Chicago Tribune: Same Safety Standards for Ride-Share

Thursday, May 8, 2014 - Posted by Advertising Department

The following is a paid advertisement.

“As we’ve said before, the part-time/full-time distinction is meaningless to the customer ordering a ride. The same safety standard should apply to all ride shares and, yes, to taxis. We’re increasingly wary of leaving it to the ride shares to police themselves when it comes to making those checks, given (Uber’s) unapologetic disregard for rules. UberX just underscored that point.”

Chicago Tribune editorial, “UberX thumbs its nose at the rules,” May 8, 2014

Ride-share companies claim they can regulate themselves, but time and time again they prove they have no interest in following the rule of law or even in protecting their own passengers.

As the Chicago Tribune editorial board points out, the distinction between ride-share drivers is “meaningless.” What’s important is that everyone is held to the same fundamental public safety and consumer protection standards that come with the proper chauffeur licensing.

Instead, multi-billion dollar companies like Uber and Lyft continue to fight the same public safety protections that transportation companies currently follow, including HB 4075, which would provide safety standards for all drivers across the board.

Customers deserve to have the peace of mind knowing that their driver has passed a comprehensive police background check and drug test and carries sufficient insurance in case of an accident.

It’s time for these common sense safety standards for everyone in the transportation industry. Ask Uber why they would want less.

Vote YES on HB 4075 and support ride-share protections for all!

Comments Off

|

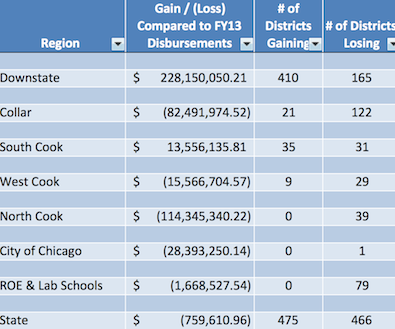

Downstate a big winner in Manar plan

Thursday, May 8, 2014 - Posted by Rich Miller

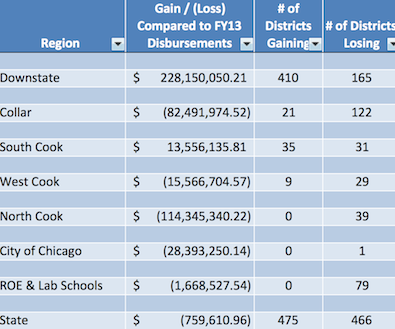

* After Republican outrage that Sen. Andy Manar’s school funding reform plan would provide a windfall to Chicago, it turns out that Chicago wouldn’t do all that well. From the State Board of Education’s analysis of the plan, which weights poverty rates much heavier on school funding…

* Finke…

Manar said the numbers show that the poorer school districts in the state fare better under his revised formula. By poorer, Manar said, that includes both districts with high numbers of students from poverty backgrounds and districts that have lower property values that do not generate enough tax revenue. […]

Manar said that the “most striking thing in the (report) is how far downstate districts lag behind in terms of funding. Downstate is very different than it was in 1997 when the current (funding) law was put in place and we have to account for those things to a better degree than we do today.”

That argument did not necessarily play well with Republicans who represent school districts in the suburban Chicago area. Sen. Matt Murphy, R-Palatine, said school districts in his area already supply 90 percent of their funding from local property taxes. Yet, under Manar’s revised formula, they would lose state assistance, with one district dropping $13 million in state aid.

“If that narrow amount that we get from the state is cut, what do people in my district, who already have high property taxes, do if they want to maintain the current funding level?” Murphy asked Manar at a committee hearing Wednesday. “It sounds like you are telling my constituents to raise their property taxes.”

* AP…

Schools in Palatine, Murphy’s hometown, would see an 87 percent decrease in overall state aid under the funds — about a $13 million dip compared to how much they received in the 2011-12 school year, the year the state board used to make the calculations.

Similarly, schools in Skokie and Evanston in Chicago’s northwest suburbs would lose 85 percent of state aid under the new formula. Meanwhile, Galesburg schools could stand to gain a 30 percent funding boost — about $5 million more a year than they receive now.

Schools in Red Bud, an Illinois suburb of St. Louis, would see an 83 percent decrease.

* Erickson…

State Sen. Dave Luechtefeld, R-Okawville, said many of the schools in his Southern Illinois district would gain under the proposal. He acknowledged it would be a tough vote for lawmakers in areas that would be losing state funds.

“It may not end up a Republican-Democrat issue,” Luechtefeld said.

The measure won approval in the Senate Executive Committee on a 10-3 vote with Luechtefeld voting “present.” He said the overhaul needs more work.

Republicans said the changes might be made more palatable if the state eases back on some of the programs and paperwork it requires of local school districts.

It remains unclear whether the House will take up the proposal if it emerges from the Senate. The plan was developed through a series of hearings in which the House was not involved.

Discuss.

50 Comments

|

The carrot and the stick

Thursday, May 8, 2014 - Posted by Rich Miller

* Let’s revisit yesterday’s Daily Herald story about how some municipal groups were contemplating whether to back an extension of the state income tax in order to possibly get a bigger piece of the revenue sharing pie or to ward off an attack by Democrats.

The story was based on a letter that DuPage Mayors and Managers Executive Director Mark Baloga wrote to his members…

You likely have seen recent news reports of Governor Quinn and Legislative Leaders discussing the opportunity for local governments to secure, or even increase, the local share of state income tax (aka “LGDF”) if the current 5% income tax rate is extended beyond its current sunset date of 2015. Senate President Cullerton directly addressed this topic with DMMC members on April 9 during our Springfield Drive Down. Since that meeting, our lobbyist has been in discussions with legislators and has conveyed the following:

1. Extension of the 5% income tax is almost certain to pass regardless of municipal support, opposition, or neutrality.

2. If municipalities and municipal groups uniformly oppose or fail to support the legislation, then it is also a near certainty that LGDF will be eliminated or severely cut. This would be framed as cutting state expenses to help balance their budget.

3. If municipalities and municipal groups such as DMMC support the tax rate extension, this could secure an increase in the local share of income tax and direct deposit of LGDF revenue—both long- standing DMMC legislative priorities.

4. Support for the tax rate extension would generate ongoing political capital for DMMC, other municipal groups, and municipalities themselves.

5. “Support” can range from a simple statement of organizational support, to individual mayors actively supporting the legislation and the legislators who vote for it, and anything between. More active support would result in even more political leverage on LGDF and other current and future issues.

After extensive discussion, the DMMC Legislative Committee (by unanimous consent, on April 25) and the DMMC Board of Directors (by a 9-4 vote, on May 1) approved DMMC’s conditional support for continuation of the 5% tax rate as long as the bill adequately increases the current 6% LGDF portion of income tax and provides for direct deposit of LGDF revenue to eliminate delays in payments to municipalities. The Board’s motion further specified using this opportunity to pursue additional legislative action including:

A. Stoppage of HB 5485 which would require negotiation of minimum staffing for fire departments and districts.

B. Consideration of additional legislative priorities such as expenditure authority for non-home rule hotel motel tax revenue.

C. Ability to participate actively in development of municipal public safety pension reform legislation.

That’s all really quite fascinating. A grand bargain laid open.

* OK, now back to yesterday’s Daily Herald story…

Cullerton spokeswoman Rikeesha Phelon said she couldn’t confirm the conversations between her boss and municipal leaders.

However, Phelon said Cullerton has said for months that mayors would see a smaller share of state income taxes if the rates don’t get extended.

“That’s not a threat,” she said. “That’s just math.”

In order to cut the municipal share, new legislation would have to be passed.

“This certainly sounds to me like out-and-out extortion,” said Madeleine Doubek, chief operating officer of Chicago-based Reboot Illinois, a voter-advocacy digital media group. “This just pulls back the curtain on the worst of Illinois government in action. Who, in this equation, is looking out for the taxpayers?”

* As I also told you yesterday in an update, Sen. Donne Trotter unveiled legislation yesterday designed to put heat on the mayors…

After facing years of funding cuts, Illinois’ schools could get more than $1 billion in new funding as State Senator Donne Trotter (D-Chicago) is urging his colleagues to truly make education the priority they claim it is.

Currently, mayors and village presidents get a cut of the state’s income tax with no strings attached. Trotter’s proposal ends that giveaway and instead steers the dollars – $1.45 billion in the upcoming budget year – to the state’s public schools in an effort to have the state finally live up to its education funding commitments.

* The bill had a hearing today. Trotter eventually pulled the proposal out of the record, but the SDems tweeted extensively during the debate…

Discuss.

6 Comments

|

* As I told subscribers on Monday morning, the Commission on Governmental Forecasting and Accountability has revised its Fiscal Year 2014 revenue estimate upwards by $588 million. Most of this is considered to be a one-time income tax windfall, so next fiscal year’s estimate was revised up by just $167 million.

