Every vote counts

Tuesday, May 20, 2014 - Posted by Rich Miller

* Sun-Times…

With votes tight for keeping a 2011 tax increase in place, the attorney representing indicted state Rep. Derrick Smith has asked a federal judge to delay the start of his May 28th corruption trial by three days.

If a federal judge agrees to the request, House Speaker Michael Madigan stands to get valuable extra time, if he needs it, to round up the necessary votes to pass a tax-extension bill. The speaker is believed to be well short of the necessary 60 votes he needs to send the legislation to the Senate.

“We’re asking the judge if he can be there through the end of session,” defense lawyer Victor Henderson said of his client in an interview with the Chicago Sun-Times on Monday. […]

U.S. District Judge Sharon Johnson Coleman is expected to decide on the motion during a hearing Wednesday morning.

Henderson stated in his motion that prosecutors have no position on the request.

* Tribune…

In a motion filed last week, the West Side legislator asked U.S. District Judge Sharon Johnson Coleman to again reset the trial for June 2 due to “significant pieces of legislation to be voted upon” in the House before the traditional end of the session by May 31.

“Representative Smith is required to attend in order to represent his district,” the motion stated.

House Speaker Michael Madigan, D-Chicago, said Monday that Smith “will vote yes” on the income tax hike vote. But Madigan has acknowledged he is still “significantly” short of the 60 votes necessary to pass the measure in the House. If Smith isn’t available to cast a vote in favor, Madigan said, “It will be one less vote.”

This is mostly snark, but why would you vote to raise your jury’s taxes right before you go on trial for alleged bribery?

33 Comments

|

New job training tax credit pushed

Tuesday, May 20, 2014 - Posted by Rich Miller

* Greg Hinz has some details of a new proposal to help spur hiring…

The proposed Illinois State Employment and Training Program, or I-Step, would give a credit worth as much as $5,000 per job for training net new hires for Illinois operations, after factoring in any job cuts.The credit would apply not only against a company’s state income tax liability but against individual income taxes it withholds from employee paychecks — a much more lucrative deal for many companies. […]

(T)he tax credit would cover training costs in the first year of employment and amount to 75 to 100 percent of costs, the larger figure in the case of jobs that will be particularly long-lived.

The jobs must pay at least 175 percent of the federal minimum wage and be posted for at least two weeks on a state job board… The key change was an agreement that would allow a company to still reduce employment in one location, so long as it was adding jobs in another location at least 60 miles away from the first. […]

By itself, the program probably won’t be enough to lure a company to Illinois, [the IMA’s Mark Denzler] said. But it will be “beneficial” for existing employers considering expanding, particularly since the program will be “automatic” and not require special approval by state bureaucrats in each instance.

Discuss.

6 Comments

|

* From a press release…

Gubernatorial candidate Bruce Rauner today released automated calls to voters in six key state legislative districts where the General Assembly’s vote on making Pat Quinn’s state income tax increase permanent could be decided.

“Pat Quinn thinks you don’t pay enough in taxes – but I disagree,” Rauner says in the calls. “There’s still time to help me fight Pat Quinn’s tax increase – and to let State Representative Deb Conroy know you want her to protect you from higher income taxes.”

The calls come one day after media reported that Quinn and House Speaker Michael Madigan convened a secret backroom meeting with Democratic lawmakers to pressure them to vote for Quinn’s tax hike. Reports indicate the meeting did not go well for Quinn with lawmakers rejecting the governor’s false choice between raising taxes and funding education.

Rauner encouraged voters to stand against Pat Quinn’s tax increase proposal and ensure State Representatives Deb Conroy (LD 46), Marty Moylan (LD 55), Carol Sente (LD 59), Sam Yingling (LD 62), Mike Smiddy (LD 71), Kate Cloonen (LD 79), and Sue Scherer (LD 96) vote against it if Madigan calls a vote.

That’s seven, not six, as the press release says.

And I know Rauner is unfamiliar with the Statehouse, but room 114 isn’t a “backroom.” It’s a hearing room.

* The robocall…

* Script…

Hello, this is Bruce Rauner. Yesterday, Governor Pat Quinn and Mike Madigan held a secret backroom meeting with State Representatives, pressuring them to raise your income taxes. Pat Quinn thinks you don’t pay enough in taxes – but I disagree. There’s still time to help me fight Pat Quinn’s tax increase – and to let State Representative [insert name] know you want [him/her] to protect you from higher income taxes. If you oppose higher income taxes and want to get more involved in my campaign, call me at 312-583-0704. Paid for by Citizens for Rauner, Inc

If you call the number, you’re asked to “dial zero” for an operator. I did so and was put on hold and then transferred into a voicemail account for volunteers.

Usually, these sorts of robocalls offer to connect you to your legislators. So Rauner’s calls aren’t interactive in the traditional sense.

…Adding… If Rauner really wanted to have an impact on the vote itself, he wouldn’t target most of those folks listed above. They’re already solid “No” votes on a tax hike extension. Instead, he’d go after Democrats who aren’t quite decided, or are staying mum.

30 Comments

|

Unclear on the concept

Tuesday, May 20, 2014 - Posted by Rich Miller

* Illinois Review…

On Illinois’ first day of statewide legalized gay marriage Westboro Baptist protesters will be outside the State Capitol, a press release from the church said Monday.

“Each rebel in the IL legislature will stand before God in the judgment and account for eading the people to error in running to this abomination,” the announcement says. Signs saying “Same Sex marriage dooms nations” and “America is doomed,” is featured on the press release, which says the Westboro picket will be held on Monday, June 2 from 8:45 to 9:15 am “in dire warning” to state lawmakers.

The morons, known for their insane anti-gay protests at military funerals, may be screaming outside the Statehouse, but unless something goes horribly wrong with the spring session, nobody but tourists and staff will be inside the building since adjournment is scheduled, as always, for May 31st.

So, their “dire warning” to lawmakers won’t be heard by any lawmakers. The cretins might as well just stay in their bat caves.

* Meanwhile…

Westboro Baptist Church is planning to protest next month’s Chicago Pride Fest, according to a Tweet posted Sunday morning.

In response to an article about the two-day street festival published by On Top Magazine, a content partner of ChicagoPride.com, the Topeka-based hate church tweeted: “@LGBTNewsNow @OnTopMag @WGNNews Westboro Baptist Church to picket @PrideFestChi! #SoExcited.”

Yeah. And I’m sure they’ll all get a nice, warm Chicago welcome, right?

32 Comments

|

Question of the day

Tuesday, May 20, 2014 - Posted by Rich Miller

* The setup…

Tuesday, Republican House member Dennis Reboletti called for voters to have a say in whether the 2011 state income tax increase should remain permanent or sunset at the end of 2014. S

Several Republican General Assembly members stood with Reboletti to support his effort, saying the Democrats have purposely cut Republicans out of budget talks - leaving their constituents with no voice in how taxpayer funds will be spent in 2015.

“We all here have been cut out of the [budget] process,” Reboletti said. “We’re going to ask the people to be citizen soldiers and join us in the fight. And if they think their voice isn’t being heard by the majority, they will have the opportunity to step up and cast a vote. […]

Rep. Ron Sandack pointed out that there are already several referenda on the November ballot, and one more asking the people their opinion on the tax hike is reasonable. A simple majority vote in both chambers before the legislature adjourns next week would put the question before voters.

And just to be clear, there are no limits on the number of non-binding advisory referenda that the General Assembly can put on the ballot.

* The Question: Should there be a statewide referendum on extending the income tax hike? Take the poll and then explain your answer in comments, please.

polls & surveys

81 Comments

|

“It’s not my job”

Tuesday, May 20, 2014 - Posted by Rich Miller

* At about the 2:30 mark in a YouTube video uploaded this morning by the Bruce Rauner campaign, WTTW’s Phil Ponce asks reporter Paris Schutz if Rauner has yet come up with an alternative plan to making the income tax hike permanent. Schutz’s response…

“Phil, he hasn’t. And today he said he wanted to wait for those lawmakers to figure out what they’re going to do before he unveiled the specifics of his [plan].”

Watch…

* So, which is it? Either he doesn’t have a plan or he has one and he’s waiting until after session ends.

I asked Rauner’s spokesman for a clarification…

I just listened to the audio from the gaggle and this is what Bruce said:

“We are going to be coming out with our own plan of spending priorities and tax strategies in the not too distant future.”

* But why wait?

I mean, if the tax hike is so bad, if it hurts the economy so much, then why make Illinoisans wait until next year to get rid of it?

