Reader comments closed for the weekend

Friday, May 9, 2014 - Posted by Rich Miller

* My mom doesn’t like loud music. Never has. It bothers her. And, unfortunately for her, she married a rocker and had five sons who loved to turn it all the way up. It’s a good thing for us that she had a lot of patience and a very strong sense of humor.

My dad always used to crank up the volume and sing this week’s song to my mom, whose name is Barbara. She’d usually roll her eyes and tell him to stop it, but always with a smile, albeit sometimes forced.

I actually grew to love this song over the years. It’s so loose, which is something the super-tight, even uptight Beach Boys weren’t exactly known for back then. The song was part of an album called “Beach Boys’ Party!,” which was made to sound like it was recorded during a party. Check out their version of the Beatles’ “I Should Have Known Better.” It really does sound like it was just a bunch of folks at an impromptu beach party singalong. You can almost see the campfire. It’s a fun little album.

Anyway, let’s hope Mom’s sense of humor is with her today…

Tried Peggy Sue

Tried Betty Lou

Tried Mary Lou

But I knew she wouldn’t do

Comments Off

|

Question of the day

Friday, May 9, 2014 - Posted by Rich Miller

* This Sunday is Mother’s Day. So, how about telling us your favorite story about your mom?

38 Comments

|

#SaveTheDE

Friday, May 9, 2014 - Posted by Rich Miller

* Last year, the folks who run SIUC’s student newspaper made an agreement with University President Glenn Poshard. They’d slash costs and Poshard would reallocate a little money to keep the paper afloat until a student fee could be approved. The Undergraduate Student Government approved a $9 fee to keep the daily paper going last December, while Poshard was still in charge. Carbondale Chancellor Rita Cheng backed the fee in February. The university’s Edwardsville campus has an $8 fee for a weekly newspaper, so the Carbondale fee wasn’t out of line at all.

Well, within six days of new SIU President Randy Dunn’s taking office, he and the board of trustees nixed the fee. Really bad move.

SIUC has the most committed alumni at the Statehouse. While the U of I alumni are incredibly organized statewide and are truly feared, Salukis have a tight-knit group of folks who make sure to unofficially watch out for the university’s interests. The Senate President’s chief of staff, the House Speaker’s spokesman, and on and on and on and on. That Saluki list is really long. I’m constantly amazed by it.

I’m assuming President Dunn is hearing from those folks this week.

What a wonderful little welcoming party they’ll be planning for his next Springfield visit.

* Then there’s this…

The paper’s closure would mean the end of the School of Journalism. There is no selling point without the Daily Egyptian, and future graduates will be less prepared than their peers who worked for college dailies. It renders us moot in the field of journalism; an already bleak job market.

The Daily Egyptian has former editors in prestigious positions around the country in media outlets such as the Chicago Tribune, St. Louis Post-Dispatch, Washington Post, Pittsburgh Post-Gazette, USA Today Weekly Edition and Almanac of American Politics.

Several of those folks took to social media yesterday to voice their opposition to President Dunn’s move.

* I’m no fan of journalism schools. At all. But my brother Devin received great hands-on training at the DE. I’ve known several people over the years who had the same experience at the paper. To me, newspaper reporting is more like a trade. I’m not sure that extensive classroom training is hugely important, but on the job training - and especially learning from real-time, real-life mistakes - can be crucial. And the DE, by all accounts, does a very good job.

Since the chancellor was for it, and the student government was for it and the other campus has a similar fee, I really don’t see the problem with allowing this small fee to proceed.

45 Comments

|

Drone bill clears both chambers

Friday, May 9, 2014 - Posted by Rich Miller

* SB2937 passed the House unanimously today and now goes to the governor. From the synopsis…

Provides that except as provided in the Act, a law enforcement agency may not acquire information from or direct the acquisition of information through the use of a drone owned by a private third party. Provides that in the event that law enforcement acquires information from or directs the acquisition of information through the use of a privately owned drone under the Act, any information so acquired is subject to the retention and disclosure requirements of the Act. Provides that nothing in the Act prohibits private third parties from voluntarily submitting information acquired by a privately owned drone to law enforcement. Provides that in the event that law enforcement acquires information from the voluntary submission of that information whether under a request or on a private drone owner’s initiative, the information is subject to the retention and disclosure requirements of the Act.

Senate Committee Amendment No. 1

Allows use of a drone without a search warrant, if a law enforcement agency is using a drone during a disaster or public health emergency. The use of a drone does not require an official declaration of a disaster or public health emergency prior to use. The drone may be used to obtain information necessary for the determination of whether or not a disaster or public health emergency should be declared, to monitor weather or emergency conditions, to survey damage, or to otherwise coordinate response and recovery efforts. The use of a drone is permissible during the disaster or public health emergency and during subsequent response and recovery efforts. Disaster and public health emergency have the meaning as defined by the Illinois Emergency Management Agency Act.

* From the ACLU…

With today’s vote on Senate Bill 2937, Illinois soon will have some of the most far-reaching regulation of the use of drones by law enforcement in the nation. This new bill builds on last year’s enacted law, and ensures that law enforcement cannot simply turn to the growing army of private drone operators to conduct surveillance and evade the current law’s regulations. We hope the Governor will quickly add these protections to Illinois law.

The emerging drone technology is a powerful surveillance tool. We must ensure that our laws keep current with this advancing technology in order to protect privacy in our state. This measure is consistent with our commitment to this process.

Discuss.

18 Comments

|

Fun with numbers

Friday, May 9, 2014 - Posted by Rich Miller

* GOP Rep. Patti Bellock and Sen. Dale Righter held a press conference yesterday to claim that Medicaid reform has turned into “un-reform.” From a press release…

Bellock and Righter said they feel an added sense of urgency because of recent meetings in which majority Democrats in the Senate and House of Representatives have been pushing for further unraveling of the agreed-to reforms.

“What we have seen since passage of the 2011 and 2012 laws is the ‘un-reform’ of the Medicaid system,” said Righter. “Where the reforms have been implemented, the state has experienced significant savings. However, these carefully negotiated reforms have consistently fallen short of projections and mandated goals because the Quinn administration and Democrat lawmakers refuse to implement the reforms as mandated in law and have quietly worked behind the scenes to undermine and disassemble the bipartisan reforms we enacted.”

In 2011, only 7% of Medicaid enrollees were in a managed care program, leaving the majority of Medicaid enrollees without a medical “home,” with many relying on more costly emergency room care. In response, the 2011 Medicaid reforms mandated that within four years, managed care enrollment was statutorily required to reach 50%. Well over three years later, and quickly approaching the end-of-year deadline, the number in managed care stands at an abysmal 16%.

The lawmakers stress this lagging enactment is indicative of the program’s overall implementation. Many provisions in the SMART Act have been ignored and program expansions have continued. Provisions limiting the number of prescriptions have not been enforced, and the third-party vendor hired to scrub the Medicaid rolls was relieved of its duties—despite saving the state more than $86 million after only reviewing 25% of total Medicaid cases.

* SJ-R…

Illinois Department of Healthcare and Family Services personnel were not available for comment Thursday, but department director Julie Hamos said in a statement that the state is on pace to meet the goals set out in the SMART Act.

“Since the implementation of that plan two years ago, we reduced Medicaid spending by $3.2 billion, and are now managing within that budget,” Hamos said.

She said the Act was passed with strong bipartisan support to put the state “on track to catch up with the nation’s other states by implementing coordinated care. As a result, we are on target to achieve the state’s 50 percent mandate by Jan. 1, 2015.”

She said the department’s goal is to provide better health care at a lower cost, “and we are doing that.”

The lag on managed care enrollment is indeed quite curious and deserves a much better response. Soon.

* However, Righter’s claim during the press conference that the effort to root out fraud was a “stunning success” caught my eye.

Bruce Rauner and many other Republicans have claimed that billions of dollars could be saved by kicking ineligible recipients off Medicaid. Yet, the outside contractor only found $86 million in savings? That’s not a “stunning success,” and it can’t even be easily projected out over the other 75 percent when you remember this crucial point by Doug Finke last December…

the ones that were checked first were mostly cases where the state already had suspicions. In other words, easy pickings. Once those are gone, it’s entirely possible the rate of fraud discovered will go down.

And what happens when the rate of fraud discovered goes down as most likely will be the case? Well, critics will contend it’s all Quinn’s fault.