Anyway, some Senate Republicans have a plan for spending some of that found money…

Thousands of state workers are owed an estimated 112 million dollars in back wages. Governor Pat Quinn negotiated raises with members of AFSCME back before the 2010 elections, but lawmakers never came through with the money to pay them. […]

“We’re not calling for any new spending, any new spending proposals here. We’re just asking for commitments to be honored. Bottom line,” [GOP Sen. Sam McCann] said.

Under McCann’s proposal, the rest of the extra revenue would be used to pay down the state’s backlog of bills. Illinois owes schools, hospitals, and many other service providers nearly five billion dollars.

Sounds like a good idea to me.

* Related…

* McCann still open to keeping current tax rates: “I don’t think the people of the 50th District sent me here, just like the people of everyone’s respective districts back home sent them here, to stick their fingers in their ears and not listen to what people have to say,” said Carlinville Republican Sen. Sam McCann. “They don’t send us here not to roll up our sleeves and go to work on their behalf. They send us here to engage.”

16 Comments

|

Today’s numbers are lousy

Thursday, May 8, 2014 - Posted by Rich Miller

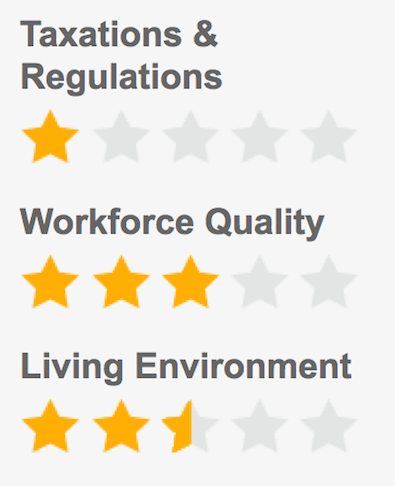

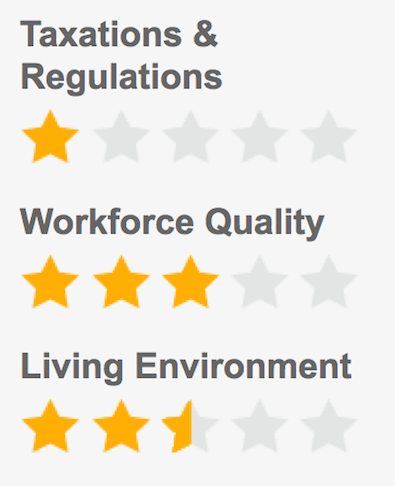

* Chief Executive Magazine ranked Illinois 48th in the nation for business…

Anti-growth hot mess can only coast on Chicago’s economic engine for so long.

And…

Oof.

* Numbers…

State GDP

% Growth ’11-’12: 1.9

% Growth ’11-’12 v. Nat’l Avg. (2.5%): -0.6

Unemployment

Unemployment Rate Dec. 2013 %: 8.6

Comparison with Nat’l Rate (6.70%): 1.9

Domestic Migration

Domestic Net Migration 2013: -67,313

Rank: 49

State Government

State Debt per Capita Fiscal Year ’13 ($): 5,569

State & Local Gov’t Employees per 10k Residents: 503.1

Oy.

* But considering all the screaming about taxes, our state/local tax burden is pretty average…

State-Local Tax Burden

Rate (%): 10.2%

Compared to Nat’l Avg. (9.9%): 0.34%

74 Comments

|

Rauner: “Step down” the tax hike

Thursday, May 8, 2014 - Posted by Rich Miller

* I thought about putting this in the post below about another temporary tax hike extension but wanted to wait until I heard back from the Bruce Rauner campaign about his statement yesterday regarding the tax hike. Sun-Times…

“I’m very much against keeping the tax hike permanent,” Rauner said. “They promised it would be temporary. We’re going to have a plan we’ll be coming out with soon on how to step that back down, all the way down.”

So, does “step that back down” mean a phaseout? That would be more like what Toni Preckwinkle did with the hugely unpopular sales tax hike - phased it out over a period of years.

I’m pretty sure he’s said this before, but if Rauner was being accurate about his position yesterday, phasing it out is actually a far more fiscally responsible approach than just eliminating the tax hike outright in January.

* The campaign offered no further insight today…

Bruce has always said he wants to get rid of the Quinn-Madigan tax hike and comprehensively reform the tax code so it is pro-growth and fair to all taxpayers. That is still the plan.

* Related…

* Quinn, Rauner address Illinois business leaders

* Quinn, Rauner paint different pictures of Illinois at business lunch

* Quinn, Rauner trade jabs in separate talks with business leaders

22 Comments

|

Under the bus he goes

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

One of the people behind Gov. Pat Quinn’s troubled anti-violence program is now heading a new initiative to reduce Chicago violence that’s backed by major businesses and Mayor Rahm Emanuel.

The Chicago Sun-Times reports that Toni Irving was a deputy chief of staff for Quinn when his Neighborhood Recovery Initiative was formed in 2010. […]

She told the newspaper she had no role in implementing Quinn’s program, but the newspaper says she chose grant recipients.

The Sun-Times reports that Irving helped steer the choice of the Chicago Area Project as “the main conduit for state anti-violence grants in West Garfield Park.” CAP then hired Dorothy Brown’s husband.

* There’s an interesting little political development in the Sun-Times story as well. Mayor Emanuel kinda threw Gov. Quinn under the bus…

At an unrelated news conference Wednesday, Emanuel sought to distinguish Get In Chicago from Quinn’s troubled Neighborhood Recovery Initiative, which was launched during the governor’s closely contested campaign in 2010. Republican critics have blasted the Quinn initiative as a political “slush fund” created to generate support for Quinn.

“First of all, this is private money. Totally different,” Emanuel said.

“If you were doing it only one-year and around the campaign season, I understand why people would get cynical. But given that it’s also in the years that there is no campaign, but it’s about safety, I would say look at the consistency over the four-year time.”

13 Comments

|

Today’s quotable

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Baise from the Illinois Manufacturers Association….

“I think business owners in this state have really gotten to the point that they want to see a change. … I think the business community’s perception of this state (is) if we don’t make a drastic change of some sort, a lot of my members who can will move, and I hear that lament over and over again.”

Baise has told me this more than once and he’s pretty darned adamant about it. Whether he’s right or wrong is beside the point. The guy who runs one of the most influential biz groups in the state truly believes an exodus is coming. And Baise is not someone who regularly engages in hyperbole.

64 Comments

|

SURS to re-interpret pension language

Thursday, May 8, 2014 - Posted by Rich Miller

* AP…

The State Universities Retirement System now says a troublesome piece of last year’s state pension-reform law may not cut retirees’ pensions after all.

William Mabe is the executive director of the retirement system. He said the language in law that would cost retirees’ a year of pension should be interpreted as if it didn’t – because it wasn’t intended to.

That’s based on the interpretation the Teachers Retirement System has been using when it looks at the law. Now SURS plans to follow suit.

* The News-Gazette broke the story…

Teachers also have a money-purchase option when they retire, and that annuity calculation was changed in the new pension bill as well. But the Teachers Retirement System chose to interpret the “legislative intent” of the added provision, preserving members benefits earned through June 30, 2014.

“From the get-go the way we read the law, the legislative intent was designed to hold members harmless,” said spokesman Dave Urbanek. “Our interpretation was fiscal year 2014 all along.”

The state pension code says that whenever a statute’s language is ambiguous, the interpretation must favor the employee, he said.

Only about 14 percent of teachers use that option when they retire, as opposed to approximately 60 percent of SURS retirees, officials said.

Mabe said SURS had been trying to get the problem fixed legislatively for months, and had been considering adopting the approach used by the teachers’ retirement system anyway when he received [House Speaker Michael Madigan’s] letter. There is legal precedent to support that approach, he said, and Madigan’s letter provided evidence of “clear evidence of intent.”

* From Madigan’s letter to Mabe…

With respect to the money purchase benefit, SURS is the only pension system interpreting the language in a manner that is inconsistent with the intent of the General Assembly. It is my understanding that SURS and the University of Illinois were directly involved in the development of the money purchase benefit language, and reviewed several drafts of the legislation prior to the General Assembly taking final action. At no point did SURS, University of Illinois, or any other pension system indicate there was a technical error with the language that would cause it to be inconsistent with the intent of the Conference Committee Report.

Given that members of the General Assembly have received numerous letters and emails regarding this issue, it is worth addressing the timeline related to the development of the language. The concept of changing the money purchase benefit was introduced on April 30, 2013, in House Amendment #1 to Senate Bill 1, and approved by the House on May 2, 2013. When the Conference Committee was appointed, the members of the Committee met with representatives from SURS and the University of Illinois, and together they drafted the language that ultimately became law. The pension systems were provided with copies of draft legislation throughout the fall and prior to the General Assembly taking action in December 2013. On November 26, 2013, legislative staff specifically asked each of the pension systems if there were any technical concerns with the language. At this time, SURS did not present this objection.

