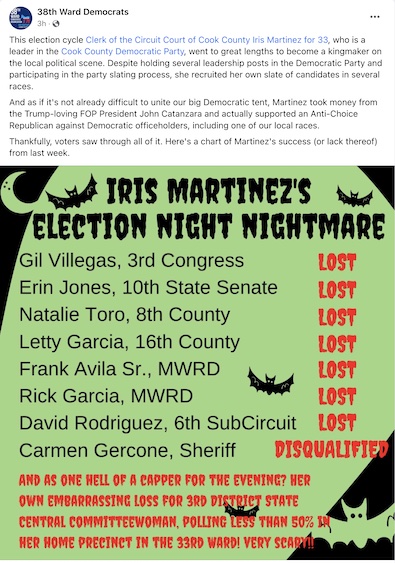

Primary roundup

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* My weekly syndicated newspaper column…

The four Illinois legislative leaders did not have a spectacular primary day. House Speaker Emanuel “Chris” Welch lost three incumbents to primary challengers. Senate President Don Harmon lost an appointed incumbent and an open seat race. And House Republican Leader Jim Durkin lost two incumbents and came up short in some other races. Senate GOP Leader Dan McConchie came away with one ding.

On the other hand, it was a pretty darned good day to be a young progressive Democrat or a Donald Trump/Darren Bailey-affiliated Republican. State Rep. Delia Ramirez bested well-funded Chicago Ald. Gil Villegas (36th) in the 3rd Congressional District primary by a mind-boggling 42 points — the same margin as Republican Bailey achieved in the governor’s primary.

All of Welch’s defeated incumbents were bested by talented challengers from their left. Rep. Mike Zalewski, D-Riverside, helped found a caucus for moderate Democrats and voted against repealing the Parental Notification of Abortion Act. His ties to former Speaker Michael Madigan helped for years, but not this time, when they were effectively used against him. Zalewski is a strong legislator, a friend to most and is actually beloved by many progressive legislators, but the winds and the super hard-charging Abdelnasser Rashid got him.

Rep. Denyse Wang Stoneback, D-Skokie, was elected as a progressive two years ago, but alienated the gun law reform lobby as well as many colleagues and others during her tenure. The Gun Violence Prevention PAC went after her with a vengeance because she walked away from a landmark bill that G-PAC had negotiated. She’d also alienated her own state senator, Ram Villivalam, and he and a host of area politicos pushed hard for Kevin Olickal, who basically ran on Stoneback’s 2020 progressive platform.

The Associated Press has declared U.S. Rep. Jesus “Chuy” Garcia’s ally Norma Hernandez the winner over Rep. Kathy Willis, D-Addison. Hernandez ran a Chuy-style campaign — lots of family and friends networking, non-stop door-knocking and making sure progressive Latinos got to the polls.

Senate Democrats and their allies spent hundreds of thousands of dollars to back appointed Sen. Eric Mattson, D-Joliet, against progressive Will County Board member Rachel Ventura, but Ventura won by 15 points, even though she raised only $19,000 all year. This is, needless to say, a big loss. After Sen. John Connor decided to run for judge, the Dems and local pols engineered Mattson’s candidacy and his eventual appointment to Connor’s seat, believing that Ventura could put the district on the bubble this November if she won.

The Dems also supported Lamont Williams against Willie Preston in an open seat race. Preston was up by 8 points when he declared victory. The Williams campaign had a bunch of oppo on Preston and never used it. The Illinois Network of Charter Schools spent heavily for Preston, who had a host of endorsements, although his claimed endorsement by Secretary of State Jesse White proved to be false.

House Republican Conference Chair David Welter, R-Morris, and freshman Rep. Mark Luft, R-Pekin, both lost. The Bailey campaign and people like Jeanne Ives put a big target on Welter’s back. Welter’s opponent Jed Davis was also a very hard worker and won by 9 points with all votes counted except what was still in the mail.