36 Comments

|

Union wants Quinn intervention

Friday, May 9, 2014 - Posted by Rich Miller

* UNITE HERE Local 1 represents approximately 15,000 hospitality workers and casino workers in the Chicago area, including a couple of dozen workers at the Thompson Center food court. From a press release…

Today, food service workers at Great State Fare in the Thompson Center are calling on Governor Quinn to protect their jobs. Sodexo, the food service company that employs Great State Fare workers, is leaving its post at the State of Illinois building putting all 29 workers’ jobs at risk, some who have worked at the cafeteria for over two decades. Layoffs are expected to begin in the coming days. Workers are rallying outside of the State of Illinois building, home of Governor Pat Quinn’s Chicago office.

Sodexo workers at Great State Fare have recently ratified a collective bargaining agreement that improves their wages. The new contract would bring the lowest paid worker up to $10.35 an hour – more than the minimum wage increase to $10.00 that the Governor has been advocating. Yet, as the company plans to leave in the coming weeks, workers will not make it to the wage increase they’ve bargained for.

“Just as we’re about to make a more livable wage, we’re losing our jobs,” said Maria Sanchez, Sodexo worker at Great State Fare. “I’ve been able to rely on this job to support my family for over 20 years. But, now, I don’t even know if I will have job next week.”

In Illinois, a full-time worker earning the state minimum wage of $8.25 an hour makes approximately $17,000, which is far below the Federal Poverty Threshold of $19,790 for a family of three. By increasing the minimum wage to just $10.00, those that earn the current minimum wage would make an extra $4,800 a year.

Should Quinn intervene?

41 Comments

|

*** UPDATED x1 with photo *** Chicken man?

Friday, May 9, 2014 - Posted by Rich Miller

* It’s Friday, so a light post is in order. AP…

Things are getting a little fowl at the Illinois governor’s mansion.

A flock of eight clucking hens has moved onto Executive Mansion property, laying eggs that are eaten by guests dining at the home in downtown Springfield.

The chickens peck at flowers, recycle plant waste and provide manure for the gardens. They live in a donated coop that’s inside a fenced-in enclosure and are part of an ongoing sustainability effort.

Backyard chickens are legal in Springfield and several other Illinois communities. They’ve become increasing popular as part of a local food movement among other reasons.

* Erickson…

Located on the heavily landscaped grounds surrounding the 159-year-old Italianate home is a penned-in area home to eight laying hens.

The chickens have come home to roost at 5th and Jackson streets in downtown Springfield as one part of the governor’s ongoing sustainability initiative. […]

The chickens live in a donated coop inside of a secure fenced-in enclosure near Fifth Street and eat a mix of chicken scratch and vegetation from the gardens.

The hens are a range of breeds, including Rhode Island Reds and Ameraucana, which lay eggs that can be pastel shades of brown, green or gray.

There was a huge and very loud party Wednesday night at the governor’s mansion. I can’t help but wonder how the chickens felt about that.

*** UPDATE *** Rep. Greg Harris sent along this photo of himself posing with the chickens. He said the party didn’t appear to have bothered them at all…

Caption?

44 Comments

|

*** UPDATED x1 *** A justifiable warning

Friday, May 9, 2014 - Posted by Rich Miller

* Dan Proft warns legislators about voting to make the income tax hike permanent…

Liberty Principles PAC intends to monitor very closely the votes of those legislators up for re-election in November, such as the 11 House Democrat sponsors of HB 1064, who made a commitment to sunset the 2011 tax increases as originally promised.

I hasten to add that Liberty Principles PAC’s willingness to engage is bipartisan in nature, as was proven in the March primary election. We will also take an interest in the political future of any Republicans who would aid and abet defrauding Illinois taxpayers.

If we do not hold to account legislators who make promises they know they will not keep, we will beget more of those kinds of legislators. And if we do not have legislators who keep their promises, Illinois will keep losing businesses and families to states that do.

Liberty Principles PAC has a balance of more than $1 million in its campaign account currently. I am confident that figure will grow substantially between now and November.

* Set aside the rhetoric and Proft makes an extremely good point about HB 1064, which was introduced last year…

Reduces the rate of tax to 3% for individuals, trusts, and estates and 4.8% for corporations.

The bill’s sponsorship list…

Martin J. Moylan - Stephanie A. Kifowit - Sam Yingling - Katherine Cloonen - Natalie A. Manley, Deborah Conroy, Sue Scherer, Jerry F. Costello, II, Carol A. Sente, Patrick J. Verschoore and Kathleen Willis

Those legislators, plus historically anti-tax Democratic state Rep. Jack Franks, are more than enough to kill the tax hike extension on their own. If any of them flip, Proft and everyone else will have good reason to go after them.

*** UPDATE *** I also seriously doubt that former Rep. Keith Farnham’s recent replacement can be a “Yes” vote on the tax hike extension. That’s 13 total. The House Dems have 71 members with 60 needed for passage. Do the math. This ain’t gonna be easy or pretty.

68 Comments

|

* Tribune…

Cook County prosecutors are investigating a land deal that netted Circuit Court Clerk Dorothy Brown and her husband tens of thousands of dollars with no money down, the Tribune has learned.

Brown’s husband, Benton Cook III, confirmed that a grand jury is probing the deal, which saw him get a North Lawndale building for free from a longtime campaign contributor to Brown.

The court clerk quickly became a co-owner, and her company sold the parcel for $100,000 to a Frankfort real estate developer who’d long had his eye on it. The developer said Thursday that he testified before a grand jury earlier this year about how he came to acquire the land.

The investigation of the land deal comes as State’s Attorney Anita Alvarez’s office also is looking at money Cook received as part of a controversial state anti-violence program that Democratic Gov. Pat Quinn launched in fall 2010 as he was locked in a close election campaign. County prosecutors have issued subpoenas seeking documents related to the Neighborhood Recovery Initiative and specifically requested information about the agency that hired Cook. […]

Musa Tadros, the owner of south suburban Frankfort-based Crown Commercial Real Estate and Development, told the Tribune that he testified before a grand jury in January or February about the land deal.

It’s becoming even more clear that Alvarez’s probe of Gov. Quinn’s anti-violence initiative is a lot more about Brown than it is about Quinn - at least, for now.

* Meanwhile, from the Sun-Times…

Not long after taking over the budget committee of a state agency, Cook County Circuit Clerk Dorothy Brown voted by proxy to channel $5 million to a West Side nonprofit to help continue funding Gov. Pat Quinn’s now-disbanded Neighborhood Recovery Initiative.

That vote by Brown came at the same time the nonprofit, Chicago Area Project, employed her husband, Benton Cook III, to oversee millions of dollars in Neighborhood Recovery Initiative programming. The organization subsidized his paycheck with state anti-violence grant money.

It’s not clear whether any of the grant funds Brown authorized for Chicago Area Project’s use in September 2012 trickled into Cook’s paycheck since the nonprofit says he left its payroll in October of that year.

As I told subscribers earlier this week, that decision about CAP’s funding came directly from Quinn’s office. The vote was most likely a mere formality, and it doesn’t look like Brown’s husband got much, if any, benefit from it.

* But that didn’t stop the governor’s office from once again throwing Brown under the bus…

“If that’s the case, it’s unacceptable,” Quinn spokeswoman Brooke Anderson said of her vote. “Potential and actual conflicts of interest should always be disclosed by public officials and their designees. They should recuse themselves from decision-making on any matter involving a member of their family.

“The governor’s office has asked the authority’s chairman to look into this matter and act appropriately to address any conflict-of-interest issues,” Anderson said.

26 Comments

|

[The following is a paid advertisement.]

Credit unions are committed to several cooperative principles, including social responsibility. At First Illinois Credit Union in Danville, reaching out to area school children as part of their financial literacy program is a top priority. For over 20 years, the credit union has partnered with area schools, educated students in the classroom and has invited them to open savings accounts. Scholarships are awarded to graduating eighth graders. Members that are high school graduates are also granted scholarships. By giving out scholarships at school-wide functions, it affords the credit union the opportunity to provide financial education to hundreds of students in the audience. Educating children is just one facet of the credit union’s extensive outreach, which also includes breakfast meals for low income families, financial education for seniors during Money Smart Week, volunteering as a buddy at baseball games for children with disabilities, and many more local clubs and organizations. For all their efforts, First Illinois Credit Union has been recognized by their members and the community as a top financial institution. At the heart of the credit union philosophy is the principle of people before profits – and another reason why members are so fiercely loyal.

Comments Off

|

|

Comments Off

|

|

Comments Off

|

Chicago Tribune: Same Safety Standards for Ride-Share

Thursday, May 8, 2014 - Posted by Advertising Department

The following is a paid advertisement.