Legislative staff was advised that SURS preferred a hard date for the provision, but that this request was simply to ease administrative burden and would not impact the intent of the provision.

With respect to your concerns regarding the effective date of the bill and the method used to determine the effective rate of interest, again, SURS reviewed this language over the course of many months and did not present any objections. After passage, legislative staff was advised that these provisions could be difficult, but would not be impossible to administer.

While I support efforts to correct the technical error, I urge SURS to consider that its interpretation is inconsistent with the intent of the General Assembly, and also inconsistent with the way TRS has interpreted the same language. A similar reading by SURS may help ease the concerns of university faculty and personnel impacted by the language and assist with avoiding unintended consequences for our universities.

With kindest personal regards, I remain

Sincerely yours,

MICHAEL J. MADIGAN

Speaker of the House

30 Comments

|

CTU peace gesture on pension reform

Thursday, May 8, 2014 - Posted by Rich Miller

* Greg Hinz has an important story about a pension reform peace gesture by CTU President Karen Lewis…

During an appearance yesterday afternoon before the Crain’s editorial board, Ms. Lewis specifically said the union is willing to consider reducing benefits for those who still are working, although she emphatically ruled out changes for members who already have retired.

“There could be some modification (for current workers),” said Ms. Lewis, who has a reputation as a firebrand and who on May 5 opened the door to a second teachers strike in three years. “We’re interested in talking about modifications, yes.”

* Lewis said she wouldn’t talk about specific cuts until revenue had been negotiated. She’s generally opposed to raising property taxes and has floated things like a financial transaction tax (which was shot down by Mayor Emanuel yesterday) and a commuter tax, which is going nowhere. However, there’s another idea out there…

Ms. Lewis said Chicago Public Schools officials lately have been “more open to discussion [about revenue] than in the past.”

She didn’t say what they’re “open” to. A source who should know says a plan to dedicate revenue from expiring tax-increment financing districts is picking up steam because it would provide a revenue stream for pension bonds without raising the overall property tax rate above today’s level.

* On to Mayor Emanuel…

What he has ruled out — pointedly and specifically — is a transaction tax, a city income tax increase, and a commercial lease tax like the one championed by Mayor Harold Washington during the mid-1980’s. A Circuit Court judge overturned the six percent lease tax in 1986. The city appealed that decision, but the City Council repealed the tax before the city’s appeal was heard.

The mayor has also nixed the idea of using the jackpot of revenue from a Chicago casino to solve the pension crisis.

“I don’t think you should go to the roulette table with somebody’s retirement check. I’m not gonna do that,” the mayor said last month.

“How long has it been laying out there?… A lot of the credit agencies want something that’s reliable that they count on. I’m trying to stop the city from going to a place that I don’t think it can if we…do the morally responsible thing to ensure that every workers, every retiree gets a pension.”

14 Comments

|

Make it temporary again?

Thursday, May 8, 2014 - Posted by Rich Miller

* Rep. Jerry Costello is against making the tax hike permanent, or even extending it a few years, but suggests another temporary extension might be an alternate way forward…

There might not be enough votes in the House to make Illinois’ temporary tax hike permanent, so a one-year extension of the increase might be sought instead, according to a local lawmaker.

“They’re having problems — leadership in the Democratic Party — coming up with enough votes to pass a permanent extension of the tax,” said Rep. Jerry Costello II, D-Smithton. […]

“I think for some of the people on the fence, if they could say it was a finite situation, it would be easier for them. For me, it doesn’t change my position — I’m a ‘no,’” Costello said.

Steve Brown, a spokesman for Madigan, said he’s not aware of any plan to back away from the permanent increase, in favor of another temporary one.

“That’s news to me,” Brown said. “I know the speaker is supporting what the governor has proposed. The speaker has told the press in recent days that he’s continuing to work on that roll call.”

As subscribers know, the House Speaker is, indeed, having some problems with that permanent tax hike. But another temporary tax hike would mean yet another politically contentious tax vote in a few years, and the Speaker isn’t loving that idea.

Your thoughts?

48 Comments

|

|

Comments Off

|

|

Comments Off

|

ComEd rates to rise

Wednesday, May 7, 2014 - Posted by Rich Miller

* Tribune…

Customers who receive energy from Commonwealth Edison will see a 38 percent increase in the price of electricity as a result of rising costs to reserve power from power plants.

According to regulator Illinois Commerce Commission, the cost of electricity, coupled with reservation fees and transmission costs, will rise to 7.5 cents per kilowatt hour from 5.5 cents per kilowatt hour next month.

The average ComEd residential customer uses approximately 655 kilowatts of electricity per month, according to ComEd, which, together with delivery costs would increase bills by 21 percent from about $68 to about $83 per month.

* More from Steve Daniels at Crain’s…

ComEd’s price is largely in line with deals municipalities have struck recently with outside energy marketers to supply power to their residents and small businesses. In many cases, savings from these municipal contracts will be minuscule.

For example, ComEd’s 7.596 cents is slightly above the 7.47 cents average apartment and condo dwellers will pay in the city of Chicago under a one-year deal with Chicago-based Integrys Energy Services. That’s a less than 2 percent savings on just the energy portion of the bill and a 1 percent savings overall.

But owners of larger single-family homes, which consume more energy, actually will pay an energy charge of 7.63 cents, which is slightly higher than ComEd’s. […]

On the other hand, some suburbs still will enjoy significant savings from ComEd. The northern suburbs of Wilmette, Northfield, Glenview and Kenilworth, acting together in a consortium, recently negotiated a 6.72 cent-per-kilowatt-hour price with supplier MC Squared for the next year. That’s an 11.6 percent savings on ComEd’s energy price, or about 7 percent for the electric bill as a whole.

17 Comments

|

Today’s number: 150

Wednesday, May 7, 2014 - Posted by Rich Miller

* The Quinn campaign reacted today to the Rauner nursing home bankruptcy case and included a new claim…

This was an elaborately orchestrated scheme to cheat the legal system, defraud families and take advantage of those who were too vulnerable to care for themselves in order to make a buck.

But the grand scheme stretches beyond just Florida: Rauner and GTCR have been hit with at least 150 lawsuits in 15 different states, and they continue to roll in today.

47 Comments

|

*** UPDATED x1 *** Question of the day

Wednesday, May 7, 2014 - Posted by Rich Miller

* Back in 2011, several mayors openly opposed the income tax hike plan. As a result of that, and the fact that Democrats wanted to get every state dollar they could get in a very tough time, the revenue from the 2 point tax hike was not shared with local governments.

Things are apparently different this time around…

In a May 1 letter to members that was obtained by the Daily Herald, the head of the Oak Brook-based [DuPage Mayors and Managers Conference] urges municipal leaders to support keeping the state’s income tax rate at 5 percent to curry future “political capital” and possibly increase the local share of the income tax revenue.

“More active support would result in even more political leverage on (the Local Government Distributive Fund) and other current and future issues,” the agency’s executive director, Mark Baloga, wrote in the letter. […]

Baloga’s letter indicates the group’s support for keeping the higher tax rate would be “conditional” on increasing the share of income taxes that goes to towns and on direct deposit of that revenue into municipal coffers to end delays in state payments. […]

“It’s a statement of political reality,” he said. “We have heard again and again from our advisers that the extension is likely to happen regardless of anything DuPage Mayors and Managers does or does not do. The best way to protect or enhance those funds is to support the extension.” […]

Meanwhile, officials at the Illinois Municipal League, which also receives taxpayer funding from dues paid by member towns, has publicly announced its support of the tax rate’s continuation, but on the condition that the local share be increased to 10 percent.

* The Question: Should the state share any of the revenue from the 2-point tax hike with local governments if the tax hike is made permanent? Take the poll and then explain your answer in comments, please.

survey hosting

*** UPDATE *** As if on cue, here comes the heat. From a press release…

After facing years of funding cuts, Illinois’ schools could get more than $1 billion in new funding as State Senator Donne Trotter (D-Chicago) is urging his colleagues to truly make education the priority they claim it is.

Currently, mayors and village presidents get a cut of the state’s income tax with no strings attached. Trotter’s proposal ends that giveaway and instead steers the dollars – $1.45 billion in the upcoming budget year – to the state’s public schools in an effort to have the state finally live up to its education funding commitments.

“We cannot afford to ignore the fact that a strong education system is the key to our state’s future, especially with the looming proposition of extreme budget cuts when across the board tax breaks kick in at the end of this year,” said Trotter, a longtime advocate for public schools students. “Money with no restrictions on how it may be used in the hands of mayors and local officials is not a prudent expenditure of taxpayer dollars given the realities we face. If we have to prioritize state funding, I believe that education should always be at the top of our list.”