Durkin also backed Arin Thrower in the primary to take on Rep. Suzanne Ness, D-Crystal Lake. But Thrower is trailing the much more rightward Connie Cain by just 64 votes.

Jennifer Korte, another Bailey/Ives candidate backed to the hilt by Sen. Jason Plummer, R-Edwardsville, is defeating GOP-supported Joe Hackler by a 34-point margin for the right to take on Rep. Katie Stuart, D-Edwardsville. The Durkin crew thought Korte was too far-right to have a chance against Stuart. Now they’re stuck with her.

Of the five House Republicans endorsed by Bailey, four won, with only Kent Gray losing badly to Rep. Tim Butler, R-Springfield.

Bailey supported two Senate Republican candidates. One won. Bailey-backed Sen. Win Stoller, R-East Peoria, beat the Jim Durkin-backed Brett Nicklaus by about two points. Durkin jumped into this race for Nicklaus after Travis Weaver announced against Luft as a way of pushing back against the Senate Republicans and Weaver’s father, whom he blamed for the younger Weaver’s candidacy.

The Senate Republicans backed a candidate who ended up with bad opposition research trouble, so they got out of the race.

Also, the ultra-conservative Chicago Fraternal Order of Police endorsed three conservative and not all that talented challengers to sitting Democratic legislators and all three incumbents won by huge margins.

21 Comments

|

* The Conversation…

In 2019, we published a population-based study analyzing the data in a bid to evaluate the effect that the federal ban on assault weapons had on mass shootings, defined by the FBI as a shooting with four or more fatalities, not including the shooter. Here’s what the data shows:

Before the 1994 ban:

From 1981 – the earliest year in our analysis – to the rollout of the assault weapons ban in 1994, the proportion of deaths in mass shootings in which an assault rifle was used was lower than it is today.

Yet in this earlier period, mass shooting deaths were steadily rising. Indeed, high-profile mass shootings involving assault rifles – such as the killing of five children in Stockton, California, in 1989 and a 1993 San Francisco office attack that left eight victims dead – provided the impetus behind a push for a prohibition on some types of gun.

During the 1994-2004 ban:

In the years after the assault weapons ban went into effect, the number of deaths from mass shootings fell, and the increase in the annual number of incidents slowed down. Even including 1999’s Columbine High School massacre – the deadliest mass shooting during the period of the ban – the 1994 to 2004 period saw lower average annual rates of both mass shootings and deaths resulting from such incidents than before the ban’s inception.

From 2004 onward:

The data shows an almost immediate – and steep – rise in mass shooting deaths in the years after the assault weapons ban expired in 2004.

Breaking the data into absolute numbers, between 2004 and 2017 – the last year of our analysis – the average number of yearly deaths attributed to mass shootings was 25, compared with 5.3 during the 10-year tenure of the ban and 7.2 in the years leading up to the prohibition on assault weapons.

* Newsweek…

19 Comments

|

FOID and the finger of blame

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* Tribune…

Authorities said Crimo legally purchased the high-powered rifle he allegedly used to shoot more than three dozen people, including seven who were killed. And he did so even after a threatening episode was reported to Highland Park police, who in turn notified Illinois State Police, and after authorities had been alerted to him being suicidal.

It appeared that existing law — including the state’s so-called red flag law — wasn’t used to take weapons away from Crimo, long before he allegedly perched atop a roof along the parade route and opened fire. And current laws did nothing to head off his purchase of weapons, even in politically blue Illinois. […]

Crimo would have had to pass a criminal-background check, both to secure an Illinois gun permit, or FOID card, and to make the purchase. Generally, it takes a felony conviction or committal to a mental facility to bar someone from having a firearm in the state, experts said.