“As we’ve said before, the part-time/full-time distinction is meaningless to the customer ordering a ride. The same safety standard should apply to all ride shares and, yes, to taxis. We’re increasingly wary of leaving it to the ride shares to police themselves when it comes to making those checks, given (Uber’s) unapologetic disregard for rules. UberX just underscored that point.”

Chicago Tribune editorial, “UberX thumbs its nose at the rules,” May 8, 2014

Ride-share companies claim they can regulate themselves, but time and time again they prove they have no interest in following the rule of law or even in protecting their own passengers.

As the Chicago Tribune editorial board points out, the distinction between ride-share drivers is “meaningless.” What’s important is that everyone is held to the same fundamental public safety and consumer protection standards that come with the proper chauffeur licensing.

Instead, multi-billion dollar companies like Uber and Lyft continue to fight the same public safety protections that transportation companies currently follow, including HB 4075, which would provide safety standards for all drivers across the board.

Customers deserve to have the peace of mind knowing that their driver has passed a comprehensive police background check and drug test and carries sufficient insurance in case of an accident.

It’s time for these common sense safety standards for everyone in the transportation industry. Ask Uber why they would want less.

Vote YES on HB 4075 and support ride-share protections for all!

Comments Off

|

Downstate a big winner in Manar plan

Thursday, May 8, 2014 - Posted by Rich Miller

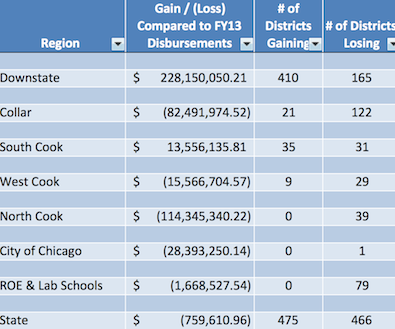

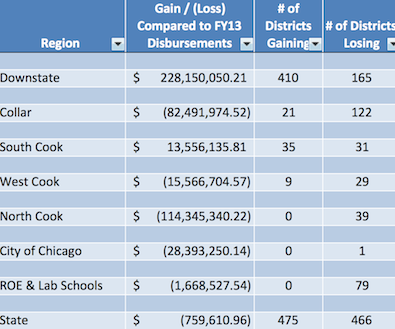

* After Republican outrage that Sen. Andy Manar’s school funding reform plan would provide a windfall to Chicago, it turns out that Chicago wouldn’t do all that well. From the State Board of Education’s analysis of the plan, which weights poverty rates much heavier on school funding…

* Finke…

Manar said the numbers show that the poorer school districts in the state fare better under his revised formula. By poorer, Manar said, that includes both districts with high numbers of students from poverty backgrounds and districts that have lower property values that do not generate enough tax revenue. […]

Manar said that the “most striking thing in the (report) is how far downstate districts lag behind in terms of funding. Downstate is very different than it was in 1997 when the current (funding) law was put in place and we have to account for those things to a better degree than we do today.”

That argument did not necessarily play well with Republicans who represent school districts in the suburban Chicago area. Sen. Matt Murphy, R-Palatine, said school districts in his area already supply 90 percent of their funding from local property taxes. Yet, under Manar’s revised formula, they would lose state assistance, with one district dropping $13 million in state aid.

“If that narrow amount that we get from the state is cut, what do people in my district, who already have high property taxes, do if they want to maintain the current funding level?” Murphy asked Manar at a committee hearing Wednesday. “It sounds like you are telling my constituents to raise their property taxes.”

* AP…

Schools in Palatine, Murphy’s hometown, would see an 87 percent decrease in overall state aid under the funds — about a $13 million dip compared to how much they received in the 2011-12 school year, the year the state board used to make the calculations.

Similarly, schools in Skokie and Evanston in Chicago’s northwest suburbs would lose 85 percent of state aid under the new formula. Meanwhile, Galesburg schools could stand to gain a 30 percent funding boost — about $5 million more a year than they receive now.

Schools in Red Bud, an Illinois suburb of St. Louis, would see an 83 percent decrease.

* Erickson…

State Sen. Dave Luechtefeld, R-Okawville, said many of the schools in his Southern Illinois district would gain under the proposal. He acknowledged it would be a tough vote for lawmakers in areas that would be losing state funds.

“It may not end up a Republican-Democrat issue,” Luechtefeld said.

The measure won approval in the Senate Executive Committee on a 10-3 vote with Luechtefeld voting “present.” He said the overhaul needs more work.

Republicans said the changes might be made more palatable if the state eases back on some of the programs and paperwork it requires of local school districts.

It remains unclear whether the House will take up the proposal if it emerges from the Senate. The plan was developed through a series of hearings in which the House was not involved.

Discuss.

50 Comments

|

The carrot and the stick

Thursday, May 8, 2014 - Posted by Rich Miller

* Let’s revisit yesterday’s Daily Herald story about how some municipal groups were contemplating whether to back an extension of the state income tax in order to possibly get a bigger piece of the revenue sharing pie or to ward off an attack by Democrats.

The story was based on a letter that DuPage Mayors and Managers Executive Director Mark Baloga wrote to his members…

You likely have seen recent news reports of Governor Quinn and Legislative Leaders discussing the opportunity for local governments to secure, or even increase, the local share of state income tax (aka “LGDF”) if the current 5% income tax rate is extended beyond its current sunset date of 2015. Senate President Cullerton directly addressed this topic with DMMC members on April 9 during our Springfield Drive Down. Since that meeting, our lobbyist has been in discussions with legislators and has conveyed the following:

1. Extension of the 5% income tax is almost certain to pass regardless of municipal support, opposition, or neutrality.

2. If municipalities and municipal groups uniformly oppose or fail to support the legislation, then it is also a near certainty that LGDF will be eliminated or severely cut. This would be framed as cutting state expenses to help balance their budget.

3. If municipalities and municipal groups such as DMMC support the tax rate extension, this could secure an increase in the local share of income tax and direct deposit of LGDF revenue—both long- standing DMMC legislative priorities.

4. Support for the tax rate extension would generate ongoing political capital for DMMC, other municipal groups, and municipalities themselves.

5. “Support” can range from a simple statement of organizational support, to individual mayors actively supporting the legislation and the legislators who vote for it, and anything between. More active support would result in even more political leverage on LGDF and other current and future issues.

After extensive discussion, the DMMC Legislative Committee (by unanimous consent, on April 25) and the DMMC Board of Directors (by a 9-4 vote, on May 1) approved DMMC’s conditional support for continuation of the 5% tax rate as long as the bill adequately increases the current 6% LGDF portion of income tax and provides for direct deposit of LGDF revenue to eliminate delays in payments to municipalities. The Board’s motion further specified using this opportunity to pursue additional legislative action including:

A. Stoppage of HB 5485 which would require negotiation of minimum staffing for fire departments and districts.

B. Consideration of additional legislative priorities such as expenditure authority for non-home rule hotel motel tax revenue.

C. Ability to participate actively in development of municipal public safety pension reform legislation.

That’s all really quite fascinating. A grand bargain laid open.

* OK, now back to yesterday’s Daily Herald story…

Cullerton spokeswoman Rikeesha Phelon said she couldn’t confirm the conversations between her boss and municipal leaders.

However, Phelon said Cullerton has said for months that mayors would see a smaller share of state income taxes if the rates don’t get extended.

“That’s not a threat,” she said. “That’s just math.”

In order to cut the municipal share, new legislation would have to be passed.

“This certainly sounds to me like out-and-out extortion,” said Madeleine Doubek, chief operating officer of Chicago-based Reboot Illinois, a voter-advocacy digital media group. “This just pulls back the curtain on the worst of Illinois government in action. Who, in this equation, is looking out for the taxpayers?”

* As I also told you yesterday in an update, Sen. Donne Trotter unveiled legislation yesterday designed to put heat on the mayors…

After facing years of funding cuts, Illinois’ schools could get more than $1 billion in new funding as State Senator Donne Trotter (D-Chicago) is urging his colleagues to truly make education the priority they claim it is.

Currently, mayors and village presidents get a cut of the state’s income tax with no strings attached. Trotter’s proposal ends that giveaway and instead steers the dollars – $1.45 billion in the upcoming budget year – to the state’s public schools in an effort to have the state finally live up to its education funding commitments.

* The bill had a hearing today. Trotter eventually pulled the proposal out of the record, but the SDems tweeted extensively during the debate…

Discuss.

6 Comments

|

* As I told subscribers on Monday morning, the Commission on Governmental Forecasting and Accountability has revised its Fiscal Year 2014 revenue estimate upwards by $588 million. Most of this is considered to be a one-time income tax windfall, so next fiscal year’s estimate was revised up by just $167 million.