Existing law takes 6 percent of all the individual income money and nearly 7 percent of all corporate income tax net collections and sends it to local governments. The funding is based solely on population. Need is not a factor.

Meanwhile, Trotter’s plan would reverse the recent trend of the state failing to live up to its own school funding expectations, with the current budget only providing 89 percent of what the state says it should be providing. To help remedy this situation, Trotter’s plan would fill that gap and potentially allow for an increase.

“We face a lot of tough decisions in our budget. In a funding fight between city hall and the classroom, I’m always going to side with the school children. If our students and schools aren’t our top priority then our future is truly in trouble,” Trotter said.

27 Comments

|

Caption contest!

Wednesday, May 7, 2014 - Posted by Rich Miller

* Gov. Pat Quinn spoke at a Springfield business group event today. From a reader…

Outside Abraham Lincoln hotel in Springfield. If this is a Rauner thing, they need to get higher quality signs! God knows they can afford it.

* The pic…

That’s not a great Blagojevich mask, either.

49 Comments

|

* Michael Kolenc, the campaign manager for the Yes for Independent Maps group, sent out a fundraising e-mail this morning…

We’re just leaving the courthouse in downtown Chicago. It’s been a wild week…before we even delivered 533,000 signatures to Springfield, political leaders sued to push independent redistricting off the ballot.

Their politically motivated lawsuit seeks to silence the voices of Democrats, Republicans and Independents across this state. We’ve come too far to let that happen. Please contribute so we have the resources to defend ourselves, and give Illinois the chance to put the voters back in charge.

* I asked him what, if anything, went down…

Our petition to intervene was granted by the judge, meaning that the Yes campaign can defend the constitutionality of our amendment in court.

We also set a schedule. Oral arguments will be on June 18th at 2 pm.

The AG’s office was there. They have not decided what role they are going to play and have until May 20th to decide, even though there is precedent that they not be involved in dealing with . Not to mention the conflict of interest.

* And he added a brief counter-argument against part of the challenge to the constitutionality of the measure. Everyone who serves on the remap commission would be barred from running for state and judicial office for ten years, which the plaintiffs insist goes well beyond the Constitution’s strict limit on what can be in a citizens’ amendment…

Service on the commission is voluntary, and a person can simply choose not to serve on the commission. Imposing qualifications and restrictions of this nature on the commission – which is established under Article 4 of the Constitution – is within the scope of subjects that may be addressed through this referendum process.

Discuss

21 Comments

|

* A Florida bankruptcy judge delivered some bad news to Bruce Rauner…

The Federal Court’s March 14 Opinion describes a “bust out” scheme orchestrated by GTCR, the private equity firm chaired by Rauner for years up until October 2012. The Court ruled that claims against GTCR for aiding and abetting a breach of fiduciary duty have merit and therefore can proceed.

The Court also ruled that claims for breach of fiduciary duty can proceed against Edgar Jannotta, formerly one of Rauner’s fellow GTCR principals. Jannotta is currently one of the largest financial contributors to Rauner’s campaign.

Under Rauner’s chairmanship of GTCR the firm was accused of complicity in the wrongful deaths of multiple nursing home residents. GTCR was then later accused of participating in a scheme allegedly intended to fraudulently transfer assets for the purpose of hiding them from successful plaintiffs and other creditors.

The opinion is here.

* The federal judge wrote that the plaintiffs’ case “has all the makings of a legal thriller” and summarized the plaintiffs’ contention with a headline about how Rauner’s “GTCR Group orchestrates the ‘Bust Out scheme’”…

In the second linked transaction, THI sold all of its stock in THMI to the Debtor for $100,000. The Debtor had been incorporated just months before the transaction by the law firm of Troutman Sanders, where Forman (one of FLTCH’s owners) was a partner.

The Debtor’s sole shareholder is Barry Saacks, an elderly graphic artist who currently lives in a nursing home. Although Saacks has some recollection of being asked if he was interested in buying computer equipment, he was not aware that he owns the Debtor or that he acquired the stock in THMI.

And, it turns out, Saacks (who did not have any money to buy any computer equipment in the first place) did not pay the purchase price—FLTCH apparently loaned him the $100,000—nor did he ever receive any of THMI’s assets. In short, the complaint paints this as a sham transaction. […]

After the sale, FLTCH rebranded THMI assets and continued generating millions of dollars of profits, but without the millions of dollars in liabilities.

Oy.

* THI was funded by Rauner’s GTCR. From the opinion…

Aside from raising capital for THI, the GTCR Group was also instrumental in THI’s day-to-day management and administration. From the start, the GTCR Group entered into a Professional Services Agreement with THI in July 1998, around the time THI was created. Under its agreement with THI, the GTCR Group was responsible for formulating THI’s corporate strategy and corporate investments, including acquisitions, divestitures, and debt and equity financing

Hmm. Rauner’s firm was far more involved than he may have let on.

Then again…

While the Court tends to agree with the GTCR Group that any one of facts alleged in the complaint (i.e., an 83% ownership interest, majority control of the board, day-to-day control over business operations, etc.), taken by itself, would not plausibly give rise to domination or control, all of the facts—when taken together—could.

* THMI was a wholly owned subsidiary of THI until March of 2006, when it sold its stock to FLTCH, Fundamental Long Term Care Holdings, LLC, and others. From the judge’s summary of the complaint…

According to the complaint, THI Holdings, LLC (“THIH”) and THIH’s primary shareholder, a series of entities referred to as the “GTCR Group,” conspired to allow THI’s two primary secured lenders—General Electric Capital Corporation (“GECC”) and Ventas, Inc. (“Ventas”)—to loot THI and THMI to repay $75 million in loans before the GTCR Group and THIH ultimately sold THI’s and THMI’s assets to a group of individuals and entities referred to as the “Fundamental Entities”—Fundamental Long Term Care Holdings, LLC (“FLTCH”), Fundamental Administrative Services (“FAS”), Tr ans Health, Inc.-Baltimore (“THI-Baltimore”), Murray Forman, Leonard Grunstein, and Rubin Schron—for far less than their fair market value in order to preserve the substantial investment the GTCR Group made in THI.

To complete the alleged bust-out scheme, THMI’s liabilities were transferred to the Debtor (a sham entity created for the sole purpose of acquiring THMI’s liabilities), and THI was allowed to slowly go out of business before being put into a state-court receivership.

Wow.

…Adding… From the judge…

These, of course, are only allegations in the complaint. As discussed below, the Court is required to accept all well-pled allegations in the complaint as true.

By reciting the factual background of this case, the Court is not making any determination regarding the veracity of the allegations. They are just that—allegations

* More from the judge…

So the GTCR Group, in an effort to save some of its investment, hatched a scheme whereby it allowed THI’s primary lenders (GECC and Ventas) to siphon millions from the company in the form of interest and fees only to later sell the company to the Fundamental Entities for far less than fair market value, with the end result that THI-Baltimore, FLTCH, FAS, Forman, and Grunstein get a company worth—when stripped free from its liabilities—over $100 million for less than $10 million, the GTCR Group pockets $10 million for a company whose assets would have gone to pay hundreds of millions (if not billions) of dollars in judgments, and the Debtor ends up with a liability-ridden shell company.

From those facts, the Court can reasonably infer that the GTCR Group and THIH knowingly participated in Jannotta’s alleged breach of fiduciary duty.

81 Comments

|

* State and local workers who have jobs which are partially subsidized by federal funds can now run for political office. Government Executive has the deets…

The Office of Personnel Management issued a final rule Monday to implement the 2012 Hatch Act Modernization Act, which will go into effect June 4. The law marked the first update to the Hatch Act — which governs political activity for government workers — in more than 20 years.

The change will no longer prohibit state and local employees who work in programs financed in part or in whole by federal funds from running for partisan office. Only those workers whose salaries are paid for entirely by federal grants or loans will remain banned from launching political bids.

The bill also expanded the options for penalizing federal employees who violate the law. Previously, these employees faced immediate termination.

The new rules are here.

8 Comments

|

Chairman Kennedy blasts “insane” pension reform

Wednesday, May 7, 2014 - Posted by Rich Miller

* The State University Retirement System is the only state pension system to interpret the new pension reform law as calculating an employee’s pension benefits using last year’s salary instead of this year’s. They’ve been asking for a legislative fix, but it hasn’t moved as of yet.

Chris Kennedy, who chairs the University of Illinois Board of Trustees, wants another fix…

Kennedy said the U. of I. trustees insist that the Legislature has to correct a second issue: A change in the guaranteed investment earnings rate for employees from 7.75 percent a year to a market-based rate based on the 30-year U.S. Treasury bond rate as of July 1, plus 0.75 percent. The market rate amounts to about 4.5 percent.