If Rauner really does have some ideas, isn’t now the time to lay them out, before the Legislature has adjourned?

* The Rauner campaign’s response to this notion…

But to your larger point, Pat Quinn, Mike Madigan and John Cullerton are in charge now. It’s up to them to pass a budget during the session. As Bruce said he will put forth a budget plan in the not too distant future.

* Look, I totally get the politics here. There’s no good political reason to jump into a self-made train wreck like this Democrats-only tax hike debate.

And it is their job, not his at the moment, to craft a solution to this vexing problem.

But he is a life-long citizen of Illinois. And he has loudly and bitterly complained for well over a year about how the tax hike is killing Illinois and driving away businesses and families. If he has some ideas for dealing with this awful mess, shouldn’t he try to help his state?

/rant

46 Comments

|

Chicago a “dystopian nightmare” for business

Tuesday, May 20, 2014 - Posted by Rich Miller

* Matthew Yglesias…

The US Chamber of Commerce Foundation put together a little pamphlet looking at municipal business regulations in 10 major American cities. They combine all the information into a somewhat arbitrary aggregate index, but some of the specific findings are striking.

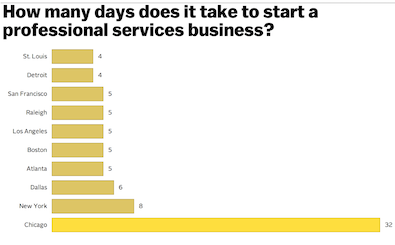

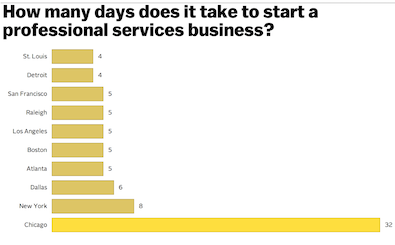

For example, if you want to start a professional services business in Chicago you are basically facing a dystopian nightmare:

* If the accompanying chart doesn’t make you sick to your stomach, I don’t know what will…

32 days compared to five in heavily regulated San Francisco?

42 Comments

|

Stuff you may not know

Tuesday, May 20, 2014 - Posted by Rich Miller

* From a Sun-Times editorial…

Two years ago, 30,000 Illinoisans thought they’d voted on Election Day, but in fact their ballots were tossed out because those would-be voters weren’t properly registered. […]

They are allowed to cast provisional ballots, but if they are not properly registered or at in the wrong precinct, those votes won’t count. That’s what happened to those 30,000 voters two years ago. […]

Cook County Clerk David Orr estimates that 25 percent of eligible Illinois voters aren’t registered. It happens for a variety of reasons. Some people, of course, are lazy or uninterested. But others have moved and simply haven’t kept up their registrations. Each year, half a million people move from one address to another in Cook County alone, and in 2012, more than 13 percent of Illinoisans changed addresses.

To put it into a little perspective, 30,000 is about the same as Gov. Pat Quinn’s winning margin four years ago.

* Crain’s has a very informative piece on the difficulties manufacturers have recruiting employees, despite job openings…

Crain’s conducted its own analysis of state manufacturing wages for this story. Over the past decade, they grew by 29 percent overall, according to figures provided by the Illinois Department of Employment Security. But consider this: Over the same period, wages in construction grew by 42 percent, in education by 43 percent and in finance by 61 percent.

Basically, if you’re a young grad following the money trail, why go into manufacturing? “It boils down to our view of the trade fields,” says Maciek Nowak, associate professor of supply-chain management at Loyola University Chicago’s Quinlan School of Business. “Dad says to son, ‘You can do better.’ “ […]

After receiving $13 million in federal money in 2012, a consortium of 21 Illinois community colleges has moved quickly to implement degree programs and apprenticeships for advanced manufacturing. Even Peoria-based Caterpillar Inc. chose to partner with colleges and universities around the country to help form a pipeline of skilled workers. In the meantime, however, Cat has spent the past decade laying off employees and freezing pensions and wages. It has also steadily shifted work from union strongholds in the North to right-to-work states in the South.

* Daily Herald…

On the second night of the NFL draft, an Oakland Raiders pick from 40 years ago sat in a one-story house in Des Plaines with a wheelchair ramp out front, a home he’s both lived and worked in for 12 years.

Dozens of millionaires would be newly minted via the draft.

But on that Friday evening, Gregory Mathis, the Raiders’ 15th pick in 1974, planned to watch the Chicago Blackhawks playoff hockey game with the residents of the house as part of his $10.70-an-hour job.

Six people with disabilities live at the home, called Cambridge House for the quiet Des Plaines street where it sits. Mathis is charged with taking care of them for the afternoon, overnight and early the next morning. He charts their progress, prepares meals, cleans up, and helps them bathe and use the bathroom.

Mathis, 62, has received $1.70 in raises in a dozen years for his work. His pay reflects stagnant state funding for agencies like his employer, Avenues to Independence, an issue that demonstrates how the political give and take in this month’s state budget battle can hang over daily life.

Go read the whole thing.

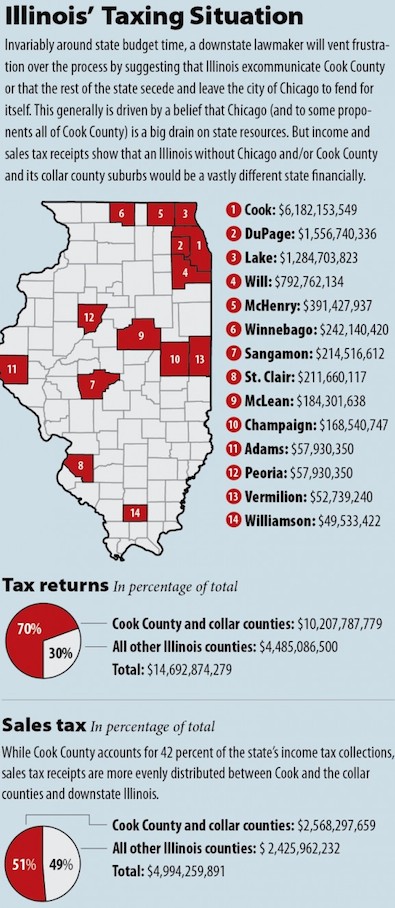

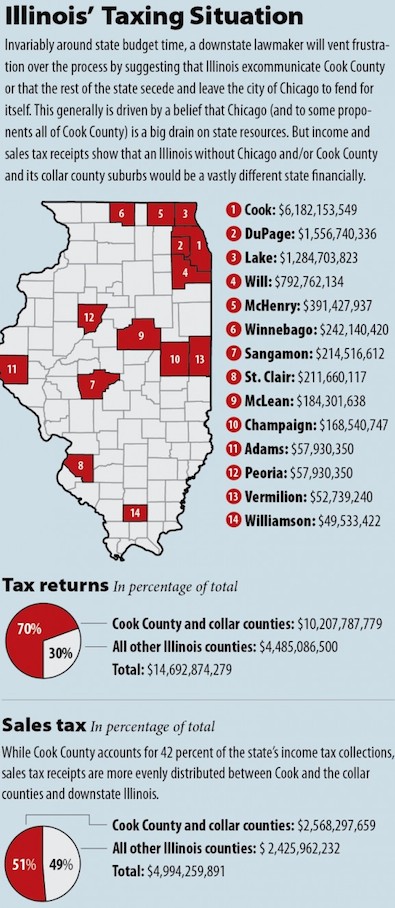

* And, finally, a Reboot infographic…

37 Comments

|

[The following is a paid advertisement.]

In an overwhelming show of support last Thursday, the Illinois Senate approved HB 4075 and trailer bill HB 5331 and paved the way for this legislation to be signed by Governor Quinn. This important public safety law would provide police background checks, drug tests and proper insurance requirements for all drivers and vehicles in transportation industry.

The remarkable support in both chambers of the Illinois legislature shows that this legislation strikes the right balance between protecting Illinois consumers and promoting new transportation options in Illinois.

Thank you to the Illinois General Assembly for their diligent work in crafting sensible statewide standards that will allow everyone in the transportation industry to prosper, including the thousands of jobs and families the taxi industry supports throughout Illinois.

Special thanks goes to Illinois’ legislative leaders: House Speaker Michael Madigan, Senate President John Cullerton, House Republican Leader Jim Durkin and Senate Republican Leader Christine Radogno.

As well as the bills’ sponsors in the Illinois Senate: Senators Antonio Munoz, Martin A. Sandoval, Karen McConnaughay, John M. Sullivan, Emil Jones III, Steven M. Landek, Melinda Bush, Jacqueline Collins and Linda Holmes.