Anyway, some Senate Republicans have a plan for spending some of that found money…

Thousands of state workers are owed an estimated 112 million dollars in back wages. Governor Pat Quinn negotiated raises with members of AFSCME back before the 2010 elections, but lawmakers never came through with the money to pay them. […]

“We’re not calling for any new spending, any new spending proposals here. We’re just asking for commitments to be honored. Bottom line,” [GOP Sen. Sam McCann] said.

Under McCann’s proposal, the rest of the extra revenue would be used to pay down the state’s backlog of bills. Illinois owes schools, hospitals, and many other service providers nearly five billion dollars.

Sounds like a good idea to me.

* Related…

* McCann still open to keeping current tax rates: “I don’t think the people of the 50th District sent me here, just like the people of everyone’s respective districts back home sent them here, to stick their fingers in their ears and not listen to what people have to say,” said Carlinville Republican Sen. Sam McCann. “They don’t send us here not to roll up our sleeves and go to work on their behalf. They send us here to engage.”

16 Comments

|

Today’s numbers are lousy

Thursday, May 8, 2014 - Posted by Rich Miller

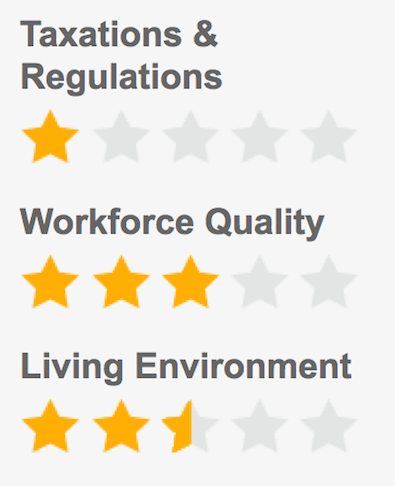

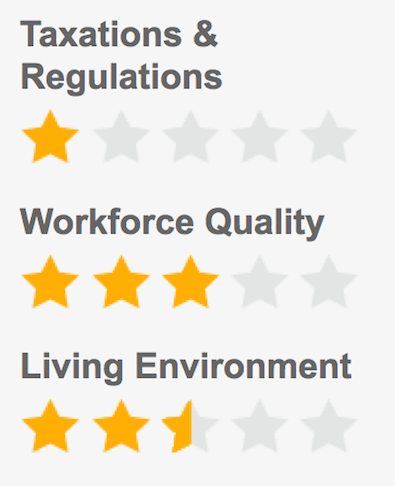

* Chief Executive Magazine ranked Illinois 48th in the nation for business…

Anti-growth hot mess can only coast on Chicago’s economic engine for so long.

And…

Oof.

* Numbers…

State GDP

% Growth ’11-’12: 1.9

% Growth ’11-’12 v. Nat’l Avg. (2.5%): -0.6

Unemployment

Unemployment Rate Dec. 2013 %: 8.6

Comparison with Nat’l Rate (6.70%): 1.9

Domestic Migration

Domestic Net Migration 2013: -67,313

Rank: 49

State Government

State Debt per Capita Fiscal Year ’13 ($): 5,569

State & Local Gov’t Employees per 10k Residents: 503.1

Oy.

* But considering all the screaming about taxes, our state/local tax burden is pretty average…

State-Local Tax Burden

Rate (%): 10.2%

Compared to Nat’l Avg. (9.9%): 0.34%

74 Comments

|

Rauner: “Step down” the tax hike

Thursday, May 8, 2014 - Posted by Rich Miller

* I thought about putting this in the post below about another temporary tax hike extension but wanted to wait until I heard back from the Bruce Rauner campaign about his statement yesterday regarding the tax hike. Sun-Times…

“I’m very much against keeping the tax hike permanent,” Rauner said. “They promised it would be temporary. We’re going to have a plan we’ll be coming out with soon on how to step that back down, all the way down.”

So, does “step that back down” mean a phaseout? That would be more like what Toni Preckwinkle did with the hugely unpopular sales tax hike - phased it out over a period of years.

I’m pretty sure he’s said this before, but if Rauner was being accurate about his position yesterday, phasing it out is actually a far more fiscally responsible approach than just eliminating the tax hike outright in January.

* The campaign offered no further insight today…

Bruce has always said he wants to get rid of the Quinn-Madigan tax hike and comprehensively reform the tax code so it is pro-growth and fair to all taxpayers. That is still the plan.

* Related…

* Quinn, Rauner address Illinois business leaders

* Quinn, Rauner paint different pictures of Illinois at business lunch

* Quinn, Rauner trade jabs in separate talks with business leaders

22 Comments

|

Under the bus he goes

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

One of the people behind Gov. Pat Quinn’s troubled anti-violence program is now heading a new initiative to reduce Chicago violence that’s backed by major businesses and Mayor Rahm Emanuel.

The Chicago Sun-Times reports that Toni Irving was a deputy chief of staff for Quinn when his Neighborhood Recovery Initiative was formed in 2010. […]

She told the newspaper she had no role in implementing Quinn’s program, but the newspaper says she chose grant recipients.

The Sun-Times reports that Irving helped steer the choice of the Chicago Area Project as “the main conduit for state anti-violence grants in West Garfield Park.” CAP then hired Dorothy Brown’s husband.

* There’s an interesting little political development in the Sun-Times story as well. Mayor Emanuel kinda threw Gov. Quinn under the bus…

At an unrelated news conference Wednesday, Emanuel sought to distinguish Get In Chicago from Quinn’s troubled Neighborhood Recovery Initiative, which was launched during the governor’s closely contested campaign in 2010. Republican critics have blasted the Quinn initiative as a political “slush fund” created to generate support for Quinn.

“First of all, this is private money. Totally different,” Emanuel said.

“If you were doing it only one-year and around the campaign season, I understand why people would get cynical. But given that it’s also in the years that there is no campaign, but it’s about safety, I would say look at the consistency over the four-year time.”

13 Comments

|

Today’s quotable

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Baise from the Illinois Manufacturers Association….

“I think business owners in this state have really gotten to the point that they want to see a change. … I think the business community’s perception of this state (is) if we don’t make a drastic change of some sort, a lot of my members who can will move, and I hear that lament over and over again.”

Baise has told me this more than once and he’s pretty darned adamant about it. Whether he’s right or wrong is beside the point. The guy who runs one of the most influential biz groups in the state truly believes an exodus is coming. And Baise is not someone who regularly engages in hyperbole.

64 Comments

|

SURS to re-interpret pension language

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

The State Universities Retirement System now says a troublesome piece of last year’s state pension-reform law may not cut retirees’ pensions after all.

William Mabe is the executive director of the retirement system. He said the language in law that would cost retirees’ a year of pension should be interpreted as if it didn’t – because it wasn’t intended to.

That’s based on the interpretation the Teachers Retirement System has been using when it looks at the law. Now SURS plans to follow suit.

* The News-Gazette broke the story…

Teachers also have a money-purchase option when they retire, and that annuity calculation was changed in the new pension bill as well. But the Teachers Retirement System chose to interpret the “legislative intent” of the added provision, preserving members benefits earned through June 30, 2014.

“From the get-go the way we read the law, the legislative intent was designed to hold members harmless,” said spokesman Dave Urbanek. “Our interpretation was fiscal year 2014 all along.”

The state pension code says that whenever a statute’s language is ambiguous, the interpretation must favor the employee, he said.

Only about 14 percent of teachers use that option when they retire, as opposed to approximately 60 percent of SURS retirees, officials said.

Mabe said SURS had been trying to get the problem fixed legislatively for months, and had been considering adopting the approach used by the teachers’ retirement system anyway when he received [House Speaker Michael Madigan’s] letter. There is legal precedent to support that approach, he said, and Madigan’s letter provided evidence of “clear evidence of intent.”

* From Madigan’s letter to Mabe…

With respect to the money purchase benefit, SURS is the only pension system interpreting the language in a manner that is inconsistent with the intent of the General Assembly. It is my understanding that SURS and the University of Illinois were directly involved in the development of the money purchase benefit language, and reviewed several drafts of the legislation prior to the General Assembly taking final action. At no point did SURS, University of Illinois, or any other pension system indicate there was a technical error with the language that would cause it to be inconsistent with the intent of the Conference Committee Report.

Given that members of the General Assembly have received numerous letters and emails regarding this issue, it is worth addressing the timeline related to the development of the language. The concept of changing the money purchase benefit was introduced on April 30, 2013, in House Amendment #1 to Senate Bill 1, and approved by the House on May 2, 2013. When the Conference Committee was appointed, the members of the Committee met with representatives from SURS and the University of Illinois, and together they drafted the language that ultimately became law. The pension systems were provided with copies of draft legislation throughout the fall and prior to the General Assembly taking action in December 2013. On November 26, 2013, legislative staff specifically asked each of the pension systems if there were any technical concerns with the language. At this time, SURS did not present this objection.