Kennedy said he hopes Legislature will correct the second issue by the end of May or the state will stand to suffer a tremendous brain drain of senior faculty members, mostly ages 45 to 60, who will take their higher retirement payout now and get new positions elsewhere.

“They [legislators] can watch the intellectual leadership of the state move to the coasts, because all of the university leadership in a certain age bracket who have at least a decade or two left in their careers will be incentivized to move somewhere else,” Kennedy said in a phone interview. “We will pay them to leave. That’s the sick thing. That is insane.”

* It doesn’t seem likely, however…

Steve Brown, spokesman for Illinois House Speaker Michael Madigan, said the interest rate change was meant to stabilize the precarious pension system.

“It will make the system stable,” Brown said. “The system prior to the legislation was completely unstable and could go out of business in a few years. Some of these artificial return figures were brought back to a real basis.”

Discuss.

52 Comments

|

Ride-Sharing: Read the Fine print - Support HB 4075

Wednesday, May 7, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

Ride-sharing companies claim in their Capitol Fax advertorial on May 5th that HB 4075 “undermines…regulations that prioritize safety and accountability” and that they have “developed strict criteria and comprehensive insurance policies that are 3 times what is currently provided in Illinois.”

Really?

Then why do they force all their users to sign a waiver agreeing to use their service “at your own risk?” Uber even admits “you may be exposed to transportation that is potentially dangerous, offensive, harmful to minors, unsafe” and then forces its users to “release the company from any and all liability, claims, or damages.”

Recently, an Uber driver in San Francisco hit and killed a 6-year-old girl, only to have the company deny responsibility and keep the little girl’s family from any insurance compensation.

When you read the fine print, the truth is multi-billion dollar companies like Uber are fighting against the same public safety protections that all licensed commercial transportation companies in Illinois currently follow. HB 4075 provides standard police background checks, drug testing and proper insurance covering the public while the driver is working, “App on to App off.”

HB 4075 provides common sense protections. Ask Uber why they want less.

Comments Off

|

Rate the US Chamber’s new Bob Dold cable ad

Wednesday, May 7, 2014 - Posted by Rich Miller

* As I told you yesterday, the US Chamber is spending $367K on a new cable TV ad touting Republican congressional candidate Bob Dold. The ad was finally posted online this morning…

* Politico has more…

The U.S. Chamber of Commerce is poised to unveil an onslaught of general-election advertising this week, launching TV spots in nearly a dozen of the most competitive House districts in the 2014 midterm elections.

The heavily funded, Republican-friendly group also has reserved airtime in the Kentucky and Colorado Senate races. The Colorado ads are expected to feature Florida Sen. Marco Rubio, whose PAC has endorsed Republican candidate Cory Gardner.

The Chamber declined to share the cost of the TV campaign but called it a multimillion dollar effort, and it appears to represent the powerful business lobby’s most intensive effort so far to leave a mark on the congressional landscape. […]

All of the ads are positive, Holmes said, “and feature candidates who believe in economic growth and the free enterprise system, who know how to govern and who can win in November.”

12 Comments

|

[The following is a paid advertisement.]

Credit unions are committed to several cooperative principles, including social responsibility. At First Illinois Credit Union in Danville, reaching out to area school children as part of their financial literacy program is a top priority. For over 20 years, the credit union has partnered with area schools, educated students in the classroom and has invited them to open savings accounts. Scholarships are awarded to graduating eighth graders. Members that are high school graduates are also granted scholarships. By giving out scholarships at school-wide functions, it affords the credit union the opportunity to provide financial education to hundreds of students in the audience. Educating children is just one facet of the credit union’s extensive outreach, which also includes breakfast meals for low income families, financial education for seniors during Money Smart Week, volunteering as a buddy at baseball games for children with disabilities, and many more local clubs and organizations. For all their efforts, First Illinois Credit Union has been recognized by their members and the community as a top financial institution. At the heart of the credit union philosophy is the principle of people before profits – and another reason why members are so fiercely loyal.

Comments Off

|

Transaction tax not going anywhere

Wednesday, May 7, 2014 - Posted by Rich Miller

* As we’ve already discussed, Chicago Teachers Union President Karen Lewis wants a tax on financial transactions to help fund the woefully underfunded city teachers pension fund…

William Barclay, an economist advising the CTU, estimates a $1-to-$2 tax levied on the sellers and buyers of futures, futures options and securities option contracts traded on the Chicago Mercantile Exchange and the Chicago Board Options Exchange could raise up to $12 billion a year for the state, some of which could be used for pensions.

* But the governor dumped cold water on the idea yesterday…

A financial transaction tax faces several legal hurdles, including a change in state law, a City Hall official said. And Gov. Pat Quinn also was skeptical.

“I just don’t think there’s the votes for that,” Quinn said Tuesday in Springfield. “I think that would be very difficult to do.”

* And CME’s spokesperson Laurie Bischel was completely opposed…

“However, we do not believe the way to accomplish a strong public school system is through singling out futures traders with a tax more than 200 percent higher than what the average trader pays to buy or sell a futures contract,” Bischel said. “Futures traders do not have to do their business in Chicago today and this tax would make sure that they don’t do business in our city going forward.”

Discuss.

23 Comments

|

* Gov. Pat Quinn has said over and over that he was “the first” person to spot the problems with his anti-violence initiative. But as Mark Brown clearly shows today, this just isn’t true…

(A)ccording to his own account of events, the governor didn’t figure out he had a problem there until state legislators forced him to take a closer look.

Most of the recent stories about the governor’s anti-violence program say the controversy was sparked by a scathing February audit from Illinois Auditor General William Holland.

That’s true, but don’t forget that audit didn’t just spring out of nowhere.

Republican legislators in both the House and Senate raised questions about the program during appropriations committee hearings in early 2011.

Sen. Matt Murphy, R-Palatine, even introduced a resolution asking for the auditor general to be ordered to audit the program, but couldn’t advance it out of committee.

In 2012, Rep. David Reis, R-Ste. Marie, tried again with a resolution of his own in the House, but this time he found some surprising allies on the other side of the aisle.

Many Democrats from high crime areas, mainly Latino legislators, were upset that money from the program had not been spent in their communities, Reis said.

Together, they not only approved the audit in May 2012, but also cut spending for the program in half, to $30 million from $15 million. Reis said House Speaker Mike Madigan supported the effort.

Quinn’s own timeline of events, as prepared by his press office, says it was in June 2012 that “inadequacies in program monitoring and fiscal oversight” were brought to the governor’s attention by his staff.

* Meanwhile, the governor blamed partisan political games yesterday after the Legislative Audit Commission’s vote to grant itself subpoena powers…

Standing outside the Capitol, Quinn dismissed as “politics as usual” a Republican state senator’s call for the Legislative Audit Commission to use subpoena power to dig deeper into questions that already have gotten the attention of federal prosecutors in Springfield and Cook County State’s Attorney Anita Alvarez in Chicago.

“It’s a political time of year,” Quinn said.

Trouble is, the commission voted 10-1 to grant the subpoena powers. All but one Democrat voted for it. This wasn’t just about politics.

* However, as subscribers know in more detail, the subpoena powers move is a bit more show than go…

The proposal received bipartisan support; however, several Democrats on the commission voiced concerns that a probe from the commission would at best produce nothing beyond what will come out during the ongoing criminal investigations and would at worst impede them. “What’s the value at the end of the day that we’ll be putting on the table?” asked Hoffman Estates Democratic Rep. Fred Crespo, who sponsors HB 3820. “What can we do that they cannot do?” Crespo and others said that the commission does not have the resources to launch a major investigation.

Barickman, who chairs the committee, and co-chair Rep. Frank Mautino, a Democrat from Spring Valley, would both have to sign off on any subpoenas issued. Mautino was the sole vote against the motion. He argued that the information the committee needs is already available and that subpoenas may be unecessary. He noted that Holland’s office has several boxes of documents related to the audit and that no legislative staffers have gone through them at this point. Mautino said that the panel should first ask for the information and witnesses it is seeking instead of resorting to subpoena powers.

Holland said he would provide the commission with any information they want. “You don’t have to subpoena the records, and you don’t have to FOIA the records. You make an appointment, you come in and you take a look. That’s the way we do business,” He said. Holland also said that state agencies are required by law to comply. Barickman said that because the agency that oversaw the program has been dissolved and some of the people who worked on the NRI have since left state government, the commission may need the legal power to compel them to cooperate.

* And…

It’s not clear if any subpoenas will actually be issued. There’s a dispute over whether the Democrats who run the House and Senate have to sign off on them; and if they do, it remains to be seen if they will.

* And in other news, the governor found somebody to throw under the bus yesterday…

Cook County Circuit Clerk Dorothy Brown’s partnership with her husband to tap into Neighborhood Recovery Initiative grants is “troublesome,” and her spouse’s dual role as an overseer and provider of anti-violence programming represents a “clear conflict,” Gov. Pat Quinn said.