And to the bills’ sponsors in the Illinois House: Representatives Michael J. Zalewski, Arthur Turner, Marcus C. Evans Jr., Dennis M. Reboletti, Edward J. Acevedo, Camille Y. Lilly, Ann Williams, Elizabeth Hernandez and Derrick Smith.

Now it’s time to tell Governor Quinn to sign HB 4075 and support common sense public safety protections for all.

Comments Off

|

|

Comments Off

|

Today’s numbers are harsh

Tuesday, May 20, 2014 - Posted by Rich Miller

* From an op-ed by David M.A. Jensen, president and chief operations officer of Lutheran Social Services of Illinois…

Lutheran Social Services of Illinois is the largest statewide provider of social services, and last year we served more than 96,000 residents. Approximately 80 percent of the people we served are below the poverty level.

The demand for our services continues to grow, as poverty and its associated hardships impact almost 2 million people in our great state. Poverty exists in every corner of Illinois, leaving many communities finding it difficult to address necessary resources to the human services infrastructure. Should the personal income tax not be extended, we estimate the following impact on our citizens based on our own research and that of the Fiscal Policy Center at Voices for Illinois Children:

• 21,000 seniors would not receive the help they need from in-home caretakers

• 140,000 people with mental illness would be denied medication and/or therapy

• 35,000 people with mental illness would no longer receive any services

• 25,000 adults with developmental disabilities would lose community-based services

• 13,600 people would have supportive housing and homeless services

Behind each of these statistics are very real people, in need of hope and a future. The most vulnerable people in our society are at risk for not finding the services they need. Even with generous support from private donors, as a community-based agency we depend on government funding to help our most vulnerable citizens.

* The Voices for Children’s Fiscal Policy Center’s research paper is here. The numbers look pretty sound…

There has been some dispute among legislators about the size of the budget shortfall that would result from the loss of income tax revenue in FY 2015. The revenue-collapse budget submitted by the Governor would reduce “discretionary” spending from the General Funds by about $2 billion. Some critics claim that this figure exaggerates the problem and that the shortfall is much smaller. But independent analysis by the Fiscal Policy Center (FPC), using somewhat different assumptions than the Governor’s Office of Management and Budget (GOMB), produces a similar estimate.

To estimate the shortfall, the FPC begins with projected FY 2015 revenue and then subtracts “mandatory” spending at projected FY 2015 levels and “discretionary” spending at FY 2014 levels. The difference is the projected budget shortfall (see Appendix 2).

The FPC uses revenue estimates from the Commission on Government Forecasting and Accountability (CGFA), a legislative support agency that has statutory responsibility for preparing revenue estimates for the General Assembly. CGFA’s updated projections for FY 2015 are $272 million lower than GOMB’s estimates.

The FPC revenue estimate also includes $402 million from two new special state funds — the Fund for the Advancement of Education and the Commitment to Human Services Fund. Beginning in calendar year 2015, each of these funds will receive 1/30 of revenue from individual income taxes. While the authorizing statute (Public Act 96-1496) stipulates that resources in each fund “shall supplement and not supplant” current levels of funding, there is no way of enforcing this provision.

In regard to “mandatory” spending, the FPC estimate reduces pension contributions from the General Funds by $150 million, based on offsetting revenue generated from unclaimed property. Otherwise, the FPC uses the same estimates as GOMB. In regard to “discretionary” spending, this comparative analysis assumes that appropriations remain at the FY 2014 level.

The GOMB spending estimate subtracts $234 million for unspent appropriations, while the FPC estimate omits this item. For decades, Illinois governors and legislatures have used estimates of unspent appropriations in formulating balanced budgets. This practice is contrary to sound fiscal policy and should be discontinued. Given the state’s current financial situation, unspent appropriations should be used to pay outstanding bills. If the backlog is eliminated, any unanticipated surplus should go into a rainy day fund.

In short, the FPC analysis indicates that the shortfall in the revenue-collapse budget — and the resulting cuts in “discretionary” spending — would still total about $2 billion (see Appendix 2). Any substantially smaller figure would have to involve questionable policy choices such as underfunding “mandatory” spending or ignoring the backlog of unpaid bills.

45 Comments

|

In other revenue and spending developments…

Tuesday, May 20, 2014 - Posted by Rich Miller

* Tribune…

Madigan filed legislation Monday that would keep the 2011 income tax hike in place and send homeowners a $500 property tax refund.

* More on the refund plan…

Under the proposal, refunds could be issued for 2013 property taxes as soon as September. That’s just weeks before the November election, when Quinn and many other lawmakers face re-election.

The idea behind this isn’t difficult to discern. They want to send voters a check before the election.

* From a recent AP story…

The temporary income tax hike Illinois lawmakers are considering extending is costing the typical taxpayer about $1,100 more this year, according to calculations by the Governor’s Office of Management and Budget.

he 67 percent increase on individuals approved in 2011 is producing about $6.6 billion in additional revenue for the state this year. Democrats promised when they raised the individual rate from 3 percent to 5 percent that it would roll back to 3.75 percent in January 2015. Now Gov. Pat Quinn and legislative Democrats want to make the 5 percent rate permanent.

The AP also calculated that rolling back the reduction on schedule to 3.75 percent would save the average taxpayer $688.

Instead, the state is planning to give every homeowner $500. And, by the way, those homeowners will very likely be liable for state and federal taxes on their election year bonus checks.

That’s kinda goofy, if you ask me.

How about rolling back the income tax hike by $700 million, which is the net new cost of this property tax “rebate” plan?

Sheesh.

51 Comments

|

* House Speaker Michael Madigan talked to reporters after yesterday’s marathon meeting with House Democrats and Gov. Pat Quinn…

Madigan said that Quinn worked hard to present his case, but he doesn’t know yet if any minds were changed. “I thought he did an excellent job of presenting his position, arguing for his position, taking questions. He took every question. He answered every question. He got very animated on a lot of his answers because, at times, he wasn’t hearing what he wanted to hear,” Madigan said.

“I think it’s significant that there was opposition expressed from all sectors of our caucus. I’m going to continue to work to find 60 Democrats to vote for the governor’s bill. We are significantly away from 60 today.” When asked how he would get the votes, Madigan said, “It’s going to take a great deal of persuasion.” He refused to answer questions about possible alternative revenue sources or what would happen with the budget if he cannot get the votes for the extension.

Opposition was, indeed, expressed from “all sectors” of the caucus. As I tweeted yesterday during the meeting…

Subscribers have more details.

* The governor tried to be more upbeat…

“It was really enjoyable. Everybody had a good chance to speak their minds,” the governor said afterward.

Quinn declined to talk in specifics about how much support he thinks there is for the tax issue. […]

Quinn centered his presentation Monday on the state’s responsibility to fund education, even carrying a copy of the state Constitution into the meeting to emphasize that it says the state is primarily responsible for education.

So, it was an “up day”?

Sigh.

* But he did demonstrate that he understands the reality of his situation…

“I think we need to make sure that we properly invest in our schools. Our state over relies right now on property tax to fund education. I think we have to do better. We have to use a tax based on ability to pay, the income tax, to properly fund our schools. I spoke about that quite a bit in the caucus,” Quinn said after he addressed the Democrats. […]

“You’re always building a majority on any issue; it’s a building of a majority to get to 60. I think we’re doing our very best to get that majority. I think my philosophy in life is hope for the best and work for it. So, we’re working real hard on getting those 60 votes in the House of Representatives. Obviously, we have to keep on working until we get there.”

* The reaction from Bruce Rauner was expected…

Monday’s meeting between the governor and his erstwhile House Democratic allies came after he endured another withering day of being beaten up by Republican gubernatorial rival Bruce Rauner, who labeled Quinn a “tax-and-spend” politician and failed leader who can’t move Democratic supermajorities in the House and Senate to do his bidding.

“They’re playing political games and showing a lack of leadership and unfortunately in Springfield, that’s been the status quo,” Rauner said after a campaign event in Northbrook.

“Right now, they’re trying to portray themselves as just doing whatever the voters want. They’re saying voters like more spending so we’re gonna give them more spending. Voters don’t like taxes so we’re just not going to vote on taxes,” Rauner charged.

“That’s political gamesmanship. That’s playing political football with our financial health. It’s a huge mistake. It’s a failure of leadership. It’s a failure of the General Assembly and the governor down there,” Rauner said.