Legislative staff was advised that SURS preferred a hard date for the provision, but that this request was simply to ease administrative burden and would not impact the intent of the provision.

With respect to your concerns regarding the effective date of the bill and the method used to determine the effective rate of interest, again, SURS reviewed this language over the course of many months and did not present any objections. After passage, legislative staff was advised that these provisions could be difficult, but would not be impossible to administer.

While I support efforts to correct the technical error, I urge SURS to consider that its interpretation is inconsistent with the intent of the General Assembly, and also inconsistent with the way TRS has interpreted the same language. A similar reading by SURS may help ease the concerns of university faculty and personnel impacted by the language and assist with avoiding unintended consequences for our universities.

With kindest personal regards, I remain

Sincerely yours,

MICHAEL J. MADIGAN

Speaker of the House

30 Comments

|

CTU peace gesture on pension reform

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Hinz has an important story about a pension reform peace gesture by CTU President Karen Lewis…

During an appearance yesterday afternoon before the Crain’s editorial board, Ms. Lewis specifically said the union is willing to consider reducing benefits for those who still are working, although she emphatically ruled out changes for members who already have retired.

“There could be some modification (for current workers),” said Ms. Lewis, who has a reputation as a firebrand and who on May 5 opened the door to a second teachers strike in three years. “We’re interested in talking about modifications, yes.”

* Lewis said she wouldn’t talk about specific cuts until revenue had been negotiated. She’s generally opposed to raising property taxes and has floated things like a financial transaction tax (which was shot down by Mayor Emanuel yesterday) and a commuter tax, which is going nowhere. However, there’s another idea out there…

Ms. Lewis said Chicago Public Schools officials lately have been “more open to discussion [about revenue] than in the past.”

She didn’t say what they’re “open” to. A source who should know says a plan to dedicate revenue from expiring tax-increment financing districts is picking up steam because it would provide a revenue stream for pension bonds without raising the overall property tax rate above today’s level.

* On to Mayor Emanuel…

What he has ruled out — pointedly and specifically — is a transaction tax, a city income tax increase, and a commercial lease tax like the one championed by Mayor Harold Washington during the mid-1980’s. A Circuit Court judge overturned the six percent lease tax in 1986. The city appealed that decision, but the City Council repealed the tax before the city’s appeal was heard.

The mayor has also nixed the idea of using the jackpot of revenue from a Chicago casino to solve the pension crisis.

“I don’t think you should go to the roulette table with somebody’s retirement check. I’m not gonna do that,” the mayor said last month.

“How long has it been laying out there?… A lot of the credit agencies want something that’s reliable that they count on. I’m trying to stop the city from going to a place that I don’t think it can if we…do the morally responsible thing to ensure that every workers, every retiree gets a pension.”

14 Comments

|

Make it temporary again?

Thursday, May 8, 2014 - Posted by Rich Miller

* Rep. Jerry Costello is against making the tax hike permanent, or even extending it a few years, but suggests another temporary extension might be an alternate way forward…

There might not be enough votes in the House to make Illinois’ temporary tax hike permanent, so a one-year extension of the increase might be sought instead, according to a local lawmaker.

“They’re having problems — leadership in the Democratic Party — coming up with enough votes to pass a permanent extension of the tax,” said Rep. Jerry Costello II, D-Smithton. […]

“I think for some of the people on the fence, if they could say it was a finite situation, it would be easier for them. For me, it doesn’t change my position — I’m a ‘no,’” Costello said.

Steve Brown, a spokesman for Madigan, said he’s not aware of any plan to back away from the permanent increase, in favor of another temporary one.

“That’s news to me,” Brown said. “I know the speaker is supporting what the governor has proposed. The speaker has told the press in recent days that he’s continuing to work on that roll call.”

As subscribers know, the House Speaker is, indeed, having some problems with that permanent tax hike. But another temporary tax hike would mean yet another politically contentious tax vote in a few years, and the Speaker isn’t loving that idea.

Your thoughts?

48 Comments

|

|

Comments Off

|

|

Comments Off

|

ComEd rates to rise

Wednesday, May 7, 2014 - Posted by Rich Miller

* Tribune…

Customers who receive energy from Commonwealth Edison will see a 38 percent increase in the price of electricity as a result of rising costs to reserve power from power plants.

According to regulator Illinois Commerce Commission, the cost of electricity, coupled with reservation fees and transmission costs, will rise to 7.5 cents per kilowatt hour from 5.5 cents per kilowatt hour next month.

The average ComEd residential customer uses approximately 655 kilowatts of electricity per month, according to ComEd, which, together with delivery costs would increase bills by 21 percent from about $68 to about $83 per month.

* More from Steve Daniels at Crain’s…

ComEd’s price is largely in line with deals municipalities have struck recently with outside energy marketers to supply power to their residents and small businesses. In many cases, savings from these municipal contracts will be minuscule.

For example, ComEd’s 7.596 cents is slightly above the 7.47 cents average apartment and condo dwellers will pay in the city of Chicago under a one-year deal with Chicago-based Integrys Energy Services. That’s a less than 2 percent savings on just the energy portion of the bill and a 1 percent savings overall.

But owners of larger single-family homes, which consume more energy, actually will pay an energy charge of 7.63 cents, which is slightly higher than ComEd’s. […]

On the other hand, some suburbs still will enjoy significant savings from ComEd. The northern suburbs of Wilmette, Northfield, Glenview and Kenilworth, acting together in a consortium, recently negotiated a 6.72 cent-per-kilowatt-hour price with supplier MC Squared for the next year. That’s an 11.6 percent savings on ComEd’s energy price, or about 7 percent for the electric bill as a whole.

17 Comments

|

Today’s number: 150

Wednesday, May 7, 2014 - Posted by Rich Miller

* The Quinn campaign reacted today to the Rauner nursing home bankruptcy case and included a new claim…

This was an elaborately orchestrated scheme to cheat the legal system, defraud families and take advantage of those who were too vulnerable to care for themselves in order to make a buck.

But the grand scheme stretches beyond just Florida: Rauner and GTCR have been hit with at least 150 lawsuits in 15 different states, and they continue to roll in today.

47 Comments

|

*** UPDATED x1 *** Question of the day

Wednesday, May 7, 2014 - Posted by Rich Miller

* Back in 2011, several mayors openly opposed the income tax hike plan. As a result of that, and the fact that Democrats wanted to get every state dollar they could get in a very tough time, the revenue from the 2 point tax hike was not shared with local governments.

Things are apparently different this time around…

In a May 1 letter to members that was obtained by the Daily Herald, the head of the Oak Brook-based [DuPage Mayors and Managers Conference] urges municipal leaders to support keeping the state’s income tax rate at 5 percent to curry future “political capital” and possibly increase the local share of the income tax revenue.

“More active support would result in even more political leverage on (the Local Government Distributive Fund) and other current and future issues,” the agency’s executive director, Mark Baloga, wrote in the letter. […]

Baloga’s letter indicates the group’s support for keeping the higher tax rate would be “conditional” on increasing the share of income taxes that goes to towns and on direct deposit of that revenue into municipal coffers to end delays in state payments. […]

“It’s a statement of political reality,” he said. “We have heard again and again from our advisers that the extension is likely to happen regardless of anything DuPage Mayors and Managers does or does not do. The best way to protect or enhance those funds is to support the extension.” […]

Meanwhile, officials at the Illinois Municipal League, which also receives taxpayer funding from dues paid by member towns, has publicly announced its support of the tax rate’s continuation, but on the condition that the local share be increased to 10 percent.

* The Question: Should the state share any of the revenue from the 2-point tax hike with local governments if the tax hike is made permanent? Take the poll and then explain your answer in comments, please.

survey hosting

*** UPDATE *** As if on cue, here comes the heat. From a press release…

After facing years of funding cuts, Illinois’ schools could get more than $1 billion in new funding as State Senator Donne Trotter (D-Chicago) is urging his colleagues to truly make education the priority they claim it is.

Currently, mayors and village presidents get a cut of the state’s income tax with no strings attached. Trotter’s proposal ends that giveaway and instead steers the dollars – $1.45 billion in the upcoming budget year – to the state’s public schools in an effort to have the state finally live up to its education funding commitments.