In slamming Brown and her husband, Benton Cook III, Quinn Tuesday ramped up his defense against the growing political fallout from his self-acknowledged, botched Neighborhood Recovery Initiative in 2010 that is now under state and federal investigation. […]

The governor also blamed Chicago Area Project, the West Side non-profit that hired Cook and that Quinn’s administration chose to participate in the Neighborhood Recovery Initiative, for “letting all of us down” by neglecting to perform a criminal background check on him before giving him a supervisory role in overseeing $2.1 million in anti-violence programming in West Garfield Park. Such a check might have found Cook’s 1999 felony conviction for writing bad checks in Tennessee.

The head of the Chicago Area Project in his first public comment since the scandal broke said the organization was unaware of Cook’s criminal past when he applied for the job.

“During the application process, during the interview process none of that came out,” David E. Whittaker, the organization’s exectuive directory, said in an interview with WTTW’s “Chicago Tonight.” “Nothing that was in his background would have led us to believe he was not qualified for the position.”

* And, finally, some Republicans are privately saying that Cook County State’s Attorney Anita Alvarez’s probe of her fellow Democrat may be politically suspect. One such Republican made sure to point me to this Tribune revelation today…

Federal authorities in Springfield have made inquiries about the grant program, which was absorbed by the Illinois Criminal Justice Information Authority. Both Alvarez and Brown are members of that board under state law.

A spokeswoman for Quinn declined to say if it was a conflict of interest for Alvarez to sit on the board of an agency that took over responsibility for the anti-violence program, saying “it’s up to the state’s attorney to determine whether there is a conflict or not.”

Alvarez spokeswoman Sally Daly said it was not a conflict for the Cook County grand jury to subpoena documents from an agency on whose board Alvarez sits. She declined to answer other questions, noting that the investigation of the grant program continued and the secrecy of grand jury proceedings.

106 Comments

|

|

Comments Off

|

|

Comments Off

|

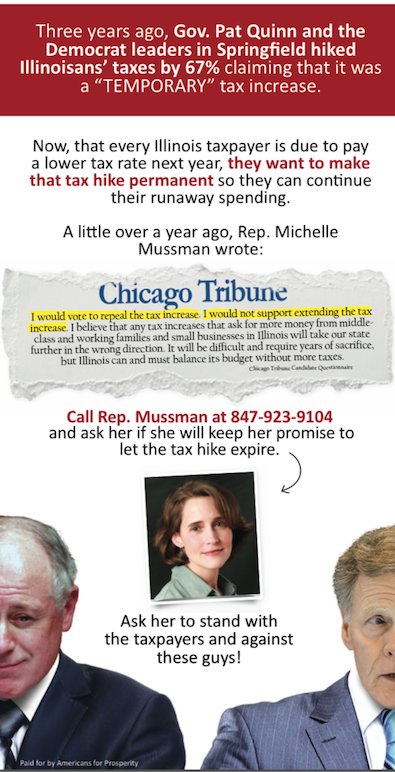

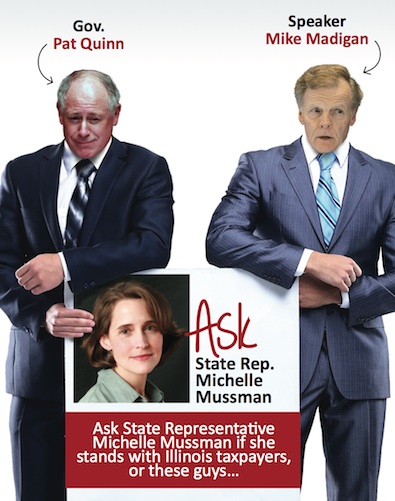

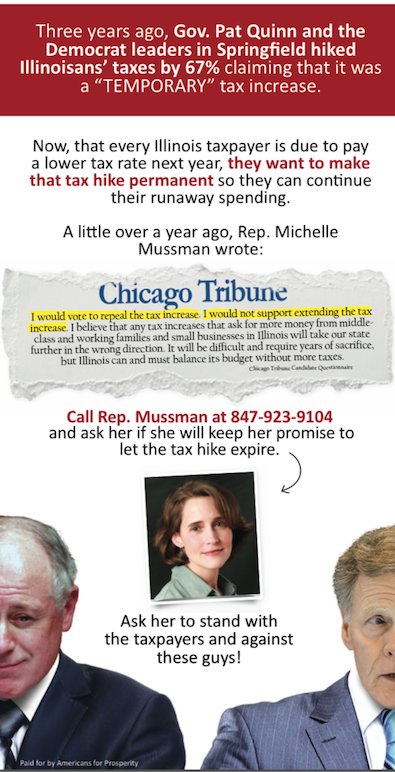

* From a press release…

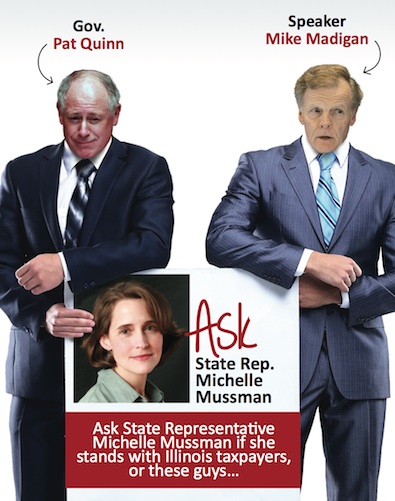

Today Americans for Prosperity - Illinois is launching the first phase of a campaign calling on legislators to honor their promise to taxpayers by keeping the 67% income tax hike temporary. The effort consists of a massive direct mail effort, along with a website, KeepItTemporary.com, and grassroots efforts to oppose Governor Quinn and Speaker Madigan’s push to permanently hike the income tax. The efforts will seek to hold 17 state legislators accountable by highlighting their prior stated support for letting the income tax hike expire as scheduled.

“Illinoisans want to know: will those legislators who said they supported letting the income tax expire while campaigning stand up for taxpayers now? Or will they join Gov. Quinn and Speaker Madigan in breaking trust with their constituents and again hike taxes on all Illinoisans further damaging the state’s dismal economy?” asked David From, Illinois State Director of Americans for Prosperity. “Many of these legislators at one point recognized that permanently increasing the income tax will harm Illinois’s hardworking families and slow economic recovery. They need to honor their commitment to their constituents and allow the tax hike to expire as promised to taxpayers when the measure was passed.”

The legislators being held accountable are: Reprentatives Fred Crespo (44th District), Emily McAsey (85th District), Katherine Cloonen (79th District), Deborah Conroy (46th District), Laura Fine (17th District), Stephanie Kifowit (84th District), Natalie Manley (98th District), Michelle Mussman (55th District), Brandon Phelps (118th District), Marty Moylan (55th District), Sam Yingling (62nd), Jerry Costello II (116th), Mike Smiddy (71st) and Senators Jennifer Bertino-Tarrant (49th District), Julie Morrison (29th District), Melinda Bush (31st District), and Michael Hastings (19th District).

Today’s direct mail and online efforts build on AFP’s on-going grassroots opposition to the income tax hike, which includes regular door knocking and phoning to educate and mobilize Illinoisans against the tax hike.

* A sample mailer…

51 Comments

|

OK, we can’t pass this up

Tuesday, May 6, 2014 - Posted by Rich Miller

* Former Illinois Congressman Ken Gray wrote a letter to Caroline Kennedy and then talked to the Daily American about his relationship to Caroline’s father John F. Kennedy…

“Your dad asked me to run for president after his two terms would have expired,” writes Gray.” The Constitution only allows two terms for a president and he was not fond of Lyndon Johnson and wanted me to succeed him.”

Why this revelation had never seen the light of day has more to do with Gray’s safety than it did his privacy. He says he was concerned for his own life which would have paralleled his dear friend in politics, issues and programs.

“He wanted me to be a candidate because he knew we shared the same ideology,” said Gray. […]

Gray says he was more interested in hunting down a killer than becoming president which could have been fatal. […]

He says from that time on he knew that his life was at risk should he continue in the footsteps of Kennedy.

“I feel there is still some danger, but I’m at an age now that it wouldn’t be so harmful,” said Gray who spoke with authority and total clarity throughout the interview.

“I could have been killed if they knew of the friendship,” he continued.

Um, OK.

* The accompanying photo…

No, that’s not Phil Spector.

Caption?

76 Comments

|

Question of the day

Tuesday, May 6, 2014 - Posted by Rich Miller

* Gov. Pat Quinn stressed to reporters again today that the problems with his anti-violence initiative are at the grant recipient level, not at his level. The top people in his administration who were closely associated with the grant program are mostly no longer in government, so throwing them off the train ain’t gonna work. Throwing them under the bus probably won’t work either because he praised them both when they resigned. He’s tried to highlight real, substantive reforms he’s hoping to put in place, but was mostly ignored by reporters. He’s even getting blamed for the fact that Dorothy Brown’s husband was hired by one of the oldest and most respected anti-poverty, anti-violence groups in the nation, and that nobody knew the guy had an out of state felony conviction for writing a bad check.