It’s not that I disagree, it’s just that I’d kinda like to see a plan from Rauner. It doesn’t have to be a 500-page line item appropriations bill. Just sketch something out on a napkin or something. Anything.

* More…

If Madigan is “determined and he needs his 60 votes, he finds a way to get there,” [House GOP Leader Jim Durkin] said. “But he’s not going to get it with Republican participation.”

Madigan and Quinn both dismissed remarks from Durkin and Republican governor candidate Bruce Rauner, who was critical of Democrats for pushing a tax hike that he says is not needed. Rauner has contended the high taxes are causing businesses and people to leave Illinois.

Madigan shot back: “People are leaving because they’re looking at the prospect of Rauner as the governor.”

Nice pivot, but I kinda doubt that.

* Watch the raw video of both Quinn and Madigan via our good friends at BlueRoomStream.com…

77 Comments

|

|

Comments Off

|

Caption contest!

Monday, May 19, 2014 - Posted by Rich Miller

* I’m sure you know this already…

The Illinois Republican Party State Central Committee on Saturday elected Cook County Commissioner Tim Schneider as its chairman.

Schneider, who was unanimously elected to a four-year term as the Illinois Republican Party’s chairman, replaces Jack Dorgan, who held the position since June and was named co-chair of GOP gubernatorial candidate Bruce Rauner’s finance committee last week.

Schneider, a small business owner from Bartlett, has been a Cook County commissioner for the 15th district since 2007.

Little is known about Schneider’s view on social issues, and there aren’t that many pictures of him on the Internet, so this Facebook pic, of Schneider standing between ousted GOP Chairman Pat Brady and state Sen. Matt Murphy, will have to do. Let’s welcome Chairman Schneider, shall we?…

47 Comments

|

Question of the day

Monday, May 19, 2014 - Posted by Rich Miller

* Tribune…

More than 40 years after the Equal Rights Amendment was first passed by the U.S. Congress, an Illinois state senator is taking another crack at getting her colleagues in Springfield to adopt the provision that would enshrine in the U.S. Constitution the idea that rights can’t be abridged on account of sex.

Sen. Heather Steans, D-Chicago, said the proposed amendment is still relevant today given the ongoing debates about equal pay, abortion rights and other issues on which women are fighting for equality.

And she said it’s symbolically important to “get Illinois off the list” of 15 states that have not yet adopted the proposed amendment. The other holdouts are mostly traditionally more conservative states in the southern and western parts of the country. […]

The amendment appeared to die in 1982 after only 35 states passed it by the deadline that Congress set after adopting it in 1972. That was three short of the 38 needed to amend the Constitution. Supporters of the amendment are now pushing a “three state solution,” arguing the 1982 deadline should not apply. If three more states pass it, the supporters will try to make the case that there is no need for the U.S. Congress to start the amendment process over.

Steans has tried to pass the amendment a few times before, without success.

* The text…

Section 1. Equality of rights under the law shall not be denied or abridged by the United States or by any State on account of sex.

Section 2. The Congress shall have the power to enforce, by appropriate legislation, the provisions of this article.

Section 3. This amendment shall take effect two years after the date of ratification.

* A little history…

The ERA was introduced into every Congress between 1923 and 1972, when it was passed and sent to the states for ratification. The original seven-year time limit in the ERA’s proposing clause was extended by Congress to June 30, 1982, but at that deadline, the ERA had been ratified by 35 states, three states short of the 38 required to put it into the Constitution.

It was a very big deal here. Before my time, but stories still abound.

* The Question: Should the Illinois General Assembly ratify the ERA, even if it is too late? Take the poll and then explain your answer in comments, please.

online polls

77 Comments

|

|

Comments Off

|

More reform and renewal

Monday, May 19, 2014 - Posted by Rich Miller

* AP…

An Illinois Department of Transportation administrator has resigned amid an investigation into his time at the agency.

Agency spokesman Guy Tridgell said Monday that Carmen Iacullo retired April 30.

That was about the time Tridgell says the department turned over information about Iacullo’s tenure to the Office of the Executive Inspector General. Tridgell would not elaborate. […]

Tridgell says the investigation is not connected to an agency scandal in which as many as 200 people were hired without following rules barring political hiring decisions.

* More…

A former colleague described Iacullo as “a kingmaker” at IDOT’s Schaumburg district, having a big say in who was hired and how new employees were assigned.

“He would drop [new hires] in the bureau and say, ‘Find him something to do,’” said Patricia Casale, a retired IDOT clerical secretary.

Casale said one of her roles was to type up lists of questions to be asked of prospective employees during interviews. She said she personally handed the lists to Iacullo prior to interview sessions.

In 2006, Iacullo testified about his time at the Chicago Department of Transportation during the corruption trial of Robert Sorich, patronage chief for then-Chicago Mayor Richard M. Daley before being convicted of rigging the city’s hiring system to favor candidates with clout. During the trial, Iacullo talked about attending meetings with Sorich, where “Iacullo would recommend candidates, including individuals from his [Democratic] political group, for promotions,” according to court records.

13 Comments

|

*** UPDATE *** The governor blinks…

Moving to head off a developing campaign issue, Gov. Pat Quinn today called for amending the state’s ethics law to impose a blanket one-year ban on top ex-aides lobbying their former colleagues.

After a series of recent media reports about activities by his ex-chief of staff, Jack Lavin, who left state payroll last September, Mr. Quinn’s office released a statement saying that he will push for legislation to forbid such work for one year after a senior official leaves office.

“The governor favors amending the law to say that any chief of staff, deputy chief of staff or deputy governor – whether they’re participated in a decision or not – should not be permitted to lobby any official in state government for one year,” Mr. Quinn’s spokeswoman said. “We’re pursuing legislation.”

Mr. Quinn’s office previously said that the lobbying work by Mr. Lavin had been reviewed by attorneys and met the requirements of law. But that stance today came under fire from a top ethics watchdog group and from the campaign of Mr. Quinn’s election rival, GOP nominee Bruce Rauner.

[ *** End Of Update *** ]

* Longtime readers know that “Reform and renewal” was a deliberately sarcastic headline I used countless times during the Rod Blagojevich years because it was one of his campaign slogans.

So, let’s get back to it…

A former top aide to Gov. Pat Quinn is now working as a lobbyist for a group representing casino owners and a company hoping to get into the medical marijuana business, raising eyebrows among some who want to strengthen the state’s so-called revolving door ban.

Jack Lavin, who left his job as Quinn’s chief of staff last September, started his own lobbying business in February and has landed several contracts in recent weeks, Lee Enterprises reported Sunday.

Records show Lavin represents the Illinois Casino Gaming Association, which has been in the middle of talks regarding an expansion of gambling in Illinois. He’s also signed on with Effingham-based Healthcentral LLC, a company formed to compete for a license to grow marijuana after lawmakers approved a four-year medical marijuana pilot program.

* This is all legal…

Although Illinois has a revolving door ban designed to put roadblocks in front of agency directors and other top state officials seeking to join companies that have contracts with state government, Lavin has apparently moved into his new role without a hitch.

Under the law, certain state employees or former state workers cannot accept employment or compensation from a non-state employer if the worker, in the past year, made regulatory or licensing decisions or awarded contracts affecting the non-state employer.

As chief of staff from December 2010 to October 2013, Lavin was in the midst of some of the biggest decisions facing Quinn, ranging from expanding gambling to the legalizing medical marijuana.

* Greg Hinz…

And should a governor who frequently brags about how he’s cleaned up state government after the Rod Blagojevich years just watch as his former top aide exploits a huge loophole to swing the revolving door in his favor? […]

Rauner campaign manager Mike Schrimpf was even more pointed.

“First Pat Quinn’s running mate is hired by Blagojevich’s former budget director, then we learn about dozens of political hires in Quinn’s administration,” he said, referring to Paul Vallas and a hiring scandal in the Illinois Department of Transportation. “How Pat Quinn’s former chief of staff is trying to cash in as a lobbyist. There’s seemingly no end to the ethical cloud hovering over Pat Quinn.”

* Lavin was also hired by a ride-sharing firm…

In the latest move, Uber Technologies Inc. has brought aboard Jack Lavin, who until September was chief of staff to Gov. Pat Quinn. Another addition: lobbyist Al Ronan, whom I hadn’t seen on previous lists. They join, among others, former state Sen. Jim DeLeo, D-Chicago, and Mike Kasper, who has close ties to both Mayor Rahm Emanuel and House Speaker Michael Madigan.