But an emerging picture of a very troubled background, including not only chilling online video postings about gun violence but also an attempted suicide and a threat on a family member with knives, raised questions about Illinois’ gun-permit system. […]

[Sgt. Chris Covelli, the spokesman for the Lake County Major Crimes Task Force] said police did not have probable cause to make an arrest and also that no one signed a complaint against Crimo. But Highland Park police did notify Illinois State Police, the agency that issues Illinois gun permits, about the incident.

“Highland Park police notified Illinois State Police,” Covelli said, when pressed by reporters for details. “Where it goes from there, I don’t want to speak to.”

* The attorney retained by the alleged mass murderer’s parents also tried passing the buck to the ISP, even though the father is the one who sponsored his son’s FOID application…

* Illinois State Police statement issued July 5, 5:50 pm…

In September 2019, ISP received a Clear and Present Danger report on the subject from the Highland Park Police Department. The report was related to threats the subject made against his family. There were no arrests made in the September 2019 incident and no one, including family, was willing to move forward on a complaint nor did they subsequently provide information on threats or mental health that would have allowed law enforcement to take additional action. Additionally, no Firearms Restraining Order was filed, nor any order of protection.

At that time of the September 2019 incident, the subject did not have a FOID card to revoke or a pending FOID application to deny. Once this determination was made, Illinois State Police involvement with the matter was concluded.

Then, in December of 2019, at the age of 19, the individual applied for a FOID card. The subject was under 21 and the application was sponsored by the subject’s father. Therefore, at the time of FOID application review in January of 2020, there was insufficient basis to establish a clear and present danger and deny the FOID application.

* ISP statement a few hours later…

In our continued investigation into the shooting in Highland Park on July 4, 2022, the Illinois State Police (ISP) looked into the criminal background of the individual charged in the crime.

The individual passed four background checks when purchasing firearms, through the Firearms Transaction Inquiry Program (FTIP), which includes the federal National Instant Criminal Background Check System (NICS):

• June 9, 2020

• July 18, 2020

• July 31, 2020

• September 20, 2021

The only offense included in the individual’s criminal history was an ordinance violation in January 2016 for possession of tobacco.

ISP has no mental health prohibitor reports submitted by healthcare facilities or personnel.

The September 2019 Clear and Present Danger report made by the Highland Park Police Department was made in response to threats allegedly directed at the family, but the report indicates when police went to the home and asked the individual if he felt like harming himself or others, he responded no. Additionally and importantly, the father claimed the knives were his and they were being stored in the individual’s closet for safekeeping. Based upon that information, the Highland Park Police returned the knives to the father later that afternoon.

ISP will continue to provide as much information as possible in an effort to be fully transparent.

Thoughts?

101 Comments

|

Here’s how you can help

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* NBC 5…

Highland Park Community Foundation

To help those directly impacted by the mass shooting in Highland Park, the Highland Park Community Foundation has established a July 4th Highland Park Shooting Response Fund.

According to the city, “All contributions to the Response Fund will go directly to victims and survivors or the organizations that support them.”

Here’s how to donate.

Illinois Crime Victims Fund

According to the Illinois Attorney General, “The Crime Victims Compensation Act was established by the Illinois General Assembly in 1973 with the primary goal of helping to reduce the financial burden imposed on victims of violent crime and their families.”

According to the fund’s website, “the Illinois Crime Victim Compensation Program can provide eligible victims and their families with up to $27,000 in financial assistance for expenses accrued as a result of a violent crime. “No victim of a crime should be paying out of pocket for their medical or therapy bills (and no family member should be paying for funeral bills).”

Here’s how to [see if you’re eligible for assistance].

There’s a lot more, including a plea for blood donors, so please, click here.

3 Comments

|

Open thread

Wednesday, Jul 6, 2022 - Posted by Rich Miller

* We’ll get to the Highland Park shooting in a little bit, so please hold your comments on that topic until we have a related post. Thanks.

25 Comments

|

|

Comments Off

|

LIVE COVERAGE

Wednesday, Jul 6, 2022 - Posted by Rich Miller

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|