As a commenter put it today…

here’s the recurring problem for Quinn, he can’t stay on a single message.

Message #1: i found the corruption and put an end to it. False-Senate R’s found it first.

Message #2: it’s all politics. False-Bipartisan group of legislators just called for investigation.

stay tuned for message #3

And I’m pretty sure whatever message he decides on next will be outdated or proved false as soon as he delivers it.

* The Question: What should Gov. Quinn do now to deal with this mess?

65 Comments

|

Chamber jumps in early for Dold

Tuesday, May 6, 2014 - Posted by Rich Miller

* I don’t have the ad yet, but the US Chamber just dumped a bunch of cable money into CD 10 supporting Republican Bob Dold…

US Chamber of Commerce

Targeting US Congressional D10/ supporting GOP candidate

Agency: Smart Media, DC

Order total: $367,700

Flight dates: 5 /7/14 - 5/28/14

Networks: AEN, DISC, ESPN, FOOD, HIST, TBS, TNT, TWC

Dayparts: 9A-4P, 7P-midnight

Syscodes / Zones / $ by syscode

1277 /Barrington / $37,800

5126 / Highland Park / $53,600

1863 / Libertyville / $32,750

5553 / Gurnee / $54,920

1283 / Glenview Evanston / $37,720

1794 / Mt Prospect / $45,520

6221 / Rolling Meadows / $59,300

0573 /McHenry / $46,090

Total All zones: $367,700

…Adding… I’m told it’s a positive spot about Dold and doesn’t mention his opponent.

17 Comments

|

Fun with numbers

Tuesday, May 6, 2014 - Posted by Rich Miller

* From the Illinois Policy Institute…

According to the governor’s own estimates, when the tax hike sunsets next year, the state’s General Fund Revenue will drop to about $35 billion. That’s more than the state spent just two years ago during the 2012 fiscal year – not quite the doomsday scenario Quinn is trying to sell.

* If you click here and take a look at a document published by the Commission on Government Forecasting and Accountability, you’ll see that the Policy Institute is right about their simple comparison between FY 2012 and FY 2015. Total operating and transfers out spending in FY12 was $34.1 billion, while the same number in the governor’s not recommended (no tax hike) proposal is $34.6 billion.

But, dig down a little for the real story.

* For instance, FY12’s pension fund contributions totaled $4.13 billion, while pension contributions next fiscal year in the governor’s “not recommended” budget are projected to be $6.24 billion - a $2.11 billion jump.

Plus, the state had a $477 million operating deficit in FY 2012, which was down from the $3.8 billion operating deficit the year before, but still pretty darned high. The not recommended budget’s operating surplus for next fiscal year is $357 million - an $834 million swing from FY12.

Compared to FY12, mandated transfers out (debt service, etc.) are about $316 million higher by next fiscal year.

Also, in inflation-adjusted terms, FY12’s $34.1 billion in total spending equals $35.1 billion in today’s dollars. That’s a half billion dollars more than the state is projected to actually spend in the coming fiscal year with the not recommended budget.

* So, increased pension payments, wiping out the operating deficit and creating a small surplus, higher mandated transfers out, plus inflation adds up to $3.76 billion in net budget pressures that didn’t exist in FY 2012. At least by my math.

And they still have to somehow fund the government on net appropriations that are projected in the not recommended budget to be $1.9 billion lower next fiscal year than in FY12, not counting inflation ($25.07 billion in FY12 vs. $23.12 billion in FY15). The difference is $730 million higher when you factor for inflation.

Yes, it’s a real problem.

33 Comments

|

*** UPDATE 2 *** Subpoenas were approved on a vote of 10-1, with Rep. Mautino as the lone “No” vote.

*** UPDATE 1 *** Click here to listen to live audio of the Legislative Audit Commission hearing.

[ *** End Of Updates *** ]

* Sun-Times…

A co-chairman of a legislative audit panel on Tuesday plans to seek authority to issue subpoenas for records and witnesses in a probe of the troubled Neighborhood Recovery Initiative in what could become a lingering — and potentially more of a public — headache for Gov. Pat Quinn.

State Sen. Jason Barickman, R-Bloomington, on Monday first told the Sun-Times political portal Early & Often that he will move to formally ask for the authority to subpoena records and witnesses from the anti-violence program that the state’s auditor slammed as riddled with mismanagement. […]

Barickman is a co-chairman of the Legislative Audit Commission, which is made up of six Republicans and six Democrats. He plans a morning news conference following the commission meeting.

I wrote about this issue in today’s subscriber edition. House Speaker Michael Madigan’s spokesman e-mailed this to me after reading what I wrote…

I think the Senator [Barickman] is about to learn the Auditor General already has subpoena power

* Meanwhile, it’s the gift that keeps on giving. Sun-Times again…

Cook County Circuit Clerk Dorothy Brown had a direct managerial role in a not-for-profit group that got an anti-violence grant from Gov. Pat Quinn’s now-disbanded Neighborhood Recovery Initiative, state records obtained by the Chicago Sun-Times show.

The group, Dream Catchers Community Development Corp., was founded by Brown’s husband, Benton Cook III. It was asked to return unexpended grant money after having its contract terminated in 2011 by Chicago Area Project, a larger not-for-profit that had been overseeing organizations that had received money through the Quinn anti-violence initiative.

Dream Catchers was supposed to be paid as much as $10,000 by Chicago Area Project to distribute anti-violence literature between February 2011 and November 2011.

The group initially was awarded $3,333 of the $10,000. But Chicago Area Project ended the deal after only a few months, in May 2011, saying it learned of the potential conflict of interest posed by Cook also being paid tens of thousands of dollars by Chicago Area Project to oversee other Neighborhood Recovery Initiative programs.

60 Comments

|

Today’s history lesson

Tuesday, May 6, 2014 - Posted by Rich Miller

* WBEZ’s Lauren Chooljian traces the origins of Illinois’ Sunday car sales ban…

The state’s Sunday auto sales ban is one of many state-level blue laws, which — as a category — prohibit certain secular activities on Sundays. The ban first made its way through the Illinois legislature in 1951. Dealers wanted to allow a day off, but any single dealership couldn’t close its doors while competitors stayed open. Legislators agreed to a mandatory day off and passed a bill to make it happen, but the story got complicated as soon as the bill hit Governor Adlai Stevenson’s desk.

Stevenson’s Attorney General, Ivan A. Elliott, encouraged the governor to veto the bill, saying it likely violated the Illinois Constitution “as an interference with the right of an individual to pursue any trade or occupation which is not injurious to the public or a menace to the safety or welfare of society.”

Stevenson heeded the AG’s word, and vetoed Senate Bill 504.

“If such a restriction on Sunday trade is sound for automobiles, why should it not be extended to newspapers, groceries, ice cream cones and other harmless commercial transactions?” Stevenson wrote in a veto message. “Carried to its logical extreme, any business group with sufficient influence in the legislature can dictate the hours of business of its competitors. And if hours, why not prices?”

Go read the whole thing. I learned quite a lot from this piece.

34 Comments

|

An early adjournment?

Tuesday, May 6, 2014 - Posted by Rich Miller

* Even with all the big issues still on the table? Senate President John Cullerton thinks it’s possible…

Cullerton said there’s a chance that both the budget and tax increase could get wrapped up early this year.

“We finish up on a Saturday, which this time (of) year in May, you have people who have graduations and that sort of thing,” he said. “I think it would be better to finish the major issues like the tax extension and the budget sooner than the last day.”

He’s got a good point. If your kid is graduating from college, you don’t want to be in Springfield that day. Then again, early adjournment is never easy.

20 Comments

|

Prescribing Psychologists: Still Unsafe for Patients

Tuesday, May 6, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

We knew it would happen this way: A last-minute amendment hurried out in the hope no one would read it too carefully. But despite some new window dressing, HFA #2 to SB 2187 – which would allow psychologists to prescribe – still fails to protect patients.

Among the dangers in the new bill:

• Inadequate Training & Education: House Floor Amendment #2 to SB 2187 does not require psychologists to complete medical education and training equal to that of an advanced practice nurse (APN) or physician assistant (PA). APNs and PAs have earned the confidence of physicians to work together through collaborative and supervisory agreements.

• A Woefully Insufficient “Conditional License”: Real clinical training programs involve multiple health professionals who expose trainees to all types of patients, including geriatric patients, children, adolescents, and pregnant women, and do so in a variety of medical settings, including the emergency room.