Uber, Lyft and other ride-sharing firms could use the help because, so far, they’re losing in Springfield. […]

Mr. Quinn’s spokeswoman, Brooke Anderson, said hiring Mr. Lavin won’t have any impact on his ex-boss. “The governor will treat this legislation just like any other,” she insisted.

* Again, this is all legal and Quinn can’t just tell Lavin that he can’t make money because Lavin doesn’t work for him any longer.

But it’s probably also fair political game and another smallish strike against the governor.

29 Comments

|

Adventures in budgeting

Monday, May 19, 2014 - Posted by Rich Miller

* Sigh…

During last week’s budget debate in the House, Republicans started complaining about the Illinois Department of Transportation budget that includes the state airplanes.

It turns out a rumor they had heard was true. The state planes had been used to fly prairie chickens from Kansas to Illinois as part of a repopulation effort. Most of the costs are covered by the feds, but there’s a few thousand state dollars involved, although to listen to the Republicans it’s enough to wipe out a $2 billion budget deficit. Still, the debate focused attention on the air fleet, which is a favorite whipping boy.

Including to Rep. Sue Scherer, D-Decatur, who has several times focused on the state airplanes as a source of waste that could be eliminated to help avoid higher taxes. She’s even advocated getting rid of them altogether.

So when the IDOT budget came up for a vote after the blow-up over the bird flights, how did Scherer vote? Yes, of course.

Looks like one of the duckling handlers messed up.

* Other budget stuff…

* Rauner: Gov, lawmakers ‘playing political games’ with budget: “I think it’s absolutely wrong to do what they’re doing. They’re playing political games and showing a lack of leadership and unfortunately in Springfield, that’s been the status quo. Right now, they’re trying to portray themselves as just doing whatever the voters want. They’re saying voters like more spending so we’re gonna give them more spending. Voters don’t like taxes so we’re just not going to vote on taxes,” Rauner charged. “That’s political gamesmanship. That’s playing political football with our financial health. It’s a huge mistake. It’s a failure of leadership. It’s a failure of the General Assembly and the Governor down there.”

* Quinn to lobby House Democrats on tax hike extension: After the bills passed, Madigan put a hold on them to stop them from being sent to the Senate. Madigan said the action was needed because the House may choose to change the bills later. It also prevents the Senate from making alterations while House lawmakers figure out the revenue side of the budget equation. “If they’re here, they can’t be amended by the Senate,” Madigan said.

* Civic Federation: Property Tax Rebates Inefficient

* IHSA payroll under scrutiny: Altogether, the IHSA’s tab for “salaries, other compensation [and] employee benefits” totaled nearly $3.1 million for the last school year, 2012-2013, up 21 percent over the previous year.

* Republican Wozniak takes shot at Democrat Smiddy over budget votes

* Editorial: Quinn, get off the ropes and sign city pension bill

* Legislator rolls dice that letter will revive gambling bill

* Casino association opposed to slots at racetracks proposal; revenue at riverboats down since 2007

9 Comments

|

Today’s numbers are depressing

Monday, May 19, 2014 - Posted by Rich Miller

* From a new study by Roosevelt University’s Illinois Consortium on Drug Policy…

In Illinois, 84% of all marijuana arrests are for misdemeanor possession and these arrests represent a sizable portion of arrests within the state. For example:

* Three year averages for marijuana misdemeanor arrests from 2010-2013 are over 41,000 per year;

* In comparison to FBI index crimes, arrests for marijuana misdemeanors were equivalent to 50% of arrests for all index crimes, that is serious and violent crimes;

* Compared to all drug arrests, marijuana misdemeanor arrests make up 39% of drug arrests – including sales and possession of controlled substances - in the state of Illinois;

* Of marijuana misdemeanor arrests, 85% of arrests were for possession of cannabis totaling less than 10 grams.

* More…

* In Champaign, 75% of marijuana misdemeanor offenders received a ticket instead of arrest […]

* In Chicago, 93% of misdemeanor marijuana possession violations resulted in an arrest and in only 7% of cases a ticket was issued […]

* Chicago was the only municipality studied with a marijuana arrest rate higher than the state rate, specifically 150% higher than the state average; and more than 230% higher than the U.S. rate

* Context…

* Illinois’s marijuana possession arrest rate is more than 150% higher than the national average;

* Illinois ranked third in the nation for the black to white racial disparity of marijuana possession offenders, despite the fact that marijuana use is the same between these two groups;

* In Illinois, African Americans were about 7.6 times more likely to be arrested than whites;

* Cook County made the most marijuana possession arrests of any county in the nation with

33,068 arrests in 2010 and also had one of the worst racial disparity rates in the nation;

* Illinois’ estimated spending for marijuana possession ranged from $78 million to $364 million

per year on marijuana possession arrests and adjudications.

* Related…

* Study: Despite new law, pot arrests still likelier than fines

* Pot Enforcement ‘Uneven, Unjust,’ Says Roosevelt University Study: Chicago’s 2013 arrests actually increased in some areas, “predominantly minority neighborhoods on the city’s South and West sides.”

* Chicago cops likely to arrest — not ticket — for pot possession

39 Comments

|

*** UPDATED x3 *** Rauner at home and at ease

Monday, May 19, 2014 - Posted by Rich Miller

* ABC 7’s Charles Thomas scored the first interview of Bruce Rauner at his home…

Rauner still lives in the house he built 20 years ago. By far it is not one of the largest or most expensive homes in tiny Winnetka.

“I’m not into conspicuous consumption at all,” he said. “That’s not of interest to me.”

Trulia estimates the house is worth about $2 million, which ain’t much considering the man’s fortune, which he estimated to Thomas runs in the “hundreds of millions of dollars for sure.” From a screen cap…

And a satellite view…

…Adding… Satellite view of the governor’s private house…

* But Rauner doesn’t appear to put on airs with his biker buddies…

He’s a member of the A.B.A.T.E. Motorcycle Club whose leader said Rauner joined in 2008.

“I was shocked when I heard,” Patrick Jones said of Rauner’s wealth. “To us he’s just a regular guy.”

The piece included footage of Rauner shaking hands with a biker who has a Confederate flag on his jacket arm (a detail I hadn’t noticed until someone with the Quinn operation pointed it out last night)….

*** UPDATE 1 *** The Quinn campaign is now trying to make this an issue…

Illinois Leaders Call for Apology After Bruce Rauner Embraces Supporter Wearing Confederate Flag

CHICAGO – Cook County Board President Toni Preckwinkle, Secretary of State Jesse White, Congressman Bobby Rush, Congresswoman Jan Schakowsky, Congressman Danny Davis, Congresswoman Robin Kelly and Cook County Recorder of Deeds Karen Yarbrough issued the below statement rejecting Bruce Rauner’s television appearance warmly embracing a supporter wearing the Confederate flag. The story was a profile about Rauner and the people with whom he hangs out, including a man wearing the Confederate flag with the inscription “Fighting Terrorism Since 1861″:

“It is shocking to see Republican candidate for Governor, Bruce Rauner, warmly embracing a supporter wearing the Confederate flag.

“Bruce Rauner owes the people of Illinois an apology.

“There’s no place in the Land of Abraham Lincoln for the Confederate flag, a symbol of racism and slavery.

“There’s one and only one flag of the United States of America - the stars and stripes.”

I didn’t notice that inscription.

*** UPDATE 2 *** Rauner responds…

I really doubt he saw that flag patch when he shook the guy’s hand. This is more of an advance staff error than a Rauner error.

…Adding… No way did he say “condones.” Nobody’s that stupid. That’s gotta be a typo. I’ve asked Monique for clarification.

*** UPDATE 3 *** As I suspected…

[ *** End Of Updates *** ]

* And, finally…

He says he would not be surprised if democrats uncover more scandals involving some of the companies in which his company has invested.

“Human beings aren’t perfect and we’ve invested in thousands of executives and sometimes their behavior isn’t what it should be,” he said.

147 Comments

|

The pension militia?

Monday, May 19, 2014 - Posted by Rich Miller

* Make sure to read the last sentence in this section of Doug Finke’s latest column…

The state finally filed its response last week to the five pension-reform lawsuits.

It essentially raised the arguments most thought it would. The pension debt is so severe that the pressures it was putting on the state’s efforts to meet its other obligations justifies the reforms.

Opponents of the reform law have argued pension benefits represent a contract between the state and public employees and thus cannot be changed. The response from the state, though, says the extraordinary nature of the problem allows the state to modify those contracts, including those established under the pension-protection clause of the Illinois Constitution.

At least, it appears that way. The pension-protection provisions are under Article XIII of the state Constitution. The state’s response makes reference to Article XII, which deals with the militia.