“We cannot afford to ignore the fact that a strong education system is the key to our state’s future, especially with the looming proposition of extreme budget cuts when across the board tax breaks kick in at the end of this year,” said Trotter, a longtime advocate for public schools students. “Money with no restrictions on how it may be used in the hands of mayors and local officials is not a prudent expenditure of taxpayer dollars given the realities we face. If we have to prioritize state funding, I believe that education should always be at the top of our list.”

Existing law takes 6 percent of all the individual income money and nearly 7 percent of all corporate income tax net collections and sends it to local governments. The funding is based solely on population. Need is not a factor.

Meanwhile, Trotter’s plan would reverse the recent trend of the state failing to live up to its own school funding expectations, with the current budget only providing 89 percent of what the state says it should be providing. To help remedy this situation, Trotter’s plan would fill that gap and potentially allow for an increase.

“We face a lot of tough decisions in our budget. In a funding fight between city hall and the classroom, I’m always going to side with the school children. If our students and schools aren’t our top priority then our future is truly in trouble,” Trotter said.

27 Comments

|

Caption contest!

Wednesday, May 7, 2014 - Posted by Rich Miller

* Gov. Pat Quinn spoke at a Springfield business group event today. From a reader…

Outside Abraham Lincoln hotel in Springfield. If this is a Rauner thing, they need to get higher quality signs! God knows they can afford it.

* The pic…

That’s not a great Blagojevich mask, either.

49 Comments

|

* Michael Kolenc, the campaign manager for the Yes for Independent Maps group, sent out a fundraising e-mail this morning…

We’re just leaving the courthouse in downtown Chicago. It’s been a wild week…before we even delivered 533,000 signatures to Springfield, political leaders sued to push independent redistricting off the ballot.

Their politically motivated lawsuit seeks to silence the voices of Democrats, Republicans and Independents across this state. We’ve come too far to let that happen. Please contribute so we have the resources to defend ourselves, and give Illinois the chance to put the voters back in charge.

* I asked him what, if anything, went down…

Our petition to intervene was granted by the judge, meaning that the Yes campaign can defend the constitutionality of our amendment in court.

We also set a schedule. Oral arguments will be on June 18th at 2 pm.

The AG’s office was there. They have not decided what role they are going to play and have until May 20th to decide, even though there is precedent that they not be involved in dealing with . Not to mention the conflict of interest.

* And he added a brief counter-argument against part of the challenge to the constitutionality of the measure. Everyone who serves on the remap commission would be barred from running for state and judicial office for ten years, which the plaintiffs insist goes well beyond the Constitution’s strict limit on what can be in a citizens’ amendment…

Service on the commission is voluntary, and a person can simply choose not to serve on the commission. Imposing qualifications and restrictions of this nature on the commission – which is established under Article 4 of the Constitution – is within the scope of subjects that may be addressed through this referendum process.

Discuss

21 Comments

|

* A Florida bankruptcy judge delivered some bad news to Bruce Rauner…

The Federal Court’s March 14 Opinion describes a “bust out” scheme orchestrated by GTCR, the private equity firm chaired by Rauner for years up until October 2012. The Court ruled that claims against GTCR for aiding and abetting a breach of fiduciary duty have merit and therefore can proceed.

The Court also ruled that claims for breach of fiduciary duty can proceed against Edgar Jannotta, formerly one of Rauner’s fellow GTCR principals. Jannotta is currently one of the largest financial contributors to Rauner’s campaign.

Under Rauner’s chairmanship of GTCR the firm was accused of complicity in the wrongful deaths of multiple nursing home residents. GTCR was then later accused of participating in a scheme allegedly intended to fraudulently transfer assets for the purpose of hiding them from successful plaintiffs and other creditors.

The opinion is here.

* The federal judge wrote that the plaintiffs’ case “has all the makings of a legal thriller” and summarized the plaintiffs’ contention with a headline about how Rauner’s “GTCR Group orchestrates the ‘Bust Out scheme’”…

In the second linked transaction, THI sold all of its stock in THMI to the Debtor for $100,000. The Debtor had been incorporated just months before the transaction by the law firm of Troutman Sanders, where Forman (one of FLTCH’s owners) was a partner.

The Debtor’s sole shareholder is Barry Saacks, an elderly graphic artist who currently lives in a nursing home. Although Saacks has some recollection of being asked if he was interested in buying computer equipment, he was not aware that he owns the Debtor or that he acquired the stock in THMI.

And, it turns out, Saacks (who did not have any money to buy any computer equipment in the first place) did not pay the purchase price—FLTCH apparently loaned him the $100,000—nor did he ever receive any of THMI’s assets. In short, the complaint paints this as a sham transaction. […]

After the sale, FLTCH rebranded THMI assets and continued generating millions of dollars of profits, but without the millions of dollars in liabilities.

Oy.

* THI was funded by Rauner’s GTCR. From the opinion…

Aside from raising capital for THI, the GTCR Group was also instrumental in THI’s day-to-day management and administration. From the start, the GTCR Group entered into a Professional Services Agreement with THI in July 1998, around the time THI was created. Under its agreement with THI, the GTCR Group was responsible for formulating THI’s corporate strategy and corporate investments, including acquisitions, divestitures, and debt and equity financing

Hmm. Rauner’s firm was far more involved than he may have let on.

Then again…

While the Court tends to agree with the GTCR Group that any one of facts alleged in the complaint (i.e., an 83% ownership interest, majority control of the board, day-to-day control over business operations, etc.), taken by itself, would not plausibly give rise to domination or control, all of the facts—when taken together—could.

* THMI was a wholly owned subsidiary of THI until March of 2006, when it sold its stock to FLTCH, Fundamental Long Term Care Holdings, LLC, and others. From the judge’s summary of the complaint…

According to the complaint, THI Holdings, LLC (“THIH”) and THIH’s primary shareholder, a series of entities referred to as the “GTCR Group,” conspired to allow THI’s two primary secured lenders—General Electric Capital Corporation (“GECC”) and Ventas, Inc. (“Ventas”)—to loot THI and THMI to repay $75 million in loans before the GTCR Group and THIH ultimately sold THI’s and THMI’s assets to a group of individuals and entities referred to as the “Fundamental Entities”—Fundamental Long Term Care Holdings, LLC (“FLTCH”), Fundamental Administrative Services (“FAS”), Tr ans Health, Inc.-Baltimore (“THI-Baltimore”), Murray Forman, Leonard Grunstein, and Rubin Schron—for far less than their fair market value in order to preserve the substantial investment the GTCR Group made in THI.

To complete the alleged bust-out scheme, THMI’s liabilities were transferred to the Debtor (a sham entity created for the sole purpose of acquiring THMI’s liabilities), and THI was allowed to slowly go out of business before being put into a state-court receivership.

Wow.

…Adding… From the judge…

These, of course, are only allegations in the complaint. As discussed below, the Court is required to accept all well-pled allegations in the complaint as true.

By reciting the factual background of this case, the Court is not making any determination regarding the veracity of the allegations. They are just that—allegations

* More from the judge…

So the GTCR Group, in an effort to save some of its investment, hatched a scheme whereby it allowed THI’s primary lenders (GECC and Ventas) to siphon millions from the company in the form of interest and fees only to later sell the company to the Fundamental Entities for far less than fair market value, with the end result that THI-Baltimore, FLTCH, FAS, Forman, and Grunstein get a company worth—when stripped free from its liabilities—over $100 million for less than $10 million, the GTCR Group pockets $10 million for a company whose assets would have gone to pay hundreds of millions (if not billions) of dollars in judgments, and the Debtor ends up with a liability-ridden shell company.

From those facts, the Court can reasonably infer that the GTCR Group and THIH knowingly participated in Jannotta’s alleged breach of fiduciary duty.

81 Comments

|

* State and local workers who have jobs which are partially subsidized by federal funds can now run for political office. Government Executive has the deets…

The Office of Personnel Management issued a final rule Monday to implement the 2012 Hatch Act Modernization Act, which will go into effect June 4. The law marked the first update to the Hatch Act — which governs political activity for government workers — in more than 20 years.

The change will no longer prohibit state and local employees who work in programs financed in part or in whole by federal funds from running for partisan office. Only those workers whose salaries are paid for entirely by federal grants or loans will remain banned from launching political bids.

The bill also expanded the options for penalizing federal employees who violate the law. Previously, these employees faced immediate termination.

The new rules are here.

8 Comments

|

Chairman Kennedy blasts “insane” pension reform

Wednesday, May 7, 2014 - Posted by Rich Miller

* The State University Retirement System is the only state pension system to interpret the new pension reform law as calculating an employee’s pension benefits using last year’s salary instead of this year’s. They’ve been asking for a legislative fix, but it hasn’t moved as of yet.