• Does Not Improve Access: HFA #2 to SB 2187 will not improve access to mental health services. It makes no provisions for telepsychiatry or integrated care, nor does it feature programs to cross-train psychologists in medical schools. In the two states that allow some psychologists to prescribe – Louisiana and New Mexico – less than 10% have pursued prescriptive authority.

To date, four Illinois newspapers have editorialized against SB 2187: the Chicago Tribune, the Chicago Sun-Times, the Rockford Register Star and the Lake County News-Sun. This bill was written to benefit psychologists – not patients. Tell your representative to vote NO, and visit http://coalitionforpatientsafety.com.

Comments Off

|

[The following is a paid advertisement.]

We all agree that Illinois has serious financial challenges. The immediate issue in the final month of the General Assembly session is deciding what we are willing to do to avert a catastrophe from devastating cuts if current tax rates are not maintained.

This issue is not just about hospitals and health systems. It’s also about roads, schools and public safety, and yes, health care. Without the continuation of current tax revenues, these areas will be subject to severe cuts in funding.

We have all witnessed first-hand the needed improvements in Illinois roads, health care, public safety, and education. We have much work to do to improve the lives of all Illinoisans, which requires stable and predictable state funding.

Deciding to support a continuation of current tax rates is not easy. But taking the easy way out today will only make tomorrow’s problems worse. We must collectively find the courage to do the right thing now. We need to keep our promises to Illinoisans to keep our state safe, well-educated and healthy.

No silver bullet can solve these issues. It takes tough decisions and sacrifice for the greater good of the state. That’s why the Illinois Hospital Association and the hospital community support taking this difficult action.

Now is the time for political courage and statesmanship – and for legislators to make tough decisions for these tough times. We ask state lawmakers to vote “Yes” to enact an FY2015 state budget that maintains current tax rates and avoids harmful cuts. Our future depends on it.

For more information, see our fact sheet.

Comments Off

|

|

Comments Off

|

|

Comments Off

|

Ethics probe continues

Monday, May 5, 2014 - Posted by Rich Miller

* Sun-Times…

The House Committee on Ethics announced on Monday it will continue a review of whether Rep. Luis Gutierrez, D-Ill., violated House rules and federal law through a hiring agreement he made with his former chief of staff, Doug Scofield, while declining to take the more serious step of creating a special panel to investigate the allegations.

The committee chairman, Rep. Michael Conway, R-Texas, and ranking member, Rep. Linda Sanchez, D-Calif., said in a four-paragraph statement they will continue to “gather additional information necessary” for the review and did not set a timetable for their work to be completed.

At issue is the $590,000 Scofield received over 10 years from federal funds allocated to run Gutierrez’s congressional office.

The ethics probe is looking at whether Scofield functioned as a contractor — which is permissible — or if his long-term relationship with Gutierrez’s congressional office was really more like that of a consultant who performed more like an employee, which is not allowed. […]

“Today’s announcement by the Committee reveals that it will not convene a special ethics panel. As the Committee reviews this matter, Congressman Gutiérrez and his office will continue to cooperate fully. As the Committee points out, its review does not indicate that any violation has occurred or reflect any judgment on behalf of the Committee,” Gutierrez spokesman Doug Rivlin said in a statement.

“After its exhaustive review, the OCE made a single recommendation that the House Committee on Ethics assess whether the approved contract was permissible under ambiguous House rules.”

Go read the whole thing. The report is here. Scofield declined to cooperate.

8 Comments

|

[The following is a paid advertisement.]

HB 4075 is a taxi-industry protection bill that not only pre-empts Chicago’s home-rule authority, but undermines common-sense regulations that prioritize safety and accountability.

Creating bureaucratic roadblocks and burdensome guidelines aimed at preserving the status quo only wipes out emerging competition, stifles innovation and eliminates consumer choice.

The truth is that new technology provides an opportunity to increase safety above and beyond what is required of taxis, which is why ride-sharing services have developed strict criteria and comprehensive insurance policies that are 3 times what is currently provided in Illinois taxis.

The people of Illinois – tens of thousands of whom use ridesharing – deserve affordable, convenient and safe transportation choices, especially those living or working in underserved areas ignored by taxis.

“…the status quo needs to change. Those six-digit medallions are out of reach of actual drivers…they work long shifts with no guaranteed income, and sometimes don’t break even…Consumers, meanwhile, have no choices.”

- Chicago Tribune Editorial, April 30

“…[state] negotiations should not result in a bill that serves as a roadblock for ride-sharing.”

- Chicago Sun-Times Editorial, March 27

Vote NO to the status quo and NO on HB 4075.

Comments Off

|

Question of the day

Monday, May 5, 2014 - Posted by Rich Miller

* The White Sox play the Cubs tonight in Wrigley Field. Trash talking, anyone?

53 Comments

|

Madigan’s constitutional irony

Monday, May 5, 2014 - Posted by Rich Miller

* From the Daily Herald editorial board…

Last week, a close ally of Illinois House Speaker Michael Madigan filed suit to challenge citizens initiatives to impose term limits on state legislators and to change the way legislative districts are drawn every 10 years.

We’re big fans of the remap referendum. We’ve editorialized on its behalf for months as a solution to the politicized way districts are drawn. We are not as enamored with the term limit referendum. We see some pros but also many cons.

But the important thing isn’t whether we like either initiative. The important thing is that the public has made clear its interest in putting these questions on the ballot.

It’s important also that the politically motivated suit against it was predictable. For a long time, the cynics have said — no way will Madigan and the politicians let these referendums happen.

The challenge only confirms that cynicism — and in doing so, spreads it further.

As Eric Zorn and I have already pointed out on multiple occasions, there are some legit constitutional questions about both of these petition drives. Those questions, in my opinion, do deserve a full hearing.

* However, it is beyond richly ironic that while Speaker Madigan is relying on a highly precise and quite literal reading of the Illinois Constitution to defeat the two proposed citizen initiatives, he’s also arguing that the common sense, plain meaning of the Constitution should be ignored when it comes to pension reform.

Just sayin…

41 Comments

|

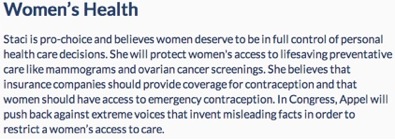

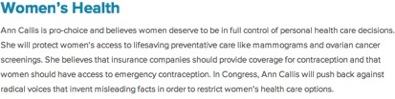

*** UPDATE 2 *** Cleared…

Charges of plagiarism dogged Democrat Ann Callis’ campaign for Congress for about six hours Monday until a staffer running a campaign in Iowa cleared the former judge from Edwardsville.

Callis, vying to unseat Republican U.S. Rep. Rodney Davis of Taylorville in Illinois’ 13th Congressional District, was accused by Illinois Republican Party Chairman Jack Dorgan Monday morning of pilfering lines for her campaign website from Iowa Democrat Staci Appel.

By mid-afternoon, Appel campaign manager Ben Miller said it was his campaign that copied the material.

“The language identified on that page was intended to be a temporary placeholder and was inadvertently published,” Miller said in an email. “We removed the copy when it was brought to our attention.”

*** UPDATE 1*** From an e-mail…

Rich,

Just wanted to get you the correct information regarding your post on the Callis website. The Republican attacks are a lie—our site was up with full content weeks before the Appel campaign had anything but a splash page on their site.

August 16, 2013: Callis launches live site with issue statements: https://twitter.com/callis4illinois/status/368484491867594753

September 7, 2013: A web capture search found that on 9/7/2013 the Appel campaign only has a splash page—without any issue content. https://web.archive.org/web/20130907220609/http://appelforiowa.com/

Let me know if you have any other questions.

Best,

Marshall

–

Marshall Cohen

Campaign Manager, Ann Callis for Congress (IL-13)

Apparently, nobody can play this game.

Heh.

[ *** End Of Updates *** ]

* Yesterday, a state Republican Party official sent me a screen shot of Democratic congressional candidate Ann Callis’ campaign home page…

He noted that the domain named had expired on May 3rd. “Heck of a campaign so far!” he cracked.

Oops.

* The Republicans appear to have been doing some opposition research, because after the website went live again, the state GOP unleashed this attack…

BREAKING: Ann Callis Caught Plagiarizing On Her Campaign Website

“Cut-and-Paste Callis” lifts whole sections from Iowa Democrat’s “Issues” Page… and tries to pass them off as her own.

Plagiarism Scandal is the latest example of Callis’ refusal to tell the voters of the 13th District what she stands for.

SPRINGFIELD, IL – Ann Callis, running for Congress in Illinois’s 13th Congressional District, was caught today plagiarizing key phrases, issue positions, and entire sections of the “issues” page on her website.

In two sections of her “issues” page, Callis’ entire position on “Women’s Health” and “Alternative Energy” are nearly identical to the positions on the website of Staci Appel, a Democrat running for Congress in Iowa, with the name changed to “Ann Callis” instead.