Oops.

52 Comments

|

A new twist to an old game

Monday, May 19, 2014 - Posted by Rich Miller

* My weekly syndicated newspaper column…

Every year, we get at least one “corporate fight” in Springfield. Two or more corporations or industries will duke it out over some proposed law change or another.

The cable TV industry, for instance, tried a while back to convince the General Assembly to tax satellite TV users. When I first started doing this job many moons ago, banks wanted the right to sell insurance to the public, which the insurance agents’ lobby opposed, as did a union which represented some insurance agents. The banks fought for years and eventually won.

This year has been relatively quiet until probably a few weeks ago. Psychologists want the right to dispense prescriptions to their patients, even though they’re not medical doctors. The doctors are opposed and so are the psychiatrists. Both sides recently hired a bevy of Statehouse lobbyists.

But the biggest issue to develop this spring was the fight between taxi company owners and ride-sharing companies Uber and Lyft. Rather than call a cab company or wave a taxi down on the street, ride-share consumers use smart phone apps to book their rides. It’s become hugely popular in many cities around the world, but taxi company owners see the industry as an encroachment on their turf.

The ride-share companies started operating in Chicago without so much as a “How do you do” to the local government regulators and the fairly heavily regulated taxi companies retaliated. They initially tried to put the ride-sharing companies out of business with a ridiculously over the top bill.

Attempts at compromise failed. Eventually, a somewhat reasonable bill emerged, but Uber and Lyft fought it hard and both sides bulked up. Their spending rapidly escalated as independent contract lobbyists were hired left and right.

But the Statehouse spending may not have stopped there.

Earlier this month, some wealthy taxi company owners converged on Springfield and met with the Legislative Black Caucus at their headquarters near the Statehouse. The taxi owners’ goal was to convince the legislators to support tough – some would say too tough – regulations of Uber and Lift. Most House Black Caucus members subsequently voted for the regulatory bill, along with the vast majority of most other state Representatives.

Rumors soon began flying, though, that the taxi owners had donated money to the Black Caucus Foundation’s annual golf outing. The Foundation is a private, not-for-profit organization that raises money for things like college scholarships.

Maze Jackson, a former Statehouse lobbyist, was named the Foundation’s executive director effective March 1st. Jackson terminated his lobbying registration in late February. Before he did so, he worked with a lobbying firm that now represents the taxi industry.

Jackson admitted last week that he had held “discussions” of a “possible” donation, but he flatly denied that anything was solidly pledged and defended the talks because, he said, they were not directly related to any legislation. The donation wasn’t discussed at the meeting with legislators, he insisted. The Foundation is prohibited from being involved in politics, and Jackson said he’s committed to raising as much money as he can from anyone he can for minority scholarships.

Black Caucus Chairman Rep. Ken Dunkin(D-Chicago) also flatly denied that anything untoward had taken place. Other members of the Black Caucus, however, privately expressed worries that the situation could taint their Foundation in an era when even a slight appearance of impropriety can invite a federal probe.

Jackson also claimed that a lobbyist for a ride-sharing company had approached him about making a donation. But that lobbyist said that he was conversing with Jackson at the Statehouse and Jackson casually asked him what he was working on. When the lobbyist told Jackson that he was lobbying for a ride-sharing company, Jackson said that the taxi companies had already donated to the Foundation. The lobbyist said he told Jackson that his company would probably do the same, but he said he never actually followed up with his client.

One of the ride-sharing companies pushed this story hard last week in what was apparently a last-ditch attempt to derail the regulatory package. So far, though, the legislation appears to be on track.

There is no solid evidence right now of any direct quid pro quo here. Obviously, though, this doesn’t look good on its face. At all. And it needs to stop.

Thoughts?

10 Comments

|

* My latest column for Crain’s Chicago Business…

Chicago property taxes are most likely rising soon. But that doesn’t mean Chicagoans have to be happy about their plight.

I commissioned a poll on May 14 to gauge just how deep the anger really is.

It’s deep. Deep Tunnel deep.

“Despite recent pension reform legislation in Springfield,” respondents were told, “the city of Chicago must still come up with $50 million next year and $250 million a year in five years to fully fund just two of the city’s six pension systems. Mayor Rahm Emanuel says property taxes will likely go up to prevent cutting needed city services. Do you agree with Mayor Emanuel that a property tax increase is probably necessary?”

Click here to read the rest and see the results for this and other polling questions. Subscribers have crosstabs.

* Meanwhile, Greg Hinz has a new Crain’s column entitled “Emanuel’s still strong, but here’s how he could lose in 2015″…

In politics, you can get away with not being liked. Or you can be a governmental failure who can’t get much done. But you can’t be both at once and, however Mr. Emanuel defends himself, that’s the narrative that’s increasingly playing around Chicago.

Discuss.

35 Comments

|

* From AFP-IL director David From…

AFP-IL is launching a new ad today aimed at holding Gov. Quinn and legislators accountable on their promise that the tax hike is temporary. It’s a $140,000 cable buy running in markets across the state, specifically the NW Cook Suburbs, Quad Cities, Will Co., Metro East, and Springfield markets.

The TV ad is the next effort to complement AFP’s mail and grassroots campaign in a dozen House districts.

* Rate it…

…Adding… Script…

They say nothing lasts forever.

Unless you’re Governor Pat Quinn.

Three years ago, when he raised taxes by 67 percent, he promised it would be temporary.

Now, he wants to make his “temporary” tax hike permanent and continue the overspending.

Quinn’s policies are costing Illinois – we have the third highest unemployment rate and people are fleeing our state for places with LESS taxes and MORE opportunity.

Tell Pat Quinn we don’t want another tax hike or broken promise.

40 Comments

|

|

Comments Off

|

An interesting development

Friday, May 16, 2014 - Posted by Rich Miller

* RxP Illinois, which is pushing a bill to allow psychologists to receive extra training and supervision so that they could prescribe medication. The group sent this e-mail to its supporters today…

We are hearing from legislators that they are concerned by the number of psychologists calling in opposition to SB 2187. Please make some time to give your Representative(s) another call in the Springfield office today or early next week. They will be in Springfield every weekday until they adjourn for the summer.

If you have social worker, counselor, or nurse colleagues who are supportive of SB 2187 or have neighbors or friends who are supportive and have not called yet, please ask them to do so also. We need to keep making the point that many more psychologists and associated professionals and citizens are supportive of SB 2187 than are opposed.

I’m not sure yet if those are organized phone calls or not, but check out the comments under a recent op-ed by Sen. Don Harmon, the bill’s main Senate sponsor. You’ll see quite a few comments by opponents who say they’re psychologists.

15 Comments

|

Question of the day

Friday, May 16, 2014 - Posted by Rich Miller

* House Speaker Michael Madigan confirmed today that Gov. Pat Quinn will address the House Democratic caucus on Monday…

Quinn will reportedly talk about his tax hike extension plan, among other things.

* The Question: Top talking points the governor will use to convince House Democrats to vote to permanently extend the income tax hike?

It’s Friday, so have fun.

43 Comments

|

Today’s numbers: 4 million and 20,000

Friday, May 16, 2014 - Posted by Rich Miller

* If true, that’s almost a third of the state’s population…

Approximately 4 million people in Illinois currently have some type of arrest or conviction record that would show up on a routine background check, said Anthony Lowery, director of policy and advocacy with the Chicago-based Safer Foundation, an organization focused on reducing recidivism rates.

“You may find a few employers who may understand the need for providing second chances, but the majority of employers don’t,” he stressed. “This has been a long-standing battle over the years to just level the playing field [and] provide people who show that they’ve rehabilitated their lives the opportunity to just work. I think the simplicity of work is the most direct link to reduce recidivism, saving taxpayers in this state millions of dollars in the associated costs of incarceration.”

Illinois already prohibits state agencies from asking about criminal history on initial government job applications. Job applicants no longer have to check a box on state employment applications indicating whether they have pled guilty to or been convicted of any criminal offense other than a minor traffic violation.

* On to our second number…

Under the Juvenile Court Act, both arrest and court records for juveniles in Illinois are confidential and sealed. That sounds pretty off-limits. So why should people have to spend time and money to expunge juvenile records, if they’re already protected? […]

These are jobs in which the application form will typically include a request for authorization to run a background check. Once a prospective employer sees that, “even while you may figure that these records are sealed and you don’t have to worry about them,” Hamann said, “there’s a whole number of exceptions where it’s within their right and it’s commonplace for them to consider juvenile arrest records.”