Chris Kennedy, who chairs the University of Illinois Board of Trustees, wants another fix…

Kennedy said the U. of I. trustees insist that the Legislature has to correct a second issue: A change in the guaranteed investment earnings rate for employees from 7.75 percent a year to a market-based rate based on the 30-year U.S. Treasury bond rate as of July 1, plus 0.75 percent. The market rate amounts to about 4.5 percent.

Kennedy said he hopes Legislature will correct the second issue by the end of May or the state will stand to suffer a tremendous brain drain of senior faculty members, mostly ages 45 to 60, who will take their higher retirement payout now and get new positions elsewhere.

“They [legislators] can watch the intellectual leadership of the state move to the coasts, because all of the university leadership in a certain age bracket who have at least a decade or two left in their careers will be incentivized to move somewhere else,” Kennedy said in a phone interview. “We will pay them to leave. That’s the sick thing. That is insane.”

* It doesn’t seem likely, however…

Steve Brown, spokesman for Illinois House Speaker Michael Madigan, said the interest rate change was meant to stabilize the precarious pension system.

“It will make the system stable,” Brown said. “The system prior to the legislation was completely unstable and could go out of business in a few years. Some of these artificial return figures were brought back to a real basis.”

Discuss.

52 Comments

|

Ride-Sharing: Read the Fine print - Support HB 4075

Wednesday, May 7, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

Ride-sharing companies claim in their Capitol Fax advertorial on May 5th that HB 4075 “undermines…regulations that prioritize safety and accountability” and that they have “developed strict criteria and comprehensive insurance policies that are 3 times what is currently provided in Illinois.”

Really?

Then why do they force all their users to sign a waiver agreeing to use their service “at your own risk?” Uber even admits “you may be exposed to transportation that is potentially dangerous, offensive, harmful to minors, unsafe” and then forces its users to “release the company from any and all liability, claims, or damages.”

Recently, an Uber driver in San Francisco hit and killed a 6-year-old girl, only to have the company deny responsibility and keep the little girl’s family from any insurance compensation.

When you read the fine print, the truth is multi-billion dollar companies like Uber are fighting against the same public safety protections that all licensed commercial transportation companies in Illinois currently follow. HB 4075 provides standard police background checks, drug testing and proper insurance covering the public while the driver is working, “App on to App off.”

HB 4075 provides common sense protections. Ask Uber why they want less.

Comments Off

|

Rate the US Chamber’s new Bob Dold cable ad

Wednesday, May 7, 2014 - Posted by Rich Miller

* As I told you yesterday, the US Chamber is spending $367K on a new cable TV ad touting Republican congressional candidate Bob Dold. The ad was finally posted online this morning…

* Politico has more…

The U.S. Chamber of Commerce is poised to unveil an onslaught of general-election advertising this week, launching TV spots in nearly a dozen of the most competitive House districts in the 2014 midterm elections.

The heavily funded, Republican-friendly group also has reserved airtime in the Kentucky and Colorado Senate races. The Colorado ads are expected to feature Florida Sen. Marco Rubio, whose PAC has endorsed Republican candidate Cory Gardner.

The Chamber declined to share the cost of the TV campaign but called it a multimillion dollar effort, and it appears to represent the powerful business lobby’s most intensive effort so far to leave a mark on the congressional landscape. […]

All of the ads are positive, Holmes said, “and feature candidates who believe in economic growth and the free enterprise system, who know how to govern and who can win in November.”

12 Comments

|

[The following is a paid advertisement.]

Credit unions are committed to several cooperative principles, including social responsibility. At First Illinois Credit Union in Danville, reaching out to area school children as part of their financial literacy program is a top priority. For over 20 years, the credit union has partnered with area schools, educated students in the classroom and has invited them to open savings accounts. Scholarships are awarded to graduating eighth graders. Members that are high school graduates are also granted scholarships. By giving out scholarships at school-wide functions, it affords the credit union the opportunity to provide financial education to hundreds of students in the audience. Educating children is just one facet of the credit union’s extensive outreach, which also includes breakfast meals for low income families, financial education for seniors during Money Smart Week, volunteering as a buddy at baseball games for children with disabilities, and many more local clubs and organizations. For all their efforts, First Illinois Credit Union has been recognized by their members and the community as a top financial institution. At the heart of the credit union philosophy is the principle of people before profits – and another reason why members are so fiercely loyal.

Comments Off

|

Transaction tax not going anywhere

Wednesday, May 7, 2014 - Posted by Rich Miller

* As we’ve already discussed, Chicago Teachers Union President Karen Lewis wants a tax on financial transactions to help fund the woefully underfunded city teachers pension fund…

William Barclay, an economist advising the CTU, estimates a $1-to-$2 tax levied on the sellers and buyers of futures, futures options and securities option contracts traded on the Chicago Mercantile Exchange and the Chicago Board Options Exchange could raise up to $12 billion a year for the state, some of which could be used for pensions.

* But the governor dumped cold water on the idea yesterday…

A financial transaction tax faces several legal hurdles, including a change in state law, a City Hall official said. And Gov. Pat Quinn also was skeptical.

“I just don’t think there’s the votes for that,” Quinn said Tuesday in Springfield. “I think that would be very difficult to do.”

* And CME’s spokesperson Laurie Bischel was completely opposed…

“However, we do not believe the way to accomplish a strong public school system is through singling out futures traders with a tax more than 200 percent higher than what the average trader pays to buy or sell a futures contract,” Bischel said. “Futures traders do not have to do their business in Chicago today and this tax would make sure that they don’t do business in our city going forward.”

Discuss.

23 Comments

|

* Gov. Pat Quinn has said over and over that he was “the first” person to spot the problems with his anti-violence initiative. But as Mark Brown clearly shows today, this just isn’t true…

(A)ccording to his own account of events, the governor didn’t figure out he had a problem there until state legislators forced him to take a closer look.

Most of the recent stories about the governor’s anti-violence program say the controversy was sparked by a scathing February audit from Illinois Auditor General William Holland.

That’s true, but don’t forget that audit didn’t just spring out of nowhere.

Republican legislators in both the House and Senate raised questions about the program during appropriations committee hearings in early 2011.

Sen. Matt Murphy, R-Palatine, even introduced a resolution asking for the auditor general to be ordered to audit the program, but couldn’t advance it out of committee.

In 2012, Rep. David Reis, R-Ste. Marie, tried again with a resolution of his own in the House, but this time he found some surprising allies on the other side of the aisle.

Many Democrats from high crime areas, mainly Latino legislators, were upset that money from the program had not been spent in their communities, Reis said.

Together, they not only approved the audit in May 2012, but also cut spending for the program in half, to $30 million from $15 million. Reis said House Speaker Mike Madigan supported the effort.

Quinn’s own timeline of events, as prepared by his press office, says it was in June 2012 that “inadequacies in program monitoring and fiscal oversight” were brought to the governor’s attention by his staff.

* Meanwhile, the governor blamed partisan political games yesterday after the Legislative Audit Commission’s vote to grant itself subpoena powers…

Standing outside the Capitol, Quinn dismissed as “politics as usual” a Republican state senator’s call for the Legislative Audit Commission to use subpoena power to dig deeper into questions that already have gotten the attention of federal prosecutors in Springfield and Cook County State’s Attorney Anita Alvarez in Chicago.

“It’s a political time of year,” Quinn said.

Trouble is, the commission voted 10-1 to grant the subpoena powers. All but one Democrat voted for it. This wasn’t just about politics.

* However, as subscribers know in more detail, the subpoena powers move is a bit more show than go…

The proposal received bipartisan support; however, several Democrats on the commission voiced concerns that a probe from the commission would at best produce nothing beyond what will come out during the ongoing criminal investigations and would at worst impede them. “What’s the value at the end of the day that we’ll be putting on the table?” asked Hoffman Estates Democratic Rep. Fred Crespo, who sponsors HB 3820. “What can we do that they cannot do?” Crespo and others said that the commission does not have the resources to launch a major investigation.

Barickman, who chairs the committee, and co-chair Rep. Frank Mautino, a Democrat from Spring Valley, would both have to sign off on any subpoenas issued. Mautino was the sole vote against the motion. He argued that the information the committee needs is already available and that subpoenas may be unecessary. He noted that Holland’s office has several boxes of documents related to the audit and that no legislative staffers have gone through them at this point. Mautino said that the panel should first ask for the information and witnesses it is seeking instead of resorting to subpoena powers.