He says that includes the Chicago Park District and many government jobs. […]

In 2013 there were about 26,000 juvenile arrests in Cook County. A little over 20,000 of those were arrests that never led to formal criminal charges. Now, bear in mind that juvenile records can’t be expunged until a person turns 18. So each year you have people in the pipeline, coming of age, who are eligible for those expungements. But as you see in the chart above, in 2013, there were only 660 juvenile records expunged in all of Cook County.

38 Comments

|

Credit Unions – Individual service, united in focus

Friday, May 16, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

As not-for-profit financial cooperatives, credit unions hold a strong belief in giving back to their communities at the credit union level and on a geographic basis. Twenty-four chapters unite the state’s 333 credit unions and are integral to fulfilling their mission for nearly three million consumer members. Like the boards at credit unions, chapter boards are also run by volunteers. The Illinois Quad Cities Chapter alone serves 10 credit unions and their 234,000 members in a three county area. Similarly to other credit union chapters, Illinois Quad Cities is particularly active in community charitable activities and worthwhile causes. This includes helping consumers protect their personal information by sponsoring community shred days to properly dispose of documents. The chapter also hosts “community nights” to provide local organizations a forum to request financial support. As a result, more than $15,000 has been provided to a variety of local charities. Motivated by their stories, credit unions separately hold fundraisers to support these groups, as well participate in events for others, including the local children’s hospital. Members know credit unions will be there for their daily financial needs and support their community – just some of the many virtues that define the credit union difference.

Comments Off

|

Rant of the week

Friday, May 16, 2014 - Posted by Rich Miller

* Fox 32 reports on the often contentious appropriations bill debates yesterday…

The Illinois House was voting all day, and sent one appropriations bill after another to the State Senate. However, angry Republicans, and several suburban Democrats, complained that the Democratic majority is spending money the state doesn’t have.

They had signs asking, “Temporary?”

It was a mocking reference to the state income tax increase that is scheduled to roll back next January.

* One of the signs…

* But the Democrats did have a response…

Democrats, however, say Republicans only want to criticize, and haven’t put forth a plan of their own.

Representative Jay Hoffman (D-Swansea) says he searched for the Republican budget everywhere. He even asked his dog.

“And I said, ‘Willie, did you eat the Republicans’ plan?’ But he wouldn’t do that to you, he’s a good dog, he would never eat your plan,” he said. “You know what your plan is? Your plan is to not have a plan.”

Regardless of what you think of the debate, Hoffman’s full speech was hilarious. Our good friends at BlueRoomStream.com isolated it for me last night, but their live video host livestream.com has been down since late last night. I asked Amanda Vinicki at WUIS if she could post a copy of Hoffman’s entire rant. Listen to the whole thing…

Heh.

28 Comments

|

*** UPDATED x1 *** This Is Illinois

Friday, May 16, 2014 - Posted by Rich Miller

*** UPDATE *** AP…

The 16 flights cost a total of about $7,400. This is the first year of a three-year program that’s largely funded by federal dollars.

[ *** End Of Update *** ]

* Scott Reeder…

Our cash-strapped state government has found a new use for its fleet of aircraft – flying birds into Illinois.

I kid you not.

State aircraft are flying to Kansas and transporting prairie chickens back to the Land of Lincoln.

And at a time state lawmakers are looking at raising the state income tax, Illinois state employees have been hiking across Kansas trapping these chickens.

Talk about fowl fiscal deeds.

State pilots have flown between Illinois and Kansas not once, not twice but 14 times this year taking prairie chickens to downstate Jasper and Marion counties.

“Illinois is the Prairie State and prairie chickens are an endangered species here, so we thought it would be a good idea to bring them back,” said Scott Simpson, site manager for Prairie Ridge State Natural Area in Newton, Ill.

The feds are chipping in $337,000 toward the program and the state will pay $117,000. Some of the cost to state government may be offset by private fundraising done by the Audubon Society, Simpson said.

* The AP has the state’s response…

Illinois Department of Natural Resource spokesman Chris Young says the greater prairie chicken is a threatened species. He says the state started a program this spring to bring the chickens to the Prairie Ridge State Natural Area near Effingham to increase their dwindling population. Young says the Kansas chickens are needed to improve genetic diversity. The state has brought about 90 chickens to Illinois on multiple flights.

Young says hunting and fishing license fees along with private donations pay the rest.

* And we’re getting the birds from more states than just Kansas. From Minnesota Public Radio…

In the past few years, several hundred Minnesota chickens have been captured and relocated to help rebuild populations in North Dakota, Illinois and Wisconsin. There’s even talk of moving Minnesota birds to Texas to help save a cousin, the Atwater Prairie Chicken.

Missouri is also getting threatened birds from Kansas, but they’re driving the birds, not flying them.

65 Comments

|

* Attorney General Lisa Madigan responded yesterday to the multiple lawsuits filed against the pension reform law. The Tribune’s Rick Pearson has a very good story about her arguments…

In arguing to uphold the law, Madigan’s office contended that since 2000 and the subsequent recession, the state’s underfunding of the pension systems “contributed significantly to a severe financial crisis…that adversely affected the long-term financial soundness of those retirement systems, the cost of financing the state’s operations and outstanding debt, and the state’s abilty to provide critical services to Illinois residents and businesses.

“Although the systems have been underfunded for many years, their underfunding now greatly exceeds the state’s annual budget for all categories of expenditure, including, without limitation, public education, public health and safety, medical coverage for the poor and for current and retired public employees, road construction, repair and maintenance, and all other public services provided by state employees,” the attorney general’s response to the challenges said. […]

The state’s response also argued that a significant driver of the unfunded liability, annual 3 percent compounded cost of living adjustments on retiree pensions, was not a “core benefit” that would be protected by the state constitution.

The law “is a permissible exercise of the State of Illinois’ reserved sovereign powers (sometimes referred to as the State’s police powers),” Madigan’s response said, adding that those challenging the statute “cannot sustain their burden of establishing that (it) is unconstitutional.”

* Here are AG Madigan’s four five responses…

* We Are One lawsuit

* ISEA lawsuit

* Doris Heaton et al vs. TRS

* State University Annuitants Association vs. SURS

* ADDING: RSEA lawsuit

88 Comments

|

Another cart before the horse

Friday, May 16, 2014 - Posted by Rich Miller

* I’m assuming that we’ll be hearing more about this in the not too distant future. From yesterday’s approp bill debates, here’s a choice nugget from the Sun-Times…

Republicans also injected some election-year politics into the debate, focusing on the federal investigation of Gov. Pat Quinn’s now-disbanded Neighborhood Recovery Initiative and asking whether anti-violence spending tucked into some of Thursday’s budget bills represented a continuation of that botched 2010 program.

In one instance, Rep. Jeanne Ives, R-Wheaton, zeroed in on a mysterious $15 million grant program for at-risk communities that Democrats inserted in the state Department of Labor budget with little to no explanation of its purpose.

“Can I have the criteria for qualifying for this grant program?” Ives asked Arroyo, who sponsored that spending bill, as well.

After a brief back and forth with Ives, Arroyo answered, “We’ll develop the program after we pass this budget.”

“You cannot make this stuff up,” Ives shot back in disgust. “I hope people are watching. This is appalling. This sickens me.”

I gotta agree with Ives on this one. Bad move.

* And speaking of the NRI, this is from the Senate Republicans…

The Legislative Audit Commission will begin its review of the NRI audit at a meeting scheduled for May 28, 8:30am. We anticipate Auditor General Bill Holland will present the audit, the findings and the recommendations before taking questions from Commission members. If time permits, the Audit Commission will hear from Jack Cutrone, CJIA head, as well.

23 Comments

|

House budget roundup

Friday, May 16, 2014 - Posted by Rich Miller

* Reuters…

Democratic lawmakers pushed dozens of fiscal 2015 appropriations bills through the Illinois House of Representatives on Thursday over protests largely from Republicans that the money does not exist to pay for higher spending.

The bills for the budget that takes effect July 1 were based on Governor Pat Quinn’s preferred spending plan that calls for making permanent higher income tax rates that were put in place in 2011 and are scheduled to partially expire on January 1. But instead of voting first on the taxes, Democratic House Speaker Michael Madigan decided to start with appropriations.[…]

At the beginning of Thursday’s marathon budget session, House Republican Leader Jim Durkin said that the budget process was taking the wrong turn.

“We are voting today for an unconstitutional budget, plain and simple,” he said.

* Illinois Issues…

The plan approved [yesterday] was largely based on Gov. Pat Quinn’s budget proposal, which calls for an extension of the current income tax rates. The rates are scheduled to begin stepping down in the second half of next fiscal year. The plan would increase spending for K-12 and higher education, as well as human services. The spending includes several line items specifically requested by Quinn, including increased funding to the Monetary Assistance Program (MAP) for low-income college students, additional funding for maternal and early childhood health programs, money to turn two shuttered youth centers into special treatment centers for mentally ill and substance addicted adult inmates and raises for home health care workers.

Still, the plan would not fully fund General State Aid to schools. GSA has been prorated for the last three years. The legislation passed today would fund GSA at 90 percent. Some Republicans argued that if there is going to be a tax increase, more of the money should go to education. The line item for transportation would be funded at 83 percent. “We’re spending more money than at any time in history and the question is where is the money? Cause it doggone sure is not in education,” said Rep. Chad Hays, a Catlin Republican. “Where is the money? This process doesn’t add up.” Lewiston Democratic Rep. William Davis, who is chairman of the House K-12 education budgeting committee, said that K-12 education would be getting a bigger chunk of revenue than other areas of the budget. “Tell me someone in this chamber who doesn’t run on some education platform—that they support education and want to see it fully funded? I think we all agree on that. But I think the reality is that there are always some limitations. We don’t have an unlimited pot of resources that we can use.”

* Daily Herald…

On scores of votes, state Reps. Sam Yingling of Grayslake, Marty Moylan of Des Plaines, Anna Moeller of Elgin, Stephanie Kifowit of Aurora and Deborah Conroy of Villa Park voted “no.” The five could face tough Republican opponents in November.

“It’s irresponsible to vote for a budget with a fictional income source,” Yingling said in a statement.

And Moylan said he’s opposed the tax extension and therefore couldn’t vote for a budget that relies on its money.

Other Democrats who have had competitive races in the past — state Reps. Michelle Mussman of Schaumburg, Fred Crespo of Hoffman Estates, Elaine Nekritz of Northbrook and Kathleen Willis of Addison — voted “yes” on the budget.

* SJ-R…

Among those voting for most of the bills was Rep. Sue Scherer, D-Decatur, who previously said she is against extending the temporary tax hike and even co-sponsored a bill in 2013 to immediately eliminate the tax increase. The bill never came to a vote.

Scherer received substantial financial support from House Speaker Michael Madigan, D-Chicago, both in her first election campaign in 2012 and again this spring in the primary election during which she successfully fended off a challenge from Gina Lathan of Springfield.

Scherer said Thursday her votes for the budget do not indicate she will vote to extend the temporary income tax increase.

“My feeling has not changed,” Scherer said. “There’s not been a single vote taken today about taxes. I know there are people trying to say this is a tax vote. This is a budget vote, which is not an annual financial report. It’s a budget vote.”

* Illinois News Network…

“I’ve been visited a lot today by people who know the extension is going to be very vital for social services, hospitals; they’ve all contacted me,” state Rep. Daniel Beiser, D-Alton. “What I’m trying to do right now is I’m trying to figure out what’s best for my district. … What if we don’t extend the tax? What’s going to be cut in my area? Because I don’t need one more job cut in my area. I don’t need anything else closed. I’m going to take all of that into consideration and I’m going to do what’s best for my district.”

His view was echoed by state Rep. Mike Smiddy, D-Hillsdale.

“We have two and a half weeks left in the session to look at whether or not people want to keep the … tax increase that was put into effect three years ago,” he said. “I think we could’ve done things a little bit differently. I’m a freshman down here and whatever they decide to do, I have to make the best of and make my decisions on how I would like to vote.”

* Sun-Times…

In a late development Thursday filled with political intrigue, House Speaker Michael Madigan, D-Chicago, invoked a rare parliamentary maneuver that blocks the spending bills from being sent to the Senate, keeping them under House control. […]

The day offered no clarity on whether House Speaker Michael Madigan, D-Chicago, was making any headway toward reaching the necessary 60 House votes from his 71-member caucus to keep the temporary income-tax increases from rolling back in January. At one point Thursday, the Capitol Fax political blog estimated that Madigan’s headcount stood at a mere 53.

“He hasn’t given me a number, but I think we’re a decent ways away,” Madigan spokesman Steve Brown said late Thursday, when asked how far his boss had to go to reach the 60-vote threshold.

That estimate was made before the votes were clear yesterday. Subscribers know more.

* Also…

House Speaker Michael Madigan has filed a motion that will effectively prevent the more than 70 budget bills passed today from automatically going to the Senate. Madigan told the Chicago Tribune that the move was needed in case the House wanted to further amend the bills.

* WUIS…

There are other possibilities: there are murmurs of meeting in the middle; instead of keeping the tax rate where it is or letting it drop to 3.75 percent, choose a number in between.

Other lawmakers say Illinois could come up with more cash by closing so-called corporate loopholes, or reducing the portion of state taxes shared with cities and towns. The problem is, neither of those ideas would match the amount of money Illinois would rake in through a higher income tax.

Which leaves Democrats scrambling to herd their members.

* The typical taxpayer is forking over about $1,100 more this year as a result of the tax hike, according to government numbers crunched by the AP…

Number of Illinois taxpayers: 5.99 million

Average taxable income: $55,000

2014 average state tax liability at 5 percent: $2,750

Average liability at 3 percent rate: $1,650

Average liability at 3.75 percent if tax is rolled back: $2,062

Average reduction with the rollback: $688

* From House GOP Leader Jim Durkin’s press release…

Leader Durkin has sent a letter requesting an Attorney General opinion regarding the constitutionality of an appropriation of public funds in a state budget, where the appropriations listed in the budget exceed the funds estimated by the General Assembly for that fiscal year.

House Democrats are expected to pass further budget bills next week and the total spending number is expected to climb and could reach a record high of $38 billion before adjournment.

* And there was also this quite harsh press release from Democratic freshman Rep. Sam Yingling…

State Representative Sam Yingling will once again assert his independence by voting against a State budget proposal promoted by Democratic leadership in the Illinois House. The series of budget proposals are based on the assumption that Illinois’ temporary income tax increase will be extended or made permanent, something Yingling staunchly opposes.

“It’s irresponsible to vote for a budget with a fictional income source,” said Yingling from Springfield, “I will fight against the income tax increase and it would be illogical, hypocritical, to vote for a budget on a premise I believe is the wrong direction for taxpayers.” […]

“I was elected to fight the status-quo, no be part of it. My area has among the highest property taxes in the County, asking people to pay more is beyond comprehension.”

27 Comments

|

* Sun-Times…

House Speaker Michael Madigan plans Friday to push a plan to ask voters this fall to decide whether Illinois’ lowest-earning workers deserve an increase in pay. […]

Madigan’s legislation is posted for a Friday morning hearing in Springfield. Brown said a floor vote on the measure likely will come next week. […]

As much as Madigan is seeking input from voters on the question, his push also could help spur turnout in the Democratic Party base and help Quinn in what is a tight re-election bid against Bruce Rauner.

The referendum also keeps alive what key Democrats believe is a potent campaign weapon against Rauner, the multimillionaire private equity investor who has waffled on the question of whether to require employers put more in the pockets of Illinois’ lowest wage earners.

* Tribune…

Under the measure, voters could voice their opinion on whether the minimum wage in Illinois for adults over the age of 18 should be raised to $10 an hour by Jan. 1. With the first-of-the-year trigger date, the referendum could place the matter on the legislative agenda in the post-election fall veto session, since it’s unlikely to pass before lawmakers go home at month’s end. […]

Democratic Sen. Kim Lightford of Maywood said approval of a referendum could help her bid to pass a minimum wage hike in the Senate, where she believes she is a couple of votes shy of the 30 needed to pass. The idea of a referendum gained currency as Madigan, who doubles as Illinois Democratic Party chairman, and U.S. Sen. Dick Durbin, D-Ill., suggested the issue should go before the general public to build support, Lightford said.

As we’ve discussed before, this is a “win-win” for Madigan and Senate President John Cullerton. They avoid a fight-to-the-death showdown with groups like the Illinois Retail Merchants Association, put Bruce Rauner on the spot by making this a campaign issue and maybe gin up a little turnout in November.

*** UPDATE 1 *** From Dave McKinney…

*** UPDATE 2 *** Both unclear on the concept. Sun-Times…

Madigan got into a testy exchange with one Republican on the panel, state Rep. Jeanne Ives, R-Wheaton, who opposes his plan and justified her position from observations she collected as a tax preparer for eight years.