Holland said he would provide the commission with any information they want. “You don’t have to subpoena the records, and you don’t have to FOIA the records. You make an appointment, you come in and you take a look. That’s the way we do business,” He said. Holland also said that state agencies are required by law to comply. Barickman said that because the agency that oversaw the program has been dissolved and some of the people who worked on the NRI have since left state government, the commission may need the legal power to compel them to cooperate.

* And…

It’s not clear if any subpoenas will actually be issued. There’s a dispute over whether the Democrats who run the House and Senate have to sign off on them; and if they do, it remains to be seen if they will.

* And in other news, the governor found somebody to throw under the bus yesterday…

Cook County Circuit Clerk Dorothy Brown’s partnership with her husband to tap into Neighborhood Recovery Initiative grants is “troublesome,” and her spouse’s dual role as an overseer and provider of anti-violence programming represents a “clear conflict,” Gov. Pat Quinn said.

In slamming Brown and her husband, Benton Cook III, Quinn Tuesday ramped up his defense against the growing political fallout from his self-acknowledged, botched Neighborhood Recovery Initiative in 2010 that is now under state and federal investigation. […]

The governor also blamed Chicago Area Project, the West Side non-profit that hired Cook and that Quinn’s administration chose to participate in the Neighborhood Recovery Initiative, for “letting all of us down” by neglecting to perform a criminal background check on him before giving him a supervisory role in overseeing $2.1 million in anti-violence programming in West Garfield Park. Such a check might have found Cook’s 1999 felony conviction for writing bad checks in Tennessee.

The head of the Chicago Area Project in his first public comment since the scandal broke said the organization was unaware of Cook’s criminal past when he applied for the job.

“During the application process, during the interview process none of that came out,” David E. Whittaker, the organization’s exectuive directory, said in an interview with WTTW’s “Chicago Tonight.” “Nothing that was in his background would have led us to believe he was not qualified for the position.”

* And, finally, some Republicans are privately saying that Cook County State’s Attorney Anita Alvarez’s probe of her fellow Democrat may be politically suspect. One such Republican made sure to point me to this Tribune revelation today…

Federal authorities in Springfield have made inquiries about the grant program, which was absorbed by the Illinois Criminal Justice Information Authority. Both Alvarez and Brown are members of that board under state law.

A spokeswoman for Quinn declined to say if it was a conflict of interest for Alvarez to sit on the board of an agency that took over responsibility for the anti-violence program, saying “it’s up to the state’s attorney to determine whether there is a conflict or not.”

Alvarez spokeswoman Sally Daly said it was not a conflict for the Cook County grand jury to subpoena documents from an agency on whose board Alvarez sits. She declined to answer other questions, noting that the investigation of the grant program continued and the secrecy of grand jury proceedings.

106 Comments

|

|

Comments Off

|

|

Comments Off

|

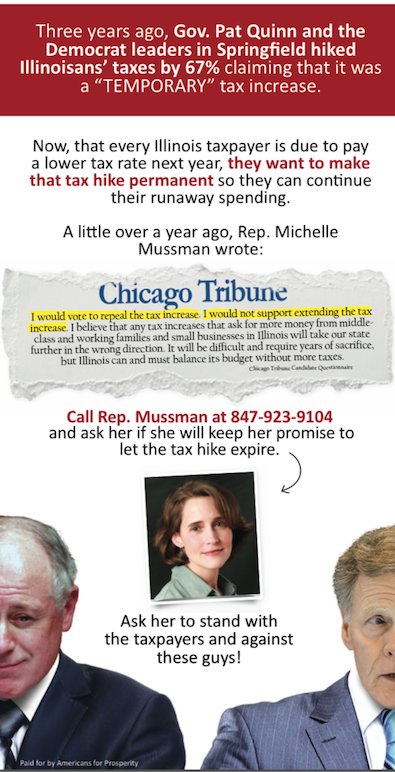

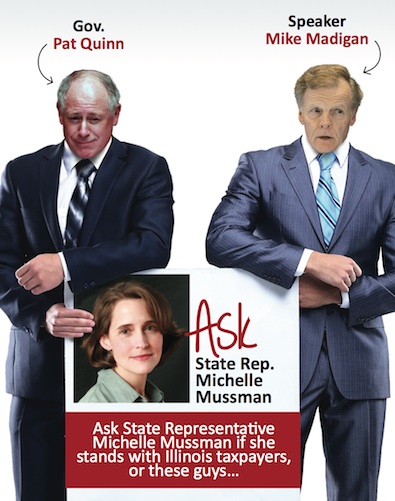

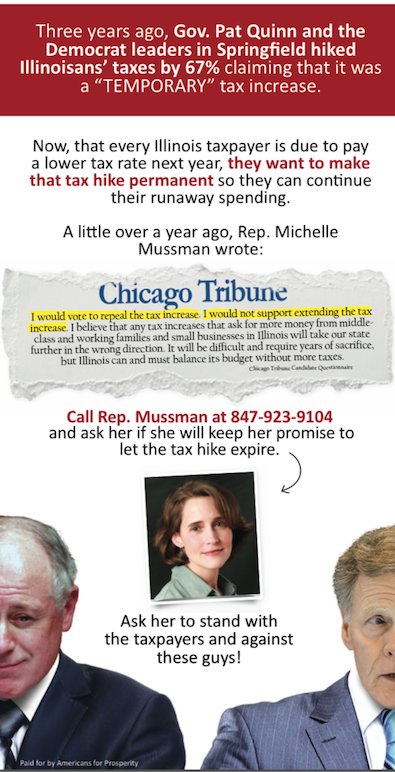

* From a press release…

Today Americans for Prosperity - Illinois is launching the first phase of a campaign calling on legislators to honor their promise to taxpayers by keeping the 67% income tax hike temporary. The effort consists of a massive direct mail effort, along with a website, KeepItTemporary.com, and grassroots efforts to oppose Governor Quinn and Speaker Madigan’s push to permanently hike the income tax. The efforts will seek to hold 17 state legislators accountable by highlighting their prior stated support for letting the income tax hike expire as scheduled.

“Illinoisans want to know: will those legislators who said they supported letting the income tax expire while campaigning stand up for taxpayers now? Or will they join Gov. Quinn and Speaker Madigan in breaking trust with their constituents and again hike taxes on all Illinoisans further damaging the state’s dismal economy?” asked David From, Illinois State Director of Americans for Prosperity. “Many of these legislators at one point recognized that permanently increasing the income tax will harm Illinois’s hardworking families and slow economic recovery. They need to honor their commitment to their constituents and allow the tax hike to expire as promised to taxpayers when the measure was passed.”

The legislators being held accountable are: Reprentatives Fred Crespo (44th District), Emily McAsey (85th District), Katherine Cloonen (79th District), Deborah Conroy (46th District), Laura Fine (17th District), Stephanie Kifowit (84th District), Natalie Manley (98th District), Michelle Mussman (55th District), Brandon Phelps (118th District), Marty Moylan (55th District), Sam Yingling (62nd), Jerry Costello II (116th), Mike Smiddy (71st) and Senators Jennifer Bertino-Tarrant (49th District), Julie Morrison (29th District), Melinda Bush (31st District), and Michael Hastings (19th District).

Today’s direct mail and online efforts build on AFP’s on-going grassroots opposition to the income tax hike, which includes regular door knocking and phoning to educate and mobilize Illinoisans against the tax hike.

* A sample mailer…

51 Comments

|

OK, we can’t pass this up

Tuesday, May 6, 2014 - Posted by Rich Miller

* Former Illinois Congressman Ken Gray wrote a letter to Caroline Kennedy and then talked to the Daily American about his relationship to Caroline’s father John F. Kennedy…

“Your dad asked me to run for president after his two terms would have expired,” writes Gray.” The Constitution only allows two terms for a president and he was not fond of Lyndon Johnson and wanted me to succeed him.”

Why this revelation had never seen the light of day has more to do with Gray’s safety than it did his privacy. He says he was concerned for his own life which would have paralleled his dear friend in politics, issues and programs.

“He wanted me to be a candidate because he knew we shared the same ideology,” said Gray. […]

Gray says he was more interested in hunting down a killer than becoming president which could have been fatal. […]

He says from that time on he knew that his life was at risk should he continue in the footsteps of Kennedy.

“I feel there is still some danger, but I’m at an age now that it wouldn’t be so harmful,” said Gray who spoke with authority and total clarity throughout the interview.

“I could have been killed if they knew of the friendship,” he continued.

Um, OK.

* The accompanying photo…

No, that’s not Phil Spector.

Caption?

76 Comments

|

Question of the day

Tuesday, May 6, 2014 - Posted by Rich Miller